Ola Electric Mobility may well have made a subdued debut on the bourses on August 9, but since then shares of the electric two-wheeler maker have registered a strong rally with analysts betting big on the counter on the back of factors including sustained policy support, ability to reduce costs, and a favourable risk-reward profile for the battery venture.

On Tuesday, shares of Ola Electric touched an intra-day high of Rs 157.53 -- more than double compared to the issue price of Rs 76. However, shares ended nearly 6 percent lower as investors booked partial profit.

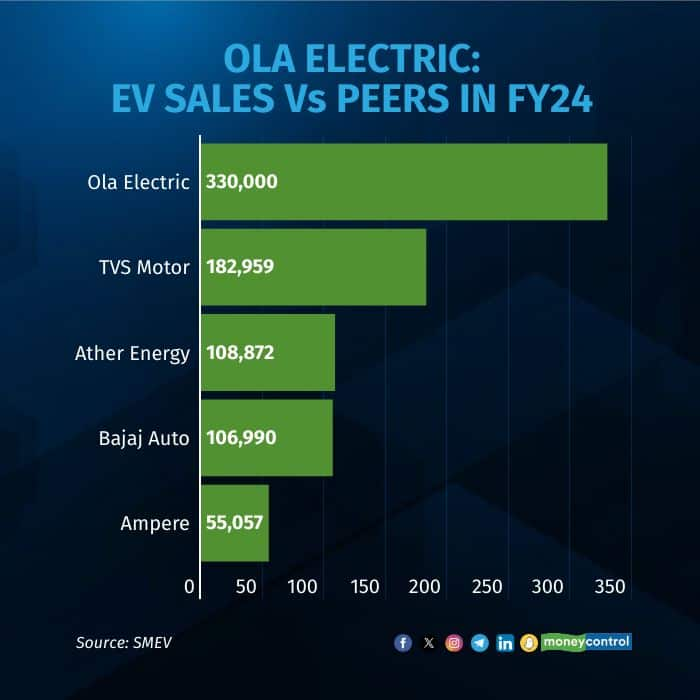

Incumbent players, however, could still pose a challenge to the new entrant. Here’s how Ola compares with other two-wheeler giants.

Read: Mutual funds garner 18% of Ola Electric IPO allotment

Market-share

Ola Electric currently has the highest market share in the EV space with the second slot occupied by TVS Motors. While the company has a solid expansion plan, maintaining the market share would be dependent on how the incumbents in the space decide to play the game.

Analysts believe that irrespective of current hurdles, the company's growth prospects look promising. “The localization of battery cells, combined with government incentives under the production-linked incentive (PLI) scheme, is expected to benefit the company in the short to medium term," Unnati Bhavekar (Jadhav) Lead Analyst at KR Choksey told Moneycontrol.

Read more: Ola Electric IPO garners over $2 billion worth of bids from institutions: Report

Financials

In Q1 FY25, the company’s net loss jumped 30 percent year-on-year to touch Rs 347 crore. The firm's consolidated revenue from operations rose 32 percent YoY to Rs 1,644 crore, as per the company's filings on BSE on August 14.

On a quarter-on-quarter basis, the company's net loss has come down by 16 percent – the loss was pegged at Rs 416 crore for the quarter ended March 31, 2024.Valuation

Meanwhile, the company incurred a loss of Rs 1,584 crore in FY24 – higher than the previous fiscal’s loss of Rs 1,472 crore. Further, the company also has a negative cash flow and a limited operating history.

Incidentally, EVs are a sunrise sector and the company has still not got on the path to profitability because it is still in the investment phase.

On the other hand, Bajaj Auto reported an 18 percent on-year rise in its Q1 FY25 consolidated net profit to Rs 1,941.79 crore, thanks to consistent demand, robust 2-wheeler sales and higher realisations. Hero MotoCorp, the world's largest two-wheeler manufacturer, reported a 36 percent year-on-year rise in Q1 FY25 standalone net profit to Rs 1,122.63 crore. Meanwhile, TVS Motora posted a 23 percent increase in consolidated net profit, reaching Rs 577 crore for the quarter ended June 30.

Valuation

Unnati is of the view that since the company is loss-making, an earnings multiple comparison is irrelevant. The company is currently valued at a price-to-sales (P/S) ratio of 6.7x.

"Ola has created a strong position for itself in the electric scooters market and is in the process of making itself one of the key players in the battery business in India. While the business outlook and growth prospects look promising, its journey towards profitability could be a key thing to look at as we believe its scooters and battery business are 2-3 years away from breakeven and sustainable profitability," Prabhudas Lilladher said in a recent note on the company.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.