The market saw some volatility in December, but it remained largely range bound during the month. The bulls were just able to stick their neck out and pushed the Nifty up 2.18 percent.

Investors grappled with an uncertainty surrounding the impact of the Omicron variant of COVID virus, hawkish views of the US Fed and other central banks about speeding up the interest rate hikes, and lowering of monthly bond purchases as well as rising inflation.

The bulls, however, kept the momentum going and pushed the Nifty Large Cap and Small Cap indices higher by 2.18 and 2.67 percent. Broader indices also performed better with the BSE Multi Cap and Small Cap indices edging up 2.29 and 5.44 percent.

“All the above indices have entered into a sideways phase for the past 2-3 months after giving a good rally in 2021. The mid-cap and small-cap stocks rallied much greater, compared to large-caps and, going ahead, we expect mid-cap and small-cap to continue this trend,” said Manoj Dalmia, Founder and Director, Proficient Equities Limited.

The Smallcap index has rallied through the past seven quarters and touched an all-time high on January 10. “The Smallcap index shows a breakout after three months of consolidation and for the last two-odd weeks, the advance decline ratio has remained positive despite the Sensex going up and down. This shows the relative strength of the Smallcap index in the near term,” Deepak Jasani, of Retail Research at HDFC Securities, said.

Experts are of the view that allocation to equities should be more from the bottom-up perspective and should be based on company story and valuations. There would be years when large-caps will do well and then there will be periods when small-cap and mid-cap will perform.

Even though the major indices displayed positive trend in December, there were many portfolio management service (PMS) schemes from the broader markets that outperformed the Nifty and the Sensex and generated even better returns last month.

PMS schemes cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. Their professional fee structure is different from that of regular mutual funds.

Out of 269 schemes tracked by pmsbazaar.com in December, 157 schemes (58 percent of total schemes) generated better returns than the Nifty 50, the data shows. There were 42 schemes (16 percent) that generated more than 5 percent returns during the month.

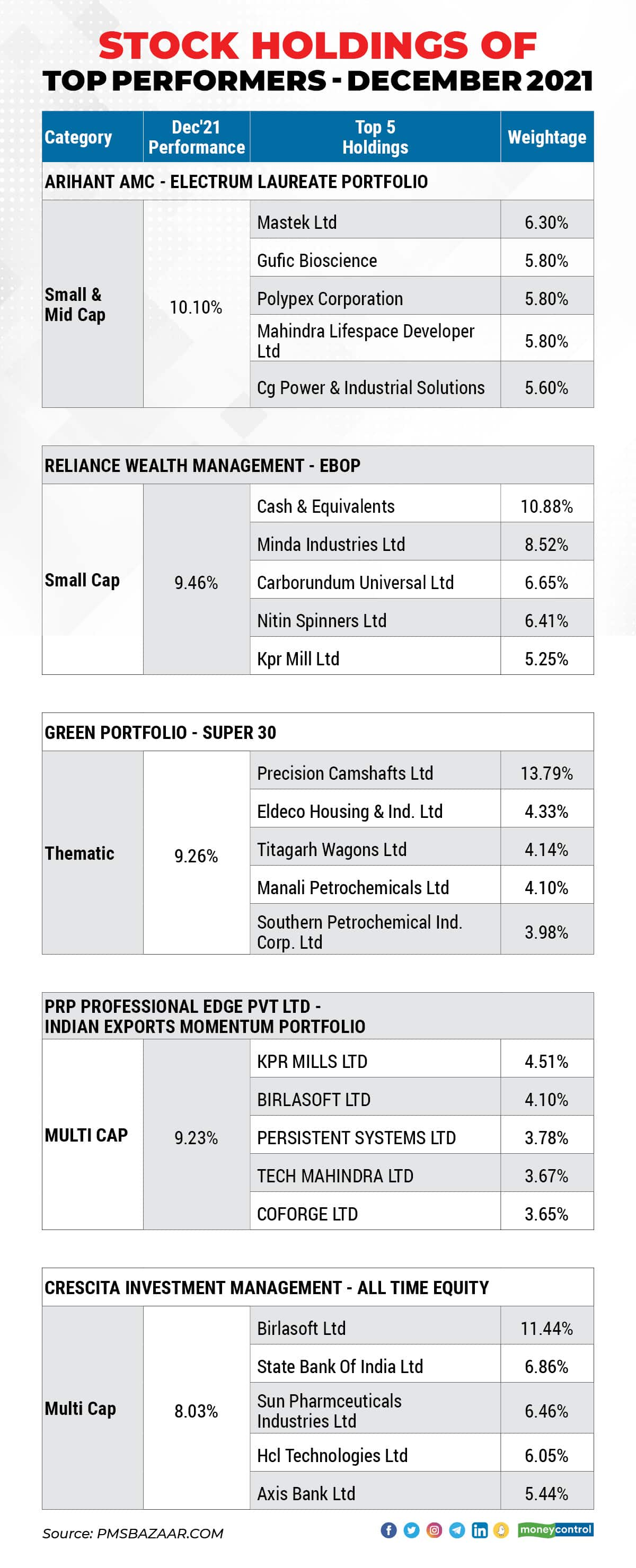

These were led by Arihant AMC – Electrum Laureate Portfolio (+10.1 percent), Reliance Wealth Management Ltd – EBOP (+9.5 percent), Green Portfolio – Super 30 (+9.3 percent), PRP Professional Edge Pvt Ltd – Indian Exports Momentum (+9.2 percent) and Right Horizons – Minerva India Underserved (+8.1 percent).

Not all of these top schemes disclosed their stock holdings for November. Moneycontrol has collated a list of the top five from among those that have disclosed their holdings.

This list may give investors an idea about which stocks the fund managers of these schemes betted on. But they should not in any case be considered ‘buy’ recommendations as every fund manager has his own investment strategy.

This scheme primarily focuses on mid-cap and small-cap stocks and generated the highest returns of 10.1 percent among all PMS schemes in December. Its top 5 picks were Mastek Ltd, Gufic Bioscience Ltd, Polyplex Corporation, Mahindra Lifespace Developer Ltd., CG Power & Industrial Solutions.

Reliance Wealth Management – EBOPPrimarily focusing on small-cap stocks, this scheme generated 9.5 percent returns for its investors last month. Its top holdings were Minda industries Ltd, Carborundum Universal Ltd., Nitin Spinners Ltd and KPR Mill Ltd. It also used cash and equivalents in had to manage its strategy.

Green Portfolio – Super 30This thematic scheme generated returns of 9.3 percent for December. It invested its funds in Precision Camshafts Ltd, Eldeco Housing & Ind Ltd, Titagarh Wagons Ltd, Manali Petrochemicals Ltd and Southern Petrochemicals Ind. Corp. Ltd.

PRP Professional Edge Pvt Ltd – Indian Exports Momentum PortfolioIt generated 9.2 percent returns by investing in multi-cap stocks such as KPR Mill Ltd., Birlasoft Ltd., Persistent Systems Ltd, Tech Mahindra Ltd and Cofroge Ltd.

Crescita Investment Management – All Time EquityThis multi-cap scheme returned 8 percent returns and its top investments were in Birlasoft Ltd, State Bank of India, Sun Pharmaceuticals Industries Ltd, HCL Technologies Ltd and Axis Bank Ltd.

The OutlookMarket experts continue to remain positive about the Indian equity markets and suggest that any dips will be a good buying opportunity for investors from a medium to long term perspective.

“We believe that small-caps will continue to outperform large-caps in the medium term,” said Mohit Nigam, Head of PMS at Hem Securities. But he cautioned investors that they should carefully invest their money in quality small-cap and mid-cap companies with strong fundamentals, growth visibility and clean balance sheets.

Lot of small-cap and mid-cap companies have improved their CAPEX, balance sheets within this low-interest regime.

Dalmia of Proficient Equities expects this trend to continue and expects mid and small-cap companies to fare better in the near-medium term. “The anti-China sentiment shift has very much helped many small-cap and mid-cap companies,” he said.

"Small and mid-caps do very well in rising economic cycles and there is a positive correlation between economic growth and returns for small and midcap,” said Akhil Chaturvedi, Chief Business Officer at Motilal Oswal Asset Management Company.

In the medium term, mid and small-caps have gone up quite a bit and given their current valuation, Chaturvedi advises that balanced allocation between large and mid-caps makes a lot of sense and at the same time he suggests to “buy quality companies with good fundamentals irrespective of their market capitalisation”.

Going forward, COVID-affected sectors such as the travel, housing and hospitality could see some support from the government, feel the experts.

“Core sectors such as infrastructure, power and capital goods will remain in focus. Divestment and monetisation of PSUs should gain more traction as there are a few more PSUs where divestment is still pending,” said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd.

On the other hand, Ankit Pareek, Research Analyst at Choice Broking, recommends investors to, investors to prefer large-cap stocks over mid-caps/small-caps stocks for short to mid-term investments.

“After the steep rally in equity market, we believe there are still investment opportunities available for long term investors in mid-cap space, thereby investors are advised to pick only fundamentally strong stocks with favourable valuations,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.