Closing Bell: Nifty around 19,600, Sensex falls 248 pts; autos outperform

-330

October 19, 2023· 16:27 IST

Indian benchmark indices ended lower for the second consecutive session on October 19 with Nifty below 19,650. At close, the Sensex was down 247.78 points or 0.38 percent at 65,629.24, and the Nifty was down 46.40 points or 0.24 percent at 19,624.70.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

October 19, 2023· 16:25 IST

-330

October 19, 2023· 16:23 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap down however it did not witness follow through on the downside. It witnessed a pullback after opening gap down and closed well off the day’s low though down ~46 points. On the daily charts, the Nifty has taken support at the 19530 – 19500 zone where support in the form of the 61.82% Fibonacci retracement level of the previous rise form 19333 – 19850 is placed. We expect the Nifty stage a pullback after the recent sharp correction since the past couple of days. We believe that today’s low of 19512 shall act as a crucial support and until that is not breached on the downside we can expect the Nifty to witness a pullback towards 19730 – 19800 from short term perspective.

Bank Nifty also opened gap down and tested the 43600, low touched in August, 2023. There are signs of positive divergence developing on the daily momentum indicator as a new low in prices was not accompanied by a new low on the momentum indicator which indicates momentum on the downside is weakening and the probability of a pullback is high. We expect the Bank Nifty to witness a pullback towards 44000 – 44400 from short term perspective.

-330

October 19, 2023· 16:19 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

Markets remained vulnerable amidst simmering Middle-East geopolitical tensions. Pessimism still continues to run high amidst negative catalysts like deepening Israel-Palestine conflict, uninspiring Q2 from corporate India Inc so far, the 10-year US Treasury yields spiking to 4.87%, rising expectations of one more interest rate increase from the Fed, and anxiety ahead of Powell's speech later today. For Nifty, the support is placed at 19501 mark, while any strength can be seen only after index breaks the 19887 hurdle.

-330

October 19, 2023· 16:14 IST

Shrey Jain, Founder and CEO SAS Online - India's Deep Discount Broker:

On Thursday, both major domestic indices, BSE Sensex and NSE Nifty 50, opened in the negative territory for the second consecutive day. This decline was influenced by weak trends in global markets and recent outflows of foreign funds. The disappointing earnings report from IT services giant Wipro further weighed down the benchmark indices. It's important to closely monitor the US market as there are significant developments expected today, with Fed's chairperson Powell set to address amid the current volatile landscape.

Amid the prevailing global uncertainty, it is not recommended to open new positions in Nifty and Bank Nifty. For individuals who already have existing positions, it is crucial to implement sound risk management strategies and effectively hedge their positions to mitigate potential losses. Nifty found support at 19,500 but encountered resistance at 19,750.

-330

October 19, 2023· 16:08 IST

Shrikant Chouhan, Head of Research (Retail), Kotak Securities:

A sharp fall in several benchmark Asian and European indices dented the local market sentiment as the ongoing Middle East war continued to force investors to cut their exposure to equities. The key concern is that if the war continues for long, investors would move to safe haven assets to safeguard their interest.

Technically, the Nifty is trading near the 50-day SMA (Simple Moving Average). For the traders now, the 50-day SMA or 19625 would act as a trend decider level. Above the same, we could see a technical bounce back till 19700-19735 levels. On the flip side, below 19625 the index could retest the level of 19520-19480.

-330

October 19, 2023· 16:01 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty declined on October 19 before paring some losses to close lower for the second consecutive day. At close, Nifty was down 0.24% or 46.4 points at 19624.7. Smallcap index ended in the positive while Midcap index fell less than the Nifty even as the advance decline ratio improved to 0.96:1.

Global equities slid on Thursday as risk aversion prevailed due to mounting worries over Middle East conflict, while the bond sell-off intensified, taking Treasury yields to fresh 16-year highs ahead of a keenly awaited speech from Fed Chairman.

Nifty fell on October 19 with a downgap but filled the gap by recovering in the morning session. A late selloff again took the Nifty into negative territory. The 19840-19850 band is proving to be an overhead resistance for the Nifty and post a small recovery, it could again seek lower levels. On upmoves, Nifty could face resistance in the 19680-19730 band while 19480-19512 band could provide support.

-330

October 19, 2023· 15:53 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

It turned out to be a roller coaster ride for participants on the weekly expiry day as Nifty oscillated sharply on both sides and finally settled marginally lower at 19,624 level. Meanwhile, mixed trend on the sectoral front kept the traders occupied wherein auto & FMCG edged higher while metal and energy traded under pressure. The broader indices too witnessed a muted session and ended almost unchanged.

The recent price action in index shows indecision amid mixed cues. And, earnings has cascaded the choppiness on sectoral front too, making stock selection difficult for the traders. We thus suggest limiting aggressive positions and preferring hedged trades until we see some clarity over next directional move.

-330

October 19, 2023· 15:50 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Amid increasing global political strain, US treasury yield, and underwhelming IT earnings, the domestic market continued to trade with a minor cut. However, some optimism was evident in the equity market given global efforts to stabilize the West Asia conflict, which deescalated crude prices trend. Auto sector stocks outperformed, driven by Q2 results outcome. Investors are closely monitoring the Q2 earnings season, US Fed chair speak and West Asia developments.

-330

October 19, 2023· 15:42 IST

Aditya Gaggar Director of Progressive Shares:

The market witnessed a complete reversal in today's trade. Post a tepid opening, the Index gradually began to recover its losses and at one point in time it was in green. However, Index found resistance around its 21DMA i.e. 19,670, and reversed to end the weekly expiry day lower at 19,624.70 with a loss of 46.40 points.

Among the sectors, Auto was the top performer while Metal and Energy corrected by over 0.50%.

Quick recovery from the lower levels helped the Mid and Smallcaps to outperform Frontline peers. Benchmark Index is broadly oscillating in the range of 19,490-19,850 and at present it is near the lower end of the range; for a trend reversal and its confirmation, Index has to give a convincing close above 19,850.

-330

October 19, 2023· 15:40 IST

Stock Market LIVE Updates | HUL Q2 Earnings:

Net profit up 3.9% at Rs 2,717 crore against Rs 2,616 crore and revenue up 3.6% at Rs 15,276 crore versus Rs 14,751 crore, YoY.

-330

October 19, 2023· 15:38 IST

Stock Market LIVE Updates | NCLT approves Himadri Speciality's resolution plan for acquisition of Birla Tyres

Hon’ble National Company Law Tribunal, Kolkata Bench (NCLT) has now approved verbally the resolution plan submitted jointly by Himadri Speciality Chemical and Dalmia Bharat Refractories Limited for acquisition of Birla Tyres Limited.

-330

October 19, 2023· 15:33 IST

Rupee Close:

Indian rupee ended marginally higher at 83.24 per dollar versus previous close of 83.27.

-330

October 19, 2023· 15:30 IST

Market Close:

Benchmark indices ended lower for the second consecutive session on October 19 with Nifty below 19,650.

At close, the Sensex was down 247.78 points or 0.38 percent at 65,629.24, and the Nifty was down 46.40 points or 0.24 percent at 19,624.70. About 1810 shares advanced, 1759 shares declined, and 129 shares unchanged.

Wipro, Tech Mahindra, UPL, Bharti Airtel and Hindalco Industries were among major losers on the Nifty, while gainers were Bajaj Auto, LTIMindtree, Nestle India, Hero MotoCorp and UltraTech Cement.

On the sectoral front, bank, metal, power, realty, oil & gas and pharma down 0.3-0.9 percent, while auto index up 0.5 percent.

The BSE Midcap and Smallcap indices ended on a flat note.

-330

October 19, 2023· 15:23 IST

Stock Market LIVE Updates | CLSA View On ICICI Lombard General Insurance Company

-Buy call, target Rs 1,640 per share

-Q2FY24 combined operating ratio of 103.9 percent was better than our estimate

-Better COR despite floods & seasonal diseases because of better motor book performance.

-Premium growth for H1FY24 was 18 percent

-Given FY2H is dominated by retail

-Expect this healthy momentum to continue

-Thus, raise FY24 growth estimate from 15 percent to 17 percent

-330

October 19, 2023· 15:20 IST

-330

October 19, 2023· 15:17 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee declined on Thursday pressurised by a weak tone in the domestic markets and a rise in US Dollar. FII selling also weighed on the domestic currency. However, a decline in crude oil prices and likely intervention by the RBI. US Dollar gained on escalation of geopolitical tensions between Hamas and Israel after a hospital blast in Gaza. US’ support to Israel has not gone down well with the Middle East. Economic data from US was mixed with building permits missing forecast while housing starts were significantly above expectations.

We expect Rupee to trade with a slight negative bias as risk aversion in the global markets amid rising geopolitical uncertainty in the Middle East may put pressure on Rupee. Rising US Dollar and surge in US bond yields may further pressurise the domestic unit. 10-year yields are at fresh cyclical highs amid higher-for-longer interest rate theme. However, any diplomatic efforts to contain the conflict in the Middle East may support Rupee at lower levels.

Traders may take cues from weekly unemployment claims and existing home sales data from US. Investors may remain cautious ahead of US Federal Reserve Chair, Jerome Powell’s speech for some cues over monetary policy trajectory. USDINR spot price is expected to trade in a range of Rs 83 to Rs 83.60.

-330

October 19, 2023· 15:11 IST

Stock Market LIVE Updates | Goldman Sachs View On Wipro

-Sell call, target Rs 380 per share

-Q2 revenue growth of -2 percent QoQ

-Revenue growth was below estimate of -1 percent QoQ

-Q3FY24 revenue guidance of -3.5 percent to -1.5 percent QoQ indicates further deceleration in rev growth

-Revenue guidance continued market share erosion

-Q2Fy24 EBIT was 4 percent below estimate (7 percent below consensus)

-Expect weak revenue growth outlook to result in further headwinds to near-term margins

-Lower our FY24-26 EBIT/EPS estimates for Wipro by up to 8 percent

-330

October 19, 2023· 15:07 IST

Stock Market LIVE Updates | Biocon Biologics appoints Kedar Upadhye as new CFO

Biocon Biologics Ltd (BBL), a subsidiary of Biocon, announced that the Board of Directors of Biocon Biologics have appointed Kedar Upadhye as the new Chief Financial Officer (CFO) and the Company’s current CFO, MB Chinappa, will transition to take on a strategic finance role at Biocon Group. These leadership changes will be effective October 31, 2023.

-330

October 19, 2023· 15:01 IST

Stock Market LIVE Updates | Power Mech Projects launches QIP issue on October 18, floor price set at Rs 4,085.44 per share

Power Mech Projects approved the opening of QIP (qualified institutions placement) issue on October 18 for raising of funds via issue of equity shares. The floor price has also been approved at Rs 4,085.44 per share. The said issue will be close on October 23.

-330

October 19, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Wendt | 14,855.00 | 14,060.00 | -795.00 46 |

| RamkrishnaForge | 683.90 | 655.65 | -28.25 11.73k |

| PNB Gilts | 99.50 | 95.40 | -4.10 2.68m |

| Som Distillerie | 326.65 | 313.90 | -12.75 200.88k |

| Art Nirman | 53.00 | 51.00 | -2.00 46 |

| Accelya | 1,577.50 | 1,521.95 | -55.55 41.29k |

| NRB Industrial | 31.20 | 30.25 | -0.95 400 |

| Le Merite | 48.45 | 47.00 | -1.45 2.06k |

| Cinevista | 21.95 | 21.35 | -0.60 23.89k |

| Guj Raffia Ind | 35.00 | 34.05 | -0.95 429 |

-330

October 19, 2023· 14:56 IST

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Jai Corp | 338.75 | 371.80 | 33.05 2.69m |

| Canarys Automat | 46.35 | 50.00 | 3.65 - |

| Saakshi Medtech | 262.00 | 279.00 | 17.00 10.50k |

| Radhika Jewel | 46.35 | 49.05 | 2.70 700.96k |

| P E Analytics | 225.00 | 235.60 | 10.60 1.20k |

| DCW | 56.15 | 58.75 | 2.60 131.73k |

| Aurionpro Solut | 1,476.00 | 1,542.30 | 66.30 649 |

| Mitcon Cons | 78.00 | 81.35 | 3.35 5.09k |

| Indian Terrain | 60.45 | 62.95 | 2.50 6.26k |

| Vascon Engineer | 77.50 | 80.55 | 3.05 68.26k |

-330

October 19, 2023· 14:54 IST

Stock Market LIVE Updates | Prabhudas Lilladher View On Polycab India:

Broking house upward revised FY24/25/FY26E earnings estimates by 7.1%/6.2%/2.9% to mainly reflect revision in top-line growth assumption (3.7% in FY24/FY25/FY26) and margin improvement (~14% EBITDA margin in FY24) with segment & product mix.

Polycab reported healthy revenue growth of 26.6% YoY in Q2FY24, on the back of robust volume growth (~30%) in domestic W&C business. The company expects to achieve Rs 200bn revenues sooner than targeted by FY26E under Project LEAP given 1) strong volume growth in domestic W&C from infrastructure/real estate/construction activities (which accelerated institution business growth), 2) focus on B2C through increase in advertisement (3-5% of retail revenue vs 2.1% in FY23), expanding reach & change in product mix and 3) expected W&C market share gain of ~2% in coming years with wide SKUs, availability of products, logistics support etc.

Prabhudas Lilladher expect revenue/EBITDA/PAT CAGR of 19.8%/21.7%/22.8% over FY23-26E led by strong domestic demand environment supported by government measures & revival in private capex. Maintain ‘Accumulate’ with Target Price of Rs 5943 (earlier Rs 5665).

-330

October 19, 2023· 14:50 IST

Stock Market LIVE Updates | Ramkrishna Forgings Q2 Results:

Net profit up 22.3% at Rs 82.2 crore versus Rs 67.2 crore and revenue up 19.1% at Rs 981.5 crore versus Rs 824.4 crore, YoY.

-330

October 19, 2023· 14:47 IST

Stock Market LIVE Updates | Mastek Q2 Results:

Net profit down 20.6% at Rs 62.8 crore versus Rs 79.1 crore and revenue up 22.4% at Rs 765.5 crore versus Rs 625.3 crore, YoY.

-330

October 19, 2023· 14:46 IST

Stock Market LIVE Updates | Nomura On LTIMindtree

-Reduce call, target cut to Rs 4,510 per share

-Q2FY24 a mixed bag; growth outlook uncertain

-High-single-digit growth in FY24 unlikely, given sluggish execution

-Margin recovery on expected lines, led by utilisation improvement

-Lower FY24-26 EPS by approximately 2-3 percent

-330

October 19, 2023· 14:36 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 16624.80 0.54 | 31.82 1.98 | 0.37 30.69 |

| NIFTY IT | 31572.20 -0.11 | 10.31 -1.35 | -4.70 12.52 |

| NIFTY PHARMA | 15287.25 -0.29 | 21.35 0.67 | -1.39 17.40 |

| NIFTY FMCG | 52550.60 0.21 | 18.97 0.36 | 0.67 19.73 |

| NIFTY PSU BANK | 5027.05 -0.02 | 16.41 -1.82 | -3.65 59.40 |

| NIFTY METAL | 6797.20 -0.96 | 1.10 -0.96 | -2.31 18.50 |

| NIFTY REALTY | 606.35 -0.28 | 40.42 -0.63 | 4.74 41.95 |

| NIFTY ENERGY | 27091.00 -0.57 | 4.72 -0.31 | -1.62 5.32 |

| NIFTY INFRA | 6251.90 -0.37 | 19.04 -0.82 | -0.27 24.48 |

| NIFTY MEDIA | 2322.30 -0.04 | 16.58 -1.07 | 1.09 10.39 |

-330

October 19, 2023· 14:31 IST

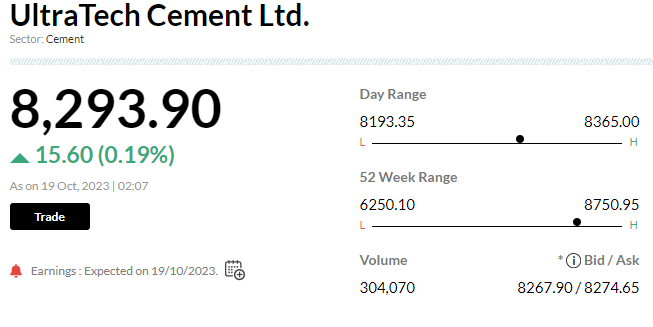

Stock Market LIVE Updates | UltraTech Cement Q2 net Income misses estimates at Rs 1,280 crore, despite strong revenue growth

UltraTech Cement's second-quarter net income reached Rs 1,280 crore, up 69% year-on-year, but it fell short of the estimated Rs 1,334 crore. The company reported revenue of Rs 16,010 crore, a 15% YoY increase, surpassing the estimated Rs 15,769 crore. However, total costs amounted to Rs 14,490 crore, a 12% YoY increase. Raw material costs were Rs 2,350 crore, up 18% YoY, below the estimated Rs 2,539 crore, while power and fuel expenses were Rs 4,390 crore, a 2.1% YoY increase, exceeding the estimated Rs 4,003 crore.

-330

October 19, 2023· 14:25 IST

-330

October 19, 2023· 14:18 IST

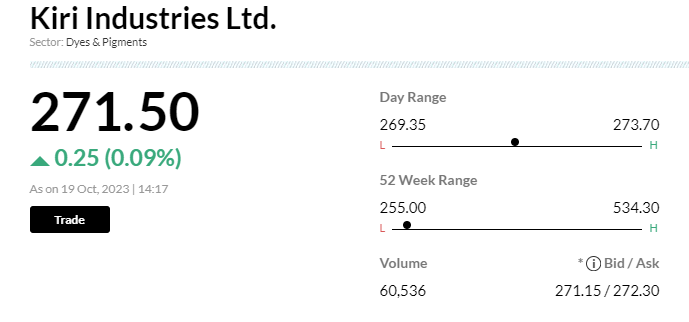

Stock Market LIVE Updates | Kiri Industries gains 0.5% after huge block deal

Shares of Kiri Industries gained 0.5 percent after a huge block deal. Around 1.14 million shares of the company changed hands in a block deal, Bloomberg reported. However, details of the buyers and sellers were not known.

-330

October 19, 2023· 14:13 IST

-330

October 19, 2023· 14:06 IST

Stock Market LIVE Updates | Macquarie View On Bajaj Auto

-Neutral call, target Rs 5,383 per share

-Q2FY24 marginal EBITDA beat, EV ramp-up a key focus

-Company revised its shareholder policy

-Annual payout (as percent of net profit) will depend upon cash balance at end of FY

-Management reiterated that export volumes have bottomed

-Export volumes should continue to witness a gradual recovery

-330

October 19, 2023· 14:00 IST

Sensex Today | Market at 2 PM

The Sensex was down 95.88 points or 0.15 percent at 65,781.14, and the Nifty was down 16.40 points or 0.08 percent at 19,654.70. About 1595 shares advanced, 1570 shares declined, and 87 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bajaj Auto | 5,438.95 | 5.87 | 2.09m |

| LTIMindtree | 5,443.10 | 5.58 | 1.41m |

| Nestle | 24,100.00 | 3.6 | 230.99k |

| Hero Motocorp | 3,233.05 | 2.53 | 758.51k |

| IndusInd Bank | 1,450.05 | 2.09 | 11.69m |

| Cipla | 1,221.60 | 0.91 | 1.64m |

| BPCL | 353.15 | 0.84 | 1.98m |

| Eicher Motors | 3,520.20 | 0.69 | 278.52k |

| Apollo Hospital | 5,007.20 | 0.6 | 157.67k |

| Larsen | 3,060.15 | 0.48 | 1.11m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Wipro | 394.80 | -3.1 | 10.79m |

| Grasim | 1,934.45 | -1.09 | 439.42k |

| Tech Mahindra | 1,174.60 | -1.05 | 2.15m |

| HDFC Life | 638.25 | -1.05 | 2.65m |

| Bharti Airtel | 943.30 | -1 | 3.15m |

| UPL | 614.85 | -0.92 | 1.46m |

| Tata Steel | 125.95 | -0.9 | 22.42m |

| NTPC | 239.85 | -0.89 | 7.83m |

| Sun Pharma | 1,143.20 | -0.88 | 1.34m |

| SBI Life Insura | 1,344.55 | -0.87 | 309.85k |

-330

October 19, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Creative Cast. | 839.40 | 783.85 | -55.55 46 |

| Sri Nachammai | 35.95 | 33.65 | -2.30 153 |

| HB Estate Dev | 44.63 | 41.80 | -2.83 19 |

| Teesta Agro Ind | 101.95 | 95.55 | -6.40 10 |

| Globe Commercia | 27.70 | 26.00 | -1.70 45 |

| MBL Infra | 29.92 | 28.19 | -1.73 12.27k |

| Frontline Trans | 43.28 | 40.80 | -2.48 144 |

| Active Clothing | 69.80 | 66.20 | -3.60 47 |

| Jindal Leasefin | 33.71 | 32.00 | -1.71 6 |

| Accelya | 1,675.00 | 1,595.05 | -79.95 128 |

-330

October 19, 2023· 13:57 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| CHL | 25.21 | 27.45 | 2.24 200 |

| Contil India | 103.05 | 111.00 | 7.95 9 |

| Raj Tube | 38.44 | 40.95 | 2.51 421 |

| Citadel Realty | 25.50 | 27.15 | 1.65 218 |

| Daikaffil Chem | 49.00 | 52.10 | 3.10 1.11k |

| AVAILABLE FINAN | 152.00 | 160.50 | 8.50 1.05k |

| Garbi Finvest | 26.50 | 27.88 | 1.38 3.03k |

| Punj Comm | 41.33 | 43.48 | 2.15 72 |

| Bella Casa | 155.25 | 162.95 | 7.70 1.39k |

| Jai Corp | 322.35 | 337.70 | 15.35 12.03k |

-330

October 19, 2023· 13:55 IST

Stock Market LIVE Updates | Kirloskar Pneumatic Company Q2 results:

Net profit down 25.7% at Rs 20.2 crore versus Rs 27.2 crore and revenue down 4.5% at Rs 281.9 crore versus Rs 295.2 crore, YoY.

-330

October 19, 2023· 13:46 IST

Stock Market LIVE Updates | HSBC View On Wipro

-Hold call, target cut to Rs 350 per share

-Reported weak Q2 revenue growth & guided for an even weaker Q3

-Margin expansion was lower than peers as well

-Wipro is undoubtedly impacted by demand slowdown

-There are also clear signs of market share loss

-Wipro is stuck between an undemanding valuation & weak business traction

-330

October 19, 2023· 13:40 IST

Stock Market LIVE Updates | Alkyl Amines Chemicals commences commercial production in new plant at existing Kurkumbh site

Alkyl Amines Chemicals has commenced commercial production in the newly set up plant at its existing Kurkumbh site. The new plant will enhance company's manufacturing capacity of Ethyl Amines.

-330

October 19, 2023· 13:37 IST

Stock Market LIVE Updates | Elara Capital View on Zomato:

Restaurants/QSR chains continue to invest in advertising on aggregator platforms. The current offerings in advertisement are more dominated by search. But other means of advertising such as display and video on the app are big, untapped opportunities, which may boost Zomato’s profitability.

As per the assessment, most e-commerce companies generate 2-5% of GOV as advertisement revenue. For food tech companies, this could be at the lower end, as there is only one category

– restaurants, which may advertise on the platform. Expect this segment to see a healthy CAGR of >40%, led by adoption of e-commerce advertising.

Reiterate buy on Zomato, with raised SoTP-Target Price of Rs 140 (from Rs 130 earlier).

-330

October 19, 2023· 13:32 IST

European markets opened lower Thursday as investors assess the impact of the crisis in the Middle East as well as earnings and economic data.

-330

October 19, 2023· 13:30 IST

-330

October 19, 2023· 13:27 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Jaiprakash Pow | 200000 | 10.28 | 0.21 |

| Jaiprakash Pow | 200000 | 10.25 | 0.2 |

| GTL Infra | 500000 | 0.95 | 0.05 |

| Jaiprakash Pow | 715780 | 10.27 | 0.74 |

| GTL Infra | 1148333 | 0.95 | 0.11 |

| Jaiprakash Pow | 200000 | 10.27 | 0.21 |

| Jaiprakash Pow | 1049834 | 10.24 | 1.08 |

| Jaiprakash Pow | 200000 | 10.22 | 0.2 |

| Jio Financial | 65264 | 213 | 1.39 |

| ADCONPP | 500000 | 0.99 | 0.05 |

-330

October 19, 2023· 13:22 IST

Stock Market LIVE Updates | South Indian Bank Q2 Results:

Profit up 23.2% at Rs 275 crore versus Rs 223 crore and net interest income (NII) up 14.4% at Rs 830.6 crore versus Rs 726.2 crore, YoY.

-330

October 19, 2023· 13:19 IST

Stock Market LIVE Updates | Paytm Q2 revenue uptick likely on steady lending, payments

Paytm is expected to post healthy sequential growth in revenue for Q2 FY24, driven by steady loan disbursements and new device additions. Paytm's operating profitability is seen increasing in the July-September quarter on account of improvement in contribution and operating leverage. The digital payments platform is slated to announce its Q2 results on October 20, 2023.

Contribution margin is the money left over from sales after paying all variable expenses while operating leverage shows how a company’s revenue growth translates into growth in its operating income. Brokerages expect Paytm's Gross Merchandise Value (GMV) growth to accelerate on a sequential basis on the back of higher market share. Read More

-330

October 19, 2023· 13:15 IST

Earnings Today:

-330

October 19, 2023· 13:12 IST

-330

October 19, 2023· 13:10 IST

Stock Market LIVE Updates | Welspun Corp bags order for supply of 61,000 MT bare pipes & bends to Middle East

Welspun Corp has received a contract for export of LSAW pipes and bends to the Middle East which will be executed from its facilities in Anjar, India. The contract is for supply of approximately 61,000 MT bare pipes and bends which will be used for offshore production and transport of gas. With this order, it has cumulatively received total orders of 1,91,000 MT of line pipes, to be executed from India and USA facilities.

-330

October 19, 2023· 13:07 IST

Stock Market LIVE Updates | ICICI Lombard Q2 profit drops 2.2% YoY to Rs 577.3 crore

ICICI Lombard General Insurance Company has recorded profit at Rs 577.3 crore for the quarter ended September FY24, falling 2.2% compared to year-ago period. Excluding one time impact of reversal of tax provision in Q2FY23, profit grew by 24.8% in Q2FY24. Gross direct premium income of the company was at Rs 6,086 crore during the quarter, up 17.4% YoY.

Gross premium written grew by 18.3% YoY to Rs 6,272.32 crore in Q2FY24. Underwriting loss at Rs 146 crore for the quarter narrowed from loss of Rs 152.3 crore YoY, while operating profit increased by 17% YoY to Rs 597.15 crore during the same period. The company has announced an interim dividend of Rs 5 per share.

-330

October 19, 2023· 13:02 IST

Sensex Today | Market at 1 PM

The Sensex was down 97.85 points or 0.15 percent at 65,779.17, and the Nifty was down 18.20 points or 0.09 percent at 19,652.90. About 1584 shares advanced, 1548 shares declined, and 89 shares unchanged.

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Roto Pumps | 392.45 10.55% | 200.50k 3,140.00 | 6,285.00 |

| Anjani Portland | 210.55 12.9% | 45.42k 1,107.80 | 4,000.00 |

| Rushil Decor | 350.15 20% | 196.53k 6,664.40 | 2,849.00 |

| Vardhman Steels | 223.90 11.5% | 162.77k 7,653.20 | 2,027.00 |

| Shree Bhavya | 28.20 20% | 147.54k 11,832.60 | 1,147.00 |

| Kirloskar Pneum | 676.30 2.11% | 35.46k 2,983.40 | 1,088.00 |

| CRISIL | 4,091.55 1.49% | 14.11k 1,493.80 | 845.00 |

| WE WIN | 73.00 0.86% | 9.42k 1,214.00 | 676.00 |

| Shakti Pumps | 1,108.35 20% | 84.29k 11,072.80 | 661.00 |

| Nectar Life | 24.56 3.15% | 84.03k 11,355.80 | 640.00 |

-330

October 19, 2023· 12:58 IST

Stock Market LIVE Updates | Nomura View On Wipro

-Hold call, target Rs 400 per share

-Q2 at bottom end of guidance; missing consensus estimate

-Discretionary demand remains weak

-Q3FY24 guidance shows weakness to persist

-Margin improvement unlikely in FY24

-3-6 percent cut in FY24-26 EPS

-330

October 19, 2023· 12:54 IST

Stock Market LIVE Updates | Bharat Agri Fert & Realty to launch soft booking for residential project in Thane on October 24

Bharat Agri Fert & Realty will launch the soft booking for its construction project Wembley in Thane, Maharashtra, on Dussehra, on October 24.

-330

October 19, 2023· 12:49 IST

Stock Market LIVE Updates | PVR Inox Q2 Earnings:

Net profit at Rs 166.3 crore versus loss of Rs 82 crore and revenue up 53.3% at Rs 1999.9 crore versus Rs 1,305 crore, QoQ.

-330

October 19, 2023· 12:47 IST

Sensex Today | Oil falls as Israel embargo concerns fade, Venezuela sanctions to ease

Oil prices fell on Thursday, reversing gains in the previous session, after OPEC showed no signs of supporting Iran's call for an oil embargo on Israel and as the United States plans to ease Venezuela sanctions to allow more oil to flow globally.

Brent futures for December fell 0.3%, or 29 cents, to $91.21 a barrel. U.S. West Texas Intermediate (WTI) futures for November, which expire on Friday, was nearly flat at $88.34 per barrel, up 2 cents from its settlement price.

The more active December WTI contract fell 0.2%, or 13 cents, to $87.14 a barrel at 0645 GMT.

-330

October 19, 2023· 12:43 IST

Stock Market LIVE Updates | Titagarh Rail Systems Q2 profit jumps 46.4% YoY to Rs 70.6 crore with healthy topline

Titagarh Rail Systems has recorded consolidated profit at Rs 70.6 crore for July-September period FY24, growing 46.4% over the corresponding period last fiscal, with revenue from operations rising 54% YoY to Rs 935.5 crore.

-330

October 19, 2023· 12:40 IST

Stock Market LIVE Updates | BSE Auto index rose 0.4 percent led by Bajaj Auto, Hero MotoCorp, TVS Motor

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bajaj Auto | 5,393.90 | 4.86 | 53.01k |

| Hero Motocorp | 3,223.65 | 2.27 | 80.38k |

| TVS Motor | 1,609.50 | 0.67 | 12.02k |

| Eicher Motors | 3,515.90 | 0.63 | 3.02k |

| UNO Minda | 597.55 | 0.53 | 2.13k |

| Apollo Tyres | 382.90 | 0.05 | 23.87k |

-330

October 19, 2023· 12:34 IST

Stock Market LIVE Updates | RPG Life Sciences Q2 profit grows 29.5% YoY to Rs 25.9 crore, revenue rises 14%

RPG Life Sciences has registered a 29.5% on-year growth in profit at Rs 25.86 crore for quarter ended September FY24, driven by healthy topline and operating performance. Revenue for the quarter at Rs 153.58 crore increased by 14% over a year-ago period.

-330

October 19, 2023· 12:32 IST

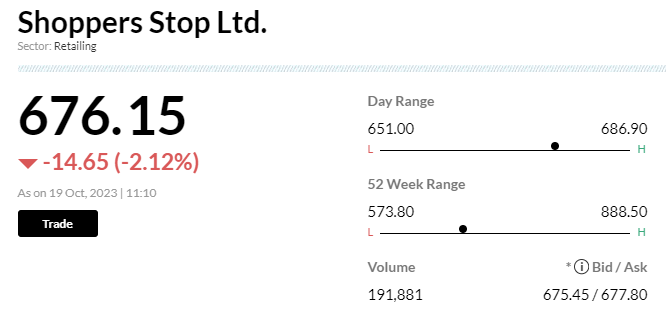

Stock Market LIVE Updates | Shoppers Stop plunges 2% on sharp decline in Q2 net profit

Shares of Shoppers Stop plunged 2 percent on October 19 after the department store chain reported a sharp decline in its net profit for the September quarter of the current financial year.

The retailer's net profit nosedived 83.3 percent to Rs 2.70 crore from Rs 16.2 crore in the year-ago period. The decline can be attributed to Rs 5 crore paid by the company for stock damaged in a fire in Delhi, though the firm is confident of receiving nearly full compensation from insurance companies. Read More

-330

October 19, 2023· 12:27 IST

Stock Market LIVE Updates | Astral Q2 profit jumps 90% YoY to Rs 131.2 crore, revenue grows 16.3%

Astral has registered a massive 90% on-year growth in consolidated profit at Rs 131.2 crore for the quarter ended September FY24, driven by robust operating performance. Revenue from operations grew by 16.3% year-on-year to Rs 1,363 crore for the quarter.

-330

October 19, 2023· 12:26 IST

-330

October 19, 2023· 12:22 IST

Stock Market LIVE Updates | HSBC View On IndusInd Bank

-Buy call, target Rs 1,680 per share

-Overall Q2 results in-line

-Q2 slippages of Rs 1,465 crore were higher than estimate, retail slippages subsided in quarter

-A change in loan mix, operating leverage & lower credit costs could serve as levers

-Change could serve as levers to protect RoA if NIMs compress

-As per management, slippages in vehicle finance & microfinance should improve in H2FY24

-Overall slippages in FY24 should be Rs 4,800-5,000 crore, as per management

-Company was confident of staying within 110-130 bps credit cost guidance

-Confident of staying within 110-130 bps adding to contingency buffers hereon

-330

October 19, 2023· 12:19 IST

Stock Market LIVE Updates | Central Bank of India enters into a strategic co-lending partnership with Capri Global Capital

Central Bank of India has entered into a strategic Co-Lending Partnership with M/s. Capri Global Capital Limited to offer MSME Loans at competitive rates, subject to compliance with the applicable law(s) including the applicable guidelines issued by Reserve Bank of India (RBI).

-330

October 19, 2023· 12:18 IST

Stock Market LIVE Updates | SJVN gets JKPCL & RUVNL consent for power purchase

Alert: JKPCL Is Jammu & Kashmir Power Corporation, RUVNL Is Rajasthan Urja Vidyut Nigam

SJVN has offered power to the beneficiaries of Northern Region from 1,000 MW Solar PV Station to be developed under CPSU scheme of GoI at Village Bandarewala / Karnisar, Tehsil Poogal, District Bikaner, Rajasthan. The power generated by the project will be used by Government entities, either directly or through DISCOMS.

Further, Jammu & Kashmir Power Corporation Limited and Rajasthan Urja Vidyut Nigam Limited has given their consent for purchase of 600 MW & 500 MW power respectively against a total capacity of 1000 MW at a tariff of Rs 2.57/ kWh.

-330

October 19, 2023· 12:13 IST

Stock Market LIVE Updates | Indoco Remedies Q2 Earnings:

Net profit down 29.4% at Rs 35.1 crore versus Rs 49.7 crore and revenue up a7% at Rs 473.6 crore versus Rs 404.9 crore, YoY.

-330

October 19, 2023· 12:13 IST

-330

October 19, 2023· 12:11 IST

Stock Market LIVE Updates | Wisdomtree India Investment Portfolio Inc picks half a percent stake in Gujarat Pipavav Port

Wisdomtree India Investment Portfolio Inc has bought 24.71 lakh shares, which is equivalent to 0.51% of paid-up equity in Gujarat Pipavav Port, at an average price of Rs 138.23 per share.

-330

October 19, 2023· 12:08 IST

Sensex Today | BSE Oil & Gas index down 0.5 percnet dragged by Indraprastha Gas, Gail, Gujarat Gas:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IGL | 458.60 | -4.66 | 41.70k |

| Gujarat Gas | 416.30 | -0.82 | 20.90k |

| GAIL | 130.00 | -0.76 | 449.93k |

| Petronet LNG | 229.30 | -0.65 | 25.17k |

| Adani Total Gas | 590.20 | -0.4 | 7.12k |

| Reliance | 2,315.00 | -0.37 | 70.68k |

| ONGC | 186.15 | -0.35 | 86.37k |

| IOC | 90.52 | -0.29 | 453.75k |

-330

October 19, 2023· 12:06 IST

-330

October 19, 2023· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was down 119.81 points or 0.18 percent at 65,757.21, and the Nifty was down 28.60 points or 0.15 percent at 19,642.50. About 1476 shares advanced, 1614 shares declined, and 108 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 65755.33 -0.18 | 8.08 -0.98 | -2.72 11.25 |

| BSE 200 | 8601.85 -0.19 | 9.55 -0.75 | -2.17 12.40 |

| BSE MIDCAP | 32144.11 -0.29 | 26.98 -0.55 | -0.85 28.22 |

| BSE SMALLCAP | 38481.13 0.05 | 33.03 0.74 | 2.34 33.89 |

| BSE BANKEX | 49409.15 0.09 | 1.03 -1.47 | -4.27 7.01 |

-330

October 19, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Globesecure | 97.00 | 80.40 | -16.60 4.50k |

| Pansari Develop | 81.60 | 77.20 | -4.40 2.48k |

| Shree Vasu | 172.40 | 165.00 | -7.40 100 |

| Bhartiya Inter | 231.00 | 223.00 | -8.00 58 |

| Incredible Ind | 38.25 | 36.95 | -1.30 6.94k |

| ABM Inter | 39.50 | 38.30 | -1.20 120 |

| Inspire Films | 68.50 | 66.50 | -2.00 - |

| Emami Realty | 78.30 | 76.15 | -2.15 4.35k |

| E Factor Experi | 155.00 | 150.85 | -4.15 - |

| Supreme Infra | 29.45 | 28.70 | -0.75 15.29k |

-330

October 19, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shiva Mills Lim | 81.05 | 86.65 | 5.60 3.90k |

| Guj Raffia Ind | 33.50 | 35.70 | 2.20 577 |

| Aban Offshore | 55.15 | 58.60 | 3.45 312.59k |

| Magnum Ventures | 46.30 | 49.00 | 2.70 30.26k |

| AMD Industries | 63.70 | 67.40 | 3.70 18.76k |

| NRB Industrial | 29.55 | 31.25 | 1.70 1.04k |

| WE WIN | 72.15 | 75.80 | 3.65 15.76k |

| Weizmann | 113.50 | 119.00 | 5.50 3.32k |

| Manaksia Coated | 25.05 | 26.20 | 1.15 16.12k |

| Seamec | 639.45 | 668.00 | 28.55 8.35k |

-330

October 19, 2023· 11:55 IST

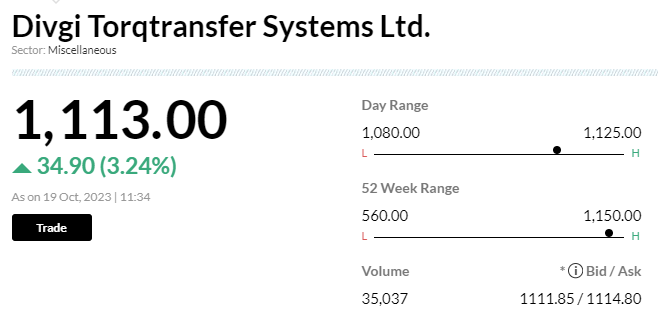

Stock Market LIVE Updates | ICICI Prudential MF buys Rs 67.35 crore shares in Divgi Torqtransfer Systems

ICICI Prudential Mutual Fund has bought 6,23,646 equity shares in Divgi Torqtransfer Systems via open market transactions, at an average price of Rs 1,080 per share, amounting to Rs 67.35 crore. However, Motilal Oswal Mutual Fund sold 5.5 lakh shares in the firm at an average price of Rs 1,080 per share, and 4.84 lakh shares at an average price of Rs 1,080.29 per share, amounting to Rs 111.71 crore.

-330

October 19, 2023· 11:50 IST

Stock Market LIVE Updates | Global Cloud Xchange partners with Sonata Software for business transformations

Sonata Software has signed an agreement with Global Cloud Xchange (GCX), a leading network service provider powering global connectivity for new media providers, telecom carriers and enterprises.

Sonata’s investments in Cloud, Data and Generative AI technologies made Sonata the partner of choice for GCX as they start a multi-year business transformation of GCX’s enterprise operations, systems and business intelligence systems.

-330

October 19, 2023· 11:47 IST

Stock Market LIVE Updates | Bajaj Healthcare commissions Alkaloid extraction plant in Gujarat

Bajaj Healthcare has commissioned Alkaloid extraction plant in Vadodara, Gujarat. The existing capacity for extracting Alkaloid from poppy gum was 100 metric tons per annum, which now extended to 300 metric tons per annum.

-330

October 19, 2023· 11:45 IST

Sensex Today | Gold firms on Middle East conflict; spotlight on Powell speech

Gold prices hovered near a 2-1/2-month high on Thursday as escalating Middle East turmoil buoyed demand for the safe-haven asset, while investors awaited U.S. Federal Reserve Chair Jerome Powell's speech due later in the day.

Spot gold was steady at $1,948.06 per ounce by 0522 GMT after hitting its highest since Aug. 1 on Tuesday. U.S. gold futures eased 0.4% to $1,960.10.

-330

October 19, 2023· 11:43 IST

Stock Market LIVE Updates | Morgan Stanley View On IndusInd Bank:

-Overweight call, target cut to Rs 1,775 per share from Rs 1,800 per share

-Q2 positives include steady margins (despite higher funding costs)

-Q2 positives include improving retail deposit mix & strong loan growth

-Q2 negatives include higher costs & elevated slippages

-Estimate trims reflect higher opex & slower overall deposit growth

-330

October 19, 2023· 11:35 IST

Stock Market LIVE Updates | Motilal Oswal offloads 3.38% stake in Divgi Torqtransfer for Rs 112 crore; shares rise 4%

Divgi Torqtransfer Systems shares rose 4.3 percent in early trade. On October 18, Motilal Oswal Mutual Fund offloaded its entire stake in the company for a total consideration of Rs 112 crore via open market transactions.

The domestic mutual fund pared its entire stake of 3.38 percent or 10,34,225 shares in two separate tranches, according to bulk deals data on the NSE. The shares were sold in the range of 1,080-1,080.29 apiece. On the other hand, ICICI Prudential Mutual Fund purchased 6,23,646 shares of the company at around Rs 1,080 per equity share. The value of this deal is Rs 67.35 crore.

Compared to the closing price of Rs 1,122.75 on the NSE, Motilal Oswal sold the shares at a 3.8 percent discount.

-330

October 19, 2023· 11:29 IST

-330

October 19, 2023· 11:22 IST

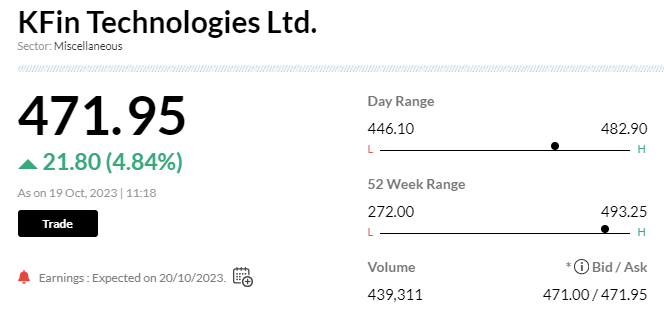

Stock Market LIVE Updates | KFin Tech bags investment management solution contract from LIC Pension Fund

-330

October 19, 2023· 11:17 IST

Stock Market LIVE Updates | Nestle India announces 1:10 stock split

It marks Nestle India's first-ever stock split.

-330

October 19, 2023· 11:13 IST

Stock Market LIVE Updates | Shoppers Stop plunges 6% on sharp decline in Q2 net profit

Shares of Shoppers Stop plunged around 6 percent in the morning trade on October 19 after the department store chain reported a sharp decline in its net profit for the September quarter of the current financial year.

The retailer's net profit nosedived 83.3 percent to Rs 2.70 crore from Rs 16.2 crore in the year-ago period. The decline can be attributed to Rs 5 crore paid by the company for stock damaged in a fire in Delhi, though the firm is confident of receiving nearly full compensation from insurance companies.

The company's aggressive capital expenditure to expand its footprint also pulled the bottomline lower.

-330

October 19, 2023· 11:07 IST

Nestle India Q3 Results:

Net profit up 37.3% at Rs 908 crore versus Rs 661.4 crore and revenue up 9.5% at Rs 5,036.8 crore versus Rs 4,601.8 crore, YoY.

-330

October 19, 2023· 11:05 IST

Stock Market LIVE Updates | RITES signs MoU with Spain-based INTECSA-INARSA, S.A.U to explore business avenues in Guyana & Colombia

RITES has signed Memorandum of Understanding (MoU) with INTECSA-INARSA, S.A.U, a company incorporated in Spain, to achieve the effectiveness of synergy and co-operation on a long term basis. They will explore business interests in relation to the development and execution of projects in Republic of Guyana and Republic of Colombia.

-330

October 19, 2023· 11:00 IST

Sensex Today | Market at 11 AM

The Sensex was down 380.15 points or 0.58 percent at 65,496.87, and the Nifty was down 109.80 points or 0.56 percent at 19,561.30. About 1355 shares advanced, 1680 shares declined, and 121 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 16531.40 -0.02 | 31.08 1.41 | -0.20 29.95 |

| NIFTY IT | 31486.75 -0.38 | 10.01 -1.61 | -4.96 12.21 |

| NIFTY PHARMA | 15217.10 -0.74 | 20.79 0.20 | -1.85 16.86 |

| NIFTY FMCG | 52158.35 -0.54 | 18.08 -0.39 | -0.08 18.84 |

| NIFTY PSU BANK | 5011.20 -0.33 | 16.04 -2.13 | -3.95 58.90 |

| NIFTY METAL | 6779.55 -1.22 | 0.84 -1.22 | -2.56 18.19 |

| NIFTY REALTY | 603.60 -0.73 | 39.79 -1.08 | 4.27 41.31 |

| NIFTY ENERGY | 27061.70 -0.68 | 4.61 -0.42 | -1.72 5.21 |

| NIFTY INFRA | 6233.10 -0.67 | 18.68 -1.12 | -0.57 24.10 |

| NIFTY MEDIA | 2323.75 0.03 | 16.65 -1.01 | 1.15 10.45 |

-330

October 19, 2023· 10:58 IST

Stock Market LIVE Updates | Granules India gets USFDA nod for Esomeprazole Magnesium Capsules

Granules India Limited announced today that the US Food & Drug Administration (US FDA) has approved its Abbreviated New Drug Application (ANDA) for Esomeprazole Magnesium Delayed-Release Capsules USP, 20 mg and 40 mg. It is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Nexium Delayed-Release Capsules, 20 mg and 40 mg, of AstraZeneca Pharmaceuticals LP.

-330

October 19, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Mohite Ind | 30.73 | 27.34 | -3.39 483 |

| Ceeta Industrie | 35.35 | 32.20 | -3.15 120 |

| Raj Tube | 42.48 | 39.00 | -3.48 300 |

| Panorama Studio | 268.95 | 248.20 | -20.75 75 |

| Standard Capita | 51.58 | 47.75 | -3.83 6.94k |

| Sterling Green | 40.79 | 37.80 | -2.99 0 |

| Soma Textile | 23.37 | 21.74 | -1.63 1.07k |

| Active Clothing | 71.00 | 66.20 | -4.80 1.71k |

| SP Capital Fin | 23.30 | 21.81 | -1.49 190 |

| Confidence Futu | 124.80 | 116.90 | -7.90 214 |

-330

October 19, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| DB (Int) Stock | 37.00 | 43.26 | 6.26 4.04k |

| Pan Electroncis | 37.66 | 44.00 | 6.34 162 |

| Faze Three Auto | 94.90 | 109.80 | 14.90 70.94k |

| Arrow Greentech | 389.00 | 430.35 | 41.35 694 |

| Shree Bhavya | 24.01 | 26.55 | 2.54 9.45k |

| Anjani Portland | 189.90 | 208.95 | 19.05 30 |

| YOGI | 25.00 | 27.49 | 2.49 1.11k |

| Aditya Consumer | 61.21 | 67.00 | 5.79 2.00k |

| Fervent Synergi | 19.22 | 20.98 | 1.76 164 |

| PNB Gilts | 90.33 | 98.52 | 8.19 18.49k |

-330

October 19, 2023· 10:56 IST

Stock Market LIVE Updates | Maruti Suzuki India receives favourable order from CESTAT, Chandigarh in Rs 3.8 crore tax & penalty demand

Maruti Suzuki India has received a favourable order from CESTAT (Customs, Excise and Service Tax Appellate Tribunal), Chandigarh. The appeals filed by the company for period April 2006 to March 2012 have been allowed. The said appeals were filed by the company against the order of the Commissioner-Central Excise dated August 3, 2012. The total tax and penalty amount involved is Rs 3.8 million and the CESTAT has deleted the said demand.

-330

October 19, 2023· 10:52 IST

Sensex Today | BSE Realty index down 1 percent dragged by DLF, Brigade Enterprises, Prestige Estates Projects:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| DLF | 556.50 | -1.93 | 55.02k |

| Brigade Ent | 616.50 | -1.65 | 2.12k |

| Prestige Estate | 722.20 | -1.55 | 11.18k |

| Oberoi Realty | 1,114.05 | -0.93 | 3.51k |

| Macrotech Dev | 810.50 | -0.5 | 12.90k |

| Godrej Prop | 1,669.70 | -0.46 | 7.86k |

| Sobha | 764.90 | -0.2 | 13.83k |

| Indiabulls Real | 78.38 | -0.06 | 251.75k |

-330

October 19, 2023· 10:48 IST

-330

October 19, 2023· 10:45 IST

Stock Market LIVE Updates | Income Tax Department conducting a search at Trident's premises since October 17

The Income Tax Department is conducting a search at premises and plants of Trident, since October 17. The entire IT assets of all the senior officials including the undersigned are under the control of Income Tax Department, for scrutiny. The officials of the company are fully cooperating with the Income Tax Department and are responding to the queries raised by them.

-330

October 19, 2023· 10:41 IST

Stock Market LIVE Updates | IndusInd Bank Q2 slippages a worry but margins offer comfort, stock gains

The IndusInd Bank share gained 2 percent in the morning trade on October 19, a day after the private sector lender reported a mixed set of numbers for the July-September quarter.

Though the numbers were largely in line with the street estimates, analysts flagged elevated slippages and slower overall deposit growth as major drags.

The bank’s gross non-performing asset (NPA) at 1.93 percent saw little improvement from 1.94 percent in the previous quarter. Net NPAs were at 0.57 percent against 0.58 percent in Q1FY24. Read More

-330

October 19, 2023· 10:35 IST

Stock Market LIVE Updates | Mastek gets 3-year contract from the UK’s Government Digital Service

Mastek has received a three-year contract from the UK’s Government Digital Service (GDS). The three-year contract is valued at 8.5 million pound, with options available to extend to a total of five years. Company, in collaboration with UK GDS will design, build, and operate the GOV.UK One Login Technical Service Desk (TSD).

-330

October 19, 2023· 10:31 IST

Sensex Today | BSE Metal index down 1 percent dragged by APL Apollo, Coal India, Jindal Steel

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| APL Apollo | 1,720.00 | -2.53 | 4.29k |

| Coal India | 310.00 | -2.16 | 122.18k |

| Jindal Steel | 670.85 | -1.8 | 10.07k |

| Tata Steel | 125.10 | -1.57 | 780.40k |

| Hindalco | 478.00 | -1.36 | 59.42k |

| NALCO | 97.20 | -1.36 | 242.56k |

| JSW Steel | 777.75 | -0.84 | 14.04k |

| Vedanta | 229.10 | -0.52 | 126.29k |

| SAIL | 87.60 | -0.25 | 326.95k |

| NMDC | 161.10 | -0.25 | 276.28k |

-330

October 19, 2023· 10:29 IST

Stock Market LIVE Updates | Pankaj Malhan resigns as Deputy MD & Group CEO of Va Tech Wabag

Pankaj Malhan has resigned as Deputy Managing Director & Group CEO (key managerial personnel) of Va Tech Wabag due to personal reasons. He will be relieved from the services of the company with effect from October 30.

-330

October 19, 2023· 10:27 IST

-330

October 19, 2023· 10:25 IST

Stock Market LIVE Updates | Persistent Systems gains 3% on healthy Q2 earnings, record deal wins

Shares of Persistent Systems rose 3 percent in early trade on October 19, a day after the information technology company posted a healthy set of earnings for the September quarter, marked by its record high deal wins. The IT major's net profit jumped close to 20 percent on a yearly basis while it was up 15 percent sequentially in Q2. Revenue also rose 9.4 percent on year to Rs 2,448 crore while it was up 4 percent sequentially.

Strong deal wins during the quarter were a major factor behind the IT company's healthy earnings in July-September. The company reported its highest-ever deal win at a total contract value (TCV) of $475 million, marking a sharp jump from $380 million in the preceding quarter. The company derives around 80 percent of its revenue from the BFSI and hi-tech verticals. Read More

-330

October 19, 2023· 10:18 IST

Stock Market LIVE Updates | Titagarh Rail share price trades lower despite profitable Q2FY24

Shares of Titagarh Rail Systems Ltd (formerly known as Titagarh Wagons) opened at Rs 812.70, nearly 1.2 percent lower on the NSE on October 19, a day after the rail equipment manufacturer announced its Q1FY24 results.

On October 18, the company reported a 46.5 percent year-on-year (YoY) increase in net profit to Rs 70.6 crore. The results were announced post market close. Read More

-330

October 19, 2023· 10:16 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| GKW | 1,449.85 | 42.93 | 1,014.40 |

| Cinevista | 22.10 | 29.24 | 17.10 |

| Signet Ind | 78.65 | 28.30 | 61.30 |

| Radhika Jewel | 45.10 | 25.45 | 35.95 |

| Radhika Jewel | 45.10 | 25.45 | 35.95 |

| Sky Gold | 738.40 | 25.39 | 588.90 |

| Nucleus Softwar | 1,449.40 | 24.64 | 1,162.90 |

| Newgen Software | 1,141.00 | 22.03 | 935.05 |

| SecUR Credentia | 21.45 | 21.19 | 17.70 |

| Shakti Pumps | 1,091.00 | 19.85 | 910.30 |

-330

October 19, 2023· 10:10 IST

Sensex Today | Veer Trivedi, Research Analyst, SAMCO Securities:

The Government has announced that it plans to sell a 3.5% stake in HUDCO through offer for sale. In case of oversubscription, the government will offer an additional 3.5% stake in HUDCO. Thus, if the entire 7% stake gets sold the government’s holding will come down to 74.81% from 81.81% levels.

HUDCO has been a significant partner in financing infrastructure development projects, especially those focused on providing housing for economically disadvantaged sections. However, given its historically average growth and the recent surge in its stock price over the past year, the floor price appears on the expensive side. Therefore, investors can look to avoid the OFS.

-330

October 19, 2023· 10:04 IST