Closing Bell: Nifty below 24,150, Sensex down 582 pts after RBI keep rates unchanged

-330

August 08, 2024· 16:09 IST

Market Ends lower; Nify below 24150, Sensex down 582

Indian benchmark indices ended lower in the highly volatile session on August 8 with Nifty below 24,150. At close, the Sensex was down 581.79 points or 0.73 percent at 78,886.22, and the Nifty was down 180.50 points or 0.74 percent at 24,117.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

August 08, 2024· 16:06 IST

Ajit Mishra – SVP, Research, Religare Broking

Markets struggled to maintain Wednesday's recovery, ending over half a percent lower due to weak global cues. After an initial dip, the Nifty showed volatile movements, ultimately closing near the day's low at 24,117. Sectors like IT, metals, and energy were the hardest hit. However, the broader indices outperformed slightly, posting only minor losses.

The ongoing global uncertainty is making market participants cautious, and short-term relief seems unlikely. The Nifty is encountering resistance around the 24,350 mark, and a decisive break below 23,900 could lead to a further decline. Traders are advised to adjust their positions with a hedged strategy to navigate the current volatility.

-330

August 08, 2024· 16:05 IST

Vinod Nair, Head of Research, Geojit Financial Services

The domestic market reversed its earlier gains as the RBI's decision to hold its current policy with a caution to revise upward the CPI and moderate the growth forecast for Q1. Meanwhile the global market is focusing on US job data and the probability for deeper slowdown has raised concerns that the US economy is heading for a recession, forcing the federal reserve to cut rates faster than initially expected.

-330

August 08, 2024· 15:44 IST

Aditya Gaggar Director of Progressive Shares

Amid extreme volatility on either sides, Nifty50 settled the weekly expiry day on a weak foot at 24,117 with a loss of 180.50 points. Among the sectors, Pharma was the best performer while IT and Metal corrected the most.

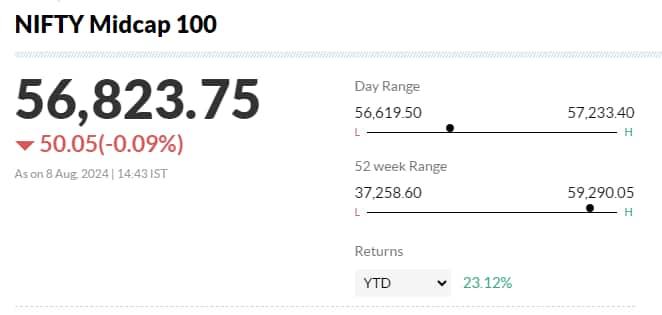

With a marginal loss of over 0.30% Mid and Smallcaps outperformed the Frontline Index.

The Index is oscillating in a wide range where the downside seems to be protected at 23,965 (near 50DMA) while the higher side is capped at 24,330 (bearish gap zone) and a breakout on either side is a must for a clear picture.

-330

August 08, 2024· 15:31 IST

Currency Check | Rupee closes flat

Indian rupee ended flat at 83.96 per dollar on Thursday versus Wednesday's close of 83.95.

-330

August 08, 2024· 15:30 IST

Market Close | Sensex, Nifty end lower on policy day

Indian benchmark indices ended lower in the highly volatile session on August 8 with Nifty below 24,100.

At close, the Sensex was down 581.79 points or 0.73 percent at 78,886.22, and the Nifty was down 180.50 points or 0.74 percent at 24,117.00. About 1702 shares advanced, 1679 shares declined, and 84 shares unchanged.

LTIMindtree, Grasim Industries, Asian Paints, Power Grid Corp and Infosys were among major losers on the Nifty, while gainers included HDFC Life, Tata Motors, SBI Life Insurance, HDFC Bank and Cipla.

On the sectoral front, except pharma, healthcare and media, all other indices ended in the red with metal, realty, oil & gas, information technology down 1-2 percent.

BSE Midcap index was down 0.4 percent and Smallcap index ended flat.

-330

August 08, 2024· 15:26 IST

Stock Market LIVE Updates | BSE Sensex falls 800 points from day's high

-330

August 08, 2024· 15:25 IST

Sensex Today | Nifty index slips 250 points from day's high

-330

August 08, 2024· 15:21 IST

Stock Market LIVE Updates | Garware Hi-Tech Films appoints Abhishek Agarwal as CFO

-330

August 08, 2024· 15:18 IST

Stock Market LIVE Updates | SJVN to raise funds via securitization of assets and stake sale in arm

The company board of directors in its meeting scheduled to be held on Tuesday, 13th August 2024, will consider the proposal for raising of funds through Securitization of assets and stake sale in its wholly owned subsidiary i.e., SJVN Green Energy Limited.

-330

August 08, 2024· 15:16 IST

Sensex Today | Nifty Energy index down 1.6%; Tata Power, Gail, Power Grid among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Power | 417.95 | -2.87 | 22.86m |

| GAIL | 227.13 | -2.74 | 12.73m |

| Power Grid Corp | 342.50 | -2.71 | 14.29m |

| HINDPETRO | 388.60 | -2.07 | 13.62m |

| ONGC | 322.35 | -2.05 | 21.95m |

| NTPC | 408.05 | -1.98 | 14.77m |

| BPCL | 338.60 | -1.47 | 13.78m |

| Reliance | 2,895.65 | -1.16 | 5.60m |

| IOC | 170.30 | -1.11 | 13.23m |

-330

August 08, 2024· 15:11 IST

Brokerage Call | Jefferies keeps 'underperform' call on Cummins, target Rs 2,190

#1 Q1 EBITDA was 7 percent below estimates with a 19 percent revenue miss

#2 Powergen segment sales declined 8 percent YoY with the impact of the CPCB IV + transition

#3 FY24-27E EPS CAGR is just 18 percent, as factor in margin weakness ahead

-330

August 08, 2024· 15:05 IST

Earnings Watch | Shilpa Medicare Q1 net profit at Rs 14.1 crore Vs Rs 1.2 crore, YoY

-330

August 08, 2024· 15:01 IST

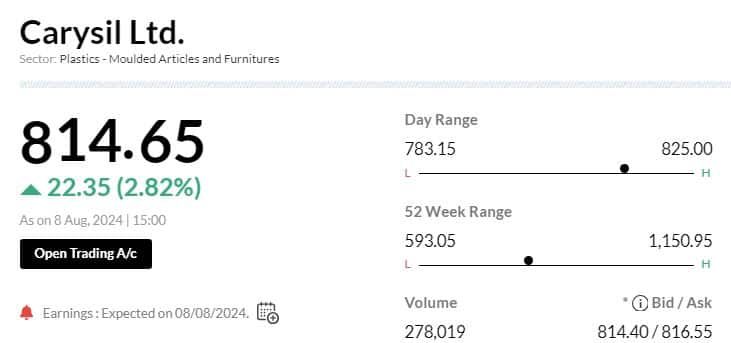

Earnings Watch | Carysil India Q1 net profit up 37% at Rs 15.9 crore Vs Rs 12 crore, YoY

-330

August 08, 2024· 15:00 IST

Earnings Watch | Page Industries Q1 net profit up 4.3% at Rs 165.2 crore Vs Rs 158 crore, YoY

-330

August 08, 2024· 14:59 IST

Earnings watch | AstraZeneca Q1 net loss at Rs 11.8 crore Vs profit of Rs 54 crore, YoY

-330

August 08, 2024· 14:56 IST

Sensex Today | BSE Realty index down 1.2%; Godrej Properties, Macrotech Developers among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Godrej Prop | 2,888.60 | -3 | 14.77k |

| Macrotech Dev | 1,184.00 | -2.63 | 29.45k |

| Sobha | 1,689.15 | -1.57 | 12.04k |

| DLF | 832.55 | -1.54 | 32.84k |

| Mahindra Life | 559.70 | -1.5 | 15.47k |

| Brigade Ent | 1,161.05 | -1.15 | 5.22k |

| Oberoi Realty | 1,753.30 | -0.97 | 6.44k |

| Phoenix Mills | 3,257.15 | -0.41 | 4.89k |

-330

August 08, 2024· 14:52 IST

After Sebi's F&O proposals, Jefferies cuts BSE's EPS estimates for FY26/27 by 10%

If the market regulator goes ahead with its proposals on index-derivatives, BSE may discontinue its Bankex product, according to Jefferies, which has therefore cut its earnings per share (EPS) estimates for FY26/27 by 10 percent.

In its latest report on the exchange, the brokerage's analysts have retained their hold rating on the stock and have cut their price target to Rs 2,850 (at an implied P/E of 24x June 26E) from the earlier Rs 3,000.

Jefferies wrote that they "remain watchful on the final impact on volumes of continuing products post the new norms". Read More

-330

August 08, 2024· 14:46 IST

Sonal Verma, Managing Director, and Chief Economist (India and Asia ex-Japan) at Nomura

Even though the stance is unchanged, we think it is a neutral hold. The downgrade to Q1 GDP (from 7.3% to 7.1%) due to weak high frequency data was a surprise to us, since the RBI has so far been raising its growth forecasts, so it is acknowledging softer numbers incrementally. On inflation, the near-term upward revision has been offset by downward revision to Q4, implying the food price shock is seen as transitory. Our estimates show that the RBI’s upward revision to Q2 CPI (from 3.8% to 4.4%) may not materialise, since food prices are already reversing in August, so inflation may surprise lower relative to the RBI’s near-term forecast. We expect the RBI to begin its easing cycle from October with a 25bp cut, as both inflation and growth surprise on the downside. Past evidence suggests the RBI does not offer any forward guidance ahead of its monetary policy pivots. We expect 75bp worth of cumulative easing in this cycle to a terminal repo rate of 5.75% by March 2025.

-330

August 08, 2024· 14:44 IST

Stock Market LIVE Updates | Nifty Midcap slips into the red, nearly 400 pts off highs

-330

August 08, 2024· 14:38 IST

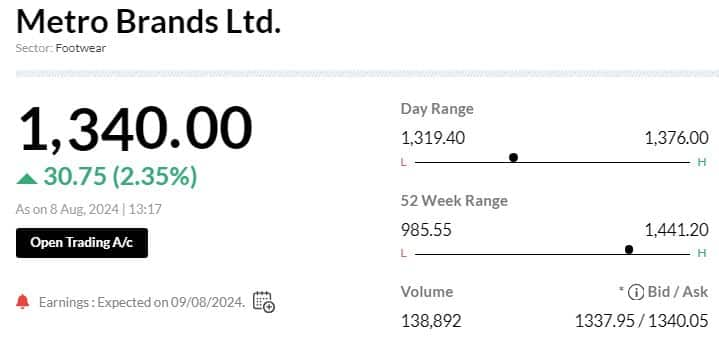

Stock Market LIVE Updates | Metro Brands stock rises 5% on pact with athleisure brand New Era Cap

A partnership with renowned American headwear brand New Era Cap sent shares of Metro Brands sharply higher on August 8, marking the shoe brand's foray into the athleisure segment.

New Era Cap makes caps for major US sports leagues, and is backed by the National Football League, Major League Baseball and the National Basketball Association.

The partnership will enhance New Era's retail presence in India and support Metro Brands' (MBL) expansion in the athleisure market. Under the agreement, MBL will have exclusive rights to distribute and sell New Era products, including headwear, apparel, and accessories, through retail stores and online platforms. Additionally, New Era products will be available in upcoming Foot Locker stores in India.

-330

August 08, 2024· 14:36 IST

Rajkumar Singhal, CEO, Quest Investment Advisors

The RBI’s Monetary Policy Committee's decision met market expectations, with no changes to policy rates or the policy stance and overall policy announcement was largely uneventful.

On the growth front, the RBI has maintained its forecast at 7.2% reflecting confidence in the economy’s growth trajectory.

Regarding CPI, RBI takes solace in the favorable monsoon and a decline in core CPI. However, the persistent rise in food prices, a significant driver of CPI, remains a concern which also impacts household inflation expectations.

In the banking sector, the RBI has noted discomfort with the rapid growth in personal loans, particularly credit cards, which pose macro-prudential risks. Overall, the RBI appears confident in the current growth dynamics but remains focused on achieving its 4% inflation target. Given these considerations, it is unlikely that the RBI will adjust policy rates in the near future.

-330

August 08, 2024· 14:34 IST

Earnings Alert | RVNL Q1 net profit down 35% to Rs 224 crore

#1 Net Profit Down 34.7% At Rs 224 Cr Vs Rs 343 Cr (YoY)

#2 Revenue Down 27% At Rs 4,074 Cr Vs Rs 5,571.6 Cr (YoY)

#3 EBITDA Down 48% At Rs 182 Cr Vs Rs 349 Cr (YoY)

#4 Margin At 4.5% Vs 6.3% (YoY)

-330

August 08, 2024· 14:19 IST

Sensex Today | Expect rupee to trade with a negative bias: Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee traded in a narrow range after the RBI kept repo rate unchanged at 6.5% and maintained policy stance, in line with market expectations. Weak domestic markets, surge in crude oil prices and FII outflows weighed on the Rupee. However, a decline in the US Dollar index prevented the Rupee from declining sharply.

We expect rupee to trade with a negative bias on selling pressure from foreign investors and weak domestic markets. Ongoing geopolitical tensions in the Middle East may also pressurise the Rupee.

However, weak Dollar may support the Rupee at lower levels. Any intervention by RBI may also support the Rupee. Traders may take cues from weekly unemployment claims data from the US. USDINR spot price is expected to trade in a range of Rs 83.75 to Rs 84.20.

-330

August 08, 2024· 14:16 IST

Brokerage Call | Nomura keeps 'buy' rating on Tata Motors, target Rs 1,303

#1 Company launched its Curvv.Ev on August 7, 2024

#2 Believe Tata Curvv breaks all key barriers for EV adoption

#3 Brings price parity between EV & ICE

#4 It significantly reduces range anxiety, offers real-world range of 350-400 Km

-330

August 08, 2024· 14:10 IST

Brokerage Call | Morgan Stanley maintains 'equal-weight' call On Godrej Consumer, target Rs 1,325

#1 Q1 revenue was a miss while EBITDA margin ahead of estimate

#2 While India business volumes were strong, GAUM business performance remains weak

#3 Entry into pet care: GCPL to invest Rs 500 crore primarily in opex, sales & marketing over five years

-330

August 08, 2024· 14:07 IST

IPO Updates | FirstCry IPO subscribes 1.20 times

QIB – 1.13x

NII – 1.06x

Retail – 1.60x

Employee – 5.18x

-330

August 08, 2024· 14:06 IST

Stock Market LIVE Updates | Vipul Organics develops a new organic intermediate

Vipul Organics announced the development of a refined grade of organic intermediate for manufacturing specialty chemical to be finally used for the Automobile Industry.

-330

August 08, 2024· 14:04 IST

Now, first rate cut seems to be more likely in December or February given RBI's hawkish tone

The Governor is probably trying to tone down market expectations with respect to timing of rate cut(s), especially in the context of rising global expectations of a rate cut by the Fed in September....Read More

-330

August 08, 2024· 14:01 IST

Markets@2 | Sensex down 500 points, Nifty below 24150

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 1,046.40 | 2.06 | 658.96k |

| HDFC Bank | 1,644.55 | 1.21 | 386.23k |

| Bharti Airtel | 1,455.50 | 0.96 | 83.13k |

| ITC | 495.15 | 0.54 | 314.18k |

| IndusInd Bank | 1,349.50 | 0.34 | 80.47k |

| Tech Mahindra | 1,477.00 | 0.25 | 20.49k |

| Sun Pharma | 1,736.90 | 0.12 | 34.96k |

| SBI | 809.35 | 0.03 | 563.25k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Infosys | 1,736.00 | -3.13 | 140.69k |

| Asian Paints | 3,011.00 | -2.89 | 33.42k |

| Power Grid Corp | 343.00 | -2.58 | 275.43k |

| Larsen | 3,560.00 | -2.33 | 83.11k |

| UltraTechCement | 11,320.75 | -1.95 | 5.28k |

| HCL Tech | 1,564.80 | -1.91 | 96.70k |

| Wipro | 488.20 | -1.87 | 232.58k |

| Tata Steel | 151.00 | -1.85 | 2.30m |

| JSW Steel | 891.20 | -1.77 | 137.00k |

| NTPC | 409.65 | -1.61 | 384.56k |

-330

August 08, 2024· 13:55 IST

Stock Market LIVE Updates | TVS Supply Chain Solutions gets new business contract

The supply chain solutions provider has secured a new business contract from JCB in India for managing their in-plant warehousing and logistics operations at the Vadodara facility in Gujarat for three years.

The supply chain solutions provider has secured a new business contract from JCB in India for managing their in-plant warehousing and logistics operations at the Vadodara facility in Gujarat for three years.

-330

August 08, 2024· 13:53 IST

Stock Market LIVE Updates | Hindalco Industries shares fall after Novelis Q1 net income declines

#1 Net income falls 3 percent to $151 million

#2 Net income excluding special items jumps 32 percent to $204 million

#3 Adjusted EBITDA grows 19 percent to $500 million

#4 Rolled product shipments at 951 kilotonnes increase 8 percent

#5 Adjusted EBITDA per tonne shipped grows 10 percent to $525

-330

August 08, 2024· 13:52 IST

Sensex Today | BSE Telecom index up 0.6%; TataTeleservices, Route India, HFCL, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Route | 1,632.00 | 8.66 | 48.57k |

| TataTeleservice | 95.59 | 3.98 | 2.35m |

| HFCL | 141.30 | 2.58 | 3.12m |

| GTL Infra | 2.84 | 2.53 | 50.33m |

| Vodafone Idea | 16.06 | 2.16 | 52.12m |

| OnMobile Global | 78.75 | 1.01 | 71.68k |

| Railtel | 468.95 | 0.96 | 370.15k |

| Bharti Airtel | 1,455.30 | 0.94 | 84.67k |

-330

August 08, 2024· 13:49 IST

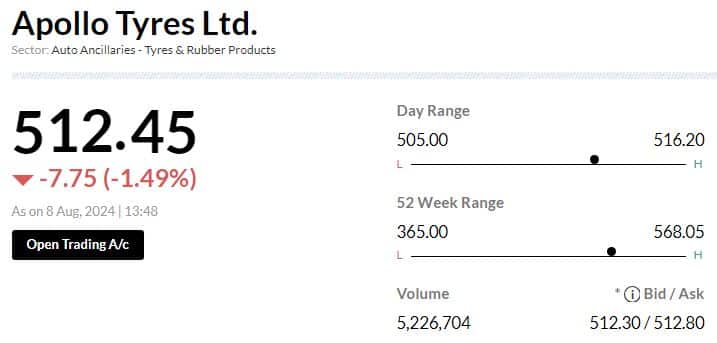

Stock Market LIVE Updates | Apollo Tyres shares fall after Q1 profit tanks

#1 Profit tanks 23.9 percent to Rs 302 crore Vs Rs 396.9 crore, YoY

#2 Revenue grows 1.4 percent to Rs 6,334.8 crore Vs Rs 6,244.6 crore, YoY

-330

August 08, 2024· 13:47 IST

IPO Check | Unicommerce eSolutions issue subscribed 47x on Day 3 so far, NII portion booked 110x

The public offer of Unicommerce eSolutions witnessed strong traction from investors and was subscribed 47.67 times on its final day of bidding (August 8), led by retail investors and non-institutional bidders.

Non-institutional investors took the lead, buying 110.76 times the portion set aside for them, and retail investors took the second position, picking 80.85 times the allotted quota. Qualified institutional buyers showed a rather tepid interest, subscribing just 7.51 times the reserved portion.

The software products provider opened its public issue on August 6, targeting to mobilise Rs 276.57 crore via an offer-for-sale. The price band for the offer has been fixed at Rs 102-108 per share.

The issue was subscribed 12.23 times at the end of the second day of bidding on August 7, the subscription data available with the exchanges showed.

-330

August 08, 2024· 13:45 IST

Earnings Watch | Garden Reach Q1 net profit up 13.7% at Rs 87.2 crore Vs Rs 77 crore, YoY

-330

August 08, 2024· 13:42 IST

RBI MPC | Experts pick top 9 rate-sensitive stocks as RBI holds repo rate but revises Q1 GDP, inflation forecasts

Moneycontrol collated a list of top 9 rate sensitive stocks from experts with a 3-4-week perspective....Read More

-330

August 08, 2024· 13:39 IST

Stock Market LIVE Updates | Apollo Tyres shares fall post Q1 earnings

#1 Profit tanks 23.9 percent to Rs 302 crore Vs Rs 396.9 crore, YoY

#2 Revenue grows 1.4 percent to Rs 6,334.8 crore Vs Rs 6,244.6 crore, YoY

-330

August 08, 2024· 13:28 IST

Earnings Watch | Alembic Pharma Q1 net profit up 11.7% at Rs 134.7 crore Vs Rs 121 crore, YoY

-330

August 08, 2024· 13:27 IST

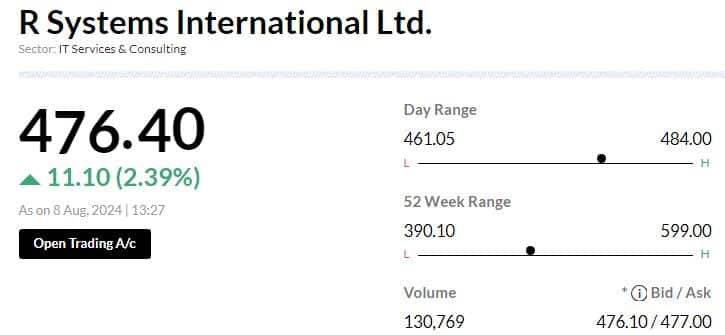

Stock Market LIVE Updates | R Systems shares gain 2% after Q1 profit jumps 72.5%

#1 Profit jumps 72.5 percent to Rs 24.9 crore Vs Rs 14.4 crore, YoY

#2 Revenue increases 6.2 percent to Rs 432 crore Vs Rs 406.8 crore, YoY

#3 Tax cost falls to Rs 21.9 crore Vs Rs 31.09 crore, YoY

-330

August 08, 2024· 13:25 IST

Stock Market LIVE Updates | Balaji Amines shares down 6% as Q1 profit down 32.7%

#1 Profit plunges 32.7 percent to Rs 45.6 crore Vs Rs 67.7 crore, YoY

#2 Revenue declines 17 percent to Rs 384.7 crore Vs Rs 463.7 crore, YoY

-330

August 08, 2024· 13:24 IST

Ranen Banerjee- Partner and Leader Economic Advisory, PwC India

The continued pause in the policy rate and sticking with the stance of withdrawal of accommodation was expected given the RBI Governor’s earlier statements.

There is no pressing need for any action on the policy rate as the yields on 10 year paper have already softened by almost 20bps owing to the index linked flows.

There is still volatility in food prices and risk of food inflation that will keep the CPI elevated above 4% in FY25. So, we should expect a continued pause till Q4 unless we have a lowering of weightage of food in the index being adopted in the interim.

A very important announcement has been on delegated payments in UPI. This will be game changing as far as base expansion for digital payment adoption and financial inclusion is concerned.

-330

August 08, 2024· 13:22 IST

Dr Lal Pathlabs drops 4% as valuation concerns outweigh Q1FY25 positives

Several brokerages downgraded shares of Dr Lal PathLabs due to its high valuations, which they believe limit the potential for further upside. However, recognising growth prospects, price targets were raised....Read More

-330

August 08, 2024· 13:20 IST

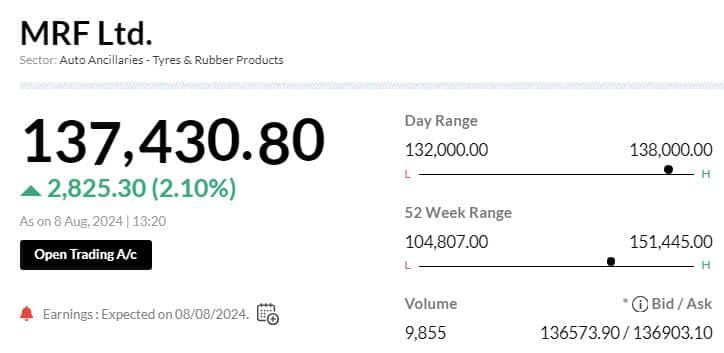

Earnings Watch | MRF Q1 net profit down 3.3% at Rs 562.6 crore Vs Rs 581.5 crore, YoY

-330

August 08, 2024· 13:19 IST

Earnings Watch | Unichem Laboratories Q1 net profit at Rs 9 crore Vs loss of Rs 0.7 crore, YoY

-330

August 08, 2024· 13:18 IST

Bharat Forge board approves Rs 2,000 crore fundraising; reports mixed Q1 results

Bharat Forge saw a 13.5% decline in net profit, amounting to Rs 269.4 crore compared to Rs 312 crore in the same period last year. ...Read More

-330

August 08, 2024· 13:17 IST

Stock Market LIVE Updates | Metro Brands in strategic partnership with New Era Cap

New Era Cap, the New York-based brand revolutionizing headwear

in sports fashion, today announced the signing of a long-term licensing agreement with Metro Brands .

This partnership will expand the retail presence of New Era in India and deepen MBL’s retail expansion in the athleisure market.

-330

August 08, 2024· 13:16 IST

Stock Market LIVE Updates | Lemon Tree Hotels shares down 7% post Q1 earnings

#1 Profit declines 26.9 percent to Rs 20.1 crore Vs Rs 27.5 crore, YoY

#2 Revenue grows 19.5 percent to Rs 268 crore Vs Rs 224.2 crore, YoY

-330

August 08, 2024· 13:14 IST

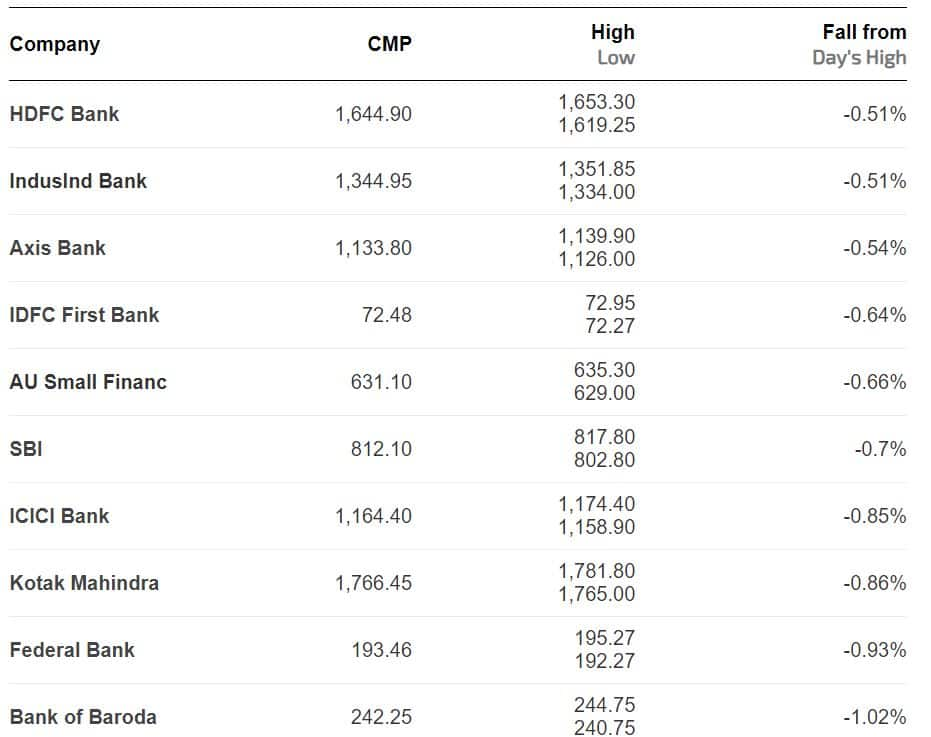

Sensex Today | Nifty Bank index shed 260 points from day's high

-330

August 08, 2024· 13:12 IST

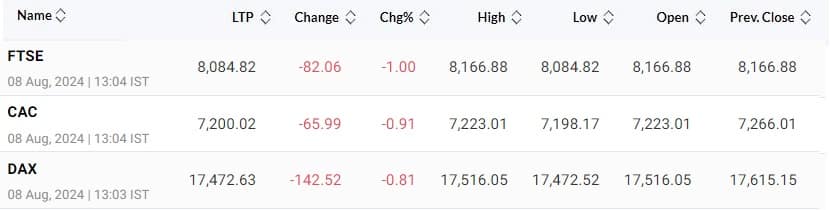

Market Turmoil: S&P always looks good next to European stocks

August’s turmoil hit a weak European stock market that’s delivered a bittersweet earnings season. The region’s firms are feeling pressure from East and West ...Read More

-330

August 08, 2024· 13:10 IST

Stock Market LIVE Updates | Biocon shares trade lower ahead of Q1 earnings

-330

August 08, 2024· 13:08 IST

Trent Q1 Preview: Net profit set to almost double on Zudio, Westside popularity

Trent's net profit is likely to come in at Rs 294 crore for the three months ended June, jumping 98 percent on-year. ...Read More

-330

August 08, 2024· 13:06 IST

Sensex Today | European indices down 0.5-1%

-330

August 08, 2024· 13:03 IST

Suzlon Energy stock hits multi-year high on Renom acquisition; shares rise 290% in a year, should you buy?

Suzlon energy is a vertically integrated wind turbine manufacturer and O&M service provider with over 20.7GW of installed capacity across the globe....Read More

-330

August 08, 2024· 13:02 IST

Markets@1 | Sensex down 240 pts, Nifty around 24200

-330

August 08, 2024· 12:58 IST

Earnings Watch | Ajmera Realty Q1 net profit up 48.8% at Rs 31.4 crore Vs Rs 21 crore, YoY

-330

August 08, 2024· 12:57 IST

Earnings Watch | Snowman Logistics Q1 net profit down 48% at Rs 1.8 crore Vs Rs 3 crore, YoY

-330

August 08, 2024· 12:56 IST

Sensex Today | Biocon, Alembic Pharmaceuticals, Astral, among others to announce results today

Eicher Motors, Life Insurance Corporation of India, ABB India, Oil India, Biocon, Alembic Pharmaceuticals, Astral, Astrazeneca Pharma, Bajel Projects, Gujarat State Petronet, IRCON International, Minda Corporation, MRF, Page Industries, Rail Vikas Nigam, Steel Authority of India, Sobha, Unichem Laboratories, and Va Tech Wabag will release their quarterly earnings on August 8.

-330

August 08, 2024· 12:51 IST

Option strategy of the day | Long build up in Cipla; Bull call spread suggested for upside

Cipla stock has rebounded multiple times from the current support zone, and is trading above its short and long-term moving averages....Read More

-330

August 08, 2024· 12:49 IST

Brokerage Call | Nomura maintains 'buy' rating on Uno Minda, target Rs 1,190

#1 Expanding TAM to sustain strong growth

#2 Q1 ahead; focus on affordable premiumization

#3 Scale-up in E4W components keep growth visibility high

#4 Stock trading at 42.3x FY26 EPS, which believe is attractive given strong 24 percent FY24-27 EPS CAGR

-330

August 08, 2024· 12:47 IST

Sensex Today | BSE IT index down 0.6%; Axiscades Technologies, 63 Moons Technologies among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Axiscades Tech | 525.75 | -2.92 | 11.15k |

| 63 Moons Tech | 357.45 | -2.01 | 12.87k |

| Expleo Solution | 1,277.45 | -1.83 | 563 |

| Sasken Tech | 1,606.90 | -1.76 | 433 |

| Infosys | 1,760.50 | -1.76 | 91.20k |

| LTIMindtree | 5,468.10 | -1.74 | 3.59k |

| COFORGE LTD. | 5,923.30 | -1.59 | 2.26k |

| KSolves | 1,068.50 | -1.53 | 1.06k |

| Wipro | 491.35 | -1.24 | 190.95k |

| MphasiS | 2,697.15 | -1.1 | 4.10k |

-330

August 08, 2024· 12:45 IST

Ceigall India makes a modest IPO debut on NSE; should you buy, sell, or hold?

While Ceigall listed at a moderate premium, its future growth potential and strategic positioning in the infrastructure sector provide a strong case for holding shares in the long run, according to analysts....Read More

-330

August 08, 2024· 12:42 IST

Earnings Watch | Bharat Forge Q1 net profit at Rs 269.4 crore

-330

August 08, 2024· 12:41 IST

Brokerage Call | HSBC maintains 'hold' rating on Lupin, target raises to Rs 1,920

#1 Better mix (mirabegron launch in US, traction in existing US products) led EBITDA margins beat in Q1

#2 Lower R&D-led EBITDA margin beat in Q1

#3 Good line-up of opportunities in FY25-26

#4 Timely approval and execution will be critical to sustain US sales momentum

-330

August 08, 2024· 12:30 IST

Sensex Today | Nifty Bank index recovers 550 points from day's low

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HDFC Bank | 1,647.90 | 1.5 | 9.70m |

| SBI | 816.65 | 0.99 | 8.62m |

| Federal Bank | 193.65 | 0.49 | 3.16m |

| AU Small Financ | 632.45 | 0.25 | 538.17k |

| IDFC First Bank | 72.63 | 0.14 | 8.11m |

| Bank of Baroda | 243.70 | 0.12 | 6.35m |

| ICICI Bank | 1,172.70 | 0.02 | 4.92m |

| Kotak Mahindra | 1,776.75 | 0.01 | 1.20m |

| Axis Bank | 1,136.90 | 0.01 | 3.66m |

-330

August 08, 2024· 12:29 IST

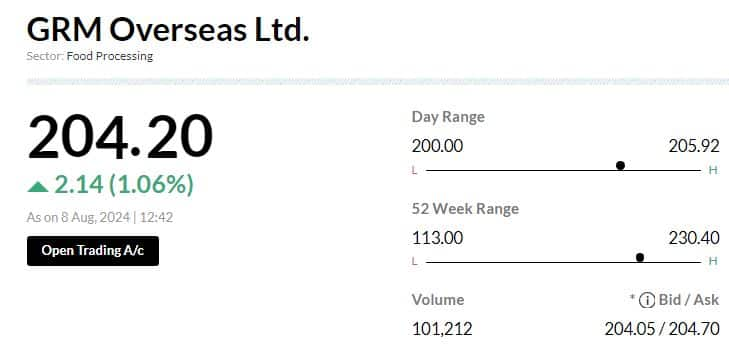

Sensex Today | GRM Overseas in partnership with Solariz Invest in Morocco

GRM Overseas expands its Global Presence through Partnership with Solariz Invest in Morocco.

This collaboration represents a pivotal moment in GRM's global expansion efforts, as it introduces its flagship basmati rice brand ‘Tanoush’ to Moroccan consumers via Solariz Invest’s wide-reaching distribution network.

-330

August 08, 2024· 12:27 IST

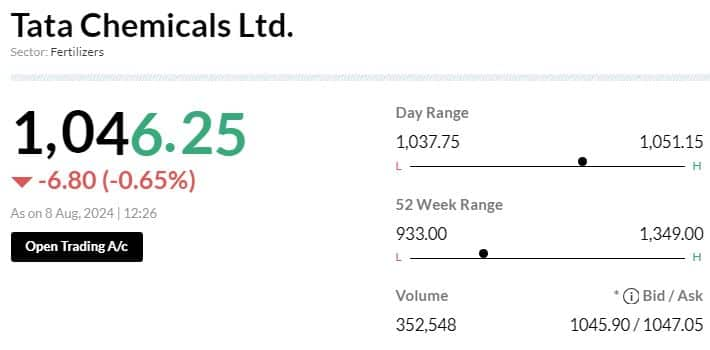

Brokerage Call | HSBC keeps 'reduce' rating on Tata Chemicals, target Rs 800

#1 Q1 results weaker than consensus

#2 US and India businesses improve but negative surprises in UK and Africa

#3 Muted outlook as capacity additions outpace demand growth

#4 Upside risks from solar/EV and any capacity disruptions

-330

August 08, 2024· 12:20 IST

RBI policy: India's real GDP growth for FY25 retained at 7.2%

The MPC by a 4-2 majority left the repo rate unchanged at 6.5 percent...Read More

-330

August 08, 2024· 12:20 IST

Earnings Watch | KPI Green Q1 net profit up 98% at Rs 66 crore Vs Rs 33 crore, YoY

-330

August 08, 2024· 12:12 IST

Brokerage Call | Nomura keeps 'neutral' rating on Cummins India, target Rs 3,740

#1 Buoyant outlook

#2 Raise EBITDA margin by 51 bps/35 bps/31 bps for FY25/26/27

#3 Domestic demand strong, with exports bottoming out

#4 Demand agnostic to price increase led by CPCB IV+

#5 Stock remains expensive & trades at 44x/37x FY26F/27F EPS

-330

August 08, 2024· 12:08 IST

Sensex Today | 1.23 million shares of ITC traded in block: Bloomberg

-330

August 08, 2024· 12:06 IST

Earnings Watch | Nava Q1 net profit rises 36.3% at Rs 355.7 crore Vs Rs 261 crore, YoY

-330

August 08, 2024· 12:05 IST

RBI Policy: MPC keeps repo rate unchanged for 9th time in a row

Stance also remained unchanged at “withdrawal of accommodation”...Read More

-330

August 08, 2024· 12:01 IST

Markets@12 | Sensex down 170 pts, Nifty below 24250

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 1,043.30 | 1.76 | 490.86k |

| Bharti Airtel | 1,462.15 | 1.42 | 59.80k |

| HDFC Bank | 1,645.55 | 1.27 | 242.66k |

| SBI | 814.40 | 0.66 | 345.45k |

| ITC | 495.35 | 0.58 | 235.51k |

| M&M | 2,694.05 | 0.43 | 51.29k |

| Tech Mahindra | 1,478.60 | 0.36 | 13.24k |

| Sun Pharma | 1,738.10 | 0.19 | 25.71k |

| TCS | 4,203.10 | 0.05 | 41.33k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Asian Paints | 3,025.75 | -2.41 | 12.06k |

| Infosys | 1,757.35 | -1.93 | 75.95k |

| UltraTechCement | 11,332.15 | -1.85 | 3.38k |

| Wipro | 489.30 | -1.65 | 162.71k |

| Power Grid Corp | 346.45 | -1.6 | 170.99k |

| Tata Steel | 151.40 | -1.59 | 860.19k |

| Larsen | 3,594.05 | -1.4 | 51.18k |

| JSW Steel | 894.95 | -1.36 | 121.97k |

| Maruti Suzuki | 12,217.95 | -1.28 | 5.54k |

| Nestle | 2,490.25 | -1.26 | 101.87k |

-330

August 08, 2024· 11:59 IST

Stock Market LIVE Updates | Coromandel International appoints S Sankarasubramanian as MD and CEO

The Board of Directors has appointed S Sankarasubramanian as Managing Director and Chief Executive Officer (CEO) of Coromandel International, effective August 7. S Sankarasubramanian was previously the Executive Director – Nutrient Business.

-330

August 08, 2024· 11:56 IST

Sensex Today | BSE Smallcap index up 0.6%, Symphony, ITD Cementation, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Symphony | 1,706.00 | 13.93 | 105.63k |

| ITD Cementation | 545.05 | 12.78 | 747.87k |

| Balu Forge Indu | 587.20 | 9.37 | 204.57k |

| Oswal Greentech | 51.95 | 8.75 | 618.99k |

| BASF | 7,522.35 | 8.62 | 24.56k |

| Ramco System | 397.50 | 8.55 | 49.17k |

| Venkys | 2,369.05 | 8.11 | 44.58k |

| Chaman Lal Seti | 252.85 | 8.08 | 100.49k |

| Epigral | 1,898.30 | 7.98 | 15.03k |

| Snowman Logist | 84.79 | 7.88 | 177.90k |

-330

August 08, 2024· 11:54 IST

FirstCry IPO: Issue subscribed 46% on Day 3 so far, employee portion booked 4.73x

Brainbees Solutions, the parent of FirstCry, mobilised Rs 1,885.8 crore through anchor book on August 5...Read More

-330

August 08, 2024· 11:53 IST

Sensex Today | 2.88 million shares of Ashok Leyland traded in a block: Bloomberg

-330

August 08, 2024· 11:52 IST

Sensex Today | BSE Smallcap index outperform

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 79277.59 -0.24 | 9.74 -3.16 | -0.85 20.40 |

| BSE 200 | 11241.61 -0.24 | 16.63 -2.90 | -0.41 32.37 |

| BSE MIDCAP | 46881.78 0.11 | 27.26 -2.83 | -1.03 54.33 |

| BSE SMALLCAP | 53576.11 0.56 | 25.55 -2.49 | -0.85 51.99 |

| BSE BANKEX | 57138.09 0.18 | 5.08 -2.88 | -4.91 13.16 |

-330

August 08, 2024· 11:51 IST

Brokerage Call | Nomura keeps 'buy' rating on Tata Motors, target Rs 1,303

#1 Company launched its Curvv.Ev on August 7, 2024

#2 Believe Tata Curvv breaks all key barriers for EV adoption

#3 Brings price parity between EV & ICE

#4 It significantly reduces range anxiety, offers real-world range of 350-400 Km

-330

August 08, 2024· 11:46 IST

Sensex Today | Sonal Verma, chief economist at Nomura

Even though the stance is unchanged, we think it is a neutral hold. The downgrade to Q1 GDP (from 7.3% to 7.1%) due to weak high frequency data was a surprise to us, since the RBI has so far been raising its growth forecasts, so it is acknowledging softer numbers incrementally. On inflation, the near-term upward revision has been offset by downward revision to Q4, implying the food price shock is seen as transitory. Our estimates show that the RBI’s upward revision to Q2 CPI (from 3.8% to 4.4%) may not materialise, since food prices are already reversing in August, so inflation may surprise lower relative to the RBI’s near-term forecast. We expect the RBI to begin its easing cycle from October with a 25bp cut, as both inflation and growth surprise on the downside. Past evidence suggests the RBI does not offer any forward guidance ahead of its monetary policy pivots. We expect 75bp worth of cumulative easing in this cycle to a terminal repo rate of 5.75% by March 2025.

-330

August 08, 2024· 11:40 IST

No impact on home loan EMIs as RBI keeps repo rate steady

Several economists expect the Monetary Policy Committee to change its stance to Neutral in October, and start the rate cutting cycle from December. Existing borrowers will have to contend with higher interest rates for a few more months....Read More

-330

August 08, 2024· 11:32 IST

Sensex Today | Caplin Point Gets Final US FDA ANDA Nod For Timolol Maleate Ophthalmic Solution

#1 Alert: Timolol Maleate Ophthalmic Soln Is Used For Eye Treatment

-330

August 08, 2024· 11:26 IST

Earnings Watch | KPI Green Q1 net profit up 98% YoY; stock up 5%

#1 Net Profit at Rs 66 Cr Vs Rs 33 Cr (YoY)

#2 Revenue Up 84% At Rs 348 Cr Vs Rs 189.3 Cr (YoY)

#3 EBITDA Up 91% At Rs 131.7 Cr Vs Rs 69 Cr (YoY)

#4 Margin At 38% Vs 36.5% (YoY)

-330

August 08, 2024· 11:20 IST

Sensex Today | ITC has 1.23 mln shares traded in a block: Bloomberg

-330

August 08, 2024· 11:18 IST

-330

August 08, 2024· 11:14 IST

Sensex Today | BSE Healthcare index un 1%; RPG Life, Strides Pharma, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| RPG Life | 2,040.10 | 4.76 | 635 |

| Krsnaa Diagnost | 706.00 | 4.34 | 5.65k |

| Strides Pharma | 1,162.25 | 4.24 | 16.31k |

| Abbott India | 29,235.00 | 3.82 | 1.90k |

| Kovai Medical | 4,765.10 | 3.35 | 1.97k |

| Alembic Pharma | 1,259.90 | 3.27 | 16.00k |

| GlaxoSmithKline | 2,905.70 | 2.98 | 9.25k |

| Krishna Inst. | 2,205.15 | 2.96 | 3.58k |

| Pfizer | 5,979.30 | 2.85 | 1.66k |

| Aarti Drugs | 519.00 | 2.78 | 2.43k |

-330

August 08, 2024· 11:11 IST

Stock Market LIVE Updates | V Arun Roy resigns as Chairman TamilNadu Petroproducts

V Arun Roy has resigned as Chairman and Non-Executive Non-Independent Director on the board of the company, following the withdrawal of nomination by Tamilnadu Industrial Development Corporation (TIDCO).

-330

August 08, 2024· 11:09 IST

Sensex Today | Nifty Media index up nearly 1%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| DB Corp | 340.05 | 3.44 | 129.71k |

| Zee Entertain | 140.60 | 2.66 | 6.63m |

| Dish TV | 15.20 | 1.13 | 5.59m |

| Sun TV Network | 889.70 | 0.16 | 149.77k |

-330

August 08, 2024· 11:05 IST

Stock Market LIVE Updates | Anish T Mathew resigns as CFO of Allcargo Gati

Anish T Mathew has resigned as Chief Financial Officer, effective October 31, 2024, due to personal reasons. The Board has approved the appointment of Deepak Jagdish Pareek as Deputy Chief Financial Officer of the company, with immediate effect.

-330

August 08, 2024· 11:01 IST

Markets @11 | Sensex, Nifty extend losses

-330

August 08, 2024· 10:59 IST

Sensex Today | BSE Bank index down 0.3%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ICICI Bank | 1,160.05 | -1.09 | 66.48k |

| Canara Bank | 107.05 | -1.02 | 171.77k |

| Bank of Baroda | 241.50 | -0.84 | 217.87k |

| Axis Bank | 1,128.30 | -0.79 | 42.14k |

| IndusInd Bank | 1,337.65 | -0.54 | 15.70k |

| Kotak Mahindra | 1,774.35 | -0.15 | 21.80k |

| SBI | 808.15 | -0.12 | 224.97k |

-330

August 08, 2024· 10:59 IST

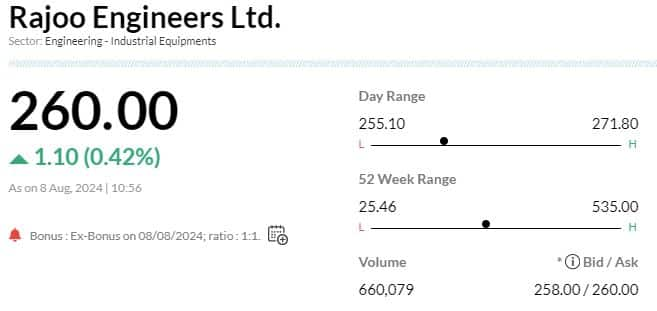

Stock Market LIVE Updates | Rajoo Engineers stock trades ex-bonus

-330

August 08, 2024· 10:55 IST

Expect change of stance, monetary easing in H2 FY 2025: Deepak Agrawal, CIO- Debt, Kotak Mahindra AMC

Amidst the global volatility in financial and divergent Central Banker actions, RBI remained calm and decided to maintain status quo on rates and continue with “withdrawal of accommodation stance” with 4:2 vote.

Growth and Inflation targets were unchanged. RBI has not taken active measure on liquidity front and intend to continue with VRRR auction to suck out surplus liquidity.

We continue to expect change of stance and monetary easing in H2 FY 2025, market reaction has been muted and the 10 year is expected to trade in the range of 6.75%-6.95%.

-330

August 08, 2024· 10:53 IST

Santosh Meena, Head of Research, Swastika Investmart

The recent RBI policy announcement was largely uneventful, with the central bank keeping policy rates unchanged and continuing the withdrawal of accommodation as expected. The focus remains on tackling inflation, with no concerns about growth, and there are no indications of rate cuts in the near term.

Consequently, the market will now turn its attention back to global cues. Although there are signs of a temporary bottom in the global market, Nifty, and Banknifty, there is still a risk of fresh selling pressure at higher levels.

Technically, Nifty is forming a bottom around the 50-DMA of 24,000, with important hurdles at 24,350, 24,525, and 24,700.

-330

August 08, 2024· 10:49 IST

Stock Market LIVE Updates | RITES trade ex-dividend

-330

August 08, 2024· 10:44 IST

Brokerage Call | Jefferies keeps 'buy' rating on Godrej Consumer, target Rs 1,580

#1 Missed estimate due to margin miss in India

#2 India organic volume growth at 8 percent however stands out across peer-set

#3 Focus on launches continue & GCPL has now forayed into rapidly growing pet care

#4 Like the excessive focus on growth

-330

August 08, 2024· 10:37 IST

Listing Today | Dhariwalcorp IPO brings listing gains, shares open with 41.5% premium on NSE SME

Dhariwalcorp Ltd made a strong debut on the NSE SME exchange on August 8, with shares listing at Rs 150 -- a premium of 41.5 percent over the issue price of Rs 106. The IPO was open for bidding during August 1-5.

The Dhariwalcorp IPO was a book-built issue, raising a total of Rs 25.15 crore by issuing 23.72 lakh fresh shares. The price band for the shares was set in the band of Rs 102-106 per share. Investors needed to commit to a minimum lot size of 1,200 shares, amounting to an investment of Rs 1.27 lakh. For High Net-Worth Individuals (HNIs), the minimum investment was set at 2 lots (2,400 shares), totalling Rs 2.54 lakh. Read More

-330

August 08, 2024· 10:35 IST

Bank indices down nearly half a percent as RBI holds repo rate steady

The RBI's monetary policy committee has left the repo rate unchanged at 6.5 percent for the ninth time...Read More

-330

August 08, 2024· 10:34 IST

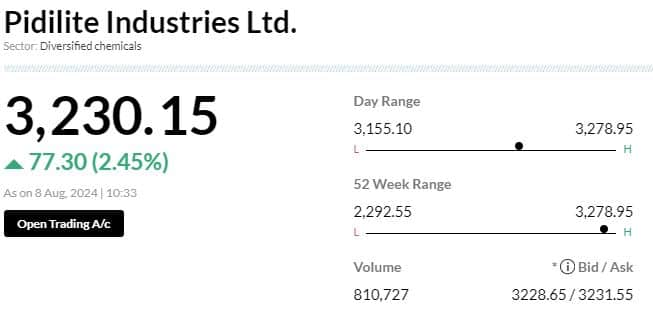

Brokerage Call | Jefferies maintains 'hold' rating on Pidilite Industries, target raises to Rs 3,310

#1 Posted double-digit UVG yet again - for 3 consecutive quarters now

#2 Rural growth outpaced that in urban

#3 B2B UVG in Q1 (+18 percent) outpaced that in B2C (+8 percent), led by exports

#4 Gross margin rose to 53.8 percent (+480 bps YoY)

#5 Raise FY25-27 EPS by +4 percent & estimate FY24-27e EPS CAGR at +18 percent