It was a historic week for Indian markets as both Sensex and Nifty50 touched their fresh record highs but the major action was seen in the small & midcap space.

Strong global cues, fall in daily COVID cases and the statement released by the Department of Economic Affairs stating that the economic impact of COVID second wave will most likely be restricted to Q1FY22 helped the sentiment.

The S&P BSE Sensex touched a high of 52,641 on Friday while Nifty50 also raced above 15,800 levels to touch a record high of 15,835. The S&P BSE Midcap index also touched a high of 23045 while the Smallcap index touched a lifetime high of 25,248.

S&P BSE Sensex rose 0.7 percent while the Nifty50 was up 0.8 percent for the week ended June 11 compared with the 1.8 percent rally seen in the S&P BSE Midcap index, and 3.5 percent gains seen in the S&P BSE Smallcap index in the same period.

“The decline in the active COVID case trajectory and as well as the phased re-opening by a few states resulted in the improvement in the market sentiment,” Shibani Sircar Kurian, Senior EVP & Head- Equity Research, Kotak Mahindra Asset Management Company said.

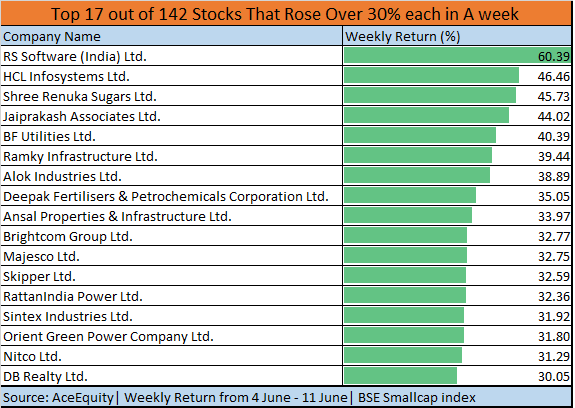

Tracking the momentum in the broader market space, there are as many as 142 stocks in the S&P BSE Smallcap index that rose 10-60% in just 5 trading sessions.

Stocks that rose in double digits include names like Inox Wind, Punj Lloyd, Dr Lal Pathlabs, Den Networks, VRL Logistics, JMT Auto, HCL Infosystems, and RS Software among others.

Experts advise caution in the smallcap and the midcap space which has outperformed benchmark indices so far in 2021. The S&P BSE Smallcap index rallied over 30 percent while the BSE Midcap index was up 27 percent compared to a 13 percent gain seen in the Nifty50.

"The exuberance in the mid and small-cap space is an area of concern. But markets can over-react proving the sceptics wrong in the short run. In 2017 the small index rose around 60%," Dr V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services said.

"The froth was removed in 2018 with big pain to the late entrants. Leading financial, IT, pharma and metals are on a strong wicket. Stay invested in these segments while exercising caution when investing in small-caps," he said.

Sectorally, buying was seen in Utilities, Power, IT which were up more than 4 percent each while marginal selling was seen in Capital Goods, as well as banking space.

Global trends will dominate the price action in the coming week, suggest experts. On the domestic front, a flurry of IPOs hitting D-Street, the pace of vaccinations as well as re-opening of the economy will be key triggers that will dominate the price action.

“Next week’s US FOMC meet would keep the market volatile though they have already hinted at keeping interest rates to near-zero levels in order to aid the recovering economy,” Nirali Shah, Head of Equity Research, Samco Securities said.

“Any development on the same would be keenly awaited. Nevertheless, at the current juncture, increase in rates and tapering fears appear kind of muted, with the US 10-year Treasury yield already hovering near the bottom end of its recent range,” she said.

Shah further added that primary markets are gaining traction with two upcoming IPOs while the secondary market is attentively focusing on the conclusion of privatization process by the Government.

Technical Factors:

The Nifty50 hit a fresh record high of 15835 on Friday but failed to close above 15,800 levels. The index rose 0.8 percent for the week ended June 11.

The trend still remains to be on the upside, and fresh highs will continue in the coming week as well. The market rally remains broad-based with a healthy rally witnessed in BSE Midcap and BSE Smallcap index which is a positive sign

There are no signs of topping out hence traders should avoid going contra at current levels, suggest experts with supports placed at 15500-15300 levels. FPIs have remained net buyers, month to date, to the tune of Rs 4769 crore, they said.

“Nifty 50 showed some resistance in the 15,800-15,850 zone, we believe a convincing closing above 15,850 levels will open the gates for 16,000 in Nifty 50,” Mohit Nigam, Head, PMS - Hem Securities said.

“Strong buying is witnessed in Metal and IT stocks while some selling pressure is seen in selected FMCG and banking. Immediate resistance levels for Nifty 50 are 15850 and 16000 while key support levels for Nifty 50 are 15500 and 15300,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.