BUSINESS

KEC International: All-round improvement to support earnings, stock

With higher scale, strong orders in hand, order pipeline and improvement in margins, the earnings trajectory remains strong

MONEYCONTROL-RESEARCH

IdeaForge Technology: Pricing in too much optimism

Growth levers are in place and the company is moving towards a higher scale

BUSINESS

Cummins India: Slow growth in export market hurts sentiment

The company expects margins to improve on the back of cost reduction and investments in new products and technologies

BUSINESS

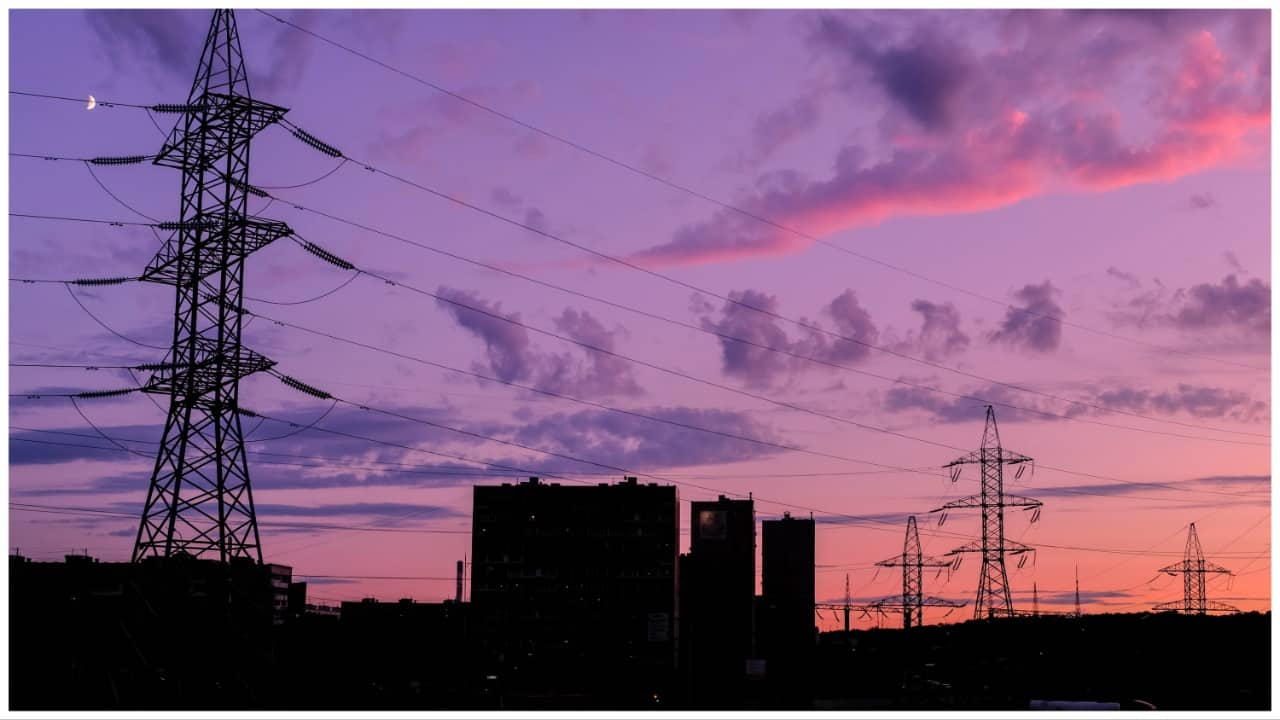

Power Grid Corporation of India: Tweaking strategy to grow fast

Higher capex and other measures to help tap new opportunities

BUSINESS

NTPC: Focus on renewables to cheer shareholders in the long run

The company has the experience and expertise in executing renewable projects. Plus, because of the low cost of capital borrowing, at around 6-6.5 percent, it has a huge advantage in the long run

BUSINESS

Thermax: Growth in earnings well priced in the stock

While the outlook is improving, one should be cautious in the near term, given that the stock has moved up swiftly.

BUSINESS

Bharat Electronics: Strong growth curve set to continue

Better execution, capacity expansion, and improving margins to support earnings growth

BUSINESS

Larsen & Toubro Q1 FY24: Execution picking up, earnings to follow

Strap: Strong order inflows, better execution, and momentum in capex cycle augur well for the company

BUSINESS

Engineers India: Stock set to ride on earnings, valuations support

Business driven by strong order inflows, improving execution, stable margins, diversification into new markets, and a focus on green energy.

BUSINESS

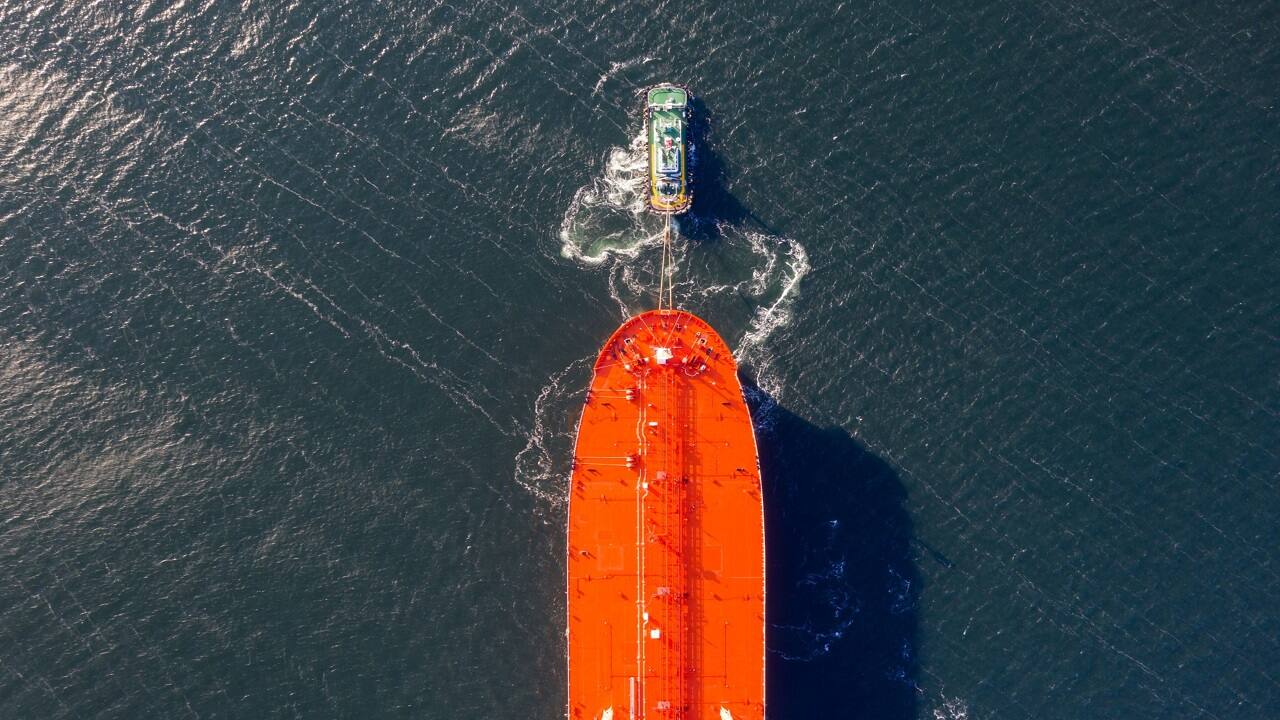

Cochin Shipyard: Sailing through steady waters

Slow execution of some of the large projects, delays in approvals, change in scope of projects, and non-availability of key imported components have hit the company. In the current year, it is expecting close to Rs 3,900 crore revenue – an YoY growth of almost 65%

BUSINESS

Bharat Dynamics: Recovery in business to support sentiment

The stock is reasonably valued after the recent correction. Order flows are expected to be good, with some of the large defence programmes reaching the final stages. The management has guided to a revenue of Rs 3,200 crore in fiscal 2024, up 28.5% from last fiscal.

BUSINESS

Ideaforge IPO: Are you looking at a long-term compounder?

With the govt restricting import of drones and focusing on the domestic space, Ideaforge has a bright future. It is already sitting on an order book of close to Rs 192 crore on an annual revenue of Rs 186 crore

BUSINESS

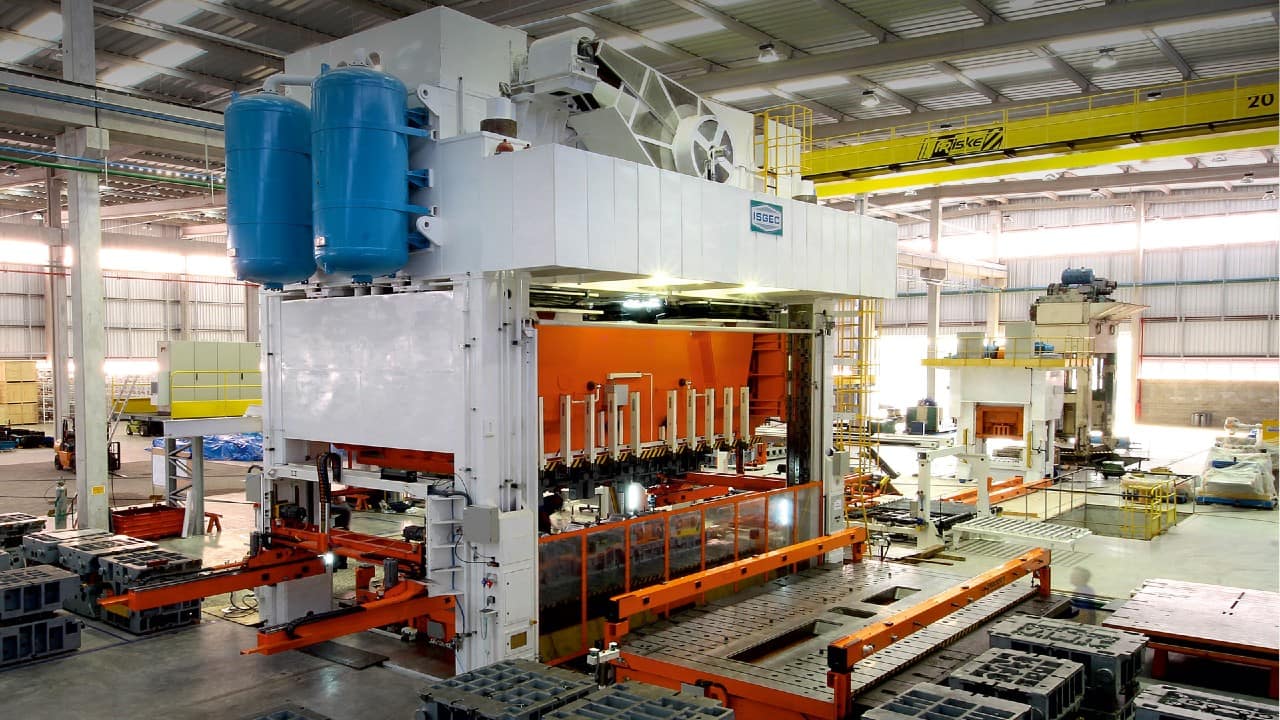

Is BHEL’s turnaround story for real?

BHEL’s turnaround strategies may result in an improvement in the long term, but the current state of financials and business do not support the euphoric rise in its share prices

BUSINESS

Railway engineering stocks: The valuation curve could get back to mean

Valuations have bumped up, but they may not remain sustainable in the medium term

BUSINESS

What should you do with IEX after the steep decline?

The power exchange is finding it difficult to protect its moat amid regulatory uncertainties

BUSINESS

Defence Shipbuilders: Time to be selective

Too much expectations built into the valuation of the stocks

BUSINESS

NTPC: Plugging into a new circuit of growth

The power generator is riding on the back of stable earnings and better demand along with its increasing footprint in the renewable space

BUSINESS

Indian Energy Exchange takes a pause as earnings narrow in the near term

The energy market is stabilising with the expectations of demand coming back in the near future

BUSINESS

Engineers India: Growth momentum gathering steam

With order inflows and orders in hand remaining strong, there is enough scope for improvement in execution and margins

BUSINESS

Cummins India: Riding on strong economic revival

Recovery in the end market and improving profitability are expected to support earnings of Cummins

BUSINESS

Bharat Electronics: Strong orders fire up the growth cannon

Diversification and initiatives in the emerging segments are yielding positive results

BUSINESS

Va Tech Wabag: Better growth, profitability on the way

Order inflows remain strong while focus on debt reduction and profitability continue to drive earnings

BUSINESS

Thermax: Faster execution at the heart of growth

March quarter sees a 16 percent YoY jump in consolidated revenues; margins improve

BUSINESS

Hindustan Aeronautics: Eyeing higher growth

With strong orders in hand and better earnings visibility company continues to ride higher