The market rebounded after a seven-day losing streak and closed 0.3 percent higher on November 19, with breadth favouring bulls. About 1,628 shares gained, while 846 shares declined on the NSE. The market may extend its upward move amid consolidation in the upcoming session, but the "sell on rally" strategy remains valid due to the overall bearish sentiment. Below are some trading ideas for the near term:

Ashish Kyal, CMT, Founder and CEO of Waves Strategy AdvisorsFortis Healthcare | CMP: Rs 657.8

On the daily chart, Fortis Healthcare has not given a close below its previous day’s low since November 14, despite major indices falling, which suggests that the trend is in favour of the bulls. Additionally, the prices recently bounced upward after taking support from the base line (red line) of the Ichimoku Cloud indicator, suggesting a fresh course of buying in this stock. The RSI (Relative Strength Index) is trading at 64, providing room for further price movement. Hence, the current trend for Fortis Healthcare is positive. A breach above the Rs 665 level can lift the prices toward Rs 695, followed by Rs 720, as long as Rs 635 holds as support on the downside.

Strategy: Buy

Target: Rs 695, Rs 720

Stop-Loss: Rs 635

Sammaan Capital | CMP: Rs 150.63

Sammaan Capital has reversed on the upside from a major support area at Rs 130. The stock has shown a rally of more than 17 percent in just two trading days. After such a sharp rise, buying on dips appears to be a prudent strategy for better risk-reward. The stock has also recently closed above the previous swing high near Rs 149.98, which is a positive sign. Hence, the current trend for Sammaan Capital looks positive. Use dips as a buying opportunity with a target of Rs 155, followed by Rs 158. On the downside, Rs 145 is the crucial support area.

Strategy: Buy

Target: Rs 155, Rs 158

Stop-Loss: Rs 145

Kirloskar Brothers | CMP: Rs 2,187

In the previous session, Kirloskar Brothers showed a sharp rally of 8 percent. The stock looks to have formed a rounding bottom pattern on the daily chart. A break above Rs 2,200 can confirm the breakout of the said pattern. If this happens, we can expect a fresh course of buying in this stock. Last week, prices bounced upward from the Ichimoku Cloud support, which is a bullish signal. Hence, the trend for Kirloskar Brothers is bullish. A break above Rs 2,200 is essential for bullish momentum to continue, with targets of Rs 2,330 followed by Rs 2,400. On the downside, Rs 2,110 is the nearest support level to watch.

Strategy: Buy

Target: Rs 2,330, Rs 2,400

Stop-Loss: Rs 2,110

Vidnyan Sawant, Head of Research at GEPL CapitalFederal Bank | CMP: Rs 206.65

Federal Bank has demonstrated high relative strength despite prevailing market volatility. On the weekly scale, the stock continues to trend upwards, maintaining its rising trajectory. The momentum indicator, RSI, has signaled a bullish crossover and is holding above 60, indicating that the trend's strength is well-supported by momentum.

Strategy: Buy

Target: Rs 237

Stop-Loss: Rs 194

Supriya Lifescience | CMP: Rs 690.35

Supriya Lifesciences has displayed a robust chart pattern on the weekly scale, with a notable change in polarity at its 2022 multi-year high, which acted as support in October 2024. This structural shift has propelled the stock into a new phase of bullish territory, signaling further upside potential. The RSI stands above 70, indicating strong momentum supporting the price action.

Strategy: Buy

Target: Rs 801

Stop-Loss: Rs 630

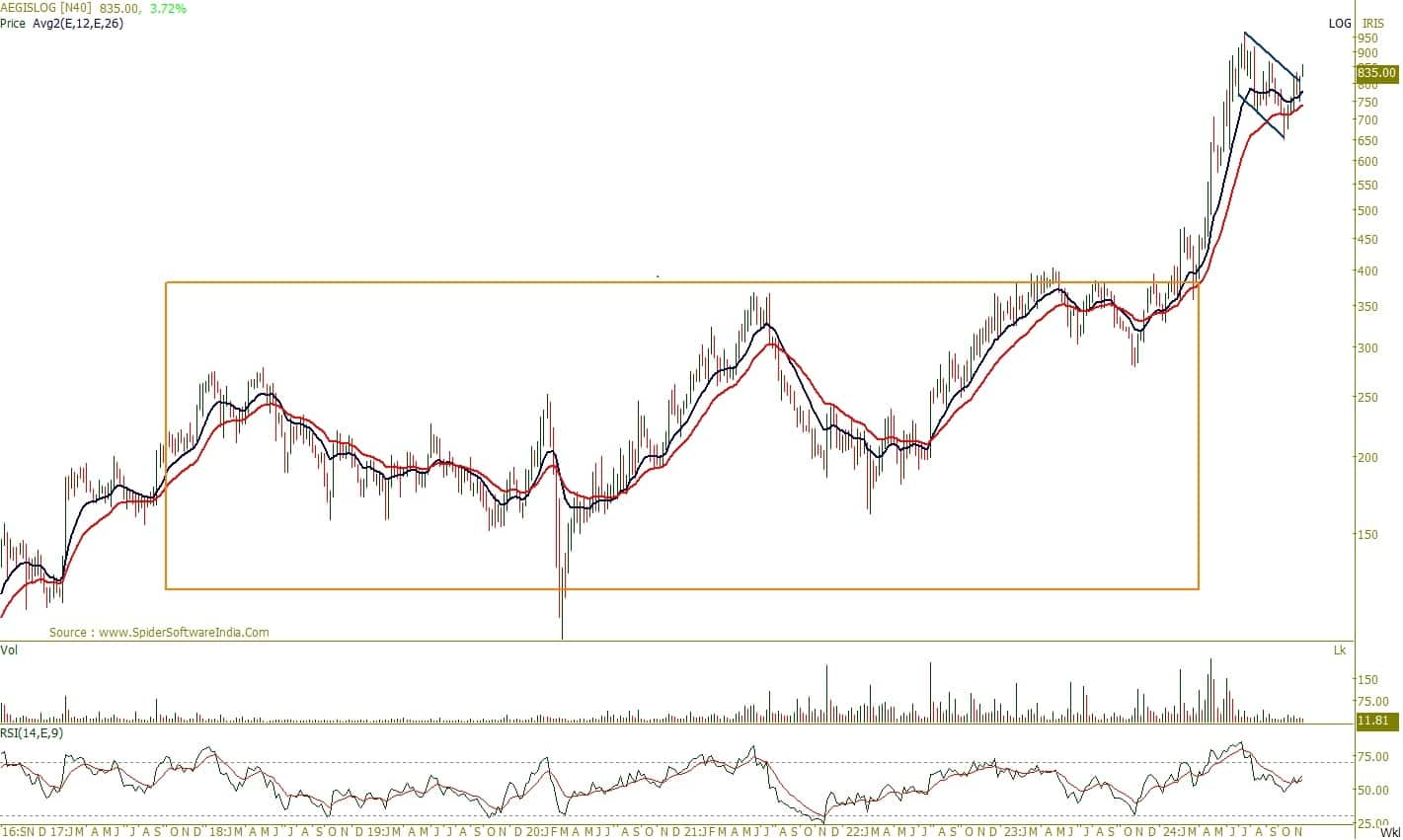

Aegis Logistics | CMP: Rs 840

Aegis Logistics is exhibiting a bullish mean reversion from its 26-week EMA (Exponential Moving Average) and has recently broken out of a Flag pattern, signaling the continuation of its upward trend. The momentum indicator, RSI, has displayed a bullish crossover and is holding above 60, indicating a renewed strength in momentum.

Strategy: Buy

Target: Rs 976

Stop-Loss: Rs 768

National Aluminium Company | CMP: Rs 240.3

National Aluminium Company has been in a strong uptrend, consistently outperforming both the Nifty and Nifty Metal indices despite market volatility. The stock has maintained its position above key short-term averages, highlighting its high relative strength. Additionally, the weekly volume indicates a steady build-up, further supporting the bullish trend. The momentum indicator, MACD (Moving Average Convergence Divergence), remains in buy mode, signaling that the stock’s upward movement is supported by both volume and momentum.

Strategy: Buy

Target: Rs 274

Stop-Loss: Rs 224

Om Mehra, Technical Analyst at Samco SecuritiesDeepak Nitrite | CMP: Rs 2,671.3

Deepak Nitrite has shown strong momentum, closing above its previous resistance at Rs 2,650. The stock is trading above the 9 DMA (Day Moving Average) and 20 DMA, signaling a sustained bullish trend. A potential breakout above Rs 2,715 could further fuel the rally, opening doors for higher levels. Additionally, the stock is holding firmly above the 23.6 percent Fibonacci retracement level, highlighting the positive outlook and indicating strong support at lower levels. Hence, based on the above technical structure, one can initiate a long position at CMP (current market price).

Strategy: Buy

Target: Rs 2,940

Stop-Loss: Rs 2,520

Uno Minda | CMP: Rs 1,040.3

After a significant correction, Uno Minda has stabilized, forming a strong base that suggests a potential trend reversal. The daily RSI is currently at 60, indicating that momentum is improving, and the breakout above a declining trendline strengthens the stock's recovery prospects. The stock is now trading above its 9 and 20-day moving averages, indicating a positive shift in short-term sentiment. The increased delivery volumes over the last two sessions provide additional support for the bullish outlook. Hence, based on the above technical structure, one can initiate a long position at CMP.

Strategy: Buy

Target: Rs 1,160

Stop-Loss: Rs 980

Indian Hotels Company | CMP: Rs 754

Indian Hotels has shown strong momentum, closing above the previous resistance of Rs 750. The stock is trading above both the 20 and 50 DMAs, reflecting sustained bullish momentum. The weekly trend also remains positive. A breakout above the Rs 760 level could further extend the rally. Additionally, the stock has given a consolidation breakout, enhancing the bullish outlook. Hence, based on the above technical structure, one can initiate a long position at CMP.

Strategy: Buy

Target: Rs 825

Stop-Loss: Rs 720

Riyank Arora, Technical Analyst at Mehta EquitiesIndraprastha Gas | CMP: Rs 320.45

Indraprastha Gas (IGL) has reached a critical support zone at Rs 320, with the RSI (14) at 16.6, signaling extreme oversold conditions rarely observed. This technical setup suggests a high probability of a mean reversion, with potential for a rebound towards Rs 380 and Rs 400. The stock's risk-reward ratio is highly favourable, with the support level serving as a pivot for upward movement. A stop-loss at Rs 300 ensures risk mitigation in case of further downside volatility.

Strategy: Buy

Target: Rs 380, Rs 400

Stop-Loss: Rs 300

Tata Steel | CMP: Rs 139.5

Tata Steel is trading near a key horizontal support level at Rs 135, with the RSI (14) at 34, approaching oversold territory. This position indicates a potential bounce-back as the stock consolidates at lower levels. A breakout above Rs 140 could catalyze an upward trajectory toward Rs 148 and Rs 152. The proximity to support makes this trade structurally robust, with a stop-loss at Rs 134 safeguarding against unexpected price weakness.

Strategy: Buy

Target: Rs 148, Rs 152

Stop-Loss: Rs 134

Gujarat Fluorochemicals | CMP: Rs 3,878

Gujarat Fluorochemicals has rebounded from its key demand zone at Rs 3,800, with the RSI (14) at 35, indicating an accumulation phase and momentum shift from oversold levels. The price action reflects the potential for a breakout towards Rs 4,400 and Rs 4,500, supported by a bullish divergence in momentum indicators. The defined stop-loss at Rs 3,600 ensures controlled risk in this high-conviction setup.

Strategy: Buy

Target: Rs 4,400, Rs 4,500

Stop-Loss: Rs 3,600

SJS Enterprises | CMP: Rs 1,112.4

SJS Enterprises is holding steady at a major confluence of support near Rs 1,120, with the RSI (14) at 48, indicating a balanced momentum profile with an upward bias. The stock exhibits signs of bullish continuation, with a potential move towards Rs 1,200 and Rs 1,250 driven by increased accumulation at lower levels. This trade offers an excellent risk-reward structure, with a stop-loss at Rs 1,050 to manage downside exposure.

Strategy: Buy

Target: Rs 1,200, Rs 1,250

Stop-Loss: Rs 1,050

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.