Closing Bell: Sensex, Nifty end flat amid volatility; pharma, oil & gas outperform

-330

November 07, 2023· 22:59 IST

The live blog session has concluded. For more news, views and updates, stay tuned with Moneycontrol.com.

-330

November 07, 2023· 16:18 IST

-330

November 07, 2023· 16:17 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets took a breather after three days of advance and ended almost unchanged. After the flat start, Nifty oscillated in a narrow range till the end and finally settled at 19,406.70 levels. A mixed trend was witnessed on the sectoral front wherein pharma and energy posted decent gains while realty and media settled lower. The broader indices managed to edge higher for yet another session wherein smallcap gained nearly a percent.

We may see further consolidation in the index in line with the global peers however there will be no shortage of stock-specific opportunities. Traders should align their positions accordingly, with a focus on sectors that are trading in sync with the benchmark.

-330

November 07, 2023· 16:15 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Profit taking in select stocks ended the 3-day rally as key indices ended marginally lower in a sluggish trading session. Due to weakness in Asian and European markets, investors traded with caution back home even as crude oil prices declined further. The fall was quite sharp in early trades, but markets pared losses and languished in negative territory thereafter. Technically, the confirmation of strength for Nifty can be seen only above its biggest hurdles at 19707 mark, while support is placed at 19225 mark.

-330

November 07, 2023· 15:57 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened on a flat note and witnessed an intraday dip. The dip towards 19330 was bought into and during the second half of the session it witnessed a sharp rebound which helped it to recover, and the Nifty closed marginally in the red down ~5 points. The dip towards the support zone of 19330 – 19300 where the key hourly moving averages were placed was bought into and the hourly momentum indicator has also triggered a positive crossover from the equilibrium line which indicates that it has started a new cycle on the upside. It is still trading around the crucial resistance zone 19450 – 19500 and a decisive close above it shall lead to a further rally upwards till 19690. On the downside, 19300 – 19270 shall act as a crucial support zone from short term perspective.

Bank Nifty recover sharply from intraday dip and closed around the highs for the day. On the downside 43300 – 43200 acted as a strong support and is now extending on the upside. It is likely to inch towards 44000. Momentum setup is in sync with the price action and is likely to provide speed to the upmove.

-330

November 07, 2023· 15:49 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The market witnessed some resistance at higher levels as caution prevails due to the start of the key state elections, and further negative global cues on account of a more than expected fall in Chinese exports, highlighting a continued slowdown in global trade. Despite the extension of supply cuts by Saudi Arabia and Russia, crude oil prices moderated, a positive for India in the midst of geopolitical tension. This, along with the moderation in US bond yields and the positive ongoing earnings season, will support long-term returns.

-330

November 07, 2023· 15:45 IST

Aditya Gaggar Director of Progressive Shares:

The rangebound session comes to an end at 19,406.70 with a minuscule loss of 5.05 points. Among the sectors, Pharma was the top performer by ending the day with gains of 1.32% while profit booking pressure dragged the Realty segment lower. Stock-specific action was witnessed in the IT and Metal space. Mid and Smallcaps extended their journey towards the north and outperformed the Frontline Index.

On the daily chart, the Index has made an Inside bar candlestick pattern which generally represents a period of consolidation or indecision in the markets. A convincing close above 19,420 will open the doors for 19,560 while a downside is protected at 19,350. BankNifty has given a compelling close above its critical hurdle of 43,600 as well as its 21DMA which indicates a continuation of the current up move and is likely to soar higher towards 44,000 while a level of 43,300 will act as a strong support.

-330

November 07, 2023· 15:33 IST

Rupee Close:

Indian rupee ended at 83.27 per dollar versus previous close of 83.21.

-330

November 07, 2023· 15:30 IST

Market Close:

Benchmark indices ended on a flat note in the volatile session on November 7.

At close, the Sensex was down 16.29 points or 0.03 percent at 64,942.40, and the Nifty was down 5.10 points or 0.03 percent at 19,406.70. About 1878 shares advanced, 1616 shares declined, and 146 shares unchanged.

Hero MotoCorp, Coal India, Bajaj Finance, JSW Steel and Divis Labs were among major losers on the Nifty, while gainers included Sun Pharma, BPCL, NTPC, Axis Bank and Dr Reddy's Labs.

Among sectors, healthcare and oil & gas up 1 percent each, while realty down 1 percent.

BSE Midcap index up 0.5 percent and Smallcap index up 0.4 percent.

-330

November 07, 2023· 15:29 IST

Lumax Industries Q2

Net profit down 20.3% at Rs 26.3 crore versus Rs 33 crore and revenue up 3.8% at Rs 643.8 crore versus Rs 620.1 crore, YoY.

-330

November 07, 2023· 15:23 IST

Stock Market LIVE Updates | Morgan Stanley View On FSN E-Commerce Ventures (Nykaa):

-Overweight call, target Rs 173 per share

-Q2 EBITDA margin was slightly lower

-Improving NSV growth & contribution margin in fashion segment are key positives

-BPC GMV rose 23 percent & contribution margin was broadly stable at 26.4 percent

-Shift in festive season to drive Q3 growth

-330

November 07, 2023· 15:20 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 16149.00 -0.15 | 28.05 1.46 | 0.99 20.12 |

| NIFTY IT | 30990.10 0.06 | 8.27 1.33 | -4.18 7.82 |

| NIFTY PHARMA | 15271.80 1.32 | 21.23 4.01 | 0.95 15.43 |

| NIFTY FMCG | 52141.60 0.13 | 18.04 1.71 | 1.09 16.62 |

| NIFTY PSU BANK | 5025.50 0.5 | 16.37 1.85 | -3.69 36.19 |

| NIFTY METAL | 6572.35 0.08 | -2.25 1.86 | -2.55 2.31 |

| NIFTY REALTY | 643.25 -1.27 | 48.97 6.67 | 9.49 43.68 |

| NIFTY ENERGY | 27493.85 0.16 | 6.28 2.65 | 2.85 1.44 |

| NIFTY INFRA | 6251.10 -0.01 | 19.02 2.55 | 0.34 17.91 |

| NIFTY MEDIA | 2267.20 -0.65 | 13.81 3.10 | -0.85 7.70 |

-330

November 07, 2023· 15:18 IST

Stock Market LIVE Updates | HSBC View On Crompton Greaves Consumer Electrical:

-Buy call, target Rs 330 per share

-Q2 performance was disappointing

-Strong performance in ECD segment was offset by weakness in other segments

-See revenue & earnings returning to growth trajectory from Q3 onwards

-330

November 07, 2023· 15:15 IST

Sensex Today | Praveen Singh – Associate VP, Fundamental Currencies and Commodities, Sharekhan by BNP Paribas

:

The USDINR pair is currently trading with a gain of 3 Paise at Rs 83.26 as rebounding US yields supported the US Dollar Index yesterday that closed with a gain of 0.20%.

Crude oil is under pressure as Israel says that it is open to tactical little pauses in the war in the Middle East. Investors will look forward to the Fedspeak as Fed’s Waller, Barr, Williams, Logan and Schmid go on air today. IMF has upgraded its China’s GDP growth forecasts for 2023 from 5% to 5.40% on post-Covid recovery, though it still expects the Chinese economy to slow down in 2024. China’s October trade balance data were mixed as exports fell short of expectations.

Lower oil prices and weak US data are positive for the domestic currency; however, FIIs outflows stood at Rs 3613.87 crore yesterday, which is bearish. The USDINR pair is expected to stick to its range-bound theme. In near term, the pair can move lower on Fed peak rate notion supported by disappointing US data.

-330

November 07, 2023· 15:13 IST

Stock Market LIVE Updates | Jefferies View On FSN E-Commerce Ventures (Nykaa):

-Buy call, target Rs 200 per share

-Q2 EBITDA missed forecasts due to lower GM

-Management attributed this to higher discounting in the BPC portfolio

-Higher discounting led by increased competition, lower ad income & product mix change

-Revenue growth was strong, led mainly by strong user growth in both key segments

-330

November 07, 2023· 15:09 IST

Stock Market LIVE Updates | Jefferies View On JK Lakshmi Cement

-Hold call, target Rs 790 per share

-Q2 EBITDA grew 33 percent YoY on 14 percent YoY volume growth, higher PX & lower costs

-After 3 quarters of tepid performance, Q2 was a beat versus estimates

-Some of the new management initiatives were reflected in better unit EBITDA

-Management continues to target Rs 1,000 EBITDA/t in next 18-24 months

-Consistent performance here may drive re-rating

-Upgrade FY24/FY25 EBITDA estimates by 9 percent/3 percent to factor in Q2 beat

-330

November 07, 2023· 15:08 IST

Stock Market LIVE Updates | Varroc Engineering Q2 Results:

Net profit at Rs 54.2 crore against loss of Rs 795 crore and revenue up 2.9% at Rs 1,886.8 crore versus Rs 1,834.1 crore, YoY.

-330

November 07, 2023· 15:04 IST

Stock Market LIVE Updates | Saksoft Q2 results:

Net profit up 0.8% at Rs 25.3 crore versus Rs 25.1 crore and revenue up 3.8% at Rs 190.4 crore versus Rs 183.5 crore, QoQ.

-330

November 07, 2023· 15:03 IST

Stock Market LIVE Updates | Jefferies On Whirlpool of India

-Hold call, target Rs 1,480 per share

-Despite marginal volume growth, company’s Q2 sales declined by 6 percent YoY

-Sales decline due to price cuts effected in early 2023 to support competitiveness

-Overall Q2 demand was impacted due to shift in festive season

-Margin declined to 4.8 percent due to higher employee & other expenses

-Cut FY25-26 EPS estimate by 2-3 percent, while FY24E cut is sharper

-330

November 07, 2023· 15:00 IST

Sensex Today | Market at 3 PM

The Sensex was down 44.86 points or 0.07 percent at 64,913.83, and the Nifty was down 4.30 points or 0.02 percent at 19,407.50. About 1700 shares advanced, 1484 shares declined, and 106 shares unchanged.

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Jaiprakash Pow | 222393 | 14.01 | 0.31 |

| Rajnish Wellnes | 331433 | 11.5 | 0.38 |

| Jai Corp | 40377 | 306.9 | 1.24 |

| JSW Infra | 251741 | 207.4 | 5.22 |

| Rajnish Wellnes | 500000 | 11.59 | 0.58 |

| Vodafone Idea | 320000 | 13.99 | 0.45 |

| Rattanindia Ent | 200000 | 58.93 | 1.18 |

| Vodafone Idea | 321992 | 13.99 | 0.45 |

| Vodafone Idea | 373379 | 13.9 | 0.52 |

| Jaiprakash Pow | 477829 | 14.1 | 0.67 |

-330

November 07, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| PRITIKA | 86.50 | 80.00 | -6.50 13.71k |

| Kirloskar Bros | 912.75 | 847.60 | -65.15 6.68k |

| Radiant Cash | 99.40 | 92.95 | -6.45 10.32k |

| Poddar Housing | 154.65 | 145.10 | -9.55 1 |

| SKP Bearing | 232.70 | 220.15 | -12.55 396 |

| Pansari Develop | 84.00 | 79.50 | -4.50 2.63k |

| TPL Plastech | 54.60 | 52.15 | -2.45 13.96k |

| Likhitha | 316.95 | 303.15 | -13.80 8.35k |

| Kontor Space | 89.00 | 85.55 | -3.45 - |

| Vascon Engineer | 78.85 | 75.80 | -3.05 46.38k |

-330

November 07, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Neuland Lab | 4,118.95 | 4,671.30 | 552.35 8.55k |

| Global Educatio | 201.45 | 225.90 | 24.45 3.72k |

| Trent | 2,240.05 | 2,416.55 | 176.50 121.41k |

| Nagreeka Cap | 20.60 | 21.70 | 1.10 316 |

| Osia Hyper Reta | 52.65 | 55.45 | 2.80 40.07k |

| VST Tillers | 3,515.70 | 3,690.00 | 174.30 653 |

| Megastar Foods | 313.15 | 327.35 | 14.20 2.06k |

| Nacl Industries | 74.05 | 77.20 | 3.15 6.63k |

| Apollo Micro Sy | 108.95 | 113.50 | 4.55 445.81k |

| Eimco Elecon | 1,423.75 | 1,480.10 | 56.35 1.20k |

-330

November 07, 2023· 14:57 IST

Sensex Today | Harjeet Singh Arora, Managing Director at Mastertrust

In light of mounting fundamental tailwinds, the market is poised to sustain its prevailing bullish momentum into Vikram Samvat 2080. Renowned global banks and financial institutions have clearly expressed optimism towards the Indian market. The stage of a bullish scenario is being set by strong corporate performance, overwhelming domestic economic numbers, and growing expectations of the return of the Modi government, known for its pro-business policies.

FDI inflows in India stood at US $ 45.15 billion in 2014-2015 which has increased to the highest ever FDI at $83.6 billion in 2021-2022. The bullish sentiment is further bolstered by the speculation that the U.S. Federal Reserve has concluded its rate hike cycle, a factor contributing to the positive market outlook.

Investment in equity and gold should depend on your investment objective, time horizon, and risk profile, but proper asset allocation is require in the portfolio. Gold has been considered a safe-haven asset and used as a hedge against inflation. Gold should be viewed as a long-term investment option rather than a short-term investment.

Equity markets have remained volatile both in India and globally but outperformed against other asset class. One should invest in equity from a long-term investment perspective, the equity market can deliver a phenomenal return. Ideally, you should diversify investments in sync with your risk appetite and your original investment plan that you have made for achieving your short and long-term financial goals.

-330

November 07, 2023· 14:55 IST

Sensex Today | Sunil Nyati, Managing Director of Swastika Investmart:

With the Indian elections looming and an impending peak in the interest rate environment in the US, the outlook for the Indian equity markets is positive. It is expected that gold and equities will both perform well in the coming months, with gold that might further benefit from the anticipated economic slowdown in the US in 2024.

My preferred choice for investment leans heavily toward Indian equities as the favored asset class, the Indian equity markets are poised to outshine not only gold but also other global markets.

-330

November 07, 2023· 14:52 IST

Stock Market LIVE Updates | Neuland Laboratories Q2 Results:

Net profit at Rs 89.2 crore versus Rs 38 crore and revenue up 42.2% at Rs 417.7 crore versus Rs 293.7 crore, YoY.

-330

November 07, 2023· 14:51 IST

Stock Market LIVE Updates | Mold-Tek Packaging Q2 Earnings:

Net profit down 19.1% at Rs 15.7 crore versus Rs 19 crore and revenue down 6.6% at Rs 170.4 crore versus Rs 182.5 crore, YoY.

-330

November 07, 2023· 14:44 IST

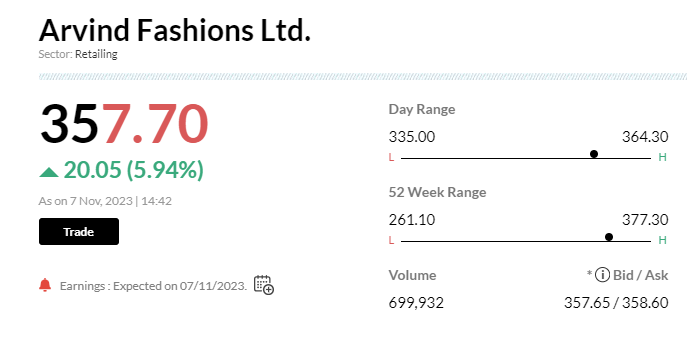

Stock Market LIVE Updates | Arvind Fashions reports Q2 earnings

- Net profit up 32% at Rs37 cr vs Rs28 cr (YoY)

- Revenue up 7.2% at Rs1,266.9 cr vs Rs1,181.8 cr (YoY)

- EBITDA up 26.8% at Rs147.3 cr vs Rs116.2 cr (YoY)

- Margin At 11.6% Vs 9.8% (YoY)

-330

November 07, 2023· 14:40 IST

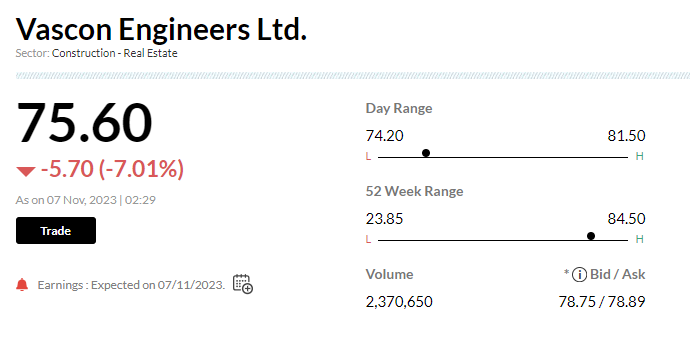

Stock Market LIVE Updates | Vascon Engineers reports Q2 earnings

- Net profit down 8.8% at Rs20. 6 cr vs Rs23 cr (YoY)

- Revenue down 0.1% at Rs217.1 cr vs Rs217.3 cr (YoY)

- EBITDA down 4.6% at Rs10.4 cr vs Rs10.9 cr (YoY)

- Margin at 4.8% vs 5% (YoY)

-330

November 07, 2023· 14:37 IST

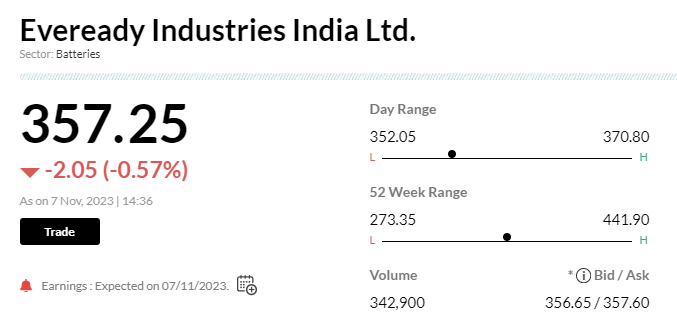

Stock Market LIVE Updates | Eveready Industries reports Q2 earnings

- Net profit up 72.8% at Rs25.4 cr vs Rs15 cr (YoY)

- Revenue down 2.9% at Rs364.9 cr vs Rs375.7 cr (YoY)

- EBITDA up 7.9% at Rs46.4 cr vs Rs43 cr (YoY)

- Margin at 12.7% vs 11.4% (YoY)

-330

November 07, 2023· 14:33 IST

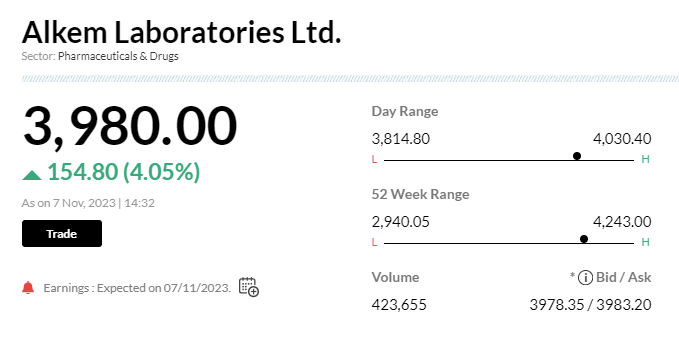

Stock Market LIVE Updates | Alkem Lab's Q2 Net Income Soars 88%, Tops Estimates

In Q2, Alkem Lab exceeded analyst expectations with a net income of Rs621 crore, marking an 88% YoY increase. Their revenue also outperformed, reaching Rs3440 crore, up 12% YoY. Notably, India sales were at Rs2330 crore, up 5% YoY, while US revenue reached Rs768 crore, a 27% YoY increase. Additionally, other regions' revenue showed a robust 28% YoY growth at Rs287 crore. However, total costs increased by 2.6% YoY to reach Rs2800 crore.

-330

November 07, 2023· 14:26 IST

-330

November 07, 2023· 14:22 IST

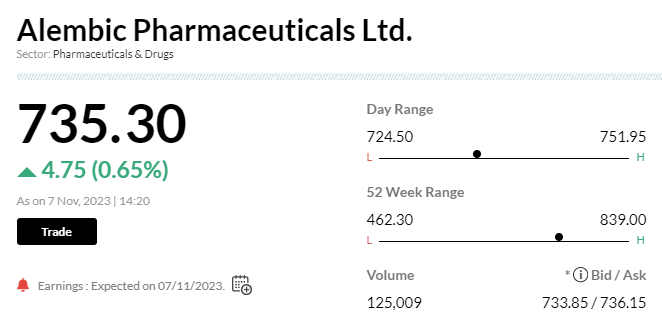

Stock Market LIVE Updates | Alembic Pharma's Q2 net income misses estimates

Alembic Pharma's second-quarter net income fell short of the average analyst estimate. Net profit reached Rs 137 crore, up 3% year-on-year, slightly below the estimated Rs 140 crore. Total costs amounted to Rs 1,470 crore, marking an 11% increase from the previous year, with raw material costs at Rs 414 crore, up 20% year-on-year. EBITDA was Rs 218 crore, down 5.6% year-on-year, compared to the estimated Rs 239 crore. Revenue reached Rs 1,590 crore, showing a 7.4% year-on-year increase, surpassing the estimated Rs 1,566 crore.

-330

November 07, 2023· 14:12 IST

-330

November 07, 2023· 14:06 IST

Stock Market LIVE Updates | Trent Q2 Results:

Standalone net profit up 55.9% at Rs 289.6 crore versus Rs 186 crore and revenue up 59% at Rs 2,891 crore versus Rs 1,814 crore, YoY.

-330

November 07, 2023· 14:05 IST

Stock Market LIVE Updates | Cochin Shipyard Q2 Earnings:

Net profit up 61% at Rs 181.5 crore versus Rs 113 crore and revenue up 48.1% at Rs 1,011.7 crore versus Rs 683.2 crore, YoY.

-330

November 07, 2023· 14:04 IST

Stock Market LIVE Updates | Rolex Rings Q2 Earnings:

Net profit down 4% at Rs 47 crore versus Rs 49 crore and revenue up 12% at Rs 321 crore vs Rs 287 crore, YoY.

-330

November 07, 2023· 13:59 IST

Stock Market LIVE Updates | Meghmani Organics Q2 Results:

Net loss of Rs 15.3 crore versus profit of Rs 66.1 crore and revenue down 41.4 percent at Rs 378.7 crore versus 645.7 crore, YoY.

-330

November 07, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Giriraj Civil D | 450.00 | 420.00 | -30.00 1.22k |

| Bombay Metrics | 130.00 | 124.05 | -5.95 1.06k |

| Inspire Films | 69.80 | 67.00 | -2.80 - |

| Bohra Industrie | 52.60 | 50.50 | -2.10 316 |

| NRB Industrial | 30.95 | 29.85 | -1.10 1.02k |

| MOS Utility | 95.50 | 92.25 | -3.25 1.40k |

| Auro Impex | 62.00 | 60.00 | -2.00 862 |

| Avalon Technolo | 513.30 | 498.20 | -15.10 19.34k |

| Lorenzini Appar | 283.10 | 275.00 | -8.10 0 |

| Harsha Engineer | 408.75 | 397.50 | -11.25 7.02k |

-330

November 07, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Dhanuka Agritec | 792.85 | 890.00 | 97.15 5.09k |

| Pansari Develop | 77.20 | 84.00 | 6.80 5.80k |

| GP Petroleums | 54.25 | 57.95 | 3.70 6.32k |

| JSW Infra | 195.45 | 207.10 | 11.65 1.09m |

| Jyothy Labs | 379.20 | 399.40 | 20.20 214.00k |

| Cineline India | 111.40 | 117.00 | 5.60 1.84k |

| Indiabulls Hsg | 162.85 | 171.00 | 8.15 533.94k |

| Texmaco Infra | 100.60 | 105.30 | 4.70 723.59k |

| Homesfy Realty | 348.00 | 364.00 | 16.00 0 |

| Sungarner | 184.00 | 192.00 | 8.00 1.62k |

-330

November 07, 2023· 13:57 IST

Stock Market LIVE Updates | Dhanuka Agritech Q2 Earnings:

Net profit up 39.5 percent at Rs 101.8 crore versus Rs 73 crore and revenue up 13.8 percent at Rs 617.9 crore versus Rs 542.9 crore, YoY.

-330

November 07, 2023· 13:56 IST

Stock Market LIVE Updates | Gujarat Heavy Chemicals Q2 Earnings:

Net profit down 50 percent at Rs 143 crore versus Rs 289 crore and revenue down 32 percent at Rs 805 crore versus Rs 1,176 crore, YoY.

-330

November 07, 2023· 13:54 IST

Stock Market LIVE Updates | Alkem Laboratories Q2 Results:

Net profit up 87.5 percent at Rs 620.5 crore versus Rs 331crore and revenue up 11.7 percent at Rs 3,440 crore versus Rs 3,079.4 crore, YoY.

-330

November 07, 2023· 13:51 IST

Sensex Today | Gaurang Shah, Senior Vice President at Geojit Financial Services:

We expect the earnings of reality companies to improve going forward from here on keeping in mind the demand along with that interest rates have been stable. A large possibility of interest rates cut coming through next year depending upon the recovery on the domestic data points. Large projects getting executed and the number of registration run rates also being on the higher side can possibly last for some time going forward from here on.

One of the stocks that we are positive on in the real estate sector is Godrej Properties.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sobha | 756.95 | -3.82 | 61.85k |

| Macrotech Dev | 832.45 | -3.34 | 27.18k |

| Godrej Prop | 1,779.00 | -2.47 | 19.99k |

| Oberoi Realty | 1,217.60 | -2.39 | 12.95k |

| Brigade Ent | 671.30 | -1.32 | 7.85k |

| Phoenix Mills | 2,030.00 | -0.99 | 3.27k |

| Prestige Estate | 800.00 | -0.06 | 22.18k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Mahindra Life | 500.75 | 1.14 | 5.88k |

| Prestige Estate | 801.55 | 0.14 | 21.58k |

-330

November 07, 2023· 13:45 IST

Stock Market LIVE Updates | Morgan Stanley View On Bharat Forge

-Overweight call, target Rs 1,176 per share

-Business outlook remains unchanged

-Increase market share in core, scale up defence & EV verticals

-To Improve profitability in overseas subsidiaries

-FY25 outlook is flattish for the export CVs

-Management was bullish on India CVs, sees challenges on renewables

-Management sees challenges in wind energy

-In defence & industrials verticals, management targets 25 percent EBITDA margin by FY25

-330

November 07, 2023· 13:40 IST

Stock Market LIVE Updates | Redington Q2 profit tanks 20% YoY to Rs 312 crore

Redington has recorded consolidated profit at Rs 311.6 crore for quarter ended September FY24, falling 20.5% compared to corresponding period last fiscal despite healthy topline, impacted by weak operating performance. Revenue from operations grew by 16.6% YoY to Rs 22,220 crore in Q2FY24.

-330

November 07, 2023· 13:34 IST

Stock Market LIVE Updates | Jyothy Labs Q2 Results:

Net profit jumped 60% at Rs 104 crore versus Rs 65 crore and revenue up 11% at Rs 732 crore against Rs 659 crore, YoY.

-330

November 07, 2023· 13:31 IST

Stock Market LIVE Updates | Info Edge Q2 Results:

Net profit up 99% at Rs 205.1 crore versus Rs 103 crore and revenue up 3.6% at Rs 625.8 crore versus Rs 604.1 crore, YoY.

-330

November 07, 2023· 13:25 IST

Stock Market LIVE Updates | HSBC View On Container Corporation of India:

-Hold call, target raised to Rs 780 per share

-Strong performance in Q2 both on volume growth as well as on profitability

-Earnings downgrade cycle seems to be over

-Volume growth likely to be strong in the near term while margins remain soft

-330

November 07, 2023· 13:20 IST

Stock Market LIVE Updates | NHPC Q2 profit rises 0.7% YoY to Rs 1,546 crore

NHPC has recorded consolidated profit at Rs 1,546 crore for July-September period of FY24, rising 0.7% over a year-ago period despite lower topline and operating performance, supported by tax write back. Consolidated revenue from operations increased by 11.6% YoY to Rs 2,931.3 crore during the quarter. Meanwhile, the company said the board has approved the Joint Venture Agreement for formation of joint venture company, between NHPC and Andhra Pradesh Power Generation Corporation, for implementation of pumped storage hydro power projects and renewable energy projects in Andhra Pradesh.

-330

November 07, 2023· 13:17 IST

Stock Market LIVE Updates | Jefferies View On HPCL

-Underperform call, target Rs 225 per share

-EBITDA ahead on higher inventory gains despite weaker refining margins

-Refining margins have fallen sharply in Q3FY24 lowering marketing losses

-Earnings should be sharply lower in H2FY24

-Earnings should be lower due to continued marketing loss in diesel & compressed GRM

-Election heavy calendar could preclude any possibility of a retail fuel price hike

-Raise FY24E EBITDA on a better H1FY24 result

-330

November 07, 2023· 13:12 IST

Stock Market LIVE Updates | Ujjivan Financial Services Q2 profit drops 12% YoY to Rs 226 crore, but revenue up 44%

Ujjivan Financial Services has recorded consolidated profit at Rs 225.8 crore for quarter ended September FY24, falling 12% compared to year-ago period, impacted by impairment on financial instruments. Revenue from operations grew by 44% YoY to Rs 1,496.2 crore during the quarter.

-330

November 07, 2023· 13:07 IST

Stock Market LIVE Updates | Rajesh Sadashiv Ingle elevated as Chief General Manager in Bank of India

Rajesh Sadashiv Ingle has been elevated to the post of Chief General Manager of the Bank of India, with effect from November 6. Rajesh Sadashiv Ingle was the general manager of the bank.

-330

November 07, 2023· 13:05 IST

Stock Market LIVE Updates | Jefferies View On Bharat Forge:

-Underperform call, target Rs 850 per share

-Q2 consolidated EBITDA rose 45 percent YoY but was 8 percent below estimate

-Weak performance of subsidiaries

-Standalone EBITDA grew 36 percent YoY & was in-line

-Timing of the long-awaited domestic gun order remains uncertain

-Like company’s structural story

-Concerned on cyclical headwinds in exports & rich valuations

-Cut FY24E EPS by 9 percent, fine-tune FY25-26 EPS

-330

November 07, 2023· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was down 197.67 points or 0.30 percent at 64,761.02, and the Nifty was down 44.50 points or 0.23 percent at 19,367.30. About 1662 shares advanced, 1478 shares declined, and 97 shares unchanged.

-330

November 07, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Simplex Papers | 1,003.85 | 915.10 | -88.75 3.58k |

| Diamines Chem | 505.00 | 475.15 | -29.85 120 |

| Rishi Laser | 59.82 | 56.51 | -3.31 106 |

| Remi Edelstahl | 58.00 | 55.00 | -3.00 1.54k |

| Munoth Fin Serv | 73.38 | 69.75 | -3.63 0 |

| Deccan Cements | 546.00 | 519.50 | -26.50 246 |

| Fine-line Circ | 74.00 | 70.50 | -3.50 1.39k |

| PH CAPITAL | 74.00 | 70.52 | -3.48 3 |

| Guj Raffia Ind | 32.64 | 31.15 | -1.49 26 |

| Anjani Foods | 29.91 | 28.55 | -1.36 9 |

-330

November 07, 2023· 12:57 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sugal & Damani | 20.96 | 23.35 | 2.39 206 |

| First Custodian | 53.35 | 58.95 | 5.60 101 |

| Nutech Global | 35.63 | 38.96 | 3.33 24 |

| RRIL | 25.37 | 27.70 | 2.33 21.82k |

| Alfred Herbert | 770.00 | 835.00 | 65.00 1 |

| U. H. Zaveri | 52.65 | 56.99 | 4.34 142 |

| OXYGENTA PHARMA | 29.09 | 31.30 | 2.21 3.39k |

| CIL Nova Petro | 27.10 | 29.15 | 2.05 1.57k |

| Anik Industries | 44.06 | 47.00 | 2.94 1.76k |

| Aveer Foods | 461.15 | 488.95 | 27.80 0 |

-330

November 07, 2023· 12:51 IST

Stock Market LIVE Updates | Emami Q2 profit drops 3 YoY to Rs 178.5 crore

Emami has registered a 3.1% on-year fall in consolidated profit at Rs 178.5 crore for quarter ended September FY24 despite healthy operating performance, dented by lower other income. Consolidated revenue from operations increased by 6% YoY to Rs 864.5 crore in Q2FY24, with domestic business growing 4% and international business growth at 12%. EBITDA jumped 20% on-year to Rs 234 crore and margin expanded by 300 bps to 27% during the quarter.

-330

November 07, 2023· 12:49 IST

Sensex Today | Advanced Enzyme Technologies Q2 Results:

Net profit up 31.3% at Rs 34.4 crore versus Rs 26 crore and revenue up 13.9% at Rs 157.8 crore versus Rs 138.6 crore, YoY.

-330

November 07, 2023· 12:46 IST

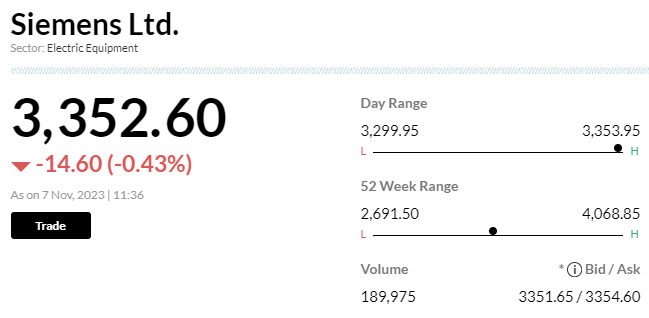

Stock Market LIVE Updates | Siemens AG reportedly seeking discount for purchase of Siemens Ltd shares, stock trades lower

Shares of Siemens were trading nearly 0.6 percent lower on the NSE at 11 am on November 7 after it was reported by Reuters that Siemens AG was seeking a discount from Siemens Energy for any possible purchases of shares in their Indian joint venture Siemens Ltd. At 11:22 am, the stock was trading at Rs 3,346.30.

Last week, it was also reported that Siemens Energy is weighing the sale of a part of its stake in Siemens Ltd. Siemens Energy currently has a 24 percent stake while Siemens AG owns 51 percent stake in Siemens ltd.

Citing two sources, the Reuters report added that Siemens AG hopes for a discount of around 15 percent. While both companies in principle agree that a deal makes sense, the report added that talks are ongoing. Read More

-330

November 07, 2023· 12:44 IST

Stock Market LIVE Updates | HPCL jumps over 3% after PSU refiner swings to Rs 5,827-cr profit in Q2

Shares of Hindustan Petroleum Corporation Limited (HPCL) rallied nearly 3.5 percent on November 7 as the oil refining and marketing PSU swung to a stellar net profit in Q2 FY24 on the back of lower crude prices. At 11:37am, the stock was trading at Rs 271.90 on the NSE.

HPCL on November 6 reported a consolidated net profit of Rs 5,826.96 crore for the second quarter of 2023-24, turning into green from Rs 2,476 crore in the red a year back because of record-high crude oil prices.

HPCL beat Bloomberg estimates of Rs 2,990 crore net profit the second quarter. Healthier marketing margins from last year helped the company book profits in the quarter. Read More

-330

November 07, 2023· 12:37 IST

Sensex Today | BSE Metal index up 0.5 percent led by NMDC, Hindalco Industries, Jindal Steel:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NMDC | 163.20 | 1.78 | 580.72k |

| Hindalco | 487.50 | 1.3 | 71.92k |

| Jindal Steel | 630.00 | 1.1 | 65.79k |

| Vedanta | 234.65 | 0.64 | 441.25k |

| Coal India | 318.00 | 0.44 | 226.16k |

| JSW Steel | 756.80 | 0.44 | 20.75k |

| Tata Steel | 119.80 | 0.34 | 1.03m |

-330

November 07, 2023· 12:33 IST

-330

November 07, 2023· 12:26 IST

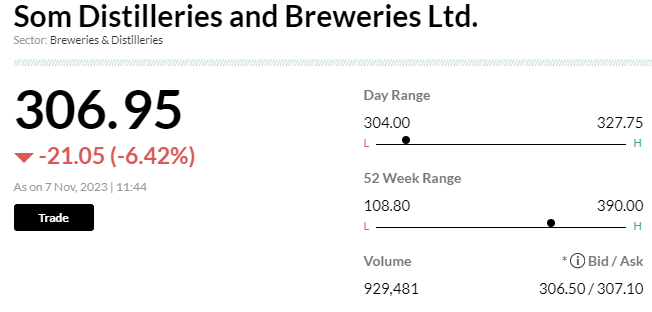

Stock Market LIVE Updates | Som Distilleries declines over 7% on reports of income tax search

Shares of Som Distilleries & Breweries Ltd tanked over 7 percent on November 7 following reports of an income tax search operation at the company premises but later recouped some losses.

According to CNBC TV-18, the income tax department began a search operation at the various premises of Som Group of Companies across the country, including Bhopal, Jabalpur and Indore, on November 7.

The company recently called off its Rs 350-crore QIP offer because of poor demand. It had planned to raise funds for expanding the beer facility in Karnataka by 60 lakh cases annually. In April, they also announced a Rs 300-crore investment in a new unit in Maharashtra. Som Distilleries and Breweries is a prominent producer of various alcoholic beverages. Read More

-330

November 07, 2023· 12:23 IST

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Marshall Machin | 835087.00 | 51.40 -4.99 | 18883 208820.85 |

| Plaza Wires | 756807.00 | 127.95 -4.98 | 6104620 0.00 |

| Peninsula Land | 1490329.00 | 43.20 -4.95 | 278964 2359832.05 |

| AMD Industries | 1.00 | 78.35 -4.45 | 101801 145521.55 |

| Winsome Yarns | 380390.00 | 5.05 -1.94 | 4313 8036.95 |

-330

November 07, 2023· 12:21 IST

Sensex Today | Prashanth Tapse Sr VP Research Analyst at Mehta Equities:

Flat listing was in line with our expectation, despite aggressive pricing and high ask valuations, though risky investors feel the price is good for long-term as the business model has high potential of growth. We would continue to remain cautious on Mamaearth on the back of the loss-making nature of the business, high portion of OFS, high competition with margin pressure, low promoter stake, and weak financials which suggest a cautionary stand as historical listings with high valuations have often faced post-listing challenges.

-330

November 07, 2023· 12:15 IST

Stock Market LIVE Updates | DB Realty Q2 Results:

Net profit up 55.5% at Rs 884.2 crore against Rs 569 crore and revenue at Rs 68 crore versus Rs 10 crore, YoY.

-330

November 07, 2023· 12:13 IST

-330

November 07, 2023· 12:09 IST

Stock Market LIVE Updates | Zydus Lifesciences Q2 Earnings:

Net profit up 53.5% at Rs 802 crore versus Rs 522 crore and revenue up 9.1% at Rs 4,369 crore versus Rs 4,005.5 crore, YoY.

-330

November 07, 2023· 12:08 IST

Stock Market LIVE Updates | L&T Construction bags order in the range of Rs 1,000-2,500 crore

Water & Effluent Treatment Business of L&T Construction has secured repeat orders from the Water Resources Department, Government of Odisha to execute Cluster XXII & Cluster XXV Mega Lift Irrigation Projects.

The Business has also secured an add-on order from the Water Resources Department, Government of Madhya Pradesh to execute Pressurized Piped Lift Irrigation Projects on a turnkey basis to irrigate about 34,942 Ha of culturable command area in the Dewas District of Madhya Pradesh.

-330

November 07, 2023· 12:06 IST

Stock Market LIVE Updates | KPI Green Energy bags repeat orders for 2.70 MW solar power projects

KPI Green Energy has received repeat orders for 2.70 MW for executing solar power projects under ‘Captive Power Producer (CPP)’ Segment of the company.

With addition of the order mentioned above, the cumulative orders of solar power projects, till date have crossed 115+ MW under CPP segment, company said.

-330

November 07, 2023· 11:59 IST

| Company | Price at 11:00 | Price at 11:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sahana Systems | 491.40 | 465.00 | -26.40 336.19k |

| IRIS Business S | 126.25 | 119.50 | -6.75 15.97k |

| Atam Valves | 156.60 | 149.00 | -7.60 9.62k |

| Digjam | 84.00 | 80.10 | -3.90 647 |

| Anik Industries | 46.05 | 44.00 | -2.05 100.11k |

| Frog Cellsat | 237.95 | 228.00 | -9.95 4.04k |

| RBM Infracon | 281.00 | 270.00 | -11.00 1000 |

| NRB Industrial | 31.10 | 29.95 | -1.15 53 |

| INFOLLION | 192.00 | 185.00 | -7.00 7.09k |

| Welspun Invest | 671.50 | 648.40 | -23.10 105 |

-330

November 07, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Orchid Pharma | 510.85 | 551.40 | 40.55 3.49k |

| SecMark Consult | 84.75 | 90.00 | 5.25 340 |

| IFGL Refractory | 586.25 | 621.40 | 35.15 74.01k |

| Plastiblends | 273.35 | 288.55 | 15.20 6.11k |

| Rajgor Castor | 53.00 | 55.90 | 2.90 25.82k |

| Hb Stockhol | 55.00 | 57.75 | 2.75 1.90k |

| On Door Concept | 167.20 | 174.95 | 7.75 - |

| CSL Fin | 340.00 | 353.95 | 13.95 68.14k |

| Precot | 212.30 | 220.90 | 8.60 2 |

| Crayons | 139.10 | 144.45 | 5.35 2.29k |

-330

November 07, 2023· 11:57 IST

Stock Market LIVE Updates | Devyani International Q2 Results

Net profit down 43% at Rs 33.3 crore versus Rs 58.7 crore and revenue up 10% at Rs 819 crore versus Rs 747 crore, YoY.

-330

November 07, 2023· 11:54 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| UltraTechCement | 8,659.00 | 8,659.85 8,587.65 | -0.01% |

| SRF | 2,348.50 | 2,349.00 2,322.80 | -0.02% |

| Route | 1,559.00 | 1,559.25 1,540.05 | -0.02% |

| Capri Global | 767.00 | 767.20 748.40 | -0.03% |

| Schaeffler Ind | 2,768.95 | 2,769.75 2,727.85 | -0.03% |

| Kajaria Ceramic | 1,296.45 | 1,297.00 1,270.60 | -0.04% |

| Zydus Life | 596.55 | 596.95 584.40 | -0.07% |

| Siemens | 3,351.45 | 3,353.80 3,299.75 | -0.07% |

| Syngene Intl | 716.45 | 717.00 709.25 | -0.08% |

| Jindal Steel | 632.10 | 632.75 619.70 | -0.1% |

-330

November 07, 2023· 11:50 IST

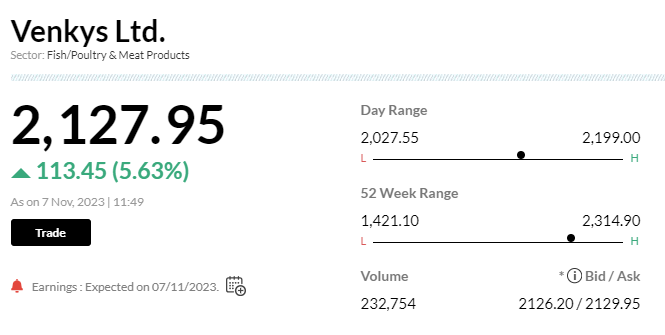

Stock Market LIVE Update | Venkys reports Q2 net profit at Rs 34.1 crore against loss year ago

Venky's reported a net profit of Rs 34.10 crore in the July-September quarter, marking a stark improvement from the net loss of Rs 20.60 incurred in the same period of the previous fiscal. However, revenue fell nearly 5 percent to Rs 912.60 crore while margins remained at 5.44 percent.

-330

November 07, 2023· 11:46 IST

Stock Market LIVE Update | Som Distilleries plunges over 7% on reports of income tax search

Shares of Som Distilleries & Breweries Ltd tanked over 7 percent on November 7 following reports of an income tax search operation at the company premises but later recouped some losses.

According to CNBC TV-18, the income tax department began a search operation at the various premises of Som Group of Companies across the country, including Bhopal, Jabalpur and Indore, on November 7.

The company recently called off its Rs 350-crore QIP offer because of poor demand. It had planned to raise funds for expanding the beer facility in Karnataka by 60 lakh cases annually. In April, they also announced a Rs 300-crore investment in a new unit in Maharashtra. Som Distilleries and Breweries is a prominent producer of various alcoholic beverages.

-330

November 07, 2023· 11:41 IST

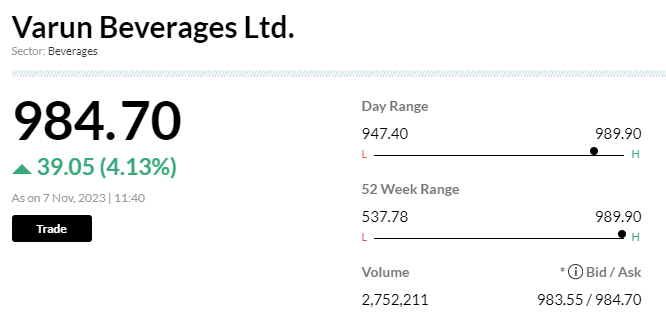

Stock Market LIVE Update | Varun Beverages shares rise 4% on healthy Q2 profit, revenue

Shares of Varun Beverages rose over 4 percent on November 7 after the company reported a healthy set of September quarter results. Its net profit jumped nearly 30 percent to Rs 514.05 crore and revenue rose 21 percent to Rs 3,937.75 crore, with volume growth and higher realisation driving sales and low raw material prices aiding margin expansion.

Analysts are largely positive on the PepsiCo bottler as they believe that the company is doing exceeding well in the FMCG category, led by expanding the go-to-market, unlike peers, and penetration in rural areas. It continues to maintain its growth momentum guidance for CY23, supported by its robust on-ground execution, expanding manufacturing capacities, and increasing distribution reach.

Axis Securities expects Varun Beverages to continue its market-leading performance on account of normalized Operations along with market share gains in newly-acquired territories; Management’s continued focus on the efficient go-to-market execution in acquired and underpenetrated territories as reflected in its recently commissioned Bihar plant operations.

-330

November 07, 2023· 11:37 IST

Stock Market LIVE Update | Siemens AG reportedly seeking discount for purchase of Siemens Ltd shares, stock trades lower

Shares of Siemens were trading lower on November 7 after it was reported by Reuters that Siemens AG was seeking a discount from Siemens Energy for any possible purchases of shares in their Indian joint venture Siemens Ltd.

Last week, it was also reported that Siemens Energy is weighing the sale of a part of its stake in Siemens Ltd. Siemens Energy currently has a 24 percent stake while Siemens AG owns 51 percent stake in Siemens Ltd.

Citing two sources, the Reuters report added that Siemens AG hopes for a discount of around 15 percent. While both companies in principle agree that a deal makes sense, the report added that talks are ongoing.

-330

November 07, 2023· 11:31 IST

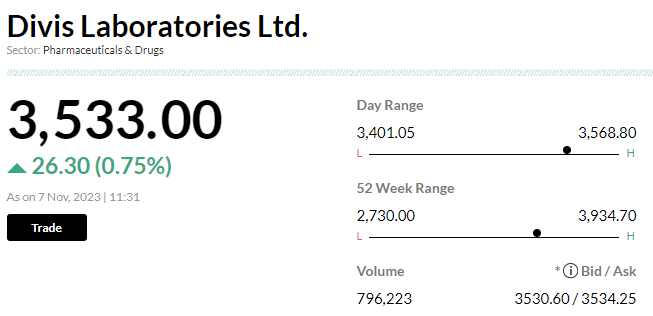

Stock Market LIVE Update | Jefferies downgrades Divi's Labs, slashes price target

-Downgrade to Hold, target cut to Rs 3,510 from Rs 4,300 per share

-Q2 a miss on lower sales and higher opex leading to margin contraction

-While there should be a sequential pick-up from Q3

-Key growth drivers like scale up in contrast media new capacities are a year away

-Cut FY24-26E EPS by 15-18%

-330

November 07, 2023· 11:26 IST

-330

November 07, 2023· 11:18 IST

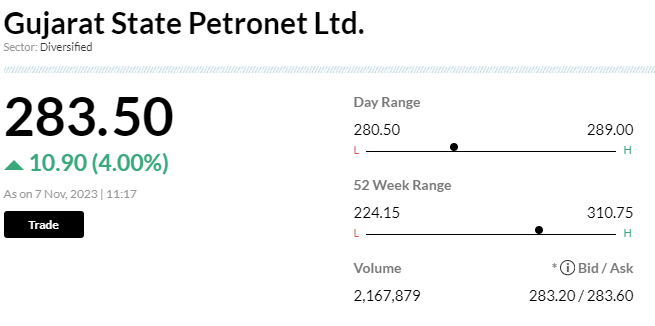

Stock Market LIVE Update | Gujarat State Petronet rises 4% on good Q2 show

Shares of Gujarat State Pertronet (GSPL) jumped more than 4 percent in early trade on November 7 post registering robust profit growth of 36 percent on QoQ basis to Rs 590 crore.

Gujarat State Petronet, a prominent gas transmission company, has released its financial results for the quarter ending in September of the fiscal year 2023-24.

The company's performance during this period exhibited remarkable strength, with a consolidated profit of Rs 590.4 crore. This figure represents a substantial 36 percent growth when compared to the previous quarter, highlighting the company's robust and dynamic operating performance.

-330

November 07, 2023· 11:09 IST

Stock Market LIVE Updates | Atul board approves upto Rs 50 crore share buyback at Rs 7,500 per share

The Board of Directors of Atul at its meeting held on November 07, 2023, has, approved the buy-back of fully paid up equity shares by the company having face value of Rs 10 each from open market through stock exchanges at a price not exceeding Rs 7,500 per equity share.

-330

November 07, 2023· 11:07 IST

-330

November 07, 2023· 11:05 IST

Sensex Today | Maitreya Medicare lists at 98%, Mish Designs at 31% premium to IPO prices

Maitreya Medicare shares made a bumper debut on November 7, listing at a 98.2 percent premium to the issue price, while the Mish Designs stock opened at a 31 percent premium.

The Maitreya stock opened at Rs 162.55 as against the issue price of Rs 82 on the NSE SME platform while Mish Designs shares listed at Rs 160 against the IPO price of Rs 122 on BSE SME.

The Mish Designs IPO received a decent response from investors. The Rs 9.76-crore issue was subscribed 135 times. The price for the issue, which opened for subscription on October 31 and closed on November 2, was fixed at Rs 122 per share. Read More

-330

November 07, 2023· 11:01 IST

Sensex Today | Market at 11 AM

The Sensex was down 147.17 points or 0.23 percent at 64,811.52, and the Nifty was down 29.40 points or 0.15 percent at 19,382.40. About 1708 shares advanced, 1293 shares declined, and 139 shares unchanged.

-330

November 07, 2023· 10:57 IST

Stock Market LIVE Updates | Geojit View on Larsen & Toubro:

The company delivered a remarkable earnings performance in Q2FY24, with substantial revenue and order growth across segments. The management is confident of surpassing the earlier guidance of revenue (12-15%) and order inflow (10-12%) growth thanks to the exceptional execution of projects in H1FY24 and higher order inflow prospects.

Remain optimistic about the company's outlook and reiterate BUY rating on the stock with a revised target price of Rs 3,348 based on SOTP valuation.

-330

November 07, 2023· 10:54 IST

Stock Market LIVE Updates | Anupam Rasayan Q2 Results:

Net profit fell 2.2 percent at Rs 40.6 crore versus Rs 41.5 crore and revenue down 0.2 percent at Rs 392.1 crore versus Rs 392.7 crore, YoY.

-330

November 07, 2023· 10:52 IST

Stock Market LIVE Updates | Keystone Realtors arm to acquire 100% equity of Real Gem BuildTech

Kingmaker Developers Private Limited – a 100% owned subsidiary of Keystone Realtors has entered into share purchase agreement to acquire 100% equity share and all preference share from existing shareholders of Real Gem BuildTech Private Limited.

-330

November 07, 2023· 10:47 IST

Stock Market LIVE Updates | Jefferies On Divis Laboratories

-Downgrade to hold, target cut to Rs 3,510 from Rs 4,300 per share

-Q2 a miss on lower sales & higher opex leading to margin contraction

-While there should be a sequential pick-up from Q3

-Key growth drivers like scale up in contrast media new capacities are a year away

-Cut FY24-26E EPS by 15-18 percent

-330

November 07, 2023· 10:45 IST

-330

November 07, 2023· 10:40 IST

Sensex Today | ICICI Securities View on PB Fintech:

PB Fintech’s (PBF) H1FY24 performance continues to track along the expected lines of strong premium growth, especially in health/term along with credit disbursement growth, stable contribution margins, rangebound fixed costs and controlled losses in new initiatives.

The roadmap remains to become profitable in FY24 while aiming ~ Rs 10 billion in adjusted PAT by FY27. The crux of the business remains an exponential increase in contribution driven by (1) renewals, (2) new business growth and (3) efficiencies in new business growth.

Maintain ADD with DCF-based target price of Rs 818 (unchanged), implying a valuation multiple of ~40x for FY27E.

-330

November 07, 2023· 10:38 IST

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

Honasa Consumer, a leading Indian beauty and personal care (BPC) company, made its stock market debut today at Rs 330 per share, a premium of around 2% to its IPO price of Rs 324. The IPO was subscribed to 7.95 times, which is a good subscription level.

While Honasa Consumer is still a relatively young company, it has quickly grown to become a major player in the Indian BPC market. The company has a diverse product portfolio that includes face care, baby care, hair care, body care, color cosmetics, and fragrances. However, the financial condition of the company is facing some turbulence, and there are other operation-related risks as well.

After receiving a decent subscription, stock was able to give a positive listing. Investors are now suggested to book profit and exit their position.

-330

November 07, 2023· 10:36 IST

Stock Market LIVE Updates | Gland Pharma Q2 profit plunges 20% YoY to Rs 194 crore

Gland Pharma has recorded consolidated profit at Rs 194.1 crore for July-September period of FY24, falling 20% despite healthy topline, impacted by weak EBITDA margin performance. Consolidated revenue increased by 32% YoY to Rs 1,373.4 crore in Q2FY24.

-330

November 07, 2023· 10:29 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 19368.85 -0.22 | 6.98 1.52 | -1.45 6.41 |

| NIFTY BANK | 43433.30 -0.43 | 1.04 1.37 | -2.09 4.19 |

| NIFTY Midcap 100 | 40079.45 0.36 | 27.20 3.09 | -0.51 25.39 |

| NIFTY Smallcap 100 | 13159.00 0.11 | 35.22 4.02 | 2.51 33.78 |

| NIFTY NEXT 50 | 45305.70 0.17 | 7.39 2.92 | 0.79 4.67 |

-330

November 07, 2023· 10:23 IST

Stock Market LIVE Updates | Prabhudas Lilladher View on Emami:

Broking house increase FY24E/FY25E EPS estimates by 3.6%/2.1% following higher than expected gross margin expansion and higher volume growth at 2% in 2Q.

Emami has given cautiously optimistic outlook given benign raw material prices, expected pickup in rural demand and likely traction from various new launches under Zandu and international business.

2Q saw volume growth of 2% led by robust growth in both MT & E-com channel. HMN remains positive on OTC Healthcare, Navratna & new launches under Boroplus.

Emami is investing for growth with 1) new launches in existing categories like Boroplus, Zandu, Kesh King and new product launches in D2C 2) investment in new D2C new age businesses & Modern Trade 3) increase in direct town coverage to 60k and 4) strengthen its healthcare portfolio with acquisition of Axiom Ayurveda (blend of fruit juice and aloe Vera).

Prabhudas Lilladher estimate 9.6% PAT CAGR over FY23-26 and value the stock at 26x Sep25 EPS assigning a value of Rs564 (Rs524 earlier). Retain Accumulate.

-330

November 07, 2023· 10:21 IST

Sensex Today | Nifty Pharma up 0.5 percent Zydus Lifesciences, Aurobindo Pharma, Dr Reddy's Laboratories:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Zydus Life | 595.35 | 1.8 | 294.84k |

| Aurobindo Pharm | 888.80 | 1.72 | 493.44k |

| Dr Reddys Labs | 5,427.95 | 1.68 | 159.14k |

| Alkem Lab | 3,869.25 | 1.15 | 55.19k |

| Torrent Pharma | 1,979.35 | 0.65 | 51.15k |

| Sun Pharma | 1,157.50 | 0.65 | 227.49k |

| Lupin | 1,204.25 | 0.41 | 254.30k |

| Cipla | 1,208.80 | 0.39 | 190.31k |

-330

November 07, 2023· 10:15 IST

Stock Market LIVE Updates | Radico Khaitan gains 2% on healthy Q2 results, stock up 28% so far this year

Shares of Radico Khaitan gained 2 percent to trade at Rs 1,328 on November 7 after the company put up a strong September-quarter (Q2FY24) performance. The S&P BSE Sensex was down 170 points or 0.2 percent to 64,788 levels, as of 9:20am.

Radico Khaitan’s consolidated net profit grew 19 percent on-year to Rs 64.8 crore in Q2FY24, led by strong demand for premium brands, while revenue from operations surged 23 percent on-year to Rs 3,715 crore. Read More

-330

November 07, 2023· 10:09 IST

Stock Market LIVE Updates | Tata Communications in multi-year agreement with Singapore Airlines

Tata Communications and Singapore Airlines announced a multi-year agreement to transform the airlines communications and collaboration tools to enhance employee productivity and boost user experience.

-330

November 07, 2023· 10:06 IST

Sensex Today | Mamaearth-parent Honasa Consumer sees tepid listing on bourses

Despite oversubscription, Honasa Consumer saw an uninspiring start on the bourses on November 7. Shares of Mamaearth's parent company started trading at Rs 330 on the NSE and Rs 324 on the BSE, against issue price of Rs 324.

Mamaearth’s IPO had sailed through, led by qualified institutional bidders (QIB) who bought 11.5 times while retail investors remained cautious, subscribing 1.4 times the allotted quota. Read More

-330

November 07, 2023· 10:03 IST