With the Indian market falling like ninepins since September, over 90 percent of companies in the S&P BSE 100 index or India's top 100 companies have given negative returns since August 28, when Sensex hit a record high.

Only eight companies out of top 100 companies managed to brave the fall, which includes Wipro, Aurobindo Pharma, HCL Technologies, Infosys, Hindalco, Vedanta and NMDC.

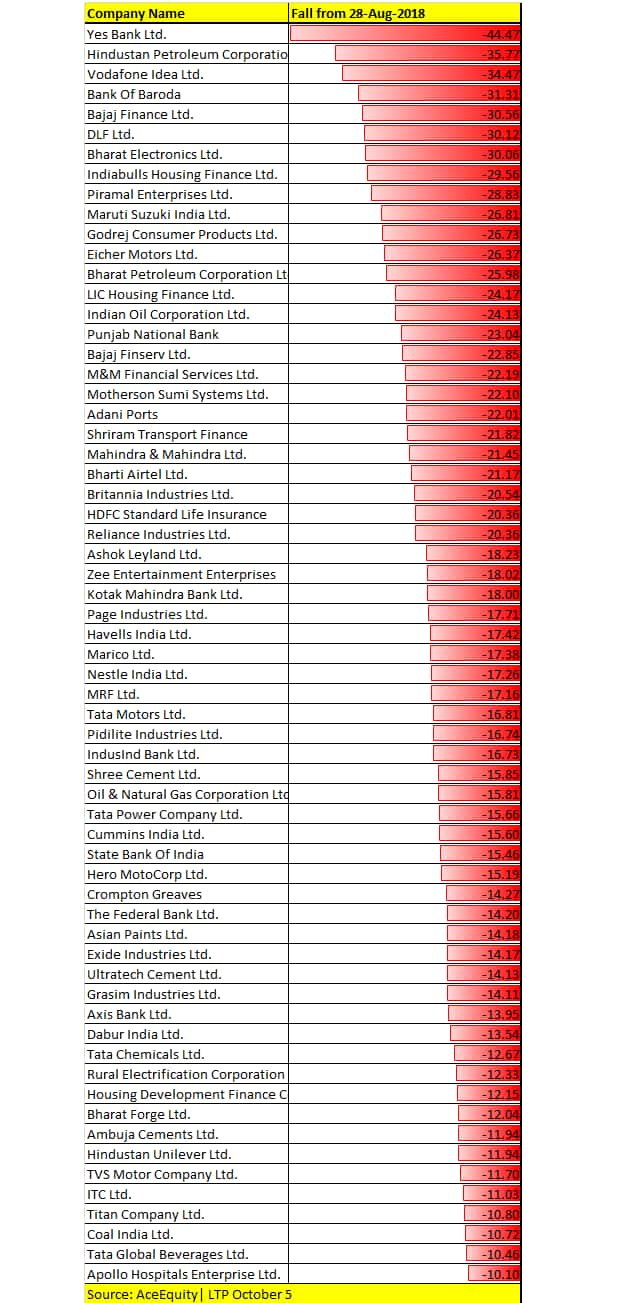

Over 60 companies in the S&P BSE 100 index fell 10-40% since August 28 with most experts advising investors to allocate more towards large-cap stocks from medium-term perspective.

As many as 63 stocks in the BSE 100 index fell 10-40 percent. The list includes Yes Bank, HPCL, Bank of Baroda, Eicher Motors, Maruti Suzuki, BPCL, Punjab National Bank, LIC Housing Finance, Bharti Airtel, Britannia Industries, etc.

"We do believe that markets are likely to end 2018 higher, and our target for Sensex is 37,500. We believe that largecaps are a better bet for the moment. Firstly, they are less volatile and valuations favour large-caps. We would look at factors like valuations, earnings growth, business model, quality of management. Some large-cap stocks we like are Mahindra & Mahindra, Hero Motor, ICICI Bank," Vivek Ranjan Misra, Head of Fundamental Research at Karvy Stock Broking, told Moneycontrol.

Indian markets are in the midst of a correction which is likely to extend further, according to experts and hence, there will be plenty of opportunities for investors to enter into quality stocks on declines.

The fall in the market was largely on account of a decline in Rupee as well as higher oil prices, fears of liquidity crunch following IL&FS default, change in stance by the Reserve Bank of India (RBI), persistent selling by foreign investors as well as trade war fears between the two biggest economies US and China.

It will be prudent to stick with only superior fundamental as downside risk is persistent in current scenario, and deploy ‘buy at dip’ strategy with longer investment horizon, feel experts.

"With multiple challenges coming simultaneously in the market, the risk to the downside is likely to stay for a prolonged period. As few fundamental stocks also witnessed a substantial fall during recent correction, it offers a buying opportunity for the investors ahead of festive seasons," Dinesh Rohira, Founder & CEO, 5nance.com, told Moneycontrol.

How to pick large-cap stocks?

The upside in the market is likely to remain capped ahead of crucial state elections which will start from November. Data suggests that if investors invest in Nifty just six months ahead of general elections and hold it for 2 years then returns have usually been positive.

"Across 7 elections in the last 27 years, whenever an investor entered the markets 6 months before the general elections and held on for 2 years, the investor made on average annualized returns of 23 percent, with most money made in the 2009 elections when the UPA government held the fort," said Sunil Sharma, Chief Investment Officer, Sanctum Wealth Management.

"While the least return has been a positive 1.5 percent in 1999 (when the incumbent party i.e. BJP won), this strongly implies that the 27-year track record has never yielded principal erosion when entering pre-elections," he said.

Also, investors should track the reason why a stock corrected. Any fall pertaining to fundamental or structural reasons should be avoided. Because not every stock which fell in the current correction are top buy.

"The basic criterion to select companies irrespective of market-caps should be solely on the basis of fundamental backed by superior return-on-equity, consistent revenue and profit growth, and sustainable business module across market cycle," said Rohira.

He further added that the most prudent way to approach a falling stock is to study a reason for fall and understand the details of all highlighted reasons because ‘not’ every stock which has fallen will be a good buy, and should avoid generalizing stock on the basis of their fall.

Disclaimer: The stocks mentioned in the article are for reference and not buy or sell recommendation. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.