Closing Bell: Nifty at 24,950, Sensex up 286 pts; metal, pharma, power gain

-330

July 31, 2024· 16:13 IST

Market Close: Sensex up 286 pts, Nifty at 24,950

Indian benchmark indices ended higher for the fourth straight session on July 31 with Nifty at 24,950. At close, the Sensex was up 285.94 points or 0.35 percent at 81,741.34, and the Nifty was up 93.90 points or 0.38 percent at 24,951.20.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

July 31, 2024· 16:10 IST

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

The up move with range bound action continued in the market on Wednesday and Nifty closed the day higher by 93 points. After opening with a positive note, the Nifty shifted into a narrow range movement with positive bias for better part of the session. There was an attempt to break above the range towards the end and the market closed near the highs.

A small positive candle was formed on the daily chart with minor upper shadow. Technically, this pattern signals an attempt of upside breakout of smaller range movement at 25K mark.

Positive chart pattern like higher tops and bottoms is intact on the daily chart. Nifty is currently on the way to form another higher top of the pattern. Though placed at the highs, still there is no signs of any reversal pattern building at the new highs. However, a decisive move above 25100 levels could open sharp upside ahead. Immediate support is at 24750 levels.

-330

July 31, 2024· 15:55 IST

Rupak De, Senior Technical Analyst, LKP Securities

Nifty remained strong throughout the day as put writers were seen shifting their positions to 24,900. On the hourly chart, the index has given a consolidation breakout. The RSI is in a bullish crossover on both the hourly and daily timeframes. A fresh leg of bullishness starts above 25,000, while support is placed at 24,900. If the index falls below this level, it might correct down towards 24,750.

Bank Nifty remained rangebound ahead of the Fed meeting on the rate decision. So far, the index has stayed below the 21 EMA. On the other hand, the daily RSI has entered a bullish crossover. A sustained trade above 51,600 might induce a rally towards 52,000-52,200. On the lower end, support is placed at 51,200-51,000.

-330

July 31, 2024· 15:38 IST

Aditya Gaggar Director of Progressive Shares

After some movement in the morning trade, the index remained rangebound for the rest of the day to settle the last day of the month on a positive note at 24,951.15 with gains of 93.85 points.

Among the sectors, Metal was the top performer followed by Pharma and Media while the PSU Banking sector underperformed with a loss of 0.43%. A mixed trend was noticed in the Broader markets where Midcaps outperformed the Frontline Index while Smallcaps ended the session in red.

The Index is heading towards the psychological barrier of 25,000 and a sustainable move above the same will push the Index further higher to 25,200 whereas on the downside 24,800 will be considered as immediate support.

-330

July 31, 2024· 15:32 IST

Currency Check | Rupee closes flat

Indian rupee ended flat at 83.72 per dollar on Wednesday versus Tuesday's close of 83.72.

-330

July 31, 2024· 15:31 IST

Earnings Watch | Maruti Suzuki Q1 net profit up 46.9% at Rs 3,650 crore Vs Rs 2,485 crore, YoY

-330

July 31, 2024· 15:30 IST

Market Close | Nifty above 24,950, Sensex up 350 pts; metal, pharma, power gain

Indian benchmark indices ended higher for the fourth straight session on July 31 with Nifty at 24,950.

At close, the Sensex was up 285.94 points or 0.35 percent at 81,741.34, and the Nifty was up 93.90 points or 0.38 percent at 24,951.20. About 1828 shares advanced, 1613 shares declined, and 78 shares unchanged.

NTPC, Asian Paints, BPCL, JSW Steel and Tata Motors were among the top gainers on the Nifty, while losers were Britannia Industries, Dr Reddy's Labs, Tata Consumer, Reliance Industries, Grasim Industries.

On the sectoral front, except realty and PSU Bank, all other sectoral indices ended in the green with media, power, healthcare, metal and pharma added 1 percent each.

The BSE midcap index added nearly a percent while smallcap index was ended marginally lower.

-330

July 31, 2024· 15:25 IST

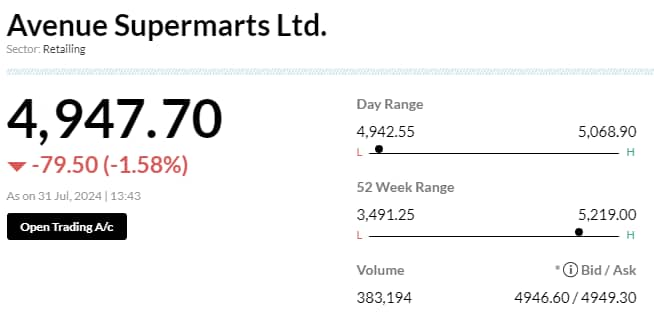

Brokerage Call | Macquarie 'outperform' call on Avenue Supermarts, target Rs 5,600

#1 DMart shared confidence on a general merchandise sales recovery

#2 Company targets 10-15 percent store additions, albeit feel FY25 may see 40-45 new stores

#3 Store additions may move towards 60 in future

#4 Outperform call on belief of continuing relevance of DMart's value positioning versus quick commerce

#5 Outperform call on no material increase in price-based competition

-330

July 31, 2024· 15:19 IST

IDBI Bank receives RBI's 'fit and proper' nod, bidders to start due diligence soon: CNBC-TV18

It is expected that Centre may call the financial bids for IDBI Bank before the end of the financial year. ...Read More

-330

July 31, 2024· 15:18 IST

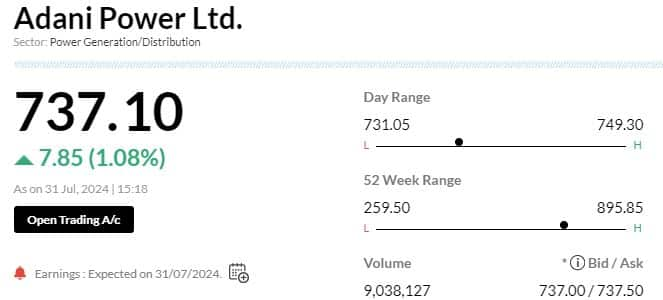

Earnings Watch | Adani Power Q1 net profit 55.3% at Rs 3,912.8 crore Vs Rs 8,759.4 crore, YoY

-330

July 31, 2024· 15:17 IST

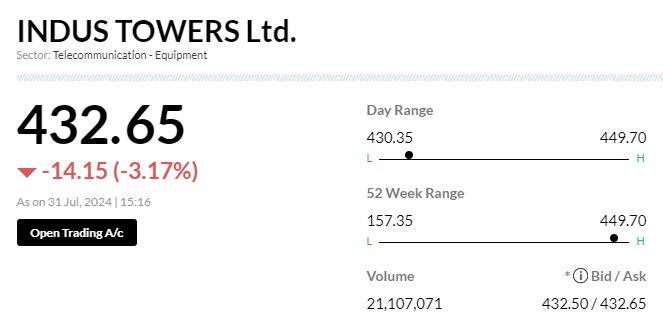

Brokerage Call | Citi keeps 'buy' rating on Indus Towers, target Rs 500

#1 Q1 performance was ahead of expectations, with EBITDA rising 11 percent QoQ, 12 percent beat

#2 Beat was driven by a higher provision reversal of Rs 760 crore pertaining to Voda Idea’s past dues

#3 Company has now recovered Rs 130 crore of past dues, outstanding amount is Rs 460 crore

-330

July 31, 2024· 15:13 IST

-330

July 31, 2024· 15:11 IST

Sensex Today | Tata Steel shares trade higher ahead of Q1 earnings

-330

July 31, 2024· 15:09 IST

Earnings Watch | Mankind Q1 net profit up 10.2% at Rs 536.5 crore Vs Rs 487 crore, YoY

-330

July 31, 2024· 15:08 IST

Earnings Watch | Crompton Greaves Consumer Q1 net profit roses 25% at Rs 152.4 crore Vs Rs 122 crore, YoY

-330

July 31, 2024· 15:08 IST

Brokerage Call | Nomura maintains 'buy' rating on CarTrade Tech, target Rs 1,112

#1 On track to capitalise on strong potential in OLX

#2 Q1 EBITDA ahead across segments & margin tailwinds in place

#3 Stock trades at 22x FY26 EV/EBITDA (factoring in 51 percent stake in SAMIL), which think is attractive

-330

July 31, 2024· 15:05 IST

Brokerage Call | CLSA upgrades Persistent Systems to 'outperform' from 'underperform', target raises to Rs 5,525

#1 Key player in high end-software engineering, creating underlying codes

#2 Roughly 2/3rd of revenues are derived from large product engineering market

#3 Strongest set of digital capabilities across hyper-scalers and SaaS platforms

#4 Robust set of client base with tie-ups among top 5-10 in each industry vertical

#5 Forecast mid-high teens revenue growth with just 100 bps margin expansion

-330

July 31, 2024· 15:01 IST

Markets@3 | Sensex, Nifty trade higher

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HDFC Life | 715.80 | 2.67 | 5.59m |

| JSW Steel | 926.00 | 2.65 | 2.16m |

| Asian Paints | 3,078.30 | 2.44 | 3.19m |

| NTPC | 416.10 | 2.25 | 23.52m |

| Bharti Airtel | 1,502.25 | 2.17 | 3.74m |

| SBI Life Insura | 1,756.60 | 2.07 | 760.84k |

| Adani Ports | 1,570.85 | 1.59 | 2.19m |

| Adani Enterpris | 3,174.20 | 1.45 | 2.19m |

| Hindalco | 668.45 | 1.2 | 5.82m |

| ITC | 495.70 | 1.18 | 8.81m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TATA Cons. Prod | 1,184.55 | -0.87 | 2.30m |

| Britannia | 5,793.70 | -0.83 | 204.38k |

| Apollo Hospital | 6,600.05 | -0.62 | 191.48k |

| Reliance | 3,010.10 | -0.54 | 3.91m |

| Power Grid Corp | 347.95 | -0.53 | 13.06m |

| Dr Reddys Labs | 6,768.95 | -0.52 | 188.68k |

| Infosys | 1,868.45 | -0.46 | 3.29m |

| Tata Motors | 1,157.45 | -0.38 | 8.94m |

| Grasim | 2,780.85 | -0.36 | 418.51k |

| IndusInd Bank | 1,425.40 | -0.3 | 2.91m |

-330

July 31, 2024· 14:58 IST

Sensex Today | BSE FMCG Index up 0.5%; CCL Products, Kokuyo Camlin, Andrew Yule among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| CCL Products | 676.85 | 9.94 | 159.20k |

| Kokuyo Camlin | 182.70 | 7.41 | 114.16k |

| Andrew Yule | 58.94 | 6.78 | 2.24m |

| Gulshan Poly | 204.90 | 5.05 | 53.56k |

| M K Proteins | 12.90 | 4.88 | 344.07k |

| Gokul Agro | 190.15 | 3.54 | 109.96k |

| Uttam Sugar | 346.20 | 3.22 | 24.93k |

| Globus Spirits | 972.00 | 2.92 | 41.55k |

| Chaman Lal Seti | 228.00 | 2.4 | 23.22k |

| Emami | 812.75 | 1.78 | 27.50k |

-330

July 31, 2024· 14:52 IST

RBI ‘Fit & Proper’ nod for IDBI Bank privatisation received: Sources

-330

July 31, 2024· 14:52 IST

Adani Ports and SEZ Q1 preview: Volumes, realisation to aid strong revenue growth

According to a Bloomberg poll of eight brokerages, Adani Port is expected to report a revenue of Rs 7006.80 crore, a 12% increase from the previous year and flat quarter-on-quarter. ...Read More

-330

July 31, 2024· 14:47 IST

Earnings Watch | Satin Creditcare Network Q1 net profit up 19.6% at Rs 105.3 crore Vs Rs 88 crore, YoY

-330

July 31, 2024· 14:45 IST

Spot USDINR to trade in a range of 83.50-84: Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee depreciated on importer demand for US Dollar and overnight surge in crude oil prices and touched fresh all-time low against the US Dollar. Rupee gained earlier in the day on weak Dollar and surge in domestic markets. US Dollar fell on Wednesday after Bank of Japan raised interest rates by 15 bps to 0.25% from 0.1% which led to a sharp surge in the Yen. Other Asian currencies too appreciated on weakness in the US Dollar.

We expect Rupee to trade with a slight negative bias on month-end Dollar demand from importers and OMCs. However, positive tone in the domestic markets and weak US Dollar may support the Rupee at lower levels.

Any fresh intervention by RBI may also support the Rupee. Investors may watch out for FOMC meeting outcome today and Bank of England’s monetary policy tomorrow. USDINR spot price is expected to trade in a range of Rs 83.50 to Rs 84.

-330

July 31, 2024· 14:43 IST

Earnings Watch | Barbeque Nation Hospitality Q1 net loss at Rs 5 crore Vs loss of Rs 4.3 crore, YoY

-330

July 31, 2024· 14:42 IST

Earnings Watch | JBM Auto Q1 net profit up 10.6% at Rs 33.4 crore Vs Rs 30 crore ,YoY

-330

July 31, 2024· 14:35 IST

-330

July 31, 2024· 14:26 IST

Earnings Watch | Asahi India Q1 net profit down 25% YoY

#1 Net Profit Rs78 Cr Vs Rs104 Cr (YoY)

#2 Revenue Up 4% At Rs1,132.6 Cr Vs Rs1,088.6 Cr (YoY)

#3 EBITDA Down 13% At Rs182 Cr Vs Rs209 Cr (YoY)

#4 Margin At 16% Vs 19% (YoY)

-330

July 31, 2024· 14:19 IST

Sensex Today | Suzlon Energy rises for 8th day

-330

July 31, 2024· 14:13 IST

Earnings Watch | Dwarikesh Sugar Q1 net Loss at Rs9.7 Cr vs Rs40.6 Cr (YoY)

#1 Revenue 40.3% at Rs314.2 Cr vs Rs571.2 Cr (YoY)

#2 EBITDA down 97% at Rs2.3 Cr vs Rs77.1Cr (YoY)

#3 Margin at 0.7% Vs 13.5% (YoY)

-330

July 31, 2024· 13:57 IST

Stock Market LIVE Updates | RITES Q1 board approves bonus issue of 1 share for every 1 share held

Net Profit down 24.4% at Rs 90.4 crore Vs Rs 119.6 crore and revenue down 10.8% at Rs 486 crore Vs Rs 544.3 crore, YoY

-330

July 31, 2024· 13:56 IST

Earnings Watch | HeidelbergCement India Q1 net profit down 23.5% at Rs 40 crore Vs Rs 52.3 crore, YoY

-330

July 31, 2024· 13:52 IST

Sensex Today | Nifty Auto index up 0.7%; TVS Motor, Ashok Leyland, Samvardhana Motherson top contributors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TVS Motor | 2,545.20 | 1.94 | 1.55m |

| Ashok Leyland | 258.40 | 1.9 | 6.53m |

| MOTHERSON | 197.42 | 1.71 | 6.66m |

| Balkrishna Ind | 3,316.25 | 1.7 | 202.61k |

| M&M | 2,961.25 | 1.34 | 2.69m |

| MRF | 141,754.10 | 1.3 | 8.25k |

| Bajaj Auto | 9,671.80 | 1.12 | 217.91k |

| Hero Motocorp | 5,496.35 | 0.96 | 473.09k |

| Maruti Suzuki | 12,982.25 | 0.84 | 472.33k |

| Eicher Motors | 4,978.40 | 0.54 | 291.72k |

-330

July 31, 2024· 13:48 IST

Earnings Watch | Zee Enterprises Q1 net profit at Rs 118.1 crore Vs loss of Rs 53.4 crore, YoY

-330

July 31, 2024· 13:44 IST

Brokerage Call | UBS maintains 'buy' rating on Avenue Supermart, target Rs 6,000

#1 Company’s focus is on growing topline driven by store additions

#2 Gross margin to remain in the range of 14.5-15.5 percent

#3 General Merchandise And Apparel (GM&A) segment is seeing recovery since H2FY24

#4 Closed a few DMart Ready pick up points to focus on home delivery

#5 45 percent of deliveries happen within 12 hours

#6 Investing in hiring new talents and building capabilities for the medium term

#7 Multiple grocery retailers can operate profitably given huge growth opportunity in India

-330

July 31, 2024· 13:40 IST

Titan Q1 Preview: Fewer wedding dates, spike in gold prices to hit profit

Titan is expected to see a tepid quarter amid lower number of wedding days, rising gold prices and increasing competition from regional players....Read More

-330

July 31, 2024· 13:36 IST

Earnings Watch | Indian Metals Q1 net profit up 2.7% at Rs 113 crore Vs Rs 110 crore, YoY

-330

July 31, 2024· 13:34 IST

Sensex Today | Nifty Pharma index up 1%; Lupin, Zydus Life, Aurobindo Pharma, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Lupin | 1,921.75 | 3.18 | 1.56m |

| Zydus Life | 1,247.10 | 2.27 | 857.10k |

| Aurobindo Pharm | 1,424.00 | 1.75 | 372.12k |

| Torrent Pharma | 3,163.15 | 1.67 | 525.42k |

| Alkem Lab | 5,312.95 | 1.66 | 134.12k |

| Sun Pharma | 1,724.85 | 1.37 | 936.60k |

| Biocon | 364.35 | 1.36 | 2.01m |

| Cipla | 1,545.15 | 1.06 | 975.39k |

-330

July 31, 2024· 13:31 IST

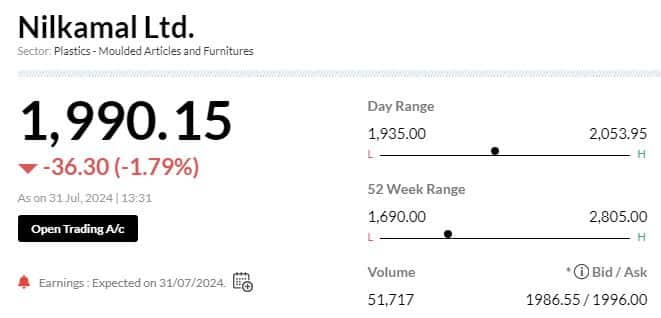

Earnings Watch | Nilkamal Q1 net profit down 43.5% at Rs 18.3 crore Vs Rs 32.4 crore, YoY

-330

July 31, 2024· 13:29 IST

Stock Market LIVE Updates | Balu Forge shares jump 6% post Q1 earnings

#1 Net profit at Rs 34.2 crore versus Rs 16.7 crore, YoY

#2 Revenue up 56 percent at Rs 175.3 crore versus Rs 112,4 crore, YoY

#3 EBITDA up 97.3 percent at Rs 43.2 crore versus Rs 21.9 crore, YoY

#4 Margin at 24.6 percent versus 19.5 percent, YoY

-330

July 31, 2024· 13:26 IST

Earnings Watch | Deepak Fertilisers Q1 net profit up 77.8% at Rs 195.6 crore Vs Rs 110 crore, YoY

-330

July 31, 2024· 13:25 IST

Earnings Watch | Birlasoft Q1 net profit down 16.6% at Rs 150.2 crore Vs Rs 180 crore, QoQ

-330

July 31, 2024· 13:21 IST

Stock Market LIVE Updates | Lexus Granito shares up marginally post Q1 numbers

#1 Net loss at Rs 3.8 crore versus loss of Rs 3.5 crore, YoY

#2 Revenue at Rs 177.8 crore versus Rs 315.7 crore, YoY

-330

July 31, 2024· 13:19 IST

Brokerage Call | Citi keeps 'buy' on Navin Fluorine International, target raises to Rs 4,350

#1 Company’s Q1 EBITDA was down 12 percent YoY, nearly 9 percent QoQ

#2 Weakness seen in agrochemical exports partly offset by higher sales in pharma CDMO

#3 Management expects improvement through FY25

#4 Improvement expected via new supply agreements in agro chemicals, commissioning & ramp-up of agro speciality plant at Dahej

-330

July 31, 2024· 13:16 IST

Sensex Today | BSE Power index up more than 1%; NTPC, JSW Energy, Suzlon Energy, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NTPC | 415.65 | 2.15 | 567.41k |

| JSW Energy | 727.80 | 1.75 | 139.06k |

| Suzlon Energy | 69.37 | 1.64 | 19.34m |

| Adani Power | 740.95 | 1.62 | 256.92k |

| Tata Power | 450.20 | 1.38 | 816.28k |

| Adani Green Ene | 1,857.35 | 1.31 | 143.70k |

| Adani Energy | 1,136.25 | 0.96 | 303.28k |

| ABB India | 7,899.70 | 0.74 | 1.41k |

| Siemens | 7,050.00 | 0.46 | 2.70k |

-330

July 31, 2024· 13:12 IST

Sensex Today | Five Star Biz Finance shares trade flat post Q1 earnings

#1 Net profit up 37% at Rs 251.6 crore Vs Rs 184 crore, YoY

#2 Revenue up 40% at Rs 666.1 crore Vs Rs 480.4 crore, YoY

-330

July 31, 2024· 13:10 IST

Sensex Today | Nifty PSU Bank index down 0.5%; J&K Bank, UCO Bank, IOB, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| JK Bank | 110.01 | -2.08 | 2.53m |

| UCO Bank | 56.26 | -1.21 | 4.78m |

| IOB | 66.77 | -1.13 | 6.01m |

| Bank of Baroda | 253.40 | -1.11 | 7.79m |

| Punjab & Sind | 66.30 | -1 | 1.42m |

| PNB | 124.44 | -0.85 | 21.93m |

| Bank of Mah | 67.23 | -0.65 | 5.36m |

| Central Bank | 63.84 | -0.56 | 3.05m |

| Canara Bank | 115.34 | -0.37 | 9.41m |

| Union Bank | 134.57 | -0.24 | 4.33m |

-330

July 31, 2024· 13:05 IST

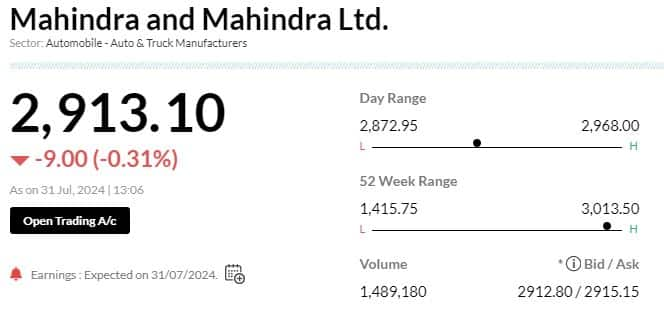

Earnings Watch | M&M Q1 net profit at Rs 2,612 crore and revenue at Rs 27,039 crore

-330

July 31, 2024· 13:04 IST

Sensex Today | Nifty Media index up 0.7%; Network 18, TV TodayNetwork, Sun TV Network, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Network 18 | 96.98 | 6.61 | 6.66m |

| TV TodayNetwork | 270.39 | 3.98 | 1.22m |

| Sun TV Network | 894.00 | 1.67 | 734.79k |

| DB Corp | 356.60 | 1.29 | 122.49k |

| Zee Entertain | 146.83 | 1.15 | 9.80m |

| Dish TV | 16.35 | 0.93 | 17.08m |

| JagranPrakashan | 101.24 | 0.37 | 209.15k |

-330

July 31, 2024· 13:01 IST

Earnings Watch | BHEL Q1 net loss at Rs 211.4 crore Vs loss of Rs 205 crore, YoY

-330

July 31, 2024· 12:57 IST

Britannia Industries Q1 Preview: Price cuts, higher grammage to support volumes, impact topline

Amid the harsh summer, out-of-consumption will be impacted, where Britannia will have a volume impact. However, price cuts are expected to buoy volumes. ...Read More

-330

July 31, 2024· 12:53 IST

Brokerage Call | Nomura maintains 'buy' rating on IOC, target Rs 195

#1 Q1 above estimates on surprising large inventory gain

#2 Results included a surprisingly large crude inventory gain of Rs 390 crore

#3 Large crude inventory gain came in a quarter where EoP crude prices remained largely steady

#4 Trades at an attractive valuation of 1.2x FY26 P/B

-330

July 31, 2024· 12:49 IST

Sensex Today | BSE Metal index up 0.7%; JSW Steel, SAIL, Hindalco Industries, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| JSW Steel | 925.55 | 2.6 | 61.49k |

| SAIL | 150.65 | 1.69 | 1.24m |

| Hindalco | 668.05 | 1.15 | 57.96k |

| Jindal Steel | 986.50 | 0.98 | 34.18k |

| Coal India | 522.20 | 0.63 | 189.94k |

| APL Apollo | 1,479.70 | 0.49 | 13.35k |

| Tata Steel | 164.40 | 0.21 | 1.10m |

| Jindal Stainles | 744.90 | 0.07 | 38.46k |

| Vedanta | 447.00 | 0.01 | 387.63k |

-330

July 31, 2024· 12:45 IST

Earnings Watch | Jain Irrigation Q1 net profit down 61.6% at Rs 13.6 crore Vs Rs 35.4 crore, YoY

-330

July 31, 2024· 12:44 IST

-330

July 31, 2024· 12:42 IST

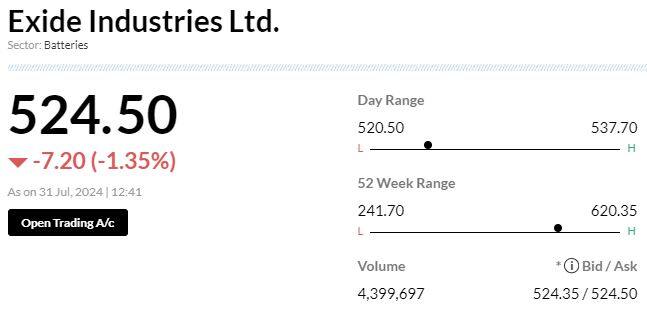

Brokerage Call | Nomura keeps 'buy' rating on Exide Industries, target Rs 589

#1 Q1 EBITDA margin below estimate

#2 Company witnessing healthy demand in automotive division, in both domestic & international markets

#3 According to management, its focus is on expanding product portfolio

#4 Management focus is on increasing market reach & offering exemplary after-sales services to customers

#5 Industrial sector segments like UPS, solar, traction, railways continue to deliver strong volumes

-330

July 31, 2024· 12:37 IST

Akums Drugs IPO sees strong retail interest, subscribed 2.4X on day 2

The Akums Drugs IPO comprises a fresh issue of 1 crore shares valued at Rs 680 crore, alongside an offer for sale of 1.73 crore shares amounting to Rs 1,176.74 crore....Read More

-330

July 31, 2024· 12:33 IST

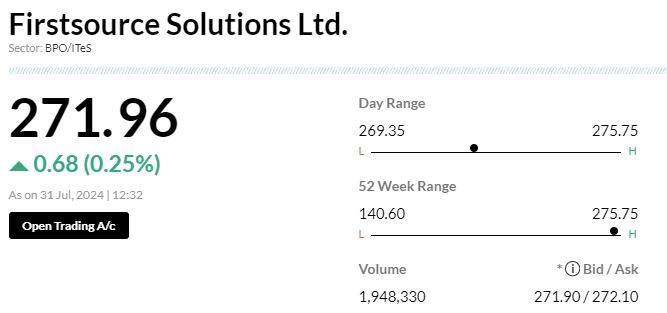

Brokerage Call | Nomura keeps 'buy' rating on Firstsource Solutions, target Rs 300

#1 Q1 revenue was a beat, margin in-line

#2 FY25 revenue growth guidance of 11.5-13.5 percent seems conservative

#3 Margin expansion to remain slow initially with front-loading of investments

#4 Raise FY26-27 EPS by 3-4 percent

-330

July 31, 2024· 12:27 IST

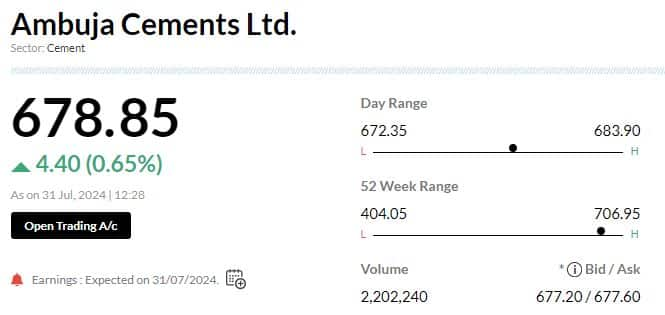

Earnings Watch | Ambuja Cements Q1 net profit down 11.5% at Rs 571 crore Vs Rs 645 crore, YoY

-330

July 31, 2024· 12:20 IST

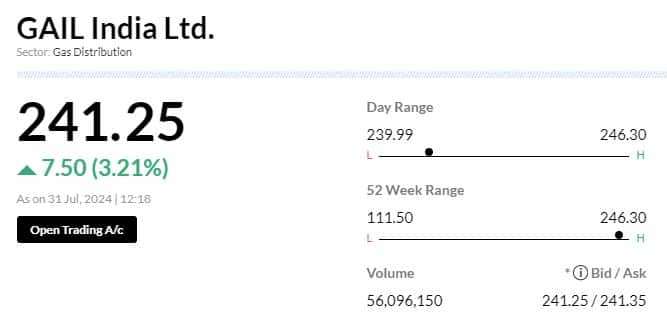

Stock Market LIVE Updates | Gail India shares gain 3% post Q1 profit rises 25%

#1 Net profit up 25.1 percent at Rs 2,724 crore versus Rs 2,177 crore, QoQ

#2 Revenue up 4.2 percent at Rs 33,673.8 crore versus Rs 32,317 crore, QoQ

#3 EBITDA up 27.3 percent at Rs 4,528.1 crore versus Rs 3,558 crore, QoQ

#4 Margin at 13.5 percent versus 11 percent, QoQ

-330

July 31, 2024· 12:17 IST

Sensex Today | BSE Healthcare, Metal indices outshine

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 60225.150.53 | 42.625.34 | 4.6967.21 |

| BSE CAP GOODS | 75648.470.21 | 35.955.71 | 4.0271.75 |

| BSE FMCG | 22478.280.26 | 9.82-0.07 | 8.4318.39 |

| BSE Metal | 32622.110.66 | 20.863.11 | -2.0147.07 |

| BSE Oil & Gas | 32634.630.51 | 41.765.68 | 10.4568.01 |

| BSE REALTY | 8583.820.1 | 38.742.29 | -0.1989.23 |

| BSE IT | 41790.860.21 | 16.051.86 | 11.0638.03 |

| BSE HEALTHCARE | 40485.400.82 | 28.323.54 | 8.6845.96 |

| BSE POWER | 8436.191.39 | 44.996.50 | 6.3992.62 |

| BSE Cons Durables | 61028.380.58 | 22.062.28 | 2.8342.75 |

-330

July 31, 2024· 12:08 IST

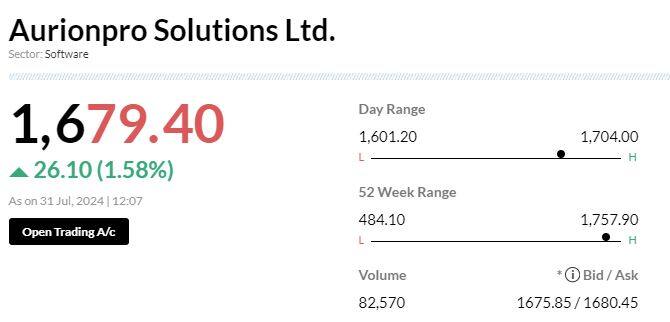

Sensex Today | Aurionpro secures major deal with Malaysia's Leading Bank

Aurionpro Solutions announced a strategic win with a leading bank in Malaysia to modernize its corporate processes. The deal is valued close to USD 3 million and is expected to be implemented over a 15 months period.

-330

July 31, 2024· 12:04 IST

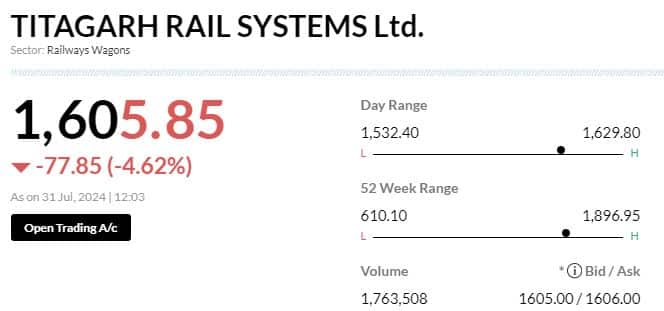

Stock Market LIVE Updates | Titagarh Rail shares fall despite Q1 profit rises

#1 Net profit up 8.4 percent at Rs 67 crore versus Rs 62 crore, YoY

#2 Revenue down 0.9 percent at Rs 903 crore versus Rs 910.8 crore, YoY

#3 EBITDA down 4.1 percent at Rs 101.7 crore versus Rs 106.1 crore, YoY

#4 Margin at 11.2 percent versus 11.7 percent, YoY

-330

July 31, 2024· 12:00 IST

Markets@12 | Nifty above 24,900, Sensex up 208 points

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Asian Paints | 3,089.00 | 2.79 | 2.44m |

| NTPC | 415.95 | 2.21 | 17.76m |

| JSW Steel | 920.35 | 2.02 | 1.15m |

| Adani Ports | 1,571.05 | 1.6 | 1.46m |

| HDFC Life | 707.40 | 1.46 | 1.90m |

| ONGC | 336.60 | 1.42 | 10.03m |

| SBI Life Insura | 1,745.35 | 1.41 | 367.41k |

| Bharti Airtel | 1,490.40 | 1.36 | 1.77m |

| Sun Pharma | 1,724.70 | 1.36 | 755.49k |

| Hindalco | 668.25 | 1.17 | 3.37m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TATA Cons. Prod | 1,178.15 | -1.4 | 1.17m |

| Divis Labs | 4,845.60 | -1.36 | 675.96k |

| Tata Motors | 1,153.85 | -0.69 | 5.89m |

| Axis Bank | 1,162.80 | -0.62 | 8.61m |

| Power Grid Corp | 347.95 | -0.53 | 9.22m |

| Infosys | 1,867.60 | -0.51 | 1.69m |

| Dr Reddys Labs | 6,776.95 | -0.4 | 76.43k |

| Reliance | 3,014.60 | -0.39 | 2.51m |

| IndusInd Bank | 1,426.00 | -0.26 | 1.59m |

| SBI | 870.70 | -0.24 | 4.21m |

-330

July 31, 2024· 11:52 IST

Reserve Bank of India to hold rates in August, first cut in Q4

A sharp spike in food prices drove inflation in Asia's third-largest economy to a five-month high of 5.08% in June, well above the RBI's 4% medium-term target, suggesting the central bank will be wary of easing monetary policy too soon....Read More

-330

July 31, 2024· 11:50 IST

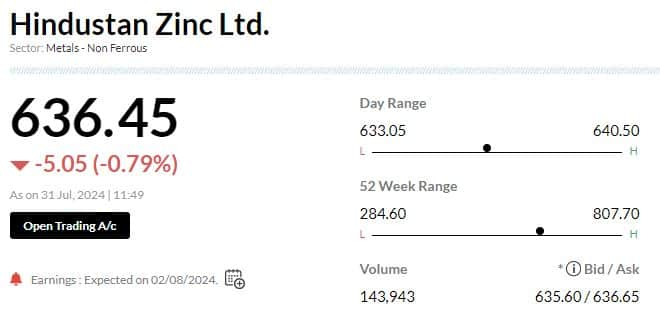

Stock Market LIVE Updates | Hindustan Zinc shares fall on I-T demand order of Rs 1,170 crore for AY 2020-21

-330

July 31, 2024· 11:47 IST

Sensex Today | BSE Smallcap index hits new high

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oswal Greentech | 42.46 | 15.16 | 478.04k |

| Jayaswal Neco | 53.75 | 13.83 | 124.68k |

| KFin Tech | 890.90 | 8.46 | 106.51k |

| SML Isuzu | 2,252.80 | 6.81 | 3.94k |

| Aptech | 235.15 | 6.67 | 38.80k |

| Granules India | 625.85 | 6.47 | 214.13k |

| Skipper | 429.00 | 6.25 | 284.00k |

| Thyrocare Techn | 821.75 | 5.89 | 29.48k |

| Kokuyo Camlin | 179.60 | 5.58 | 98.29k |

| Suven Pharma | 1,000.10 | 5.52 | 110.76k |

-330

July 31, 2024· 11:45 IST

Brokerage Call | CLSA downgrade Dixon Technologies to 'hold', target raises to Rs 11,400

#1 Strong Q1 with PAT up 108 percent YoY & expect this momentum to continue

#2 Mobile phones are likely to be mainstay in near-term

#3 Likely to see ramp-up of existing contracts & new clients onboarding

#4 Believe company is gearing up for strong medium-term growth by entering into IT hardware segment and mobile components

-330

July 31, 2024· 11:36 IST

Stock Market LIVE Updates | L&T bags order in the range of Rs 1,000-2,500 cr for the construction of automobile plant

-330

July 31, 2024· 11:34 IST

Shrey Jain, Founder and CEO, SAS Online

The Nifty index has encountered resistance at the 25,000 level for two consecutive days, with recent trading patterns indicating a possible decline to 24,600 or even 24,500. The significant open interest (OI) of around 76 lakh shares at the 25,000 call strike points to robust resistance. In contrast, the 24,600 put strike has an OI of approximately 43 lakh shares, suggesting it may offer support.

In parallel, the Bank Nifty has shown volatility, closing near 51,500 yesterday. For today's monthly settlement, the Bank Nifty is likely to face resistance at higher levels, particularly at the 52,000 strike, which has considerable OI. On the downside, the 51,000 level is expected to act as support.

Investors should be cautious and refrain from taking aggressive short positions unless there is a clear break in the upward trend.

-330

July 31, 2024· 11:29 IST

Stock Market LIVE Updates | Zydus Life gets nod from Mexico regulator for Trastuzumab Biosimilar

Zydus Life receives marketing approval from Mexican regulatory authority for drug is used in the treatment of early breast cancer (EBC) and advanced gastric cancer

-330

July 31, 2024· 11:26 IST

Stock Market LIVE Updates | GAIL concall snippets

#1 We Saw Increased Natural Gas Marketing Volumes In Domestic Markets

#2 Profits Higher Due To Better Gas Trading Margins & Gas Transmission Volumes

#3 There Was An Increase Of 5 mmscmd Volumes In Domestic Market Led By Power Segment

#4 We Aim To Add 80 New CNG Stations In The Next 2 Years

#5 GAIL Gas Turnover Stood At Rs 279 Cr In Q1FY25 Due To Better Volumes In CNG Segment

#6 PAT For GAIL Gas Stood At Rs 110 Cr

-330

July 31, 2024· 11:20 IST

Stock Market LIVE Updates | Dixon to start making Google Pixel from September, Atul Lall confirms CCI nod for Transsion deal

Leading electronics manufacturer Dixon Technologies has secured the Competition Commission of India's clearance to acquire a majority 50.10 per cent share in Ismartu India - a subsidiary of Chinese handset maker Transsion Technology - company’s Managing Director, Atul Lall said in the earnings call on July 30.

Lall confirmed that Dixon Tech through its subsidiary Padget Electronics' pact with Taiwan's Compal Electronics will start making Google Pixel smartphones from September this year.

"On the Ismartu deal, we received approval from the Competition Commission of India this month, and we will start consolidating those financials...we have got a large scale through the deal," he said during the Q1 earnings call.

Dixon has created a capacity of 45 million smartphones and will add another 10-12 million after the Ismartu acquisition, which is around 55-60% of the opportunity pool in this business. Read More

-330

July 31, 2024· 11:15 IST

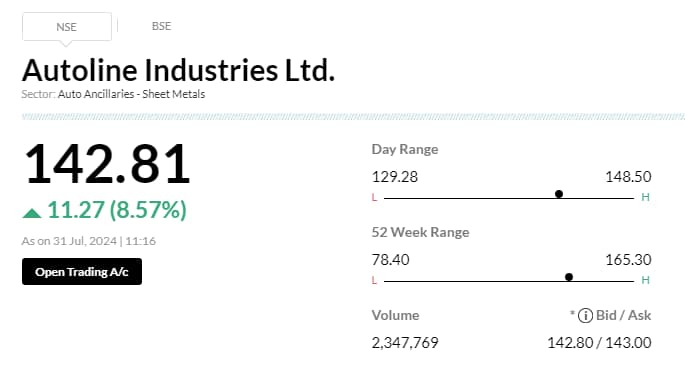

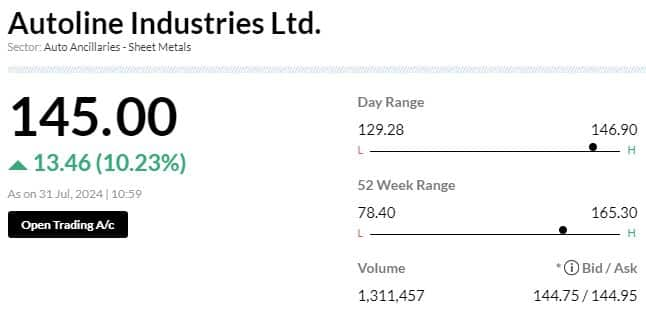

Stock Market LIVE Updates | Autoline Industries bags order worth Rs 147 crore from Tata Motors Passenger Vehicle

-330

July 31, 2024· 11:09 IST

Sensex Today | BSE Midcap index up nearly 1%, hits fresh record high

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Torrent Power | 1,873.65 | 17.13 | 267.09k |

| Linde India | 8,344.55 | 4.31 | 9.34k |

| Persistent | 4,958.15 | 3.73 | 20.59k |

| Clean Science | 1,641.00 | 3.6 | 65.49k |

| New India Assur | 294.65 | 3.26 | 134.67k |

| Jubilant Food | 598.70 | 3.22 | 109.53k |

| Gujarat Fluoro | 3,378.15 | 3.15 | 5.13k |

| Lupin | 1,912.65 | 2.72 | 21.14k |

| Polycab | 6,855.00 | 2.68 | 6.77k |

| GMR Airports | 102.69 | 2.67 | 3.31m |

-330

July 31, 2024· 11:05 IST

Sensex Today | BSE Midcap index outperform

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 81706.270.31 | 13.101.94 | 2.8122.82 |

| BSE 200 | 11579.430.45 | 20.132.69 | 3.6035.33 |

| BSE MIDCAP | 48632.410.85 | 32.013.87 | 4.2059.87 |

| BSE SMALLCAP | 55522.390.2 | 30.113.14 | 4.8558.62 |

| BSE BANKEX | 58855.240.17 | 8.230.12 | -1.6714.43 |

-330

July 31, 2024· 10:59 IST

Stock Market LIVE Updates | Autoline Industries bags order from Tata Motors

Autoline Industries entered into an order/contract with Tata Motors Passenger Vehicle for manufacturing tools & supply of sheet metal parts & assemblies.

-330

July 31, 2024· 10:55 IST

SEBI curbs combined with tax increases will take the wind out of the derivative market

Reducing the number of weekly expiry indices is likely to reduce trading volume significantly. With only two expiries instead of the current five, exchange volumes will drop considerably....Read More

-330

July 31, 2024· 10:52 IST

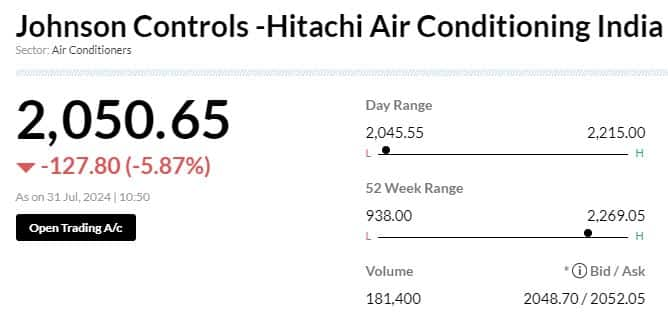

Stock Market LIVE Updates | Johnson Controls slips 5% despite posting profit in Q1

#1 Net profit at 36.2 crore versus loss of 41 crore, YoY

#2 Revenue up 75.6 percent at Rs 996 crore versus Rs 567.2 crore, YoY

#3 EBITDA at Rs 56.6 crore versus EBITDA loss of Rs 36 crore, YoY

#4 Margin at 5.7 percent, YoY

-330

July 31, 2024· 10:49 IST

Adani Energy Solutions launches QIP to raise up to Rs 8,373 crore, sees 5x demand from investors: CNBC-TV18

Adani Energy Solutions QIP issue has garnered strong demand, being subscribed almost five times, with investor interest amounting to nearly $5 billion...Read More

-330

July 31, 2024· 10:45 IST

Sensex Today | Loyal Textiles, Priti International, among others locked at upper circuit

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Priti Internati | 137609.00 | 163.6420 | 13511222696.10 |

| Loyal Textiles | 19317.00 | 718.7019.99 | 217382334.25 |

| Indiabulls Ent | 600300.00 | 11.9910 | 2476594490841.55 |

| Ind-Swift | 277331.00 | 27.0710 | 285494122001.90 |

| Country Condos | 175126.00 | 8.079.95 | 968975468740.10 |

| Cerebra Int | 4310256.00 | 10.715 | 179186385006.35 |

| Indo Tech Trans | 9069.00 | 2127.655 | 857527973.90 |

| Hexa Tradex | 234485.00 | 224.135 | 968571347.85 |

| Almondz Global | 115487.00 | 35.505 | 20172601474260.35 |

| Walchandnagar | 178957.00 | 418.895 | 423824915313.70 |

-330

July 31, 2024· 10:42 IST

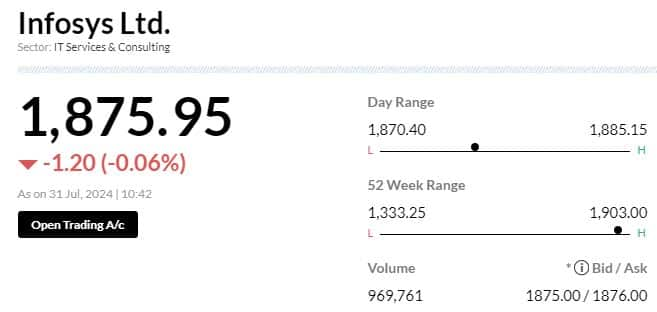

Stock Market LIVE Updates | Infosys collaborates with TDC net to accelerate digital transformation

Infosys has partnered with TDC Net, a Danish infrastructure provider, to transform TDC Net into a customer-centric technology company. The collaboration aims to modernize TDC Net's IT infrastructure, enhance customer experience, and optimize service costs.

Infosys will implement AI-driven hyper-automation and consolidate TDC Net's IT systems to boost productivity.

-330

July 31, 2024· 10:39 IST

Government looking at 100% FDI in online gaming: Report

The change could eliminate the need for official approval under the automatic route, making it easier for startups to attract foreign capital ...Read More

-330

July 31, 2024· 10:35 IST

Sensex Today | BSE Oil & Gas index up 0.7%; Gail, Petronet LNG, HPCL, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| GAIL | 244.20 | 4.52 | 1.96m |

| Petronet LNG | 372.25 | 2.52 | 72.53k |

| HINDPETRO | 399.20 | 0.87 | 543.34k |

| ONGC | 334.55 | 0.83 | 310.11k |

| IGL | 556.50 | 0.61 | 21.60k |

| BPCL | 350.10 | 0.46 | 440.42k |

| Adani Total Gas | 900.00 | 0.42 | 28.38k |

-330

July 31, 2024· 10:32 IST

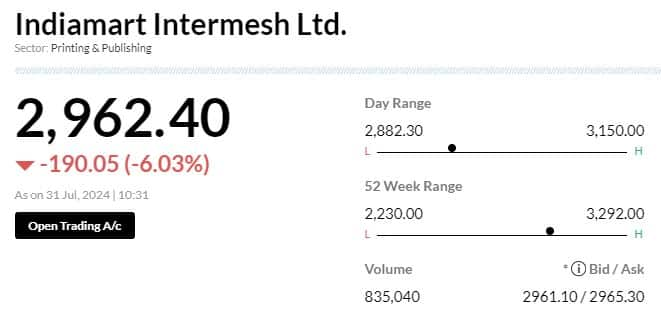

Brokerage Call | Nomura maintains 'neutral' call on Indiamart Intermesh, target Rs 2,520

#1 Q1FY25 results a mixed bag

#2 Key positive: Sharp increase in EBITDA margin to 36.1 percent, up 870 bps YoY

#3 Key negative: Weak net subscriber additions at 1,519 Vs 5,000 YoY & 2,600 QoQ

#4 Weak collections at Rs 340 crore, up 14 percent YoY Vs estimate of 19 percent growth

#5 No end in sight to high churn of subscribers

#6 Reported EBITDA margin to have tailwinds in near term, but drop once churn reduces

-330

July 31, 2024· 10:29 IST

IndiaMART shares tank 6% on lower subscriber additions in Q1

IndiaMART's collections from customer rose 14 percent to Rs 366 crore, primarily comprising of standalone collections of Rs 341 crore. ...Read More

-330

July 31, 2024· 10:27 IST

Stock Market LIVE Updates | Torrent Power shares up 9% after Q1 profit jumps 87%

#1 Net profit up 87.2 percent at Rs 996.3 crore versus Rs 532.3 crore, YoY

#2 Revenue up 23.3 percent at Rs 9,033.7 crore versus Rs 7,327.6 crore, YoY

#3 EBITDA up 56.8 percent at Rs 1,857.9 crore versus Rs 1,184.8 crore

#4 Margin at 20.6 percent versus 16.2 percent, YoY

-330

July 31, 2024· 10:21 IST

Manglam Infra makes impressive debut on NSE SME by listing at 90% premium

The funds raised through the IPO will be utilised to meet the company's working capital requirements and general corporate purposes....Read More

-330

July 31, 2024· 10:18 IST

Stock Market LIVE Updates | Jindal Stainless shares up 3% despite Q1 profit dips

#1 Net profit down 13.1 percent at Rs 648.1 crore versus Rs 746 crore, YoY

#2 Revenue down 7.4 percent at Rs 9,429.8 crore versus Rs 10,184 crore, YoY

#3 EBITDA up 1.6 percent at Rs 1,211.8 crore versus Rs 1,192.4 crore, YoY

#4 Margin at 12.9 percent versus 11.7 percent, YoY

#5 Board approves raising funds up to Rs 5,000 crore

-330

July 31, 2024· 10:15 IST

Sensex Today | NTPC, BPCL, Tech Mahindra, among others hit 52-week high

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| NTPC | 417.40 | 417.40 | 415.25 |

| Tech Mahindra | 1560.70 | 1560.70 | 1,558.35 |

| BPCL | 354.10 | 354.10 | 350.75 |

| Maruti Suzuki | 13076.30 | 13076.30 | 12,945.05 |

| Tata Motors | 1167.90 | 1167.90 | 1,154.00 |

| Power Grid Corp | 350.65 | 350.65 | 345.75 |

-330

July 31, 2024· 10:08 IST

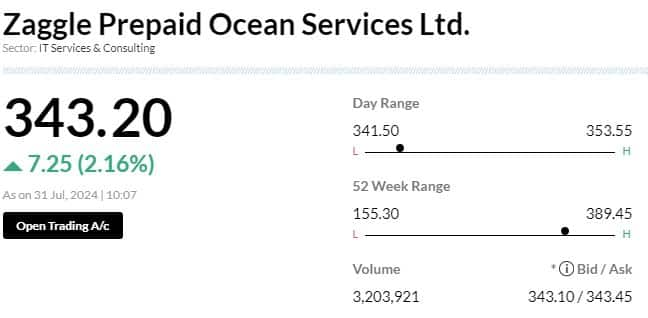

Stock Market LIVE Updates | Zaggle Prepaid Ocean Services shares gain 2% post Q1 results

#1 Net profit at Rs 16.7 crore versus Rs 2 crore, YoY

#2 Revenue at Rs 252.2 crore versus Rs 118.5 crore, YoY

#3 EBITDA at 22.4 crore versus Rs 8 crore, YoY

#4 Margin at 8.9 percent versus 6.8 percent, YoY

-330

July 31, 2024· 10:04 IST

Markets@10 | Sensex, Nifty trade higher

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NTPC | 417.15 | 2.51 | 11.91m |

| Asian Paints | 3,077.45 | 2.41 | 1.01m |

| Hindalco | 669.40 | 1.35 | 1.67m |

| Adani Enterpris | 3,169.00 | 1.29 | 480.88k |

| Bharti Airtel | 1,487.75 | 1.18 | 782.24k |

| JSW Steel | 912.45 | 1.15 | 394.32k |

| BPCL | 351.80 | 1.03 | 6.89m |

| ONGC | 335.05 | 0.95 | 4.56m |

| ICICI Bank | 1,220.00 | 0.87 | 4.65m |

| ITC | 493.90 | 0.82 | 1.66m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TATA Cons. Prod | 1,175.55 | -1.62 | 624.25k |

| Axis Bank | 1,161.00 | -0.77 | 5.63m |

| Power Grid Corp | 347.40 | -0.69 | 5.71m |

| IndusInd Bank | 1,420.40 | -0.65 | 691.52k |

| Reliance | 3,007.25 | -0.63 | 1.69m |

| HUL | 2,677.10 | -0.53 | 237.93k |

| Tata Motors | 1,155.80 | -0.52 | 3.24m |

| Divis Labs | 4,887.35 | -0.51 | 193.34k |

| Grasim | 2,779.15 | -0.42 | 81.70k |

| HCL Tech | 1,627.60 | -0.16 | 318.05k |

-330

July 31, 2024· 10:02 IST

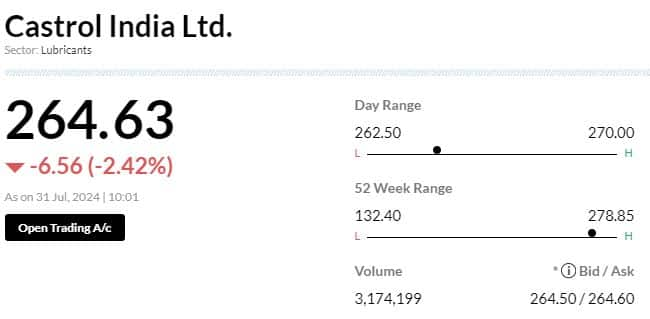

Stock Market LIVE Updates | Castrol India shares fall 2% post Q2 results

#1 Net Profit up 3 percent At Rs 232.2 crore Versus Rs 225 crore, YoY

#2 Revenue up 4.8 percent at Rs 1,397.5 crore versus Rs 1,333.8 crore, YoY

#3 EBITDA up 4.1 percent at Rs 322.4 crore versus Rs 309.8 crore, YoY

#4 Margin at 23.1 percent versus 23.2 percent, YoY

-330

July 31, 2024· 09:55 IST

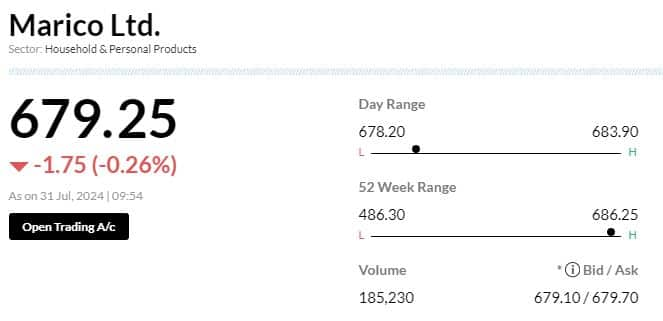

Stock Market LIVE Updates | Marico gets income tax demand order of Rs 142.07 crore for Assessment Year 2020-21

-330

July 31, 2024· 09:52 IST

Sensex Today | BSE Healthcare index gain 0.5%; Suven Pharma, Thyrocare Technologies, Jubilant Pharmova among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Suven Pharma | 1,053.45 | 11.15 | 60.31k |

| Thyrocare Techn | 826.80 | 6.54 | 11.19k |

| Jubilant Pharmo | 773.95 | 5.37 | 15.59k |

| Dishman Carboge | 177.00 | 4.95 | 15.80k |

| Granules India | 610.85 | 3.92 | 81.24k |

| SMS Pharma | 296.80 | 3.27 | 26.49k |

| Ajanta Pharma | 2,595.60 | 2.89 | 8.63k |

| AstraZeneca | 7,162.90 | 2.49 | 158 |

| SOLARA ACTIVE P | 624.95 | 2.47 | 373 |

| GlaxoSmithKline | 2,768.30 | 2.43 | 1.24k |

-330

July 31, 2024· 09:50 IST

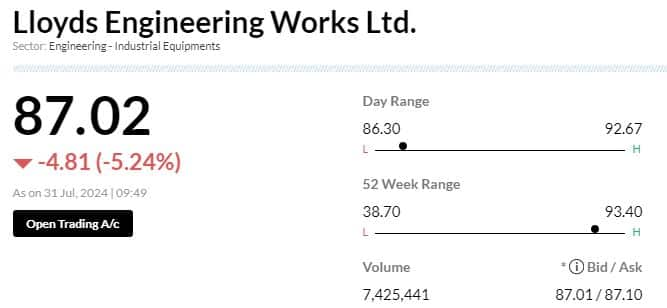

Stock Market LIVE Updates | Lloyds Engineering board approves right issue

Lloyds Engineering Works board approved the issuance of fully paid-up or partly paid up equity shares of the company for an amount not exceeding Rs 1,050 crore by way of a rights issue to the eligible equity shareholders of the company.

-330

July 31, 2024· 09:49 IST

Stock Market LIVE Updates | South Indian Bank board approves fund raising up to Rs 750 core via QIP or FPO or other mode

-330

July 31, 2024· 09:46 IST

M&M Q1 Preview: Net profit remains muted, revenue may rise 17% on auto, tractor recovery

During the quarter, the company will likely outperform Tata Motors (3rd largest) for a fifth consecutive quarter. ...Read More

-330

July 31, 2024· 09:43 IST

Sensex Today | BSE Realty down 0.5%; Sobha, Phoenix Mills, Brigade Enterprises, among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sobha | 1,791.05 | -2.22 | 3.66k |

| Phoenix Mills | 3,641.45 | -1.5 | 2.93k |

| Brigade Ent | 1,262.60 | -1.07 | 1.71k |

| Godrej Prop | 3,159.10 | -0.68 | 2.60k |

| DLF | 873.80 | -0.68 | 14.77k |

| Mahindra Life | 609.00 | -0.33 | 1.28k |

| Prestige Estate | 1,843.80 | -0.22 | 5.06k |

-330

July 31, 2024· 09:34 IST

Adani Group may consider $1 billion bid for Jaypee’s realty assets: Reports

The acquisition would place Adani in direct competition with other major players in the Indian real estate sector, such as the Godrej Group, Tata Group, Larsen & Toubro, and the Raymond Group. ...Read More

-330

July 31, 2024· 09:32 IST

Stock Market LIVE Updates | Adani Energy launches QIP to raise up to Rs 8,373 crore | Sources

#1 Indicative price of Rs 976 per share

#2 Indicative price at 13.24 percent discount to closing price & 4.98 percent discount to SEBI floor price

#3 To utilise QIP proceeds for capex requirements & debt repayment