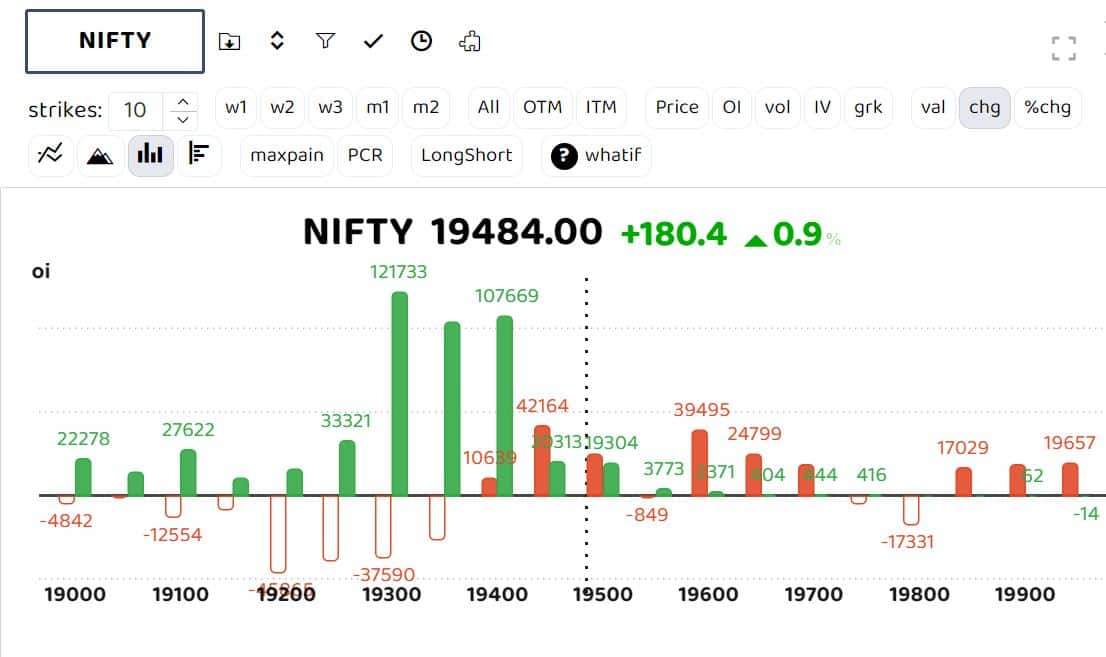

The benchmark Indian indices traded in the red on November 7 after three consecutive positive sessions, amid mixed global cues. The advance/decline ratio returned above 1.1 during the current week after recording a bearish extreme of 0.27 last week, indicating a broad-based recovery. Heavy put writing in the Nifty, seen at 19,400, forms a crucial support for the day. Analysts anticipate the index to move towards a short-term milestone of 19,600 in the coming weeks.

Analysts also expect a cooling-off in global and domestic yields, as well as a reversal in the dollar index, to be key catalysts for the acceleration of the upward movement.

Among sectors, the realty index was down 0.5 percent, while metal, PSU Bank, pharma and oil and gas were up 0.5-1 percent.

At 11am, the Sensex was down 147.17 points or 0.23 percent at 64,811.52, and the Nifty was down 29.40 points or 0.15 percent at 19,382.40. About 1,708 shares advanced, 1,293 declined, and 139 traded unchanged.

Options data suggests heavy put writing at the 19,300, 19,350, and 19,400 strikes, forming a crucial resistance for the day. "The index is expected to head towards the short-term milestone of 19,600 in the coming weeks, as it is the placement of the resistance trend line drawn adjoining September-October highs. Therefore, any temporary cool-off should be capitalised on to accumulate quality stocks amid the progression of the earnings season," ICICI Securities said.

ICICI Securities' positive bias is further validated by the following observations:

- Bank Nifty (which holds a 36 percent weightage in Nifty) has consistently shown buying demand from the 52-week EMA. After testing the 52-week EMA in each of the past three occasions post-Covid lows, Bank Nifty rallied back to highs. Thus, ICICI Securities expects banking to lead the recovery in the coming weeks.

- The formation of a higher low signifies supportive efforts at an elevated support base, prompting a revision of the support base upward to 19,000, as it coincides with the confluence of the 200-day EMA and last week’s low of 18,940.

Among individual stocks, JK Cements, Aartiind, Deepak Nitrite witnessed long build-up, while Bank of Baroda, UPL and Idea saw short build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.