Pharmaceutical company Cipla is expected to report a steady growth in its July-September net profit on consistent sales in the US and robust traction in its domestic chronic and over-the-counter segment. The Mumbai-headquartered drugmaker will announce its September quarter earnings on October 27.

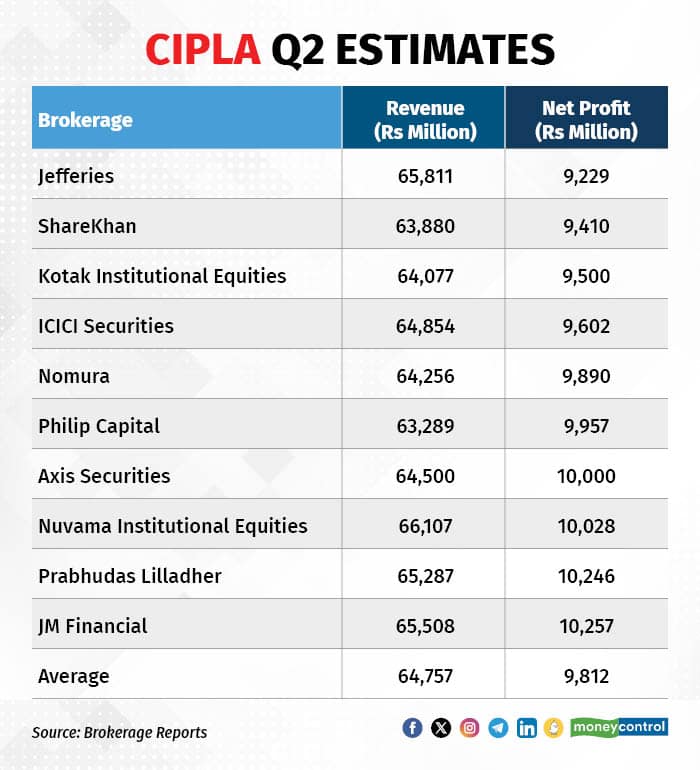

According to a poll of brokerages collated by Moneycontrol, the drugmaker is expected to report a net profit of Rs 981.20 crore, up 23 percent on year. The topline is also poised for a double-digit increase at Rs 6,475.50 crore, reflecting 11 percent growth from the base quarter.

Sequentially, growth is expected to moderate, largely on the back of lower Revlimid sales in the US. The company delivered record US sales of $222 million in the previous quarter, thanks to the stellar sales of Revlimid.

US sales to moderate but still deliver on-year growth

Even though sales in the US are likely to moderate from record highs of the previous quarter, they will post steady growth on a year-on-year basis. Brokerages said a moderation in Revlimid sales (to around $26 million) will be partially compensated by gradual ramp-up of Lanreotide (used to treat tumours) and Leuprolide (a cancer drug), market share gains in Albuterol (a respiratory drug) and Diclofenac gel (an anti-inflammatory drug).

Analysts at Axis Securities also peg $214 million base sales in the US market, which could be driven by Revlimid, Albuterol and Lenotirade. Out of that, JM Financial expects $46 million of contribution to come from Revlimid.

Not so subdued domestic growth

In the domestic market, growth for Cipla is going to be led by its chronic therapies and over-the-counter (OTC) consumer sentiment, which will offset much of the weakness arising from the lag in sales of acute drugs.

Sales of acute drugs remained weak this quarter due to a sporadic monsoon that resulted in a slower uptick of viral infection, thereby denting demand.

"Cipla is focusing on the OTC segment to increase sales in the domestic region," ICICI Securities said.

Factoring it in, JM Financial pegged 11 percent on-year growth in Cipla's domestic business despite weakness in sales of acute drugs.

Margins to remain steady

Despite some headwinds of growth slowdown, Cipla is expected to record improved margins in the quarter under review, thanks to a better product mix on increased contribution of branded generics, price hikes in the domestic market along with softening of raw material and freight costs.

On that account, Philip Capital expects EBITDA margin to power up 230 basis points on year to 23.6 percent led by the benefit of high-margin drugs Revlimid and lanriotide, and improved domestic sales, leading to a growth of 31 percent in EBITDA. One basis point is one-hundredth of a percentage point.

In the last quarter, the company had raised its margin guidance for FY24 to 23 percent as against a target of 22 percent.

Apart from the earnings, stakeholders will also focus on updates on Cipla's launch timeline of its blockbuster respiratory drug Advair. This comes into focus especially after the Pithampur site, where the drug was supposed to be manufactured got classified as 'Official Action Indicated' by the US Food and Drug Administration.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.