Closing Bell: Market mayhem: Nifty, Sensex tanks almost 3% on global sell-off

-330

August 05, 2024· 16:26 IST

Market Close | Sensex, Nifty down nearly 3% each

Indian benchmark indices shed more than 2.5 percent on August 5 with Nifty at 24,050. At close, the Sensex was down 2,222.55 points or 2.74 percent at 78,759.40, and the Nifty was down 662.10 points or 2.68 percent at 24,055.60.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

August 05, 2024· 16:00 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

Domestic equity indices came under the grip of global markets carnage as a host of external factors like recession fears in the US on the back of weak jobs data, interest rate hike in Japan leading to impact on Yen-carry trade and a raging Middle East conflict triggered massive sell-off across the board. Such corrections in the past were temporary and we saw the market rebounding fast. But we fear that this time it will be quite different from history.

Our advice for traders is trading positions should be trimmed or strict stop losses should be observed on either side of trade and option writers should be careful. Investments with a 2/3-year horizon can be considered to allocate funds in a phase wise manner. Technically, Nifty closing below 24000 would be seen as sentimentally negative with support at 23800 and any move above 24,125 would push the index towards 24,200 and 24,300 levels.

-330

August 05, 2024· 15:55 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

Nifty opened gap down and traded with a negative bias throughout the day. It closed down ~670 points today. The Nifty has breached below the budget day low of 24075 and hence violating the uptrend. It has decisively closed below the 20-day moving average (24575) indicating weakness.

We believe that the Nifty is in the process of retracing the rally it witnessed from 21280 – 25078. Crucial Fibonacci retracement level is placed at 23628 and 23280 is the 20-week moving average. On the upside immediate hurdle is placed at 24300 – 24350.

The bank Nifty has also breached and closed below the previous swing low of 50440 suggesting continuation of the fall and is likely to drift lower towards 47650 – 47500 where the 200-day moving average is placed. The 20-week moving average is placed at 49800, which can provide some relief however rallies towards 50400 – 50500 should be used as a selling opportunity.

-330

August 05, 2024· 15:47 IST

Ajit Mishra – SVP, Research, Religare Broking

Markets plunged sharply on Monday, losing over 2.5% due to weak global cues. After a gap-down start, Nifty inched gradually lower throughout the day, briefly breaching the 50-day EMA support zone around 23,950 before closing at 24,055.60 level. All key sectors declined in line with the benchmark, with realty, metal, and energy being the top losers. The broader indices also suffered, losing between 3.6% and 4.6%.

Going forward, we may see continued volatile swings with a negative bias due to multiple global headwinds, including the unwinding of Yen carry trades, recession fears in the US, and escalating tensions in the Middle East.

On the index front, we are eyeing the 23,250-23,400 zone as key support for Nifty, while the 24,500-24,700 zone will act as resistance in the event of a rebound. Traders should align their positions accordingly and prefer a hedged approach. Investors, on the other hand, should view this correction as an opportunity to accumulate quality stocks on dips.

-330

August 05, 2024· 15:47 IST

Vinod Nair, Head of Research, Geojit Financial Services

The global market was jolted into a cautious mode by recessionary fears in the US following disappointing job statistics and an unwinding of carry trade following the rapid rise of the yen. The effects were felt by the domestic market as well and is expected to impact in the near-term.

Nevertheless, the market showed resilience at day's low and recovered to close above 24,000.

Historically, the Indian market had showcased a solid track record of outperformance compared to the global market, in the long-term. This trend is expected to stay as GDP growth is forecast to be robust for the decade aided by progressive policies, fiscal prudence, and a favourable political landscape.

-330

August 05, 2024· 15:33 IST

Currency Check | Rupee closes at record low

Indian rupee ended 10 paise lower at record low at 83.84 per dollar on Monday versus Friday's close of 83.74

-330

August 05, 2024· 15:30 IST

Market Close | Nifty at 24,050, Sensex slips 2,223 on global sell-off

Indian benchmark indices shed more than 2.5 percent on August 5 with Nifty at 24,050.

At close, the Sensex was down 2,222.55 points or 2.74 percent at 78,759.40, and the Nifty was down 662.10 points or 2.68 percent at 24,055.60. About 471 shares advanced, 3082 shares declined, and 88 shares unchanged.

Biggest Nifty losers were Tata Motors, Adani Ports, ONGC, Hindalco, Tata Steel, while gainers included HUL, Nestle, Tata Consumer, HDFC Life.

All the sectoral indices ended in the red with auto, metal, capital goods, oil & gas, power, media, realty down 4 percent each.

BSE Midcap index shed 3.6 percent and Smallcap index fell 4.2 percent.

-330

August 05, 2024· 15:26 IST

Stock Market LIVE Updates | Sensex recovers 440 points from day's low

-330

August 05, 2024· 15:25 IST

Sensex Today | BSE Power index down 4%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Energy | 1,167.60 | -7.41 | 288.15k |

| CG Power | 690.90 | -5.74 | 460.69k |

| Adani Green Ene | 1,780.90 | -5.29 | 79.41k |

| JSW Energy | 684.50 | -5.25 | 262.46k |

| Suzlon Energy | 68.09 | -4.69 | 31.11m |

| Power Grid Corp | 342.10 | -4.44 | 309.17k |

| Tata Power | 439.90 | -4.43 | 1.56m |

| Adani Power | 694.80 | -4.35 | 1.15m |

| NHPC | 99.50 | -3.73 | 6.68m |

| Siemens | 6,682.80 | -2.85 | 20.34k |

-330

August 05, 2024· 15:19 IST

Earnings watch | Som Distilleries Q1 net profit jumps 20.2% at Rs 40.5 crore Vs Rs 33.7 crore, YoY

-330

August 05, 2024· 15:12 IST

Earnings watch | Honeywell Automation Q1 net profit up 32% at Rs 136.5 crore Vs Rs 103.4 crore, YoY

-330

August 05, 2024· 15:11 IST

Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee hit fresh all-time low on Monday on sell-off in broader global markets. Global markets witnessed a sell-off amid rising geopolitical tensions in the Middle East and worries over recession in the US. However, a weak US Dollar and a decline in crude oil prices prevented a sharp decline in the Rupee.

US Dollar fell on disappointing non-farm payrolls report. US jobs rose at a slower pace than forecast while unemployment rose to 4.3% vs forecast of 4.1%. this raised rate cut expectations.

We expect Rupee to trade with a negative bias on risk aversion in the global markets. Escalation of geopolitical tensions in the Middle East and outflows by foreign investors may further pressurize the domestic unit. However, a weak US Dollar and declining crude oil prices may support the Rupee at lower levels. Any intervention by RBI may also support the Rupee.

Traders may take cues from US ISM services PMI data. Investors may watch out for RBI’s monetary policy decision this week. USDINR spot price is expected to trade in a range of Rs 83.60 to Rs 84.20.

-330

August 05, 2024· 15:06 IST

Markets#3 | Sensex down 2180 points, Nifty above 24000

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HUL | 2,719.85 | 0.98 | 176.18k |

| Nestle | 2,516.55 | 0.89 | 26.94k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 1,023.15 | -6.72 | 2.78m |

| SBI | 807.40 | -4.78 | 1.93m |

| Tata Steel | 150.80 | -4.68 | 4.07m |

| Power Grid Corp | 342.10 | -4.44 | 311.88k |

| Maruti Suzuki | 12,220.00 | -4.01 | 41.64k |

| JSW Steel | 864.95 | -3.88 | 98.01k |

| Tech Mahindra | 1,454.85 | -3.68 | 103.34k |

| Larsen | 3,532.00 | -3.66 | 236.06k |

| Infosys | 1,755.05 | -3.64 | 517.22k |

| Wipro | 484.45 | -3.5 | 273.06k |

-330

August 05, 2024· 15:05 IST

Sensex Today | HG Infra Q1 net profit up 8.3% at Rs 162.5 crore Vs Rs 150 crore, YoY

-330

August 05, 2024· 15:04 IST

Expect more volatility in Nifty, say F&O experts; heavy put writing at 23,700 strike

The India Volatility Index surged 50.84 percent to 21.6 levels, the highest in 9 years...Read More

-330

August 05, 2024· 15:01 IST

Stock Market LIVE Updates | Tata Motors July JLR UK sales up 11% at 6.121 units Vs 5,516 units, YoY

-330

August 05, 2024· 15:00 IST

Sensex Today | Nifty Auto index down 3.7%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharat Forge | 1,556.75 | -9.36 | 2.37m |

| MOTHERSON | 176.18 | -8.83 | 79.97m |

| Tata Motors | 1,021.80 | -6.83 | 23.20m |

| Balkrishna Ind | 3,168.60 | -5.3 | 257.00k |

| Bosch | 32,500.00 | -4.16 | 29.52k |

| Sona BLW | 661.00 | -4.09 | 2.86m |

| Maruti Suzuki | 12,210.00 | -4.06 | 1.06m |

| Tube Investment | 3,916.90 | -3.29 | 356.44k |

| M&M | 2,679.95 | -2.53 | 3.32m |

| TVS Motor | 2,504.30 | -2.53 | 1.51m |

-330

August 05, 2024· 14:53 IST

Stock Market LIVE Updates | GAIL inks JV agreement with Coal India to set up coal to synthetic natural gas project at Eastern Coal Field

-330

August 05, 2024· 14:49 IST

Stock Market LIVE Updates | Aster DM in advanced talks with Blackstone to expand its hospital network, CNBC-TV18 reports

CNBC-TV18 reports citing sources

-Aster DM in advanced talks with Blackstone to expand its hospital network

-Aster DM eyes Blackstone's CARE Hospital for bed expansion plan

-Aster DM & BlackStone looking at a share swap to conclude this deal

-Blackstone owns 72.5% in CARE Hospitals, Moopen Family owns 42% in Aster DM

-CNBC-TV18 reached out to Aster DM, yet to receive a response

-330

August 05, 2024· 14:41 IST

Stock Market LIVE Updates | Nifty Realty index extends fall to fourth day, slumps 15% from peak; Brigade Enterprises, Godrej Properties worst hit

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Brigade Ent | 1,125.75 | -10.51 | 292.80k |

| Godrej Prop | 2,817.05 | -6.15 | 1.64m |

| Equinox India | 124.41 | -6.13 | 6.31m |

| Sunteck Realty | 552.40 | -5.24 | 615.49k |

| Hemisphere | 199.24 | -5.18 | 1.70m |

| Phoenix Mills | 3,305.70 | -4.8 | 942.79k |

| Oberoi Realty | 1,697.85 | -4.58 | 863.10k |

| DLF | 810.90 | -3.97 | 5.20m |

| Prestige Estate | 1,632.85 | -3.71 | 1.57m |

| Sobha | 1,679.35 | -3.02 | 517.96k |

-330

August 05, 2024· 14:35 IST

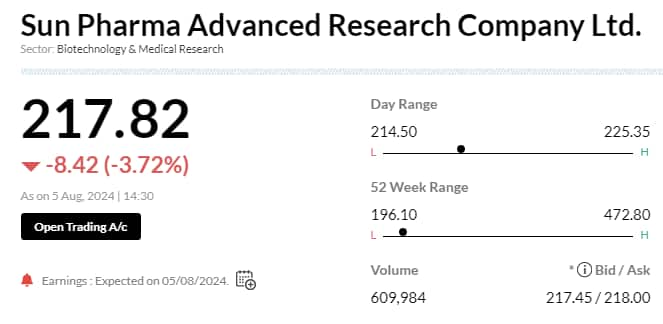

Earnings Watch | SPARC net loss slightly widens to Rs 96 crore in Q1, up from Rs 95.3 crore a year ago

-330

August 05, 2024· 14:30 IST

Adrian Mowat To CNBC-TV18

-The Impact Of Monetary Policy Is With A Lag

-Maybe Fed Is A Bit Behind The Curve, But Not Much Could Be Done About The Data

-It Will Be Terrible For The Markets To Get An Intra-Meeting Cut

-Yen Could Go Back To Being A Weak Currency

-Don’t Think Bank Of Japan Should Take The Risk Of Policy Tightening

-330

August 05, 2024· 14:26 IST

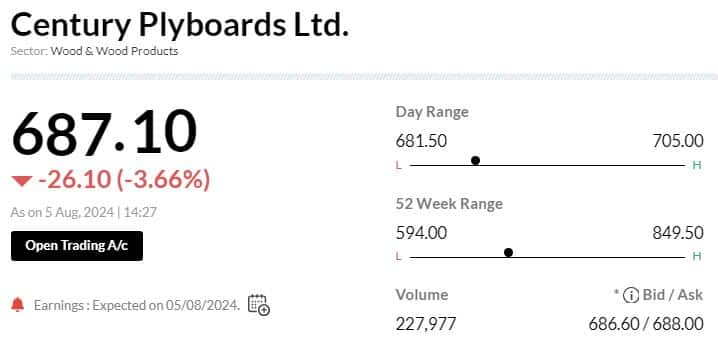

Earnings watch | Century Ply Q1 net profit down at Rs 34.4 crore Vs Rs 87 crore, YoY

-330

August 05, 2024· 14:25 IST

Sensex Today | Nifty Realty index down 4.5%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Brigade Ent | 1,132.80 | -9.95 | 275.78k |

| Godrej Prop | 2,810.25 | -6.37 | 1.60m |

| Equinox India | 124.45 | -6.1 | 6.25m |

| Sunteck Realty | 552.45 | -5.23 | 610.25k |

| Phoenix Mills | 3,301.55 | -4.92 | 932.42k |

| Hemisphere | 199.98 | -4.83 | 1.66m |

| Oberoi Realty | 1,699.50 | -4.49 | 838.56k |

| DLF | 810.70 | -4 | 5.12m |

| Prestige Estate | 1,628.55 | -3.96 | 1.54m |

| Sobha | 1,670.00 | -3.56 | 490.44k |

-330

August 05, 2024· 14:20 IST

PSU pack bleeds with Mazagon, RVNL, Cochin Ship plunging up to 8% in market selloff

PSU stocks plunged sharply, in-line with overall market, citing heavy losses in RVNL, IRFC and Mazagon Dock, as US recession worries, Yen's sudden strength and geopolitical tensions triggered a selloff....Read More

-330

August 05, 2024· 14:17 IST

Sensex Today | BSE Midcap index slips 3.5%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MOTHERSON | 174.05 | -9.98 | 4.41m |

| LIC Housing Fin | 689.90 | -7.82 | 305.75k |

| CG Power | 684.30 | -6.64 | 419.17k |

| SAIL | 136.90 | -6.43 | 4.46m |

| UCO Bank | 51.87 | -6 | 2.42m |

| GMR Airports | 92.15 | -5.97 | 2.69m |

| Nippon | 602.40 | -5.94 | 87.17k |

| Godrej Prop | 2,825.00 | -5.89 | 49.70k |

| L&T Technology | 4,810.00 | -5.74 | 21.47k |

| MphasiS | 2,616.50 | -5.68 | 14.14k |

-330

August 05, 2024· 14:14 IST

Earnings watch | Vijaya Diagnostic Q1 net profit rises 19.5% at Rs 31.3 crore Vs Rs 26 crore, YoY

-330

August 05, 2024· 14:12 IST

Earnings watch | Sundaram Finance Q1 net profit up 16% at Rs 435 crore Vs Rs 375 crore, YoY

-330

August 05, 2024· 14:11 IST

Stock Market LIVE Updates | ONGC shares fall 5% ahead of Q1 earnings

-330

August 05, 2024· 14:07 IST

Treasuries surge as traders bet on emergency Fed rate cut

Previous worries about the risk of elevated inflation have virtually disappeared, swiftly giving way to speculation that growth will stall unless the central bank starts pulling interest rates down from a more than two-decade high. Traders now see a roughly 60% chance of an emergency quarter-point cut within one week....Read More

-330

August 05, 2024· 14:02 IST

Markets@2 | Sensex down 2000 pts, Nifty above 24100

The Sensex was down 2,025.95 points or 2.50 percent at 78,956.00, and the Nifty was down 594.00 points or 2.40 percent at 24,123.70. About 436 shares advanced, 3101 shares declined, and 85 shares unchanged.

-330

August 05, 2024· 13:58 IST

earnings Watch | Marico Q1 net profit at Rs 474 crore and revenue at Rs 2,643 crore

-330

August 05, 2024· 13:55 IST

Ola Electric IPO: Just how good is it compared to TVS Motors, Bajaj Auto and Hero Moto?

Ola Electric's IPO marks the debut of India's first electric vehicle startup and is set to be one of the largest new-age IPOs of 2024. ...Read More

-330

August 05, 2024· 13:51 IST

Earnings watch | Hawkins Cooker Q1 profit jumps to Rs 25 crore versus Rs 21 crore

-330

August 05, 2024· 13:47 IST

Sensex Today | Nifty Bank index sees minor recovery, back above 50,000

-330

August 05, 2024· 13:45 IST

Tata Power gets LoI from PFC Consulting to acquire SPV in Odisha

Tata Power on Monday said it has received a letter of intent from PFC Consulting to acquire a project-specific special purpose vehicle.

PFC Consulting is a wholly-owned subsidiary of Power Finance Corporation.

In an exchange filing, Tata Power said it "has received a Letter of Intent (LoI) from PFC Consulting to acquire Paradeep Transmission Ltd, a project special purpose vehicle (SPV)." The SPV would be developed on build, own, operate and transfer basis, to provide transmission service for 35 years from the schedule date of commercial operation, it said.

The date of commercial operation is effective 24 months from the date of SPV acquisition, Tata Power said.

-330

August 05, 2024· 13:44 IST

Sensex Today | Nifty recovers 200 points from day's low

-330

August 05, 2024· 13:41 IST

Sensex Today | Nifty Midcap 100 index slips 4%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharat Forge | 1,563.30 | -8.98 | 2.15m |

| MphasiS | 2,632.55 | -7.79 | 682.07k |

| LIC Housing Fin | 690.50 | -7.76 | 10.50m |

| Bharat Dynamics | 1,344.85 | -7.27 | 1.49m |

| Yes Bank | 23.65 | -7.07 | 298.21m |

| BSE Limited | 2,388.00 | -6.85 | 1.11m |

| Kalyan Jeweller | 526.10 | -6.01 | 3.07m |

| Rail Vikas | 554.40 | -6 | 18.01m |

| Godrej Prop | 2,823.00 | -5.95 | 1.49m |

| SAIL | 137.62 | -5.89 | 40.78m |

-330

August 05, 2024· 13:37 IST

Earnings Watch | Orient Cement Q1 net profit down 1% at Rs 36.7 crore Vs Rs 37 crore, YoY

-330

August 05, 2024· 13:28 IST

Brokerage Call | CLSA downgrade LIC Housing Finance to 'hold' with target Rs 800

#1 Q1 loan growth in-line with expectations but margin moderate

#2 Gross NPLs steady but net slippage spiked

#3 Credit cost was at its lowest in 14 quarters

#4 Credit cost driven by reduction in provision coverage across stage 2 & stage 3 loans

#5 Calculated spread declined 35 bps QoQ due to lower interest income on NPL accounts

#6 Management disclosed this metric for the first time

#7 Loan growth remains muted in mid-single digits

#8 A pickup in disbursement growth will take time to be reflected in AUM growth

-330

August 05, 2024· 13:23 IST

Sensex Today | Nifty Information Technology index sheds 4%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MphasiS | 2,615.55 | -8.39 | 632.24k |

| L&T Technology | 4,811.50 | -5.67 | 131.08k |

| Infosys | 1,742.20 | -4.34 | 7.39m |

| COFORGE LTD. | 5,843.75 | -3.89 | 516.87k |

| Wipro | 482.70 | -3.87 | 7.86m |

| Tech Mahindra | 1,456.20 | -3.42 | 1.55m |

| Persistent | 4,483.50 | -3.3 | 337.96k |

| TCS | 4,155.00 | -2.99 | 1.66m |

| LTIMindtree | 5,346.90 | -2.96 | 546.51k |

| HCL Tech | 1,561.80 | -2.95 | 2.37m |

-330

August 05, 2024· 13:22 IST

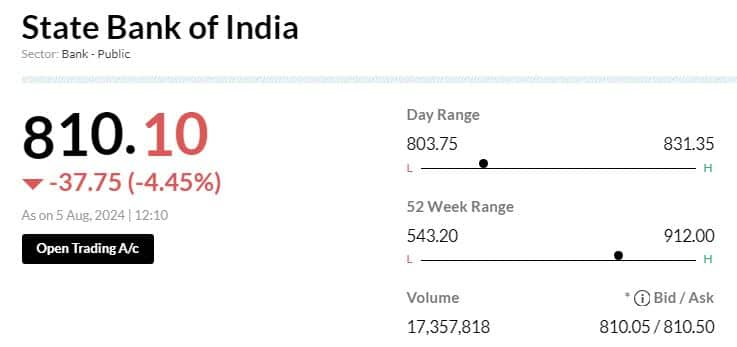

Brokerage Call | UBS keeps 'sell' rating on SBI, target Rs 725

#1 Lower opex & higher other income offset NII miss in Q1; credit costs inch up

#2 Deposits declined 0.3 percent QoQ; in-line with muted deposit growth in sector

#3 Credit costs of 50 bps (annualised) in Q1 came in higher than FY24 levels

#4 Expect company’s current RoA of >1 percent to decelerate as believe credit costs would trend up

#5 Low counter cyclical buffers leaves little cushion on current profitability

#6 Management remain confident of unsecured retail segment's asset quality

-330

August 05, 2024· 13:18 IST

IPO News | Akums Drugs can list with 10-15% gain: Prashanth Tapse, Senior VP (Research), Mehta Equities

Despite pressure in the market, we believe Akums Drugs can list with a decent debuting gains in the range of 10-15% on the issue price. Considering healthy subscription demand especially from QIB (90x) and unique business matrix, we continue to believe and hold our long term positive outlook in the India’s largest CDMO player by revenue, production capacity and client base. We think the company's comprehensive product offerings and extensive manufacturing capabilities, along with its strategic presence across the pharmaceutical value chain, provide a solid foundation for sustained growth.

On a valuation parse at the upper band Rs 679/-, the issue was asking for a Market Cap of Rs.10687 crore. Given the anticipated growth in the Indian CDMO market, along with Akums expanding global footprint and strategic move into API manufacturing, further enhance its long-term prospects.

Hence, we recommend allotted investors to “Hold” Akums Drugs and Pharmaceuticals IPO for a long term perspective. Post listing, we believe the market can give Akums a premium multiple towards its leadership position which may result in delivering healthy post listing gains on its issue price.

-330

August 05, 2024· 13:13 IST

-330

August 05, 2024· 13:10 IST

Sensex Today | Cooperating with BoJ, FSA, closely monitoring markets with senses of urgency: Japan Finance Minister

-330

August 05, 2024· 13:08 IST

Global News | US Bond traders bet big on the Fed launching into rescue mode: Bloomberg

-330

August 05, 2024· 13:07 IST

Global News | US Treasuries surge as traders bet on emergency Fed rate cut: Bloomberg

-330

August 05, 2024· 13:06 IST

Sharad Chandra Shukla, Director at Mehta Equities

Global stock markets are experiencing a significant downturn as investors react to rising interest rates and geopolitical tensions. The end of Japan's carry trade, where investors borrow at low rates to invest in higher-yielding assets, is a key concern.

As central banks tighten monetary policies, borrowing costs increase, causing a shift away from riskier assets. Uncertainty in U.S. economic data and global political instability further exacerbate market volatility, prompting widespread reassessment of investment strategies.

-330

August 05, 2024· 13:02 IST

Markets@1 | Nifty at 23900, Sensex plunges 2600

The Sensex was down 2,602.45 points or 3.21 percent at 78,379.50, and the Nifty was down 784.50 points or 3.17 percent at 23,933.20.

-330

August 05, 2024· 12:57 IST

Daniel Morris of BNP Paribas Asset Management to CNBC-TV18

#1 Markets that have fallen are the ones that are up significantly this year

#2 Besides Labour market, no other indicators are pointing to a recession

#3 Strength of dollar so far was premised on growth differential versus Europe, rest of the world

-330

August 05, 2024· 12:55 IST

Global Markets | European Markets fall over 2% in early trade; FTSE down nearly 2%

-330

August 05, 2024· 12:53 IST

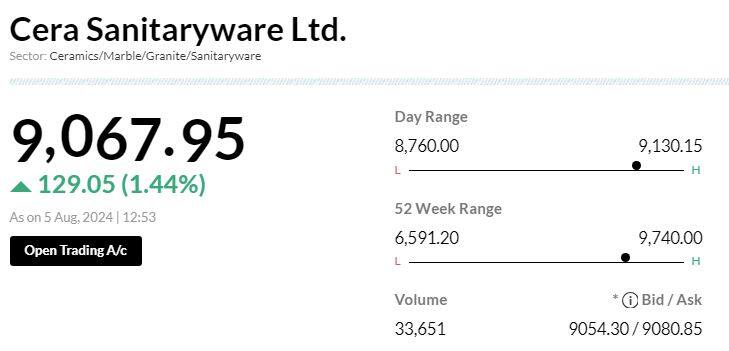

Stock Market LIVE Updates | Cera Sanitaryware shares gain on buyback approval

The board of directors of the company at its meeting held on August 5, 2024 has approved the proposal for buyback of up to 108333 fully paid-up equity shares of face value Rs 5 each by the company, representing upto0.83% of the total number of equity shares of the company, at a price of Rs 12000 per equity share.

-330

August 05, 2024· 12:51 IST

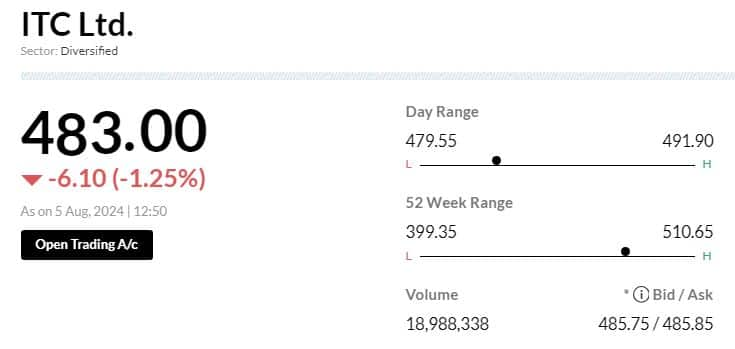

Sensex Today | 6.15 million shares of ITC traded in a block: Bloomberg

-330

August 05, 2024· 12:50 IST

Sensex Today | 1.01 million shares of Federal Bank traded in a block: Bloomberg

-330

August 05, 2024· 12:49 IST

Stock Market LIVE Updates | USFDA issues form 483 with 3 observations for Gland Pharma's Hyderabad-based Pashamylaram facility

-330

August 05, 2024· 12:44 IST

Stock Market LIVE Updates | Ashoka Buildcon declares lowest bidder for 2 projects worth Rs 1,280.8 crore from MMRDA

-330

August 05, 2024· 12:42 IST

Tata Power Q1 Preview: Revenue, net profit to rise amid growth in solar and thermal power generation businesses

Tata Power is expected to report a 14.7 percent YoY increase in revenue at Rs 17,457 crore in Q1FY25, as per the average estimates of five brokerage firms....Read More

-330

August 05, 2024· 12:40 IST

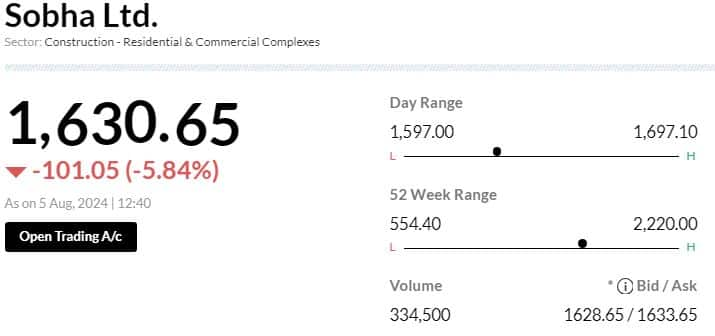

Stock Market LIVE Updates | IT infrastructure was targeted by a ransomware attack: Sobha

-330

August 05, 2024· 12:39 IST

Brokerage Call | JPMorgan keeps 'overweight' rating on Max Healthcare Institute, target raises to Rs 1,010

#1 Q1 results were in-line with estimates

#2 Growth outlook intact; new units poised for further acceleration

#3 Continue to like co for its strong execution

#4 Like co for superior growth prospects

#5 Forecast revenue/EBITDA CAGR of 25 percent/25 percent over FY24-27

-330

August 05, 2024· 12:36 IST

Nifty has next support at 23,800: Rajesh Palviya, Axis Securities

Next support for Nifty at 50-DMA of 23,800. One can focus on stocks which are related to domestic consumption theme for the near term.

-330

August 05, 2024· 12:35 IST

Brokerage Call | Nomura keeps 'buy' rating on LIC Housing Finance, target Rs 875

#1 Q1 asset quality stable, credit cost declines mainly driven by ECL reversal

#2 Disbursements grew 19 percent YoY/ down 29 percent QoQ, AUM growth tepid at 4.4 percent/0.6 percent YoY/QoQ

#3 NIMs contracted 40 bp QoQ due to lower yields

#4 Believe current valuation at 1x FY26 book value remains reasonable

-330

August 05, 2024· 12:31 IST

Long-term outlook on India's growth trajectory remains positive: Atul Parakh - CEO, Bigul

The recent market correction was primarily driven by weak global cues as disappointing job data caused potential recession worries in the US and the fears of a reverse Yen carry trade following an interest rate hike by the Bank of Japan. While the near-term situation is unpredictable, the long-term outlook on India's growth trajectory remains positive, backed by strong macroeconomic fundamentals.

It is advisable for investors not to enter the market immediately as better entry levels will emerge. So, investing in fundamentally strong companies operating in high-growth potential sectors at appropriate valuations is recommended.

However, profit booking in overvalued stocks is advisable due to the near-term market situation. Following this approach would help investors mitigate losses and maximize their returns in the long run.

-330

August 05, 2024· 12:23 IST

Earnings watch | VRL LogisticsQ1 net profit down 60.6% at Rs 13.4 crore Vs Rs 34 crore, YoY

-330

August 05, 2024· 12:22 IST

Earnings Watch | Devyani International Q1 net profit at Rs 30.1 crore Vs Rs 2 crore, YoY

-330

August 05, 2024· 12:21 IST

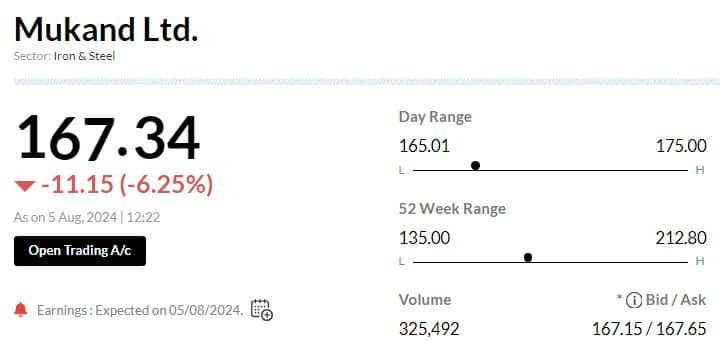

Earnings Watch | Mukand Q1 net profit down 22.6% at Rs 24 crore Vs Rs 31 crore, YoY

-330

August 05, 2024· 12:19 IST

Sensex Today | Ajooni Biotech, Cerebra Integrated Technologies, GTL, among others locked at lower circuit

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Ajooni Biotech | 395786.00 | 7.29-5.08 | 23602734235793.65 |

| GTL | 145429.00 | 13.30-5.07 | 618504729436.55 |

| Cerebra Int | 170880.00 | 9.18-5.07 | 1317801636715.30 |

| Parsvnath | 3714095.00 | 16.55-5.05 | 1255921570264.80 |

| GVP Infotech | 83076.00 | 13.17-5.05 | 96601139894.40 |

| Century Extr | 17518.00 | 25.70-5.03 | 368580569843.80 |

| Vipul | 985784.00 | 36.29-5.02 | 102462829786.05 |

| Dhanlaxmi Bank | 131896.00 | 43.51-5.02 | 27262632170928.60 |

| Almondz Global | 121756.00 | 34.64-5.02 | 14982061867112.95 |

| Indiabulls Ent | 83546.00 | 12.12-5.02 | 4693361186662.75 |

-330

August 05, 2024· 12:14 IST

Brokerage Call | Macquarie keeps 'outperform' rating on Titan, target Rs 4,100

#1 Q1 beat led by stronger jewellery margin

#2 Company sees custom duty improving the operating environment

#3 Market share flattish

#4 Company retained guidance for 11.5-12.5 percent jewellery margin despite expected reduction in discounting pressures

-330

August 05, 2024· 12:13 IST

Christopher Wood, Jefferies

The moment that GREED & fear has been waiting for, what seems like an eternity, finally arrived on Friday. That is, unambiguous evidence of a weakening in the US labour market at a time when inflation is still above the Federal Reserve's 2% target.

The reaction of the money markets shows that investors share GREED & fear's long-standing view that the Fed, in the event of such an outcome, will prioritise the labour market over inflation.

Money markets are now discounting 116 bps of easing by the end of this year whereas before the payroll data it was only 86 bps. An intra-meeting cut, the first since March 2020, now looks likely.

-330

August 05, 2024· 12:13 IST

Indian economy likely to grow at 7-7.2% in FY25: Deloitte

Deloitte India Economist Rumki Majumdar said, India will witness robust growth in the second half after a period of uncertainty in the first six months of the year....Read More

-330

August 05, 2024· 12:10 IST

Brokerage Call | Investec maintains 'buy' rating on SBI, target Rs 880

#1 Company reported a miss on NIMs/core PpOP in Q1

#2 NII growth weak

#3 Credit costs doubled sequentially to 0.43 percent owing to seasonally higher slippages

#4 Expect credit growth to be strong at 15 percent YoY for FY25 with bank having adequate liquidity buffers

-330

August 05, 2024· 12:07 IST

IPO Watch | Ola Electric Mobility IPO Subscribed at 0.66 times

QIB – 0.0 times

NII - 0.71 times

Retail – 2.49 times

Employee Reserved - 8.10 times

-330

August 05, 2024· 12:06 IST

Sensex Today | Rupee at record low, approaches 84 vs US dollar

-330

August 05, 2024· 12:05 IST

Markets Today | Key indices fall more than 2%, Nifty Bank below 50,000

#1 Key indices fall more than 2% each, Nifty down more than 500 points

I#2 CICI Bank, HDFC Bank, Infosys contribute most to Nifty's losses

#3 SBI, ICICI Bank, HDFC Bank contribute more than 700 points to Nifty Bank's fall

#4 Railway, infra stocks under pressure on Yen carry trade concerns

#5 Circuit breaker triggered for Kospi after benchmark sinks 8%

#5 Worst day for Nikkei since 1987

#6 Nifty tests 24,000; Nifty Bank slumps below 50,000

#7 Nasdaq futures down 5%

-330

August 05, 2024· 12:01 IST

Markets@12 | Sensex down 2400 points, Nifty at 24000

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 1,032.90 | -5.83 | 2.06m |

| Tata Steel | 150.30 | -4.99 | 3.20m |

| Infosys | 1,732.95 | -4.86 | 401.49k |

| JSW Steel | 856.55 | -4.81 | 77.74k |

| SBI | 807.25 | -4.79 | 1.36m |

| Tech Mahindra | 1,440.65 | -4.62 | 77.84k |

| Power Grid Corp | 342.95 | -4.2 | 222.81k |

| Maruti Suzuki | 12,196.45 | -4.2 | 22.88k |

| Wipro | 483.25 | -3.74 | 206.04k |

| Reliance | 2,886.90 | -3.72 | 167.91k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HUL | 2,715.55 | 0.82 | 137.14k |

| Nestle | 2,498.05 | 0.15 | 18.95k |

| Sun Pharma | 1,732.50 | 0.01 | 121.92k |

-330

August 05, 2024· 12:00 IST

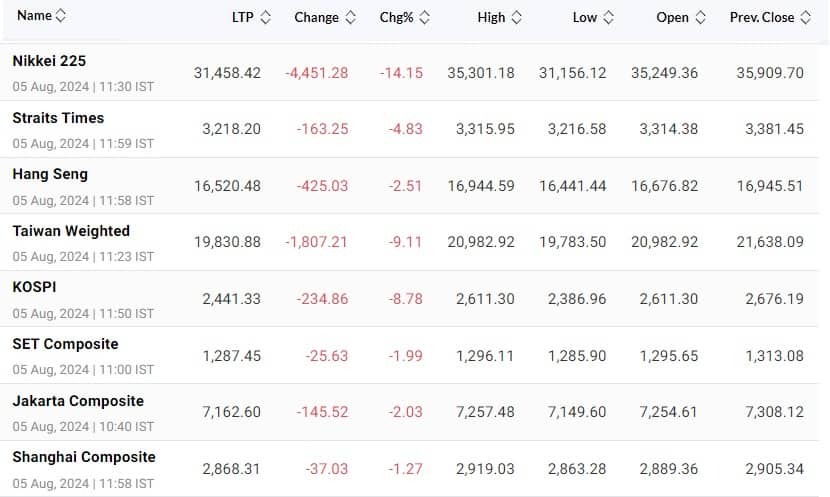

Global Markets | Taiwan's Weighted ended 9% lower

-330

August 05, 2024· 11:59 IST

Global Markets | US Futures extend losses, Nasdaq Future down 6% and S&P Future down 3%

-330

August 05, 2024· 11:54 IST

Sensex Today | BEML, ONGC, Marico, Bharti Airtel,among others to announce results today

BEML, Oil and Natural Gas Corporation, Marico, Bharti Airtel, Aban Offshore, Andhra Paper, Avanti Feeds, Bharti Hexacom, BLS International Services, Brigade Enterprises, Century Enka, Century Plyboards (I), Cupid, Deepak Nitrite, Devyani International, Gujarat State Fertilizers & Chemicals, Hawkins Cookers, Hindustan Construction, HG Infra Engineering, Honeywell Automation India, Mirza International, Motherson Sumi Wiring India, Mukand, Orient Cement, Paras Defence and Space Technologies, Sandur Manganese & Iron Ores, Sayaji Hotels, Schneider Electric Infrastructure, Som Distilleries & Breweries, SMS Pharmaceuticals, Sun Pharma Advanced Research Company, Subex, Suven Life Sciences, TAJGVK Hotels & Resorts, Tata Chemicals, Tribhovandas Bhimji Zaveri, Triveni Turbine, Vijaya Diagnostic Centre, V-Mart Retail, VRL Logistics, among others to declare earnings today.

-330

August 05, 2024· 11:46 IST

Vishnu Kant Upadhyay, AVP, Research and Advisory at Master Capital Services

The Indian benchmark indices experienced a continued decline for the second consecutive session, with the Nifty 50 plummeting nearly 3.5% and the Sensex dropping more than 4% from their all-time highs recorded last week. This significant sell-off in domestic equities has been primarily driven by weak global sentiments following disappointing U.S. economic data, particularly non-farm payrolls, manufacturing PMI, and jobless claims, which have raised concerns about a potential economic slowdown in the world’s largest economy.

Additionally, the yen carry trade has further dampened global sentiment. However, given the prevailing bullish trend, it is unlikely that prices will remain low for an extended period. A recovery from these lower levels is a probable scenario. Every market decline should be viewed as an opportunity to establish new long positions for long-term holding.

The Nifty 50 has major support in the 24,200-24,100 range, and prices are unlikely to fall below this zone, while the Sensex has significant support around 78,400, near the 55-day EMA.

-330

August 05, 2024· 11:40 IST

Taiwan stocks plunge more than 8% in afternoon trade

Taiwan stocks fell more than eight percent in the afternoon on Monday after poor US jobs data fuelled recession fears.

The Taiex, the weighted index on the Taiwan Stock Exchange, had fallen 8.43 percent to 19,813.83 as of 1:19 pm (0519 GMT) before morning trading closed, while chip giant TSMC had lost 9.52 percent.

-330

August 05, 2024· 11:38 IST

Japan’s Topix, Nikkei stock gauges drop more than 20% from peaks

Japan’s equity benchmarks slid more than 20% from record highs reached last month as investor confidence crumbled from the surge in the yen, tighter monetary policy and the deteriorating economic outlook in the US.

The Topix and Nikkei 225 Stock Average tumbled about 10% Monday, with both benchmarks poised to enter bear markets. On a three-day basis, the Topix was set for its worst drop on record, according to data compiled by Bloomberg back to 1959. Circuit breakers temporarily suspended trading of futures for both equity benchmarks.

Exporters were the heaviest drag on the Topix after the yen surged more than 2% versus the dollar on the unwinding of carry trades, while banks dropped after yields of 10-year government bonds plunged as much as 17 basis points, the most since 2003.

All 33 of the Topix’s industry groups have fallen since the Bank of Japan raised interest rates on July 31, triggering a surge in the yen that has cast a pall over the earnings outlook for exporters. Yen-funded carry trades were among the most popular in emerging markets as volatility remained low and investors bet Japanese rates would remain at rock bottom. Read More

-330

August 05, 2024· 11:34 IST

Stock Market LIVE Updates | Market selloff intensifies, all sectors bleed in the red

#1 Nifty slips below 24,000 for the first time since July 2, breaks Budget-Day low of 24,074

#2 Sensex slides 2,600 points, hit day's low of 78359

#3 BSE-listed cos erase market cap of more than Rs 10 lakh crore today so far

#4 Fear gauge India VIX records biggest single-day surge since August 2015, soars above 50%

-330

August 05, 2024· 11:29 IST

Stock Market LIVE Updates | India VIX records biggest single-day surge since August 2015

-330

August 05, 2024· 11:19 IST

Sensex Today | Nifty breaches 24,000 for the first time since July 2

-330

August 05, 2024· 11:17 IST

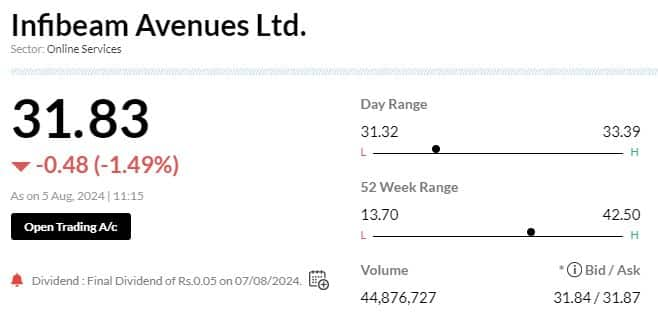

Stock Market LIVE Updates | Infibeam Avenues signs definitive agreement to acquire 54% stake in Rediff.com India

-330

August 05, 2024· 11:15 IST

Indian rupee slips to all-time low of 83.80 against US dollar in early trade

Forex traders said the sharp downfall in the domestic unit came on the heels of a significant downturn in the Indian equity markets and significant foreign fund outflows....Read More

-330

August 05, 2024· 11:04 IST

Sensex Today | India VIX up 47%

-330

August 05, 2024· 11:01 IST

Markets@11 | Sensex slips 2000 pts, Nifty at 24100

-330

August 05, 2024· 11:00 IST

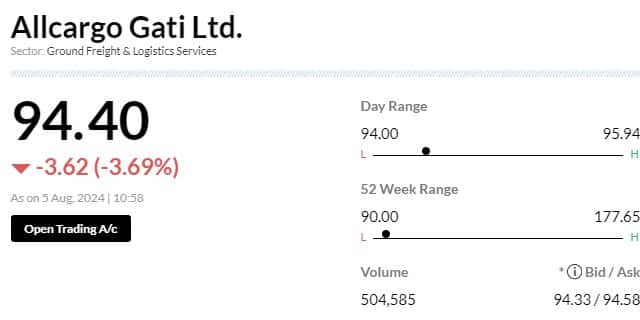

Stock Market LIVE Updates | Allcargo Gati shares shed 3% on posting losses in Q1

#1 Net loss Rs 2.2 crore versus loss of Rs 2.8 crore, YoY

#1 Net profit down 4.2 percent at Rs 408.2 crore versus Rs 426.2 crore, YoY

-330

August 05, 2024· 10:59 IST

Brokerage Call | Jefferies keeps 'underperform' call on Whirlpool, target raises to Rs 1,670

#1 Q1 PAT (+92 percent YoY) was aided by growth in refrigerators & AC verticals (strong summer)

#2 Raise FY25-27 EPS by +4-7 percent, and estimate +23 percent EBITDA CAGR

#3 Factoring healthy 8 percent+ OPM in Q4 & Q1, & positive management commentary, raise target PE by 10 percent

#4 Risk-reward appears stretched at current FY25/26 PE of 75/60x

-330

August 05, 2024· 10:56 IST

Sensex Today | BSE Smallcap index down 3%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Nucleus Softwar | 1,295.00 | -13.93 | 27.19k |

| Sudarshan Chem | 890.00 | -8.74 | 34.78k |

| Archean Chem | 701.65 | -8.63 | 76.58k |

| Kirloskar Bros | 2,052.00 | -8.38 | 6.83k |

| Kaveri Seed | 1,018.50 | -8.08 | 16.35k |

| Electrosteel | 198.00 | -7.97 | 487.21k |

| Himatsingka Sei | 135.10 | -7.72 | 131.39k |

| Savita Oil Tech | 581.00 | -7.59 | 28.55k |

| Andhra Petro | 99.95 | -6.98 | 334.59k |

| Siyaram Silk | 474.00 | -6.93 | 10.06k |

-330

August 05, 2024· 10:55 IST

India's service activity eases to 60.3 in July

Services exports had done better than goods exports in the previous fiscal ...Read More

-330

August 05, 2024· 10:49 IST

Stock Market LIVE Updates | Tamilnad Mercantile Bank shares gain nearly 4% as Q1 profit jumps 10%

#1 Net profit up 10 percent at Rs 287.3 crore versus Rs 261 crore, YoY

NII up 8 percent at Rs 174.8 crore versus Rs 161.9 crore, YoY

-330

August 05, 2024· 10:46 IST

Jubilant Pharmova Large Trade | 14.05 crore shares worth Rs 119.6 crore change hands at Rs 851.4 per share in block deal window

-330

August 05, 2024· 10:43 IST

IPO Check | Ceigall India IPO subscribed 1.5x so far on day 3; NIIs show maximum interest

Ceigall India Ltd's IPO was subscribed 1.5 times by its third and last day of bidding, August 5. Non-Institutional Investors (NIIs) led with a subscription rate of 2.5 times their allotted shares, while Retail Individual Investors (RIIs) subscribed at a rate of 1.9 times their reserved portion. Qualified Institutional Buyers (QIBs) bid for over 1.3 lakh shares of the 61.9 lakh shares available to them. The employee portion was subscribed over 6 times.

The IPO, valued at Rs 1,252.66 crore, includes a fresh issue of 1.71 crore shares worth Rs 684.25 crore and an offer for sale of 1.42 crore shares worth Rs 568.41 crore. The price band was set between Rs 380 and Rs 401 per share. Ceigall India will list its shares on the BSE and NSE, with a tentative listing date of August 8.

-330

August 05, 2024· 10:42 IST

Sensex Today | Nifty Midcap, Smallcap underperform

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 24216.35-2.03 | 11.43-2.50 | -0.4424.08 |

| NIFTY BANK | 50262.60-2.12 | 4.08-2.22 | -4.5511.99 |

| NIFTY Midcap 100 | 56308.70-2.77 | 21.93-3.52 | -1.3749.64 |

| NIFTY Smallcap 100 | 18200.05-3.19 | 20.18-4.43 | -3.9155.58 |

| NIFTY NEXT 50 | 71499.30-2.49 | 34.03-3.75 | -2.6259.72 |

-330

August 05, 2024· 10:40 IST

Sensex Today | Winsome Yarns shares gains ahead of committee of creditors meeting

The 12th meeting of committee of creditors of Winsome Yarns is scheduled to be held on Monday i.e. 05th August, 2024.

-330

August 05, 2024· 10:38 IST

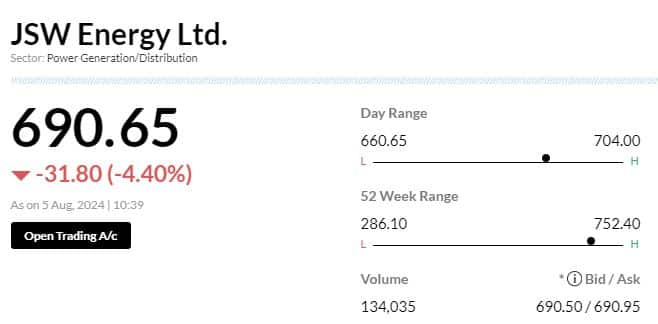

Stock Market LIVE Updates | JSW Energy achieves A rating in MSCI ESG update

JSW Energy has achieved an A rating for Environment, Social and Corporate Governance (ESG) in the latest update from Morgan Stanley Capital International (MSCI) ESG rating.

-330

August 05, 2024· 10:36 IST

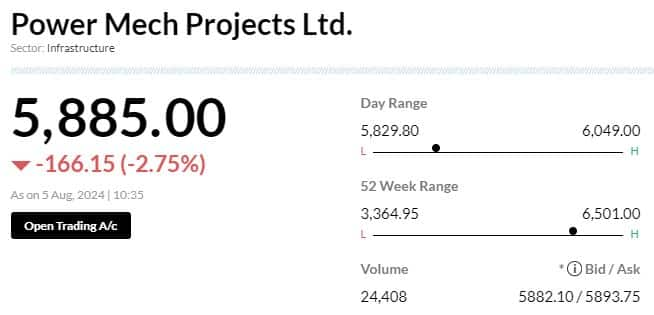

Stock Market LIVE Updates | Power Mech bags an order worth Rs 142.50 crore from Meenakshi Energy

-330

August 05, 2024· 10:34 IST

Sensex Today | 1.81 million shares of NTPC traded in another block: Bloomberg

-330

August 05, 2024· 10:33 IST

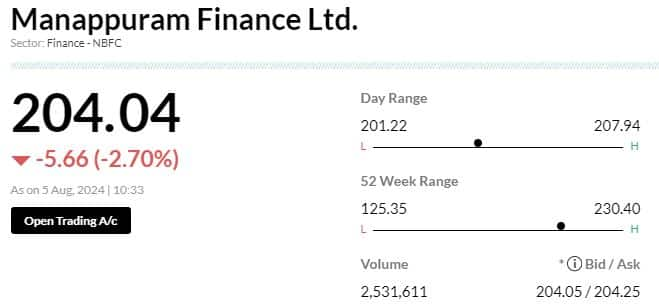

Stock Market LIVE Updates | Manappuram Finance to consider fund raising

The financial resources and management committee of the board of directors of Manappuram Finance will be meeting on Thursday, August 8,

2024, to consider the issue of non – convertible debentures.