Closing Bell: Nifty below 24,750, Sensex plunges 886 pts; auto, IT, realty top drag

-330

August 02, 2024· 16:08 IST

Market Close | Sensex, Nifty snaps 5-day winning run

Indian benchmark indices snapped five-day winning run and ended lower with Nifty below 24,750 on August 2. At close, the Sensex was down 885.60 points or 1.08 percent at 80,981.95, and the Nifty was down 293.20 points or 1.17 percent at 24,717.70.

We wrap up today's edition of the Moneycontrol live market blog, and will be back Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

August 02, 2024· 16:06 IST

Market This Week | Sensex, Nifty down 0.3% each

#1 Friday’s sharp fall leads to market snapping 8-week gaining streak

#2 Sensex & Nifty see a minor cut, down 0.3% each

#3 Broader markets see minor gains, Midcap Index & Nifty Bank Up 0.3-0.5%

#4 60% of Nifty stocks give negative returns this week

-330

August 02, 2024· 16:03 IST

Rupak De, Senior Technical Analyst, LKP Securities

Nifty has slipped sharply amid a global sell-off. Technically, it has drifted down after forming a spinning top on the daily timeframe. The RSI indicator has turned downward, indicating a bearish crossover. The market appears to be favoring "sell on rise" traders as long as it remains below 24,800. On the downside, Nifty might drift towards 24,530 or 24,400.

-330

August 02, 2024· 15:58 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

Nifty opened a gap down today and witnessed weak price action during the day. It closed down ~293 points. On the daily charts we can observe that the Nifty has closed be low of the last four trading sessions. There was a breakout failure as Nifty did not witness follow through buying interest on the upside. We expect Nifty to retrace towards 24600 – 24550 where support in the form of 20-day moving average and 38.2% fibonacci retracement level is placed. On the upside, 24820 – 24850 is the immediate resistance.

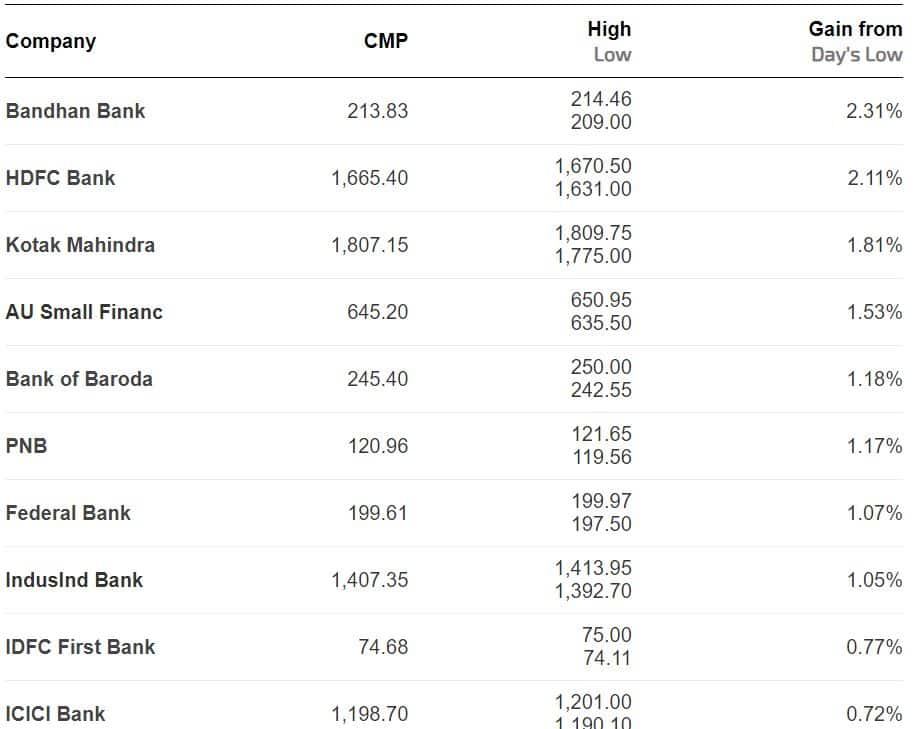

Bank Nifty consolidated around the 40-day moving average (51318) and hence the fall was less intense as compared to Nifty. The bank Nifty has been underperforming and can continue to do so. On the weekly chart the Bank Nifty has formed an Inside Bar pattern. 52550 – 50440 crucial levels to watch out for over the next few trading sessions. A range breakout shall decide the further trend hereon. Thus, shall maintain our rangebound outlook for the Bank Nifty.

-330

August 02, 2024· 15:56 IST

Shrikant Chouhan, Head Equity Research, Kotak Securities:

Market correction on Friday erased the weekly gains, with both BSE Sensex and NSE Nifty 50 index ending the week lower. BSE Midcap and BSE Smallcap index outperformed the larger peers on a weekly basis. On the sectoral front, the performance was mixed. Sectoral indices like BSE Power, BSE Healthcare, BSE Oil & Gas and BSE Power outperformed and closed with weekly gains. On the other side, BSE Realty, BSE Auto, BSE IT and BSE FMCG indices witnessed weekly loss.

Recent domestic data like India Manufacturing PMI at 58.1 and GST collection growth of 10% remained broadly healthy. Globally, markets reacted to outcome of Central Bank meetings. The US Fed kept the rates unchanged, while noting the sharp reduction in inflation and the uptick in unemployment. Bank of England announced 25 bps rate cut. Asian markets witnessed sharp correction on Friday. Indian equities saw FPI outflows this week. Stock specific action based on Q1FY25 earnings will continue for the next couple of weeks. Recent weakness in global equity markets will be closely monitored.

-330

August 02, 2024· 15:44 IST

Vinod Nair, Head of Research, Geojit Financial Services

The domestic market saw a broad-based sell-off, indicating that it may have reached an exhaustion point due to a lack of new triggers for further upward movement. Q1FY25 earnings have been lackluster so far, while broader market valuations remain significantly high.

Meanwhile, despite the US Fed hinting at a rate cut in September, global markets are consolidating as this move has already been priced in. Additionally, weak earnings from the US IT sector, a potential rise in unemployment, the possibility of further rate hikes by the BOJ, and a slowdown in China's growth are all dampening market sentiment.

-330

August 02, 2024· 15:32 IST

Currency Check | Rupee closes flat

Indian rupee ended at 83.74 per dollar on Friday versus Thursday's close of 83.72.

-330

August 02, 2024· 15:31 IST

Market Close | Nifty below 24,750, Sensex plunges 885 pts; auto, IT, realty top drag

Indian benchmark indices snapped five-day winning run and ended lower with Nifty below 24750 on August 2.

At close, the Sensex was down 885.60 points or 1.08 percent at 80,981.95, and the Nifty was down 293.20 points or 1.17 percent at 24,717.70. About 1426 shares advanced, 1960 shares declined, and 83 shares unchanged.

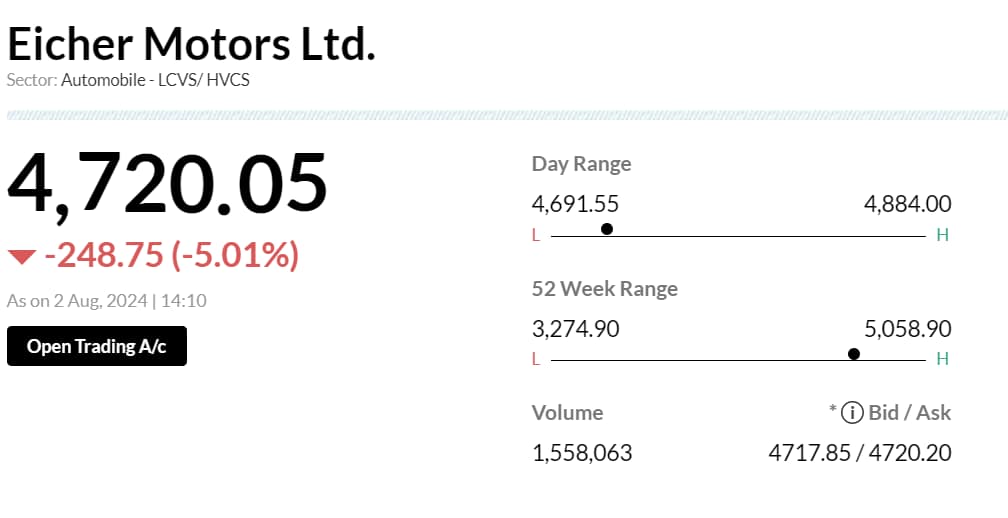

Biggest Nifty losers were Eicher Motors, Maruti Suzuki, Tata Motors, Hindalco Industries, JSW Steel, while gainers included Divis Labs, HDFC Bank, Dr Reddy's Labs, Sun Pharma and Kotak Mahindra Bank.

Among sectors, except pharma, and healthcare, all other indices ended in the red with auto, energy, PSU Bank, IT, metal and realty down 1-3 percent.

The BSE midcap index shed 1 percent and smallcap index fell 0.5 percent.

-330

August 02, 2024· 15:27 IST

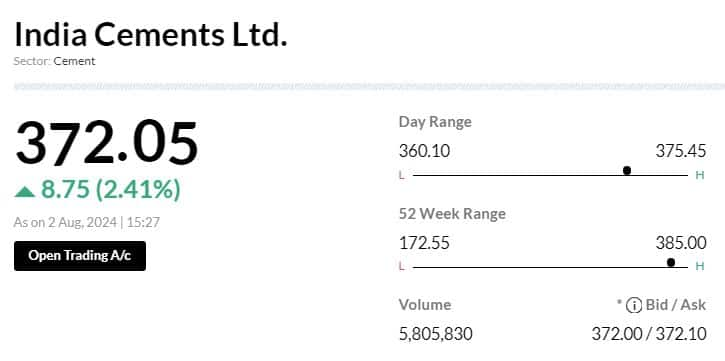

Sensex Today | UltraTech’s open offer for India Cements opens on September 19 & closes on October 3

-330

August 02, 2024· 15:18 IST

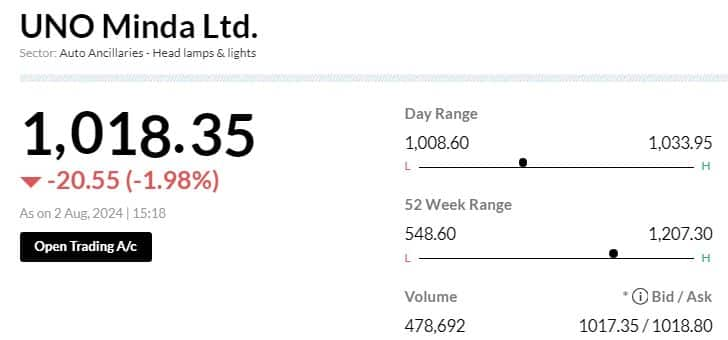

Brokerage Call | Nomura keeps 'buy' rating on Uno Minda, target Rs 1,063

#1 Enters into agreement with Aisin, Japan, for making sunroofs in India

#2 Aisin is amongst the top-10 global tier-1 automotive suppliers

#3 Believe penetration of sunroofs can touch 50- 55 percent by FY27/28

#4 Analysis suggests industry revenue opportunity of Rs 350 crore in FY24

#5 Revenue opportunity could touch Rs 680 crore by FY28, implying a 22 percent CAGR

-330

August 02, 2024· 15:15 IST

Brokerage Call | Nomura neutral call on Sun Pharma, target Rs 1,444

#1 Q1 sales below; EBITDA ahead of estimates

#2 India sales ahead of estimate, but US, & global specialty were below

#3 gRevlimid's contribution didn’t rise QoQ & was not material as per management

#4 Management expects India growth to be in-line or marginally higher than market

#5 R&D spend to step up in following quarters

-330

August 02, 2024· 15:11 IST

-330

August 02, 2024· 15:06 IST

Expect Rupee to trade with slight negative bias: Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee depreciated on weak global markets amid renewed geopolitical tensions in the Middle East and a positive US Dollar. FII outflows also put pressure on the Rupee. However, weak crude oil prices cushioned the downside.

US Dollar rose on Thursday as Bank of England cut interest rates by 25 bps to 5%, in line with street expectations. However, economic data from US remained disappointing. US weekly unemployment claims rose more than forecast to 249,000 while ISM manufacturing PMI contracted to 46.8 in July vs forecast of 48.8, sharply below expectations.

We expect Rupee to trade with a slight negative bias on weak global markets amid escalation of geopolitical tensions in the Middle East and outflows by foreign investors. However, a slight decline in US Dollar amid disappointing economic data from US may prevent sharp fall in the Rupee.

Any fresh intervention by RBI may also support the Rupee. Traders may take cues from US non-farm payrolls data which is expected weaker than previous month’s reading. USDINR spot price is expected to trade in a range of Rs 83.50 to Rs 84.

-330

August 02, 2024· 15:04 IST

Earnings Watch | Bectors Food Q1 net profit up 1.7% at Rs 35.4 crore Vs Rs 35 crore, YoY

-330

August 02, 2024· 15:01 IST

Markets@3 | Sensex down 850 pts, Nifty below 24750

-330

August 02, 2024· 14:54 IST

Sensex Today | India VIX up 10%

-330

August 02, 2024· 14:49 IST

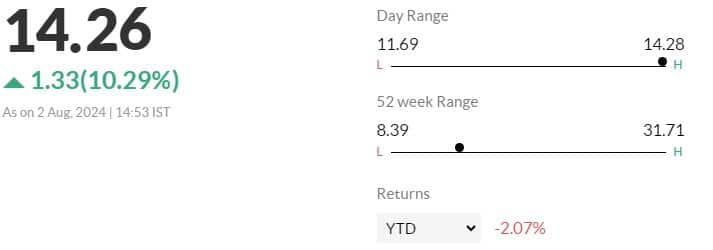

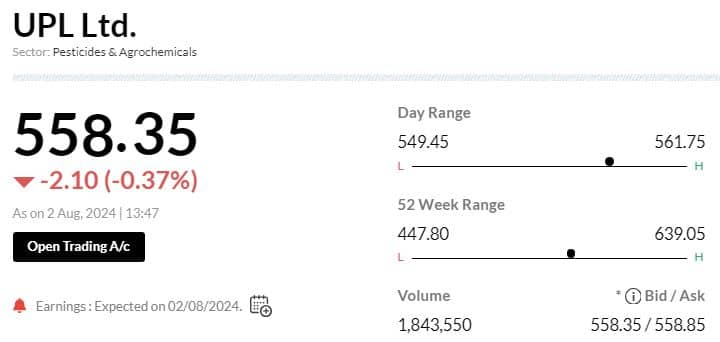

Earnings watch | UPL Q1 net loss at Rs 384 crore Vs profit of Rs 166 crore, YoY

-330

August 02, 2024· 14:46 IST

Earnings watch | Hindustan Zinc Q1 net profit up 19.4% at Rs 2,345 crore Vs Rs 1,964 crore, YoY

-330

August 02, 2024· 14:44 IST

Certain areas in market which need focus: Ananth Narayan, Whole-time Member SEBI

#1 The price of 30% of midcap & small cap stocks have tripled in last 3 years

#2 Balance in demand & supply of securities needs focus

#3 Trading in options on or closer to expiry day is like a casino machine

-330

August 02, 2024· 14:42 IST

Stock Market LIVE Updates | New Age stocks trade higher including Zomato, Paytm, Nykaa

-330

August 02, 2024· 14:40 IST

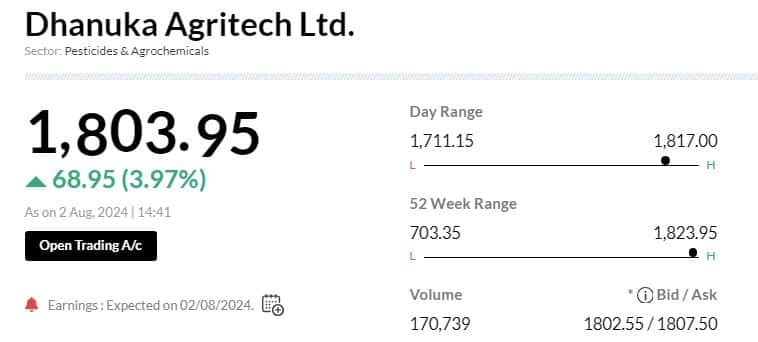

Sensex Today | Dhanuka Agritech board approves share buyback of up to Rs 100 crore at Rs 2,000 per share

-330

August 02, 2024· 14:39 IST

Sensex Today | Nifty Healthcare index up 0.5%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Divis Labs | 4,988.70 | 1.44 | 725.33k |

| Biocon | 359.15 | 1.24 | 3.34m |

| Dr Reddys Labs | 6,972.25 | 1.22 | 315.68k |

| Torrent Pharma | 3,238.05 | 1.03 | 565.92k |

| Sun Pharma | 1,731.75 | 0.96 | 2.39m |

| Alkem Lab | 5,318.00 | 0.89 | 60.88k |

| Aurobindo Pharm | 1,445.00 | 0.85 | 837.29k |

| Zydus Life | 1,250.50 | 0.73 | 937.03k |

| Glenmark | 1,448.00 | 0.72 | 418.13k |

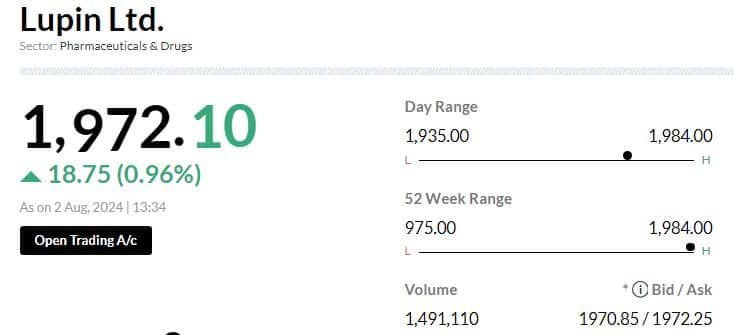

| Lupin | 1,966.25 | 0.66 | 1.77m |

-330

August 02, 2024· 14:38 IST

Shrey Jain Founder and CEO SAS Online

Indian stock market opened lower on Friday, with the Sensex dropping by 700 points and the Nifty falling below 24,800. The Nifty MidCap index also declined by 1%. This downturn reflects a global sell-off triggered by disappointing U.S. economic data, raising concerns about a potential slowdown in the world’s largest economy. Additionally, uncertainty over the Japanese central bank's future policy actions further dampened market sentiment.

For the Nifty, immediate support levels are seen around 24,775 to 24,850, while the Bank Nifty is expected to find support in the range of 50,800 to 51,000. Given the high volatility, it is advisable to avoid holding overnight positions. However, following the significant gap-down opening, investors might consider establishing buying positions at these key support levels.

-330

August 02, 2024· 14:36 IST

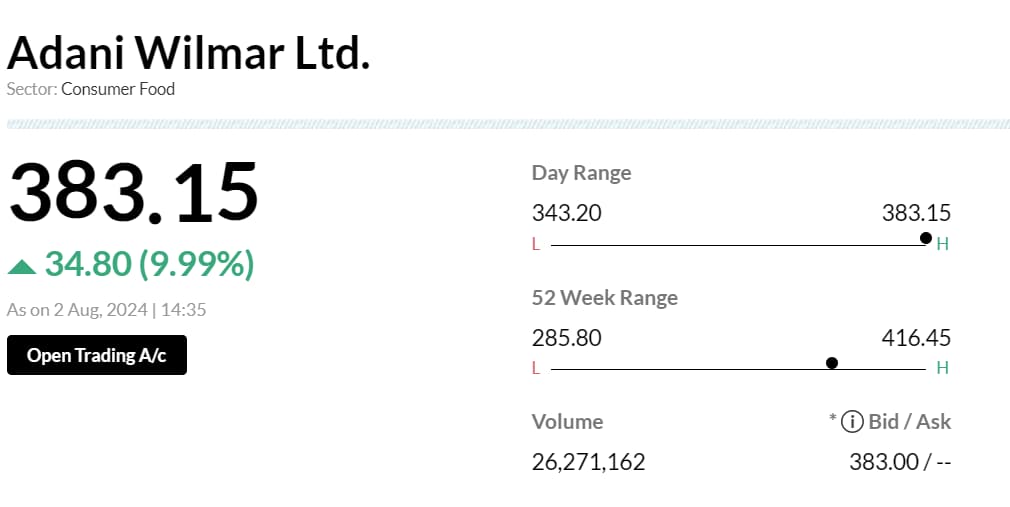

Earnings Watch | Adani Wilmar has 1.25 mln shares traded in a block: Bloomberg

-330

August 02, 2024· 14:33 IST

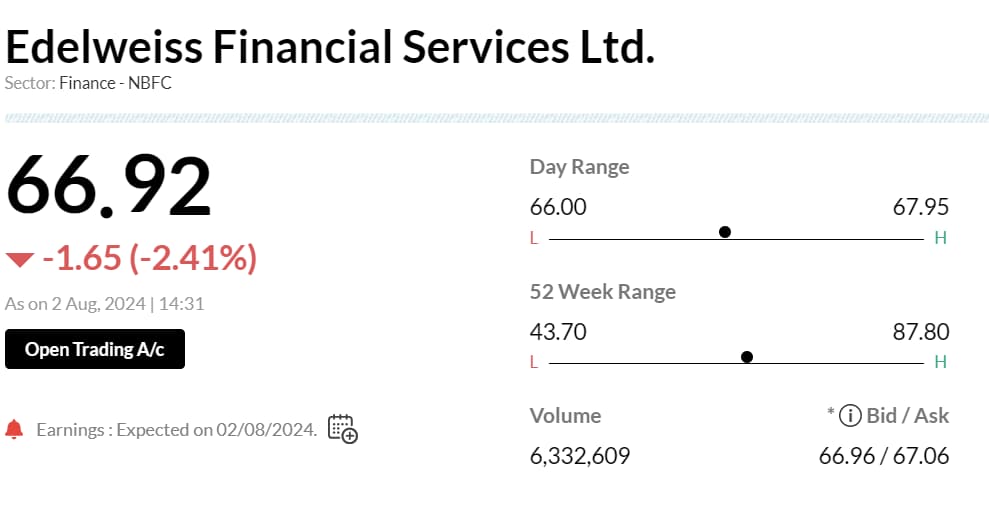

Earnings Watch | Edelweiss Fin 1Q net Income Rs58.89 cr Vs Rs50.54 cr YoY

#1 Revenue Rs2350 crore, up 19% YoY

#2 Total costs Rs2230 crore, up 13% YoY

-330

August 02, 2024· 14:27 IST

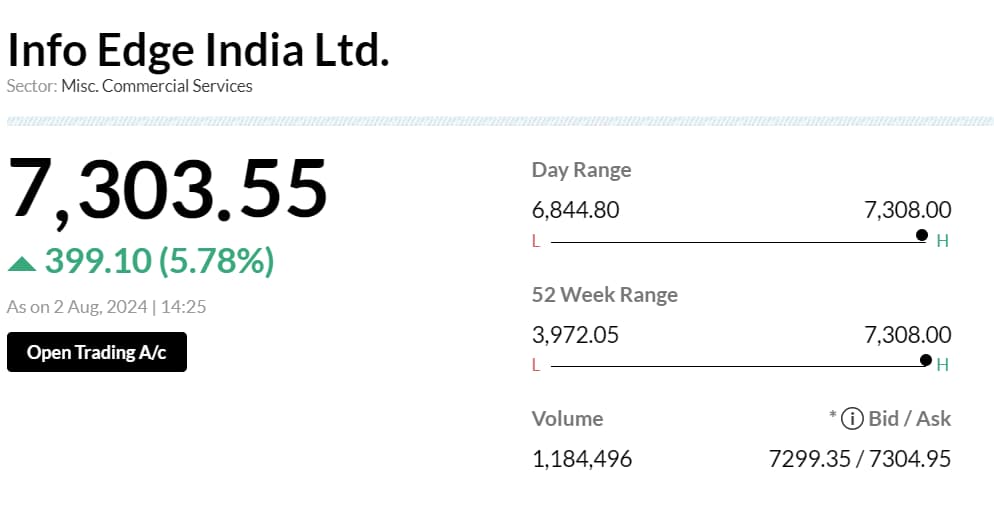

Earnings Watch | InfoEdge reports 12% rise in hiring for July 2024; IT sector leads with 17% growth

-330

August 02, 2024· 14:20 IST

Earnings Watch | Mold-Tek Packaging Q1 net profit down 11.8% YoY

#1 Net profit at Rs16.5 cr vs Rs19 cr (YoY)

#2 Revenue up 5.8% at Rs196.7 cr vs Rs186 cr (YoY)

#3 EBITDA up 1.4% at Rs35.6 cr vs Rs35 cr (YoY)

#4 Margin at 18% vs 19% (YoY)

-330

August 02, 2024· 14:13 IST

Sensex Today | Eicher Motors GST demand revised to Rs27 cr from Rs130 cr for FY18

-330

August 02, 2024· 14:06 IST

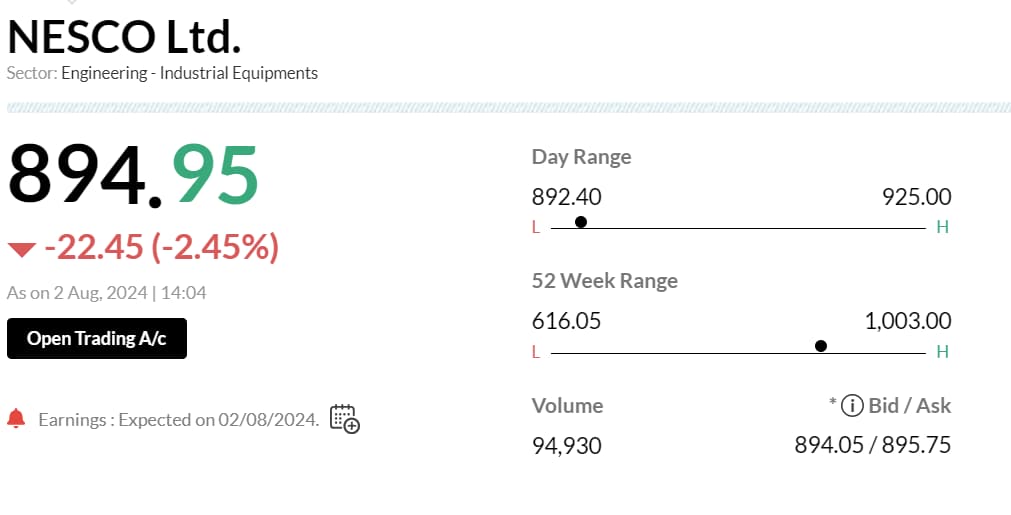

Earnings Watch | Nesco Q1 net profit down 8% YoY

#1 Net profit at Rs70 cr vs Rs76 cr (YoY)

#2 Revenue up 3.5% at Rs141.3 cr vs Rs136.5 cr (YoY)

#3 EBITDA flat at Rs86 cr (YoY)

#4 Margin at 61% vs 63% (YoY)

-330

August 02, 2024· 14:00 IST

Markets@2 | Sensex, Nifty trade lower

-330

August 02, 2024· 13:56 IST

Earnings watch | CAMS Q1 net profit up 42% at Rs 108.2 crore Vs Rs 76 crore, YoY

-330

August 02, 2024· 13:51 IST

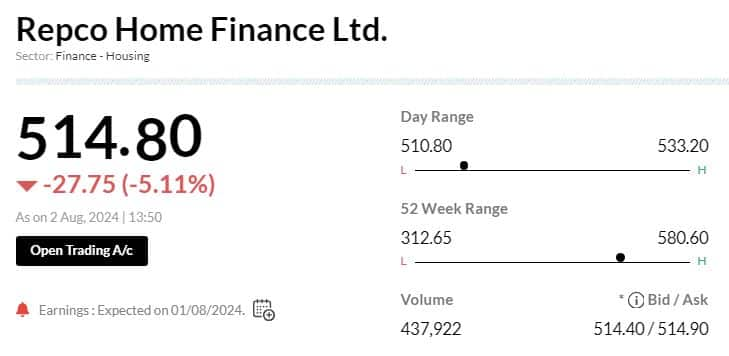

Stock Market LIVE Updates | Repco Home Finance shares fall 5% post Q1 results

#1 Net profit up 17.9 percent at Rs 112.5 crore vs Rs 95 crore, YoY

#2 NII down 24.5 percent at Rs 174.8 crore vs Rs 231.4 crore, YoY

-330

August 02, 2024· 13:49 IST

SEBI's proposed F&O curbs stoke fears of spike in dabba trading

SEBI's proposed measures to curb F&O betting has raised concerns of traders turning towards illegal dabba trading, which bypasses stock exchanges and proper KYC, posing significant risks....Read More

-330

August 02, 2024· 13:48 IST

Sensex Today | UPL shares trade marginally lower ahead of Q1 results

-330

August 02, 2024· 13:45 IST

Stock Market LIVE Updates | Britannia Industries trade flat ahead of Q1 earnings

-330

August 02, 2024· 13:42 IST

Stock Market LIVE Updates | Titan Company shares trade lower ahead of Q1 earnings

Titan Company was quoting at Rs 3,430.75, down Rs 37.75, or 1.09 percent.

-330

August 02, 2024· 13:37 IST

Sensex Today | Nifty Bank recovers 400 points from day's low

-330

August 02, 2024· 13:35 IST

Brokerage Call | Nomura maintains 'buy' rating on Lupin, target Rs 1,952

#1 Company gets favorable ruling by court for tolvaptan generic:

#2 Tolvaptan can be a significant opportunity in FY26/27

#3 Assuming USD 1.3 billion in brand sales, 40 percent price erosion & 40 percent market share

#4 Estimate company can potentially clock USD 150 million revenue during exclusivity period between April-October 2025

-330

August 02, 2024· 13:32 IST

Ola Electric Mobility IPO Subscribed 0.25 times

QIB – 0.0 times

NII - 0.11 times

Retail – 1.16 times

Employee Reserved - 3.87 times

-330

August 02, 2024· 13:27 IST

Earnings Watch | SML Isuzu Q1 net profit up 46% at Rs 46.4 crore Vs Rs 32 crore, YoY

-330

August 02, 2024· 13:25 IST

Brokerage Call | Nomura maintains 'buy' rating on Dabur, target Rs 750

#1 Q1 volumes geared to improve further aided by rural recovery

#2 Results were in-line; volume growth of 5.2 percent improved QoQ

#3 Rural value growth improved to 9 percent, while urban grew 5 percent; margin largely maintained

#4 Trades at 46.8x March’26 EPS

-330

August 02, 2024· 13:18 IST

Sensex Today | Nasdaq Futures down 2%

-330

August 02, 2024· 13:14 IST

Earnings Watch | TTK Healthcare Q1 net profit at Rs 31.6 crore versus Rs 16 crore, YoY

TTK Healthcare was quoting at Rs 1,666.20, up Rs 53.15, or 3.30 percent and touched a 52-week high of Rs 1,800.

-330

August 02, 2024· 13:12 IST

Stock Market LIVE Updates | KPI Green Energy arm bags LoI for 28.40 MW project

Sun Drops Energia, a wholly owned subsidiary of KPI Green Energy, has received Letters of Intent for executing solar power projects with a cumulative capacity of 28.40 MW under the ‘Captive Power Producer (CPP)’

business segment of the Company.

KPI Green Energy was quoting at Rs 988.10, up Rs 28.15, or 2.93 percent.

-330

August 02, 2024· 13:09 IST

Brokerage Call | Jefferies keeps 'buy' rating on Sun Pharma, target raises to Rs 2,000

#1 Q1 EBITDA 10 percent above estimate led by strong India sales growth of 16 percent YoY & lower opex

#2 Specialty sales grew 16 percent YoY with all key products ex-Levulan (seasonality) performing strongly

#3 Launch timeline for novel drug Leqselvi, recently approved in US is uncertain

-330

August 02, 2024· 13:07 IST

RBI likely selling dollars to prevent rupee from hitting record low, traders say

The rupee was at 83.73 against the dollar as of 09:20 a.m. IST, just shy of its record low of 83.7450 hit on Wednesday....Read More

-330

August 02, 2024· 13:06 IST

Brokerage Call | Morgan Stanley keeps 'equal-weight' call on Aditya Birla Capital, target Rs 215

#1 Lending businesses were muted in Q1, offset by stronger AMC results

#2 Management guidance was largely unchanged

#3 Stock is one of best performers & valuation is full

#4 Expect some consolidation & gradual profit-taking

-330

August 02, 2024· 13:03 IST

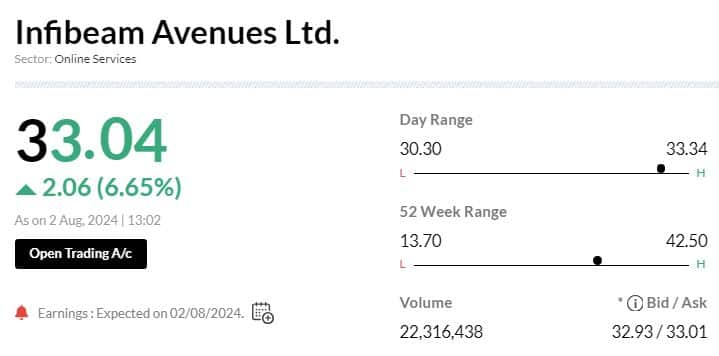

Stock Market LIVE Updates | Infibeam Avenues shares gain 6% as Q1 profit jumps to Rs 70 crore Vs Rs 26 crore, YoY

-330

August 02, 2024· 13:02 IST

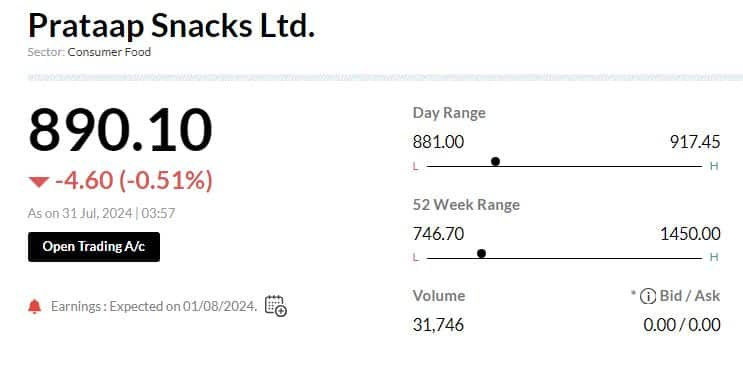

Stock Market LIVE Updates | Prataap Snacks shares down after Q1 profit dips

#1 Net profit down 29.9 percent at Rs 9.4 crore vs Rs 13 crore, YoY

#2 Revenue up 8.7 percent at Rs 421.4 crore vs Rs 387.8 crore, YoY

-330

August 02, 2024· 13:00 IST

Morepen Labs launches Rs 250 crore QIP with greenshoe option

The indicative price of the issue is Rs 54.37 per share. Motilal Oswal is the banker to the issue, it is learnt....Read More

-330

August 02, 2024· 12:59 IST

Block Deal | 1.02 million shares of Suven Pharma change hands in block trade: Bloomberg

-330

August 02, 2024· 12:58 IST

Brokerage Call | Nomura keeps 'buy' rating on Zomato, target raises to Rs 280

#1 Q1 showed that food delivery business continues steady growth path

#2 Quick commerce business to prioritise growth while ensuring neutral EBITDA in near term

#3 Company’s high growth path & improving profitability has room to go in both FD & quick comm business

Zomato was quoting at Rs 260.95, up Rs 26.85, or 11.47 percent and touched a 52-week high of Rs 278.45.

-330

August 02, 2024· 12:55 IST

Stock Market LIVE Updates | Paradeep Phosphates shares fall despite turn profitable in Q1

#1 Net profit at Rs 5.4 crore vs loss of Rs 120 crore, YoY

#2 Revenue down 22.2 percent at Rs 2,377.4 crore vs Rs 3,054.3 crore, YoY

Paradeep Phosphates was quoting at Rs 88.29, down Rs 1.75, or 1.94 percent.

-330

August 02, 2024· 12:54 IST

Stock Market LIVE Updates | Allcargo Terminals shares gains post Q1 results

#1 Net profit up 3.3 percent at Rs 9.3 crore vs Rs 9 crore, YoY

#2 Revenue up 5.7 percent at Rs 191 crore vs Rs 180.7 crore, YoY

-330

August 02, 2024· 12:48 IST

Radhika Gupta, Edelweiss at 21st Annual Capital Markets Conference

The market is expanding so rapidly is the effort by market infrastructure done over many many years. Two pieces of infra related to the MFs, one is the development of the passive funds... the ease of doing business when launching passive funds, now there is a new proposal for liter framework for passive funds.

Innovation and protection are going hand in hand. Second is a two to three years old is MF Central, which gives consumer ease.

-330

August 02, 2024· 12:44 IST

Earnings Watch | Zydus Wellness Q1 net profit up 34% at Rs 148 crore Vs Rs 110 crore, YoY

-330

August 02, 2024· 12:42 IST

Sensex Today | BSE Midcap index down nearly 1 percent

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cummins | 3,513.45 | -7.87 | 45.84k |

| Emami | 784.15 | -4.73 | 23.72k |

| Oracle Fin Serv | 10,529.05 | -3.4 | 3.07k |

| Godrej Prop | 3,032.35 | -3.05 | 27.49k |

| Schaeffler Ind | 4,052.50 | -2.62 | 1.66k |

| Voltas | 1,498.10 | -2.53 | 19.54k |

| Persistent | 4,676.00 | -2.47 | 10.12k |

| AB Capital | 214.90 | -2.36 | 370.96k |

| Nippon | 643.50 | -2.29 | 22.67k |

| SAIL | 146.90 | -2.2 | 1.67m |

-330

August 02, 2024· 12:37 IST

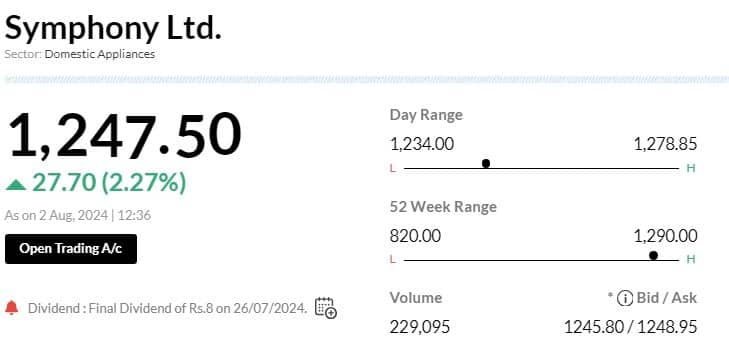

Stock Market LIVE Updates | Symphony to consider buyback on August 6

A meeting of the board of directors of the company is scheduled to be held on Tuesday, August 06, 2024, to consider and approve Unaudited Standalone and Consolidated Financial Results for the first quarter ended on June 30, 2024; and 1st Interim Dividend on equity shares, if any, for the financial year 2024-25.

At the said meeting, the board of directors shall also consider and approve the proposal for buyback of fully paid-up equity shares of Rs 2 each of the company.

-330

August 02, 2024· 12:36 IST

Stock Market LIVE Updates | SJS Enterprises shares up 12% as Q1 profit jumps 54%

#1 Net profit up 54.4 percent at Rs 27.8 crore vs Rs 18 crore, YoY

#2 Revenue up 60.9 percent at Rs 199.6 crore vs Rs 117.2 crore, YoY

SJS Enterprises was quoting at Rs 955.00, up Rs 101.30, or 11.87 percent.

-330

August 02, 2024· 12:34 IST

Sensex Today | ITD Cementation clarifies on repot of KEC International in race to acquire the company

-330

August 02, 2024· 12:33 IST

Earnings Watch | PSP Projects Q1 net profit down 7.9% at Rs 35 crore Vs Rs 38 crore, YoY

-330

August 02, 2024· 12:31 IST

Kamlesh Varshney at 21st Annual Capital Markets Conference

Go to the platform, select your IA/RA and then make your payment. This can help filter out wrong people from the system. We have seen many unregistered influencers who take money from the people and disappear. We cannot catch them with the manpower Sebi has. Therefore, we can build a system, where the investor is assured that if he goes through a system, then he is making payment to the right person.

Second piece is working with the social media platforms. We are working with media. Some platforms are cooperating with us, we send them the link, saying that they are unregistered and these are taken down. Thousands of such actions have been taken.

If we go through the enforcement action, then it will take months.

Third piece of the strategy is Association with finfluencers, the idea was to dry out the revenue of unregistered IA. If a registered entity associates with these finfluencers, then there will be a problem

-330

August 02, 2024· 12:26 IST

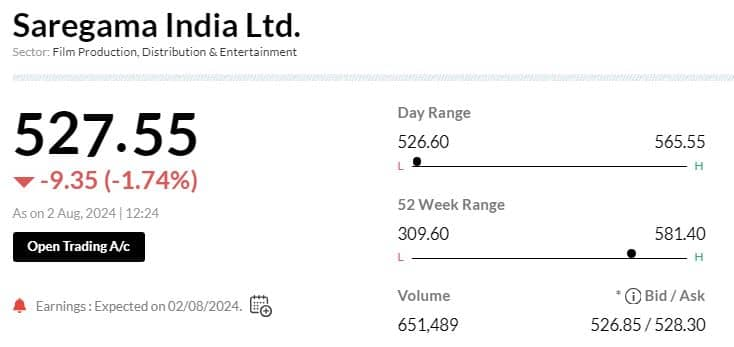

Earnings Watch | Saregama India Q1 net profit down 15% at Rs 37 crore Vs Rs 44 crore, YoY

-330

August 02, 2024· 12:22 IST

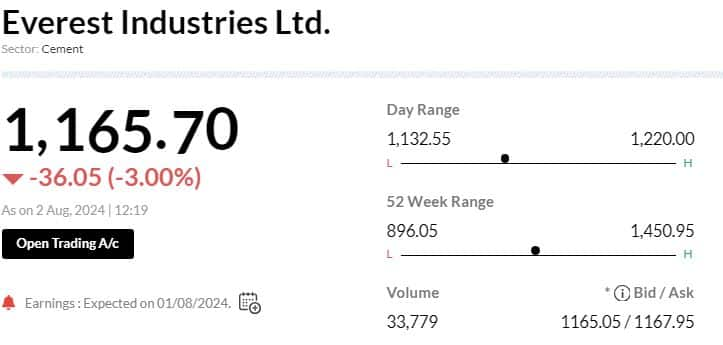

Stock Market LIVE Updates | Everest Industries shares down as Q1 profit dip

#1 Net profit down 9.7 percent at Rs 15.9 crore vs Rs 18 crore, YoY

#2 Revenue up 7.9 percent at Rs 522.3 crore vs Rs 484.1 crore, YoY

-330

August 02, 2024· 12:21 IST

Stock Market LIVE Updates | Railtel Corp shares gain as Q1 profit rises

#1 Net profit up 25.2 percent at Rs 48.7 crore vs Rs 38.9 crore, YoY

#2 Revenue up 19.4 percent at Rs 558.1 crore vs Rs 467.6 crore, YoY

-330

August 02, 2024· 12:17 IST

Sensex Today | We need to regulate all those are outside the system: Kamlesh Varshney

If we want investors to keep their faith, we need more RAs and IAs guiding them properly. Therefore, we need to regulate all those are outside the system. Bring them in the system and regulate them.

How do we regulate: If everybody is violating the traffic rules. Then can we regulate them by cutting chalan for all of them? No. The enforecement could be one solution but the main solution. If you want a (more regulated system) there has been more enforcement, where there are more awareness campaigns, there is a value system to wait for traffic lights.

Any strategy should support each other, when one fails other steps in.

Therefore we have different parts of this strategy. One was a separate platform to collect RAs and IAs fees from their clients. The feedback we received was if this was going against ease of doing business.

-330

August 02, 2024· 12:15 IST

There are only 30 pin codes in the country where there are no investors: Ashish Chauhan

Today, Chauhan added, around 20 percent of all households are invested in the stock markets. ...Read More

-330

August 02, 2024· 12:13 IST

Stock Market LIVE Updates |SML Isuzu's July total sales down 3.8 percent at 1,203 units vs 1,250 units, YoY

-330

August 02, 2024· 12:11 IST

Earnings Today | Titan, Zydus Wellness, Britannia Industries, among others to declares June quarter results

Titan Company,, UPL, Allcargo Gati, Zydus Wellness, Aptech, Britannia Industries, Computer Age Management Services, Dalmia Bharat Sugar and Industries, Delhivery, Dhampur Sugar Mills, Dhanuka Agritech, Dolphin Offshore Enterprises (India), Ador Welding, Edelweiss Financial Services, Eris Lifesciences, Forbes & Company, Glaxosmithkline Pharmaceuticals, Hindustan Zinc, IDFC, Infibeam Avenues, ION Exchange (INDIA), Jindal Hotels, Kirloskar Brothers, LIC Housing Finance, Lloyds Enterprises, Medplus Health Services, Mold-Tek Technologies, Mold-Tek Packaging, NESCO, Narayana Hrudayalaya, NIIT, PSP Projects, Rane Holdings, Shree Renuka Sugars, Saregama India, SML Isuzu, Sudarshan Chemical Industries, TAJGVK Hotels & Resorts, Texmaco Infrastructure & Holdings, Tamilnad Mercantile Bank, TTK Healthcare, among others to announce June quarter earnings today.

-330

August 02, 2024· 12:11 IST

Brokerage Call | HSBC keeps 'buy' rating on Adani Ports, target Rs 1,800

#1 Q1 throughput up 8 percent helped by robust container & liquid cargoes

#2 Yields up 4 percent and port EBITDA margin at record 72 percent

#3 Expansion in domestic ports should drive long-term growth

#4 Commencement of Vizhinjam, Tanzania projects should drive long-term growth

-330

August 02, 2024· 12:09 IST

Sensex Today | Nifty Midcap 100 index sheds 0.7%; Cummins, Escorts Kubota, among top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cummins | 3,525.50 | -7.59 | 3.06m |

| Escorts Kubota | 3,993.45 | -3.77 | 306.63k |

| Prestige Estate | 1,695.00 | -3.44 | 542.30k |

| Oracle Fin Serv | 10,585.00 | -2.99 | 120.04k |

| Yes Bank | 25.52 | -2.89 | 141.84m |

| Godrej Prop | 3,044.85 | -2.63 | 662.06k |

| Persistent | 4,672.50 | -2.58 | 199.94k |

| COFORGE LTD. | 6,129.70 | -2.49 | 148.06k |

| Voltas | 1,498.90 | -2.46 | 286.46k |

| NMDC | 237.31 | -2.23 | 3.42m |

-330

August 02, 2024· 12:08 IST

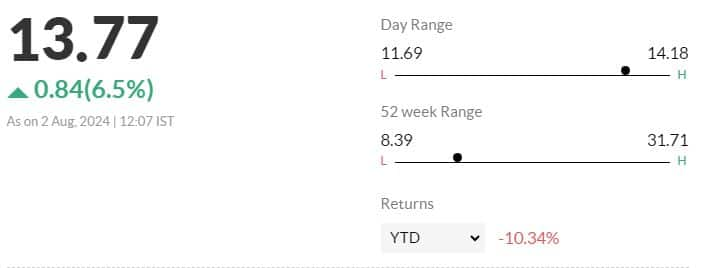

Sensex Today | India VIX up 6.5 percent

-330

August 02, 2024· 12:07 IST

Brokerage Call | Morgan Stanley maintains 'overweight' call on ITC, target raises to Rs 546

#1 Q1 revenue & margin ahead of estimates

#2 Hotels and agri saw revenue beats while cigarettes & FMCG were in-line

#3 Margin beat was led by cigarettes and FMCG

ITC was quoting at Rs 490.20, down Rs 3.55, or 0.72 percent on the BSE.

-330

August 02, 2024· 12:06 IST

Stock Market LIVE Updates | Indegene shares trade flat post Q1 earnings

#1 Net profit up 28.2 percent at Rs 87.7 crore versus Rs 68 crore, YoY

#2 Revenue up 11.4 percent at Rs 676.5 crore versus Rs 607.5 crore, YoY

Indegene was quoting at Rs 592.70, down Rs 0.70, or 0.12 percent.

-330

August 02, 2024· 12:06 IST

Coming soon, a 'combo product' of rights and preferential issue, hints Sebi chair

Through the combo product, the entire process, can be finished in 23 days, as compared to preferential allotment, which the industry loves for ease of the process, which needs more than 40 days, Buch explained....Read More

-330

August 02, 2024· 12:05 IST

Stock Market LIVE Updates | Triveni Engineering shares fall 2% post Q1 profit dips 54%

#1 Net profit down 54.1 percent at Rs 31 crore versus 67.6 crore, YoY

#2 Revenue up 7.1 percent at Rs 1,534 crore versus Rs 1,432.3 crore, YoY

Triveni Engineering and Industries was quoting at Rs 404.05, down Rs 11.30, or 2.72 percent.

-330

August 02, 2024· 12:01 IST

Markets@12 | Nifty at 24800, Sensex down 680 points

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HDFC Bank | 1,668.10 | 1.79 | 13.13m |

| Kotak Mahindra | 1,808.00 | 0.86 | 1.28m |

| Apollo Hospital | 6,739.50 | 0.49 | 402.26k |

| Divis Labs | 4,940.30 | 0.46 | 421.77k |

| Nestle | 2,493.55 | 0.38 | 426.54k |

| Dr Reddys Labs | 6,914.00 | 0.38 | 157.79k |

| Shriram Finance | 3,000.25 | 0.37 | 906.89k |

| Asian Paints | 3,110.00 | 0.34 | 762.51k |

| Adani Ports | 1,591.15 | 0.06 | 2.91m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Maruti Suzuki | 12,748.40 | -4.57 | 782.84k |

| Eicher Motors | 4,770.50 | -3.99 | 914.95k |

| Tata Motors | 1,104.55 | -3.48 | 13.94m |

| JSW Steel | 906.05 | -3.05 | 1.38m |

| Tata Steel | 158.40 | -2.86 | 40.59m |

| Hindalco | 657.05 | -2.44 | 3.91m |

| Coal India | 527.35 | -2.41 | 6.12m |

| Tech Mahindra | 1,510.00 | -2.23 | 660.23k |

| M&M | 2,767.55 | -2.15 | 1.28m |

| LTIMindtree | 5,559.00 | -2.11 | 128.99k |

-330

August 02, 2024· 12:00 IST

Ceigall India IPO subscribed 80% so far on day 2; NIIs lead

Proceeds from the IPO will be allocated to acquiring new equipment and reducing existing debts, including those of its subsidiary, Ceigall Infra Projects Pvt Ltd. ...Read More

-330

August 02, 2024· 11:59 IST

Sensex Today | Hero MotoCorp total July sales down 5.4 percent at 3.70 lakh units versus 3.91 lakh units, YoY

-330

August 02, 2024· 11:55 IST

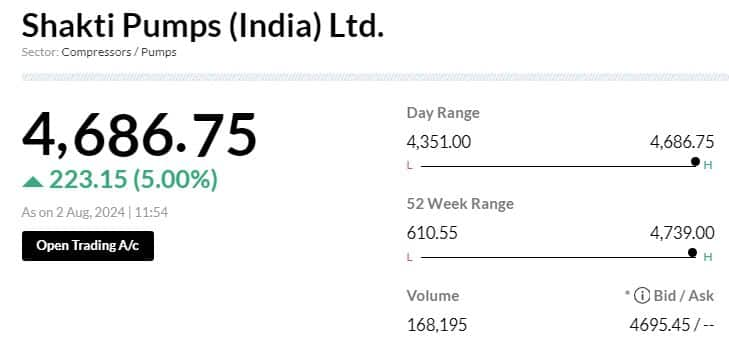

Stock Market LIVE Updates | Shakti Pumps |gets LoI for order worth Rs 558.16 crore From UP Agriculture department

-330

August 02, 2024· 11:54 IST

Stock Market LIVE Updates | Marksans Pharma arm gets UK regulator nod for Levonorgestrel Tablets

-330

August 02, 2024· 11:52 IST

Need to manage risk for the newly entered investors: Vijay Chandok, ICICI Sec

Three areas that we need a collective look in... one is cyberrisk and cyber security... that needs to be really fought vigorously. While digitation has transformed markets for us, there is also a digital divide that needs to be addressed. There is awork to be done in that area. Then coming soon or come already is data privacy is what we will all need to work together. With more and more money going into the market, we also have a role to play for managing risk for the newly entered investors in the market.

-330

August 02, 2024· 11:51 IST

Stock Market LIVE Updates | Lemon Tree signs licence agreement for 82-room hotel in Gujarat

The company has signed License Agreement under its upscale brand, Aurika Hotels & Resorts, with Aurika, Sasan Gir in Gujarat.

The property shall be operated by Carnation Hotels Pvt. Ltd., a subsidiary and management arm of Lemon Tree Hotels Ltd and is expected to open in FY 2029.

-330

August 02, 2024· 11:44 IST

Stock Market LIVE Updates | Our regulation keeps pace with the innovation with the market, says Sebi Chairperson

You see how dynamic the market is, everyday something new and interesting is happening. Even with our pace, we are one step behind the market. We don't want to be five steps behind the market.

-330

August 02, 2024· 11:42 IST

Stock Market LIVE Updates | Increased inspections required to keep up with market innovations, says Sebi Chairperson

From what I understand, we have consolidated inspections from NSE, BSE, depositories, and Sebi over the past four or five years. The increase in circulars reflects a higher consultation rate. Of all the circulars, 44 percent are focused on easing business operations and development—nearly half of them. The market is incredibly dynamic, with new developments happening daily. Despite our efforts, we often find ourselves just a step behind. We don’t want to lag five steps behind. Our regulations are designed to keep up with market innovations; otherwise, we risk arriving too late, like the policemen in Hindi movies who show up only after the hero and villain have finished their fight. We need to be timely in our approach.

-330

August 02, 2024· 11:42 IST

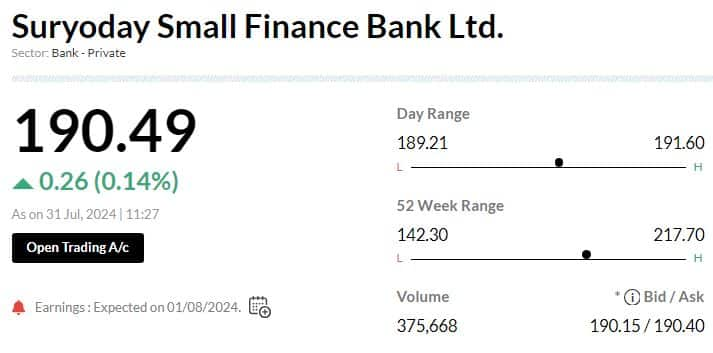

Stock Market LIVE Updates | Suryoday Small Finance Bank shares trade higehr post Q1 earnings

#1 Net profit up 47.3 percent at Rs 70.1 crore versus Rs 48 crore, YoY

#2 NII up 39.9 percent at Rs 293.2 crore versus Rs 224.7 crore, YoY

-330

August 02, 2024· 11:39 IST

Sensex Today | BSE Realty index sheds nearly 2%; Sobha, Prestige Estate, among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sobha | 1,722.15 | -3.62 | 5.51k |

| Prestige Estate | 1,694.85 | -3.39 | 8.28k |

| Phoenix Mills | 3,530.00 | -2.15 | 5.34k |

| Godrej Prop | 3,066.50 | -1.96 | 24.46k |

| Brigade Ent | 1,236.00 | -1.73 | 5.64k |

| DLF | 858.95 | -1.72 | 59.57k |

| Macrotech Dev | 1,257.15 | -1.21 | 10.09k |

| Oberoi Realty | 1,817.85 | -1.14 | 6.10k |

| Swan Energy | 724.00 | -0.71 | 101.86k |

| Mahindra Life | 604.85 | -0.53 | 4.75k |

-330

August 02, 2024· 11:37 IST

Stock Market LIVE Updates | First version of AI-based IPO document review to be out by Dec, says Sebi Chairperson

We are advancing our technology and have already implemented AI for processing public documents, such as annual reports for REITs and InvITs, with 80 percent of this work handled by AI. We are also developing AI-based processes for IPO documents, ensuring that investors can trust the thorough review of these documents. We expect to release the first version by December.

-330

August 02, 2024· 11:34 IST

Stock Market LIVE Updates | After SupTech, looking forward to RegTech solution by FICCI, says Sebi Chairperson

Version 2.0 will be a result of industry co-creation. The technology driving the entire country continues to influence Sebi’s approach. I urge participants to embrace regtech, as we are already implementing suptech. While suptech is in place, regtech needs to catch up quickly. We hope that participants will swiftly adopt these technologies so that compliance becomes a seamless background process. I am looking forward to the regtech solution developed by Ficci and hope that soon, 80 percent of your members will report its deployment.

-330

August 02, 2024· 11:30 IST

Stock Market LIVE Updates | Benchmarking agency to help compare REITs and InvITS, says Sebi Chairperson

We are developing a benchmarking agency to help investors easily compare REITs and InvITs. This will simplify comparisons across these assets.

-330

August 02, 2024· 11:27 IST

Stock Market LIVE Updates | Plan to launch performance validation agency soon, says Sebi Chairperson

We want to collaborate closely with you, thinking with you and for you. You will soon see the introduction of the Performance Validation Agency (PVA). NSE has done outstanding work in this area. For anyone looking to make claims about performance—whether they are an algo provider, RA, IA, or PMS—the technology being used is exceptional and affordable. The PVA will be launched soon to support these efforts.

-330

August 02, 2024· 11:22 IST

Stock Market LIVE Updates | Working to make settlement process easier, says Sebi Chairperson

Today, companies are routinely reporting on rumor verification. We are working to expedite the registration of intermediaries to ensure that those who wish to enter the ecosystem are facilitated promptly. We are committed to making their experience as seamless as possible throughout their entire lifecycle. To this end, we have established working groups focused on improving the ease of doing business. Of the 339 recommendations received, two-thirds have already been accepted. Of the remaining 16 percent, over a third fall outside our jurisdiction. We are also working to simplify the settlement process, aiming to make both the procedures and the settlement amounts more manageable.

-330

August 02, 2024· 11:16 IST

Stock Market LIVE Updates | Demystified offer document to make IPO process smoother, says Sebi Chairperson

The next innovation hitting the scene is the simplified offer document. A CFO from a recently listed company shared their initial fears about the process but found it less daunting once they realized: "If you have nothing to hide, it's actually quite simple." The simplified offer document will be a fill-in-the-blank IPO template, with a designated section to address any complexities. We believe this document will be clear and precise, with any variations or special conditions explained separately. This will streamline the processing time at Sebi and make the entire process more transparent.

-330

August 02, 2024· 11:12 IST

Stock Market LIVE Updates | Combo product of rights issue and preferential allotment soon, says Sebi Chairperson

A news report quoted a market participant who claimed that Sebi could reject an application if it uses a mix of active and passive voice. I was amused by this, as our main concern is that diligent applicants get stuck in the queue due to complications caused by others. We operate on a first-come, first-served basis. To streamline the process and prioritise good applicants, we return applications to clear the path. This is done to speed up the processing of strong applications. I assure you, we never return documents based on the use of active or passive voice.One of the innovations you will see very soon, which has received a positive response, is a combo product of a rights issue and a preferential allotment. This new process can be completed in 23 days, compared to the more than 40 days required for the preferential allotment process, which the industry favors for its ease. We are removing the regulator and the merchant banker from the process for this combination product for preferential allotment. We will be releasing a consultation paper on this soon.

-330

August 02, 2024· 11:03 IST

Sensex Today | Madhabi Puri Buch at 21st Annual Capital Markets Conference

#1 An extremely important pillar for this is the economy, the real economy and the financial economy or markets.

#2 It is a matter of great pride to us that India ranks number one in the number of IPOs. It is almost one every trading session.

#3 In terms of stock exchanges, we are fifth. The quantum of funds raised, it is still behind US and China. But compounded growth rate over the last five years, there is nobody equalling our growth rate

#4 The important thing is not that there is no pendency, because pendency is good because it means more activity in the market... what we track like a hawk is aging.

#5 The whole process of streamlining the approval process (of IPOs) to facilitate faster capital raise at a time when markets are conducive

-330

August 02, 2024· 11:01 IST

Markets@11 | Sensex down 630 pts, Nifty at 24800

The Sensex was down 634.04 points or 0.77 percent at 81,233.51, and the Nifty was down 189.20 points or 0.76 percent at 24,821.70. About 1475 shares advanced, 1743 shares declined, and 101 shares unchanged.

-330

August 02, 2024· 10:59 IST

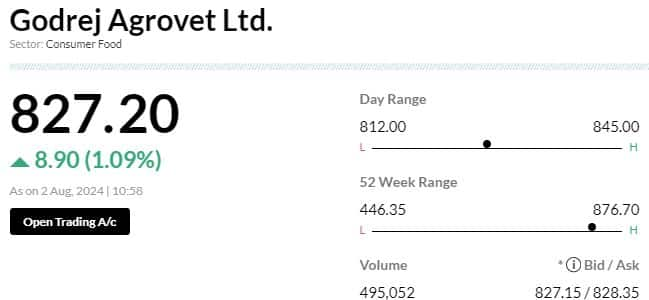

Stock Market LIVE Updates | Godrej Agrovet shares trade higher post Q1 earnings

#1 Net profit up 22.9 percent at Rs 131.6 crore vs Rs 107 crore, YoY

#2 Revenue down 6.4 percent at Rs 2,350.8 crore vs Rs 2,510.2 crore, YoY

-330

August 02, 2024· 10:57 IST

Ashish Chauhan at 21st Annual Capital Markets Conference

Today we are living in the best of times, as Charles Dickens says, but we are also living in.... so whatever regulations are needed to be put in place, needs to be put in place and we need to comply. This market is too precious for India's growth

We cannot fritter this away. India has a chance to become rich before it becomes old. This is the place from where India will become rich.

-330

August 02, 2024· 10:56 IST

20% of all Indian households directly invests in stock markets: Ashish Chauhan at 21st Annual Capital Markets Conference

#1 Small investors should stop investing in derivatives

#2 Sebi is already acting on it, after taking inputs from all of us

#2 On a good day, NSE gets more than 29 crore trades a day

-330

August 02, 2024· 10:52 IST

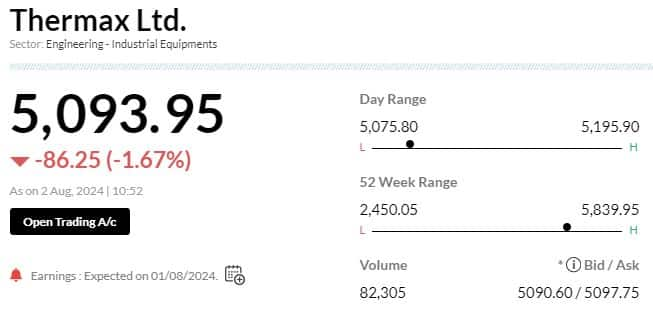

Stock Market LIVE Updates | Thermax shares trade lower despite Q1 profit rises

#1 Net profit up 96.6 percent at Rs 115.8 crore vs Rs 59 crore, YoY

#2 Revenue up 13 percent at Rs 2,184.4 crore vs Rs 1,933 crore, YoY