LiveNow

Closing Bell: Nifty ends near 24,600, Sensex up 150 pts; PSU Bank, realty, oil & gas shine

Nifty ends near 24,600, Sensex up 146 pts

Indian benchmark indices ended higher for the second consecutive session on July 15 with Nifty above 24550. At close, the Sensex was up 145.52 points or 0.18 percent at 80,664.86, and the Nifty was up 84.50 points or 0.34 percent at 24,586.70.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

The upside momentum continued in the market for the second consecutive sessions on Monday and the Nifty closed the day with a decent gain of 84 points. After opening with a positive note, the market continued to move up gradually in the early to mid part of the session. Consolidation has happened at the new highs in the mid to later part of the session and Nifty finally closed the day near the highs. New all-time high was registered at 24635.

A small candle was formed on the daily chart with identical open and close. Technically, this pattern indicates a formation of doji type candle pattern. Normally such doji formations after a reasonable upmove and at hurdles considered as an impending reversal signal from the highs post confirmation. But, having formed this pattern amidst a range movement, the significant negative anticipation could be less.

The near-term trend of Nifty remains positive. Having sustained above the hurdle of 24400 levels (1.618% Fibonacci extension), there is a higher possibility of further gradual upmove in Nifty towards 24950 levels in the next one week. Immediate support is at 24450.

Prashanth Tapse, Senior VP (Research), Mehta Equities

Investors are adopting a selective buying approach with just over a week's time left for the Budget, as the market has already run up sharply over the past few weeks in hopes of a strong reform-oriented Budget. Global cues will also dictate trends, and investors would be watchful of the geo-political tensions and the Fed's statement on rate cuts.

Rupak De, Senior Technical Analyst, LKP Securities

The index started in the green and remained sideways during the day. On the daily chart, a doji pattern has formed, indicating indecisiveness. A fall below 24,520 might trigger near-term panic in the market.

A fall below 24,250 might take the index towards 24,200-24,180. On the higher end, resistance is placed at 24,650, above which further upside looks possible.

Vinod Nair, Head of Research, Geojit Financial Services

The Indian market continues to experience optimism driven by positive expectations from the upcoming Union Budget, robust FII inflows, and better-than-expected results from the IT sector.

Additionally, the initial results from PSU banks have triggered a strong rally in the PSU index. However, the degree of optimism in the broad market is moderating as we are heading towards the budget D-day next week. Also, June's CPI inflation reached a 5-month high due to the heatwave in May-June.

Aditya Gaggar Director of Progressive Shares

A lackluster trade was seen after a knee-jerk reaction in the opening and the Index settled at 24,586.70 with gains of 84.55 points. Barring IT, all other sectors ended the day in green with PSU Bank being the top gainer followed by Media. Mid and Smallcaps advanced over 0.50% and outperformed the Frontline Index.

The Index has formed a DOJI candlestick pattern at a record level indicating a reversal but considering a strong uptrend such correction if any, will be considered a buying opportunity. The downside seems to be protected at 24,400 while on the higher side level of 24,740 will serve as an immediate hurdle.

Currency Check | Rupee closes lower

Indian rupee ended lower at 83.60 per dollar on Monday versus Friday's close of 83.53.

Market Close | Nifty ends near 24,600, Sensex up 146 pts; PSU Bank, realty, oil & gas shine

Indian benchmark indices ended higher for the second consecutive session on July 15 with Nifty above 24550.

At close, the Sensex was up 145.52 points or 0.18 percent at 80,664.86, and the Nifty was up 84.50 points or 0.34 percent at 24,586.70. About 1837 shares advanced, 1781 shares declined, and 104 shares unchanged.

ONGC, Shriram Finance, SBI Life Insurance, Bajaj Auto and SBI were among the top gainers on the Nifty, while losers were LTIMindtree, Asian Paints, Grasim Industries, Tata Steel and Axis Bank.

Among sectors, except IT all other sectoral indices ended in the green with auto, pharma, PSU Bank, realty and oil & gas indices up 1-3 percent.

The BSE midcap index gained 1 percent while the smallcap index was up 0.2 percent.

Stock Market LIVE Updates | CESC arm signs framework agreement for wind capacity with Suzlon Energy

Purvah Green Power Private Limited, a step-down subsidiary of CESC Limited has entered into a framework agreement with Suzlon Energy Limited for supply, EPC and operations and maintenance of wind turbines to be commissioned over next 2-4 years.

Sensex Today | Jio Financial Services trades near day's high

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Mah | 68.72 | 8.32 | 113.24m |

| IOB | 68.39 | 7.41 | 81.14m |

| JK Bank | 113.85 | 6 | 8.29m |

| Punjab & Sind | 62.01 | 4.64 | 7.66m |

| Central Bank | 65.59 | 3.77 | 32.06m |

| Indian Bank | 578.95 | 3.62 | 3.16m |

| UCO Bank | 56.29 | 3.51 | 36.24m |

| PNB | 120.98 | 2.75 | 31.72m |

| Canara Bank | 117.24 | 2.71 | 47.85m |

| SBI | 881.55 | 2.54 | 24.40m |

Brokerage Call | JPMorgan keeps 'overweight' rating on Avenue Supermarts, target Rs 5,400

#1 Q1FY25 operational performance broadly in-line

#2 Company continues to add stores at a gradual pace (+6 In Q1; +2 added in Q2 so far)

#3 Margin expansion was supported by better product mix

#4 Product mix was better as general merchandise and apparel contribution improved

#5 Higher-than-anticipated increase in employee costs & other expenses kept ebitda margin flat

#6 Subsidiaries’ revenue grew 27 percent YoY and 7 percent QoQ with moderating profit loss

#7 Sustained high-teen revenue makes DMART the best growth engine amongst discretionary names

#8 Earnings growth delivery makes DMART the best growth engine amongst discretionary names

Stock Market LIVE Updates | Bank of Maharashtra to consider raising long-term bonds

The Board of Directors will meet on July 18 to consider raising long-term bonds through a public issue or private placement of suitable tenor during the financial year 2025.

Brokerage Call | Morgan Stanley believes bull case is in play for UltraTech & Ambuja Cements

#1 Ambuja Cements- upgrade to overweight, target raised to Rs 775

#2 UltraTech Cement- overweight call, target raised to Rs 13,620

#3 Near-term industry may move sideways given limited upside triggers

#4 Medium-term outlook remains robust given demand led margin expansion story is intact

#5 Expect stocks with capacity share gains and cost improvement capabilities to do well

Brokerage Call | JPMorgan keeps 'neutral' rating on HCLTech, target Rs 1,510

#1 Company’s momentum stays just ahead of larger peers

#2 Cautious comments, signings & guide (nearly 0.5-2 percent CQGR) suggest company is not out of the woods yet

#3 Services revenues were down 2 percent slightly ahead of estimates, thanks to offshore shift

#4 Services revenues were down 2 percent due to productivity pass through in manufacturing (down 7 percent QoQ)

#5 Incremental guide of 0.9-2.2 percent CQGR (Q1FY25-Q4FY25) overall & 0.5-2 percent CQGR appear achievable

#6 Demand momentum appears choppy based on recent deal win trajectory & cautious commentary

Stock Market LIVE Updates | R Balaji has joins PTC India Financial Services as MD & CEO, effective July 12

Sensex Today | India June Trade Deficit at $20.98 billion

#1 Exports rose 2.6% y/y

#2 Imports rose 5% y/y

#3 Exports were $35.20 billion

#4 Imports were $56.18 billion

#5 Services exports was $30.27 billion

#6 Services imports was $17.29 billion

Sensex Today | Spot USDINR to trade between 83.30-83.80: Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee declined by 0.05% today as on positive US Dollar and rising domestic inflation. India’s CPI rose 5.08% y-o-y in June 2024 versus 4.75% in May 2024. This trimmed rate cut expectations by the RBI in its August monetary policy and raised odds of a rate cut by the RBI. WPI Inflation rose 3.36% y-o-y in June versus 2.61% in May. However, it was lower than expectations of 3.50%. India’s IIP rose 5.9% y-o-y in May 2024 versus 5% in April 2024. US Dollar rose on safe haven demand amid political violence in the US.

We expect Rupee to trade with a slight positive bias on positive domestic markets and sustained FII inflows. Softness in crude oil prices may also support the Rupee. However, positive US Dollar on safe haven demand may cap sharp upside. Rising odds of a rate cut by Fed in September may limit sharp upside in the greenback. Traders may take cues from Empire State manufacturing index data from the US. USDINR spot price is expected to trade in a range of Rs 83.30 to Rs 83.80.

Brokerage Call | CLSA keeps 'outperform' rating on Titan, target cut to Rs 3,948

#1 Company saw a perfect storm in Q1FY25 but we believe it should still grow sales broadly in-line

#2 Q1 saw a spike in gold prices coupled with sharpest YoY decline in wedding days in recent years

#3 Believe that customer growth remains positive despite headwinds is testament to brand’s power

#4 Cut estimates given the Q1 weakness & elevated gold prices

#5 Lower EPS estimates 7-12 percent over CL25-27

Stock Market LIVE Updates | RSWM in agreement with Didwania Trading to sale thermal power plant

The company has entered into an agreement with Didwania Trading Company, Bhilwara, for the sale of a thermal power plant (2 X 23 MW), which has now become cost inefficient and redundant, for Rs 48.01 crore.

Stock Market LIVE Updates | HDFC AMC Q1 net profit up 26.4% at Rs 604 crore Vs Rs 478 crore, YoY

Stock Market LIVE Updates | Central Bank of India in co-lending partnership with Arka Finca

The bank has entered into a strategic co-lending partnership with Arka Fincap to offer MSME loans.

The bank has entered into a strategic co-lending partnership with Arka Fincap to offer MSME loans.

Brokerage Call | Kotak keeps 'add' rating on HCLTech, target raises to Rs 1,650

#1 Company reported a weak quarter

#2 Revenue decline of 1.6 percent, led by anniversaries of a few mega deals & decline in ER&D segment

#3 A USD 69 million gain from Statestreet JV’s divestment led to a net profit beat

#4 Volatility in deal wins will lead to minor growth deceleration in FY25

#5 Balanced portfolio of services & good execution ensured reasonable growth YoY at 5.6 percent

#6 Deal wins need stepping up to drive growth acceleration

#7 Company has been reliant on its verizon deal for growth over past 2-3 quarters

Brokerage Alert | PhillipCapital retains sell rating on IREDA; revises target price to Rs 130 a share

PhillipCapital has maintained their 'Sell' rating on IREDA Ltd, setting a new price target of Rs 130, which suggests a potential 58% drop from the stock's intraday high of Rs 310. Previously, their target was Rs 110.

Earnings Alert | HDFC Life Q1 net income Rs 478 crore, up 15% YoY

#1 Net investment income Rs14120 crore, up 21% y/y

#2 Net premium income Rs12510 crore, up 9% y/y

#3 First Year Premium Rs2360 crore, up 28% y/y

#4 Renewal Premium Rs6410 crore, up 11% y/y

#5 Single Premium Rs4040 crore, up 0.5% y/y

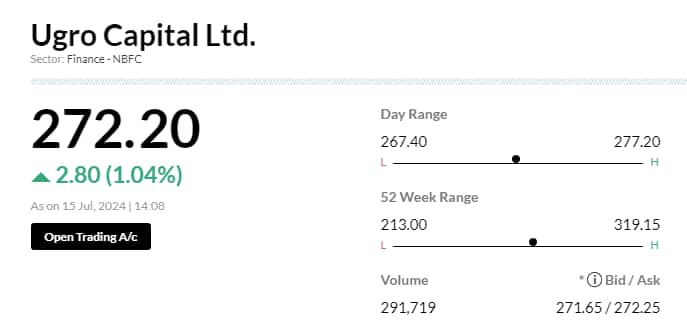

Sensex Today|Ugro Capital AUM up 36% YoY at Rs9,200 crore vs Rs6,777 crore

#1 Gross loan origination down 10% YoY at Rs1,840 crore vs Rs2,036 crore

#2 Borrowings from banks & NBFCs constitute 41% & 10% of our liability mix, respectively

#3 Achieved off-book AUM of 45% as of June 2024, up from 43% in June 2023

#4 On track to achieve stated business target of 50% off book AUM proportion

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ONGC | 321.10 | 4.56 | 37.15m |

| Dr Reddys Labs | 6,837.60 | 3.68 | 464.40k |

| SBI Life Insura | 1,610.35 | 3.04 | 1.35m |

| Bajaj Auto | 9,687.95 | 2.73 | 433.08k |

| SBI | 882.95 | 2.7 | 15.50m |

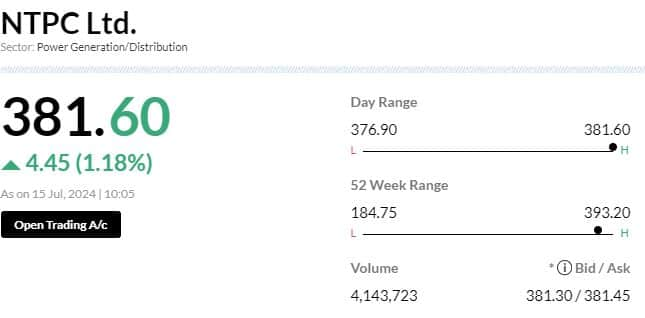

| NTPC | 386.90 | 2.59 | 19.29m |

| Shriram Finance | 2,859.25 | 2.32 | 924.10k |

| UltraTechCement | 11,810.70 | 1.8 | 285.02k |

| HDFC Life | 644.70 | 1.44 | 2.60m |

| Apollo Hospital | 6,434.35 | 1.27 | 160.27k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Grasim | 2,801.85 | -1.47 | 1.12m |

| Asian Paints | 2,955.75 | -1.45 | 1.98m |

| LTIMindtree | 5,497.80 | -1.34 | 178.99k |

| Tata Steel | 167.05 | -0.97 | 20.53m |

| TATA Cons. Prod | 1,143.25 | -0.78 | 805.87k |

| Tech Mahindra | 1,495.85 | -0.61 | 1.63m |

| Coal India | 497.05 | -0.6 | 5.40m |

| JSW Steel | 928.95 | -0.58 | 841.80k |

| Titan Company | 3,216.35 | -0.42 | 913.68k |

| Axis Bank | 1,312.80 | -0.34 | 6.11m |

Stock Market LIVE Updates | Results Today

HDFC Asset Management Company, HDFC Life Insurance Company, Jio Financial Services, Angel One, SpiceJet, Den Networks, Hatsun Agro Product, Atam Valves, Benares Hotels, Davangere Sugar Company, Ganesh Housing Corporation, Jiya Eco-Products, Kellton Tech Solutions, Modern Engineering and Projects, Monarch Networth Capital, MRP Agro, Scanpoint Geomatics, and Udaipur Cement Works will release quarterly earnings on July 15.

Brokerage Call | CLSA keeps' outperform' rating on Avenue Supermarts, target Rs 5,535

#1 Q1 profit in-line with estimates but a strong gross margin

#2 Gross profit growth 21 percent YoY, general merchandise recovery and private brands

#3 Sharp increase in employee costs keeps EBITDA margin in check

#4 Investors should focus on store additions & gross profit growth

Brokerage Call | Jefferies keeps 'hold' rating on HCL Technologies, target Rs 1,630

#1 Q1 largely in-line however profits were ahead due to gains from Statestreet divestiture

#2 Company is confident of reporting revenue growth in Q2 despite the impact of Statestreet divestiture

#3 Company has kept its FY25 growth (3-5 percent) and margin guidance (18-19 percent) unchanged

#4 Expect company to deliver 6 percent CC revenue and 9 percent EPS CAGRs over FY24-27

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Varun Beverages | 1,626.50 | 2.65 | 1.18m |

| Colgate | 3,067.05 | 2 | 202.29k |

| ITC | 463.55 | 0.98 | 11.41m |

| Dabur India | 633.00 | 0.58 | 759.35k |

| Marico | 653.60 | 0.54 | 1.40m |

| Emami | 768.45 | 0.42 | 541.39k |

| Britannia | 5,810.95 | 0.41 | 88.95k |

| United Spirits | 1,292.45 | 0.22 | 231.67k |

Stock Market LIVE Updates | IFL Enterprises to consider bonus shares issue on July 31

The management will be considering the issuance of bonus shares to the existing shareholders.

The management will also be considering the declaration of a dividend of up to 100% on every equity share of the company for the financial year 2023-2024.

Stock Market LIVE Updates | Bank Of Maharashtra Q1 net profit up 46.6% at Rs 1,293.5 crore Vs Rs 882 crore, YoY

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 57684.170.88 | 36.600.39 | -1.1261.17 |

| BSE CAP GOODS | 74755.49-0.26 | 34.35-1.14 | 2.0580.80 |

| BSE FMCG | 21756.270.6 | 6.292.47 | 5.0313.47 |

| BSE Metal | 33044.360.17 | 22.43-1.28 | -1.6454.35 |

| BSE Oil & Gas | 31543.831.7 | 37.023.58 | 6.5365.46 |

| BSE REALTY | 8694.211.84 | 40.53-0.01 | -1.43101.12 |

| BSE IT | 39989.460.4 | 11.053.87 | 12.6327.78 |

| BSE HEALTHCARE | 38870.451.23 | 23.212.11 | 4.2048.19 |

| BSE POWER | 8084.720.62 | 38.950.35 | 2.32103.53 |

| BSE Cons Durables | 58998.36-0.04 | 18.002.00 | -0.8337.83 |

Stock Market LIVE Updates | MRF announces price hike effective July 18

#1 Truck tire prices will see a rise of approximately 2 percent

#2 Passenger car and radial tire prices to increase by 3-7 percent

#3 No increase in prices for two-wheeler tires

#4 JK Tyre, Ceat & Apollo Tyres rally anywhere between 5-15 percent

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SBI | 876.20 | 1.92 | 11.95m |

| PNB | 119.81 | 1.76 | 15.24m |

| Federal Bank | 195.05 | 1.24 | 6.74m |

| Kotak Mahindra | 1,850.55 | 0.97 | 2.56m |

| Bandhan Bank | 194.18 | 0.82 | 4.01m |

| IndusInd Bank | 1,445.50 | 0.76 | 2.09m |

| Axis Bank | 1,321.65 | 0.33 | 5.23m |

| ICICI Bank | 1,236.35 | 0.28 | 7.12m |

Stock Market LIVE Updates | Lupin receives EIR from USFDA for Gujarat facility

The global pharmaceutical company has received the Establishment Inspection Report (EIR) from the United States Food and Drug Administration (US FDA) for its manufacturing facility in Dabhasa, Gujarat. The EIR was issued following the last inspection of the facility conducted from April 8 to April 12, 2024. The inspection concluded with no observations, and the facility received an inspection classification of “No Action Indicated” (NAI).

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Network 18 | 85.97 | 3.68 | 2.29m |

| JagranPrakashan | 98.85 | 2.28 | 996.55k |

| TV18 Broadcast | 44.00 | 1.8 | 7.91m |

| Sun TV Network | 820.85 | 1.55 | 1.24m |

| Dish TV | 15.28 | 1.13 | 10.69m |

| Zee Entertain | 156.66 | 0.75 | 9.33m |

Budget 2024: Cement industry hopes for major boost to housing and infra sectors

In Interim Budget in February, Finance Minister Nirmala Sitharaman had raised the infrastructure capital expenditure by 11.1 percent from Rs 10 lakh crore to Rs 11.11 lakh crore, amounting to 3.4 percent of the GDP...Read More

Stock Market LIVE Updates | Waaree Renewable Technologies bags order

Waaree Renewable Technologies has received a Letter of Award (LOA) for the execution of Engineering, Procurement and Construction (EPC) works for solar power project of 30 MW DC capacity on turnkey basis.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Chennai Petro | 1,086.05 | 3.73 | 152.74k |

| ONGC | 316.35 | 3.06 | 987.84k |

| Sanmit Infra | 15.81 | 3 | 199.53k |

| GAIL | 235.15 | 2.84 | 862.68k |

| Mahanagar Gas | 1,740.80 | 2.62 | 15.03k |

| Petronet LNG | 347.80 | 2.55 | 220.63k |

| IGL | 537.45 | 2.42 | 32.83k |

| Castrol | 257.00 | 2.17 | 252.18k |

| Guj State Petro | 324.45 | 2 | 65.81k |

| Gulf Oil Lubric | 1,236.25 | 1.93 | 10.30k |

Stock Market LIVE Updates | SRM Contractors wins contract of Rs 278 crore

SRM Contractors has informed that a new project is allotted to the company and the company has signed the agreement for EPC Project of NHAI (National Highway Authority of India) for aggregate quoted price of Rs 278.48 crore.

Sensex Today | 1.22 million shares of APL Apollo Tubes change hands in bunched trade: Bloomberg

GST council not considering proposal of ATF & natural gas under GST: Sources To CNBC-TV18

#1 GST council’s Fitment Panel not yet considered proposal of ATF & natural gas under GST

#2 Oil ministry officials met finance ministry officials, no commitment given on referring matter to fitment panel

#3 Finance Ministry expressed concerns over past disagreement with states on inclusion of natural Gas & ATF under GST

Stock Market LIVE Updates | Geojit Financial surges 11% as Q1 profit surges 107.5%

#1 Net profit surges 107.5% to Rs 45.81 crore Vs Rs 22.1 crore, YoY

#2 Revenue jumps 56.2% to Rs 181.2 crore Vs Rs 116 crore, YoY

Stock Market LIVE Updates | Marico to achieve double-digit revenue growth

According to the annual report, the FMCG major aims to achieve double-digit revenue growth in the medium term and expects domestic revenue growth to outpace volume growth from Q1FY25.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| GAIL | 235.70 | 3.08 | 741.11k |

| Petronet LNG | 349.05 | 2.92 | 204.50k |

| ONGC | 315.05 | 2.64 | 890.91k |

| IGL | 537.05 | 2.34 | 29.48k |

| HINDPETRO | 348.85 | 1.93 | 265.60k |

| IOC | 168.95 | 1.23 | 1.10m |

| Oil India | 624.60 | 1.13 | 584.00k |

| BPCL | 307.60 | 1 | 407.58k |

| Adani Total Gas | 897.55 | 0.5 | 23.88k |

Stock Market LIVE Updates | Alembic Pharmaceuticals gets USFDA approval for Selexipag for injection

The company has received tentative approval from the US Food & Drug Administration (USFDA) for Selexipag for injection, 1,800 mcg/vial. Selexipag is a prostacyclin receptor agonist indicated for the treatment of pulmonary arterial hypertension.

The company has received tentative approval from the US Food & Drug Administration (USFDA) for Selexipag for injection, 1,800 mcg/vial. Selexipag is a prostacyclin receptor agonist indicated for the treatment of pulmonary arterial hypertension.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| GAIL | 235.75 | 3.11 | 739.49k |

| Bajaj Auto | 9,712.00 | 3.01 | 8.96k |

| ONGC | 314.90 | 2.59 | 888.49k |

| NTPC | 386.95 | 2.57 | 2.20m |

| Zomato | 227.75 | 2.38 | 1.53m |

| UltraTechCement | 11,830.40 | 1.98 | 2.83k |

| Interglobe Avi | 4,416.15 | 1.97 | 10.93k |

| Vedanta | 458.15 | 1.94 | 354.86k |

| Zydus Life | 1,195.05 | 1.72 | 13.65k |

| Varun Beverages | 1,608.35 | 1.56 | 16.58k |

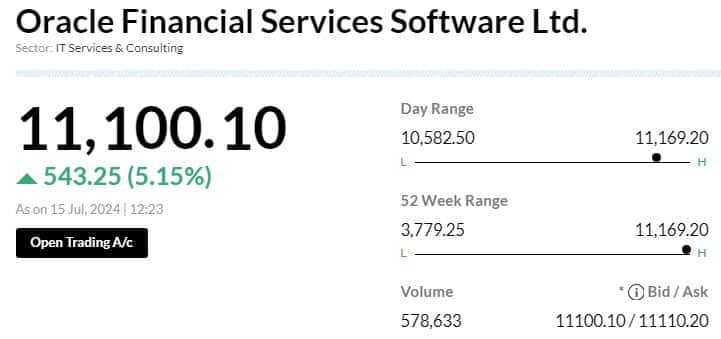

Sensex Today | Oracle Financial Services Software at record high

Stock Market LIVE Updates | Jupiter Wagons raises Rs 800 via QIP

The company completed its qualified institutional placement (QIP), raising Rs 800 crore. The QIP received total demand of Rs 2,800 crore, which was 3.5 times the size of the QIP.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 24596.950.39 | 13.191.14 | 4.8225.72 |

| NIFTY BANK | 52321.800.08 | 8.34-0.20 | 4.6416.74 |

| NIFTY Midcap 100 | 57503.300.58 | 24.521.08 | 4.1257.42 |

| NIFTY Smallcap 100 | 19069.150.63 | 25.920.85 | 5.6868.40 |

| NIFTY NEXT 50 | 74227.450.67 | 39.150.98 | 3.2567.77 |

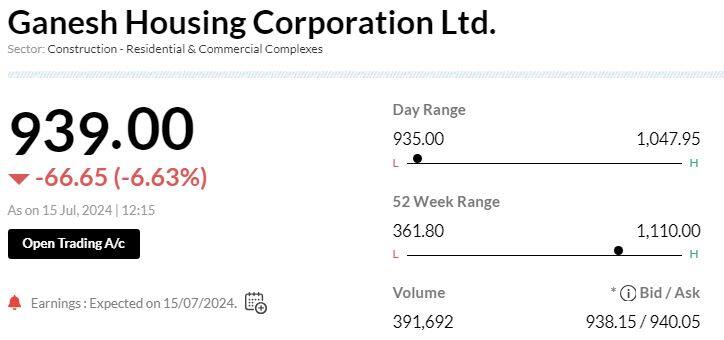

Sensex Today | Ganesh Housing Corporation shares fall 6% as Q1 net profit down 29%

#1 Net profit down 29 percent at Rs 114 crore vs Rs 161 crore, YoY

#2 Revenue down 21 percent at Rs 214 crore vs Rs 270 crore, YoY

#3 EBITDA down 31 percent at Rs 149 crore vs Rs 216 crore, YoY

#4 Margin at 69.6 percent vs 80 percent, YoY

Stock Market LIVE Updates | Apollo Micro Systems gets Make II project from the Indian Army

The company has received a Make II project from the Indian Army. This project involves the procurement of a Vehicle Mounted Counter Swarm Drone System (VMCSDS) (Version I) under the Make II category of DAP-2020.

Markets@12 | Sensex, Nifty trade higher

The Sensex was up 196.17 points or 0.24 percent at 80,715.51, and the Nifty was up 85.30 points or 0.35 percent at 24,587.50.

Stock Market LIVE Updates | USFDA issues two procedural observations to Suven Pharma

The United States Food & Drug Administration (US FDA) has completed the surveillance inspection of Casper Pharma in Hyderabad, the wholly-owned subsidiary of the company. The inspection was conducted from July 8 to 12.

Following the inspection, the US health regulator issued a Form 483 with two procedural observations.

Additionally, Suven Pharma has acquired a 51% stake in Sapala Organics.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Fert and Chem | 1,114.40 | 6.19 | 893.60k |

| Aurobindo Pharm | 1,398.00 | 5.36 | 4.03m |

| Oracle Fin Serv | 11,090.05 | 5.05 | 549.50k |

| Apollo Tyres | 542.05 | 4.48 | 6.94m |

| Macrotech Dev | 1,456.00 | 4.31 | 988.47k |

| Alkem Lab | 5,400.20 | 3.87 | 382.65k |

| Bank of Mah | 65.75 | 3.64 | 13.33m |

| NHPC | 116.91 | 3.44 | 95.87m |

| IDBI Bank | 88.89 | 3.35 | 10.97m |

| SJVN | 155.43 | 3.15 | 44.78m |

Varun Beverages signs pact to make, sell Simba Munchiez in Zimbabwe, Zambia

News Alert | June WPI inflation at 3.36% Vs 2.61%, MoM

Stock Market LIVE Updates | Hindalco Industries to sale land situated at Kalwa, Maharashtra to Ekamaya Properties

Hindalco Industries entered into agreement to sale land situated at Kalwa, Maharashtra with to M/s. Ekamaya Properties Private Limited, a wholly owned subsidiary of M/s Birla Estates Private Limited.

Stock Market LIVE Updates | EMS receives letter of award of Rs 141 crore

The company has received a letter of award for the development of distribution infrastructure-loss reduction works at EDC Dehradun rural Circle of Uttarakhand from Uttarakhand Power Corporation. The order value is Rs 141.1 crore, with EMS having a 95% share and the other JV partner having the remainder.

Sensex Today | 6.5 million shares of SAIL India traded in a block: Bloomberg

Brokerage Call | Citi maintains 'neutral' rating on HCL Technologies, target raises to Rs 1,545

#1 Company reported a largely in-line Q1

#2 Q1 CC decline of 1.6 percent QoQ & EBIT margin down 50 bps QoQ

#3 ER&D at -3.5 percent QoQ and TCV at USD 1.96 billion were weaker than expected

#4 Forward looking indicators include headcount +1.5 percent YoY (adjusted for divestiture)

Expect Indian bond yield curve to remain flat amidst favourable demand-supply dynamics, Puneet Pal, Head-Fixed Income, PGIM India Mutual Fund

We expect the Indian bond yield curve to remain flat amidst favourable demand supply dynamics though the progress of monsoons will be the key factor to access the trajectory of Food inflation and subsequently RBI’s stance on the monetary policy. The scope for rate cuts in India is on account of high real positive rates and the need to encourage private investment and there is a fair probability of rate cuts in the second half of FY25, though any rate cuts in India will follow the start of the rate cutting cycle in advanced economies and will not precede them.

Bond yields tend to move in advance of rate action and investors can look to increase allocation to Fixed Income at every uptick in yields. We expect long bond yields to continue to drift lower over the next couple of quarters. We expect the benchmark 10yr bond yield to go towards 6.50% by Q4 of FY25.

Investors with a medium to long term investment horizon can look at Dynamic Bond Funds having a duration of 6-7yrs with predominant sovereign holdings as they offer a better risk-reward currently. Investors having an investment horizon of 6-12 months can consider Money Market Funds as yields are attractive in the 1yr segment of the curve too.

Commodity Corner | Kaynat Chainwala, AVP-Commodity Research, Kotak Securities

Comex Gold has slipped 0.3% and is currently trading near $2415/oz, following an assassination attempt on Donald Trump that has raised prospects of his winning the US presidential election. Last week, Comex Gold prices surpassed $2400/oz and surged to $2430/oz as signs of weakness in the labor market and ongoing disinflationary trends bolstered expectations that the Fed might soon pivot to rate cuts. This move sent 2-year and 10-year Treasury yields to their lowest levels since March. Currently, markets are anticipating US retail sales figures for June, which Bloomberg forecasts to decline by 0.3% month-over-month, indicating another month of sluggish spending. If the data meets expectations, it could support gold prices, as markets are already nearly certain of a September rate cut. However, a negative surprise may cause traders to trim their expectations for rate cuts.

WTI Crude oil futures are holding declines owing to dollar recovery and a series of disappointing data releases from China. Crude oil closed 1.1% lower last week snapping a four week rally as concerns about supply disruptions from Hurricane Beryl eased without affecting US domestic crude oil production. Crude oil prices may find support from signs of increased fuel demand in the US during the summer travel season and expectations of an imminent change in Fed policy. However, significant upside is unlikely as markets cautiously await the third plenum meeting to see if Beijing will intensify efforts to stimulate growth amidst concerns of a slowdown, although this event primarily focuses on longer-term political and economic reforms.

Stock Market LIVE Updates | City gas players extend gains on hopes of tax relief for CNG, PNG

Shares of city gas distribution companies continue to buzz in trade, sharply off early lows on continued hope rally over relief measures like waiver or standardisation of high VAT rates on CNG and PNG.

Shares of Mahanagar Gas, IGL and Gujarat Gas all were trading higher by more than two percent in early trade on July 15.

Unconfirmed reports also suggest that Centre has also kick-started the procedure to bring natural gas and ATF under the GST fold, and Finance Minister and Oil Minister have held discussion in this regard. Moneycontrol is yet to verify this development.

On Friday, CNBC-TV18 had reported citing industry sources that CGD players have sought standardisation against the difference in taxation between EVs and LPG against CNG and PNG. More

Stock Market LIVE Updates | Tyre stocks on a roll as reports indicate MRF set to hike rates starting July 18

India's most expensive counter MRF was buzzing in early trade on July 15, after reports suggested that the tyre-maker increased prices, effective July 18. The reports sent the stock prices of other tyre players surging as well.

MRF bumped up its rates for truck tyres by 2 percent, while the prices for passenger car tyres and radial tyres have been increased between three to seven percent. There is no increase in the prices of two-wheelers as of yet, reported CNBC-TV18.

This marks the first price increase after the minor price reduction MRF undertook in March 2024 across certain categories. However, the price increases still lag the cost increases seen over the past few months.

The move by MRF comes after Apollo Tyres, CEAT and JK Tyres have undertaken a price hike of three percent already. Read More

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| TCS | 4,213.20 0.7 | 2.76m | 1,162.81 |

| HCL Tech | 1,589.35 1.87 | 7.16m | 1,150.80 |

| HDFC Bank | 1,620.00 -0.17 | 6.53m | 1,059.97 |

| SBI | 873.30 1.58 | 6.90m | 599.53 |

| ONGC | 314.85 2.52 | 18.60m | 581.26 |

| Infosys | 1,719.20 0.44 | 3.04m | 522.01 |

| NTPC | 384.70 2 | 11.83m | 452.01 |

| Reliance | 3,186.55 -0.22 | 1.36m | 432.52 |

| ICICI Bank | 1,234.00 0.09 | 3.34m | 412.36 |

| Asian Paints | 2,974.80 -0.81 | 1.35m | 398.86 |

Bajaj Auto Q1 Preview: Rich mix, volume growth to drive 18% rise in net profit

Pune-headquartered Bajaj Auto Limited is set to release its earnings report for the first fiscal quarter of FY25 on July 16, Tuesday. An increase in volumes and a diversified product mix are expected to boost the company's sales to high teen growth rates.

According to a Moneycontrol poll, the Triumph maker is anticipated to record a 14.3 percent year-on-year increase in revenue, reaching Rs 11,793 crore. Net profit is projected to surge 18 percent to Rs 1,965 crore from Rs 1,665 crore in the same quarter of the previous fiscal year.

Earnings estimates from analysts polled by Moneycontrol are in a narrow range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price. Read More

Stock Market LIVE Updates | Tanla Platforms stock surges 10% on deal with 'global tech major' to detect, curb scams

Shares of Tanla Platforms skyrocketed over 10 percent on July 15 after the company informed that it has signed a commercial agreement with a global tech major on wisely ATP to combat scams on their messaging platform by identifying fraudulent phone numbers.

Under the partnership, Tanla's AI-driven anti-phishing solution Wisely ATP, which monitors 10-digit numbers and malicious URLs, will provide real-time signals to WhatsApp regarding potential fraud.

While Tanla did not share further details due to "confidentiality reasons", Media reports suggest that the deal has been signed with Meta Platforms-owned WhatsApp.

The collaborative pact will help Tanla Platforms to identify fraudulent phone numbers in an attempt to boost efforts at controlling scams over its messaging platform, reported Economic Times citing a top executive close to the companies.

Stock Market LIVE Updates | Ashol Leyland wins order

Ashok Leyland bags single largest order of 2104 fully built buses from Maharashtra State Road Transport Corporation

Morgan Stanley upgrades Ambuja Cements to 'overweight'; raises price target for Ultratech

Morgan Stanley expects a sideways movement for the cement industry in the near-term but remains optimistic about the medium-term outlook for Ambuja Cements and Ultratech Cement due to demand-led margin expansion....Read More

Stock Market LIVE Updates | Results Today

HDFC Asset Management Company, HDFC Life Insurance Company, Jio Financial Services, Bank of Maharashtra, Angel One, SpiceJet, Den Networks, Hatsun Agro Product, Atam Valves, Benares Hotels, Davangere Sugar Company, Ganesh Housing Corporation, Jiya Eco-Products, Kellton Tech Solutions, Modern Engineering and Projects, Monarch Networth Capital, MRP Agro, Scanpoint Geomatics, and Udaipur Cement Works will release quarterly earnings on July 15.

Stock Market LIVE Updates | Stocks trade ex-dividend today

Alembic Pharmaceuticals, Duncan Engineering, Gujarat Themis Biosyn, India Motor Parts & Accessories, KPR Mill, NDR Auto Components, Rane Brake Lining, Siyaram Silk Mills, ZF Commercial Vehicle Control Systems India

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Aurionpro Solut | 4124.00 | 1566.75-5 | 5159- |

| Kaya | 18417.00 | 631.90-5 | 1412- |

| Vipul | 24115.00 | 45.34-4.99 | 75059- |

| GTL Infra | 118824194.00 | 3.08-4.94 | 2071360- |

| Teamo Productio | 3161717.00 | 1.78-4.81 | 5281094- |

Commodity Check | Gold eases, investors seek more cues on Fed's rate path

Gold prices dipped on Monday as the dollar held firm, while investors awaited comments from Federal Reserve officials and economic data for further cues on U.S. interest rate trajectory.

Spot gold eased 0.1% at $2,409.54 per ounce, as of 0250 GMT. U.S. gold futures fell 0.2% at $2,414.70.

Sensex Today | 2.43 million shares of NTPC traded in another blocks: Bloomberg

Brokerage Call | CLSA downgrades HCL Technologies to ‘hold’, target Rs 1,556

#1 Company reported Q1 revenue of USD 3,364 million, +5.6 percent YoY/-1.9 percent QoQ in constant currency (CC)

#2 Sequential decline in revenue was largely due to offshoring of a large contract in BFSI vertical

#3 Decline in revenue was due to productivity benefits passed on to large customers every year during Q1

#4 Company’s EBIT margin, at 17.1 percent, was in-line with consensus

Stock Market LIVE Updates | Zen Technologies gains 5% on unveiling four products

Zen Technologies launched four new products today.

These IP-owned innovations – Hawkeye, Barbarik-URCWS (Ultralight Remote Control Weapon Station), Prahasta, and Sthir Stab 640 – cater to a wide range of defence requirements, empowering forces with unmatched tactical superiority and enhanced operational efficiency.

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Dr Reddys Labs | 6804.75 | 6804.75 | 6,800.05 |

| ONGC | 314.00 | 314.00 | 313.70 |

| Britannia | 5847.75 | 5847.75 | 5,836.10 |

| SBI Life Insura | 1572.00 | 1572.00 | 1,568.40 |

| Tech Mahindra | 1527.50 | 1527.50 | 1,509.80 |

| Wipro | 566.90 | 566.90 | 560.30 |

| Grasim | 2852.95 | 2852.95 | 2,813.30 |

Stock Market LIVE Updates | Piramal Pharma gets Zero observations from USFDA

The US FDA conducted a Pre-Approval Inspection (PAI) of the company's PPDS Ahmedabad facility from July 10 to July 12. The inspection was completed with zero Form 483 observations and a designation of "No Action Indicated" (NAI).

Stock Market LIVE Updates | Bhansali Engineering Polymers Q1 profit increases 5.6% to Rs 53.4 cr

#1 Net profit increases 5.6% to Rs 53.4 crore Vs Rs 50.5 crore, YoY

#2 Revenue climbs 15.5% to Rs 340 crore Vs Rs 294.5 crore, YoY

#3 EBITDA rises 8.9% to Rs 61.6 crore Vs Rs 56.6 crore, YoY

#4 Margin drops to 18.1% Vs 19.2%, YoY

Sensex Today | 1.2 million shares of NTPC traded in a block: Bloomberg

Stock Market LIVE Updates | 5paisa Capital shares gain 8% as Q1 profit rises 39%

#1 Net profit jumps 39% to Rs 20.1 crore Vs Rs 14.5 crore, YoY

#2 Revenue grows 21% to Rs 102.3 crore Vs Rs 84.6 crore, YoY

Stock Market LIVE Updates | Results Today

HDFC Asset Management Company, HDFC Life Insurance Company, Jio Financial Services, Bank of Maharashtra, Angel One, SpiceJet, Den Networks, Hatsun Agro Product, Atam Valves, Benares Hotels, Davangere Sugar Company, Ganesh Housing Corporation, Jiya Eco-Products, Kellton Tech Solutions, Modern Engineering and Projects, Monarch Networth Capital, MRP Agro, Scanpoint Geomatics, and Udaipur Cement Works will release quarterly earnings on July 15.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Arvind and Comp | 86.65 | 66.63 | 52.00 |

| Essar Shipping | 68.14 | 33.09 | 51.20 |

| Keynote Finance | 256.92 | 31.65 | 195.16 |

| AMJ Land | 63.00 | 31.17 | 48.03 |

| Kellton Tech | 176.56 | 28.51 | 137.39 |

| Zenithexpo | 453.06 | 27.41 | 355.60 |

| HPL Electric & | 592.05 | 26.32 | 468.70 |

| Servotech Power | 118.01 | 24.59 | 94.72 |

| Servotech Power | 118.01 | 24.59 | 94.72 |

| Servotech Power | 118.01 | 24.59 | 94.72 |

Sensex Today | GE T&D India has received of order worth Rs 490 crore from Power Grid Corporation of India

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Brigade Ent | 1,275.30 | -2.65 | 3.56k |

| Prestige Estate | 1,727.00 | -2.13 | 9.80k |

| Godrej Prop | 3,209.60 | -1.63 | 3.69k |

| Phoenix Mills | 3,839.80 | -1.54 | 1.24k |

| Swan Energy | 710.75 | -0.98 | 14.37k |

| Oberoi Realty | 1,683.70 | -0.8 | 855 |

| Mahindra Life | 598.95 | -0.3 | 1.26k |

| Sobha | 1,948.00 | -0.27 | 2.31k |

Stock Market LIVE Updates | Plastiblends India Q1 profit spikes 41.8%

#1 Net profit spikes 41.8% to Rs 10.8 crore Vs Rs 7.6 crore, YoY

#1 Net profit spikes 41.8% to Rs 10.8 crore Vs Rs 7.6 crore, YoY

#2 Revenue grows 8.1% to Rs 211.6 crore Vs Rs 195.7 crore, YoY

#3 EBITDA zooms 24.3% to Rs 16.3 crore Vs Rs 13.1 crore, YoY

#4 Margin expands to 7.7% Vs 6.7%, YoY

Stock Market LIVE Updates | SRM Contractors wins contract of Rs 278 crore

SRM Contractors has informed that a new project is allotted to the company and the company has signed the agreement for EPC Project of NHAI (National Highway Authority of India) for aggregate quoted price of Rs 278.48 crore.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HCL Tech | 1,618.25 | 3.72 | 3.71m |

| TCS | 4,222.55 | 0.92 | 1.33m |

| MphasiS | 2,710.85 | 0.75 | 166.76k |

| Tech Mahindra | 1,510.30 | 0.35 | 292.81k |

| Infosys | 1,715.25 | 0.2 | 1.26m |

| Persistent | 4,818.00 | 0.2 | 76.92k |

| Wipro | 560.75 | 0.11 | 2.35m |

Sensex Today | 2 million shares of Eris Lifesciences change hands in bunched trade: Bloomberg