The global stock markets were witness to a lot of volatility in January, mainly due to the strict stance adopted by the US Federal Reserve regarding interest rate hikes, ever-increasing inflation and the rise in crude oil prices. The effect was widespread in the Indian stock markets, too, which was further aggravated by the uncertainties in the runup to the February 1 annual budget.

The decline in market capitalisation of the 30-pack BSE Sensex during the month was Rs 1.59 lakh crore only, but the high volatility made things very difficult for market players.

The bears pulled the BSE Sensex down by 0.41 percent, BSE 500 (representing multicap stocks) fell 0.40 percent, BSE Smallcap fell 0.78 percent and BSE Midcap fell 1.43 percent.

The Nifty50 declined by 0.08 percent, while the Nifty Midcap 150 underperformed the benchmark, falling 1.1 percent. “On the other hand, the Nifty Smallcap 250 was looking stronger and made a fresh lifetime high of 10,525 levels and closed at 9,813, down by just 0.3 percent on a monthly basis,” said Vidnyan Sawant, AVP, technical research, GEPL Capital.

“If we look at the broader space multicap front like Nifty 500, it had made the second-highest top at 15,834 which is close to its lifetime high of 16,004, and closed at 14,921, down by 0.5 percent on a monthly basis,” he added.

However at the end of January, more than 55 percent of the stocks of the Nifty 500 index were trading below their 50-day simple moving average (SMA) and 46 percent were below their 200-day SMA, which indicates broader turmoil.

“If we look at the data of October 2021, when the Nifty was at its lifetime high of 18,604 levels, 76 percent of the stocks of the Nifty 500 were sustaining above their 50-day SMA and around 62 percent of the stocks were above their 200-day SMA,” said Sawant.

The 50-day SMA takes into account data for around two and half months, indicating the short-term trend, and the 200-day SMA looks at almost a year, indicating a longer-term trend.

Even though the major indices displayed a negative trend in January, there were many portfolio management services (PMS) schemes from the broader markets that outperformed the Nifty and Sensex to generate better returns in January.

PMS schemes cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. Their professional fee structure is different from that of regular mutual funds.

Of 274 schemes tracked by pmsbazaar.com in January, 94 schemes (34 percent of the total schemes) generated better returns than the Nifty50, the data shows. There were 11 schemes (4 percent) that generated more than 5 percent returns during the month.

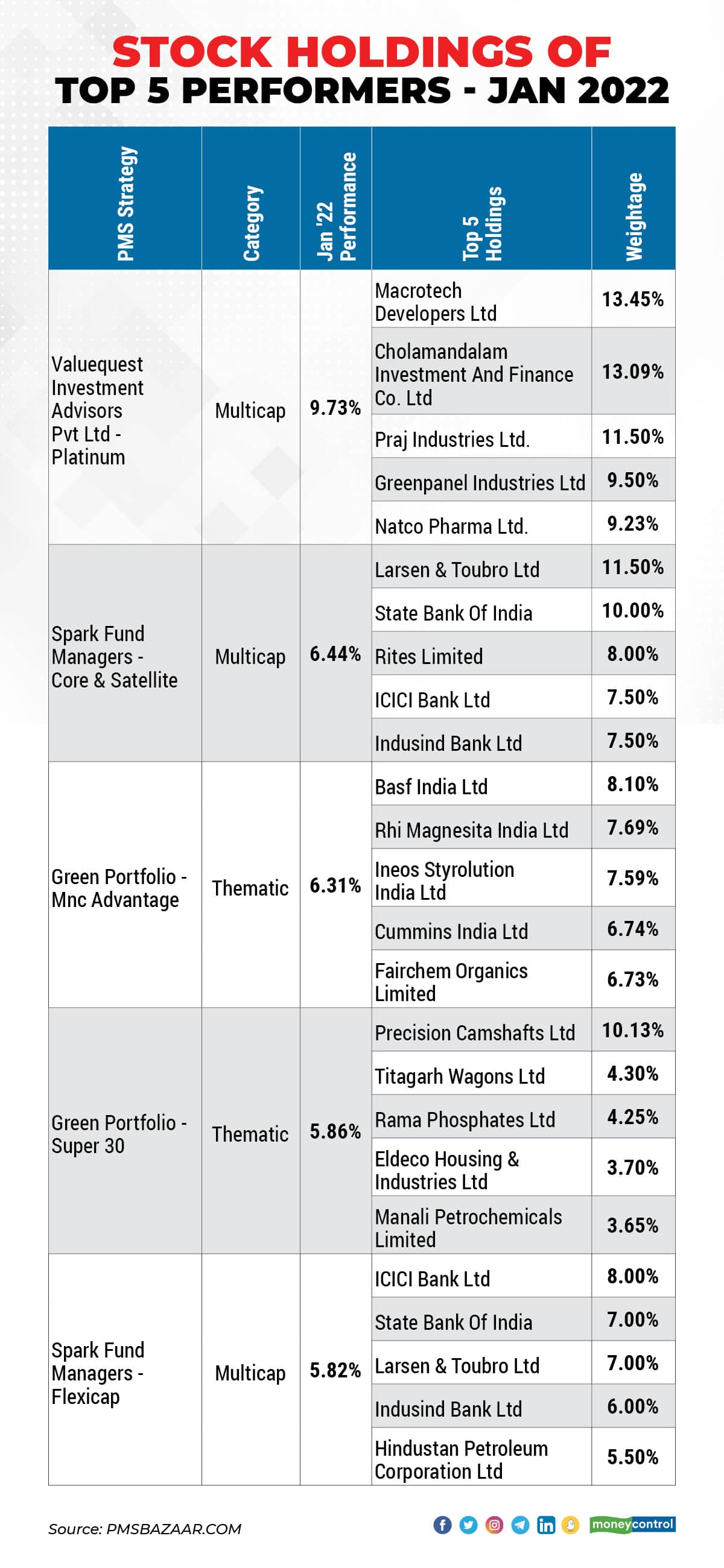

These were led by Valuequest Investment Advisors Pvt Ltd – Platinum (+9.73 percent); Spark Fund Managers – Core & Satellite (+6.44 percent); Green Portfolio – MNC Advantage (+6.31 percent); Green Portfolio – Super 30 (+5.86 percent) and Spark Fund Managers – FlexiCap (+5.82 percent).

Moneycontrol has collated a list of the holdings of these top five performing PMS schemes.

This list of holdings may give investors an idea about which stocks the fund managers of these schemes betted on but they should not be considered ‘buy’ recommendations as every fund manager has their own investment strategy.

Valuequest Investment Advisors Pvt Ltd–Platinum

Primarily focused on multicaps, this scheme generated the highest returns of 9.73 percent for its investors last month. Its top five holdings during January were Macrotech Developers Ltd, Cholamandalam Investment & Finance Company Ltd, Praj Industries Ltd, Greenpanel Industries Ltd and Natco Pharma Ltd.

Spark Fund Managers–Core & Satellite

Also with a focus on multicaps, the scheme generated 6.44 percent returns during January. Its top holdings were Larsen & Toubro Ltd, State Bank of India, Rites Ltd, ICICI Bank Ltd and IndusInd Bank Ltd.

Green Portfolio–MNC Advantage

This thematic scheme generated 6.31 percent returns during the last month by investing in stocks such as BASF Ltd, Rhi Magnesita India Ltd, Ineos Styrolution India Ltd, Cummins India Ltd and Fairchem Organics Ltd, which were also its top five holdings.

Green Portfolio–Super 30

The scheme mainly invests in thematic stocks, which helped it generate 5.86 percent returns for its investors during January. It invested in stocks of Precision Camshafts Ltd, Titagarh Wagons Ltd, Rama Phosphates Ltd, Eldeco Housing & Industries Ltd and Manali Petrochemicals Ltd.

Spark Fund Managers–FlexiCap

The scheme generated 5.82 percent returns by investing in multicaps like ICICI Bank Ltd, State Bank Of India, Larsen & Toubro Ltd, IndusInd Bank Ltd and Hindustan Petroleum Corporation Ltd.

Outlook

The market continues to be roiled by geopolitical tensions between Russia and Ukraine, talks of aggressive interest rate hikes by the US Fed and a 40- year high CPI inflation in the US. In this scenario, experts suggest that it would make more sense to have a well-diversified multicap portfolio.

“Mid- and smallcaps tend to be volatile in times of global macroeconomic uncertainty. However, from a medium- to long-term perspective, select midcaps and smallcaps are available at reasonable valuations, and can be good wealth creators in times to come,” said Vaibhav Agrawal, CIO and founder of TejiMandi.

Large caps, especially in bellwether sectors like IT and pharma, could be bastions of safety in current times, while large-cap private sector banks can be a good way to play India's cyclical upturn, he added.

He recommends investors have a well-calibrated multicap portfolio as the large-caps can provide stability and midcaps and smallcaps provide opportunities for wealth creation.

Manoj Dalmia, founder and director, Proficient Equities, suggests that “one can have a buy on dips strategy”. He believes that fundamentally strong small- and midcap stocks, considering the capex moves and initiatives by the government, can be a good bet in the near to medium term and can give massive returns going ahead.

“Some categories of stocks like (those) solving environment problems, housing finance, infrastructure and agriculture could be looked at for investments,” Dalmia concluded.

“Investors need to have a good mix of largecaps, midcaps and smallcaps in their portfolio in a mix that represents their return expectation and risk tolerance capability,” said Deepak Jasani, head of retail research, HDFC Securities. While largecaps will give stable returns, small- and midcaps will provide alpha in good times.

“Looking at the confluence of negative factors facing the global equity markets currently, it is advisable to raise the proportion of largecaps and reduce that of midcaps for some time till we see these negatives resolved or behind us,” he added.

Needless to say, investors should stop burning their hands trying to “time” the market. A better strategy may be to slice their investments over a period of 6-12 months so that they can ride the volatility wave better.

Akshat Garg, manager, research, Investica, sees tremendous value in Indian IT industry from a medium- and long-term perspective as he feels that the turbulence at present is not fundamental but mainly the result of global events that may soon fade.

“Moreover, given that India is one of the fastest-growing economies in emerging markets, investors can bet on its infrastructure and manufacturing sectors, as these cardinal sectors form the backbone of any economy,” Garg said. “This is especially true for a giant economy like India, where the central government is leveraging its resources to achieve a $5 trillion economy.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.