The benchmark indices showed a strong recovery from the day's low to close with moderate gains on February 17, snapping an 8-day fall, despite the market breadth favouring bears. A total of 1,796 shares saw a correction, compared to 835 shares that gained on the NSE. The market may extend the upward move amid consolidation, but sustainability will be key to watch. Below are some trading ideas for the near term:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Bharat Petroleum Corporation | CMP: Rs 252.3

BPCL witnessed a sharp decline of about 34% from its peak of Rs 376. It recently completed a Bullish Shark pattern around the Rs 240-242 level, which coincides with a strong support zone. This area aligns with the S1 Monthly and S1 Quarterly pivot supports, reinforcing its significance. Additionally, the price is near the 50% retracement of the uptrend from October 2022 to September 2024, suggesting a potential reversal. The confluence of technical indicators signals a possible rebound. Traders may consider entering long positions in the Rs 248-252 zone, with an upside target of Rs 275.

Strategy: Buy

Target: Rs 275

Stop-Loss: Rs 235

Tata Motors | CMP: Rs 686.6

Tata Motors saw a sharp decline of about 43% from its peak of Rs 1,179. It recently formed a Bullish Crab pattern around the Rs 665-680 range, aligning with a strong support zone and the S1 Monthly pivot support, highlighting its importance. Additionally, a bullish RSI divergence on the daily chart indicates positive momentum. Traders may consider entering long positions above Rs 685, with an upside target around Rs 755.

Strategy: Buy

Target: Rs 755

Stop-Loss: Rs 650

Bharat Heavy Electricals | CMP: Rs 193.5

On January 29, 2025, BHEL formed a bullish engulfing pattern near a support level, signaling a potential trend reversal, especially as it was backed by RSI bullish divergence. This pattern was followed by a 10% rally before a pullback occurred. Importantly, the low of the bullish engulfing pattern held firm, supported by the appearance of a couple of hammer candlesticks, indicating buying interest at lower levels. This price action took place just above the S3 Camarilla support pivot, strengthening the validity of this support zone.

The combination of bullish candlestick patterns, RSI divergence, and proximity to a key pivot level suggests a favourable setup for a potential continuation of the upward move. Traders may consider entering long positions in the Rs 190-193 zone, with an upside target around Rs 222.

Strategy: Buy

Target: Rs 222

Stop-Loss: Rs 176

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

CAMS Futures | CMP: Rs 3,424.55

Computer Age Management Services (CAMS) has closed well in positive territory in the last trading session, and it has also seen good Put additions from Rs 2,900 until Rs 3,300 strikes, indicating some base formation at lower levels. Since the stock has been introduced to the F&O segment, it has seen an increase in open interest with the price correcting and now reaching its highest levels. Hence, some short covering can’t be ruled out if there is a recovery in the index. One can buy CAMS Futures in the range of Rs 3,400 to Rs 3,425.

Strategy: Buy

Target: Rs 3,600, Rs 3,700

Stop-Loss: Rs 3,290

Apollo Tyres Futures | CMP: Rs 417.85

Apollo Tyres has closed well in positive territory in the last trading session, recovering well from its day's low. So far, the stock has fallen quite a lot from its all-time high levels, mainly due to long unwinding. The open interest in futures has reached its 4-year low, which indicates that it has become quite oversold, and a bounce-back can’t be ruled out from the current levels. One can buy Apollo Tyres Futures in the range of Rs 416-418.

Strategy: Buy

Target: Rs 450, Rs 465

Stop-Loss: Rs 406

Bajaj Finserv Futures | CMP: Rs 1,894.8

After having witnessed short positions for a long time, Bajaj Finserv is showing early signs of long buildup with higher tops and higher bottoms formations. There is also a good Put base at Rs 1,800 levels, and aggressive Put writing at Rs 1,800 to Rs 1,860 strikes, indicating that this will act as a crucial support going forward. On the upside, Rs 1,860 is the only strike with the highest Call open interest, and the stock has managed to close above the same, which is a positive sign for the stock in the near term. One can buy Bajaj Finserv Futures in the range of Rs 1,890 to Rs 1,900.

Strategy: Buy

Target: Rs 1,980, Rs 2,030

Stop-Loss: Rs 1,840

Anshul Jain, Head of Research at Lakshmishree Investments

UltraTech Cement | CMP: Rs 11,490

UltraTech Cement is showing a promising bullish Cup and Handle pattern on the daily charts, spanning 39 days. This classic technical setup, often signaling a strong uptrend continuation, is forming with diminishing volume, indicating potential strength. Although the structure appears slightly loose, the pattern is well-developed and nearing maturity for a breakout above Rs 11,800. A decisive move past this level, supported by rising volume, could trigger strong buying momentum. Traders should watch for confirmation signals like increased volume and sustained price action above the resistance to capitalize on the next bullish phase.

Strategy: Buy

Target: RS 12,490

Stop-Loss: Rs 10,990

Aarti Pharmalabs | CMP: Rs 791

Aarti Pharmalabs has broken out of a five-day inside bar consolidation on the daily charts, following a 117-day bullish VCP (Volatility Contraction Pattern) breakout. This price action indicates renewed strength after a period of tightening. Notably, the breakout is backed by volume exceeding 2x the 50-day average, signaling institutional accumulation and strong buyer interest. Such a setup often leads to sustained upward momentum, making Aarti Pharmalabs a stock to watch. Traders should monitor for continued strength above key resistance levels, as follow-through buying could push the stock into a stronger bullish phase.

Strategy: Buy

Target: Rs 900

Stop-Loss: Rs 750

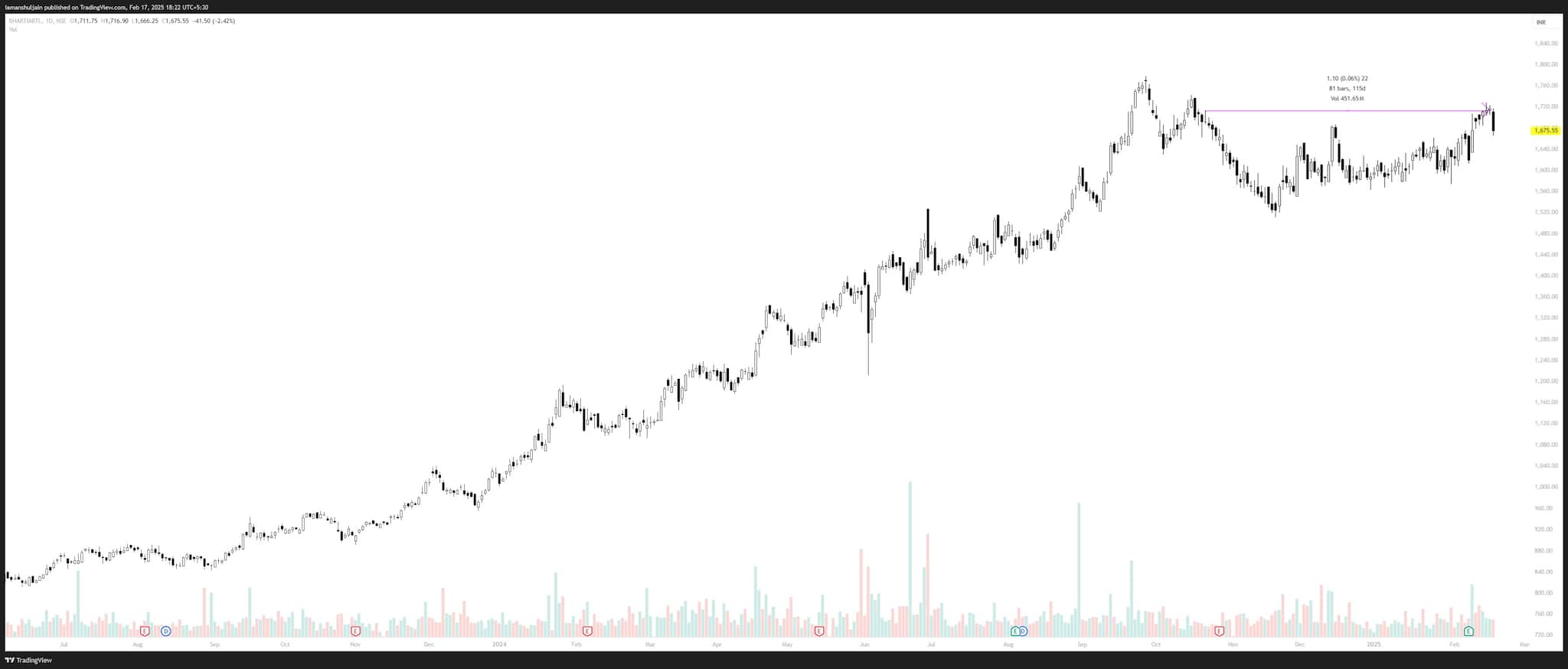

Bharti Airtel | CMP: Rs 1,675.55

Bharti Airtel has formed a corrective bar on the daily charts, but the lack of volume surge suggests no immediate institutional activity. However, the overall structure and volume within the pattern indicate that institutions are actively accumulating the stock. A decisive move above Rs 1,720 is expected to trigger fresh institutional buying, paving the way for an immediate upside towards Rs 1,800. Traders should watch for a volume surge alongside the breakout to confirm strength. If buying pressure increases, the stock could gain momentum for a strong bullish continuation in the near term.

Strategy: Buy

Target: Rs 1,800

Stop-Loss: Rs 1,625

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.