Closing Bell: Nifty around 19,750, Sensex gains 307 pts; IT stocks shine

-330

November 16, 2023· 16:18 IST

Benchmark indices ended higher for the second consecutive session on November 16 with Nifty around 19,750. At close, the Sensex was up 306.55 points or 0.47 percent at 65,982.48, and the Nifty was up 89.70 points or 0.46 percent at 19,765.20.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

November 16, 2023· 16:17 IST

-330

November 16, 2023· 16:08 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets edged higher and gained nearly half a percent, in continuation of Wednesday’s surge. After the flat start, Nifty maintained a positive tone for most of the day however profit taking in the final hour trimmed the gains. Eventually, it settled at 19,765 levels; up by 0.46%. The majority of the sectors were aligned to the move wherein IT and realty were among the top performers. The broader indices maintained their outperformance and the midcap index made a new high as well.

Nifty tested the target zone of 19,850 in no time after the breakout and we expect a breather now. All sectors are participating in the move on a rotational basis however banking is still not performing on the expected lines. Amid all, we suggest focusing on pockets that are witnessing consistent interest and using intermediate dips to accumulate them. Needless to say, the prevailing buoyancy in midcap and smallcap packs is adding to the offerings, so traders should plan their positions accordingly.

-330

November 16, 2023· 15:59 IST

Prashanth Tapse, Research Analyst-Sr VP Research, Mehta Equities

Although key indices pared gains towards the closing hour, markets continued its upward bias due to upsurge in IT and realty stocks. Moderating inflation in the US could be signalling that the Federal Reserve may be done with rate hikes, which is good for global markets. Further, domestic economic numbers like exports have shown signs of recovery, which has further boosted the market sentiment and has triggered renewed buying interest in recent sessions.

-330

November 16, 2023· 15:58 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The Indian market continued its positive resurgence, tracking global gains. Softer than expected US inflation data and easing bond yields has bought optimism that spending will emerge like in technology.

Taking the cues further, IT stocks shown a significant jump in the broader market. The market is sensing that exports based sectors like IT and Pharma could be future winners. While cut in inflation will also benefits domestic placed staples and consumer sector.

-330

November 16, 2023· 15:49 IST

Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox:

To breakout on the upside, the index must deliver a resilient closing over 19850 to mitigate any volatile scenario. When that occurs, the trend is foreseeable to hit a new historic peak. As of now, 19500 shall operate as an immediate support, and until this mark is shielded, the trend shall witness bullish bias. The trend to remain upward until medium-term support of 19300 is held high.

For Bank Nifty the 100-simple moving average (SMA) situated at 44510, should present a key hurdle for the ongoing upward rally. Unless this is taken out, the trend could take a pause. Only by overpowering the 100-SMA could the bias recoup positivity towards reaching the 46000 level. On the downside, 43500 – 43600 will pose as support range. Only a breakdown beneath 43000 could alter the optimistic bias.

-330

November 16, 2023· 15:46 IST

Aditya Gaggar Director of Progressive Shares:

Today's trade was dominated by Tech stocks which provided an impetus for the Index to compound its gains but in the last hour of the trade, the Index erased half of its gains and settled at 19,765.20 with gains of 89.75 points. Apart from IT; Realty and Pharma sectors outperformed with gains of almost 1%. Mid and Smallcaps also advanced by 0.78% & 0.58% which shows a strong market breadth.

Nifty50 has made a strong bullish candle on the daily chart but a sharp up-move has already been seen in the last two sessions and we feel that, there will be a profit-booking activity that will drag the Index lower. A level of 19,850 will continue to remain as immediate resistance while a zone of 19,580-19,550 will be a strong support area. There is a possibility of forming an Inverted Head and Shoulder as well but it is too premature to say.

-330

November 16, 2023· 15:37 IST

Rupee Close:

Indian rupee ended lower at 83.23 per dollar versus previous close of 83.14.

-330

November 16, 2023· 15:30 IST

Market Close

: Benchmark indices ended higher for the second consecutive session on November 16 with Nifty around 19,750.

At close, the Sensex was up 306.55 points or 0.47 percent at 65,982.48, and the Nifty was up 89.70 points or 0.46 percent at 19,765.20. About 1964 shares advanced, 1665 shares declined, and 109 shares unchanged.

Major gainers on the Nifty were Hero MotoCorp, Tech Mahindra, TCS, HCL Technologies and Infosys, while losers were Axis Bank, Coal India, Power Grid Corporation, Tata Consumer Products and Adani Enterprises.

Among sectors, information technology index gained nearly 3 percent, while realty, oil & gas and auto up 1 percent each.

BSE Midcap and Smallcap indices added 1 percent each.

-330

November 16, 2023· 15:28 IST

Riyank Arora, Technical Analyst at Mehta Equities

The Nifty has reached a significant major resistance level at 19,850. With the overall trend remaining positive and the immediate support at 19,700, it is anticipated that the benchmark index will consolidate near 19,700 and experience a minor pullback rally towards 19,800. The momentum is expected to be sideways, and a substantial upward movement may only be anticipated if it surpasses 19,875 and then target 19900 and above, However, a break below 19,700 could lead the index to revisit the 19,550 and 19,500 levels as part of a profit-booking downward movement.

The Bank Nifty is currently around the crucial resistance level of 44,500. The breach below Wednesday's low signals a potential profit-booking downward movement towards 43,900 and 43,680. The overall trend appears to be sideways, and it is anticipated that the Bank Nifty will trade within the broader range of 43,250 to 44,500. On the 15-minute charts, the Bank Nifty has formed a double top and seems poised to decline towards the 43,900 levels.

The overall sentiment seems to be on a profit booking mode, however the broader trend continues to remain positive - so we can expect good buying to return on levels and we recommend investors to follow a buy on dips strategy.

-330

November 16, 2023· 15:27 IST

Stock Market LIVE Updates | Jefferies View On Grasim Industries

-Buy call, target Rs 2,300 per share

-Q2 EBITDA was tad below estimate on weaker chemical segment (on pricing)

-VSF surprised positively on better volumes/improved unit EBITDA

-While standalone business remain choppy

-All eyes remain on the targeted paint launch over the next 3-4 months

-Cut EBITDA by 8-9 percent to reflect weakness in current set of standalone business

-330

November 16, 2023· 15:22 IST

Sensex Today | A R Ramachandran of Tips2Trade:

Nifty looks bullish on the Daily charts with strong resistance at 19895. A daily close above this resistance could lead to the target of 20150 in the near term. Support now will be at 19695.

Meanwhile, Nifty Bank looks bearish on the Daily charts with strong resistance at 44200. A daily close below the support of 44000 could lead to the target of 43525 in the near term.

-330

November 16, 2023· 15:19 IST

Stock Market LIVE Updates | CLSA View On Bajaj Finance

-Buy call, target Rs 9,500 per share

-View this as more of an ops breach rather than major violation of RBI’s guidelines

-Believe it should be resolved in one to two quarters

-While ban is in effect, calculations suggest that it will impact profits by 6 percent

-330

November 16, 2023· 15:13 IST

Stock Market LIVE Updates | Morgan Stanley View On Oil and Natural Gas Corporation

-Overweight call, target Rs 216 per share

-Production growth after more than a decade of decline is key for outperformance

-Management call today highlighted that it's now largely de-risked

-Will increase oil production to 45,000 barrels & gas to 10 mmscmd in FY25

-Capex of USD 4-4.2 billion per annum over the next two years, 10-17 percent higher than normal

-330

November 16, 2023· 15:05 IST

Sensex Today | Prashanth Tapse, Research Analyst-Sr VP Research, Mehta Equities:

Short term traders can buy TCS before record date (25th Nov 2023) and use the opportunity to generate decent returns based on assumed entitlement ratio. Based on the buyback rate of Rs 4150, short term investors can generate 18% ROI based on today’s price of Rs 3519. In addition, investors can get tax benefits as the income generated from this buyback of shares is tax exempted.

We advise investors to buy 48 shares (Rs 200000/4150) to get maximum entitlement under Rs 200000 retail category.

In the long term we continue to be optimistic on the IT sector wherein TCS and INFY would remain investors' favourite counters to hold.

-330

November 16, 2023· 14:49 IST

Stock Market LIVE Updates | Astrazeneca India to exit Bangalore Manufacturing site

-330

November 16, 2023· 14:44 IST

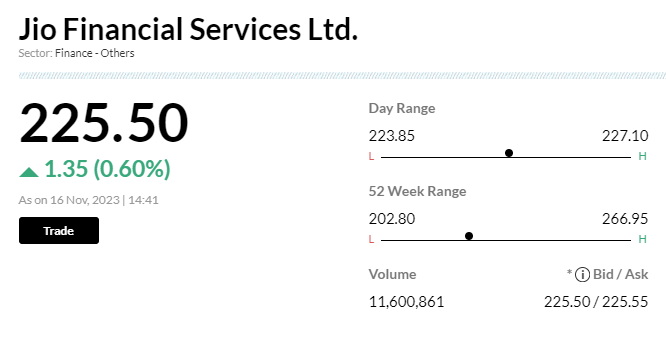

Stock Market LIVE Updates | Jio Financial Services gets RBI nod to appoint Isha Mukesh Ambani, Anshuman Thakur and Hitesh Kumar Sethia as directors of the company

-330

November 16, 2023· 14:39 IST

-330

November 16, 2023· 14:34 IST

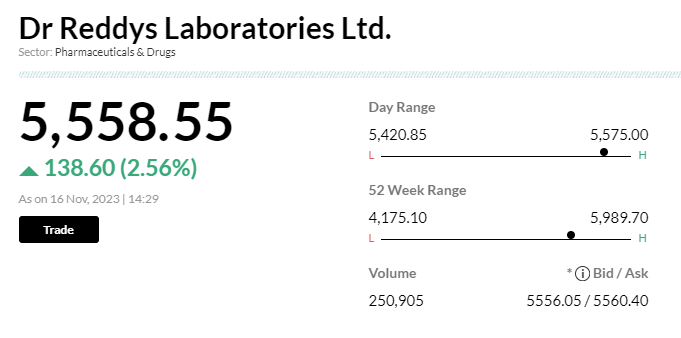

Stock Market LIVE Updates | Dr Reddy’s rolls out Nerivio, a US FDA-approved migraine management device, in India

-330

November 16, 2023· 14:29 IST

-330

November 16, 2023· 14:24 IST

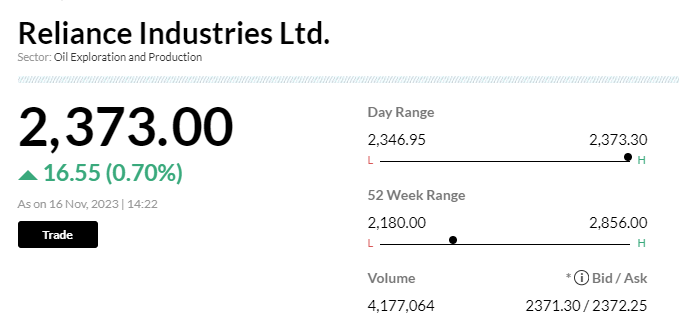

Stock Market LIVE Updates | RIL gains 0.6% after huge block deal

Shares of Reliance Industries Ltd gained 0.6 percent after a huge block deal. Around 1.06 million shares changed hands in a bunch of trades, according to Bloomberg. However, details of the buyers and sellers were not known.

-330

November 16, 2023· 14:14 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 19815.10 0.71 | 9.44 2.16 | 0.42 7.63 |

| NIFTY BANK | 44354.20 0.35 | 3.18 1.54 | 0.29 4.28 |

| NIFTY Midcap 100 | 41698.10 0.71 | 32.34 2.86 | 2.73 33.66 |

| NIFTY Smallcap 100 | 13895.25 0.77 | 42.79 4.45 | 7.37 43.30 |

| NIFTY NEXT 50 | 46584.75 0.34 | 10.42 2.02 | 2.56 7.90 |

-330

November 16, 2023· 14:09 IST

Stock Market LIVE Updates | Citi View On Bajaj Finance

-Neutral call, target Rs 8,375 per share

-Company will undertake a detailed review of key fact statement

-Will implement requisite corrective actions to RBI’s satisfaction at the earliest

-Of the 4.2 crore active EMI CIF franchise as of Sep 2023, active Insta EMI CIF was 42 lakh

-In H1FY24, 1.34 crore Insta EMI cards were acquired digitally

-B2B loans from digital EMI cards have been 3.8-4.2 percent of loans booked

-330

November 16, 2023· 14:04 IST

Stock Market LIVE Updates | Dr. Reddy's rolls out Nerivio, a USFDA-approved drug-free non-invasive migraine management device, in India

Dr. Reddy’s Laboratories announced the roll-out of Nerivio in India, a state-of-the-art United States Food and Drug Administration (USFDA) approved wearable therapy device for drug-free management of migraine.

-330

November 16, 2023· 14:00 IST

Sensex Today | Market at 2 PM

The Sensex was up 476.03 points or 0.72 percent at 66,151.96, and the Nifty was up 136.90 points or 0.70 percent at 19,812.40. About 1835 shares advanced, 1376 shares declined, and 85 shares unchanged.

-330

November 16, 2023· 13:56 IST

-330

November 16, 2023· 13:54 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Natura Hue | 12.44 | 64.99 | 7.54 |

| PRO CLB GLOBAL | 11.30 | 64.72 | 6.86 |

| Natural Biocon | 14.91 | 40.93 | 10.58 |

| Bang Overseas | 65.42 | 38.78 | 47.14 |

| Modern Steels | 31.04 | 31.97 | 23.52 |

| BCPL Railway In | 90.69 | 31.97 | 68.72 |

| Remi Edelstahl | 80.50 | 26.45 | 63.66 |

| Ashika Credit | 58.47 | 24.91 | 46.81 |

| Mishtann Foods | 16.50 | 24.72 | 13.23 |

| The Hi-Tech Gea | 497.25 | 23.07 | 404.05 |

-330

November 16, 2023· 13:44 IST

Stock Market LIVE Updates | Nomura View On ONGC

-Reduce call, target Rs 140 per share

-Reported weak earnings, as its volume trajectory remained muted

-Other expenses jumped

-Q2 EBITDA below estimates on higher opex; volumes remain muted

-KG 98/2 oil production to start from Nov 2023; peak production in CY25

-330

November 16, 2023· 13:41 IST

Sensex Today | BSE Healthcare index added 1 percent led by Gufic Biosciences, Unichem Laboratories, Wockhardt:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Wockhardt | 333.05 | 18.76 | 782.49k |

| Gufic Bio | 296.05 | 7.62 | 25.35k |

| Unichem Labs | 437.45 | 5.27 | 5.94k |

| AMSL | 167.10 | 4.6 | 76.41k |

| Marksans Pharma | 139.05 | 4.2 | 482.18k |

| Dishman Carboge | 166.25 | 3.94 | 32.44k |

| Narayana Hruda | 1,176.00 | 3.72 | 50.83k |

| Rainbow Child | 1,055.00 | 3.34 | 6.25k |

| FDC | 396.25 | 3.15 | 26.88k |

| Glenmark | 772.30 | 2.89 | 47.68k |

-330

November 16, 2023· 13:38 IST

Stock Market LIVE Updates | Geojit View on Jyothy Labs

Easing inflation, along with strong rural & consumption pushes by the GoI will aid demand. Expanded distribution and a focus on the LUP strategy will support company’s volume growth.

Geojit revise its target price to Rs 405 (from Rs 291), valuing at 37x FY25E EPS, considering the strong margins and healthy volumes. However, maintain SELL rating due to sharp increase in valuation.

-330

November 16, 2023· 13:30 IST

Stock Market LIVE Updates | Rajiv Rajgopal designated as Chairman of Akzo Nobel India

Akzo Nobel India board appointed Mr. Rohit Ghanshyamdas Totla as an Additional Director in the category of Wholetime Director (being in the whole-time employment) of the Company, effective 16th November 2023, pursuant to recommendation of the Nomination and Remuneration Committee, and subject to approval of the shareholders of the company.

Also taken note of/approved the resignation of Mr. Oscar Christian Maria Jozef Wezenbeek from the Directorship and consequently the Chairmanship of the Board of Directors of the Company and appointed/designated Mr. Rajiv Rajgopal, Managing Director, as the Chairman of the Board of Directors of the Company w.e.f. 16th November 2023.

-330

November 16, 2023· 13:26 IST

Stock Market LIVE Updates | Sharekhan View on Sanofi India:

Sanofi’s established presence in chronic therapies with a likely continued growth in anti-diabetic, cardiology, vaccines, and CNS products besides rationalisation of operations should drive profitability going forward.

High-growth visibility from chronics, strong balance sheet and cashflows, and sturdy dividends continue to be key positives. Post the decline in the stock price in the previous year, the stock has recovered and is now trading at its 52-week high on account of value unlocking for shareholders by demerging its OTC business.

At the CMP, valuations continue to look attractive at ~33.3x and ~29.2x its CY2023E and CY2024E EPS, respectively. The revised Price Target is Rs 9,084.

-330

November 16, 2023· 13:15 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Bharti Airtel | 950.80 0.11 | 2.28m | 217.04 |

| Yes Bank | 20.26 -0.44 | 42.53m | 86.08 |

| Tata Motors | 681.95 1.53 | 1.10m | 74.94 |

| Vodafone Idea | 14.48 2.91 | 52.03m | 75.33 |

| Bajaj Finance | 7,305.85 1.13 | 86.24k | 61.49 |

| Suzlon Energy | 41.99 3.7 | 11.20m | 46.85 |

| Infosys | 1,447.70 2.59 | 279.61k | 40.04 |

| Reliance | 2,366.15 0.39 | 136.90k | 32.33 |

| MCX India | 2,968.80 2.23 | 107.18k | 31.78 |

| HDFC Bank | 1,515.20 0.72 | 197.49k | 29.84 |

-330

November 16, 2023· 13:11 IST

Stock Market LIVE Updates | Morgan Stanley View On Bajaj Finance

-Overweight call, target Rs 10,300 per share

-Company does not expect the financial impact to be material

-Prima facie, it appears that new digital EMI card acquisition is not affected

-Stock could be under pressure in the near term

-Issue looks to be one that can be resolved soon, thus mitigating EPS impact

-330

November 16, 2023· 13:05 IST

Sensex Today | August Telecom Data

Reliance Jio net adds 32.5 lakh users in August versus 39.1 lakh, Bharti Airtel net adds 12.2 lakh users in August Vs 15.2 lakh and Vodafone Idea loses 49,782 users in August versus loss of 13.2 lakh, MoM.

-330

November 16, 2023· 13:04 IST

Sensex Today | Market at 1 PM

The Sensex was up 469.68 points or 0.72 percent at 66,145.61, and the Nifty was up 131.10 points or 0.67 percent at 19,806.60. About 1860 shares advanced, 1322 shares declined, and 83 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TCS | 3,512.10 | 3.32 | 77.29k |

| Tech Mahindra | 1,206.85 | 2.81 | 109.24k |

| Infosys | 1,447.65 | 2.59 | 269.58k |

| HCL Tech | 1,306.20 | 2.43 | 134.76k |

| NTPC | 251.85 | 1.82 | 795.80k |

| Bajaj Finserv | 1,621.30 | 1.71 | 155.05k |

| Tata Motors | 682.40 | 1.6 | 1.09m |

| M&M | 1,566.85 | 1.51 | 28.85k |

| Wipro | 397.15 | 1.47 | 111.65k |

| Bajaj Finance | 7,304.00 | 1.11 | 85.46k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Power Grid Corp | 207.50 | -1.31 | 555.34k |

| Axis Bank | 1,033.50 | -0.75 | 42.09k |

| JSW Steel | 770.95 | -0.18 | 17.95k |

| ICICI Bank | 938.90 | -0.18 | 92.06k |

| Maruti Suzuki | 10,448.80 | -0.11 | 2.41k |

| HUL | 2,486.00 | -0.09 | 103.87k |

| Larsen | 3,063.30 | -0.06 | 33.67k |

-330

November 16, 2023· 13:00 IST

| Company | Price at 12:00 | Price at 12:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Pennar Inds | 102.75 | 111.45 | 8.70 29.05k |

| Cambridge Tech | 65.95 | 70.00 | 4.05 1.70k |

| AAA | 68.55 | 72.55 | 4.00 46.85k |

| Wockhardt | 302.90 | 318.60 | 15.70 3.62m |

| NDL Ventures | 142.10 | 149.00 | 6.90 96 |

| Monarch Net | 469.00 | 491.40 | 22.40 133.60k |

| Gillanders Arbu | 96.15 | 100.70 | 4.55 4.18k |

| Chembond Chem | 445.85 | 464.50 | 18.65 3.44k |

| Lexus Granito | 39.00 | 40.60 | 1.60 217 |

| Inspirisys Solu | 86.30 | 89.80 | 3.50 76.95k |

-330

November 16, 2023· 12:59 IST

Stock Market LIVE Updates | Motilal Oswal View on Grasim Industries:

Caustic soda prices have improved from their lows and should benefit in 3QFY24. VSF prices too have increased in China and broking firm believe that Sep’23 exit price of Chinese VSF was ~4% higher (converted into INR) than 2QFY24 average.

Though, VSF price in China has declined in Nov’23, it believe that the INR equivalent price is ~6% higher versus 2QFY24 average. Grasim’s planned Rights issue will help ease the pressure on its balance sheet.

Broking firm reiterate BUY rating on the stock with a Target Price of Rs 2,380.

-330

November 16, 2023· 12:57 IST

Wockhardt share price rose 14 percent

-330

November 16, 2023· 12:54 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| The Hi-Tech Gea | 497.25 19.99% | 197.99k 2,498.40 | 7,825.00 |

| Bharti Airtel | 950.80 0.11% | 2.28m 58,464.00 | 3,808.00 |

| IPRU Gold ETF | 52.85 -0.21% | 980.51k 33,216.60 | 2,852.00 |

| Filatex India | 54.20 12.05% | 696.61k 27,014.60 | 2,479.00 |

| Almondz Global | 83.75 2.37% | 31.83k 1,272.40 | 2,401.00 |

| Inspirisys Solu | 89.25 0.79% | 163.72k 7,689.40 | 2,029.00 |

| Palred Tech | 165.40 8.21% | 35.81k 1,721.60 | 1,980.00 |

| General Insuran | 245.80 9.37% | 178.25k 10,553.60 | 1,589.00 |

| Atal | 15.98 4.99% | 121.39k 7,727.20 | 1,471.00 |

| KNR Construct | 283.00 7.4% | 204.94k 13,878.00 | 1,377.00 |

-330

November 16, 2023· 12:49 IST

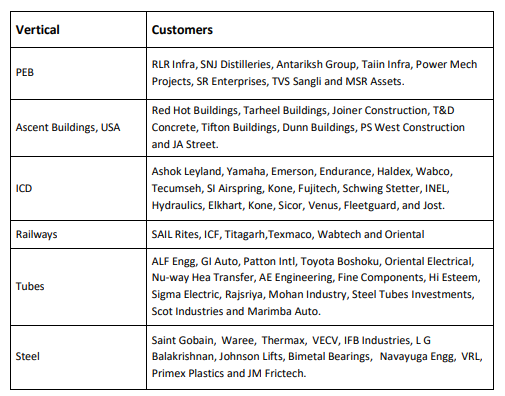

Stock Market LIVE Updates | Pennar Industries bags orders worth Rs 669 crores

-330

November 16, 2023· 12:44 IST

Stock Market LIVE Updates | Bayer Cropscience to trade ex-dividend on November 16

Bayer Cropscience will trade ex-dividend with effect from November 16. The interim dividend is Rs 105 per share. Apart from Bayer, Power Grid Corporation of India, Cigniti Technologies, Container Corporation of India, MSTC, Saksoft, and Sundram Fasteners will also turn ex-dividend on November 16.

-330

November 16, 2023· 12:41 IST

-330

November 16, 2023· 12:37 IST

Sensex Today | BSE Realty index rose 0.5 percnet supported by Sobha, Prestige Estate, Oberoi Realty:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sobha | 890.90 | 3.55 | 34.77k |

| Prestige Estate | 885.00 | 1.53 | 7.13k |

| Oberoi Realty | 1,322.85 | 1.52 | 21.64k |

| Macrotech Dev | 866.05 | 1.46 | 39.14k |

| Indiabulls Real | 82.67 | 1.08 | 333.99k |

| DLF | 627.45 | 0.83 | 61.42k |

| Mahindra Life | 511.05 | 0.19 | 5.88k |

-330

November 16, 2023· 12:32 IST

Stock Market LIVE Updates | RateGain Travel Technologies launches QIP issue, floor price at Rs 676.66 per share

The software company that provides SaaS solutions for travel and hospitality opened its qualified institutions placement (QIP) issue on November 15. The floor price has been fixed at Rs 676.66 per share.

-330

November 16, 2023· 12:26 IST

Sensex Today | Shrey Jain, Founder and CEO SAS Online:

Today, Nifty crossed the 19,800 mark, and the Sensex surged by 450 points, benefiting from positive sentiments in global markets, all thanks to a dip in global inflation numbers for October.

On the weekly expiry day, should the Nifty maintain its positive momentum and remain above 19,650, there is potential for a move to 19,840.

According to options data, there is a battle between call and put writers centered around the 19,450 level. The 19,550-19,600 range is expected to provide robust support, and as long as this level is sustained, there is the likelihood that the Index could ascend to 19,810-19,850 in the upcoming sessions.

-330

November 16, 2023· 12:20 IST

Sensex Today | BSE Smallcap index up 0.5 percent supported by Mishtann Foods, Filatex India, KPI Green Energy:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Mishtann Foods | 16.62 | 17.54 | 38.75m |

| Filatex India | 54.49 | 12.65 | 645.01k |

| KPIGREEN | 1,148.10 | 10 | 76.43k |

| Apollo Micro Sy | 146.72 | 9.99 | 1.91m |

| Sterlite Techno | 156.35 | 8.31 | 493.73k |

| Wockhardt | 302.20 | 7.76 | 337.10k |

| Dish TV | 19.05 | 7.57 | 9.36m |

| Dreamfolks Ser. | 545.00 | 7.37 | 34.40k |

| Ador Welding | 1,590.70 | 7.28 | 14.69k |

| KNR Construct | 282.30 | 7.13 | 187.88k |

-330

November 16, 2023· 12:17 IST

Stock Market LIVE Updates | Motilal Oswal View on ONGC:

The company targets to increase production by 1%/5% in FY24/25. The key wells to be targeted for exploration in 2HFY24 will be Mahanandi Basin, Western Offshore, Assam Basin, and Bengal Basin.

The company will also be infusing additional Rs 183 billion in OPAL. It intends to approach the government seeking permission to utilize gas from new wells and well interventions in OPAL. Management expects OPAL to turn profitable from FY25.

ONGC is trading at 3.1x FY24E EV/EBITDA and 4.4x FY24E P/E.

Broking house value the company at 6x FY25E adj. EPS of Rs 32.4 and add the value of investments to arrive at Target Price of Rs 235 and reiterate Buy rating on the stock with a 18% potential upside.

-330

November 16, 2023· 12:07 IST

Sensex Today | Windfall Tax Cut:

Windfall tax on crude petroleum cut to Rs 6,300/tonne from Rs 9,800/tonne. The Windfall tax on Diesel will reduce to Rs 1/litre from Rs 2/litre, while tax on Petrol will continue at nil.

-330

November 16, 2023· 12:06 IST

Sensex Today | SEBI Chairperson Madhabi Puri Buch's at FICCI's Capital Markets Conference:

We made a commitment that the regulator will not come in the way of investors and we have done that. Our role is that there is trust in teh system. While we believe in the ease of doing business, if there is not trust, there is no business. This trust is through transparency.

One thing we were very conscious of - the balance between ease of doing business, trust and stakeholder protection. What we realised that nobody has a disbute with the regulator on trust, the dispute is about how it is implemented. The devil is in the details. This led to the creation of the Industry standards Forum.

We can look forward to the forum becoming a formal part of te regulatory architecture. This will be a crucial step in creating ease of compliance.

Another commitment we had made was that SEBI will focus more on data than dogma. We have introduced a number of initiative.

We are very conscious that not everything is at it appears and what we see is a matter of perspective. The forum was inspired by the thought that there were many things we were not aware of and vice versa.

-330

November 16, 2023· 12:05 IST

Stock Market LIVE Updates | Industry Standards Forum - a step to balance ease of doing business and protect stakeholders' interest, says Madhabi Puri Buch, Chairperson, SEBI

One thing we were very conscious of - the balance between ease of doing business, trust and stakeholder protection. What we realised that nobody has a dispute with the regulator on trust, the dispute is about how it is implemented. The devil is in the details. This led to the creation of the Industry Standards Forum. We can look forward to the forum becoming a formal part of the regulatory architecture. This will be a crucial step in creating ease of compliance.

-330

November 16, 2023· 12:05 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

During the last five General elections the markets had rallied in the run up to the elections with returns ranging from 3.1% to 30.4% in the six months to the elections. Sharp movements after the elections happen only when the election results are totally unexpected. This happened after the 2009 elections when the UPA government got a thumping victory and the market set a record, hitting the upper circuit twice.

Markets like stability and, therefore, the market’s preference would be the continuation of the BJP regime. But if the I.N.D.I.A alliance succeeds in toppling the NDA, there will be a sharp correction in the market. But the probability of such an outcome is very low now.

-330

November 16, 2023· 12:03 IST

Stock Market LIVE Updates | Market looks at regulator and regulatory looks at market, says Madhabi Puri Buch, Chairperson, SEBI

We are very conscious that not everything is at it appears and what we see is a matter of perspective - it works both ways, when the regulator looks at the market and the market looks at the regulator. The forum was inspired by the thought that there were many things we were not aware of and vice versa. Almost half of what sebi does is for ease of doing business and for development and not for risk protection and greater compliance. Contrary to the belief which is otherwise.

-330

November 16, 2023· 12:02 IST

Sensex Today | Market at 12 PM

The Sensex was up 454.20 points or 0.69 percent at 66,130.13, and the Nifty was up 124.80 points or 0.63 percent at 19,800.30. About 1881 shares advanced, 1252 shares declined, and 90 shares unchanged.

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| General Insuran | 243.50 8.32% | 4.73m 257,676.60 | 1,735.00 |

| The Hi-Tech Gea | 496.55 20% | 805.50k 49,182.20 | 1,538.00 |

| Filatex India | 54.45 12.62% | 7.11m 449,911.80 | 1,479.00 |

| TCI Express | 1,371.00 2.65% | 167.83k 10,814.00 | 1,452.00 |

| Tera Software | 46.50 7.64% | 333.63k 22,498.00 | 1,383.00 |

-330

November 16, 2023· 11:59 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| V-Marc | 159.40 | 144.25 | -15.15 7.14k |

| Inspirisys Solu | 91.45 | 86.30 | -5.15 144.94k |

| Mangalam Worldw | 116.00 | 110.00 | -6.00 300 |

| Praxis Home Ret | 30.30 | 29.00 | -1.30 12.93k |

| Lexus Granito | 40.60 | 39.00 | -1.60 0 |

| Electronics Mar | 226.50 | 217.65 | -8.85 865.25k |

| Somi Conveyor | 99.00 | 95.35 | -3.65 2.10k |

| JISL | 35.25 | 34.00 | -1.25 10.59k |

| Sahana Systems | 564.70 | 545.00 | -19.70 67.81k |

| Spectrum Talent | 103.10 | 99.50 | -3.60 3.48k |

-330

November 16, 2023· 11:59 IST

Stock Market LIVE Updates | HOEC appoints Sivalai Senthilnathan as Chief Financial Officer

The Board of Directors, based on the recommendations of the Nomination & Remuneration Committee have approved the appointment of Mr. Sivalai Senthilnathan as the Chief Financial Officer of HOEC with effect from November 15, 2023.

-330

November 16, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Palred Tech | 156.10 | 171.00 | 14.90 15.93k |

| ARHAM | 142.65 | 154.70 | 12.05 8.13k |

| AAA | 64.25 | 68.50 | 4.25 3.38k |

| A B Infrabuild | 48.00 | 50.80 | 2.80 2.00k |

| Bal Pharma | 102.15 | 107.50 | 5.35 63.46k |

| Kalyani Forge | 457.50 | 480.00 | 22.50 11.25k |

| Golden Tobacco | 51.50 | 54.00 | 2.50 3 |

| Shree Vasu | 158.00 | 165.00 | 7.00 135 |

| Mindteck | 214.75 | 223.60 | 8.85 67.54k |

| Mukta Arts | 73.65 | 76.50 | 2.85 2.23k |

-330

November 16, 2023· 11:56 IST

Sensex Today | Madhabi Puri Buch, Chairperson, SEBI:

The last 6 years has taught me that there is no better way for the market to progress and the regulator to do its job than to work with the industry in partnership. This will take India to the path of realising its huge opportunity. More power to India, More Power to our markets.

-330

November 16, 2023· 11:52 IST

Stock Market LIVE Updates | Sharekhan View on Grasim Industries:

Standalone businesses are expected to face muted demand in the near term and pressure on OPMs, especially in the chemicals business. However, its efforts to increase asset productivity and focus on increasing value-added products are expected to yield results as demand recovers.

The company’s expedited paints expansion along with strong traction being witnessed in B2B E-commerce business are likely to provide it with the next leg of growth. Further, the outlook for its key subsidiary UltraTech remains healthy.

Broking house maintain Buy with a revised price target (PT) of Rs 2,300, as it roll forward the valuation multiple for standalone businesses to September 2025E earnings along with increased valuation of Vodafone Idea.

-330

November 16, 2023· 11:48 IST

Sensex Today | Nifty Information Technology index up nearly 2 percent led by Coforge, TCS, HCL Technologies:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| COFORGE LTD. | 5,508.75 | 3.1 | 263.33k |

| TCS | 3,496.00 | 2.69 | 1.62m |

| HCL Tech | 1,300.00 | 1.83 | 1.63m |

| MphasiS | 2,307.65 | 1.7 | 166.63k |

| Infosys | 1,433.70 | 1.64 | 1.94m |

| Tech Mahindra | 1,192.00 | 1.55 | 635.46k |

| Persistent | 6,333.25 | 1.11 | 176.24k |

| Wipro | 395.55 | 1 | 2.32m |

| LTIMindtree | 5,438.00 | 0.67 | 140.30k |

| L&T Technology | 4,418.90 | 0.64 | 55.18k |

-330

November 16, 2023· 11:31 IST

Stock Market LIVE Updates | GST demand notice issued to Divi's Lab; stock turns flat

Demand raised: IGST of Rs 82 crore along with applicable interest and penalty of Rs 82 crore (100 percent of the tax amount of IGST).

Hopeful of a favourable outcome thereof and does not expect the said Order to have any material financial impact, says Divi's Lab management

-330

November 16, 2023· 11:27 IST

Stock Market LIVE Updates | F&O Manual | Nifty sustains positive momentum, can move to 19,840 on weekly expiry day

The Indian equity markets were trading marginally higher on November 16 on positive global cues stemming from a cooling global inflation print in October.

At 11 am, the 30-pack Sensex was up 359.85 points or 0.55 percent at 66,035.78, and the Nifty was up 100.10 points or 0.51 percent at 19,775.60. About 1,900 shares advanced, 1,174 declined and 101 remained unchanged. READ MORE

-330

November 16, 2023· 11:15 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Mishtann Foods | 16.25 | 16.25 | 16.15 |

| Filatex India | 54.90 | 54.90 | 54.15 |

| KPIGREEN | 1148.10 | 1148.10 | 1,148.10 |

| Apollo Micro Sy | 146.72 | 146.72 | 146.49 |

| Ador Welding | 1618.00 | 1618.00 | 1,581.10 |

| Electronics Mar | 226.70 | 226.70 | 221.00 |

| CESC | 98.40 | 98.40 | 97.10 |

| Manappuram Fin | 162.30 | 162.30 | 159.75 |

| Ashoka Buildcon | 151.50 | 151.50 | 147.40 |

| Wockhardt | 296.00 | 296.00 | 294.90 |

-330

November 16, 2023· 11:10 IST

Sensex Today | Prashanth Tapse, Senior VP (Research), Mehta Equities:

Protean eGov listing was in line with street estimates, while shares of Protean eGov attracted a lot of buying interest post-listing and went on to hit all time high near Rs 1227 today against its offer price of Rs 792. The reason for soft listing was 100% offer-for-sale and fully priced-in IPO offer.

Post listing performance as we had expected a competitive advantage and first-mover advantage to its niche product offering in e-Governance services and the rising importance of eGovernance globally would bring this company in focus. Long term we are positive but from current levels upside would be limited.

-330

November 16, 2023· 11:07 IST

Sensex Today | Market at 11 AM

The Sensex was up 359.85 points or 0.55 percent at 66,035.78, and the Nifty was up 100.10 points or 0.51 percent at 19,775.60. About 1900 shares advanced, 1174 shares declined, and 101 shares unchanged.

-330

November 16, 2023· 11:01 IST

| Company | Price at 10:00 | Price at 10:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| AMBOAGRI | 31.65 | 28.75 | -2.90 0 |

| Futuristic Sol | 58.00 | 53.00 | -5.00 18 |

| Veejay Lakshmi | 44.89 | 41.20 | -3.69 0 |

| Martin Burn Ltd | 44.30 | 40.70 | -3.60 2.32k |

| Jindal Leasefin | 35.90 | 33.00 | -2.90 20 |

| Envair Electro | 254.95 | 235.15 | -19.80 510 |

| Le Lavoir | 112.50 | 104.50 | -8.00 1.30k |

| Rishi Techtex | 34.89 | 32.54 | -2.35 1.63k |

| Sri Nachammai | 32.80 | 30.60 | -2.20 1 |

| Globe Commercia | 27.50 | 25.85 | -1.65 1.05k |

-330

November 16, 2023· 10:58 IST

| Company | Price at 10:00 | Price at 10:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Filtra Consult | 38.00 | 43.00 | 5.00 0 |

| Pankaj Piyush | 97.20 | 107.00 | 9.80 100 |

| KFA Corporation | 72.80 | 80.00 | 7.20 1 |

| Vantage Knowled | 100.50 | 109.95 | 9.45 1.34k |

| Cian Healthcare | 21.45 | 23.40 | 1.95 0 |

| Simplex Papers | 985.00 | 1,074.00 | 89.00 3.58k |

| Balgopal Commer | 30.52 | 33.25 | 2.73 844 |

| Raj Tube | 33.00 | 35.90 | 2.90 72 |

| Pearl Polymers | 28.35 | 30.80 | 2.45 959 |

| Allcargo Termin | 45.18 | 48.85 | 3.67 51.94k |

-330

November 16, 2023· 10:55 IST

Stock Market LIVE Updates | Axis Securities View on KNR Construction

The Union Budget 2023-24 has increased the Road sector Capex outlay by more than 33%, thereby providing larger opportunities for companies such as KNR Construction. Further diversification into other segments bodes well for the company and expect the company to post revenue/EBITDA/APAT growth of 13%/8%/10% CAGR over FY22-25E.

However, lower awarding activity and competitive intensity pose a concern with regard to order inflows.

The stock is currently trading at16 x and 15x FY24/FY25 EPS. Maintain Buy rating on the the company and value the company at 15 x FY25E EPS and HAM projects at 1.2x book value to arrive at a target price of Rs 305 per share, implying an upside of 16% from the CMP.

-330

November 16, 2023· 10:50 IST

Stock Market LIVE Updates | Motilal Oswal View on Bajaj Finance

Deficiencies (as against the digital lending guidelines) identified by the RBI are more operational in nature (with regards to KFS) and do not raise any questions on Bajaj Finance’s processes or the structures of the various products in these two sourcing channels. The company shared that it does expect any material financial impact from this event.

This action from the RBI definitely shows that it is stringently auditing the lending institutions (including banks) and is ensuring compliance with its guidelines by imposing penalties or restrictions on new customer/loan acquisitions in certain products or through certain channels.

The broking house has not made any changes in its estimates as yet, even though acknowledge that there will be an impact on both AUM growth as well as fee income in 2HFY24. However, the long-term thesis for this franchise remains intact.

The company will take corrective action, and once successful in satisfying the RBI, its momentum will only get stronger ahead with the digital ecosystem – app, web platform and full-stack payment offerings – in place.

Reiterate Buy – any significant correction in the stock price purely because of this event should be used as an opportunity to accumulate.

-330

November 16, 2023· 10:46 IST

-330

November 16, 2023· 10:42 IST

Sensex Today | BSE Auto index rose 0.5 percent led by Bosch, Hero MotoCorp, Tata Motors:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bosch | 20,321.15 | 2.95 | 599 |

| Hero Motocorp | 3,227.30 | 1.58 | 8.34k |

| Tata Motors | 681.85 | 1.52 | 668.34k |

| Balkrishna Ind | 2,668.55 | 1.4 | 2.01k |

| Cummins | 1,840.00 | 0.73 | 9.50k |

| Ashok Leyland | 175.75 | 0.6 | 74.86k |

| MRF | 109,950.00 | 0.59 | 66 |

| TVS Motor | 1,680.70 | 0.47 | 2.14k |

| Bajaj Auto | 5,562.15 | 0.46 | 2.38k |

| UNO Minda | 643.70 | 0.44 | 6.17k |

-330

November 16, 2023· 10:40 IST

Stock Market LIVE Updates | ICICI Securities downgrades Kalyan Jewellers to add; raises target price

Broking house ICICI Securities maintained revenue/EBITDA estimates for FY24E and FY25E; modelling revenue / EBITDA / PAT CAGRs of 25% / 18% / 29% over FY23-FY25E.

It has downgraded rating to ADD with a DCF-based revised target price of Rs 360 (was Rs 300). At Target Price the stock will trade at a multiple of 47x FY25E EPS.

Key risks: Delay in showroom expansion and potentially higher competitive intensity in core south India markets.

-330

November 16, 2023· 10:35 IST

-330

November 16, 2023· 10:33 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Bajaj Finance | 7,243.00 0.26 | 2.74m | 1,940.78 |

| HDFC Bank | 1,509.10 0.31 | 3.85m | 581.25 |

| Manappuram Fin | 161.30 7.18 | 28.87m | 458.78 |

| Tata Motors | 682.35 1.61 | 6.25m | 423.48 |

| MCX India | 2,970.00 2.17 | 1.34m | 396.84 |

| TCS | 3,441.20 1.08 | 873.05k | 299.51 |

| ICICI Bank | 940.05 -0.11 | 3.15m | 295.29 |

| Reliance | 2,359.60 0.13 | 1.24m | 292.50 |

| Yes Bank | 20.15 -0.98 | 143.33m | 289.95 |

| Hindustan Aeron | 2,131.00 1.91 | 1.25m | 267.59 |

-330

November 16, 2023· 10:29 IST

Stock Market LIVE Updates | Som Distilleries stock gains 1% on promoter Jagdish Kumar Arora’s stake purchase

Shares of Som Distilleries & Breweries gained 1 percent to Rs 301 per share on November 16 after insider data revealed that promoter and managing director Jagdish Kumar Arora bought 11,000 shares of the company at an average price of Rs 297 apiece. Arora’s holding in Som Distilleries now stood at 19.67 percent.

The promoter’s stake purchase followed a week after income tax department searched premises of Som Group of Companies across the country, including Bhopal, Jabalpur, and Indore on November 7. As a result, investors turned cautious causing the stock price of Som Distilleries to plummet below Rs 300-mark. Read More

-330

November 16, 2023· 10:24 IST

Stock Market LIVE Updates | ASK Automotive up 3% on Day 2 after Goldman Sachs fund buys Rs 72-crore stake

ASK Automotive gained 2.7 percent in the early trade on November 16, clocking gains on the second straight day of trading on the bourses.

Goldman Sachs India Equity Portfolio bought 23.2 lakh equity shares in ASK Automotive, which amounts to 1.18 percent of paid-up equity, via an open market transaction at an average price of Rs 310.05 a share adding to Rs 71.95 crore. Read More

-330

November 16, 2023· 10:21 IST

-330

November 16, 2023· 10:17 IST

Stock Market LIVE Updates | Jefferies View On Bajaj Finance

-Buy call, target Rs 9,470 per share

-In a surprise move, RBI asks company to stop sanction & disbursal under 2 digital loan products

-While this is a negative, speed of correction will be key to reinstate products

-See limited financial impact as Insta EMI card base is 5 percent of total clients

-Estimate Insta EMI card base to Be 0.2 percent of disbursals

-330

November 16, 2023· 10:12 IST

Sensex Today | BSE Power index up 0.4 percent supported by NTPC, BHEL, Tata Power:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NTPC | 252.50 | 2.08 | 323.60k |

| BHEL | 139.45 | 1.57 | 639.84k |

| Tata Power | 263.15 | 1.54 | 193.39k |

| JSW Energy | 405.10 | 1.34 | 32.83k |

| NHPC | 52.21 | 0.81 | 185.05k |

| Adani Power | 393.20 | 0.67 | 141.25k |

| Siemens | 3,497.20 | 0.05 | 3.10k |

-330

November 16, 2023· 10:10 IST

-330

November 16, 2023· 10:05 IST

Sensex Today | Rahul Kalantri, VP Commodities, Mehta Equities:

Gold and silver prices experienced a significant uptick on Tuesday following the release of the latest inflation data. The numbers revealed that consumer Gold and silver prices concluded on a mixed note, with gold exhibiting slight weakness and silver registering an upward trend on Wednesday. Gold experienced some routine profit-taking from short-term futures traders, following gains earlier in the week.

The yellow metal faced headwinds due to a rebound in the U.S. dollar index and an increase in U.S. Treasury yields mid-week. Conversely, silver maintained strong momentum, building on solid gains from the previous Tuesday. The decline of 0.5% in the U.S. Producer Price Index (PPI) for October, in contrast to the 0.4% increase in September, provided support for precious metals.

Anticipating continued volatility in today's session, we note that gold has support levels at $1948-1936, with resistance levels at $1974-1984. For silver, support is found at $22.88-22.72, while resistance is at $23.24-23.40. In INR, gold is supported at Rs 59,940-59,770, with resistance at Rs 60,250 and Rs 60,430. Silver has support at Rs 71,450 and Rs 70,830, with resistance at Rs 72,550 and Rs 72,930.

-330

November 16, 2023· 10:02 IST

Sensex Today | Market at 10 AM

The Sensex was up 61.97 points or 0.09 percent at 65,737.90, and the Nifty was up 16.90 points or 0.09 percent at 19,692.40. About 1897 shares advanced, 1018 shares declined, and 109 shares unchanged.

-330

November 16, 2023· 10:01 IST

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| DYNPROPP | 450.00 | 149.50 | -300.50 - |

| National Oxygen | 45.40 | 37.40 | -8.00 - |

| Micropro Soft | 71.95 | 68.35 | -3.60 - |

| Omfurn India | 74.00 | 70.30 | -3.70 800 |

| Vertexplus | 208.00 | 197.60 | -10.40 0 |

| Barak Vally Cem | 51.10 | 48.55 | -2.55 30.93k |

| Holmarc Opto Me | 127.15 | 120.80 | -6.35 - |

| Palash Securiti | 142.15 | 135.05 | -7.10 1.11k |

| Bohra Industrie | 51.25 | 48.70 | -2.55 231 |

| Ishan Intl. | 75.45 | 71.70 | -3.75 15.40k |

-330

November 16, 2023· 09:58 IST

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Info Drive Soft | 0.65 | 332.80 | 332.15 - |

| Kesoram Ind PP | 5.00 | 28.40 | 23.40 - |

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| Bharat Gears RE | 103.25 | 172.05 | 68.80 - |

| Kundan Edifice | 102.05 | 122.25 | 20.20 - |

| Srivari Spices | 147.75 | 170.00 | 22.25 22.26k |

| The Hi-Tech Gea | 413.80 | 467.00 | 53.20 4.19k |

| Bang Overseas | 56.50 | 63.70 | 7.20 623 |

| Nidan Laborator | 32.75 | 36.35 | 3.60 1000 |

| Naga Dhunseri | 2,023.75 | 2,226.10 | 202.35 311 |

-330

November 16, 2023· 09:57 IST

Stock Market LIVE Updates | Bondada Engineering bags work order worth Rs 34.4 crore from BSNL

Bondada Engineering has received work orders worth Rs 34.35 crore from Bharat Sanchar Nigam (BSNL). Bondada will provide infrastructure as a service (IaaSP) for supply and erection of GBT, infrastructure as a service provider (IaaSP) for supply installation of infrastructure item and subsequent O&M (operation & maintenance) for 5 years for the cluster of Lakshadweep.

-330

November 16, 2023· 09:55 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Ruchinfra | 18.70 | 50.20 | 12.45 |

| Bang Overseas | 63.85 | 35.56 | 47.10 |

| Norben Tea | 13.35 | 32.18 | 10.10 |

| NK Industries | 85.45 | 29.76 | 65.85 |

| Womancart | 137.10 | 25.95 | 108.85 |

| Oil Country | 25.20 | 24.14 | 20.30 |

| Nitiraj Enginee | 136.40 | 21.51 | 112.25 |

| Veranda Learn | 260.20 | 20.74 | 215.50 |

| Apollo Micro Sy | 146.10 | 20.45 | 121.30 |

| Apollo Micro Sy | 146.10 | 20.45 | 121.30 |

-330

November 16, 2023· 09:54 IST

Stock Market LIVE Updates | VST Tillers Tractors unveils 3 new tractors at AGRITECHNICA 2023 in Germany

VST Tillers Tractors has unveiled 3 brand new tractors, including its indigenously developed electric tractor, at the Agritechnica 2023 at Hanover in Germany. The 3 products, 929 EV, 932 DI with Stage V engine and 929 with HST Transmission are displayed at AGRITECHNICA. It also showcased its state-of-the-art Stage V engine (24.5hp).

-330

November 16, 2023· 09:51 IST

Sensex Today | BSE Oil & Gas index up 1 percent led by HPCL, IOC, BPCL:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HINDPETRO | 322.90 | 2.9 | 172.09k |

| IOC | 103.60 | 1.88 | 797.31k |

| BPCL | 398.55 | 1.55 | 91.54k |

| ONGC | 201.90 | 1.23 | 244.10k |

| Gujarat Gas | 423.75 | 0.47 | 4.45k |

| GAIL | 127.25 | 0.32 | 84.25k |

| Reliance | 2,361.35 | 0.19 | 37.88k |

| IGL | 387.75 | 0.12 | 27.38k |

| Petronet LNG | 197.90 | 0.05 | 29.45k |

-330

November 16, 2023· 09:48 IST

Sensex Today | Rahul Kalantri, VP Commodities, Mehta Equities:

Crude oil prices experienced a decline in the international markets following the U.S. Energy Information Administration's report, revealing a surge in U.S. crude oil inventories by 3.6 million barrels for the week ending on November 10, surpassing the anticipated build of 1.8 million barrels. This downturn was exacerbated by concerns over demand from the European Union. Nevertheless, the positive performance of Chinese industrial production and retail sales data provided some support to crude oil prices.

Additionally, the upward revisions in demand forecasts for 2023 by OPEC+ and the IEA further bolstered crude oil prices at lower levels. Anticipating continued volatility, we project support for crude oil prices within the range of $76.30–75.50, with resistance expected at $77.90–78.50 in today's session. In terms of INR, crude oil finds support at Rs 6,340–6,280 and faces resistance at Rs 6,495–6,570.

-330

November 16, 2023· 09:42 IST

-330

November 16, 2023· 09:39 IST

Stock Market LIVE Updates | Satin Creditcare Network says board to consider fund raising proposal on November 20

Satin Creditcare Network said the board members will meet on November 20 to consider the fund raising via issuance of non-convertible debentures on private placement basis.

-330

November 16, 2023· 09:35 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Kalyani Forge | 480.00 3.23% | 10.44k 1,432.20 | 629.00 |

| Lotus Eye Care | 102.90 1.18% | 296.41k 52,483.60 | 465.00 |

| Bang Overseas | 65.10 15.22% | 764.24k 180,075.00 | 324.00 |

| Unichem Labs | 443.35 6.57% | 44.78k | 324.00 |

| Kavveri Telecom | 13.65 5% | 441.77k 220,496.80 | 100.00 |

| AB Money | 116.60 6.29% | 831.54k 435,062.60 | 91.00 |

| Bajaj Finance | 7,076.25 -2.05% | 1.53m 800,695.40 | 91.00 |

| Gokul Refoils | 41.75 6.23% | 287.24k 166,800.20 | 72.00 |

| SPML Infra | 64.45 4.97% | 54.84k | 72.00 |

| Vishnusurya | 219.00 0.62% | 276.00k 181,200.00 | 52.00 |

-330

November 16, 2023· 09:28 IST

Stock Market LIVE Updates | Paytm partners with Amadeus to redefine travel experience with Artificial Intelligence

One 97 Communications has announced a partnership with global travel technology company Amadeus to redefine travel experience with Artificial Intelligence. For the next three years, the company will integrate Amadeus's expansive travel platform, enhancing the travellers’ experience from search to booking, and payments.

-330

November 16, 2023· 09:27 IST

Stock Market LIVE Updates | Suzlon’s S144, 3 MW - 3.15 MW wind turbine series gets the RLMM listing from the government

Suzlon Energy said its S144, 3 MW - 3.15 MW wind turbine series has received the RLMM (Revised List of Models & Manufacturers) Listing from the MNRE (Ministry of New and Renewable Energy). This is an important milestone required for successful commercialisation of the product.

-330

November 16, 2023· 09:20 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Alok Industries | 229127 | 19.65 | 0.45 |

| Apollo Micro Sy | 228233 | 146.7 | 3.35 |

| Bajaj Finance | 2061 | 6985.65 | 1.44 |

| Bajaj Finance | 6291 | 6990.9 | 4.4 |

| Bajaj Finance | 3406 | 6985.35 | 2.38 |

| Bajaj Finance | 5328 | 6987.5 | 3.72 |

| Bajaj Finance | 1873 | 6985.7 | 1.31 |

| Bajaj Finance | 1998 | 6985.35 | 1.4 |

| BHEL | 258708 | 140.1 | 3.62 |

| Chambal Fert | 33510 | 315.2 | 1.06 |

-330

November 16, 2023· 09:19 IST

Stock Market LIVE Updates | RBI directs Bajaj Finance to stop sanction & disbursal of loans under its two lending products

The Reserve Bank of India has directed Bajaj Finance to stop sanction and disbursal of loans under its two lending products eCOM and Insta EMI Card, with immediate effect. This action is necessitated due to non-adherence of digital lending guidelines of Reserve Bank of India, particularly non-issuance of key fact statements to the borrowers under these two lending products and the deficiencies in the key fact statements issued in respect of other digital loans sanctioned by the company.

-330

November 16, 2023· 09:16 IST

Market Opens:

Indian indices opened flat on November 16 amid mixed global cues.

The Sensex was down 128.48 points or 0.20 percent at 65,547.45, and the Nifty was down 36.70 points or 0.19 percent at 19,638.80. About 1478 shares advanced, 586 shares declined, and 115 shares unchanged.

ONGC, BPCL, Dr Reddy's Laboratories, Coal India and TCS were among major gainers on the Nifty, while losers were Bajaj Finance, Bajaj Finserv, Power Grid Corporation, Titan Company and JSW Steel.

-330

November 16, 2023· 09:14 IST

Stock Market LIVE Updates | Gensol Engineering emerges as lowest bidder for EPC Project

Gensol Engineering has been identified as the lowest bidder for Engineering, Procurement and Commissioning (EPC) contract for a groundbreaking green hydrogenbased mobility station in Kargil, Ladakh.

-330

November 16, 2023· 09:10 IST

Sensex Today | Prashanth Tapse, Senior VP (Research), Mehta Equities:

In yesterday's trading, Nifty displayed strong momentum and ended on a positive note with a technically favorable outlook. Key hurdles are at 19887, while interweek support lies at 19421, with the 200-day moving average at 18700.

Options data suggests a likely trading range of 19100-19800. Positive global catalysts include Biden's efforts on U.S.-China relations, softer U.S. inflation, and optimistic markets. Bullish sentiment prevails with expectations that the Fed has concluded its tightening cycle. Preferred trades involve buying Nifty and Bank Nifty with specified targets.

The chart of the day is bullish on Siemens, Ashok Leyland, and L&T Financial. Additionally, a recommended stock to buy is Homefirst Finance Company for a momentum play with specific entry, target, and stop loss points.

-330

November 16, 2023· 09:07 IST

Sensex Today | Aditya Gaggar, Director of Progressive Shares:

The 15th November trade commenced on a firm note and as the day progressed, the Index compounded its gains to end the day at 19,675.45. On the daily chart, the Index has made a long-legged DOJI candlestick pattern and not only breached its falling trendline but also gave a convincing close above its 50DMA (19,580) which shows bullishness in the markets.

Now the next critical hurdle for the Index stands at 19,840 while the downside is protected at a strong support zone of 19,550-19,580. The Auto sector is set to give a much-awaited range breakout and some of the stocks have already given a strong breakout from their respective patterns which indicates the sector will follow suit (Bajaj Auto- Pennant and Pole Breakout, Eicher Motors and Tata Motors- Symmetrical Triangle Breakout).

The 12-pack BankNifty needs to clear its hurdle of 44,600 for a stronger rally while the downside is protected at 43,900. From the Energy space, we continued to remain bullish on the OMC's stocks (HPCL- Symmetrical Triangle Breakout). In yesterday's trade, the IT sector breached its immediate hurdle but we will wait for a while to confirm the congestion breakout.

The Infra sector has experienced a keenly-awaited Descending Broadening Wedge pattern and we have technical coverage on some of the infra stocks namely ITD Cementation and Welspun Enterprises. The Realty segment is in a different league by registering a new high every day; we have been bullish on the sector for a long time and our stance remain the same (Ajmera and Sunteck Realty).