Closing Bell: Nifty above 19,000, Sensex up 635 pts; all sectors in the green

-330

October 27, 2023· 16:35 IST

-330

October 27, 2023· 16:33 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap up today and continued to inch higher throughout the day to close in the green after a sharp decline during the week. We expect this pullback to continue till 19160 – 19220 where resistance in the form of a Fibonacci retracement level and the 40 hour moving average is placed. The hourly momentum indicator has a positive crossover which is a buy signal. Thus, considering the above parameters we expect the pullback to continue.

On the weekly charts we can observe that the Nifty has respected the support zone of 18800 – 18925 where multiple support parameters in the form of the 40-week average and a crucial Fibonacci retracement level was placed. Thus, going ahead the Nifty can consolidate within 18800 – 19200 before resuming next leg of the fall. In terms of levels, 19160 – 19220 shall act as a resistance while 18930 – 18900 shall act as an immediate support zone.

Bank Nifty also witnessed a pullback from the steep decline during the week. The pullback can continue till 43400 where resistance in the form of the hourly upper Bollinger band is placed. On the downside 42730 – 42600 is the crucial support zone.

-330

October 27, 2023· 16:29 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Markets ended their 6-day losing streak as Nifty reclaimed the psychological 19000 mark on the back of broad-based buying support. Despite the strong rebound, we suspect the benchmarks are not out of the woods yet. For markets to remain buoyant, some resolution is needed between the on-going Israel-Hamas war. Technically, confirmation of major strength in Nifty only above the 19700 mark.

-330

October 27, 2023· 16:25 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

After the gap-up start, Nifty gradually inched higher as the session progressed and finally settled at 19,047.25 levels. Mostly sectors contributed to the move wherein realty, energy and financials were among the top performers. The broader indices also participated in the rebound and gained in the range of 1.5%-2%.

Nifty has respected the support zone of long term moving average i.e. 200 EMA and witnessed a rebound on expected lines however participants shouldn’t read much into a single-day recovery. The earlier support zone i.e. 19200-19300 would act as a hurdle in case of further rebound. Weakness in heavyweights especially from the banking pack combined with feeble global markets would continue to weigh on the sentiment. We thus suggest utilizing a rebound to reduce longs and wait for clarity.

-330

October 27, 2023· 16:23 IST

Joseph Thomas, Head of Research, Emkay Wealth Management:

After a drastic fall in the indexes over the last few trading sessions, the major indexes rose by more than 1% in the last trading day of the week today. The fall was caused by the fall in the US markets and the aggravation of the Middle East conflict. There are strong indication that the US rates may move up further owing to the elevated inflation levels. The movements in the US markets and the geo political developments will continue to hold sway over the markets in the coming days too. The domestic economy is afforded some protection by the robust economic growth and the strong fundamentals. Another factor that adds to the positivity is the likelihood of domestic interest rates remaining stable for a longer time after the recent spike in money market yields.”

-330

October 27, 2023· 16:10 IST

Amol Athawale, Vice President - Technical Research, Kotak Securities:

Markets were in an oversold zone after a 6-session fall and investors were already anticipating a relief rally soon. Aided by a recovery in several Asian indices, domestic equities bounced back sharply on strong all-round buying support and Nifty once again retained the 19k-mark. However, lingering negative factors such as Israel-Hamas conflict, surging US bond yield, FII fund outflows, and rate hike worries will mean markets are likely to stay volatile going ahead.

Technically, on weekly charts the Nifty has formed a long bearish candle, indicating strong possibility of further weakness from the current levels. As long as the index is trading above 18900, the pullback rally is likely to continue till 19200-19275.

On the flip side, below 18900, the selling pressure is likely to accelerate and could slip till 18800. Further down side may drag the index till 18700.

For Bank Nifty, 42400-42300 would act as sacrosanct support zones, above which, it could rally till the 200-day SMA (Simple Moving Average) or 43200 and 43350 levels. On the flip side, below 42300, the uptrend would be vulnerable.

-330

October 27, 2023· 16:08 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty snapped a six-day losing streak on October 27 and ended higher aided by positive global cues. At close, Nifty was up 1.01% or 190 points at 19047.3. Volumes on the NSE did not rise with the reversal but fell towards recent lows. Broad market indices rose more than the Nifty even as the advance decline ratio rose to 4.3:1.

Asian markets mostly rose after data showed the U.S. economy was growing robustly and as robust forecasts from Amazon.com and Intel along with a pullback in Treasury yields lifted megacaps. European stocks were mixed on Friday as weak corporate earnings offset robust U.S. economic data released overnight. Energy stocks outperformed as oil prices surged on concerns over a widening of the Israel-Hamas conflict.

Nifty reversed the downtrend on October 27 but low volumes on such a day remains a concern. In the process it filled the downgap on daily charts formed on the previous day. Nifty could now head towards 19229-19298-19432 levels over the next few days while 18826-19047 band could provide support on downmoves.

-330

October 27, 2023· 16:05 IST

Rupak De, Senior Technical Analyst at LKP Securities:

After relentless selling in recent days, the Nifty has temporarily paused its decline due to an oversold chart setup. However, the index closed significantly below the critical breakdown level of 19250. As long as it stays below 19250, the market may continue to be inclined towards selling on any upward movements.

On the downside, a resumption of weakness is expected if the index falls below 18800. This is because put writers are likely to defend the Nifty with substantial positions at 18800, with immediate support placed at 19000.

After a consolidation breakdown on the daily chart, Bank Nifty experienced a 2000-point correction in a short span of time. The index appeared somewhat oversold, leading to a pullback on Friday. However, the sentiment remains predominantly bearish, and any upward movements may still face selling pressure.

On the upper side, 43000 could serve as a significant resistance level, as call writers have established substantial positions there. Support can be observed at 42500, where writers have a strong presence.

-330

October 27, 2023· 15:50 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The domestic market recovered well compared to yesterday’s sharp corrections, due to restrained FII’s selling along with moderation in currency and global bond yield volatility. Till date, the Q2 results outcome is decent, which is in-line with the buoyant estimate. Yet, the market is not enthusiastic as we are at the cusp of earnings downgrade in anticipation of further slowdown in the world economy due to elevated interest rate and geopolitical risk.

-330

October 27, 2023· 15:32 IST

Rupee Close:

Indian rupee ended flat at 83.24 per dollar on Friday versus Thursday's close of 83.23.

-330

October 27, 2023· 15:30 IST

Market Close

: Benchmark indices snapped six-day losing streak and ended higher with Nifty back above 19,000.

At close, the Sensex was up 634.65 points or 1.01 percent at 63,782.80, and the Nifty was up 190.00 points or 1.01 percent at 19,047.30. About 2673 shares advanced, 825 shares declined, and 125 shares unchanged.

Biggest gainers on the Nifty were Axis Bank, Coal India, HCL Technologies, SBI and Adani Enterprises, while losers were Dr Reddy's Laboratories, SBI Life Insurance, UPL, ITC and Asian Paints.

All the sectoral indices ended in the green with PSU Bank index up 4 percent.

BSE Midcap and Smallcap indices up nearly 2 percent each.

-330

October 27, 2023· 15:27 IST

Stock Market LIVE Updates | Dr Reddy’s Laboratories Q2 Results:

Net profit at Rs 1,480 crore and revenue at Rs 6,880 crore

-330

October 27, 2023· 15:26 IST

Stock Market LIVE Updates | Morgan Stanley View On Home First

-Overweight call, target Rs 1,050 per share

-Q2 profit beat of 5 percent driven largely by higher net interest income

-NII was 3 percent higher on better-than-expected loan spreads

-Borrowing costs compressed 13 bps QoQ

-Disbursements (+7 percent QoQ) and AUM (+8 percent QoQ) growth were strong

-Stage 3 ratio rose 15 bps QoQ

-Provision coverage at 30 percent was largely stable QoQ

-330

October 27, 2023· 15:25 IST

Sensex Today | Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas:

WTI Crude oil prices rose on Friday as media reports that the U.S military struck Iranian targets in Syria raised concerns of a widening of the Israel-Hamas conflict that could impact supply from the key Middle East producing region.

The oil prices climbed $85 or 2% during the mid-European trading hours. The oil prices were also supported by the strong US economic data showing 4.9% GDP growth in Q3CY23, however the PCE deflator eased to 2.4% in Q3, which will give cushion to US policymakers to keep the rates unchanged.

Expect crude oil prices to remain volatile for the day and will command risk premiums from the prevailing geo-political concerns in middle-east. WTI Dec futures find support at $82 and it can test the resistance of $88 during the day.

-330

October 27, 2023· 15:23 IST

Stock Market LIVE Updates | HSBC View On Asian Paints

-Buy call, target Rs 4,000 per share

-Q2 trailed expectations

-6 percent decorative volume growth, in part driven by uneven monsoons

-Uneven monsoon impacting volumes

-Margin expansion fuelled strong earnings growth

-Margin expansion remains on an upward trajectory

-Volume growth rebound expected in Q3

-H2FY24 outlook remains strong & valuation looks appealing

-330

October 27, 2023· 15:20 IST

Stock Market LIVE Updates | Sumitomo Chemical India Q2 Results:

Net profit down 28.8% at Rs 143.4 crore versus Rs 201 crore and revenue down 19.4% at Rs 903.4 crore versus Rs 1,120.4 crore, YoY.

-330

October 27, 2023· 15:17 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

Indian Rupee appreciated marginally by 2 paise on Friday on positive domestic markets. However, a positive Dollar and surge in crude oil prices capped sharp gains. US Dollar gained on robust economic data from US. US GDP rose by 4.9% y-o-y in Q3 2023 as compared to 2.1% in Q2 2023 and forecast of 4.5%. US durable goods orders increased by 4.7% in September 2023 vs 0.1% in August 2023. US core durable goods orders increased by 0.5% in September 2023 versus 0.5% in August 2023. US pending home sales increased by 1.1% in September 2023 versus -7.1% in August 2023. However, weekly unemployment claims rose to 210,000 as compared to 200,000 in the previous week.

We expect Rupee to trade with a slight negative bias on strong Dollar and elevated crude oil prices. FII outflows and escalation of geopolitical tensions in the Middle East may also put pressure on Rupee. Dollar may strengthen on safe haven demand on media reports that the U.S military struck Iranian targets in Syria. However, rise in risk appetite in global markets may support Rupee at lower levels. Traders may remain cautious ahead of core PCE price index and personal income data from US. USDINR spot price is expected to trade in a range of Rs 82.90 to Rs 83.60.

-330

October 27, 2023· 15:15 IST

Stock Market LIVE Updates | Westlife Foodworld tank 6% after Q2 net profit falls

The share price of Westlife Foodworld, McDonald's India operator, tanked 6 percent on October 27, a day after it reported a 29 percent on-year (YoY) fall in September quarter profit, missing analysts' estimates.

The company's revenue and EBITDA, however, came in higher but were below estimates.

Most analysts, however, say Westlife Foodworld is well-placed to navigate the challenging environment with execution machinery in place, a well-laddered menu architecture, sustained dine-in footfall and multiple levers for margin expansion. Read More

-330

October 27, 2023· 15:13 IST

Stock Market LIVE Updates | HSBC View On Rallis India

-Hold call, target Rs 185 per share

-Q2FY24 earnings better-than-expected

-Margins and seeds business surprised positively even as growth disappointed

-Efficient inventory management in difficult times was commendable

-High channel inventories remain a headwind

-330

October 27, 2023· 15:08 IST

Sensex Today | Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Past week, Nifty and Sensex both declined by approximately 2.5%, ranking them among the top losers in global equity markets. Smaller companies fared worse, with Nifty Midcap down 3% and BSE Smallcap down 2%.

Factors contributing to this downturn included higher global interest rates, growth concerns, and lackluster Q2FY24 earnings. All sectoral indices also saw losses, with Nifty Realty, Nifty Metals, and Media hit hardest. Notable Nifty Index gainers included Axis Bank, Coal India, and HCL Tech, while UPL, Adani Enterprises, and JSW Steel faced significant losses.

Foreign Portfolio Investors (FPIs) continued to sell, mirroring the trend in emerging markets, while Domestic Institutional Investors (DIIs) remained net buyers. In international news, the US GDP grew by 4.9% in Q3, attributed to consumer spending, exports, and government spending. The European Central Bank held interest rates, ending a streak of 10 consecutive increases due to Eurozone growth concerns.

-330

October 27, 2023· 15:06 IST

Stock Market LIVE Updates | Jefferies On Asian Paints:

-Underperform call, target Rs 2,500 per share

-Q2 was a miss due to delayed festive season along with erratic monsoon

-Q2 was a miss due to weak consumer sentiment

-Benefit of lower RM prices however drove up GM to a multi-year high

-Management commentary was positive on Q3

-Management commentary positive as shift in season should show up in D/D volume growth

-Geopolitical tensions do pose some concerns to margins

-Concerns mainly due to hardening of crude oil prices

-Grasim new capacity is <6M away now which causes heightened uncertainty

-330

October 27, 2023· 15:03 IST

Stock Market LIVE Updates | Morgan Stanley View On Punjab National Bank

-Underweight call, target Rs 55 per share

-Q2 profit missed estimate

-Staff costs were elevated (as bank stepped up wage hike provisioning)

-Overall credit costs were higher than expected

-Overall credit costs helped improve NPL coverage (80 percent vs. 76 percent)

-Impaired loans fell QoQ – a positive

-Gradual recovery remains on track

-330

October 27, 2023· 15:00 IST

Sensex Today | Market at 3 PM

The Sensex was up 719.09 points or 1.14 percent at 63,867.24, and the Nifty was up 209 points or 1.11 percent at 19,066.30. About 2567 shares advanced, 580 shares declined, and 98 shares unchanged.

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Anupam Rasayan | 850.80 0.97% | 800.13k 3,094.00 | 25,761.00 |

| Kovai Medical | 2,611.35 4.35% | 58.57k 1,476.40 | 3,867.00 |

| Industrial Inv | 137.10 6.69% | 56.38k 2,463.00 | 2,189.00 |

| GlaxoSmithKline | 1,432.55 -0.6% | 52.18k 2,892.80 | 1,704.00 |

| Piccadilly Agro | 241.25 4.98% | 712.61k 41,669.80 | 1,610.00 |

| EQUIPPP | 26.40 -2% | 56.28k 4,002.00 | 1,306.00 |

| ICICISILVE | 72.70 -0.56% | 141.17k 12,301.60 | 1,048.00 |

| SBI MF ETF | 691.84 1.12% | 280.05k 26,621.60 | 952.00 |

| Vedanta | 216.55 2.1% | 4.93m 494,439.60 | 898.00 |

| Sterlite Techno | 137.65 -8.02% | 1.89m 190,342.20 | 892.00 |

-330

October 27, 2023· 14:58 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| GNA Axles | 436.40 | 413.20 | -23.20 7.84k |

| Panache Digilif | 70.25 | 66.55 | -3.70 640 |

| Oriental Hotels | 103.10 | 98.00 | -5.10 58.95k |

| Shree Tirupati | 426.00 | 405.50 | -20.50 0 |

| Delta | 84.90 | 81.25 | -3.65 133 |

| TIPSFILMS | 542.65 | 520.00 | -22.65 39 |

| Industrial Inv | 143.55 | 137.85 | -5.70 48.06k |

| KAMOPAINTS | 144.00 | 139.00 | -5.00 1.28k |

| Madhav Copper | 28.00 | 27.05 | -0.95 814 |

| AAA | 67.30 | 65.20 | -2.10 82.33k |

-330

October 27, 2023· 14:57 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Srivari Spices | 112.05 | 127.00 | 14.95 0 |

| Suratwwala BG | 359.80 | 395.20 | 35.40 21.62k |

| SHUBHLAXMI | 78.05 | 84.00 | 5.95 667 |

| Art Nirman | 48.10 | 51.75 | 3.65 939 |

| NRB Industrial | 30.05 | 32.00 | 1.95 75 |

| Jubilant Pharmo | 353.50 | 375.50 | 22.00 24.84k |

| Mahamaya Steel | 78.20 | 82.85 | 4.65 1.66k |

| Peninsula Land | 40.20 | 42.15 | 1.95 37.64k |

| Hind Rectifiers | 436.40 | 456.75 | 20.35 1.27k |

| Punjab Chemical | 1,108.95 | 1,160.00 | 51.05 1.02k |

-330

October 27, 2023· 14:56 IST

Sensex Today | Dollar rises after blockbuster U.S. data lures in bulls

The dollar rose on Friday and is set for a third monthly gain after solid U.S. growth figures argued for interest rates to remain high for longer, while the yen struggled around the 150 level ahead of the Bank of Japan's policy meeting next week.

The U.S. economy grew at its fastest pace in nearly two years in the third quarter, data on Thursday showed, as higher wages from a tight labour market helped power consumer spending.

-330

October 27, 2023· 14:55 IST

Stock Market LIVE Updates | RIL shares trade higher ahead of Q2 earnings

Reliance Industries is expected to report a sharp jump in fiscal second quarter net profit even on a marginal revenue uptick, primarily led by refining margin gains. India’s largest company by market capitalisation is likely to show robust performance across segments, except some weakness in the petrochemicals segment.

Analysts foresee steady growth in all areas in Q2 FY24 after a weak Q1 FY24 O2C performance. Retail EBITDA will increase with higher foot traffic. Jio's EBITDA will gain from new subscribers, and Oil and Gas EBITDA will improve with increased gas production.

According to a Moneycontrol survey of 10 brokerages, RIL’s consolidated net sales are expected to come in at Rs 2.31 lakh crore in Q2 FY24, up 0.5 percent year-on-year, and 11 percent quarter-on-quarter.

Net profit is estimated at Rs 17,482 crore, up 27.2 percent year-on-year. RIL’s second quarter EBITDA is expected at Rs 39,696 crore, up 28 percent year-on-year and 9.2 percent quarter-on-quarter. Read More

-330

October 27, 2023· 14:52 IST

Stock Market LIVE Updates | Dwarikesh Sugar Industries Q2 Results

Net profit up 32.1% at Rs 10.3 crore versus Rs 8 crore and revenue down 17.5% at Rs 445.5 crore versus Rs 540.1 crore, YoY.

-330

October 27, 2023· 14:49 IST

Stock Market LIVE Updates | Nomura View On Colgate Palmolive

-Neutral call, target Rs 2,150 per share

-Q2 in-line headline but weaker-than-expected volumes

-Q2 volume decline of -1 percent YoY

-Higher-than-expected GPM expansion

-Sharp uptick in A&P leads to in-line OPM

-Company’s royalty (4.9 percent of sales) is up for renewal in Jul-24

-No changes were made in previous renewal Jul-19

-No change in renewal may loom over on margin

-Company trades at 40.5x Mar-25 EPS

-330

October 27, 2023· 14:49 IST

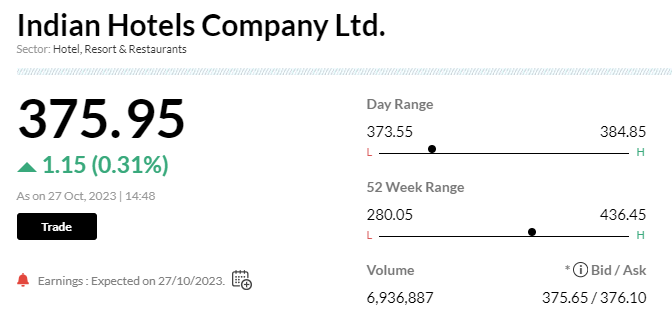

Stock Market LIVE Updates | Indian Hotels Q2 net profit jumps 37% YoY

Indian Hotels reported net income for the second quarter that missed the average analyst estimate. Net income Rs167 crore, up 37% y/y, estimated at Rs172 crore Bloomberg Consensus. Revenue Rs1430 crore, up 16% y/y, estimated at Rs1450 crore. Total costs Rs1250 crore, up 14% y/y. Other income Rs47.67 crore, up 91% y/y

-330

October 27, 2023· 14:44 IST

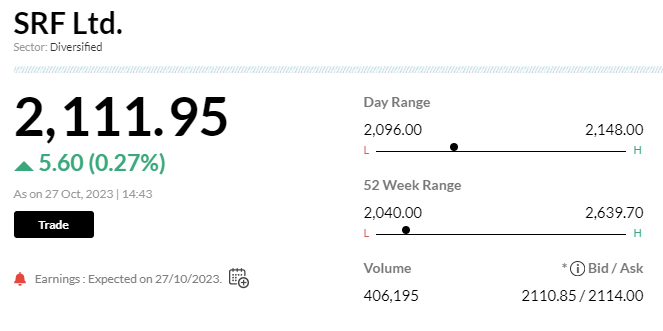

Stock Market LIVE Updates | SRF reports 37% decline in net profit for Q2

SRF reported net income for the second quarter that missed the average analyst estimate. Net income Rs301 crore, down 37% y/y, estimate Rs341 crore Bloomberg Consensus. Revenue was at Rs3180 crore, down 15% y/y, at an estimated Rs3279 crore. Total costs was at Rs2790 crore, down 11% y/y while other income Rs29.12 crore, down 11% y/y

-330

October 27, 2023· 14:39 IST

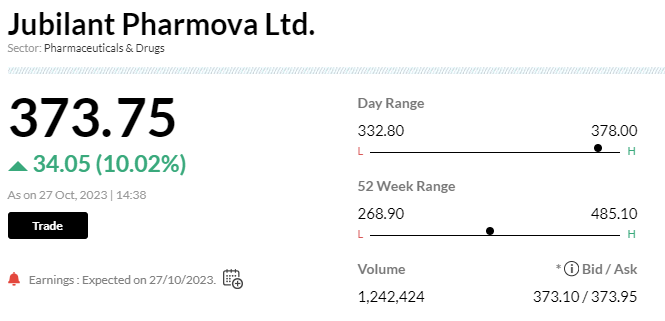

Stock Market LIVE Updates | Jubilant Pharmova gains 10% after Q2 earnings

Jubilant Pharmova Ltd reported net income for the second quarter of Rs62.50 crore versus Rs 5.4crore from a year ago. Revenue was at Rs 1680 crore up 5% y/y while total costs Rs1600 crore, up 5.3% y/y.

-330

October 27, 2023· 14:28 IST

Stock Market LIVE Updates | Blue Jet Healthcare IPO bought 3.13 times on final day, grey market premium drops

The Blue Jet Healthcare IPO has seen decent response from investors in the last three days, subscribing 3.13 times on October 27, the final day of bidding, with receiving bids for 5.32 crore equity shares against offer size of 1.7 crore shares.

High networth individuals have provided better support amongst investors, buying 5.84 times the allotted quota, followed by qualified institutional buyers whose reserved portion was subscribed 3.52 times.

Retail investors also looked interested in the company as they have bid 1.74 times the portion set aside for them.

-330

October 27, 2023· 14:23 IST

-330

October 27, 2023· 14:18 IST

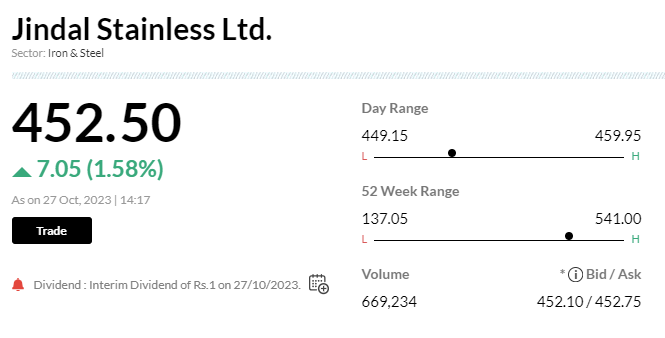

Stock Market LIVE Updates | Jindal Stainless gains 1.7% after huge block deal

Jindal Stainless jumped 1.7 percent after a huge block deal. Around 1.38 million shares in a block deal, Bloomberg reported. However, details of the buyers and sellers were not known.

-330

October 27, 2023· 14:13 IST

Sensex Today | Nifty Bank index rose nearly 1 percent led by Punjab National Bank, Bank of Baroda, State Bank of India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 72.90 | 4.37 | 80.21m |

| Bank of Baroda | 195.90 | 3.57 | 11.32m |

| SBI | 559.75 | 2.33 | 7.81m |

| IndusInd Bank | 1,440.20 | 1.81 | 1.79m |

| Axis Bank | 987.35 | 1.57 | 7.98m |

| IDFC First Bank | 85.70 | 0.88 | 19.78m |

| Federal Bank | 139.30 | 0.83 | 8.76m |

| Bandhan Bank | 213.65 | 0.56 | 3.81m |

| ICICI Bank | 913.45 | 0.53 | 5.93m |

| HDFC Bank | 1,468.95 | 0.38 | 12.12m |

-330

October 27, 2023· 14:10 IST

-330

October 27, 2023· 14:06 IST

Stock Market LIVE Updates | Schaeffler India Q2 Earnings:

Net profit up 8.1 percent at Rs 232.7 crore versus Rs 215 crore and revenue up 5.5 percent at Rs 1,853.6 crore versus Rs 1,756.4 crore, YoY.

-330

October 27, 2023· 14:04 IST

Stock Market LIVE Updates | Embassy REIT units up 3% on strong Q2 performance

Embassy Office Parks REIT units gained 3 percent in trade on October 27 after the company announced revenue from operations at Rs 889 crore, higher by 4 percent year-on-year.

Embassy Office Parks REIT leased 2 million square feet (msf) of office space across 25 deals, according to a regulatory filing on October 26. The leasing includes 1.2 msf of new leases and the company signed seven new deals over 1 lakh square feet, reflecting a return of large deal closures. Read More

-330

October 27, 2023· 13:59 IST

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Cadsys India | 253.00 | 226.00 | -27.00 0 |

| SHUBHLAXMI | 85.80 | 78.05 | -7.75 0 |

| Industrial Inv | 152.45 | 144.40 | -8.05 4.30k |

| Arvind and Comp | 76.05 | 72.30 | -3.75 251.72k |

| Carborundum | 1,142.50 | 1,102.90 | -39.60 3.41k |

| Archidply Decor | 88.00 | 85.00 | -3.00 45 |

| Kontor Space | 90.00 | 87.00 | -3.00 - |

| Agarwal Float | 61.00 | 59.00 | -2.00 5.10k |

| NRB Industrial | 31.00 | 30.05 | -0.95 163 |

| Ausom Enterp | 69.70 | 67.60 | -2.10 660 |

-330

October 27, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Dynacons Sys | 686.10 | 766.10 | 80.00 1.04k |

| AAA | 64.10 | 67.15 | 3.05 16.41k |

| Rudrabhishek En | 207.50 | 215.50 | 8.00 24.71k |

| Ameya Precision | 51.00 | 52.95 | 1.95 3.33k |

| Creative New | 548.10 | 567.80 | 19.70 2.18k |

| Bodhi Tree Mult | 147.55 | 152.65 | 5.10 12.90k |

| Vaidya Sane | 273.00 | 282.00 | 9.00 1.12k |

| Naga Dhunseri | 1,826.05 | 1,885.40 | 59.35 52 |

| Crop Life Sci. | 39.05 | 40.30 | 1.25 0 |

| Agni Green | 27.10 | 27.95 | 0.85 0 |

-330

October 27, 2023· 13:55 IST

Sensex Today | BSE Capital Goods index gained 1 percent supported by Grindwell Norton, Praj Industries, Suzlon Energy:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Grindwell Norto | 2,098.45 | 4.46 | 2.34k |

| Praj Industries | 538.80 | 4.33 | 28.82k |

| Suzlon Energy | 32.39 | 2.92 | 8.76m |

| CG Power | 382.50 | 2.85 | 53.28k |

| Lakshmi Machine | 13,530.00 | 2.82 | 201 |

| Bharat Elec | 131.85 | 2.17 | 388.33k |

| V-Guard Ind | 305.00 | 2.01 | 9.27k |

| GMR Airports | 54.50 | 1.98 | 94.91k |

| Hindustan Aeron | 1,853.95 | 1.89 | 52.92k |

| AIA Engineering | 3,487.50 | 1.79 | 230 |

-330

October 27, 2023· 13:53 IST

Stock Market LIVE Updates | Novartis India currently facing shortage of one of its product Simulect 20 mg

Novartis India is currently facing shortage of one of its product Simulect 20 mg. However, it is putting its best efforts to mitigate the supply issue on a sustainable basis.

-330

October 27, 2023· 13:49 IST

Stock Market LIVE Updates | Cipla Q2 Results:

Net profit up 43.3% at Rs 1,131 crore against Rs 789 crore and revenue up 14.6% at Rs 6,678 crore against Rs 5,828.5 crore, YoY.

-330

October 27, 2023· 13:47 IST

Stock Market LIVE Updates | Maruti Suzuki Q2 Results:

Net profit up 80.3% at Rs 3,716.5 crore versus Rs 2,061 crore and revenue up 23.8% at Rs 37,062 crore versus Rs 29,930 crore, YoY.

-330

October 27, 2023· 13:43 IST

Stock Market LIVE Updates | Rategain Travel Technologies Q2 Results:

Net profit at Rs 30 crore versus Rs 13 crore and revenue up 88.4 percent at Rs 234.7 crore against Rs 124.6 crore, YoY.

-330

October 27, 2023· 13:41 IST

-330

October 27, 2023· 13:39 IST

Stock Market LIVE Updates | RailTel Corporation of India Q2 profit jumps 23.4% YoY to Rs 68 crore

RailTel Corporation of India has reported profit at Rs 68.15 crore for quarter ended September FY24, growing 23.4% over a year-ago period despite 420 bps contraction in EBITDA margin. Revenue from operations grew by 40% on-year to Rs 599.2 crore for the quarter.

-330

October 27, 2023· 13:35 IST

Earnings on October 27:

-330

October 27, 2023· 13:33 IST

Earnings Today:

-330

October 27, 2023· 13:31 IST

Stock Market LIVE Updates | Aditya Birla Sun Life AMC Q2 profit drops 7% YoY to Rs 176.5 crore, but revenue grows 8%

Aditya Birla Sun Life AMC has recorded standalone profit at Rs 176.5 crore for quarter ended September FY24, falling 7.1% compared to year-ago period, impacted partly by lower other income. However, revenue from operations increased 7.7% year-on-year to Rs 329.2 crore in Q2FY24.

-330

October 27, 2023· 13:29 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 19044.80 0.99 | 5.19 -2.55 | -3.41 7.37 |

| NIFTY BANK | 42681.65 0.95 | -0.71 -2.38 | -4.28 3.35 |

| NIFTY Midcap 100 | 38691.65 1.51 | 22.80 -2.98 | -4.80 24.12 |

| NIFTY Smallcap 100 | 12633.20 1.96 | 29.82 -2.28 | -0.33 29.30 |

| NIFTY NEXT 50 | 43758.75 1.78 | 3.72 -1.77 | -3.24 3.22 |

-330

October 27, 2023· 13:26 IST

Stock Market LIVE Updates | Vodafone Idea Q2 loss widens to Rs 8,738 crore

Vodafone Idea has posted net loss of Rs 8,738 crore for July-September period of FY24, widening from loss of Rs 7,596 crore in corresponding period last fiscal. Revenue from operations increased by nearly 1% YoY to Rs 10,716 crore, while EBITDA grew by 4.5% on-year to Rs 4,283 crore with margin expansion of 140 bps at 40% for the quarter.

Average revenue per user jumped to Rs 140 in Q2FY24, up from Rs 131 in Q2FY23 and Rs 139 in Q1FY24.

-330

October 27, 2023· 13:24 IST

Stock Market LIVE Updates | Adani Energy commissions 2500 mw green evacuation 400 kV system in Tamil Nadu

Adani Energy Solutions has announced the successful commissioning of the Karur Transmission Ltd (KTL) project. The project includes the establishment of the 400/230 kV, 1000 MVA Karur Pooling Station and an associated transmission line spanning 8.51 circuit kilometers (CKM) in Tamil Nadu.

-330

October 27, 2023· 13:23 IST

Stock Market LIVE Updates | CLSA View On Colgate Palmolive India

-Sell call, target Rs 1,932 per share

-Q2 slight beat across metrics but decelerating top line

-EBITDA margin expanded 337 bps YoY driven by pricing & higher efficiency

-Key factors driving beat were re-launches of key brands

-Key factors driving beat were also increased reach & availability

-Outlook unclear, but pricing-led growth leaves door ajar for competition

-330

October 27, 2023· 13:20 IST

Stock Market LIVE Updates | Home First Finance Company Q2 profit grows 37% YoY to Rs 74 crore

Home First Finance Company India has recorded nearly 37% on-year growth in profit at Rs 74 crore for July-September period of FY24. Disbursement grew by 36.6% YoY to Rs 959 crore and total income increased by 47% to Rs 278 crore during the same period.

-330

October 27, 2023· 13:15 IST

Stock Market LIVE Updates | Laxmi Organic Industries Q2 profit jumps 24.6% YoY to Rs 10.7 crore

Laxmi Organic Industrie has reported a 24.6% on-year growth in consolidated profit at Rs 10.7 crore for the quarter ended September FY24 despite muted topline growth, driven by strong EBITDA performance. Revenue from operations grew by 0.01% YoY to Rs 652.3 crore for the quarter.

-330

October 27, 2023· 13:11 IST

Stock Market LIVE Updates | Bajaj Finserv Q2 Earnings:

Consolidated net profit up 24% at Rs 1,929 crore versus Rs 1,557 crore and revenue up 25.1% at Rs 26,023 crore versus Rs 20,803 crore, YoY.

-330

October 27, 2023· 13:09 IST

Stock Market LIVE Updates | Cipla share price gain ahead of September quarter earnings

Pharmaceutical company Cipla is expected to report a steady growth in its July-September net profit on consistent sales in the US and robust traction in its domestic chronic and over-the-counter segment. The Mumbai-headquartered drugmaker will announce its September quarter earnings on October 27.

According to a poll of brokerages collated by Moneycontrol, the drugmaker is expected to report a net profit of Rs 981.20 crore, up 23 percent on year. The topline is also poised for a double-digit increase at Rs 6,475.50 crore, reflecting 11 percent growth from the base quarter. Read More

-330

October 27, 2023· 13:06 IST

Sensex Today | Nifty FMCG index rose nearly 1 percent led by Dabur India, Varun Beverages, United Breweries:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Varun Beverages | 919.80 | 5.43 | 1.71m |

| Dabur India | 523.10 | 2.88 | 923.84k |

| United Brewerie | 1,608.05 | 2.37 | 85.29k |

| Nestle | 24,067.00 | 2.21 | 81.43k |

| United Spirits | 1,030.05 | 1.91 | 452.77k |

| Colgate | 2,071.35 | 1.82 | 663.98k |

| Godrej Consumer | 979.00 | 1.58 | 277.11k |

| Emami | 505.00 | 1.3 | 77.70k |

| TATA Cons. Prod | 890.00 | 1.1 | 491.64k |

| P and G | 17,000.00 | 0.83 | 12.79k |

-330

October 27, 2023· 13:01 IST

Sensex Today | Market at 1 PM

The Sensex was up 576.46 points or 0.91 percent at 63,724.61, and the Nifty was up 168.70 points or 0.89 percent at 19,026. About 2553 shares advanced, 540 shares declined, and 88 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 36587.28 0.98 | 26.50 -2.36 | -0.82 22.99 |

| BSE CAP GOODS | 45769.52 1.41 | 37.27 -3.06 | -3.08 39.46 |

| BSE FMCG | 18577.86 1.01 | 15.57 -0.91 | -1.77 15.84 |

| BSE Metal | 22271.37 0.71 | 6.79 -3.01 | -2.46 15.61 |

| BSE Oil & Gas | 18005.65 0.87 | -11.78 -3.12 | -4.92 -5.73 |

| BSE REALTY | 4618.72 1.55 | 34.00 -3.31 | 0.19 32.43 |

| BSE IT | 31044.36 1.3 | 8.27 -2.80 | -5.20 7.83 |

| BSE HEALTHCARE | 27261.06 1.04 | 18.35 -2.64 | -2.89 14.71 |

| BSE POWER | 4386.48 1.62 | 0.12 -1.91 | -5.37 -9.03 |

| BSE Cons Durables | 44160.19 0.65 | 11.17 -2.92 | -3.77 5.22 |

-330

October 27, 2023· 13:00 IST

Stock Market LIVE Updates | Ujjivan Small Finance Bank Q2 Earnings:

Net profit up 11.4 percent at Rs 327.7 crore versus Rs 294.3 crore and net interest income (NII) up 24.1 percent at Rs 823.3 crore versus Rs 663.2 crore, YoY.

-330

October 27, 2023· 12:59 IST

Stock Market LIVE Updates | Morgan Stanley View On Asian Paints

-Underweight call, target Rs 2,702 per share

-Q2 earnings missed estimate on top line and margins

-Seasonally weak quarter, monsoon and consumer mood spoils it further

-Q3 growth is expected to be strong given delayed festive season

-330

October 27, 2023· 12:56 IST

Stock Market LIVE Updates | Shree Digvijay Cement Q2 Results:

Net profit up 17.5 percent at Rs 7.4 crore vs Rs 6 crore and revenue up 12 percent at Rs 183.5 crore versus Rs 163.9 crore, YoY.

-330

October 27, 2023· 12:55 IST

Stock Market LIVE Updates | Indian Overseas Bank Q2 Results:

Net profit up 24.6% at Rs 624.6 crore versus Rs 501 crore and Net Interest Income (NII) up 20.1% at Rs 2,345.8 crore versus Rs 1,952.3 crore, YoY.

-330

October 27, 2023· 12:53 IST

Stock Market LIVE Updates | Shalby Q2 Results:

Net profit up 50 percent at Rs 27.6 crore versus Rs 18.4 crore and revenue up 17.9 percent at Rs 238 crore vs Rs 201.8 crore, YoY.

-330

October 27, 2023· 12:52 IST

Sensex Today | BSE Midcap index added 1 percent supported by Shriram Finance, Canara Bank, Bank of India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Shriram Finance | 1,944.50 | 8.17 | 122.72k |

| Canara Bank | 381.85 | 6.11 | 1.13m |

| Bank of India | 95.85 | 6.09 | 1.65m |

| Union Bank | 100.05 | 5.59 | 1.80m |

| Ajanta Pharma | 1,776.90 | 4.63 | 2.17k |

| Tube Investment | 3,052.65 | 4.33 | 8.44k |

| Nippon | 373.60 | 4.26 | 18.98k |

| L&T Finance | 136.50 | 3.84 | 857.89k |

| Zee Entertain | 247.20 | 3.58 | 262.15k |

| Delhivery | 420.35 | 3.46 | 6.19k |

-330

October 27, 2023· 12:50 IST

Stock Market LIVE Updates | Quick Heal Technologies Q2 profit tanks 42% YoY to Rs 12.9 crore

Quick Heal Technologies has registered a 41.7% YoY decline in profit at Rs 12.9 crore for July-September period of FY24, dented by lower topline. Revenue from operations for the quarter dropped 22.35% on-year to Rs 78.4 crore in Q2FY24.

-330

October 27, 2023· 12:46 IST

Stock Market LIVE Updates | CLSA View on Punjab National Bank:

-Outperform call, target raised to Rs 80 per share

-Steady Q2

-Continued improvement in asset quality

-Deposit accretion remains a challenge

-Management said choosing not to rely on wholesale deposits

-Company delivered a 0.4 percent RoA in H1FY24 & expects to maintain this in H2FY24

-Upgrade PPOP estimate by 4-9 percent for FY24/25

-Higher credit costs in FY24 (due to coverage increase) leads to a 35 percent profit cut

-330

October 27, 2023· 12:40 IST

Sensex Today | Oil rises more than $1 on fears of spread of Middle East conflict

Oil prices rose by over $1 on Friday as reports that the U.S military struck Iranian targets in Syria raised concerns of a widening of the Israel-Hamas conflict that could impact supply from the key Middle East producing region.

Brent crude futures for December rose $1.32, or 1.5%, to $89.25 a barrel by 0638 GMT. The U.S. West Texas Intermediate contract for December climbed $1.29, also 1.6%, to $84.50 a barrel.

-330

October 27, 2023· 12:38 IST

Stock Market LIVE Updates | AGI Greenpac Q2 profit surges 65% YoY to Rs 56 crore

AGI Greenpac has reported a massive 65.4% on-year growth in profit at Rs 56.1 crore for quarter ended September FY24, with revenue growing 20% YoY to Rs 615.3 crore and EBITDA increasing 59% to Rs 139 crore during the quarter.

-330

October 27, 2023· 12:35 IST

Stock Market LIVE Updates | Venus Pipes & Tubes Q2 profit spikes 97% YoY to Rs 20.3 crore

Venus Pipes & Tubes has recorded a 97.1% on-year growth in profit at Rs 20.3 crore for quarter ended September FY24, driven by healthy exports and seamless pipes business. Revenue from operations grew by 51.4% YoY to Rs 191.4 crore for the quarter and EBITDA surged 124.5% to Rs 34.8 crore with margin expansion of 592 bps at 18.2%.

-330

October 27, 2023· 12:32 IST

Sensex Today | BSE Realty index rose 1 percent led by Phoenix Mills, Indiabulls Real Estate, Macrotech Developers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 1,829.05 | 4.76 | 2.24k |

| Indiabulls Real | 73.54 | 3.19 | 149.44k |

| Macrotech Dev | 742.40 | 2.49 | 18.98k |

| Mahindra Life | 512.40 | 2.44 | 6.50k |

| Brigade Ent | 613.30 | 2.28 | 2.83k |

| Oberoi Realty | 1,087.35 | 1.58 | 6.05k |

| Godrej Prop | 1,603.35 | 1.54 | 7.68k |

| DLF | 531.35 | 1.49 | 75.37k |

| Sobha | 706.75 | 1.19 | 16.10k |

-330

October 27, 2023· 12:30 IST

Stock Market LIVE Updates | Jefferies On Colgate Palmolive India

-Buy call, target raised to Rs 2,320 per share

-Q2 in-line with trend witnessed in case of peers

-Company reported subdued volume trend, with nearly flat volumes YoY

-Pricing power however allowed a respectable revenue growth

-Smart margin expansion drove 18 percent YoY growth in operating EBITDA

-Input basket declined around 9 percent YoY bulk of which Colgate retained

-Input basket declining reflects pricing power

-Wonder, for other companies too if this could be better used to drive growth

-330

October 27, 2023· 12:24 IST

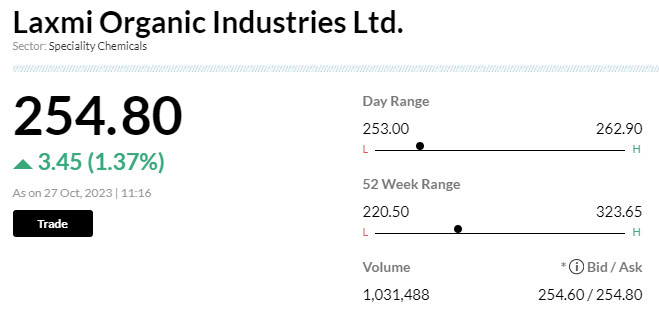

Stock Market LIVE Updates | Laxmi Organic surges 4.5% on jump in Q2 net profit, margin expansion

Laxmi Organic Industries witnessed a surge of nearly 4.5 percent in its shares during early trade on October 27. This was in response to the company's Q2 net profit, which saw a rise along with an expansion in the margin. The chemical firm reported a net profit of Rs 10.70 crore, up by 24.4 percent YoY, as compared to Rs 9 crore in the corresponding period last year.

The company's margin also increased due to lower other expenses and the ramping up of long-term projects in the specialty intermediates segment. The EBITDA margin surged to 6 percent in July-September, as opposed to the 4.4 percent recorded in the same quarter of the previous fiscal year.

However, while Laxmi Organic's Q2 earnings did rise on a year-on-year basis, it showcased a slump sequentially. Read More

-330

October 27, 2023· 12:22 IST

-330

October 27, 2023· 12:15 IST

Stock Market LIVE Updates | CLSA View On Dixon Technologies:

-Outperform call, target Rs 5,675 per share

-Q2 above estimate, growth levers intact

-Strength was driven by a sharp uptick in mobile phones

-Uptick in mobile phones should continue to be key growth driver

-Strength was also driven by ramp-up of new contracts (Xiaomi, Itel)

-Segments like refrigerators, hearables/wearables also provide strong growth visibility

-In addition, it is also exploring entry to high margin industrial electronics segments

-High margin industrial electronics segments such as auto & defence

-330

October 27, 2023· 12:08 IST

Stock Market LIVE Updates | Rajesh Sundaram elevated as Chief Business Officer - manufacturing business unit of LTIMindtree

Rajesh Sundaram has been elevated as Chief Business Officer – manufacturing business unit of LTIMindtree, with effect from October 26.

-330

October 27, 2023· 12:07 IST

Sensex Today | BSE Smallcap index rose 2 percent led by Talbros Automotive Components, Swan Energy, Indo Count:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Talbros Auto | 251.10 | 20 | 85.09k |

| Swan Energy | 386.95 | 17.6 | 689.50k |

| Indo Count | 267.50 | 11.18 | 163.60k |

| BLACK BOX | 243.85 | 10.56 | 101.26k |

| Jaiprakash Asso | 12.85 | 10.3 | 4.88m |

| HLV | 21.43 | 9.95 | 240.53k |

| Vikas Life | 4.82 | 9.79 | 3.07m |

| Optiemus Infra | 310.50 | 8.97 | 16.57k |

| Jyoti Resins | 1,598.05 | 8.83 | 22.13k |

| Venus Pipes | 1,396.90 | 8.69 | 46.40k |

-330

October 27, 2023· 12:03 IST

Sensex Today | Market at 12 PM

The Sensex was up 656.96 points or 1.04 percent at 63,805.11, and the Nifty was up 196.20 points or 1.04 percent at 19,053.50. About 2600 shares advanced, 452 shares declined, and 92 shares unchanged.

-330

October 27, 2023· 11:54 IST

Reliance Industries AGM Outcome | Shareholders approved the appointment of Isha Ambani, Akash Ambani and Anant Ambani as non-executive directors with majority, reported CNBC-TV18.

At 11:52 hrs Reliance Industries was quoting at Rs 2,267.00, up Rs 40.80, or 1.83 percent.

The company is going to announce its September quarter earnings today.

-330

October 27, 2023· 11:51 IST

-330

October 27, 2023· 11:47 IST

Stock Market LIVE Updates | RIL share price gain ahead of Q2 earnings

Reliance Industries is expected to report a sharp jump in fiscal second quarter net profit even on a marginal revenue uptick, primarily led by refining margin gains. India’s largest company by market capitalisation is likely to show robust performance across segments, except some weakness in the petrochemicals segment.

Analysts foresee steady growth in all areas in Q2 FY24 after a weak Q1 FY24 O2C performance. Retail EBITDA will increase with higher foot traffic. Jio's EBITDA will gain from new subscribers, and Oil and Gas EBITDA will improve with increased gas production.

According to a Moneycontrol survey of 10 brokerages, RIL’s consolidated net sales are expected to come in at Rs 2.31 lakh crore in Q2 FY24, up 0.5 percent year-on-year, and 11 percent quarter-on-quarter.

Net profit is estimated at Rs 17,482 crore, up 27.2 percent year-on-year. RIL’s second quarter EBITDA is expected at Rs 39,696 crore, up 28 percent year-on-year and 9.2 percent quarter-on-quarter. Read More

-330

October 27, 2023· 11:41 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,471.70 0.56 | 418.43k | 61.61 |

| Reliance | 2,264.45 1.72 | 195.30k | 44.12 |

| ICICI Bank | 913.80 0.51 | 263.63k | 24.09 |

| TCS | 3,350.60 0.38 | 70.26k | 23.52 |

| Larsen | 2,902.15 1.32 | 76.40k | 22.08 |

| SBI | 560.35 2.41 | 382.28k | 21.27 |

| Tata Motors | 633.55 1.13 | 337.99k | 21.38 |

| Infosys | 1,380.95 1.7 | 86.97k | 11.99 |

| Kotak Mahindra | 1,699.80 0.31 | 67.41k | 11.42 |

| Tata Steel | 120.75 0.71 | 937.85k | 11.32 |

-330

October 27, 2023· 11:40 IST

Cipla Q2 Preview: Another quarter of steady growth, margins to improve

Pharmaceutical company Cipla is expected to report a steady growth in its July-September net profit on consistent sales in the US and robust traction in its domestic chronic and over-the-counter segment. The Mumbai-headquartered drugmaker will announce its September quarter earnings on October 27.

According to a poll of brokerages collated by Moneycontrol, the drugmaker is expected to report a net profit of Rs 981.20 crore, up 23 percent on year. The topline is also poised for a double-digit increase at Rs 6,475.50 crore, reflecting 11 percent growth from the base quarter. Read More

-330

October 27, 2023· 11:34 IST

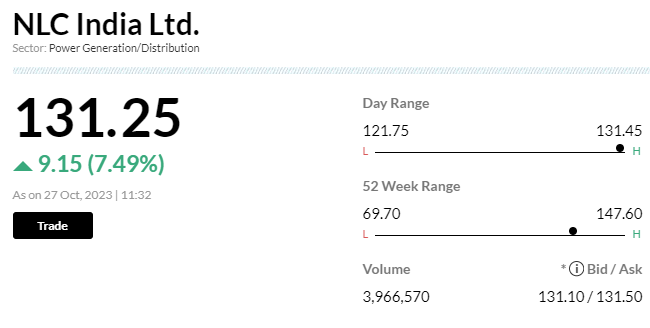

Stock Market LIVE Updates | NLC jumps 8% after Q2 net profit zooms 164%

NLC India was trading around 8 percent higher in the morning trade on October 27, a day after the state-owned company reported a 164 percent year-on-year jump in profit at Rs 1,085 crore in the June-September quarter.

The profit increased despite a fall in revenue and EBITDA on a one-time gain of Rs 1,278.5 crore.

Revenue for the quarter at Rs 2,978 crore was down 14.66 percent. The company’s EBITDA fell 29.2 percent to Rs 834.6 crore from the year-ago quarter.

-330

October 27, 2023· 11:27 IST

-330

October 27, 2023· 11:20 IST

Stock Market LIVE Updates | Laxmi Organic surges 4.5% on jump in Q2 net profit, margin expansion

Shares of Laxmi Organic Industries surged around 4.5 percent in early trade on October 27 after the company posted a rise in its Q2 net profit along with an expansion in margin. The chemical company's net profit for the September quarter grew 24.4 percent on year to Rs 10.70 crore, up from Rs 9 crore in the year-ago period.

Meanwhile, lower other expenses and ramp up in long term project in the specialty intermediates segment aided a margin expansion for the company. EBITDA margin expanded to 6 percent in July-September, up from 4.4 percent recorded in the same quarter of the preceding fiscal.However, revenue growth in the quarter was flattish at Rs 652.3 crore, largely due to the weakness seen across the sector.

Moreover, despite the growth in net profit and margin on the year-on-year basis, the earnings remained weak sequentially. On a sequential basis, net profit slumped 70 percent while revenue was down 11 percent. EBITDA margin were also sharply lower than the 10.5 percent clocked in the previous quarter.

-330

October 27, 2023· 11:13 IST

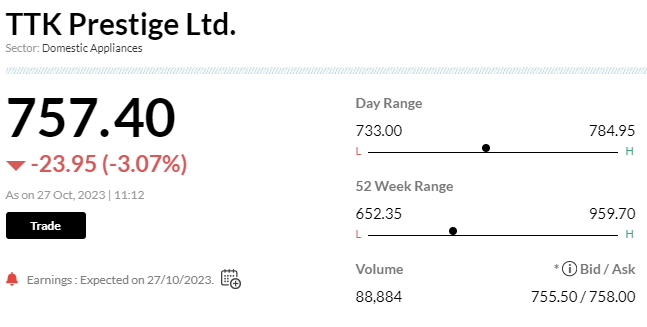

Stock Market LIVE Updates | TTK Prestige Q2 net profit falls 29.3%, revenue down 13.4%

TTK Prestige reported a 29.3 percent on year decline in its net profit for Q2 at Rs 59.30 crore while revenue also fell 13.4 percent to Rs 729.50 crore. EBITDA margin also came under pressure as it contracted to 11.1 percent in Q2 from 14.1 percent in the year-ago period.

-330

October 27, 2023· 11:06 IST

Sensex Today | BSE Oil & Gas Index up 1 percent supported by Adani Total Gas, Reliance Industries, IOC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Total Gas | 545.60 | 2.23 | 45.59k |

| Reliance | 2,265.35 | 1.76 | 141.20k |

| IOC | 87.15 | 1.2 | 174.46k |

| Petronet LNG | 221.00 | 1.01 | 22.39k |

| ONGC | 182.55 | 0.86 | 68.11k |

| GAIL | 119.45 | 0.84 | 190.27k |

| HINDPETRO | 243.60 | 0.56 | 35.81k |

| IGL | 388.75 | 0.52 | 15.99k |

| BPCL | 336.60 | 0.49 | 50.62k |

| Gujarat Gas | 405.90 | 0.48 | 18.81k |

-330

October 27, 2023· 11:05 IST

Stock Market LIVE Updates | Morgan Stanley View On Canara Bank

-Underweight call, target Rs 315 per share

-Q2 profit of Rs 3,600 crore (1 percent annualized RoA) was 10 percent above estimate

-Profit was mainly led by core performance & recovery from write-off accounts

-Core PPOP was 8 percent above estimate

-Core PPOP above estimate owing to NII beat (3 percent above estimate) & strong fees

-Asset quality trends improved

-Continue to prefer BoI & BoB

-330

October 27, 2023· 11:00 IST

Sensex Today | Market at 11 AM

The Sensex was up 522.71 points or 0.83 percent at 63,670.86, and the Nifty was up 151.70 points or 0.80 percent at 19,009. About 2524 shares advanced, 462 shares declined, and 75 shares unchanged.

-330

October 27, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| SHUBHLAXMI | 87.95 | 77.00 | -10.95 17.00k |

| Cadsys India | 271.00 | 253.00 | -18.00 0 |

| Univastu India | 139.85 | 132.00 | -7.85 752.93k |

| Aban Offshore | 56.00 | 53.00 | -3.00 103.65k |

| Plada Infotech | 47.70 | 45.15 | -2.55 6.00k |

| Surani Steel Tu | 265.90 | 252.00 | -13.90 2.00k |

| Ausom Enterp | 68.95 | 65.45 | -3.50 232 |

| Shradha Infra | 50.90 | 48.35 | -2.55 7.74k |

| Premier Polyfil | 186.35 | 177.60 | -8.75 271.54k |

| Canarys Automat | 45.40 | 43.30 | -2.10 - |

-330

October 27, 2023· 10:56 IST

| Company | Price at 10:00 | Price at 10:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| NRB Industrial | 29.50 | 32.50 | 3.00 2.40k |

| BLACK BOX | 229.35 | 248.35 | 19.00 189.91k |

| Kontor Space | 84.80 | 91.00 | 6.20 - |

| GRP | 3,700.00 | 3,915.00 | 215.00 107 |

| E Factor Experi | 155.00 | 163.95 | 8.95 - |

| Party | 68.15 | 71.85 | 3.70 4.00k |

| Karma Energy | 40.80 | 43.00 | 2.20 6.97k |

| DNL | 156.85 | 165.00 | 8.15 8.08k |

| Sadhana Nitro | 89.90 | 94.50 | 4.60 137.34k |

| Kotyark | 840.00 | 882.05 | 42.05 4.80k |

-330

October 27, 2023· 10:52 IST

Stock Market LIVE Updates | Suzlon Energy bags order for 3 mw series for development of a 50.4 mw wind power project for Juniper Green Energy

-330

October 27, 2023· 10:50 IST

Sensex Today | Rahul Kalantri, VP Commodities, Mehta Equities:

Gold and silver exhibited significant volatility, surging during the early trading session due to conflicts in the Middle East. However, the stronger-than-expected third-quarter U.S. GDP data later in the day led to a decline from their day's peak prices.

Gold prices once again tested the $2,000 per troy ounce level. While robust U.S. GDP data tempered the gains in precious metals, they found support from a sell-off in global equity markets, ongoing Middle East conflicts, and an increase in U.S. jobless claims. Nonetheless, the dollar index remains above 106 points, and U.S. 10-year bond yields are trading at their highest levels in 16 years, which is constraining the upward movement of global commodities.

Expect continued volatility in gold and silver prices during today's session. Gold has a support range at $1,970 to $1,958 and faces resistance between $1,996 and $2,010. Silver's support lies at $22.64 to $22.52, with resistance at $23.10 to $23.28. In terms of INR, gold has support between Rs 60,450 and Rs 60,220, and resistance at Rs 61,050 to Rs 61,260.

-330

October 27, 2023· 10:46 IST

Sensex Today | Nifty PSU Bank index rose 4 percent led by Canara Bank, JK Bank, Bank of India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Canara Bank | 385.00 | 7.14 | 14.29m |

| JK Bank | 105.55 | 6.19 | 4.58m |

| Bank of India | 95.60 | 5.93 | 11.77m |

| Union Bank | 99.90 | 5.44 | 12.96m |

| PNB | 73.45 | 5.15 | 42.37m |

| Bank of Mah | 43.00 | 4.12 | 26.46m |

| IOB | 39.80 | 3.65 | 50.50m |

| Indian Bank | 414.90 | 3.58 | 743.20k |

| Punjab & Sind | 39.45 | 3.41 | 2.06m |

| Central Bank | 45.30 | 3.31 | 20.82m |

-330

October 27, 2023· 10:42 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

After six continuous days of losses triggered by the elevated bond yields in the US and tensions in West Asia, the market appears to be oversold. Shorting in the FPI overweight segments like banking and IT have contributed significantly to the sharp market correction.

The US economy’s resilience is surprising. The Q3 GDP growth at 4.9% means the Fed will continue to be hawkish and the likely ‘higher for longer’ interest rate regime is negative from the stock market perspective.

On the positive side, valuations in India, which were high, have now turned fair and in sectors like banking valuations are attractive. This is the time for cherry picking for long-term investors. History tells us that corrections triggered by geopolitical events were opportunities to buy.

-330

October 27, 2023· 10:38 IST

Stock Market LIVE Updates | Colgate Palmolive Q2 profit jumps 22% YoY to Rs 340 crore on strong EBITDA margin

Colgate Palmolive has registered a 22.3% on-year growth in profit at Rs 340 crore for the quarter ended September FY24, driven by strong and better-than-expected EBITDA margin driven by pricing and efficiencies. Revenue from operations grew by 6% year-on-year to Rs 1,471 crore for the quarter. The board has declared first interim dividend of Rs 22 per share for the current fiscal. Read More

-330

October 27, 2023· 10:33 IST