LiveNow

Closing Bell: Market at fresh record highs; auto, bank, metals rally

Benchmark indices ended higher for the fourth straight session on December 27 with Nifty closing above 21,600. At close, the Sensex was up 701.63 points or 0.98 percent at 72,038.43, and the Nifty was up 213.50 points or 1.00 percent at 21,654.80.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets edged higher for the fourth successive session and reclaimed their record high, thanks to supportive global cues. After the initial uptick, Nifty oscillated in a range for most of the session however a sharp surge in the final hour helped the index to settle around the day’s high at 21,654.75.

The majority of sectors traded in sync with the move wherein metal, auto and banking were among the top contributors. Meanwhile, the broader indices underperformed the benchmark and gained nearly half a percent each.

Nifty has reclaimed its record high and closed decisively above the 21,500 mark. We expect the prevailing move to extend further and eyeing 22,150 levels. We feel the alignment of the banking index and supportive global cues would continue to play a critical role in maintaining the momentum else the move could be gradual. Traders should stay focused on stock selection and prefer index majors and quality midcaps for fresh buying.

Akanksha Power and Infra SME IPO opens today for subscription

Akanksha Power and Infra came out with its maiden Initial Public Offer (IPO) of 4998000 equity shares of Rs 10 each with a price band of Rs 52-55 per share.

The company plans to raise Rs 27.49 crore, at the upper cap of the price band. The issue opens for subscription on 27.12.23 and will close on 29.12.23.

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Strong global market undercurrent coupled with India's robust macro performance in past few quarters gave investors ample ammunition to go ballistic on India's equities as Sensex reached a new milestone level of 72k mark led by gains in banking, auto and metal stocks.

The rally came despite worries over the ongoing conflict at Gaza and attacks on ships at Red sea, while hopes of rate cuts in the US next year and receding worries of recession in developed economies going ahead dictated the optimistic mood.

Rahul Sharma Director, Head- Technical & Derivative Research, JM Financial Services:

After a brief midweek panic last week, bulls are back with a bang albeit with some caution. India VIX has touched a new high on multi-month time frame indicating possibility of some volatility as we approach the monthly expiry. FII's have been buyers in the last couple of sessions in Index options while they continue to stay long in the index futures segment. Banks have been a bit late to this party but now seem ready to breakout from the current range. PSU Banks are the strongest while private banks are expected to play catch up. 21,800 on the Nifty and 49,000 on the Nifty Bank seems likely tomorrow.

Vinod Nair, Head of Research at Geojit Financial Services:

The upbeat domestic market continued reaching a new record high and easily recovered the last week's losses. This upward trend was predominantly supported by the Santa Claus rally in anticipation of early rate cuts by the US Fed and cooling global inflation. Additionally, the news of major shipping companies resuming operations through the Red Sea despite ongoing tensions further bolstered domestic sentiment.

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty experienced a significant rally as Put writers amassed substantial positions at 21500. Additionally, the daily chart showcased a breakout from consolidation. The Relative Strength Index (RSI) indicates a bullish crossover, coinciding with the index positioned above a crucial moving average. Looking ahead, the index potentially aims for a range between 21750-21800 on the upside, with support resting at 21500."

The Bank Nifty recently experienced a breakout from consolidation as observed on the daily chart. It's been consistently maintaining a position above a critical moving average. Additionally, the Relative Strength Index (RSI) reflects a bullish crossover on the daily chart. Looking forward, the index could potentially target levels between 48500-48800 on the upside, with a support base at 48000.

Aditya Gaggar Director of Progressive Shares:

Positive momentum continues on 2nd trading session as well and Nifty50 began the day on a firm note. Due to bearish divergence in RSI, a minor correction was seen in the mid-session; however, late buying in Auto, Banking, and Metal stocks pushed the Index higher to end the day at a record level of 21,654.75 with gains of 213.40 points.

Mid and Smallcaps underperformed in today's trade as major buying was seen in the Index stocks only.

A strong bullish candle was formed on the daily chart which suggests an extension of the current underlying uptrend. Now the next hurdle for the Index will be around 21,860 while the downside seems to be protected at 21,510.

Rupee Close:

Indian rupee ended 16 paise lower at 83.35 per dollar versus previous close of 83.19.

Market Close: Benchmark indices ended higher for the fourth straight session on December 27 with Nifty closing above 21,600.

At close, the Sensex was up 701.63 points or 0.98 percent at 72,038.43, and the Nifty was up 213.50 points or 1.00 percent at 21,654.80. About 1801 shares advanced, 1848 shares declined, and 124 shares unchanged.

The biggest gainers on the Nifty included Hindalco Industries, UltraTech Cement, Bajaj Auto, JSW Steel and Tata Motors, while losers were ONGC, NTPC, Adani Enterprises, UPL and Adani Ports.

Except for oil & gas and Power, all other sectoral indices ended in the green with auto, bank and metal up 1 percent each.

BSE midcap and smallcap indices ended with marginal gains.

Stock Market LIVE Updates | HSBC View On UPL:

-Buy call, target Rs 750 per share

-Board approves equity issuance up to Rs 4,200 crore via a rights issue

-Details on issue price etc to be announced in due course

-If proceeds directed towards debt reduction in, it can be a positive

-Stock currently trades at FY25 PE of 8.6x, which is attractive

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee depreciated on Wednesday on Dollar demand from foreign banks and importers. FII outflows also weighed on the Rupee. However, positive domestic markets and the weak tone in the US Dollar cushioned the downside. India’s current account deficit declined to $8.3 billion, at 1% of GDP in the July-September 2023 quarter vs 1.1% of GDP in the prior quarter. The US Dollar declined on Tuesday on rate-cut bets. US HPI increased by 0.3% in October 2023 vs 0.8% in the previous month.

We expect Rupee to trade with a slight negative bias on month-end Dollar demand from OMCs and importers. Demand for the Dollar from foreign banks towards the end of the year may also put downside pressure on Rupee. However, domestic markets hitting fresh all-time highs and any fresh FII inflows may support the Rupee at lower levels. Traders may take cues from Richmond manufacturing index data from the US. USDINR spot price is expected to trade in a range of Rs 83 to Rs 83.70.

Stock Market LIVE Updates | Equirus View On Alkem Laboratories:

-Initiate long, target Rs 6,295 per share

-Set to embark on an unprecedented margin trajectory

-Expect higher domestic margins (+650-700 bps over FY23-FY26)

-Expect higher margin on better productivity of chronic MRs and on full-year benefit of recent NLEM price hikes

-Expect higher margin on a greater chronic market share

-Closure of the St Louis facility (100-120 bps impact) would aid further

-A possible correction in Pen-G prices could buoy gross margins (not factored into estimate)

Sensex Today | BSE Power index down 0.4 percent dragged by NTPC, CG Power, JSW Energy:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NTPC | 304.50 | -1.68 | 452.56k |

| CG Power | 458.30 | -1.46 | 54.42k |

| JSW Energy | 411.50 | -0.94 | 131.60k |

| ABB India | 4,725.00 | -0.92 | 2.43k |

| NHPC | 64.08 | -0.88 | 1.47m |

| Siemens | 3,971.20 | -0.85 | 10.55k |

| Power Grid Corp | 232.85 | -0.19 | 600.08k |

| Tata Power | 325.00 | -0.05 | 530.95k |

Stock Market LIVE Updates | PNB raises Rs 1,153 crore from Basel-III AT1 bonds at 8.55% coupon

State-run Punjab National Bank on December 27 raised Rs 1,153 crore through Basel-III additional Tier-I bonds at a coupon rate of 8.55 percent, market sources said.

On December 21, Moneycontrol had reported that Punjab National Bank was planning to raise up to Rs 3,000 crore by issuing the bonds. The issue comprised a base size of Rs 500 crore, with a greenshoe option of Rs 2,500 crore. A greenshoe option allows companies to issue more bonds or raise more funds than the base issue size.

The bonds have a call option on the fifth anniversary from the deemed date of allotment or any anniversary date thereafter with prior approval of the Reserve Bank of India (RBI). Read More

Sensex hits fresh record high of 71,997.71; metal, auto, banks shine

Stock Market LIVE Updates | Emkay View On Tejas Network

-Initiate buy, target Rs 1,050 per share

-Expect company to execute orders worth at least Rs 29,200 crore over FY24-28E

-Expect company to generate revenue/EBITDA above Rs 30,000/6,000 crore respectively

-Revenue generation led by the BSNL & Bharatnet projects

-See revenue peaking in FY25 & settling at 5x FY24 levels

-GoI emphasis on domestic manufacturing and the PLI scheme to benefit

-Large spends on BSNL, Bharatnet & the railways a positive

Sensex Today | Market at 3 PM

The Sensex was up 467.77 points or 0.66 percent at 71,804.57, and the Nifty was up 141.50 points or 0.66 percent at 21,582.80. About 1671 shares advanced, 1627 shares declined, and 86 shares unchanged.

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Mangalam Worldw | 127.70 | 119.80 | -7.90 24.57k |

| Muthoot Cap | 387.65 | 372.00 | -15.65 5.46k |

| Williamson Mago | 37.40 | 36.00 | -1.40 3.39k |

| Archidply Decor | 92.00 | 89.15 | -2.85 57 |

| DB (Int) Stock | 35.50 | 34.40 | -1.10 5.29k |

| AVG Logistics | 400.00 | 387.95 | -12.05 119.21k |

| Aurangabad Dist | 300.00 | 291.00 | -9.00 0 |

| Walchandnagar | 202.40 | 196.90 | -5.50 179.21k |

| Sundaram-Clayto | 7,500.00 | 7,300.00 | -200.00 1.36k |

| Le Merite | 43.00 | 41.85 | -1.15 1.60k |

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| KCK Industries | 24.50 | 27.50 | 3.00 4.00k |

| Aarvee Denim | 26.90 | 29.80 | 2.90 4.23k |

| Coffee Day | 61.80 | 66.70 | 4.90 585.79k |

| SecMark Consult | 103.40 | 110.15 | 6.75 10.20k |

| 3M India | 33,598.15 | 35,720.00 | 2,121.85 7.95k |

| PC Jeweller | 43.65 | 46.35 | 2.70 483.08k |

| ZIM Lab | 113.70 | 119.90 | 6.20 7.16k |

| ORIENTAL AROMAT | 364.60 | 384.15 | 19.55 2.35k |

| Shreeoswal Seed | 56.35 | 59.25 | 2.90 40.87k |

| J Kumar Infra | 596.25 | 626.60 | 30.35 180.91k |

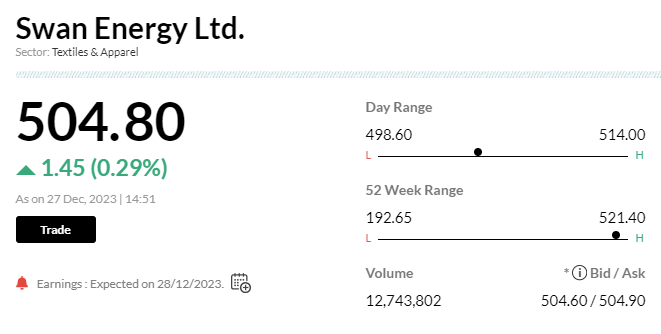

Stock Market LIVE Updates | Swan Energy: 48.6 lakh shares worth Rs 244 crore change hands: CNBC

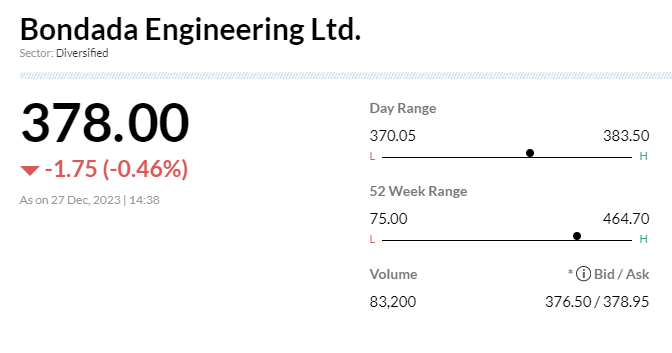

Stock Market LIVE Updates | Bondada Engineering gets Rs 3.25 crore order from Bharti Airtel

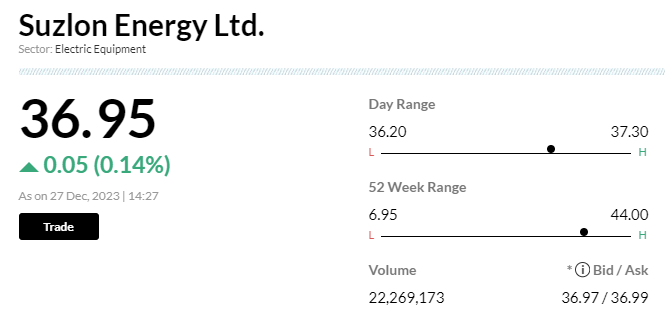

Stock Market LIVE Updates | Suzlon Energy gets 100.8mw new order from Nardic Energy to supply 32 wind turbines

Stock Market LIVE Updates | Sharekhan View on Mastek:

Post Management interaction, broking house believe the possible improvement in NHS, strong order booking from resilient UK public sector, coupled with strong US growth profile and account mining efforts will offer stronger revenue visibility for FY25 and aid in industry leading growth for the company in addition to recovery in margin profile.

Further, multiple opportunities due to policy changes, increased adoption of cloud by Public sector departments, participation in the emerging framework and newer areas in Healthcare will provide new avenues of growth.

sharekhan expect Sales/PAT CAGR of 18.2/19.3% over FY23-26E. Hence, maintain a Buy with a revised price target (PT) of Rs 3,235 (increase in PT reflects increase in target multiple to22x). At CMP, the stock trades at 23.8/18.8x its FY25/26E EPS).

Sensex Today | UltraTech Cement market cap crosses Rs 3 lakh crore for the first time ever

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Global Vectra | 108.20 | 128.90 | 20.70 2.31k |

| AksharChem | 278.45 | 301.90 | 23.45 2.56k |

| IFGL Refractory | 762.05 | 824.75 | 62.70 4.53k |

| Lasa Supergener | 30.95 | 32.85 | 1.90 77.55k |

| AVG Logistics | 377.10 | 398.90 | 21.80 123.28k |

| Kontor Space | 77.00 | 81.40 | 4.40 - |

| Sarthak Metals | 241.75 | 253.10 | 11.35 5.92k |

| GMRP&UI | 52.15 | 54.35 | 2.20 - |

| AARTIPP | 311.00 | 323.65 | 12.65 0 |

| Munjal Showa | 143.95 | 149.80 | 5.85 109.77k |

Stock Market LIVE Updates | Motilal Oswal View On Barbeque Nation Hospitality

-Neutral call, target Rs 690 per share

-Among few scalable casual dining players with healthy store eco & net cash balacesheet

-In last one year, weak macro has adversely impacted SSSg earnings

-Well-positioned to manage 15-20% growth via internal funding once the market recovers

-At EV/sales of 1.4x & EV/EBITDA of 14x on FY26, lowest in the retail space

-Company offers a better risk reward opportunity

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 41225.15 0.92 | 42.53 3.21 | 6.21 43.59 |

| BSE CAP GOODS | 54926.52 0.26 | 64.74 3.26 | 12.21 63.14 |

| BSE FMCG | 19979.12 0.07 | 24.28 1.77 | 5.08 23.60 |

| BSE Metal | 26434.97 0.99 | 26.75 5.28 | 11.08 28.08 |

| BSE Oil & Gas | 22706.09 -0.46 | 11.25 3.65 | 16.35 14.34 |

| BSE REALTY | 6084.63 0.65 | 76.53 4.52 | 9.21 79.29 |

| BSE IT | 36035.79 0.06 | 25.68 2.05 | 10.18 25.68 |

| BSE HEALTHCARE | 31248.30 0.49 | 35.66 3.93 | 5.08 34.87 |

| BSE POWER | 5751.78 -0.19 | 31.28 3.66 | 21.65 33.13 |

| BSE Cons Durables | 49737.73 0.36 | 25.21 2.95 | 7.58 27.60 |

Sensex Today | Oil holds steady as Red Sea developments monitored

Oil prices were stable on Wednesday after the previous day's strong gains as investors monitored Red Sea developments, with some major shippers resuming passage through the area despite continued attacks and broader Middle East tensions.

Brent crude futures rose 15 cents, or 0.2%, to $81.22 a barrel by 0730 GMT, while U.S. West Texas Intermediate crude eased 8 cents, or 0.1%, to $75.49 a barrel.

Stock Market LIVE Updates | HDFC Bank board approves re-appointment of Atanu Chakraborty as Chairman

The recommendation of the Nomination & Remuneration Committee, the Board of Directors of the HDFC Bank at its meeting has recommended the re-appointment of Mr. Atanu Chakraborty as the Part Time Non-Executive Chairman and Independent Director of the Bank, for a second term of three years w.e.f. May 05, 2024 to May 04, 2027 (both days inclusive).

Stock Market LIVE Updates | Equirus View On Protean eGov Technologies

-Initiate long, target Rs 1,500 per share

-A play on digital India initiatives

-Company earns 80% of its revenues on per-transaction basis across services

-Company has been generating free cashflows while being profitable

-Company is paying dividend for almost two decades

-Now has Rs 650 crore of balance sheet cash

-Expect new business of ONDC, Cloud, & International expansion to drive growth ahead

Sensex Today | Gold holds steady as activity muted, headed for best year in three

Gold prices steadied on Wednesday as trading was muted in the last week of the year, but bullion was headed for its best year in three on expectation the Federal Reserve will cut rates in the first quarter of 2024.

Spot gold was down 0.1% to $2,064.55 per ounce, as of 0611 GMT, not far from an over two-week high of $2070.39 hit on Friday. Bullion was on track to mark an over 10% gain this year - its best since 2020.

U.S. gold futures rose 0.3% to $2,075.80 per ounce.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Natura Hue | 12.44 | 51.52 | 8.21 |

| Catvision | 25.48 | 43.95 | 17.70 |

| Octaware Techno | 42.00 | 40.94 | 29.80 |

| Syncom Formula | 15.94 | 35.31 | 11.78 |

| Gallantt Ispat | 186.59 | 32.00 | 141.36 |

| Nilachal Refra | 48.67 | 29.20 | 37.67 |

| Brady and Morri | 930.00 | 28.76 | 722.30 |

| PRO CLB GLOBAL | 11.30 | 28.12 | 8.82 |

| Elnet Tech | 342.00 | 28.11 | 266.95 |

| Indsil Hydro | 53.85 | 24.77 | 43.16 |

Stock Market LIVE Updates | Suzlon Energy bags order of 100.8 MW from Mahindra Susten

Suzlon Group today announced a new order win for the development of a 100.8 MW wind power project for Mahindra Susten Private Limited, the clean‐teach arm of the Mahindra Group.

Suzlon will install 48 units of their S120 – 140m wind turbine generators (WTGs) with a Hybrid Lattice tubular (HLT) tower and a rated capacity of 2.1 MW each in Maharashtra.

Stock Market LIVE Updates | ICICI Prudential Life Insurance Company gets GST demand notice of Rs 269.86 crore:

ICICI Prudential Life Insurance Company has received an order under Section 73 of Maharashtra Goods and Service Tax Act, 2017 for FY2018, from the office of Deputy Commissioner of State Tax, Maharashtra.

Stock Market LIVE Updates | Bank of Baroda looks for buyer to sell off its 100% stake in New Zealand arm

Public sector lender Bank of Baroda (BOB) on December 27 invited proposals for the selection of investment bankers for the sale of its entire stake in the New Zealand subsidiary.

In a newspaper advertisement, the bank said: "Request for proposal for selection of investment banker for sale/disinvestment of Bank of Baroda's entire 100 percent stake in Bank of Baroda (New Zealand )." The bank has set the deadline for submission of the proposal at 2pm on January 24.

Bank of Baroda (New Zealand) is a wholly owned subsidiary of Bank of Baroda, registered since September 1, 2009, under the Reserve Bank of New Zealand Act, 1989. Read More

Sensex Today | Market at 1 PM

The Sensex was up 415.61 points or 0.58 percent at 71,752.41, and the Nifty was up 122.20 points or 0.57 percent at 21,563.50. About 1706 shares advanced, 1546 shares declined, and 84 shares unchanged.

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| NINtec SYSTEMS | 648.95 | 597.65 | -51.30 2.61k |

| AARTIPP | 337.00 | 311.00 | -26.00 0 |

| Jay Jalaram | 407.00 | 385.00 | -22.00 0 |

| Emkay Taps | 700.00 | 672.15 | -27.85 300 |

| Salasar Ext | 28.25 | 27.30 | -0.95 13.16k |

| Eimco Elecon | 1,675.00 | 1,621.00 | -54.00 440 |

| Emkay Global | 139.90 | 135.45 | -4.45 18.37k |

| Hubtown | 82.90 | 80.40 | -2.50 28.30k |

| Coral India Fin | 62.45 | 60.60 | -1.85 16.77k |

| Bafna Pharma | 95.50 | 92.70 | -2.80 214 |

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ashoka Metcast | 24.40 | 29.60 | 5.20 6.30k |

| B&B Triplewall | 256.55 | 288.60 | 32.05 978 |

| Shivam Auto | 38.00 | 41.75 | 3.75 28.91k |

| SecMark Consult | 94.75 | 100.30 | 5.55 606 |

| KAMOPAINTS | 177.15 | 186.15 | 9.00 4.26k |

| Ashapura Mine | 408.65 | 428.30 | 19.65 20.34k |

| Dynamic Service | 125.00 | 130.95 | 5.95 2.67k |

| Xelpmoc Design | 111.95 | 117.00 | 5.05 272.95k |

| Lasa Supergener | 29.70 | 30.95 | 1.25 6.05k |

| Pondy Oxides | 511.55 | 532.00 | 20.45 33.59k |

Stock Market Live Updates | ICICI Securities View On Godrej Consumer Products:

-Upgrade to buy, target raised to Rs 1,260 from Rs 1,050 per share

-Focus on market beating UVG-driven by category development initiatives

-HI segment needs improvement in product efficacy

-Volume market share gains continue in soaps

-Fast-growing categories have high double-digit volume growth potential

-Integration of acquired brands (Park Avenue & Kamasutra) is largely completed

-Indonesia growth trajectory has improved with multiple initiatives

-Target is to drive Indonesia volume growth ahead of GDP growth

-Target is to build back EBITDA margin to approximately 25% in 2-3 years

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Mihika Ind | 23.50 -2.08% | 186.52k 1,420.60 | 13,030.00 |

| Jetking Info | 61.50 -0.9% | 537.99k 12,997.20 | 4,039.00 |

| Sonal Mercant | 90.00 2.25% | 46.84k 1,312.80 | 3,468.00 |

| Nucleus Softwar | 1,445.00 -0.37% | 52.80k 2,706.20 | 1,851.00 |

| Suryalakshmi Co | 81.75 3.64% | 88.51k 5,373.80 | 1,547.00 |

| Guj Themis | 219.55 11.56% | 5.89m 431,470.80 | 1,265.00 |

| Apar Ind | 5,610.00 -0.3% | 53.47k 4,194.20 | 1,175.00 |

| Pondy Oxides | 529.05 10.87% | 87.56k 6,871.80 | 1,174.00 |

| Kansai Nerolac | 339.30 4.38% | 148.24k 13,764.40 | 977.00 |

| The Investment | 114.90 4.98% | 23.95k 2,298.80 | 942.00 |

Sensex Today | Morgan Stanley View On Gas Sector

-Gas demand in Nov-23 rose 19% YoY

-However, city gas demand de-growth was a key negative surprise

-LNG market share held at 54%

-Remain selective & prefer GAIL & Gujarat Gas, Underweight on IGL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bhagwati Oxygen | 53.59 | 5 | 4360 |

| Bombay Oxygen | 13300 | 1.64 | 62 |

| Adani Total Gas | 997 | 0.17 | 113648 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| National Oxygen | 139.45 | -4.97 | 20503 |

| GAIL | 151.25 | -1.79 | 1071048 |

| Mahanagar Gas | 1177.35 | -1.13 | 11149 |

| Gujarat Gas | 448.55 | -0.6 | 13848 |

| Refex Ind | 598 | -0.65 | 2987 |

| IGL | 411.5 | -0.06 | 43555 |

Stock Market LIVE Updates | Railtel Corporation of India bags work order worth Rs 76.19 crore from Bihar Education Project Council

RailTel Corporation of India has received the work order from Bihar Education Project Council for Supply of Teaching Learning Material for Class I to III Under Rate Contract amounting to Rs 76.19 crore (Including GST).

Stock Market LIVE Updates | Axis Bank files petition before NCLT, to initiate CIRP of Zee Learn

The petition under Section 7 of the Insolvency and Bankruptcy Code has been filed by Axis Bank, before the National Company Law Tribunal, Mumbai, to initiate Corporate Insolvency Resolution Process (CIRP) of Zee Learn. The company has received the notice of said case from NCLT. The company is compiling information to verify the facts claimed in said petition.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,696.75 0.85 | 6.61m | 1,118.55 |

| ICICI Bank | 997.35 0.23 | 6.63m | 663.00 |

| Bajaj Finance | 7,201.00 0.54 | 850.28k | 617.02 |

| Reliance | 2,593.00 0.58 | 2.34m | 606.81 |

| Tata Motors | 732.75 1.83 | 8.15m | 597.43 |

| Tata Steel | 136.75 1.15 | 34.84m | 479.33 |

| Hindalco | 597.50 3.04 | 7.80m | 464.39 |

| SBI | 643.90 0.92 | 6.90m | 444.73 |

| Infosys | 1,558.90 0.97 | 2.50m | 389.56 |

| Kotak Mahindra | 1,898.50 0.62 | 2.01m | 382.49 |

Stock Market LIVE Updates | Karnataka Bank enables payment of Direct Tax for its customers

Karnataka Bank has enabled the facility of payment of Direct Taxes (Income Tax/ Advance Tax) for its customers. It is already providing the facility of online remittance through ICEGATE portal for customs duty payment and GSTN portal for Goods and Service Taxes Payments and also over the counter mode on behalf of Central Board for Indirect Taxes and Customs (CBIC).

Stock Market LIVE Updates | Nifty Bank index up 1 percent led by Bank of Baroda, Bandhan Bank, PNB:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Baroda | 230.35 | 2.22 | 17.96m |

| PNB | 90.05 | 1.75 | 28.18m |

| Bandhan Bank | 238.80 | 1.64 | 4.75m |

| IndusInd Bank | 1,593.45 | 1.44 | 924.26k |

| SBI | 645.25 | 1.13 | 6.44m |

| HDFC Bank | 1,696.40 | 0.83 | 6.35m |

| Kotak Mahindra | 1,902.00 | 0.8 | 1.94m |

| IDFC First Bank | 88.95 | 0.51 | 11.52m |

| ICICI Bank | 998.95 | 0.39 | 6.29m |

| AU Small Financ | 771.30 | 0.23 | 541.61k |

Private banks will get back in favour, HDFC Bank valuations inexpensive: Nilesh Shah to CNBC Awaaz

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Equitas Bank | 108.04 | 2.7 | 342469 |

| Bandhan Bank | 239.1 | 1.59 | 317281 |

| IndusInd Bank | 1596 | 1.57 | 33457 |

| CSB Bank | 401.25 | 1.4 | 6312 |

| RBL Bank | 263.4 | 1.07 | 216991 |

| South Ind Bk | 26.42 | 1.26 | 2397670 |

| DCB Bank | 126.8 | 0.92 | 147922 |

| Kotak Mahindra | 1906.25 | 1.05 | 21927 |

| IDBI Bank | 66.15 | 0.96 | 430505 |

| HDFC Bank | 1697.95 | 0.88 | 332337 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| UTKARSHBNK | 52.4 | -1.11 | 141743 |

| City Union Bank | 148.15 | -0.5 | 92648 |

| ESAF SFB | 69.52 | -0.16 | 119455 |

Stock Market LIVE Updates | SJVN bags 100 MW solar power project from Gujarat Urja Vikas Nigam

SJVN has secured 100 MW solar power project from Gujarat Urja Vikas Nigam (GUVNL). The company successfully bagged the quoted capacity of 100 MW solar project at Rs 2.63 per unit on build own and operate basis. This ground mounted solar project will be developed by company’s wholly owned subsidiary i.e., SJVN Green Energy (SGEL) at a tentative cost of Rs 550 crore.

ALRT | Nifty crosses 21,600 for the first time; Nifty Bank hits fresh record

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| PNB | 158687 | 91.08 | 1.45 |

| NALCO | 800000 | 117.38 | 9.39 |

| NALCO | 800000 | 117.36 | 9.39 |

| NALCO | 800000 | 117.37 | 9.39 |

| Bosch | 4200 | 21884 | 9.19 |

| Bosch | 4200 | 21894 | 9.2 |

| Bosch | 4200 | 21889 | 9.19 |

| Sturdy Ind | 1393817 | 0.49 | 0.07 |

| Sun Retail | 528000 | 0.88 | 0.05 |

| 7NR Retail | 350000 | 0.65 | 0.02 |

Stock Market LIVE Updates | NBCC bags order worth Rs 150 crore from SAIL ISP Burnpur

The company has received civil and various types of infrastructure works for plant and township at SAIL ISP, Burnpur. The total value of the order is Rs 150 crore.

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| ANI Integrated | 65.55 | 61.55 | -4.00 1.44k |

| Vinyas Innovati | 759.00 | 716.00 | -43.00 - |

| Arvee Laborator | 185.95 | 176.10 | -9.85 742 |

| Lead Reclaim | 37.35 | 35.70 | -1.65 2.18k |

| Pritish Nandy | 53.50 | 51.20 | -2.30 14.60k |

| Simbhaoli Sugar | 32.55 | 31.30 | -1.25 2.21m |

| Maithan Alloys | 1,329.00 | 1,283.30 | -45.70 383.18k |

| Adroit Infotech | 22.35 | 21.60 | -0.75 4.83k |

| Kilitch Drugs | 378.00 | 365.30 | -12.70 2.57k |

| Arabian Petrole | 107.50 | 104.00 | -3.50 - |

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Steel City Secu | 69.90 | 77.10 | 7.20 4.99k |

| Pattech Fitwell | 50.00 | 54.90 | 4.90 2.70k |

| Tokyo Plast | 113.05 | 122.00 | 8.95 1.58k |

| Credo Brands Ma | 290.05 | 312.35 | 22.30 - |

| Pearl Polymers | 30.70 | 32.80 | 2.10 17.59k |

| Electro Force | 100.00 | 105.00 | 5.00 - |

| AARTIPP | 320.00 | 334.95 | 14.95 0 |

| Salasar Ext | 27.05 | 28.25 | 1.20 177.50k |

| SKP Bearing | 207.10 | 215.90 | 8.80 0 |

| Morarjee Text | 22.70 | 23.65 | 0.95 2.11k |

Stock Market LIVE Updates | Adani Total Gas signs MoU with Flipkart to decarbonise its supply chain

Adani Total Gas and Flipkart today announced signing of a Memorandum of Understanding (MoU).

Under the MoU, AGTL will work with Flipkart to support its vision to reduce carbon footprint in the primary, secondary and tertiary movements of goods between sourcing locations, warehouses, and customers. ATGL will provide decarbonizing solutions, aiding Flipkart’s journey to switch to cleaner fuel options, including natural gas, and the introduction of electric vehicles.

Stock Market LIVE Update | Bharat Dynamics, Hindalco, Kansai Nerolac among stocks that hit 52-week high

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Bharat Dynamics | 1810.95 | 1810.95 | 1,787.90 |

| 3M India | 33499.00 | 33499.00 | 33,115.05 |

| HEG | 1935.00 | 1935.00 | 1,875.95 |

| Kansai Nerolac | 357.30 | 357.30 | 338.45 |

| GlaxoSmithKline | 1848.00 | 1848.00 | 1,829.20 |

| Hindalco | 601.95 | 601.95 | 600.20 |

| Zensar Tech | 644.00 | 644.00 | 640.00 |

| UltraTechCement | 10376.00 | 10376.00 | 10,301.20 |

| SAIL | 118.20 | 118.20 | 116.65 |

| Bank of Baroda | 233.75 | 233.75 | 231.15 |

Stock Market LIVE Update | Britannia, NTPC, Hero Moto stocks defy market mood - among top 5 Nifty 50 laggards

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Britannia | 5,187.85 | -0.92 | 97.07k |

| NTPC | 307.35 | -0.73 | 4.93m |

| Hero Motocorp | 4,041.35 | -0.64 | 390.92k |

| Wipro | 467.80 | -0.49 | 6.52m |

| Asian Paints | 3,367.55 | -0.47 | 372.41k |

Stock Market LIVE Update | Broad-based buying seen across sectors; Nifty PSU Bank index top performer

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 18143.20 1.06 | 43.86 3.54 | 6.47 44.88 |

| NIFTY IT | 35675.50 0.51 | 24.64 2.69 | 11.29 24.58 |

| NIFTY PHARMA | 16618.55 0.34 | 31.92 3.08 | 4.16 30.91 |

| NIFTY FMCG | 55585.95 0.18 | 25.84 1.81 | 5.72 24.75 |

| NIFTY PSU BANK | 5667.90 1.63 | 31.25 2.44 | 13.88 34.13 |

| NIFTY METAL | 7842.60 1.33 | 16.65 5.67 | 14.09 18.22 |

| NIFTY REALTY | 770.00 0.67 | 78.32 4.44 | 9.54 81.16 |

| NIFTY ENERGY | 33360.75 0.34 | 28.96 3.76 | 16.81 30.10 |

| NIFTY INFRA | 7251.75 0.77 | 38.07 3.52 | 12.63 37.48 |

| NIFTY MEDIA | 2385.95 0.39 | 19.77 2.74 | 4.49 20.39 |

Stock Market LIVE Update | Hindalco, Ultratech Cement, Tata Motors among top 5 Nifty 50 gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hindalco | 600.15 | 3.5 | 6.04m |

| UltraTechCement | 10,309.75 | 2.91 | 286.27k |

| Tata Motors | 736.35 | 2.33 | 6.70m |

| Tata Steel | 138.00 | 2.07 | 29.37m |

| Bajaj Auto | 6,588.65 | 1.92 | 307.25k |

Markets Today | Nifty 50 hits fresh lifetime high of 21,594 levels powered by Hindalco, Ultratech Cement, Tata Motors

Stock Market LIVE Update | L&T scales record high on winning major contract in Saudi Arabia

Shares of Larsen & Toubro climbed nearly 2 percent to hit a record high of Rs 3,548.90 on December 27 after the company bagged a major order for the Amaala project in the Red Sea region of Saudi Arabia. The order, under the engineering, procurement and construction (EPC) type is for establishing various systems related to renewable energy generation and utilities. READ MORE

Stock Market LIVE Updates | Eugia Pharma gets USFDA nod to manufacture and market Posaconazole Injection

Aurobindo Pharma's wholly owned subsidiary company, Eugia Pharma Specialities Limited, has received final approval from the US Food & Drug Administration (USFDA) to manufacture and market Posaconazole Injection, 300 mg/16.7 mL (18 mg/mL), Single-Dose Vial, which is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Noxafil Injection, 300 mg/16.7 mL (18 mg/mL), of Merck Sharp & Dohme LLC (Merck).

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| HEG | 1935.00 | 1935.00 | 1,906.20 |

| Kansai Nerolac | 355.00 | 355.00 | 339.05 |

| Nuvoco Vistas | 398.55 | 398.55 | 387.10 |

| Zensar Tech | 643.95 | 643.95 | 641.80 |

| GlaxoSmithKline | 1846.35 | 1846.35 | 1,831.85 |

| Bharat Dynamics | 1767.90 | 1767.90 | 1,755.80 |

| SAIL | 118.15 | 118.15 | 117.45 |

| Graphite India | 572.00 | 572.00 | 562.00 |

| UltraTechCement | 10379.70 | 10379.70 | 10,308.90 |

| Bank of Baroda | 233.75 | 233.75 | 231.20 |

Stock Market LIVE Updates | UGRO Capital to consider raising of funds via NCD issuance on December 29

UGRO Capital said meeting of the Investment and Borrowing Committee is scheduled to be held on December 29, to consider raising of funds by way of issuance of non-convertible debentures through public issue.

NBCC gets Rs 2000 crore via selling over 5000 units of Amrapali: Reports

Sensex Today | Market at 11 AM

The Sensex was up 472.96 points or 0.66 percent at 71,809.76, and the Nifty was up 138.70 points or 0.65 percent at 21,580. About 2040 shares advanced, 1108 shares declined, and 106 shares unchanged.

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Vedant Asset | 50.85 | 45.58 | -5.27 0 |

| Mihika Ind | 25.20 | 22.92 | -2.28 0 |

| Dhanlaxmi Roto | 123.70 | 113.95 | -9.75 39 |

| Fundviser | 67.50 | 62.37 | -5.13 5.40k |

| YASH INNO | 34.97 | 32.59 | -2.38 216 |

| Shardul Sec | 172.00 | 160.40 | -11.60 251 |

| Nirav Comm | 509.95 | 475.70 | -34.25 1 |

| Misquita Engine | 71.00 | 66.30 | -4.70 2.00k |

| Mish Designs | 134.00 | 125.15 | -8.85 46.00k |

| Brahma Infra | 69.85 | 65.70 | -4.15 11.64k |

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Nimbus Projects | 36.01 | 40.00 | 3.99 342 |

| Gothi Plascon | 31.01 | 33.90 | 2.89 2.30k |

| Shiva Mills Lim | 91.05 | 99.54 | 8.49 153 |

| Maha Rasht Apex | 138.95 | 151.30 | 12.35 95 |

| Enterprise Intl | 19.30 | 21.00 | 1.70 1.26k |

| Photoquip India | 22.45 | 24.39 | 1.94 944 |

| Sunil Agro Food | 183.60 | 198.90 | 15.30 58 |

| Xelpmoc Design | 101.15 | 109.45 | 8.30 3.99k |

| Jhaveri Credits | 269.20 | 291.00 | 21.80 1.50k |

| Guj Themis | 207.00 | 223.75 | 16.75 28.12k |

Sensex Today | Coromandel International noticed abnormality in Ammonia unloading subsea pipeline

Coromandel International noticed abnormality on 26/12/2023 at 23.30 hrs in the ammonia unloading subsea pipeline near shoreside, outside the plant premises. The

Standard Operating Procedure activated immediately, and isolated ammonia system facility and brought the situation to normalcy in the shortest time.

During the process, few members in the local community expressed discomfort and were given medical attention immediately. All are safe and normalcy is restored.

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

Happy Forgings, the esteemed manufacturer of complex machinery components, made a debut on the stock market that landed slightly below pre-listing expectations. Nevertheless, the company secured a commendable 17.65% gain, listing at Rs 1000 per share compared to its IPO price of Rs 850.

Happy Forgings presents a mixed bag for investors. The lower-than-expected listing raises concerns, but the decent gain and strong fundamentals offer a counterpoint. A careful evaluation of both sides is crucial before making any investment decisions. Given the uncertainty surrounding the listing, a cautious approach is recommended. Existing investors in the IPO may consider holding their shares with a stop loss at 900. However, investors who were looking for listing gains may exit their positions.

Stock Market LIVE Updates | L&T at record hogh; wins order in the range of Rs 5,000-10,000 crore

The Construction arm of Larsen & Toubro has been chosen as the turnkey Engineering, Procurement and Construction contractor to establish various systems related to renewable energy generation and utilities, for the Amaala project in the Red Sea region, Saudi Arabia.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 18121.85 0.94 | 43.69 3.41 | 6.35 44.71 |

| NIFTY IT | 35749.45 0.72 | 24.90 2.90 | 11.52 24.84 |

| NIFTY PHARMA | 16614.05 0.31 | 31.88 3.06 | 4.13 30.87 |

| NIFTY FMCG | 55611.95 0.23 | 25.90 1.86 | 5.77 24.80 |

| NIFTY PSU BANK | 5678.20 1.82 | 31.48 2.63 | 14.08 34.37 |

| NIFTY METAL | 7846.35 1.38 | 16.70 5.72 | 14.14 18.28 |

| NIFTY REALTY | 770.50 0.73 | 78.44 4.50 | 9.61 81.27 |

| NIFTY ENERGY | 33343.65 0.29 | 28.89 3.71 | 16.75 30.04 |

| NIFTY INFRA | 7242.05 0.64 | 37.89 3.38 | 12.48 37.29 |

| NIFTY MEDIA | 2387.40 0.45 | 19.85 2.80 | 4.55 20.47 |

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

Credo Brands, the company behind the Mufti brand, made a lukewarm debut on the stock markets, listing at Rs 282 per share, almost flat compared to its IPO price of Rs 280. This lackluster performance falls short of pre-listing expectations.

Despite the disappointing listing, Credo Brands still possesses its core strengths, including a strong brand, a wide distribution network, and consistent financial performance.

However, the flat debut highlights the potential risks associated with the highly competitive market, seasonality, and current market sentiment.

Given the uncertain outlook, a cautious approach is warranted, and investors may consider exiting their holdings, but long-term investors with high-risk capacity may hold their position by keeping stop loss.

Stock Marjket LIVE Updates | Vishnu Prakash R Punglia receives letter of award for projects worth Rs 899 crore

Vishnu Prakash R Punglia has received Letter of Award from Government of Uttarakhand for two projects worth Rs 899 crore. Vishnu Prakash will develop water supply system with 18 years operation and maintenance (O&M), in Haldwani and Kotdwar, Uttarakhand.

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

RBZ Jewellers' stock market debut mirrored pre-listing whispers, landing at Rs 100 per share, flat listing with zero listing gain on its issue price. This lackluster listing, in line with the subdued grey market trend, reflects cautious investor sentiment toward the company despite its apparent strengths.

While RBZ Jewellers possesses strong fundamentals and a fair valuation on the surface, the significant risks cannot be overlooked. The flat listing serves as a stark reminder of the potential pitfalls associated with gold price volatility, client concentration, informal artisan arrangements, and intense competition. Thus, investors are suggested to exit their positions.

Sensex Today | Nifty Metal index up 1.5 percent led by SAIL, MOIL, Hindalco Industries:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SAIL | 117.60 | 3.57 | 45.56m |

| MOIL | 314.90 | 2.94 | 2.43m |

| Hindalco | 596.50 | 2.87 | 2.89m |

| Tata Steel | 138.55 | 2.48 | 18.26m |

| JSW Steel | 868.30 | 1.88 | 742.35k |

| NALCO | 117.25 | 1.65 | 8.73m |

| Jindal Steel | 736.85 | 0.98 | 340.21k |

| APL Apollo | 1,598.90 | 0.68 | 73.50k |

| NMDC | 203.10 | 0.62 | 3.51m |

| Ratnamani Metal | 3,437.50 | 0.52 | 7.15k |

Stock Market LIVE Updates | Piramal Enterprises subsidiary signs agreement with promoter group company AASAN Corporate Solutions for acquisition of property in Mumbai

Piramal Consumer Products' subsidiary Piramal Consumer Products Private (PCPPL) has agreed to enter into an agreement with AASAN Corporate Solutions (ACSPL), a promoter group company, for acquisition of Piramal Tower at Peninsula Corporate Park, Lower Parel, Mumbai, for Rs 875 crore. The company has invested Rs 289.59 crore in PCPPL through subscription to Rights issue. There is no change in the shareholding percentage of the company in PCPPL, post the said investment.

Sensex Today | Shrey Jain, Founder and CEO SAS Online:

In the early trading session today, the Indian equity benchmark indices extended the robust market rally momentum.

On weekly expiry day, the mood for Bank Nifty has turned positive again as the index bounces back above 47,900. In today's trading, the 48,000 Call strike has the highest open interest, indicating a potential barrier. But if Bank Nifty can stay above 48,000, it might move up to 48,500.

For Nifty, according to option data the 21,500 Call strike exhibits the highest Open Interest (OI), indicating a noteworthy level of interest. However, there's expected to be strong resistance when the index reaches 21,500. If it manages to break through this level decisively, it could lead to a significant increase in the index.

Overall, the market is leaning towards positive, and it looks like the year will end on a positive note.

Stock Market LIVE Updates | Dish TV EGM Outcome

The proposal to appoint Rajesh Sahni and Virender Kr Tagra as non-executive director is rejected.

The proposal to appoint Aanchal David as independent director and proposal to appoint Shankar Aggarwal as independent director for 2nd term of 5 years, is also rejected.

Sensex Today | Credo Brands lists at Rs 282 against IPO price of Rs 280

Credo Brands Marketing (Mufti Menswear) made a lacklustre debut on bourses on December 27, listing at barely 0.7 percent against issue price of Rs 280. The stock started trading at Rs 282.35 on the NSE and Rs 280 on the BSE.

The Rs 550-crore public issue was subscribed 51.85 times during December 19-21. Qualified institutional buyers bought 104.95 times the portion set aside for them, while the alloted quota of high networth individuals was subscribed 55.52 times and that of retail investors 19.94 times.

Sensex Today | RBZ Jewellers makes a flat start, lists at Rs 100

Ahmedabad-based RBZ Jewellers made a tepid debut on bourses on December 27 in-line with analyst expectations, listing at par with issue price. The stock started trading at Rs 100 on the NSE and BSE, against issue price of also Rs 100.

The company's Rs 100-crore IPO was subscribed 16.86 times. Retail investors showcased maximum interest as they bought 24.74 times their allotted quota while high net-worth individuals picked 9.27 times the reserved portion. On the other hand, qualified institutional buyers picked 13.43 times their reserved portion.

Sensex Today | BSE Midcap index up 0.5 percent supported by Kansai Nerolac Paints, Nuvoco Vistas Corporation, 3M India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Kansai Nerolac | 343.50 | 5.68 | 107.38k |

| 3M India | 33,094.00 | 5.2 | 526 |

| Nuvoco Vistas | 388.30 | 4.12 | 36.26k |

| Ramco Cements | 1,028.55 | 4.05 | 33.10k |

| SAIL | 117.80 | 3.63 | 3.69m |

| SJVN | 94.39 | 3.08 | 1.80m |

| Dalmia Bharat | 2,299.55 | 2.64 | 7.58k |

| M&M Financial | 277.00 | 2.4 | 61.98k |

| AB Capital | 163.25 | 2.1 | 132.45k |

| Clean Science | 1,575.10 | 2.08 | 9.56k |

Sensex Today | Happy Forgings lists 18% premium on debut

Heavy forgings manufacturer Happy Forgings Ltd shares opened 18 percent higher on debut on December 27 after its initial public offering subscribed 82 times last week.

The stock opened at Rs 1001.25 and gained as much as 17.8 percent in intraday. At 10am, the stock was trading at Rs xx on BSE, up xx percent from its issue price of Rs 850 a share.

Sensex Today | Market at 10 AM

The Sensex was up 388.23 points or 0.54 percent at 71,725.03, and the Nifty was up 115.20 points or 0.54 percent at 21,556.50. About 2210 shares advanced, 835 shares declined, and 100 shares unchanged.

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| PC Jeweller | 46.50 | 42.00 | -4.50 192.26k |

| Sikko Industrie | 113.60 | 103.00 | -10.60 102.61k |

| Suraj Estate | 360.00 | 340.00 | -20.00 330.34k |

| Starteck Financ | 410.00 | 389.50 | -20.50 45.53k |

| Times Guaranty | 157.20 | 149.35 | -7.85 145 |

| Kundan Edifice | 239.70 | 227.75 | -11.95 - |

| Hindcon Chemica | 61.25 | 58.20 | -3.05 149.57k |

| Graphisads | 76.80 | 73.00 | -3.80 546 |

| Micropro Soft | 62.50 | 59.50 | -3.00 - |

| KPIGREEN | 1,331.10 | 1,269.30 | -61.80 23.69k |

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| Motisons Jewell | 55.00 | 98.40 | 43.40 82.91k |

| Aarvi Encon | 137.00 | 164.40 | 27.40 2.09k |

| Wonder Elect. | 368.60 | 442.30 | 73.70 9.31k |

| G-Tec Jainx | 112.20 | 134.60 | 22.40 7.67k |

| VLEGOV | 41.60 | 49.25 | 7.65 14.18k |

| Sreeleathers | 377.10 | 428.35 | 51.25 11.93k |

| Pondy Oxides | 478.05 | 533.60 | 55.55 13.88k |

| Mazda | 1,249.95 | 1,393.85 | 143.90 1.15k |

| Maithan Alloys | 1,155.70 | 1,287.70 | 132.00 5.87k |

Stock Market LIVE Updates | L&T bags order in the range of Rs 5,000-10,000 crore

The Construction arm of Larsen & Toubro has been chosen as the turnkey Engineering, Procurement and Construction contractor to establish various systems related to renewable energy generation and utilities, for the Amaala project in the Red Sea region, Saudi Arabia.

Stock Market LIVE Updates | Aarti Industries enters into a long-term supply contract with a Global Agrochem major

Aarti Industries Limited (AIL)today announced that it has entered into a 9-year long-term supply contract for the supply of a niche agrochemical intermediate with a global agrochemical products and solutions company.

Stock Market LIVE Updates | Trading in Happy Forgings to start with effect from December 27

Happy Forgings will be listing on the BSE and NSE on December 27. The final issue price is Rs 850 per share.

Stock Market LIVE Updates | RBZ Jewellers to list equity shares on December 27

RBZ Jewellers will list its equity shares on December 27. The issue price has been set at Rs 100 per share.