LiveNow

Closing Bell: Sensex, Nifty end marginally higher; Auto, IT drag, banks, metal, energy shine

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets remained volatile for yet another session and ended marginally higher. After the initial downtick, the Nifty inched gradually higher and settled around the day’s high at 19,442.70 levels. Meanwhile, a mixed trend on the sectoral front kept the traders occupied wherein metal and energy posted decent gains while auto and IT were on the back foot. The broader indices continued their outperformance and gained over half a percent each.

We are seeing rotational buying across heavyweights, which is helping the index to hold strong amid consolidation. Markets are now awaiting fresh triggers and it could probably be from the global markets. Meanwhile, traders should stay focused on stock selection and maintain a positive bias until the Nifty breaks 19,200.

Shrey Jain, Founder and CEO SAS Online

Earlier today, the Sensex and Nifty experienced a decline following Federal Reserve Chairman Jerome Powell's hawkish comments on rates. However, this negative trend, which persisted over the past three days, reversed in the Friday afternoon session, witnessing a resurgence in fresh buying.

Approaching the Diwali weekend, the domestic equities displayed a constrained range, with the Nifty 50 hovering around 19,450 and concluding at 19,425.35, up 30 points. The Sensex approached the 65,000 mark and closed at 64,904.68 , and the Nifty Bank entered positive territory at 43,820, registering a gain of 136 points.

We recommend adhering to a 'buy on dips' strategy at significant support levels. For existing long positions, it is prudent to maintain a strict stop loss at 19,300 for Nifty, while a recommended stop loss of 43,300 is suggested for Nifty Bank.

Market in Samvat 2079

The broader market outperformed the benchmarks Nifty and Sensex in Samvat 2079. The Nifty Midcap 100 surged over 30 percent as against the Nifty 50's 9 percent rise in Samvat 2079. This also marks the broader market's second biggest gains in a samvat year in the past 9 years.

Majority of indices also ended the Samvat with net gains, with Realty, and PSU Banks leading at the forefront. 39 out of 50 Nifty stocks ended with net gains, with Tata Motors, L&T, ONGC and Bajaj Auto emerging as top gainers. On the other hand, Adani Enterprises, UPL and Kotak Mahindra Bank were among the few laggards.

Deveya Gaglani, Research Analyst - Commodities, Axis Securities

Many festivals in India are considered auspicious to buy Gold, and Dhanteras is among the favourites. In India, people invest in Gold for long-term gains. That is why Indian households have the highest reserves of Gold, roughly 21,000 tonnes. Gold is very close to Indian's hearts and is a more sentimental investment than a speculative one. Since Dhanteras last year, Gold has given a mind-boggling return of almost 20 per cent, easily beating the returns of the Nifty 50. Gold was lingering due to the strong dollar index and the hawkish stance of the Fed at the end of September. It trapped all the bears as war broke out between Israel and Hamas. This geopolitical tension in the Middle East boosted Gold prices as it gained almost 10 per cent from the recent swing lows and made a multi-month high of 61,500 level as investors flocked towards Gold due to its safe-haven appeal. With the US election around the corner in 2024 and the geopolitical situation worldwide, the sky-high interest will not sustain for a long period. The Fed will eventually start cutting the rates, supporting Gold prices. Any dips around 57,000-58,000 can be used as a buying opportunity for investors during this Diwali season.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

In Samvat 2080, Financials are likely to do well supported by attractive valuations and impressive growth. Sustained FII selling in financials, which is impacting the sector, will be only temporary. For investors with a 2-year time horizon, the leading private banks and 3 or 4 PSU banks are good buys with good return potential.

The mid and small-cap rally is partly driven by retail exuberance and since the valuations in this broader market is high, investors have to exercise some caution

Harjeet Singh Arora, Managing Director at Mastertrust

The Muhurat trading, also recognized as Auspicious trading, is a one-hour trading session held on Diwali. Over the past ten Muhurat trading sessions, seven instances concluded with positive returns, highlighting the auspicious nature of the occasion for market participants.

Meticulous planning is imperative, particularly within the short time frame of Muhurat trading. We have to clearly outline our financial goals whether we are looking for short-term gains or long-term investments. Usually, we witness volatile trading sessions hence thorough research is very important before deploying any trade. Look for companies with strong fundamentals, positive earnings reports, and growth potential. Additionally, we can also find stocks based on technical studies for short-term trading opportunities.

Risk management is a highly important part that we can’t afford to ignore. Risk appetite varies from individual to individual, for long-term investment, portfolio risk could be mitigated by proper diversification. Investors are not recommended to concentrate all investments in one stock or sector. However, given the short duration of muhurat trading, liquidity is also a big factor. Especially for intraday traders, choose stocks with sufficient liquidity to ensure smooth execution of trades.

Rupee at close

Rupee ends at record low of 83.34 against the US Dollar. Rupee ends at 83.34/$ against Thursday’s close of 83.28/$.

Market at close

Market recovers to close the last day of Samvat 2079 at its day's high. The Sensex settled 72.48 points or 0.11 percent higher at 64,904.68, and the Nifty was ended with gains of 30.00 points or 0.15 percent at 19,425.30.

The market breadth also favoured gainers over losers as about 1,812 shares rose, 1,747 fell, and 141 remained unchanged.

Last-hour buying in heavyweights like HDFC Bank, ITC, Axis Bank and ICICI Bank helped the benchmarks recover from losses. M&M was the worst hit among Nifty 50, down 2 percent on lower-than-expected Q2 earnings.

Within the broader market, MCX emerged as the top midcap gainer on reports of cost saving in its deal with TCS.

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Campus | 258.00 | 260.35 237.80 | 8.49% |

71.35

542.10

441.15

2,430.05

397.00

874.90

594.00

130.50

261.30

Stock Market LIVE Updates | CLSA retains 'buy' call on Adani Ports; TP at Rs 878

Buy Call, Target Rs 878 per share

Port EBITDA Up 19% & Logistics EBITDA Rises 26% YoY

Its M&A Strategy Has Paid A Rich Dividend

Krishnapatam Port Volume Up By 27% YoY, Margin Have Gone Past ADSEZ Levels

Ports Traffic Did Well In 2Q, +13% YoY (Excl Haifa M&A) Led By Crude Imports

CEO Is Resolutely Focused On Its Next Leg Of Growth

Will Bring Down Net Debt/EBITDA To 2.5x In FY24

Net Debt/EBITDA Is Already Reaching 2.8x In 1HFY24

Market at 3 PM

The Sensex was up 84.21 points or 0.13 percent at 64,916.41, and the Nifty was up 27.20 points or 0.14 percent at 19,422.50. About 1,640 shares advanced, 1,516 declined, and 114 were unchanged.

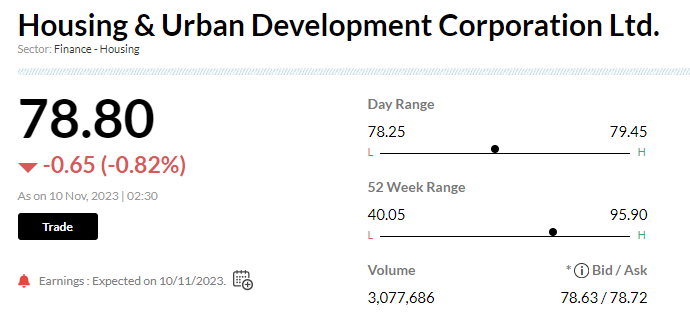

Stock Market LIVE Updates | HUDCO reports Q2 earnings

- Net profit up 13.9% at Rs451.6 cr vs Rs396.3 cr (YoY)

- Revenue up 7.3% at Rs1,864.8 cr vs Rs1,738.6 cr (YoY)

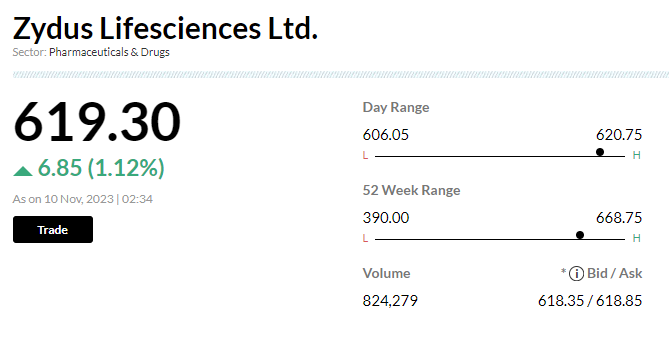

Stock Market LIVE Updates | Zydus, Torrent sign licensing pact for marketing Saroglitazar

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 3,105.15 | -2.17 | 572.22k |

| M&M | 1,527.95 | -1.55 | 4.30m |

| Titan Company | 3,241.05 | -1.3 | 1.03m |

| HCL Tech | 1,252.25 | -1.2 | 1.15m |

| Dr Reddys Labs | 5,407.25 | -0.93 | 203.30k |

| Hindalco | 480.10 | -0.9 | 2.77m |

| UPL | 545.50 | -0.89 | 1.03m |

| Wipro | 378.00 | -0.75 | 4.43m |

| Infosys | 1,365.30 | -0.69 | 2.27m |

| IndusInd Bank | 1,498.00 | -0.62 | 1.91m |

Stock Market LIVE Updates | India gross direct tax collections gain 17.6% at Rs12.4 trln

India’s direct tax collections, net of refunds, stood at Rs10.6 trillion, up 21.8% from last year, the Central Board of Direct Taxes said in an emailed statement. This tax revenue was 58.2% of the total budget estimates for FY24. In terms of gross collections, corporate income tax and personal income tax grew 7.1% and 28.3% respectively. Refunds of 1.77 trillion rupees issued April 1 to Nov. 9, Bloomberg reported.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NTPC | 241.90 | 1.66 | 7.35m |

| ONGC | 194.95 | 1.17 | 4.47m |

| UltraTechCement | 8,710.00 | 0.96 | 113.94k |

| Tech Mahindra | 1,134.00 | 0.89 | 564.20k |

| TATA Cons. Prod | 910.55 | 0.85 | 3.48m |

| HDFC Life | 626.45 | 0.82 | 2.16m |

| JSW Steel | 756.95 | 0.81 | 664.37k |

| Bajaj Finserv | 1,594.50 | 0.77 | 539.27k |

| Power Grid Corp | 211.30 | 0.71 | 8.91m |

| Bajaj Finance | 7,435.00 | 0.65 | 418.42k |

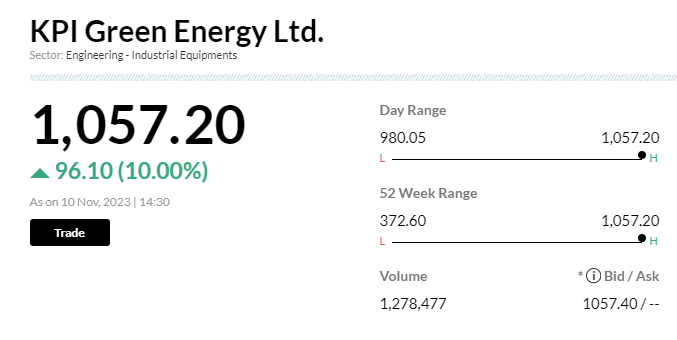

Stock Market LIVE Updates | KPI Green gets 1.6mw solar power order from Adarsh Textile

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 16242.95 -0.69 | 28.79 1.23 | 1.34 24.17 |

| NIFTY IT | 30552.70 -0.54 | 6.75 -0.74 | -6.19 7.18 |

| NIFTY PHARMA | 15493.70 0.01 | 22.99 4.11 | 2.56 19.34 |

| NIFTY FMCG | 51916.80 -0.13 | 17.53 0.03 | 0.22 16.44 |

| NIFTY PSU BANK | 5012.20 0 | 16.06 -0.85 | -2.91 32.39 |

| NIFTY METAL | 6633.60 0.51 | -1.34 2.38 | -2.20 4.98 |

| NIFTY REALTY | 659.85 -0.11 | 52.81 2.50 | 8.85 49.66 |

| NIFTY ENERGY | 27679.85 0.5 | 7.00 2.19 | 3.47 3.62 |

| NIFTY INFRA | 6293.30 0.22 | 19.82 1.91 | 1.00 20.52 |

| NIFTY MEDIA | 2218.70 -1.84 | 11.38 -2.12 | -1.80 6.22 |

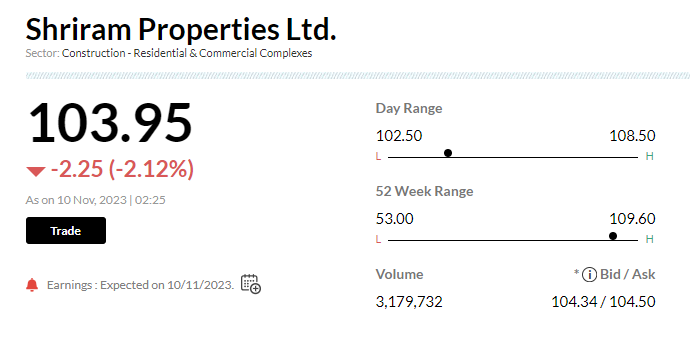

Stock Market LIVE Updates | Shriram Properties reports Q2 earnings

-Net Profit up 2% at Rs 20 Cr vs Rs 19.6 Cr (YoY)

-Revenue down 20.3% at Rs 206.1 Cr vs Rs 258.5 Cr (YoY)

-EBITDA up 17.6% at Rs40 Cr vs Rs34 Cr (YoY)

-Margin at 19.4% vs 13.1% (YoY)

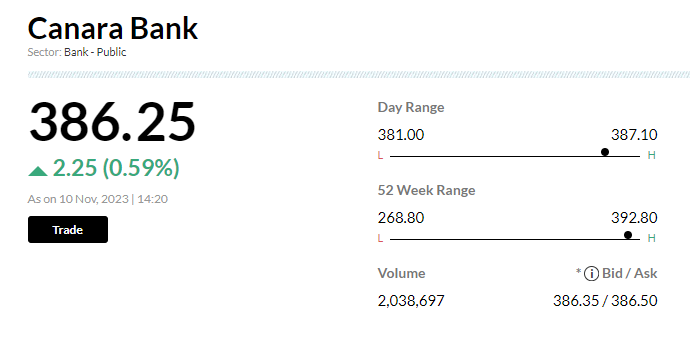

Stock Market LIVE Updates | Canara Bank is in discussion to raise $500 mln offshore loan, Bloomberg reports

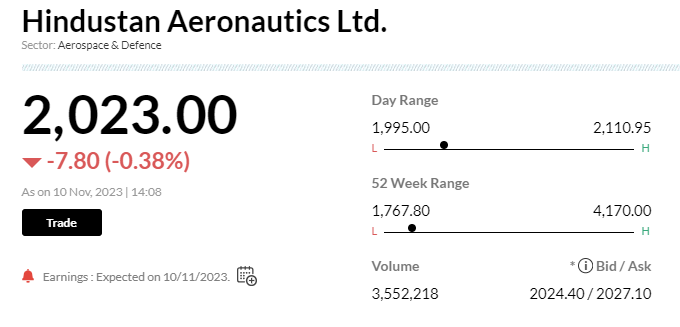

Stock Market LIVE Updates | Hindustan Aeronautics reports Q2 earnings

- Net profit up 1.3% at Rs1,236.7 cr vs Rs1,221.2 cr (YoY)

- Revenue up 9.5% at Rs5,635.7 cr vs Rs5,144.8 cr (YoY)

- EBITDA down 5.8% at Rs1,527.7 cr vs Rs1,621.7 cr (YoY)

- Margin at 27.1% vs 31.5% (YoY)

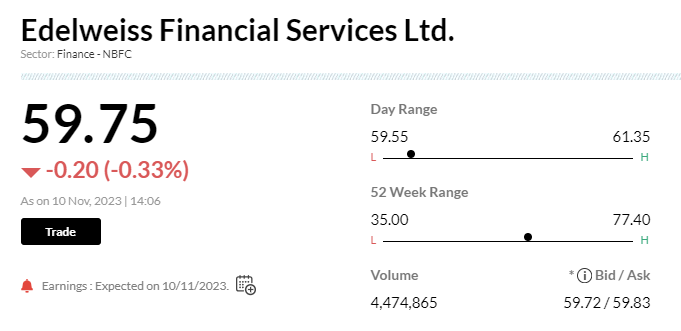

Stock Market LIVE Updates | Edelweiss Fin reports Q2 earnings

--Net income Rs75.95 crore, up 13% y/y

--Revenue Rs2160 crore, up 3.3% y/y

--Total costs Rs2060 crore, down 1.4% y/y

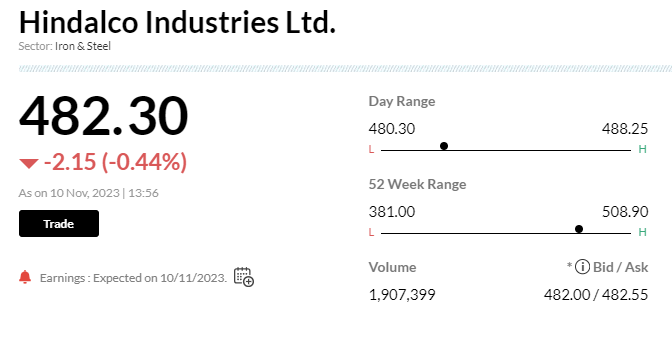

Stock Market LIVE Updates | Hindalco reports Q2 earnings

- Net profit up 54.6% at Rs847 cr vs Rs548 cr (YoY)

- Revenue up 12.5% at Rs20,676 cr vs Rs18,382 cr (YoY)

- EBITDA up 27.5% at Rs1,756 cr vs Rs1,377 cr (YoY)

- Margin at 8.5% vs 7.5% (YoY)

Stock Market LIVE Updates | Panacea Bio reports Q2 earnings

- Net loss at Rs8.3 cr vs profit of Rs15.7 cr (YoY)

- Revenue up 36% at Rs143 cr vs Rs105 cr (YoY)

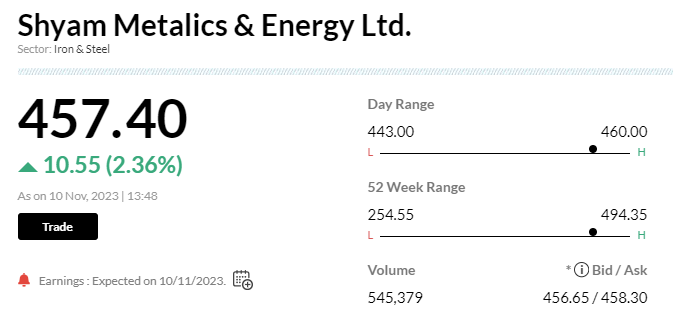

Stock Market LIVE Updates | Shyam Metalics reports Q2 earnings

- Net profit at Rs484.1 cr vs Rs114.3 cr (YoY)

- Revenue down 4.7% at Rs2,941 cr vs Rs3,085 cr (YoY)

- EBITDA up 26.4% at Rs307.4 cr vs Rs243.2 cr (YoY)

- Margin at 10.4% vs 7.8% (YoY)

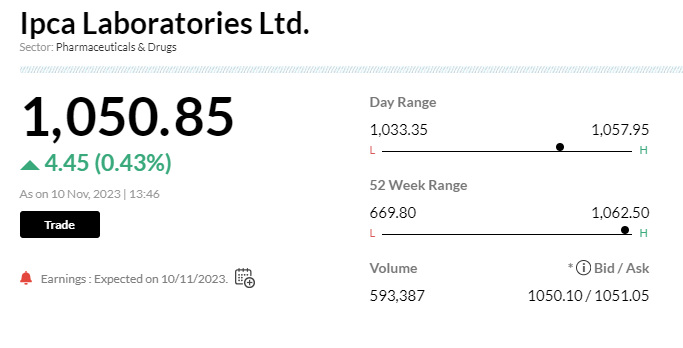

Stock Market LIVE Updates | IPCA Laboratories reports Q2 earnings

- Net profit up 0.7% at Rs145 cr vs Rs144 cr (YoY)

- Revenue up 27% at Rs2,034 cr vs Rs1,601 cr (YoY)

- EBITDA up 23.3% at Rs321.3 cr vs Rs260.6 cr (YoY)

- Margin at 15.8% vs 16.3% (YoY)

Stock Market LIVE Updates | Investors cheer Page Industries dividend move despite weak Q2; stock up 1.5%

Shares of Page Industries gained 2 percent to day’s high of Rs 38,327 per share on November 10 after investors were impressed with the company’s second interim dividend announcement of Rs 75 apiece for 2023-24 despite a weak second quarterly performance (Q2FY24). The S&P BSE Sensex was flat at 64,767 levels, as of 1:33pm.

So far this year, the stock of this inner-wear brand slipped 12 percent as against 6 percent surge in the benchmark Sensex. Page Industries’ consolidated net profit declined 7.3 percent on-year in Q2FY24, while total revenue fell 8.3 percent on-year.

However, earnings before interest, tax, depreciation, and amortisation (Ebitda) margin expanded to 20.8 percent in Q2FY24 versus 19 percent in Q2FY23 due to stable raw material prices.

USFDA issues 10 observations to Shilpa Medicare's Telangana unit

Sensex Today | Sunil shah, director at Kambatta Securities

Indian equities are expected to outperform most other global markets in the face of continued geopolitical uncertainties and relatively higher domestic economic growth. The major themes will be domestic consumption and premiumisation, enabling companies to post strong earnings growth aided by margin accretion. Infra and construction plays are expected to do well as the government’s thrust on infrastructure development is seen to continue, while higher budgetary allocation in rural-focus schemes can help drive a recovery in rural consumption, especially with the upcoming budget being the last one before the general elections. In spite of rich valuations in the small- and mid-cap segments, companies with fundamentally strong businesses and good earnings growth continue to justify their valuation. If US bond yields start coming down by the second half of CY2024, FPIs will come back to the party. Upcoming state and general elections can make the market move sideways. Inflation, interest rate trajectory, and geopolitical tensions will remain the key risks.

Stock Market LIVE Updates | Jefferies View On Piramal Enterprises

-Underperform call, target cut to Rs 855 per share

-Profit before tax well below our estimate

-NIM improved QoQ due to loan mix changes & stable asset quality

-Low-interest earning assets, elevated opex should cap RoA

Sensex Today | BSE Metal index rose nearly 1 percent supported by NMDC, Vedanta, Jindal Steel:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NMDC | 168.05 | 3.1 | 964.34k |

| Vedanta | 241.90 | 2.87 | 342.51k |

| Jindal Steel | 635.65 | 1.74 | 183.86k |

| NALCO | 91.70 | 1.4 | 302.06k |

| SAIL | 88.07 | 1.08 | 602.46k |

| JSW Steel | 757.05 | 0.87 | 44.87k |

| APL Apollo | 1,656.85 | 0.62 | 19.54k |

| Hindalco | 486.55 | 0.44 | 52.74k |

| Tata Steel | 120.15 | 0.38 | 1.45m |

| Coal India | 324.20 | 0.22 | 313.87k |

Stock Market LIVE Updates | Incred View On Ramco Cements

-Hold call, target Rs 1,060 per share

-Q2 EBITDA rises mainly due to strong volume & lower costs, outperforms peers

-Raise FY24F-25F EBITDA estimates by 4%

-Factor in a higher sales volume & profitability in 2Q

-Net debt rose QoQ driven by higher capex

-Current EV/T limits upside in stock

Stock Market LIVE Udates | M&M Q2 Results:

Net profit up 66.9% YoY at Rs 3,451.8 crore and revenue up 15.7% at Rs 24,310 crore versus Rs 21,010 crore, YoY.

Harjeet Singh Arora, Managing Director at Mastertrust

In light of mounting fundamental tailwinds, the market is poised to sustain its prevailing bullish momentum into Vikram Samvat 2080. Renowned global banks and financial institutions have clearly expressed optimism towards the Indian market. The stage of a bullish scenario is being set by strong corporate performance, overwhelming domestic economic numbers, and growing expectations of the return of the Modi government, known for its pro-business policies. FDI inflows in India stood at US $ 45.15 billion in 2014-2015 which has increased to the highest ever FDI at $83.6 billion in 2021-2022. The bullish sentiment is further bolstered by the speculation that the U.S. Federal Reserve has concluded its rate hike cycle, a factor contributing to the positive market outlook.

Investment in equity and gold should depend on your investment objective, time horizon, and risk profile, but proper asset allocation is require in the portfolio. Gold has been considered a safe-haven asset and used as a hedge against inflation. Gold should be viewed as a long-term investment option rather than a short-term investment. Equity markets have remained volatile both in India and globally but outperformed against other asset class. One should invest in equity from a long-term investment perspective, the equity market can deliver a phenomenal return. Ideally, you should diversify investments in sync with your risk appetite and your original investment plan that you have made for achieving your short and long-term financial goals.

Stock Market LIVE Updates | Hindalco trade higher ahead of Q2 results; net profit likely to jump 21% YoY

Hindalco Industries expects double-digit YoY growth in Q2 consolidated net profit, despite weak earnings from the US unit, Novelis, which contributes two-thirds of group revenue. Indian operations anticipate strong sales and margin growth, analysts said. Results will be declared on November 10.

According to a poll of brokerages conducted by Moneycontrol.com, consolidated PAT for the quarter is expected to be around Rs 2,668.10 crore, up 21 percent year on year and 9 percent higher quarter on quarter. The consolidated revenues are likely at Rs 53,558.60 crore, down 5 percent from Rs 56,176 crore a year ago. EBITDA is likely to be at Rs 6,007.50 crore, up 12 percent YoY and 5.1 percent sequentially.

Analysts project increased domestic sales volumes for Hindalco in copper and aluminum. The accumulation of lower-cost coal inventory and captive mines may enhance margins. Additionally, higher treatment and refining charges in the copper business are expected to boost overall performance. Read More

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 64792.09 -0.06 | 6.49 0.67 | -1.95 6.89 |

| BSE 200 | 8545.95 -0.01 | 8.84 1.19 | -0.81 8.71 |

| BSE MIDCAP | 32507.40 0.15 | 28.41 2.43 | 1.44 27.84 |

| BSE SMALLCAP | 38386.30 0.4 | 32.70 2.12 | 1.88 32.87 |

| BSE BANKEX | 49470.67 0.02 | 1.15 1.04 | -0.95 3.87 |

Stock Market LIVE Updates | Macquarie View On Ramco Cements

-Neutral call, target Rs 1,000 per share

-Q2 volume surprise drives EBITDA beat

-Reported EBITDA at Rs 400 crore, up 1.2x YoY & 7% ahead of estimate

-EBITDA/t at Rs 879, improved QoQ & was 1% ahead of estimate

-Company's net debt increased QoQ to Rs 5,000 crore led by higher-than-expected capex towards

-Growth focus remains but balance sheet should improve

Stock Market LIVE Updates | Macquarie View On Page Industries

-Underperform call, target Rs 31,000 per share

-Q2 sales miss; continued caution on demand

-Volume down 8.8% as demand conditions remained weak

-Peers raised discounting levels

-This could not be offset by cost control measures, EBITDA is 9% below estimate

-Management confident of 19-21% EBITDA margin

-Focus remains on cost control while sustaining required brand investments