In this month, RBL Bank and Yes Bank reduced savings account interest rates by 25 basis points, to 6.25 percent and 5.25 percent respectively. IDFC First Bank reduced its savings account interest rate from 6 percent to 5 percent. The interest rates on savings account are lower compared to those on fixed deposits offered by banks.

There are still some small and new private banks and small finance banks that continue to offer higher interest on savings accounts compared to leading private banks. It’s important to give some serious thought on how much interest is paid by banks for leaving your funds in the savings account.

Small finance and newer private banks offer higher interest rates

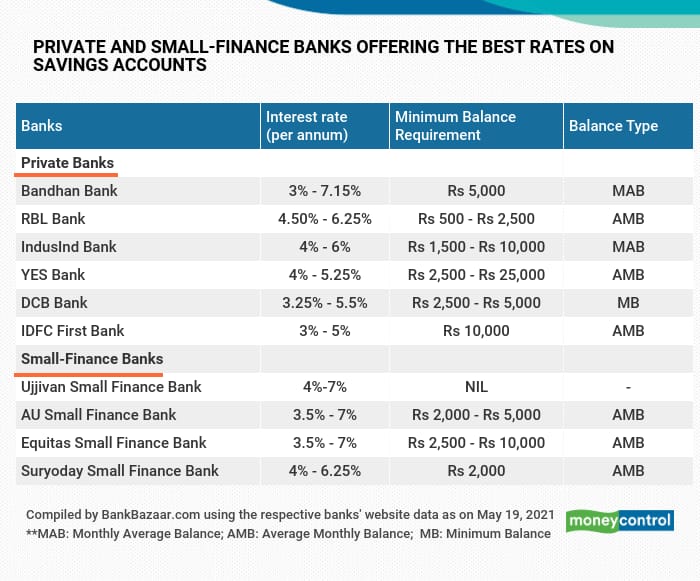

As per data compiled by BankBazaar, Bandhan bank offers up to 7.15 percent. This is followed by RBL Bank offering up to 6.25 percent and IndusInd Bank with up to 6 percent interest on savings accounts.

The interest rates are comparable with those offered by small finance banks. For instance, AU Small Finance Bank, Equitas Small Finance Bank and Ujjivan Small Finance Bank offer interest rates of up to 7 percent.

The interest rates offered by small finance banks on savings account are higher compared to leading private and large public sector banks. For instance, HDFC Bank and ICICI Bank offer 3 percent to 3.5 percent interest. The Axis Bank and Kotak Mahindra Bank are offering up to 4 percent interest. The State Bank of India (SBI) is offering 2.70 percent interest and Bank of Baroda is offering up to 3.20 percent interest respectively on their savings account.

Also read: DCB Bank and Yes Bank offer 6.75% interest on tax-saving deposits

Minimum balance requirements are higher

The minimum balance requirement in savings accounts of private banks starts from Rs 500 and it goes up to Rs 25,000. At AU Small Finance Bank and Suryoday Small Finance Bank the minimum balance requirement starts from Rs 2,000. It is kept higher by these banks compared to public sector banks because they are more interested in reaching out to the salaried middle class and self-employed professionals with their services. At Bandhan Bank, the minimum balance requirement is Rs 5,000. At leading private banks such as Axis Bank and HDFC Bank, the minimum balance requirement is Rs 2,500 to Rs 10,000.

Choose a bank with a long-term track record, good service standards, wide branch network and ATM services across cities; a higher interest on savings accounts would be a bonus.

Also read: Bank of Baroda, Kotak Mahindra Bank offer the lowest interest rates on home loans

A note about the table

Interest rate on savings account for all BSE listed public sector banks and private banks are considered for data compilation. Banks whose websites don't advertise the data are not considered. Minimum balance requirement for regular savings account and excluding basic savings bank deposit (BSBD) account are considered.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.