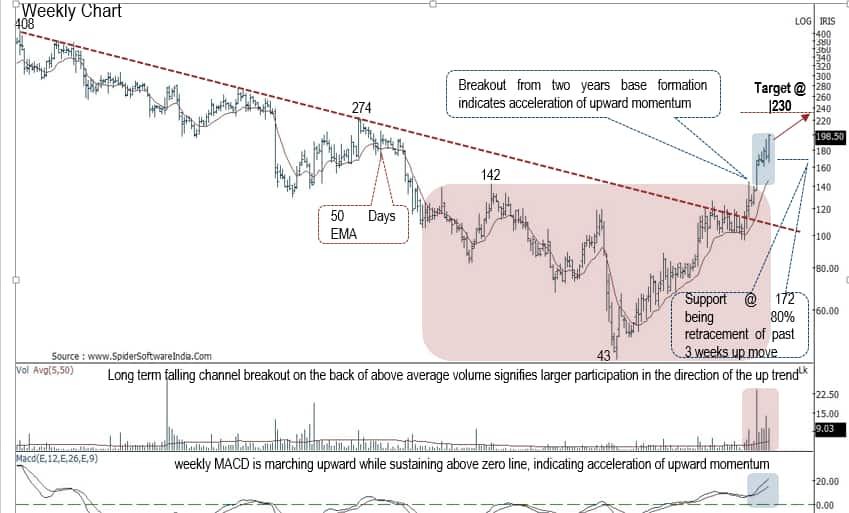

“Breakout from past two years’ base formation (142-43) indicates resumption of the primary uptrend that makes us believe the stock would resolve higher and gradually head towards our earmarked target of Rs 230 as it is 80 percent retracement of 2017-20 decline (274-43),” he said. Shah added that a key point is that since June 2021, the 50-day EMA (exponential moving average) has acted as a strong support on multiple occasions and subsequently, buying demand emerged, highlighting inherent strength. Most traders consider the EMA more reliable than the simple moving average. The EMA is a weighted moving average, which gives more weight to recent price data. Shah said that on the oscillator front, the weekly MACD (moving average convergence/divergence) is marching upward while sustaining above the zero line, indicating acceleration of an upward momentum in the stock price. Disclaimer: The views and investment tips expressed by the expert on Moneycontrol.com are his own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

“Breakout from past two years’ base formation (142-43) indicates resumption of the primary uptrend that makes us believe the stock would resolve higher and gradually head towards our earmarked target of Rs 230 as it is 80 percent retracement of 2017-20 decline (274-43),” he said. Shah added that a key point is that since June 2021, the 50-day EMA (exponential moving average) has acted as a strong support on multiple occasions and subsequently, buying demand emerged, highlighting inherent strength. Most traders consider the EMA more reliable than the simple moving average. The EMA is a weighted moving average, which gives more weight to recent price data. Shah said that on the oscillator front, the weekly MACD (moving average convergence/divergence) is marching upward while sustaining above the zero line, indicating acceleration of an upward momentum in the stock price. Disclaimer: The views and investment tips expressed by the expert on Moneycontrol.com are his own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.