Closing Bell: Sensex, Nifty flat amid volatility; eyes on RBI policy

-330

February 07, 2024· 16:24 IST

Indian benchmark indices ended on a flat note in the highly volatile session on February 7 ahead of RBI policy outcome. At close, the Sensex was down 34.09 points or 0.05 percent at 72,152.00, and the Nifty was up 1.10 points or 0.01 percent at 21,930.50.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

February 07, 2024· 16:15 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Bank Nifty index is currently witnessing an intense battle between bulls and bears, and a decisive move is anticipated soon. The lower-end support is situated in the 45600-45500 zone, and a conclusive break below this on a closing basis is expected to trigger a sharp correction. Conversely, a break above the higher-end resistance at 46200 could lead to substantial short-covering moves, propelling the index towards the 46500 level.

-330

February 07, 2024· 16:13 IST

-330

February 07, 2024· 16:08 IST

Rupak De, Senior Technical Analyst, LKP Securities

Bears exerted downward pressure on the Nifty after an initially positive start. Sentiment remained somewhat weak as the market closed. Support is positioned at 21,850, and a breach below this level could potentially initiate a correction towards 21,700. On the upside, resistance is identified at 22,000.

-330

February 07, 2024· 16:02 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

Markets erased all its gains towards the end as profit-taking in IT stocks and sluggish global indices weighed on the sentiment. Traders are adopting a cautious stance ahead of the credit policy announcement tomorrow. While investors are bracing for a status-quo on the interest rate decision, what will be important to note is the tone of the announcement which would signal the central bank's stance on interest rate going ahead.

-330

February 07, 2024· 15:57 IST

Stock Market LIVE Updates | Power Grid Corporation of India Q3 Results:

Net profit rose 10.5% at Rs 4,028.3 crore versus Rs 3,645.3 crore and revenue up 2.6% at Rs 11,549.8 crore versus Rs 11,261.8 crore, YoY.

-330

February 07, 2024· 15:55 IST

Vinod Nair, Head of Research, Geojit Financial Services

The domestic market exhibited cautious range-bound movement, despite robust PMI data and favourable global cues ahead of RBI policy meet. While no change in stance is anticipated, the RBI's commentary on any hints regarding potential rate cuts and improvements in liquidity will be closely monitored.

-330

February 07, 2024· 15:52 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets continued with the range bound bias and ended almost unchanged. After the gap-up start, Nifty oscillated in a narrow band and finally settled at 21,930.50 levels. Meanwhile, a mixed trend on the sectoral front kept the traders occupied wherein realty and energy pack were among the top performers while IT and auto took a breather. The broader indices also managed to do well amid consolidation and gained nearly a percent each.

We maintain our positive stance amid consolidation and suggest continuing with a “buy on dips” approach until Nifty holds 21,600. However, participation from the banking and financial majors would be critical for trend resumption. Apart from the domestic factors, we suggest keeping a close eye on global markets for cues.

-330

February 07, 2024· 15:49 IST

Aditya Gaggar Director of Progressive Shares

The Index erased all its gains in the morning trade itself to trade lower; however, in the last session, marginal recovery from the lower levels helped the Index to end the session in green at 21,930.50 with gains of 1.10 points. Barring the IT space, all other sectors ended the day with gains where PSU Banks and Realty were the top performers. Mid and Smallcap segments ended the day with gains of 0.75% & 0.71% respectively and outperformed the Frontline Index. Nifty50 is oscillating in the narrow range of 21,700-22,050 and breakout in either side will decide the future path.

-330

February 07, 2024· 15:43 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty opened on a positive note and consolidated during the day. It closed marginally in the green up ~11 points. On the daily charts we can observe that the Nifty has been trading in a narrow range since the past couple of weeks. On the upside, 22000 – 22050 is acting as a stiff resistance while the key hourly moving averages placed in the range 21800 – 21900 have been absorbing all the selling pressure. The Nifty needs to decisively move beyond this narrow range for the trending moves to begin on either side. Until then, stock specific action and sector rotation is likely to continue. Key support levels are 21730 – 21680 while immediate hurdle zone is placed at 22000 - 22053.

Bank Nifty closed in the green after falling for three consecutive days. We expect the retracement to continue till 46300 – 46500 over the next few trading sessions. Crucial support is placed at 45500 – 45400.

-330

February 07, 2024· 15:33 IST

Rupee Close:

Indian rupee ended higher at 82.97 per dollar versus previous close of 83.05.

-330

February 07, 2024· 15:30 IST

Market Close

: Indian benchmark indices ended on a flat note in the highly volatile session on February 7 ahead of RBI policy outcome.

At close, the Sensex was down 34.09 points or 0.05 percent at 72,152.00, and the Nifty was up 1.10 points or 0.01 percent at 21,930.50. About 1932 shares advanced, 1339 shares declined, and 60 shares unchanged.

State Bank of India, Grasim Industries, JSW Steel, HDFC Life and Axis Bank were among the top gainers on the Nifty, while losers included Tech Mahindra, Power Grid Corporation, Infosys, Adani Ports and TCS.

On the sectoral front, PSU Bank, metal, power, pharma and realty up 0.5-3 percent, while Information Technology index shed 1 percent.

BSE Midcap index rose 1.3 percent and Smallcap index added 0.4 percent.

-330

February 07, 2024· 15:29 IST

-330

February 07, 2024· 15:25 IST

Life Insurance January Data:

HDFC Life Premium up 2 percent, individual APE down 17 percent, total APE up 10 percent YoY

ICICI Prudential Premium up 9 percent, individual APE up 20 percent, total APE up 9 percent YoY

Max Life Premium up 51 percent, individual APE up 51 percent, total APE up 53 percent YoY

SBI Life Premium up 103 percent, Individual APE up 17 percent, total APE up 53 percent YoY

-330

February 07, 2024· 15:24 IST

Stock Market LIVE Updates | Zuari Agro Chemicals Q3 Results:

Net profit down 72.6% at Rs 28.6 crore versus Rs 104.2 crore and revenue down 40.4% at Rs 843.4 crore versus Rs 1,416.2 crore, YoY.

-330

February 07, 2024· 15:22 IST

Stock Market LIVE Updates | HSBC View On Finolex Industries

-Downgrade to hold, target Rs 225 per share

-Weak demand from Chinese real estate driving PVC segment lower

-Expect improvement only towards end of 2024

-Pipe demand and margins in agri business remain lacklustre

-Downgrade due to lack of catalysts which could improve earnings

-330

February 07, 2024· 15:19 IST

Sensex Today | BSE Capital Goods index down 0.4 percent dragged by AIA Engineering, Timken India, Kalpataru Projects International

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| AIA Engineering | 4,129.90 | -6.57 | 8.58k |

| Timken | 3,082.20 | -3.66 | 3.27k |

| KPIL | 851.10 | -3.44 | 10.82k |

| Rail Vikas | 280.55 | -1.63 | 1.05m |

| Praj Industries | 500.40 | -1.55 | 114.77k |

| Schaeffler Ind | 3,069.00 | -1.4 | 766 |

| CG Power | 439.20 | -1.33 | 60.69k |

| Larsen | 3,401.45 | -0.65 | 37.57k |

| Sona BLW | 628.00 | -0.63 | 61.46k |

| Bharat Elec | 182.00 | -0.6 | 848.46k |

-330

February 07, 2024· 15:14 IST

Stock Market LIVE Updates | HSBC View On FSN E-Commerce Ventures (Nykaa):

-Buy call, target Rs 240 per share

-Q3 saw revenue growth of 22 percent led by BPC GMV growth of 25 percent & fashion at 40 percent

-BPC GMV growth & fashion segment was strong amid weak demand environment

-EBITDA margin a tad lower than expected due to lower ad income, ESOPs and middle east store expenses

-Think company with its scale is formidable in BPC and fashion is on superior track now

-330

February 07, 2024· 15:10 IST

Stock Market LIVE Updates | Life Insurance Corporation of India shares touched 52-week high of Rs 1,047

-330

February 07, 2024· 15:09 IST

Sensex Today | Dollar slides against euro after pullback from nearly 3-month peak

The dollar fell on Wednesday, further retreating from a nearly three-month high against the euro hit a day earlier, with a decline in U.S. bond yields adding to the pressure.

Analysts pointed to technical factors for the dollar's pullback, following a two-day rally of as much as 1.4% against the euro after unexpectedly strong U.S. jobs data, as well as more hawkish rhetoric from Federal Reserve Chair Jerome Powell, scuppered bets for an early interest rate cut.

U.S. Treasury yields also turned down from highs on solid demand at a sale of new three-year notes, removing some support for the dollar.

The dollar was down 0.1% to $1.0762 per euro, after retreating 0.1% on Tuesday, when it had earlier touched its strongest level since Nov. 14 at $1.0722.

-330

February 07, 2024· 15:06 IST

Stock Market LIVE Updates | DAM Capital View On Navin Fluorine International:

-Neutral call, target Rs 3,145 per share

-Another weak quarter; near-term headwinds

-Revenue down 11 percent YoY Rs 500 crore impacted by lower CDMO sales

-EBITDA was below estimate, margin lowest in past 2-3 years

-PAT aided by land sale

-Believe current valuation of 47x/33x FY25/FY26 PER are fair

-Current value leaves room for limited upsides

-330

February 07, 2024· 15:04 IST

Stock Market LIVE Updates | Nocil Q3 Earnings:

Net profit up 61.3 percent at Rs 30 crore against Rs 18.6 crore and revenue up 4.6 percent at Rs 340.6 crore versus Rs 325.7 crore, YoY.

-330

February 07, 2024· 15:03 IST

Stock Market LIVE Updates | FDC Q3 Results:

Net profit up 94.6 percent at Rs 79.2 crore versus Rs 40.7 crore and revenue up 11.9 percent at Rs 458.2 crore versus Rs 409.3 crore, YoY.

-330

February 07, 2024· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was down 27.69 points or 0.04 percent at 72,158.40, and the Nifty was up 5.10 points or 0.02 percent at 21,934.50. About 1925 shares advanced, 1344 shares declined, and 58 shares unchanged.

-330

February 07, 2024· 14:59 IST

Stock Market LIVE Updates | Varroc Engineering reports its Q3 earnings

--Net Profit at Rs382.6 cr Vs Rs20.4 cr (YoY)

--Tax Credit at Rs313 Cr Vs Rs10 cr (YoY)

--Revenue up 9.4% at Rs1,884.5 cr Vs Rs1,722.7 cr (YoY)

--EBITDA up 24.8% at Rs175.4 cr Vs Rs140.6 cr (YoY)

-330

February 07, 2024· 14:56 IST

Stock Market LIVE Updates | Ramco Systems reports Q3 earnings

--Net loss of Rs26.3 cr vs loss of Rs50.2 cr (YoY)

--Revenue up 0.6% at Rs128.2 cr vs Rs127.4 cr (YoY)

--EBITDA loss at Rs4.5 cr vs EBITDA loss of Rs28.7 cr (YoY)

-330

February 07, 2024· 14:54 IST

Stock Market LIVE Updates | Shalby reports Q3 earnings

--Net Profit up 25% at Rs19 cr vs Rs15.2 cr (YoY)

--Revenue up 6.7% at Rs216 cr vs Rs202.4 cr (YoY)

--EBITDA up 25.1% at Rs42.3 cr vs Rs33.8 cr (YoY)

--Margin at 19.6% vs 16.7% (YoY)

-330

February 07, 2024· 14:49 IST

Stock Market LIVE Updates| Parag Milk reports its Q3

--Net Profit at Rs34.1 cr vs Rs9.2 cr (YoY)

--Revenue up 8.8% at Rs800.8 cr vs Rs735.8 cr (YoY)

--EBITDA up 87.7% at Rs62.7 cr vs Rs33.4 cr (YoY)

--Margin at 7.8% vs 4.5% (YoY)

-330

February 07, 2024· 14:42 IST

-330

February 07, 2024· 14:34 IST

Stock Market LIVE Updates | Indus Towers has 1.2 percent or 32.4 million of equity changed hands in eight bunches: Bloomberg

-330

February 07, 2024· 14:28 IST

-330

February 07, 2024· 14:21 IST

Stock Market LIVE Updates | Electronics Mart Q3 Results:

Net profit at Rs 45.8 crore versus Rs 21.9 crore and revenue up 20.7 percent at Rs 1,788.7 crore versus Rs 1,481.7 crore, YoY.

-330

February 07, 2024· 14:20 IST

Stock Market LIVE Updates | HSBC View On Indian Hotels

-Buy call, target raised to Rs 575 per share

-Highest-ever Q3 EBITDA was driven by better-than-expected trading

-Balance sheet strongest among peers

-Strong outlook driven by favourable demand-supply, market share gain

-Strong outlook driven by improving cost efficiencies, and continued growth

-Demanding valuations well justified by superior margin profile & market positioning

-330

February 07, 2024· 14:18 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| IOB | 74.92 | 79.90 67.95 | 10.26% |

| PI Industries | 3,326.25 | 3,358.00 3,060.00 | 8.7% |

| UCO Bank | 62.61 | 65.85 58.90 | 6.3% |

| Max Financial | 949.75 | 970.35 919.05 | 3.34% |

| Indian Hotels | 524.75 | 525.50 508.75 | 3.14% |

| AB Capital | 186.45 | 188.60 181.00 | 3.01% |

| Canara Bank | 546.20 | 550.50 530.55 | 2.95% |

| Muthoot Finance | 1,409.75 | 1,424.00 1,372.15 | 2.74% |

| L&T Finance | 174.95 | 178.30 170.65 | 2.52% |

| Max Healthcare | 819.35 | 836.90 799.75 | 2.45% |

-330

February 07, 2024· 14:12 IST

Sensex Today | BSE Bank index up 0.5 percent led by SBI, Federal Bank, Axis Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SBI | 672.65 | 3.34 | 1.99m |

| Federal Bank | 149.05 | 1.39 | 748.58k |

| Axis Bank | 1,065.05 | 1.39 | 75.31k |

| Kotak Mahindra | 1,792.75 | 0.29 | 59.65k |

| IDFC First Bank | 83.10 | 0.12 | 1.96m |

-330

February 07, 2024· 14:08 IST

Stock Market LIVE Updates | Subex Q3 Results:

Net loss at Rs 4.9 crore against loss of Rs 4.7 crore and revenue up 11 percent at Rs 81.8 crore against Rs 73.7 crore, YoY.

-330

February 07, 2024· 14:07 IST

Stock Market LIVE Updates | DreamFolks Services Q3 Results:

Net profit up 5.3 percent at Rs 20 crore versus Rs 19 crore and revenue up 49.5 percent at Rs 305 crore versus Rs 204 crore, YoY.

-330

February 07, 2024· 14:06 IST

Stock Market LIVE Updates | Jefferies On FSN E-Commerce Ventures (Nykaa):

-Buy call, target Rs 210 per share

-Q3 EBITDA missed forecasts as weak demand weighed across line items

-Ad income was lower as beauty & personal care brands prioritised discounts over marketing spends

-Discounts rose on own label, impacting gross margin

-BPC contribution margin compressed to a seven quarter low

-Fashion segment surprised positively on growth & profitability

-Growth is a priority that would likely keep CM range-bound in ST

-Operating leverage should drive up EBITDA margin

-330

February 07, 2024· 14:02 IST

Sensex Today | Market at 2 PM

The Sensex was down 9.23 points or 0.01 percent at 72,176.86, and the Nifty was up 11.60 points or 0.05 percent at 21,941. About 1960 shares advanced, 1302 shares declined, and 51 shares unchanged.

-330

February 07, 2024· 14:00 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Trent | 3,019.95 | 3,465.35 | 445.40 113.70k |

| Zenithexpo | 149.55 | 164.25 | 14.70 146 |

| Nahar Ent | 136.65 | 148.90 | 12.25 21.29k |

| Lakshmi Finance | 218.90 | 236.85 | 17.95 1.49k |

| Nath Bio-Genes | 213.25 | 228.75 | 15.50 1.06k |

| Cyber Media Res | 154.00 | 164.65 | 10.65 400 |

| Indo Amines | 164.30 | 174.35 | 10.05 10.50k |

| Talbros Auto | 270.00 | 285.90 | 15.90 4.22k |

| Lexus Granito | 41.90 | 44.30 | 2.40 1.62k |

| Nirman Agri | 247.05 | 261.00 | 13.95 1.07k |

-330

February 07, 2024· 13:56 IST

Stock Market LIVE Updates | Talbros Automotive Components Q3 Results:

Net profit rose 65.7 percent at Rs 22.7 crore versus Rs 13.7 crore and revenue up 25.4 percent at Rs 198.7 crore against Rs 158.5 crore, YoY.

-330

February 07, 2024· 13:53 IST

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Zaggle Prepaid | 705570.00 | 277.80 20 | 11310766 1104863.80 |

| Mittal Life Sty | 3106274.00 | 2.70 20 | 64522121 11069731.00 |

| TRF | 649502.00 | 327.70 19.99 | 551695 119247.85 |

| PAKKA | 249755.00 | 348.15 19.99 | 1867950 709045.00 |

| Balaji Telefilm | 1056868.00 | 110.50 19.98 | 4623329 1323467.25 |

| Patel Integrate | 643630.00 | 26.50 19.91 | 3990692 807057.80 |

| Sakthi Sugars | 2308753.00 | 39.80 19.88 | 9095753 1334794.25 |

| One 97 Paytm | 1394500.00 | 496.25 10 | 20001128 7806564.90 |

| Azad Eng | 102181.00 | 988.20 10 | 1086391 1198173.25 |

| Sadbhav Engg | 1621442.00 | 29.40 9.91 | 305625 575959.60 |

-330

February 07, 2024· 13:52 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Sasken Comm | 1,559.75 | 1,560.00 1,508.05 | -0.02% |

| Excel | 869.10 | 869.25 858.10 | -0.02% |

| Suven Life Sci | 117.40 | 117.45 114.15 | -0.04% |

| Electronics Mar | 229.10 | 229.20 219.75 | -0.04% |

| Apollo Pipes | 674.50 | 674.75 665.00 | -0.04% |

| Ashapura Mine | 411.85 | 412.00 395.00 | -0.04% |

| CSB Bank | 386.35 | 386.55 380.40 | -0.05% |

| Vimta Labs | 506.30 | 506.65 492.60 | -0.07% |

| La Opala RG | 368.55 | 368.90 360.40 | -0.09% |

| Blue Star | 1,171.75 | 1,173.10 1,145.00 | -0.12% |

-330

February 07, 2024· 13:51 IST

-330

February 07, 2024· 13:48 IST

Stock Market LIVE Updates | Jefferies On Navin Fluorine International:

-Hold call, target cut to Rs 2,950 from Rs 3,425 per share

-Weak Q3; near-term pain to persist

-Company continues to face product deferrals on subdued demand

-Company continues to face execution challenges and negative operating leverage

-Management guidance has turned more cautious, given ongoing agchem destocking cycle

-Cut FY24/25/26E EBITDA 22 percent/28 percent/23 percent

-Assuming recovery to be back-ended into FY25

-330

February 07, 2024· 13:46 IST

Stock Market LIVE Updates | Sanghvi Movers Q3 Results:

Net profit up 76.2% at Rs 61.3 crore versus Rs 34.8 crore and revenue up 36.3% at Rs 167 crore versus Rs 122.5 crore, YoY.

-330

February 07, 2024· 13:45 IST

Stock Market LIVE Updates | Power Grid Corporation of India share price trades lower ahead of Q2 Earnings:

-330

February 07, 2024· 13:43 IST

-330

February 07, 2024· 13:41 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 45531.93 -0.04 | 7.82 3.49 | 9.11 50.54 |

| BSE CAP GOODS | 56536.30 0.09 | 1.60 -0.27 | 0.53 64.71 |

| BSE FMCG | 19803.38 0.4 | -3.25 -0.45 | -4.51 20.19 |

| BSE Metal | 28317.80 0.93 | 4.92 5.82 | 6.93 40.47 |

| BSE Oil & Gas | 28366.42 0 | 23.22 9.46 | 19.67 61.16 |

| BSE REALTY | 6981.83 2.1 | 12.85 3.18 | 4.58 112.09 |

| BSE IT | 38572.67 -1.18 | 7.11 3.25 | 8.67 28.08 |

| BSE HEALTHCARE | 34750.46 0.2 | 10.15 2.76 | 6.66 56.46 |

| BSE POWER | 6560.51 1.33 | 12.75 3.85 | 9.04 84.16 |

| BSE Cons Durables | 49696.74 0.54 | -0.61 -1.30 | -1.77 29.71 |

-330

February 07, 2024· 13:40 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 72122.05 -0.09 | -0.16 0.52 | 0.13 19.63 |

| BSE 200 | 9903.25 0.26 | 2.74 1.38 | 2.13 31.08 |

| BSE MIDCAP | 39642.59 0.75 | 7.61 2.24 | 5.13 60.90 |

| BSE SMALLCAP | 46532.24 0.48 | 9.04 1.77 | 6.19 66.44 |

| BSE BANKEX | 51814.13 0.41 | -4.72 -0.36 | -4.53 10.38 |

-330

February 07, 2024· 13:38 IST

Stock Market LIVE Updates | Jefferies On Godrej Properties

-Buy call, target Rs 2,700 per share

-Back-to-back record pre-sales quarters, strong launch pipeline for Q4

-Company is in the range for another 50 percent+ sales growth this year

-Company reaping benefits of timely land acquisitions

-ASPs are now 52 percent higher than 2-years back & its take rate up 25 PPT to approximately 80 percent

-Management expects PAT margin to jump to 15-18 percent range versus 10 percent previously

-FCFs are also expected turn positive in FY25

-330

February 07, 2024· 13:33 IST

Stock Market LIVE Updates | GMR Airports Infrastructure touched 52-week high of Rs 91.15

-330

February 07, 2024· 13:31 IST

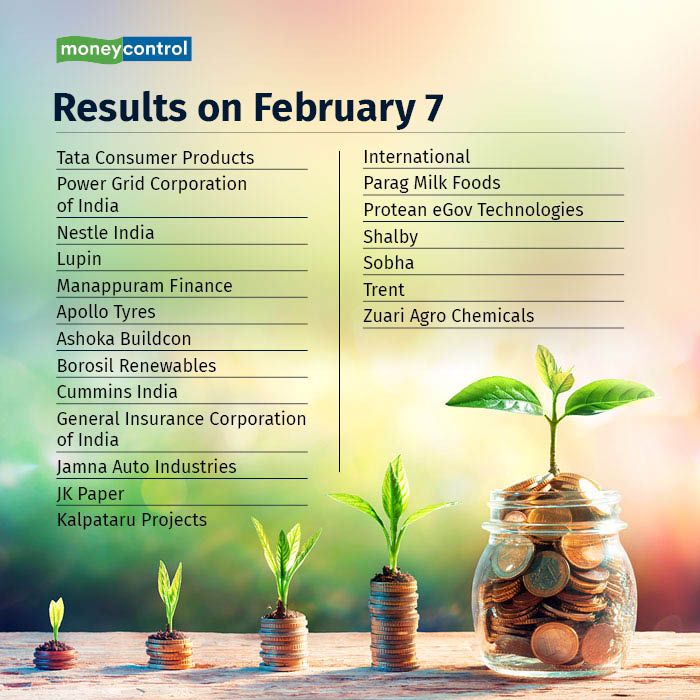

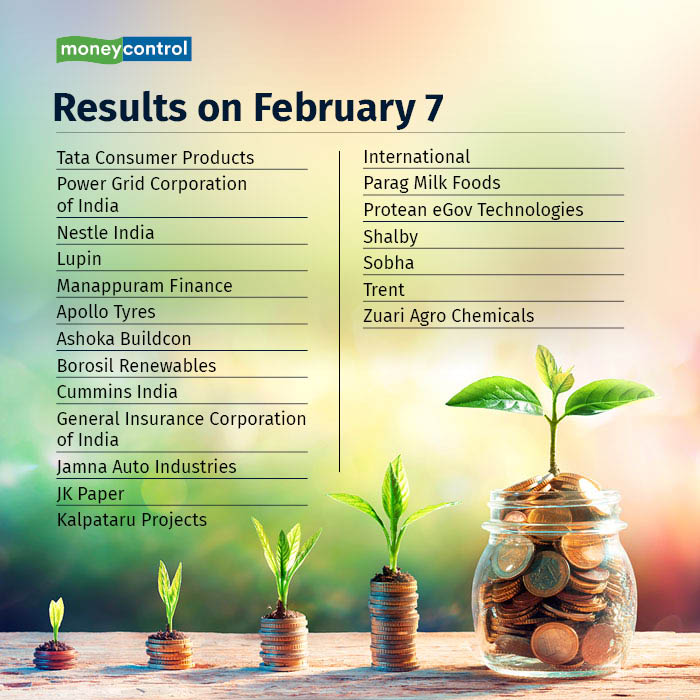

Results on February 7

-330

February 07, 2024· 13:28 IST

Stock Market LIVE Updates | Morgan Stanley View on Bharti Airtel

-Equal-weight call, target Rs 1,190 per share

-Growth priced in

-Strong execution is reflected in strong 4G & postpaid net adds

-Strong YoY growth in India EBITDA without much support from increase in tariffs

-Stock has run up, +27 percent in 6 months versus 9 percent for Sensex & positives are priced in

-330

February 07, 2024· 13:24 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 19895.40 -0.04 | 6.86 3.48 | 8.09 50.43 |

| NIFTY IT | 37815.20 -1.13 | 6.48 3.21 | 8.50 24.76 |

| NIFTY PHARMA | 18533.65 0.25 | 10.11 3.32 | 6.77 52.02 |

| NIFTY FMCG | 54752.45 0.26 | -3.92 -0.58 | -5.05 19.66 |

| NIFTY PSU BANK | 6711.45 2.37 | 17.47 7.01 | 14.95 72.52 |

| NIFTY METAL | 8300.90 0.76 | 4.05 4.11 | 5.45 44.18 |

| NIFTY REALTY | 883.50 1.99 | 12.83 3.19 | 4.64 114.65 |

| NIFTY ENERGY | 38960.50 0.62 | 16.41 6.02 | 13.87 74.04 |

| NIFTY INFRA | 7996.75 0.09 | 9.49 1.74 | 8.10 58.19 |

| NIFTY MEDIA | 2143.00 0.65 | -10.27 -0.37 | -13.17 15.63 |

-330

February 07, 2024· 13:23 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 21913.40 -0.07 | 0.84 0.86 | 0.93 23.65 |

| NIFTY BANK | 45742.95 0.11 | -5.28 -0.55 | -5.02 10.25 |

| NIFTY Midcap 100 | 49157.30 0.35 | 6.44 1.21 | 3.72 60.31 |

| NIFTY Smallcap 100 | 16555.75 0.65 | 9.32 3.30 | 7.23 76.13 |

| NIFTY NEXT 50 | 57180.25 1.27 | 7.19 3.40 | 5.31 48.08 |

-330

February 07, 2024· 13:21 IST

Stock Market LIVE Updates | Vascon Engineers Q3 results:

Net profit up 14.1% at Rs 18.6 crore versus Rs 16.3 crore and revenue up 10.4% at Rs 280.3 crore versus Rs 254 crore, YoY.

-330

February 07, 2024· 13:19 IST

Stock Market LIVE Updates | Morgan Stanley View On Godrej Properties

-Equal-weight call, target Rs 2,050 per share

-Sales booking for 9M reached Rs 13,000 crore, 93 percent of company’s full-year 2024 target

-9M collections were Rs 6,740 crore, 67 percent of FY24 guidance

-Gross operating CF for the trailing 12 months was up 32 percent YoY

-However, with high land spending of Rs 4,200 crore YTD, net debt/equity increased

-Company has achieved 52 percent of completions & 56 percent biz development activity FY24 guidance so far

-330

February 07, 2024· 13:13 IST

Sensex Today | BSE FMCG index rose 0.3 percent led by Tilaknagar Industries, Bajaj Hindusthan Sugar, LT Foods

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tilaknagar Ind | 242.25 | 7.62 | 154.07k |

| Bajaj Hindustha | 38.14 | 7.2 | 8.57m |

| LT Foods | 194.25 | 6.91 | 168.99k |

| Parag Milk Food | 221.20 | 6.6 | 119.08k |

| DCM Shriram Ind | 201.45 | 5.22 | 50.50k |

| Shree Renuka | 53.34 | 4.57 | 3.07m |

| Gokul Agro | 122.95 | 4.24 | 22.14k |

| Ugar Sugar Work | 89.06 | 4.05 | 74.13k |

| Avadh Sugar | 682.25 | 3.7 | 25.95k |

| Triveni Engg | 365.10 | 3.52 | 219.26k |

-330

February 07, 2024· 13:11 IST

Stock Market LIVE Updates | Quess Corp sells Qdigi Services to Onsitego for Rs 80 crore

Quess Corp has agreed to sell its wholly-owned subsidiary, Qdigi Services, to Onsitego. As part of the transaction, the entire team and business of Qdigi will be transferred to Onsitego. Quess will receive total cash consideration of Rs 80 crore, while Quess will be acquiring a minority stake in Onsitego. The transaction is expected to be completed over the next 2-3 months.

-330

February 07, 2024· 13:06 IST

Sensex Today | Trent Q3 net profit at Rs 370.6 crore and revenue at Rs 3,466.6 crore.

-330

February 07, 2024· 13:06 IST

Sensex Today | Vibhor Steel Tubes sets price band at Rs 141-151 for Rs 72-crore IPO

Haryana-based Vibhor Steel Tubes Ltd (VSTL) has set the price range for its initial public offering (IPO) in the range of Rs 141 to Rs 151 per share. The maiden issue will open on February 13 and close on 15th.

Khambatta Securities Limited is the sole book running lead manager to the Offer and KFIN Technologies Limited as the Registrar to the Offer.

The company said the proceeds from the issue will be used for working capital requirements and general corporate purposes.

Vibhor Tubes manufactures steel products such as Electric Resistance Welded Pipes, Hot-dipped Galvanized Pipes, Hollow section pipes, Primer painted pipes, SS Pipes and Crash Barriers at its plants located in Maharashtra, Telangana and Haryana with a total capacity of 2,21,000 MTPA. Read More

-330

February 07, 2024· 13:04 IST

Stock Market LIVE Updates | Gujarat Fluorochemicals Q3 Results:

Net profit down 76 percent at Rs 80 crore versus Rs 329 crore and revenue down 30 percent at Rs 992 crore versus Rs 1,418 crore, YoY.

-330

February 07, 2024· 13:03 IST

Stock Market LIVE Updates | UNO Minda Q3 Results

Net profit jumped 18 percent at Rs 205 crore versus Rs 174 crore and revenue up 21 percent at Rs 3,523 crore versus Rs 2,915 crore, YoY.

-330

February 07, 2024· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Pan Electroncis | 32.79 | 29.51 | -3.28 140 |

| Miven Machine | 88.48 | 80.06 | -8.42 9 |

| Longview Tea | 34.74 | 31.65 | -3.09 700 |

| IBUL-RE | 45.05 | 41.05 | -4.00 - |

| KPT Industries | 618.00 | 570.00 | -48.00 508 |

| United Credit | 22.24 | 20.61 | -1.63 196 |

| Citadel Realty | 27.90 | 26.00 | -1.90 1.20k |

| Cospower | 290.00 | 271.00 | -19.00 59 |

| Indo Cotspin | 43.77 | 41.02 | -2.75 537 |

| Softsol India | 290.00 | 273.55 | -16.45 237 |

-330

February 07, 2024· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Arihants Sec | 19.80 | 22.69 | 2.89 4.68k |

| Futuristic Sol | 105.50 | 116.89 | 11.39 187 |

| Pasupati Acrylo | 44.50 | 49.00 | 4.50 6.28k |

| Chartered Cap | 218.00 | 240.00 | 22.00 1 |

| Calcom Vision | 163.45 | 179.00 | 15.55 264 |

| Indian Terrain | 76.20 | 83.44 | 7.24 4.68k |

| Inani Sec | 29.70 | 32.39 | 2.69 782 |

| Panasonic Energ | 379.00 | 412.10 | 33.10 1.24k |

| Kirl Electric | 146.05 | 158.00 | 11.95 2.35k |

| Jindal Leasefin | 37.00 | 40.00 | 3.00 631 |

-330

February 07, 2024· 12:57 IST

Stock Market LIVE Updates | Firstsource Solutions Q3 earnings:

Net profit rose 1.7 percent at Rs 128.7 crore versus Rs 126.5 crore and revenue up 3.6 percent at Rs 1,596 crore against Rs 1,540 crore, QoQ.

-330

February 07, 2024· 12:54 IST

Stock Market LIVE Updates | Macquarie View On Delhivery

-Outperform call, target raised to Rs 560 per share

-Company is a cost leader in a complex, tech-intensive business exposed to India’s large e-comm growth runway

-Forecast a 20 percent 10-year core revenue CAGR with strong scale benefits

-Expect net profit breakeven in FY25

-330

February 07, 2024· 12:51 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Agarwal Ind | 1,090.05 -0.07 | 1,096.15 -0.56 | 13,021 |

| Vidhi Spec | 406.65 -0.37 | 409.45 -0.68 | 7,636 |

| HDFC Bank | 1,435.30 -0.61 | 1,446.15 -0.75 | 13,924,747 |

| SBI ETF PVT BAN | 234.80 -0.23 | 237.14 -0.99 | 1,561 |

| Shanthi Gears | 530.55 -0.15 | 536.95 -1.19 | 13,994 |

| PDS | 577.05 -0.47 | 584.75 -1.32 | 19,624 |

| Jay Jalaram | 449.45 -0.13 | 455.65 -1.36 | 5,000 |

| SUMITOMO | 394.50 -0.49 | 400.05 -1.39 | 81,023 |

| Kewal Kiran | 750.00 -0.43 | 761.25 -1.48 | 17,116 |

| Aries Agro | 276.80 -0.32 | 281.10 -1.53 | 75,064 |

-330

February 07, 2024· 12:49 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| MRO-TEK | 89.70 8.27 | 63.40 41.48 | 1,333,212 |

| Cords Cable Ind | 201.25 4.09 | 146.50 37.37 | 1,222,665 |

| IOB | 75.00 11.03 | 56.15 33.57 | 293,060,679 |

| Sakthi Sugars | 39.80 19.88 | 30.00 32.67 | 9,033,355 |

| Sarthak Metals | 431.35 10.19 | 325.75 32.42 | 390,176 |

| Lagnam Spintex | 121.25 0.29 | 91.80 32.08 | 294,604 |

| KCP Sugar | 51.60 0.39 | 40.55 27.25 | 1,773,442 |

| WS Industries | 169.60 19.27 | 134.45 26.14 | 1,678,631 |

| Sarveshwar Food | 10.15 4.64 | 8.05 26.09 | 36,825,715 |

| KIOCL | 481.55 16.04 | 382.55 25.88 | 4,037,641 |

-330

February 07, 2024· 12:48 IST

-330

February 07, 2024· 12:43 IST

Stock Market LIVE Updates | Paytm shares locked at 10 percent upper circuit

-330

February 07, 2024· 12:42 IST

Sensex Today | Shrey Jain, Founder & CEO, SAS Online on extension in trading hours

Many brokers still rely on exchanges for trading and margin files. They will have to overhaul this current practise and generate files at own end to be able to process trades to give timely payouts

Regulator has indicated initially only Index futures will be traded in the extended trading session. This will help traders better manage their positions in synch with International markets

-330

February 07, 2024· 12:41 IST

Sensex Today | BSE Midcap index touched fresh high of 39695.42; Indian Overseas Bank, UCO Bank, Canara Bank top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IOB | 75.07 | 11.13 | 22.34m |

| UCO Bank | 63.30 | 7.6 | 12.10m |

| Canara Bank | 546.90 | 4.92 | 572.56k |

| Max Financial | 948.00 | 3.99 | 83.98k |

| Indian Hotels | 524.85 | 3.7 | 107.75k |

| AB Capital | 186.80 | 3.66 | 832.06k |

| L&T Finance | 175.05 | 2.79 | 345.82k |

| GMR Airports | 90.54 | 2.72 | 1.25m |

| Bank of India | 137.35 | 2.69 | 2.09m |

| Vedant Fashions | 984.20 | 2.35 | 26.38k |

-330

February 07, 2024· 12:39 IST

Stock Market LIVE Updates |

Net profit up 4.4 percent at Rs 655.6 crore versus Rs 628.1 crore, YoY

Revenue up 8.1 percent at Rs 4,600 crore versus Rs 4,256.8 crore, YoY

One-time loss of Rs 107.3 crore

EBITDA up 10.2 percent at Rs 1,077 crore against Rs 976.9 crore, and margin at 23.4 percent versus 22.9 percent, YoY

-330

February 07, 2024· 12:38 IST

Sensex Today | BSE Smallcap index touched new high of 46821.39; KIOCL, Auto Stampings, EIH top contributors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| KIOCL | 485.80 | 17.39 | 273.36k |

| Auto Stampings | 536.65 | 15.84 | 84.76k |

| EIH | 408.00 | 14.88 | 377.77k |

| Action Const | 1,130.00 | 13.93 | 205.73k |

| EIH Assoc Hotel | 777.75 | 13.64 | 24.04k |

| HLV | 40.30 | 13.04 | 993.72k |

| Visaka Ind | 152.30 | 11.7 | 550.61k |

| Sportking India | 894.90 | 10.48 | 17.74k |

| Bharat Bijlee | 5,772.15 | 8.83 | 5.67k |

| Centrum Capital | 39.66 | 8.72 | 605.42k |

-330

February 07, 2024· 12:36 IST

Sensex Today | Apeejay Surrendra Park Hotels IPO subscribed 8.5 time on Day 3, QIB portion full booked

The Rs 920-crore IPO of Apeejay Surrendra Park Hotels was subscribed 8.55 times by the noon of February 7, the final day of bidding, with bids coming in for 29.7 crore equity shares against an offer size of 3.47 crore.

Retail investors lead the pack, subscribing 17.61 times their allotted quota of shares. Non-institutional investors’ potion had been booked 17.51 times and that of qualified institutional buyers (QIBs) 1.28 times.

-330

February 07, 2024· 12:33 IST

Stock Market LIVE Updates | HSBC On Ashok Leyland

-Buy call, target Rs 230 per share

-Strong Q3FY24 operating margin in seasonally weak quarter, reflects structural improvement in cost efficiencies

-CV industry trends should be stable in the long-term

-We estimate a FY24-FY27 CAGR of 6 percent

-330

February 07, 2024· 12:31 IST

Sensex Today | Shishir Baijal, Chairman and Managing Director, Knight Frank India

In the upcoming MPC meeting, we expect that the RBI will continue to maintain the policy repo rates. Consumer inflation, excluding food prices, is within the central bank's acceptable upper tolerance range and the fiscal consolidation plan outlined in the FY2024-25 budget, aiming to gradually reduce the fiscal deficit to 4.5% over the next two years, provides a buffer against potential inflationary pressures. This eases the RBI's stance on considering any interest rate hikes for the remainder of the year.

With the economic momentum holding steady, the RBI can consider maintaining the rates for now and remain open to pivot to rate cut as circumstances evolve later this year. Maintaining stability in interest rates is proving beneficial for the real estate market, particularly the residential sector. Consumers have already factored in elevated interest rates and are still actively engaging in home purchases. However, the affordable housing segment is experiencing sluggish residential sales. Consequently, a well-timed rate cut could prove advantageous for this specific market segment, providing a potential boost to affordability and create a runway for future growth.

-330

February 07, 2024· 12:29 IST

Stock Market LIVE Updates | Morgan Stanley View On Nykaa

-Overweight call, target Rs 190 per share

-Q3 earnings data was slight miss

-Q3 EBITDA margin slightly lower, at 5.5 percent versus estimate of 5.7 percent

-Stable growth trends across businesses

-Improving profitability in fashion and eB2B segments are positives

-Incremental negative EBITDA margin impact from ESOP expenses

-International expansion are negatives

-330

February 07, 2024· 12:25 IST

-330

February 07, 2024· 12:24 IST

Sensex Today | Nifty PSU Bank index up 2 percent supported by Indian Overseas Bank, UCO Bank, Canara Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IOB | 75.90 | 12.36 | 283.05m |

| UCO Bank | 63.50 | 7.99 | 120.96m |

| Canara Bank | 546.10 | 4.73 | 13.08m |

| Bank of Mah | 64.20 | 3.97 | 89.31m |

| Central Bank | 68.95 | 3.61 | 69.33m |

| SBI | 670.85 | 3.17 | 24.30m |

| Bank of India | 137.00 | 2.47 | 22.55m |

| PNB | 124.45 | 2.09 | 43.49m |

| Punjab & Sind | 72.85 | 0.55 | 11.32m |

| Union Bank | 145.45 | 0.34 | 10.10m |

-330

February 07, 2024· 12:23 IST

Stock Market LIVE Updates | Navin Fluorine International Q3 profit drops 27% YoY to Rs 78 crore

Navin Fluorine International has reported consolidated profit at Rs 78.02 crore for quarter ended December FY24, falling sharply by 26.8% compared to corresponding period of last fiscal, dented by dismal topline and operating numbers. Revenue from operations fell by 11% YoY to Rs 501.8 crore for the quarter.

-330

February 07, 2024· 12:20 IST

Stock Market LIVE Updates | CLSA On Godrej Properties

-Sell call, target Rs 2,110 per share

-Cash flow continues to lag; spending on land continues to raise debt

-Record pre-sales but cash flow lags

-Raises FY25 presale guidance & it expects 20 percent growth in mid-term

-Raise presale estimates 15 percent-17 percent over FY24-26

-330

February 07, 2024· 12:18 IST

-330

February 07, 2024· 12:17 IST

Stock Market LIVE Updats | Netsle India shares trade marginally higher ahead of Q3 results:

-330

February 07, 2024· 12:15 IST

Stock Market LIVE Updates | SBI Life Insurance Company picks Rs 239.6 crore worth of shares in KIMS

SBI Life Insurance Company has bought 11,49,074 equity shares in Krishna Institute of Medical Sciences (KIMS), which is equivalent to 1.43% of paid up equity, via open market transactions, at an average price of Rs 2,085 per share, valuing at Rs 239.6 crore.

However, alternative investment fund India Advantage Fund S4-I sold 10,70,545 equity shares or 1.3% stake in the company at same price, amounting to Rs 223.2 crore. As of December 2023, India Advantage Fund had held 2.23% stake in the company.

-330

February 07, 2024· 12:14 IST

Sensex Today | Rashi Peripherals IPO opens for subscription

Rashi Peripherals Limited IPO opened today for subscription. The Rs 600 crore issue is an entirely fresh issue of 1.93 crore shares and will close on February 9, 2024.

The price band for the issue has been fixed at Rs 295-311 per share. Read More

-330

February 07, 2024· 12:11 IST

-330

February 07, 2024· 12:10 IST

Stock Market LIVE Updates | Radico Khaitan Q3 profit grows 23% YoY to Rs 75 crore

Radico Khaitan has registered consolidated profit at Rs 75.2 crore for third quarter of FY24, rising 22.7% over a year-ago period with healthy topline and operating income. Consolidated revenue from operations grew by 34.1% year-on-year to Rs 4,246 crore for the quarter.

-330

February 07, 2024· 12:08 IST

Stock Market LIVE Updates | Nazara Technologies Q3 profit surges 47% YoY to Rs 29.5 crore

Nazara Technologies has registered consolidated net profit at Rs 29.5 crore for October-December period of FY24, growing 47% over a corresponding period of last fiscal despite muted topline growth, backed by strong operating numbers. Revenue from operations grew by 2% YoY to Rs 320.4 crore in Q3FY24.

-330

February 07, 2024· 12:06 IST

-330

February 07, 2024· 12:03 IST

Results Today:

-330

February 07, 2024· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was down 190.80 points or 0.26 percent at 71,995.29, and the Nifty was down 42.60 points or 0.19 percent at 21,886.80. About 1837 shares advanced, 1371 shares declined, and 66 shares unchanged.

-330

February 07, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Cyber Media Res | 165.70 | 154.00 | -11.70 4.59k |

| Anlon Technolog | 254.95 | 237.00 | -17.95 1.20k |

| Torrent Power | 1,205.30 | 1,126.05 | -79.25 154.15k |

| IFGL Refractory | 659.95 | 621.00 | -38.95 24.66k |

| Kody Technolab | 1,195.05 | 1,130.50 | -64.55 4.09k |

| Rajshree Sugars | 101.80 | 96.30 | -5.50 286.45k |

| Sky Gold | 1,120.00 | 1,060.00 | -60.00 2.96k |

| HOV Services | 76.95 | 73.00 | -3.95 4.36k |

| Kanpur Plast | 133.15 | 127.15 | -6.00 14.67k |

| Marvel Decor Lt | 89.00 | 85.00 | -4.00 4.40k |

-330

February 07, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Drone | 160.70 | 179.95 | 19.25 10.27k |

| PAKKA | 295.05 | 322.00 | 26.95 65.68k |

| DUGLOBAL | 57.50 | 62.20 | 4.70 2.50k |

| Everest Kanto | 158.05 | 166.15 | 8.10 627.05k |

| Welspun Invest | 715.00 | 742.35 | 27.35 395 |

| Yes Bank | 26.45 | 27.40 | 0.95 205.26m |

| Raj Television | 64.65 | 66.70 | 2.05 1.57k |

| Asian Hotels | 163.00 | 168.00 | 5.00 8.70k |

| Jayant Agro-Org | 261.10 | 269.00 | 7.90 5.49k |

| Eldeco Housing | 805.85 | 830.10 | 24.25 1.43k |

-330

February 07, 2024· 11:58 IST

Stock Market LIVE Updates | IEX falls 5% as CERC asks Grid India to run shadow pilot on market coupling

The IEX shares fell nearly 4.8 percent intraday on February 7, a day after the CERC provided enabling provisions for market coupling. At 11:07am, the stock was trading at Rs 145.45.

In a February 6 notice, CERC said that Grid India will develop the necessary software over the next two months to run a shadow pilot for market coupling of the three power exchanges - Indian Electricity Exchange (IEX), Power Exchange of India (PXIL) and Hindustan Power Exchange (HPX). After the pilot, the exchanges will share data and information with the CERC to decide on the benefits of coupling.

Market coupling is a model where buying and selling of bids for all three power exchanges will be aggregated into a uniform market clearing price. Read More

-330

February 07, 2024· 11:57 IST

-330

February 07, 2024· 11:55 IST

Stock Market LIVE Updates | GST department initiated inspection at Greaves Cotton corporate office

Greaves Cotton informed that Department of Goods and Service Tax, Government of Maharashtra, has initiated inspection from 06th February 2024 at the corporate office of the company.

The company is fully co-operating with the officials, providing them with all necessary information and support. The business operations of the Company continue as usual and are not impacted due to the inspection.

-330

February 07, 2024· 11:51 IST

BSE Auto index down 0.5 percent dragged by Samvardhana Motherson International, Balkrishna Industries, Tata Motors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MOTHERSON | 117.45 | -1.14 | 527.90k |

| Balkrishna Ind | 2,367.00 | -0.68 | 5.23k |

| Tata Motors | 933.75 | -0.61 | 231.46k |

| Apollo Tyres | 550.20 | -0.56 | 69.12k |

| Ashok Leyland | 179.00 | -0.56 | 1.27m |

| Hero Motocorp | 4,761.85 | -0.5 | 4.33k |

| Sundram | 1,240.90 | -0.47 | 1.18k |

| M&M | 1,720.00 | -0.44 | 19.95k |

| Eicher Motors | 3,931.70 | -0.33 | 9.76k |

| Maruti Suzuki | 10,815.00 | -0.31 | 6.14k |