Closing Bell: Sensex gains 595 pts, Nifty above 25,850; auto, IT, media rally

Biggest Nifty gainers were Asian Paints, Adani Enterprises, Tech Mahindra, TCS, HDFC Life, while losers were Tata Steel, TMPV, Bharat Electronics, Shriram Finance, Grasim Industries. BSE Midcap index rose 0.4 percent and smallcap index added 0.7 percent. Except, realty, all other sectoral indices ended in the green with media, auto, telecom, IT, consumer durables up 1-2 percent.

-330

November 12, 2025· 16:28 IST

Market Close | Sensex gains 550 pts, Nifty above 25,850; auto, IT, media rally

Indian equity indices ended on strong note with Nifty above 25,850 on November 12. At close, the Sensex was up 595.19 points or 0.71 percent at 84,466.51, and the Nifty was up 180.85 points or 0.70 percent at 25,875.80.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

November 12, 2025· 16:27 IST

Ajit Mishra – SVP, Research, Religare Broking

Markets extended their uptrend on Wednesday, with the Nifty 50 closing at 25,875.80, up 0.47%. The index opened firm and maintained its upward momentum throughout the session, supported by strong buying in heavyweight counters across sectors. Sectorally, IT, auto, and pharma outperformed, while realty and metal ended on a muted note. The overall market breadth remained positive, aided by gains of nearly a percent each in the midcap and smallcap indices, reflecting improving risk appetite among participants.

The rally was fueled by optimism over improving trade dialogue prospects between India and the U.S., coupled with encouraging Q2 earnings from key corporates that further lifted investor sentiment.

On the technical front, the Nifty has successfully reclaimed the 25,800 resistance level, with the next target seen around the 26,000–26,100 zone. While some consolidation may emerge on Thursday owing to the weekly expiry, the overall tone is expected to stay positive. Beyond the key performing sectors such as metal, banking, and auto, renewed interest is also visible in IT, pharma, and energy. Participants are advised to focus on selective stock opportunities in line with the ongoing rotational sectoral trend, preferring large-cap and large mid-cap names for long positions.

-330

November 12, 2025· 16:21 IST

Sudeep Shah, Head - Technical Research and Derivatives at SBI Securities

On Wednesday, the benchmark index Nifty 50 opened with a strong gap-up start and maintained positive momentum throughout most of the session. However, profit booking emerged in the final hour, leading to the formation of a high-wave candle on the daily chart, indicating selling pressure at higher levels after an intraday rally. The index eventually settled at the 25875 mark, up 0.70%.

From a technical perspective, Nifty has now recovered nearly 550 points from its recent low, taking support near the 50-day EMA. This rebound underscores the buyers’ attempt to regain control, as price action now points toward a potential retest of the 26000 zone in the near term. The overall structure suggests a shift back in favor of the bulls, though mild profit booking cannot be ruled out.

On the sectoral front, performance remained broadly positive. Except for Nifty Metal and Nifty Realty, which saw mild profit-taking, all other major indices ended in the green. Nifty IT, Nifty Auto, and Nifty Pharma were the top outperformers, showcasing renewed sectoral rotation and sustained buying interest.

In the broader market, sentiment remained robust. The Nifty Midcap 100 scaled a fresh all-time high, while the Nifty Smallcap 100 extended gains, closing 0.79% and 0.82% higher, respectively. The market breadth was firmly positive — out of the Nifty 500 universe, nearly 325 stocks closed in the green, while around 170 ended in the red, reflecting broad-based participation.

Nifty View

Going ahead, the 25760–25730 zone will act as an immediate support area for the index. A break below 25730 could trigger profit booking toward 25560. On the upside, the 26000–26030 zone will act as a key resistance, and a sustained move above 26030 could open the gates for further upside toward 26180 in the near term.

Bank Nifty View

For the banking index, the 57900–57800 zone will serve as immediate support. A breach below 57800 could extend the decline toward 57400. Conversely, the 58500–58600 zone remains a critical resistance, and a sustained breakout above 58600 could drive the index toward 59000 levels in the short term.

-330

November 12, 2025· 16:18 IST

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

Nifty continued its upside momentum for the third consecutive sessions on Wednesday and Nifty closed the day higher by 180 points. After opening with an upside gap of 139 points Nifty moved up further in the early to mid-part of the session. Consolidation was seen towards the end and Nifty finally closed near the highs. The opening upside gap remains unfilled.

A reasonable bull candle was formed on the daily chart with minor upper and lower shadow. Technically, this market action indicates an uptrend continuation pattern. If the present opening up gap remains open for the next 2-3 sessions, then that gap could be considered as a bullish runaway gap, which are normally formed in the middle of the trend.

The underlying short-term trend of Nifty remains positive. The next upside targets to be watched around 26100-26200 levels for the next few sessions. Immediate support is placed at 25700 levels.

-330

November 12, 2025· 16:11 IST

Shrikant Chouhan, Head Equity Research, Kotak Securities

Today, the benchmark indices continued their positive momentum. The Nifty ended 181 points higher, while the Sensex was up by 595 points. Among sectors, IT outperformed, rallying nearly 2 percent, whereas despite strong momentum, intraday profit booking was seen in selective Realty and Defense stocks. Technically, after a gap-up open, the market maintained positive momentum throughout the day. On intraday charts, the market is showing a continuation of the uptrend, which supports further upward movement from the current levels.

For trend-following traders, 25775/84300 and 20-day SMA (Simple Moving Average) or 25700/84000 would act as a key support zone. As long as the market is trading above this level, the bullish sentiment is likely to continue. On the higher side, the market could move up to 26000/84800. Further upside may also push the index up to 26100/85000.

On the flip side, if the market falls below the 20-day SMA or below 25700/84000, the sentiment could change. Below this level, traders may consider exiting their long positions.

-330

November 12, 2025· 16:07 IST

Taking Stock: Nifty above 25,850, Sensex gains 595 pts; mid, smallcaps rally

Biggest Nifty gainers were Asian Paints, Adani Enterprises, Tech Mahindra, TCS, HDFC Life, while losers were Tata Steel, TMPV, Bharat Electronics, Shriram Finance, Grasim Industries....Read More

-330

November 12, 2025· 16:06 IST

Sensex Today | October CPI inflation at 0.25%

October CPI inflation at 0.25% versus 1.44%, MoM

Rural inflation at -0.25% versus 1.07%, MoM

Urban inflation at 0.88% versus 1.83%, MoM

-330

November 12, 2025· 16:05 IST

SpiceJet Q2 results: Net loss widens to Rs 621 crore, revenue falls 13%

Continued airspace restrictions negatively impacted operations and resulted in a sharp escalation in operating costs, further weighing on the quarter’s performance, says the low-cost carrier...Read More

-330

November 12, 2025· 16:01 IST

Dilip Parmar – Senior Research Analyst, HDFC Securities

The Indian rupee has depreciated following its recent surge, primarily weighed down by the resilient dollar index and a noticeable lack of dollar inflows. We continue to see an imbalance between dollar demand and supply, which is pressuring the currency. However, the market is looking toward a potential US-India trade deal as the crucial catalyst needed to provide the rupee with much-needed support.

Near-term, we expect the USDINR pair to consolidate, trading between 88.40 and 88.80.

-330

November 12, 2025· 15:54 IST

Abhinav Tiwari, Research Analyst at Bonanza

Today, the Indian stock market ended on a strong note, with the Sensex jumping by 595 points and the Nifty closing at the 25,875 mark. The rally was supported by optimism around progress in the ongoing US-India trade deal talks, positive global cues, including the reopening of the US government, and encouraging exit polls suggesting a decisive NDA victory in the Bihar assembly elections.

Gains were led by sectors like IT, automobiles, and telecom, while some financial stocks came underpressure due to weak asset growth projections from key lenders. Looking ahead, the market is likely to retain a positive bias in the near term. Continued optimism surrounding the US-India trade pact could provide a further lift to export-oriented sectors by lowering tariffs and expanding trade opportunities. The political stability implied by the Bihar election forecasts should also help sustain investor confidence.

However, we will keep an eye on global economic indicators, upcoming corporate earnings, and possible volatility around derivative expiries. Despite these risks, the broader sentiment remains constructive, with expectations of policy continuity and deeper economic reforms keeping the benchmarks well supported.

The Bihar exit polls projecting a clear NDA win have eased concerns about political uncertainty that could have triggered a 5-7% correction in the Nifty if results had turned adverse. This clarity assures investors of steady governance and consistent policy direction. Simultaneously, progress in the US-India trade talks, particularly the possibility of tariff reductions and trade expansion to $500 billion by 2030 has reinforced optimism about stronger economic cooperation and export growth. Together, these developments have strengthened market sentiment and provided a solid foundation for India’s medium term growth outlook.

-330

November 12, 2025· 15:52 IST

Vinod Nair, Head of Research, Geojit Investments

Global equities rallied on renewed risk appetite, driven by optimism over the anticipated resolution of the U.S. government shutdown and growing expectations of early Fed cuts amid signs of a cooling U.S. labour market. Emerging markets outperformed, reflecting the improvement in global sentiment.

Indian indices mirrored this strength, with large-cap stocks leading gains, particularly in the auto, IT, and pharma sectors. Supportive domestic macro fundamentals—including easing CPI and WPI inflation, a strong GDP outlook, and healthy H2 earnings expectations—continue to underpin positive market momentum.

-330

November 12, 2025· 15:49 IST

Rupak De, Senior Technical Analyst at LKP Securities

The Nifty index continues its uptrend and looks strong after a gap-up opening. On the daily chart, the index has continued to rally higher following a retest of the falling channel breakout.

Besides, the index has moved above the 21EMA, confirming the prevailing uptrend. The sentiment might remain positive in the short term, with the index potentially reaching 26,000. On the lower end, immediate support is placed at 25,700.

-330

November 12, 2025· 15:31 IST

Currency Check | Rupee closes lower at 88.64

Indian rupee ended lower at 88.64 per dollar on Wednesday versus Tuesday's close of 88.56.

-330

November 12, 2025· 15:31 IST

Market Close | Sensex gains 595 pts, Nifty above 25,850; auto, IT, media rally

Indian equity indices ended on strong note with Nifty above 25,850 on November 12.

At close, the Sensex was up 595.19 points or 0.71 percent at 84,466.51, and the Nifty was up 180.85 points or 0.70 percent at 25,875.80. About 2381 shares advanced, 1655 shares declined, and 144 shares unchanged.

Biggest Nifty gainers were Asian Paints, Adani Enterprises, Tech Mahindra, TCS, HDFC Life, while losers were Tata Steel, TMPV, Bharat Electronics, Shriram Finance, Grasim Industries.

BSE Midcap index rose 0.4 percent and smallcap index added 0.7 percent.

Except, realty, all other sectoral indices ended in the green with media, auto, telecom, IT, consumer durables up 1-2 percent.

-330

November 12, 2025· 15:27 IST

Asian Paints Q2 results: Net profit rises 43% to Rs 994 crore, shares up 5%

The company declared interim dividend of Rs 4.5 per share ...Read More

-330

November 12, 2025· 15:26 IST

Sensex Today | Varroc Engineering Q2 net profit rises 9.7% at Rs 61 crore versus Rs 55.6 crore, YoY

Varroc Engineering was quoting at Rs 657.95, up Rs 13.90, or 2.16 percent.

It has touched an intraday high of Rs 660.00 and an intraday low of Rs 622.65.

It was trading with volumes of 13,404 shares, compared to its five day average of 9,493 shares, an increase of 41.20 percent.

In the previous trading session, the share closed down 0.85 percent or Rs 5.50 at Rs 644.05.

The share touched a 52-week high of Rs 665.95 and a 52-week low of Rs 365.00 on 23 September, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 1.2 percent below its 52-week high and 80.26 percent above its 52-week low.

Market capitalisation stands at Rs 10,052.58 crore.

-330

November 12, 2025· 15:24 IST

Sensex Today | Nomura maintains ‘buy’ rating on EPL, target price at Rs 350

#1 Another quarter of good performance as guided

#2 2QFY26 above estimates, strong momentum in B&C continued

#3 AMESA/oral care impacted by GST transition

#4 Guidance maintained at double-digit sales growth & operating profit growth higher than sales

-330

November 12, 2025· 15:21 IST

Sensex Today | Tenneco Clean Air India IPO subscribed at 0.30 times at 3:15 PM (Day 1)

QIB – 0.00 times

NII - 0.73 times

Retail – 0.29 times

Overall – 0.30 times

-330

November 12, 2025· 15:19 IST

Nifty may correct 5-7% if Bihar election unfavourable for BJP, markets may price in ‘coalition discount’

InCred said a reversal in Bihar would likely be viewed as a political bellwether, raising concerns over national policy stability. The note pointed to razor-thin margins between the NDA and the Mahagathbandhan (MGB) alliance....Read More

-330

November 12, 2025· 15:16 IST

Sensex Today | Jefferies keeps ‘buy’ rating on Max Financial, target price at Rs 1,900

#1 Q2 reported 25 percent YoY VNB growth, driven by 185 bps margin expansion to 25 percent & 16 percent APE growth

#2 Better product mix & positive yield curve moves may have lifted margin

#3 EV grew 15 percent YoY with operating RoEV at 16 percent YoY

#4 13-month persistency ratio fell 200 bps YoY

#5 GST changes will affect margin, company seems better placed to manage it

-330

November 12, 2025· 15:14 IST

Sensex Today | InCred retains ‘hold’ rating on Bharat Forge, target price at Rs 1,209

#1 Q2FY26 EBITDA fell 12 percent YoY due to weak US CV business

#2 Passenger vehicle & industrial businesses aided healthy 28.3 percent EBITDA margin

#3 Management expects challenging demand conditions in North America in H2FY26

#4 Tightening global environment to hit short-term profits

-330

November 12, 2025· 15:11 IST

Sensex Today | Monte Carlo Q2 net profit at Rs 16.3 crore versus Rs 8 crore, YoY

Monte Carlo Fashions was quoting at Rs 775.00, up Rs 79.60, or 11.45 percent.

It has touched an intraday high of Rs 781.30 and an intraday low of Rs 700.00.

It was trading with volumes of 22,409 shares, compared to its five day average of 1,096 shares, an increase of 1,944.62 percent.

In the previous trading session, the share closed down 1.75 percent or Rs 12.40 at Rs 695.40.

The share touched a 52-week high of Rs 984.00 and a 52-week low of Rs 507.40 on 10 December, 2024 and 04 March, 2025, respectively.

Currently, the stock is trading 21.24 percent below its 52-week high and 52.74 percent above its 52-week low.

Market capitalisation stands at Rs 1,606.73 crore.

-330

November 12, 2025· 15:10 IST

Sensex Today | Physicswallah IPO subscribed at 0.11 times at 3:06 PM (Day 2)

QIB – 0.00 times

NII - 0.04 times

Retail – 0.52 times

Employee Reserved - 1.61 times

Overall – 0.11 times

-330

November 12, 2025· 15:08 IST

Sensex Today | Asian Paints Q2 profit at Rs 1,018 crore and revenue at Rs 8,531 crore

Asian Paints was quoting at Rs 2,713.00, up Rs 58.10, or 2.19 percent.

It has touched a 52-week high of Rs 2,713.00.

It has touched an intraday high of Rs 2,713.00 and an intraday low of Rs 2,644.65.

It was trading with volumes of 49,069 shares, compared to its five day average of 115,282 shares, a decrease of -57.44 percent.

In the previous trading session, the share closed up 0.18 percent or Rs 4.65 at Rs 2,654.90.

Market capitalisation stands at Rs 260,230.36 crore.

-330

November 12, 2025· 15:07 IST

Sensex Today | EMMVEE Photovoltaic Power IPO subscribed at 0.16 times at 3:03 PM (Day 2)

QIB – 0.06 times

NII - 0.10 times

Retail – 0.57 times

Overall – 0.16 times

-330

November 12, 2025· 15:03 IST

Sensex Today | Tata Steel shares trade lower ahead of Q2 earnings today

Tata Steel was quoting at Rs 178.60, down Rs 2.40, or 1.33 percent.

It has touched an intraday high of Rs 182.30 and an intraday low of Rs 178.00.

It was trading with volumes of 1,322,705 shares, compared to its five day average of 1,047,373 shares, an increase of 26.29 percent.

In the previous trading session, the share closed down 0.22 percent or Rs 0.40 at Rs 181.

The share touched a 52-week high of Rs 187.00 and a 52-week low of Rs 122.60 on 29 October, 2025 and 13 January, 2025, respectively.

Currently, the stock is trading 4.49 percent below its 52-week high and 45.68 percent above its 52-week low.

Market capitalisation stands at Rs 222,955.87 crore.

-330

November 12, 2025· 15:02 IST

Markets@3 | Sensex rises 646 points, Nifty around 25900

The Sensex was up 646.78 points or 0.77 percent at 84,518.10, and the Nifty was up 194.70 points or 0.76 percent at 25,889.65. About 2290 shares advanced, 1527 shares declined, and 140 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY Auto | 27499.75 1.29 | 20.43 3.34 | 2.91 18.18 |

| NIFTY IT | 36902.55 2.18 | -14.85 4.62 | 3.63 -13.39 |

| NIFTY Pharma | 22584.50 0.96 | -3.54 1.12 | 1.65 1.95 |

| NIFTY FMCG | 55514.30 -0.02 | -2.26 -0.54 | 1.00 -2.44 |

| NIFTY PSU Bank | 8370.90 0.76 | 27.98 0.46 | 8.77 24.09 |

| NIFTY Metal | 10542.15 -0.16 | 21.88 0.41 | 2.73 16.12 |

| NIFTY Realty | 939.35 -0.34 | -10.74 -2.26 | 4.76 -2.95 |

| NIFTY Energy | 36313.30 0.67 | 3.20 0.10 | 2.60 -3.69 |

| NIFTY Infra | 9564.90 0.74 | 13.01 0.14 | 4.16 11.81 |

| NIFTY Media | 1484.95 0.81 | -18.31 -3.11 | -4.91 -22.80 |

-330

November 12, 2025· 14:58 IST

Sensex Today | Mukand Q2 net profit down 60.5% at Rs 10 crore versus Rs 25.3 crore, YoY

Mukand was quoting at Rs 130.90, down Rs 5, or 3.68 percent.

It has touched an intraday high of Rs 141.15 and an intraday low of Rs 126.

It was trading with volumes of 22,690 shares, compared to its five day average of 4,947 shares, an increase of 358.66 percent.

In the previous trading session, the share closed down 0.59 percent or Rs 0.80 at Rs 135.90.

The share touched a 52-week high of Rs 160.85 and a 52-week low of Rs 84.64 on 24 July, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 18.62 percent below its 52-week high and 54.66 percent above its 52-week low.

Market capitalisation stands at Rs 1,891.45 crore.

-330

November 12, 2025· 14:56 IST

Sensex Today | Jefferies keeps ‘buy’ rating on Jindal Stainless, target price at Rs 925

#1 Strong Q2 with EBITDA up 17 percent YoY & above estimates

#2 Rising SS imports pose a risk

#3 Margin remain supported as China’s conversion spread is 25 percent below long-term average

#4 Spread is expected to improve going forward

#5 Expect 9 percent volume & 16 percent/21 percent EBITDA/EPS CAGR over FY25–28, with balance sheet turning net cash by FY28

-330

November 12, 2025· 14:53 IST

Sensex Today | Steel Strips Q2 net profit down 23% at Rs 35.5 crore versus Rs 46 crore, YoY

Steel Strips Wheels was quoting at Rs 214.65, down Rs 4.20, or 1.92 percent.

It has touched an intraday high of Rs 225.20 and an intraday low of Rs 214.30.

It was trading with volumes of 7,651 shares, compared to its five day average of 6,584 shares, an increase of 16.21 percent.

In the previous trading session, the share closed down 1.06 percent or Rs 2.35 at Rs 218.85.

The share touched a 52-week high of Rs 279.60 and a 52-week low of Rs 167.50 on 01 July, 2025 and 17 March, 2025, respectively.

Currently, the stock is trading 23.23 percent below its 52-week high and 28.15 percent above its 52-week low.

Market capitalisation stands at Rs 3,373.88 crore.

-330

November 12, 2025· 14:50 IST

Sensex Today | Nifty Midcap index crosses 61000, hits new high

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Biocon | 407.50 | 5.82 | 12.64m |

| Max Financial | 1,725.60 | 5.51 | 3.80m |

| BSE Limited | 2,773.50 | 4.89 | 14.74m |

| Bandhan Bank | 155.60 | 3.09 | 7.01m |

| Tata Elxsi | 5,413.50 | 2.46 | 173.73k |

| Lupin | 2,023.20 | 2.39 | 1.14m |

| Voltas | 1,335.00 | 2.39 | 775.37k |

| INDUS TOWERS | 410.10 | 2.37 | 5.36m |

| Solar Ind | 14,109.00 | 2.33 | 171.40k |

| Apollo Tyres | 532.40 | 2.31 | 1.39m |

| Aditya Birla F | 80.35 | 2.08 | 3.37m |

| KPIT Tech | 1,237.00 | 2.02 | 828.64k |

| Adani Total Gas | 624.90 | 2.01 | 942.48k |

| MphasiS | 2,831.80 | 1.95 | 449.45k |

| Cochin Shipyard | 1,787.80 | 1.9 | 1.10m |

| Tata Tech | 697.70 | 1.88 | 884.02k |

| Glenmark | 1,851.10 | 1.86 | 1.73m |

| Godrej Prop | 2,197.90 | 1.83 | 279.04k |

| Persistent | 6,138.50 | 1.78 | 432.17k |

| Container Corp | 532.00 | 1.74 | 4.56m |

-330

November 12, 2025· 14:49 IST

Sensex Today | InCred Keeps ‘reduce’ rating on Bosch, target price at Rs 27,910

#1 Q2 EBITDA fell 4 percent QoQ, below estimate due to flat sales growth & elevated raw material prices

#2 Retain FY26F estimates, which build in H2FY26 EPS growth of 11 percent YoY

#3 Correction in the stock price to continue as valuation is rich

-330

November 12, 2025· 14:47 IST

Sensex Today | Sudarshan Chemicals Q2 net profit down 61% at Rs 11.7 crore versus Rs 30 crore, YoY

Sudarshan Chemical Industries was quoting at Rs 1,024.90, down Rs 27.75, or 2.64 percent.

It has touched an intraday high of Rs 1,066.20 and an intraday low of Rs 1,016.90.

It was trading with volumes of 12,268 shares, compared to its five day average of 7,607 shares, an increase of 61.28 percent.

In the previous trading session, the share closed down 1.39 percent or Rs 14.85 at Rs 1,052.65.

The share touched a 52-week high of Rs 1,604.00 and a 52-week low of Rs 795.75 on 24 September, 2025 and 03 March, 2025, respectively.

Currently, the stock is trading 36.1 percent below its 52-week high and 28.8 percent above its 52-week low.

Market capitalisation stands at Rs 8,056.38 crore.

-330

November 12, 2025· 14:43 IST

Sensex Today | Hindustan Aeronautics Q2 net profit up 10.5% at Rs 1,669 crore versus Rs 1,510.5 crore, YoY

Hindustan Aeronautics was quoting at Rs 4,720.00, down Rs 143.20, or 2.94 percent.

It has touched an intraday high of Rs 4,920.00 and an intraday low of Rs 4,701.00.

It was trading with volumes of 127,597 shares, compared to its five day average of 91,789 shares, an increase of 39.01 percent.

In the previous trading session, the share closed up 1.54 percent or Rs 73.70 at Rs 4,863.20.

The share touched a 52-week high of Rs 5,166.00 and a 52-week low of Rs 3,045.95 on 16 May, 2025 and 03 March, 2025, respectively.

Currently, the stock is trading 8.63 percent below its 52-week high and 54.96 percent above its 52-week low.

Market capitalisation stands at Rs 315,661.80 crore.

-330

November 12, 2025· 14:40 IST

Sensex Today | Nomura keeps ‘buy’ rating on Ather Energy, target price at Rs 790

#1 Q2 EBITDA loss lower than estimate on higher volumes

#2 Strong visibility on market share expansion

#3 Network expansion & EL launch key catalysts

#4 Expect strong 57 percent/40 percent/33 percent volume growth in FY26/27/28F

-330

November 12, 2025· 14:39 IST

Nitin Jain, Sr. Research Analyst at Bonanza

Groww made its debut on the stock market today, listing nearly 12% above the upper end of its valuation band of Rs 100, highlighting strong demand from investors.

The share made a high of Rs 124 during intraday. The initial public offering (IPO) witnessed significant investor interest, recording a total subscription of 17.60 times.

Given the company’s robust revenue and profit growth, coupled with its innovative digital business model, there is optimism about its long-term potential.

-330

November 12, 2025· 14:34 IST

Sensex Today | GROWW shares jump 32% on listing day

-330

November 12, 2025· 14:30 IST

Ashok Leyland Q2 results: Net profit nearly flat at Rs 771 crore, revenue up 9%

The company's board has recommended interim dividend of Re 1 per share ...Read More

-330

November 12, 2025· 14:20 IST

Stock Market LIVE Updates | Midcap Index hits record high, crosses earlier level of 60,926

-330

November 12, 2025· 14:17 IST

Sensex Today | Hi-Tech Pipes net profit up 12 percent at Rs 20.2 crore vs Rs 18 crore (YoY)

Revenue up 22 percent at Rs 859 crore vs Rs 706 crore (YoY)

EBITDA up 4.7 percent at Rs 44.4 crore vs Rs 42.4 crore (YoY)

EBITDA margin at 5.2 percent vs 6 percent (YoY)

-330

November 12, 2025· 14:10 IST

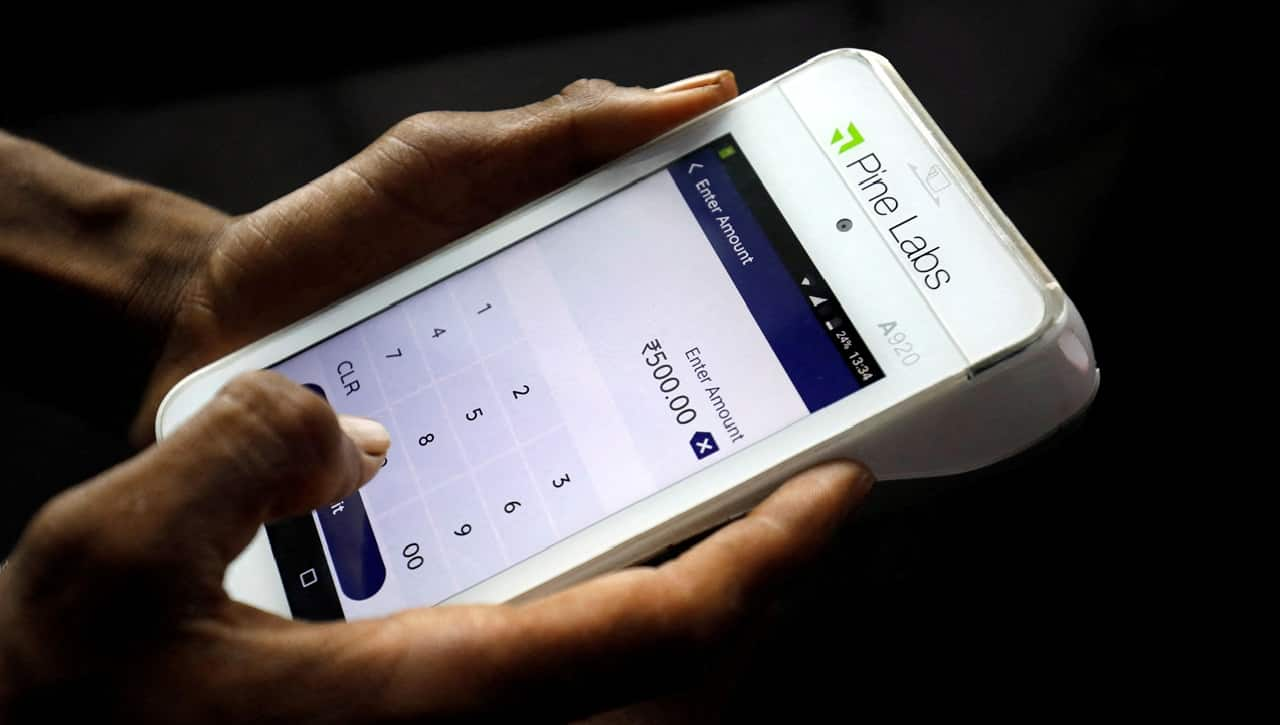

Pine Labs IPO allotment: How to check status on registrar, NSE & BSE; Check latest GMP

Pine Labs IPO shares will be listed on both NSE and BSE on November 14, following a 2.46 times subscription to Rs 3,900-crore issue. ...Read More

-330

November 12, 2025· 14:04 IST

Sensex Today | Ashok Leyland Q2 net profit at Rs 771 crore and revenue at Rs 9,588 crore

Ashok Leyland was quoting at Rs 145.95, down Rs 0.10, or 0.07 percent.

It has touched a 52-week high of Rs 147.70.

It has touched an intraday high of Rs 147.70 and an intraday low of Rs 141.95.

It was trading with volumes of 680,395 shares, compared to its five day average of 407,887 shares, an increase of 66.81 percent.

In the previous trading session, the share closed up 2.67 percent or Rs 3.80 at Rs 146.05.

Market capitalisation stands at Rs 85,728.91 crore.

-330

November 12, 2025· 14:03 IST

Markets@2 | Sensex jumps 710 points, Nifty at 25900

The Sensex was up 714.56 points or 0.85 percent at 84,585.88, and the Nifty was up 214.00 points or 0.83 percent at 25,908.95. About 2296 shares advanced, 1477 shares declined, and 144 shares unchanged.

-330

November 12, 2025· 14:02 IST

Sensex Today | Tenneco Clean Air India IPO subscribed at 0.23 times at 1:57 PM (Day 1)

QIB – 0.00 times

NII - 0.53 times

Retail – 0.23 times

Overall – 0.23 times

-330

November 12, 2025· 14:00 IST

Sensex Today | BSE Auto index up 1%, extends gain on fourth day

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 5,545.00 | 2.4 | 9.89k |

| Apollo Tyres | 531.55 | 2.17 | 93.14k |

| Hyundai Motor | 2,394.05 | 1.65 | 13.37k |

| Sona BLW | 497.45 | 1.53 | 93.09k |

| Balkrishna Ind | 2,370.70 | 1.31 | 2.25k |

| Exide Ind | 381.80 | 1.26 | 70.56k |

| Tube Investment | 3,030.80 | 1.04 | 5.20k |

| Amara Raja | 969.95 | 0.95 | 37.16k |

| Bosch | 36,950.00 | 0.79 | 650 |

| UNO Minda | 1,319.25 | 0.61 | 14.85k |

| M&M | 3,774.00 | 0.61 | 60.85k |

| Maruti Suzuki | 15,705.00 | 0.42 | 3.17k |

| MRF | 158,600.00 | 0.33 | 47 |

-330

November 12, 2025· 13:56 IST

Sensex Today | Keystone Realtors Q2 net profit down 87% at Rs 8.5 crore versus Rs 66.3 crore, YoY

-330

November 12, 2025· 13:53 IST

Sensex Today | Physicswallah IPO subscribed at 0.11 times at 1:51 PM (Day 2)

QIB – 0.00 times

NII - 0.04 times

Retail – 0.52 times

Employee Reserved - 1.60 times

Overall – 0.11 times

-330

November 12, 2025· 13:52 IST

Sensex Today | Welspun Living Q2 net profit at Rs 13 crore versus Rs 201 crore, YoY

Welspun Living was quoting at Rs 134.70, down Rs 0.10, or 0.07 percent.

It has touched an intraday high of Rs 140.80 and an intraday low of Rs 134.00.

It was trading with volumes of 539,655 shares, compared to its five day average of 94,966 shares, an increase of 468.26 percent.

In the previous trading session, the share closed up 1.97 percent or Rs 2.60 at Rs 134.80.

The share touched a 52-week high of Rs 187.80 and a 52-week low of Rs 105.00 on 10 December, 2024 and 28 February, 2025, respectively.

Currently, the stock is trading 28.27 percent below its 52-week high and 28.29 percent above its 52-week low.

Market capitalisation stands at Rs 12,919.78 crore.

-330

November 12, 2025· 13:50 IST

Sensex Today | Eris Lifesciences Q2 net profit up 31.2% at Rs 120 crore versus Rs 92 crore, YoY

-330

November 12, 2025· 13:47 IST

Sensex Today | Century Plyboards Q2 net profit up 77.7% at Rs 70.9 crore versus Rs 40 crore, YoY

-330

November 12, 2025· 13:42 IST

Sensex Today | EMMVEE Photovoltaic Power IPO subscribed at 0.13 times at 1:39 PM (Day 2)

QIB – 0.02 times

NII - 0.09 times

Retail – 0.53 times

Overall – 0.13 times

-330

November 12, 2025· 13:40 IST

Sensex Today | Info Edge Q2 revenue up 14% at Rs 746 crore versus Rs 656 crore, YoY

Info Edge India was quoting at Rs 1,363.95, up Rs 22.85, or 1.70 percent.

It has touched an intraday high of Rs 1,373.00 and an intraday low of Rs 1,331.70.

It was trading with volumes of 26,926 shares, compared to its five day average of 17,633 shares, an increase of 52.71 percent.

In the previous trading session, the share closed down 0.12 percent or Rs 1.55 at Rs 1,341.10.

The share touched a 52-week high of Rs 1,838.99 and a 52-week low of Rs 1,151.45 on 06 January, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 25.83 percent below its 52-week high and 18.45 percent above its 52-week low.

Market capitalisation stands at Rs 88,441.33 crore.

-330

November 12, 2025· 13:35 IST

Sensex Today | Insecticides India Q2 net profit down 3.9% at Rs 59 crore versus Rs 61.4 crore, YoY

Net Profit down 3.9 percent At Rs 59 crore Vs Rs 61.4 crore, YoY

Revenue up 1.8 percent At Rs 637.7 crore Vs Rs 626.6 crore, YoY

EBITDA down 0.8 percent At Rs 89.3 crore Vs Rs 90 crore, YoY

Margin at 14 percent Vs 14.4 percent, YoY

Insecticides India was quoting at Rs 676.25, down Rs 4.50, or 0.66 percent.

It has touched an intraday high of Rs 684.00 and an intraday low of Rs 666.05.

It was trading with volumes of 2,133 shares, compared to its five day average of 1,569 shares, an increase of 35.98 percent.

In the previous trading session, the share closed up 0.43 percent or Rs 2.90 at Rs 680.75.

The share touched a 52-week high of Rs 1,096.30 and a 52-week low of Rs 531.60 on 31 July, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 38.32 percent below its 52-week high and 27.21 percent above its 52-week low.

Market capitalisation stands at Rs 1,967.74 crore.

-330

November 12, 2025· 13:34 IST

Sensex Today | IRB Infra Q2 net profit rises 41% at Rs 140.8 crore

Net Profit up 41 percent at Rs 140.8 crore Vs Rs 99.8 crore, YoY

Revenue up 10.4 percent at Rs 1,751 crore Vs Rs 1,585.8 crore, YoY

EBITDA up 8 percent at Rs 924.7 crore Vs Rs 766.5 crore, YoY

Margin at 52.8 percent Vs 48.3 percent, YoY

IRB Infrastructure Developers was quoting at Rs 43.91, up Rs 0.66, or 1.53 percent.

It has touched an intraday high of Rs 44.59 and an intraday low of Rs 42.90.

It was trading with volumes of 601,449 shares, compared to its five day average of 609,314 shares, a decrease of -1.29 percent.

In the previous trading session, the share closed down 0.46 percent or Rs 0.20 at Rs 43.25.

The share touched a 52-week high of Rs 61.98 and a 52-week low of Rs 40.54 on 10 December, 2024 and 26 September, 2025, respectively.

Currently, the stock is trading 29.15 percent below its 52-week high and 8.31 percent above its 52-week low.

Market capitalisation stands at Rs 26,517.25 crore.

-330

November 12, 2025· 13:23 IST

Hemen Bhatia, Executive Director and CEO, Angel One Asset Management Company

AMFI’s latest data highlights the steady rise of passive investing in India. Between September and October 2025, passive AUM increased from Rs 12.65 lakh crore to Rs 13.30 lakh crore, reflecting a healthy month-on-month growth.

This momentum shows an inclination in investor preference towards transparent and cost-efficient investment options. As more investors adopt passive strategies for long-term wealth creation, this trend will continue to play an important role in expanding overall market participation.

-330

November 12, 2025· 13:20 IST

Sensex Today | Precision Wires Q2 net profit rises 85.4% at Rs 35.6 crore; shares hit 52-week high

#1 Net profit up 85.4 percent at Rs 35.6 crore against Rs 19.2 crore, YoY

#2 Revenue up 18 percent at Rs 1,226 crore against Rs 1,037.7 crore, YoY

#3 EBITDA up 62.8 percent at Rs 59 crore against Rs 36 crore, YoY

#4 Margin at 4.8 percent vs 3.5 percent, YoY

Precision Wires India was quoting at Rs 240.60, up Rs 9.75, or 4.22 percent.

It has touched a 52-week high of Rs 243.20.

It has touched an intraday high of Rs 243.20 and an intraday low of Rs 228.45.

It was trading with volumes of 48,761 shares, compared to its five day average of 31,787 shares, an increase of 53.40 percent.

In the previous trading session, the share closed up 1.05 percent or Rs 2.40 at Rs 230.85.

Market capitalisation stands at Rs 4,398.36 crore.

-330

November 12, 2025· 13:19 IST

SoftBank shares slide as Nvidia stake sale highlights AI funding needs

The share drop also comes amid investor concerns about the risk that rapidly rising tech valuations are overextended, even as SoftBank moves to deepen its exposure to the AI sector ...Read More

-330

November 12, 2025· 13:17 IST

Sensex Today | Campus Activewear Q2 net profit rises 40% at Rs 20 crore

#1 Net profit up 40 percent at Rs 20 crore against Rs 14.3 crore, YoY

#2 Revenue up 16 percent at Rs 386 crore against Rs 333.3 crore, YoY

#3 EBITDA up 31.7 percent at Rs 49.7 crore against Rs 37.7 crore, YoY

#4 Margin at 12.9 percent vs 11.3 percent, YoY

Campus Activewear was quoting at Rs 283.50, up Rs 8.20, or 2.98 percent.

It has touched an intraday high of Rs 286.10 and an intraday low of Rs 273.80.

It was trading with volumes of 34,728 shares, compared to its five day average of 44,404 shares, a decrease of -21.79 percent.

In the previous trading session, the share closed down 1.70 percent or Rs 4.75 at Rs 275.30.

The share touched a 52-week high of Rs 337.20 and a 52-week low of Rs 215.00 on 30 December, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 15.93 percent below its 52-week high and 31.86 percent above its 52-week low.

Market capitalisation stands at Rs 8,660.14 crore.

-330

November 12, 2025· 13:16 IST

Sensex Today | Jtekt India Q2 net profit down 6.7% at Rs 18.2 crore versus Rs 19.5 crore, YoY

JTEKT India was quoting at Rs 156.90, down Rs 1.10, or 0.70 percent.

It has touched an intraday high of Rs 164.25 and an intraday low of Rs 155.95.

It was trading with volumes of 8,722 shares, compared to its five day average of 21,651 shares, a decrease of -59.72 percent.

In the previous trading session, the share closed down 0.66 percent or Rs 1.05 at Rs 158.00.

The share touched a 52-week high of Rs 189.00 and a 52-week low of Rs 104.58 on 09 September, 2025 and 03 March, 2025, respectively.

Currently, the stock is trading 16.98 percent below its 52-week high and 50.03 percent above its 52-week low.

Market capitalisation stands at Rs 4,352.36 crore.

-330

November 12, 2025· 13:13 IST

Sensex Today | Mrs. Bectors Food Specialities Q2 net profit down 6.4% at Rs 36.5 crore versus Rs 39 crore, YoY

Bectors Food Specialities was quoting at Rs 1,287.80, down Rs 2.85, or 0.22 percent.

It has touched an intraday high of Rs 1,300.55 and an intraday low of Rs 1,281.75.

It was trading with volumes of 3,628 shares, compared to its five day average of 13,256 shares, a decrease of -72.63 percent.

In the previous trading session, the share closed up 0.09 percent or Rs 1.15 at Rs 1,290.65.

The share touched a 52-week high of Rs 1,974.65 and a 52-week low of Rs 1,201.05 on 05 December, 2024 and 07 May, 2025, respectively.

Currently, the stock is trading 34.78 percent below its 52-week high and 7.22 percent above its 52-week low.

Market capitalisation stands at Rs 7,906.85 crore.

-330

November 12, 2025· 13:11 IST

Sensex Today | Panacea Biotec gets USD 4.75 million order

Panacea Biotec has received an Award notification from PAHO under a long-term agreement for supply of Diphtheria-Tetanus-Pertussis-Hepatitis B-Haemophilus influenzae type B (DTP-HepB-Hib) Vaccine (Pentavalent) - Liquid (single dose) to PAHO, valid until December 31, 2027.

The total award to the company is for supply of Easyfive-TT Vaccine aggregating ~US$ 4.75 million (~Rs 41 crore) during Calendar Year 2026 and 2027.

Panacea Biotec was quoting at Rs 397.65, up Rs 1.25, or 0.32 percent.

It has touched an intraday high of Rs 407.05 and an intraday low of Rs 397.65.

It was trading with volumes of 3,132 shares, compared to its five day average of 5,060 shares, a decrease of -38.10 percent.

In the previous trading session, the share closed down 2.24 percent or Rs 9.10 at Rs 396.40.

The share touched a 52-week high of Rs 581.00 and a 52-week low of Rs 282.15 on 15 May, 2025 and 28 February, 2025, respectively.

Currently, the stock is trading 31.56 percent below its 52-week high and 40.94 percent above its 52-week low.

Market capitalisation stands at Rs 2,435.64 crore.

-330

November 12, 2025· 13:08 IST

Sensex Today | Hexaware Deepens Google Cloud Partnership with the Launch of Advanced Insurance Solutions

Hexaware Technologies announced the launch of two new insurance solutions developed exclusively for Google Cloud. The offerings strengthen Hexaware’s collaboration with Google and reflect a shared focus on accelerating digital transformation through automation, AI, and scalable cloud-native architectures for the insurance industry.

-330

November 12, 2025· 13:05 IST

Sensex Today | Expo Engineering and Projects nags order of Rs 14.53 crore

Expo Engineering and Projects has received a work order from Indian Oil Corporation Limited, Haldia Refinery amounting to Rs. 14,53,40,862.98.

Expo Engineering and Projects was quoting at Rs 69.10, down Rs 2.71, or 3.77 percent.

It has touched an intraday high of Rs 73.98 and an intraday low of Rs 68.50.

It was trading with volumes of 11,759 shares, compared to its five day average of 4,834 shares, an increase of 143.26 percent.

In the previous trading session, the share closed down 1.36 percent or Rs 0.99 at Rs 71.81.

The share touched a 52-week high of Rs 111.00 and a 52-week low of Rs 39.00 on 24 September, 2025 and 19 March, 2025, respectively.

Currently, the stock is trading 37.75 percent below its 52-week high and 77.18 percent above its 52-week low.

Market capitalisation stands at Rs 157.52 crore.

-330

November 12, 2025· 13:04 IST

Sensex Today | Federal Bank picks 3,20,00,000 equity shares of AFLIC from Ageas

The Federal Bank has acquired 3,20,00,000 equity shares of AFLIC, from Ageas, for a consideration of Rs 30.45 per share. Total consideration paid was INR 97,44,00,000.

Federal Bank was quoting at Rs 237.25, up Rs 1.40, or 0.59 percent.

It has touched an intraday high of Rs 237.60 and an intraday low of Rs 233.35.

It was trading with volumes of 116,379 shares, compared to its five day average of 175,621 shares, a decrease of -33.73 percent.

In the previous trading session, the share closed down 1.05 percent or Rs 2.50 at Rs 235.85.

The share touched a 52-week high of Rs 238.90 and a 52-week low of Rs 172.95 on 03 November, 2025 and 03 March, 2025, respectively.

Currently, the stock is trading 0.69 percent below its 52-week high and 37.18 percent above its 52-week low.

Market capitalisation stands at Rs 58,367.76 crore.

-330

November 12, 2025· 13:02 IST

Markets@1 | Sensex up 745 points, Nifty above 25900

The Sensex was up 745.28 points or 0.89 percent at 84,616.60, and the Nifty was up 221.65 points or 0.86 percent at 25,916.60. About 2294 shares advanced, 1422 shares declined, and 150 shares unchanged.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Reliance | 1,522.65 1.92 | 576.25k | 87.14 |

| TCS | 3,121.05 2.39 | 226.51k | 70.22 |

| Infosys | 1,553.00 1.46 | 426.46k | 66.04 |

| Bajaj Finance | 1,016.05 1.06 | 305.33k | 30.95 |

| SBI | 959.55 0.66 | 248.85k | 23.85 |

| Adani Ports | 1,508.60 2.33 | 155.19k | 23.31 |

| Eternal | 310.25 1.47 | 676.01k | 21.01 |

| M&M | 3,748.35 -0.07 | 54.78k | 20.61 |

| HDFC Bank | 994.00 0.23 | 203.29k | 20.22 |

| Trent | 4,373.10 1.32 | 46.09k | 20.04 |

| Bharat Elec | 424.25 -0.69 | 472.60k | 20.13 |

| TMPV | 404.30 -0.79 | 452.86k | 18.40 |

| Tata Steel | 179.15 -1.02 | 894.01k | 16.09 |

| Bharti Airtel | 2,069.50 1.32 | 75.62k | 15.61 |

| ICICI Bank | 1,365.20 0.5 | 97.62k | 13.29 |

| Larsen | 3,953.50 0 | 31.01k | 12.28 |

| HUL | 2,422.65 -0.26 | 49.23k | 11.92 |

| HCL Tech | 1,597.90 1.79 | 62.68k | 9.95 |

| Tech Mahindra | 1,454.70 3.25 | 59.36k | 8.56 |

| Asian Paints | 2,662.95 0.3 | 32.37k | 8.60 |

-330

November 12, 2025· 12:59 IST

Biocon reports Rs 85 crore net profit in Q2FY26

Biocon on Tuesday reported a net profit of Rs 85 crore for the quarter ended September 30, 2025, compared to a loss of Rs 16 crore a year earlier, driven by strong biosimilar sales and improved operating leverage.

Profit before tax (PBT), excluding exceptional items, rose 153% to ₹183 crore.

Consolidated revenue grew 11% year-on-year to Rs. 4,389 crore, led by a 25% jump in biosimilars, which contributed 61% of segmental revenue. Biocon's biosimilar reported Rs 2,721 crore.

-330

November 12, 2025· 12:58 IST

Sensex Today | Waaree Energies bags order for supply of 360MW solar modules

Waaree Energies was quoting at Rs 3,362.40, up Rs 42.95, or 1.29 percent.

It has touched an intraday high of Rs 3,386.80 and an intraday low of Rs 3,339.40.

In the previous trading session, the share closed up 0.14 percent or Rs 4.50 at Rs 3,319.45.

The share touched a 52-week high of Rs 3,864.40 and a 52-week low of Rs 1,808.65 on 12 September, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 12.99 percent below its 52-week high and 85.91 percent above its 52-week low.

Market capitalisation stands at Rs 96,716.38 crore.

-330

November 12, 2025· 12:56 IST

Tata Power shares fall 2% as Mundra plant shutdown weighs on Q2 earnings: Should you buy, sell or hold?

Tata Power share price: Tata Power said that operations at Mundra Power plant have been suspended since July 3 to undertake pending overhauling activities to resolve existing technical issues....Read More

-330

November 12, 2025· 12:54 IST

Sensex Today | Jefferies keeps ‘buy’ rating on PI Industries, target price at Rs 4,315

#1 Revenues declined 16 percent YoY & 8 percent above estimate as CSM exports fell 18 percent YoY

#2 Domestic revenues declined 13 percent YoY, below estimate

#3 Pharma growth surprised positively, but losses continued along expected lines

#4 Management maintained guidance for single-digit revenue growth overall in FY26

#5 New products growing 27 percent YoY in the quarter

-330

November 12, 2025· 12:50 IST

Sensex Today | Pearl Global Industries Q2 consolidated profit rises 25%

#1 Profit jumps 25.4 percent to Rs 73.3 crore Vs Rs 58.5 crore, YoY

#2 Revenue soars 9.2 percent to Rs 1,312.9 crore Vs Rs 1,201.9 crore, YoY

-330

November 12, 2025· 12:48 IST

Sensex Today | PTC India Q2 consolidated profit jumps 30%, revenue up 11%

#1 Profit spikes 30.8 percent to Rs 191.2 crore Vs Rs 146.2 crore, YoY

#2 Revenue grows 11.7 percent to Rs 5,458.7 crore Vs Rs 4,885.2 crore, YoY

PTC India was quoting at Rs 169.25, up Rs 4.30, or 2.61 percent.

It has touched an intraday high of Rs 169.65 and an intraday low of Rs 165.00.

It was trading with volumes of 74,341 shares, compared to its five day average of 54,743 shares, an increase of 35.80 percent.

In the previous trading session, the share closed down 0.36 percent or Rs 0.60 at Rs 164.95.

The share touched a 52-week high of Rs 206.90 and a 52-week low of Rs 127.75 on 24 July, 2025 and 13 January, 2025, respectively.

Currently, the stock is trading 18.2 percent below its 52-week high and 32.49 percent above its 52-week low.

Market capitalisation stands at Rs 5,009.94 crore.

-330

November 12, 2025· 12:46 IST

Sensex Today | Asian markets end higher; Hang Seng, Kospi up 1% each

-330

November 12, 2025· 12:44 IST

Sensex Today | Nomura keeps ‘buy’ rating on ONGC, target price cut to Rs 270

#1 Q2 missed estimates due to higher opex

#2 Expect 4 percent volume CAGR over FY25-28

#3 Annual capex set at Rs 30,000–35,000 crore

#4 Aiming to cut opex by around Rs 5,000 crore

#5 Targetting 10 GW renewables by 2030

#6 Mumbai high output to rise 60 percent over 10 years, peaking FY28-30

#7 Daman & DSF-II to add 5 & 4 mmscmd gas in FY26/27

#8 New well gas share may reach 30–35 percent in 3–4 years

-330

November 12, 2025· 12:39 IST

Sensex Today | HSBC keeps ‘buy’ rating on Crompton Greaves Consumer Electrical, target price cut to Rs 430

#1 Muted ECD growth & cost pressures weighed on Q2 earnings

#2 Investments in new product categories, higher A&P spend & input costs to weigh on near-term margin trajectory

#3 Cut near-term earnings forecasts by 16-20 percent

Crompton Greaves Consumer Electrical was quoting at Rs 281.80, up Rs 2.55, or 0.91 percent.

It has touched an intraday high of Rs 282.95 and an intraday low of Rs 278.25.

It was trading with volumes of 49,677 shares, compared to its five day average of 218,155 shares, a decrease of -77.23 percent.

In the previous trading session, the share closed down 0.41 percent or Rs 1.15 at Rs 279.25.

The share touched a 52-week high of Rs 419.15 and a 52-week low of Rs 269.05 on 02 December, 2024 and 07 November, 2025, respectively.

Currently, the stock is trading 32.77 percent below its 52-week high and 4.74 percent above its 52-week low.

Market capitalisation stands at Rs 18,145.52 crore.

-330

November 12, 2025· 12:36 IST

Currency Check | Rupee trades lower at 88.62

Indian rupee is trading lower at 88.62 per dollar against previous close of 88.56.

-330

November 12, 2025· 12:34 IST

Sensex Today | Jyothy Lab Q2 net profit down 16.2% at Rs 88 crore versus Rs 105 crore, YoY

Jyothy Labs was quoting at Rs 309.55, down Rs 3.85, or 1.23 percent.

It has touched an intraday high of Rs 314.25 and an intraday low of Rs 307.40.

It was trading with volumes of 12,409 shares, compared to its five day average of 7,561 shares, an increase of 64.11 percent.

In the previous trading session, the share closed up 0.02 percent or Rs 0.05 at Rs 313.40.

The share touched a 52-week high of Rs 447.00 and a 52-week low of Rs 267.90 on 13 November, 2024 and 03 October, 2025, respectively.

Currently, the stock is trading 30.75 percent below its 52-week high and 15.55 percent above its 52-week low.

Market capitalisation stands at Rs 11,367.13 crore.

-330

November 12, 2025· 12:33 IST

Flexi-cap funds lead October equity inflows as investors seek broad-based opportunities

Flexi-cap funds that are increasingly seen as the “core” equity choice for first-time investors captured a large share of these contributions. The category has now collected Rs 57,126 crore from investors since February 2025....Read More

-330

November 12, 2025· 12:31 IST

Sensex Today | EIH Q2 consolidated revenue flat, profit decreases

#1 Profit falls 12.4 percent to Rs 113.8 crore Vs Rs 129.9 crore, YoY

#2 Revenue rises 1.5 percent to Rs 597.9 crore Vs Rs 589 crore, YoY

EIH was quoting at Rs 376.70, down Rs 11.15, or 2.87 percent.

It has touched an intraday high of Rs 382.95 and an intraday low of Rs 371.60.

It was trading with volumes of 35,112 shares, compared to its five day average of 14,175 shares, an increase of 147.71 percent.

In the previous trading session, the share closed up 0.06 percent or Rs 0.25 at Rs 387.85.

The share touched a 52-week high of Rs 441.00 and a 52-week low of Rs 293.45 on 11 December, 2024 and 17 February, 2025, respectively.

Currently, the stock is trading 14.58 percent below its 52-week high and 28.37 percent above its 52-week low.

Market capitalisation stands at Rs 23,557.47 crore.

-330

November 12, 2025· 12:24 IST

Mater Capital Services

Billionbrains Garage Ventures Ltd. (Groww) made its debut on the stock market today, listing almost 12% above the upper valuation band of Rs 100, indicating strong demand among investors.

The IPO has seen significant interest from investors, with a total subscription of 17.60 times and strong retail and Qualified Institutional Investor (Ex Anchor) subscriptions of 9.43x and 22.02x respectively, which is demonstrative of their high confidence in the business’ growth story.

The company is the leading discount broker in India to facilitate growth and wealth creation through diversified financial products and services. The platform allows customers to invest and trade in stocks (with IPOs), derivatives, bonds, and mutual funds, and facilitates margin trading and personal loans.

The number of active users on Groww’s platform increased at a CAGR of 52.74% from the beginning of Fiscal 2023 through the three months ended June 30, 2025. While the brokerage industry can expect some near-term headwinds based on recently announced SEBI policy adjustments and regulatory changes, the long-term trend of financialisation and growing retail participation in the Indian capital markets should suggest a strong backdrop of opportunity.

With India’s largest and fastest-growing investment platform based on active users, Billionbrains Garage Ventures Ltd (Groww) is well-positioned to take advantage of this momentum with its technology-enabled and customer-centric business model.

-330

November 12, 2025· 12:19 IST

Sensex Today | Tenneco Clean Air India IPO subscribed at 0.15 times at 12:15 PM (Day 1)

QIB – 0.00 times

NII - 0.32 times

Retail – 0.15 times

Overall – 0.15 times

-330

November 12, 2025· 12:18 IST

Sensex Today | Zee Entertainment Enterprises share price rises most in 12 weeks

Zee Entertainment Enterprises was quoting at Rs 102.75, up Rs 3.90, or 3.95 percent.

It has touched an intraday high of Rs 103.10 and an intraday low of Rs 98.75.

It was trading with volumes of 578,236 shares, compared to its five day average of 490,973 shares, an increase of 17.77 percent.

In the previous trading session, the share closed up 1.23 percent or Rs 1.20 at Rs 98.85.

The share touched a 52-week high of Rs 151.70 and a 52-week low of Rs 89.29 on 04 July, 2025 and 04 March, 2025, respectively.

Currently, the stock is trading 32.27 percent below its 52-week high and 15.07 percent above its 52-week low.

Market capitalisation stands at Rs 9,869.34 crore.

-330

November 12, 2025· 12:15 IST

Sensex Today | Physicswallah IPO subscribed at 0.10 times at 12:12 PM (Day 2)

QIB – 0.00 times

NII - 0.04 times

Retail – 0.48 times

Employee Reserved - 1.49 times

Overall – 0.10 times

-330

November 12, 2025· 12:10 IST

Sensex Today | EMMVEE Photovoltaic Power IPO subscribed at 0.12 times at 12:09 PM (Day 2)

QIB – 0.02 times

NII - 0.08 times

Retail – 0.49 times

Overall – 0.12 times

-330

November 12, 2025· 12:07 IST

Sensex Today | M&M, HPCL, IOC, Bharat Forge, Ashok Leyland, among others hits 52-week high

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| GE Shipping | 1180.70 | 1180.70 | 1,167.60 |

| Max Financial | 1707.15 | 1707.15 | 1,696.00 |

| Adani Ports | 1514.00 | 1514.00 | 1,502.80 |

| Canara Bank | 144.55 | 144.55 | 143.45 |

| Titan Company | 3873.05 | 3873.05 | 3,870.00 |

| UPL | 767.75 | 767.75 | 762.00 |

| Adani Energy | 1022.05 | 1022.05 | 1,001.80 |

| Alkem Lab | 5823.00 | 5823.00 | 5,758.75 |

| Hitachi Energy | 22150.85 | 22150.85 | 21,995.45 |

| Bank of India | 147.85 | 147.85 | 146.10 |

| Asian Paints | 2678.00 | 2678.00 | 2,669.00 |

| NALCO | 269.20 | 269.20 | 266.75 |

| BHEL | 289.60 | 289.60 | 286.10 |

| Asahi India | 980.45 | 980.45 | 969.10 |

| Can Fin Homes | 908.95 | 908.95 | 893.40 |

| M&M | 3780.20 | 3780.20 | 3,754.00 |

| HINDPETRO | 494.55 | 494.55 | 486.95 |

| IOC | 174.45 | 174.45 | 171.75 |

| Bharat Forge | 1414.85 | 1414.85 | 1,396.15 |

| Ashok Leyland | 147.70 | 147.70 | 145.50 |

-330

November 12, 2025· 12:04 IST

Sensex Today | Zaggle Prepaid Ocean Services Q2 consolidated profit surges 72%

#1 Profit spikes 72.4 percent to Rs 35 crore Vs Rs 20.3 crore, YoY

#2 Revenue jumps 42.9 percent to Rs 432.2 crore Vs Rs 302.6 crore, YoY

-330

November 12, 2025· 12:01 IST

Markets@12 | Sensex rises 655 points, Nifty around 25900

The Sensex was up 655.01 points or 0.78 percent at 84,526.33, and the Nifty was up 194.35 points or 0.76 percent at 25,889.30. About 2309 shares advanced, 1316 shares declined, and 167 shares unchanged.

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Karnika Ind | 126.00 -5.65% | 357.00k 9,360.00 | 3,714.00 |

| Yatra Online | 184.57 11.72% | 27.69m 799,733.00 | 3,362.00 |

| Sintercom India | 118.00 3.16% | 76.73k 2,469.60 | 3,007.00 |

| Kirloskar Oil | 1,086.00 14.87% | 6.51m 254,178.20 | 2,460.00 |

| Krishival Foods | 489.35 -0.97% | 27.16k 1,200.00 | 2,163.00 |

| IOL Chemicals | 98.48 10.9% | 18.96m 943,966.40 | 1,909.00 |

| Syrma SGS | 890.50 7.15% | 9.98m 501,243.20 | 1,891.00 |

| AB Cotspin | 405.80 -3.12% | 48.60k 2,700.00 | 1,700.00 |

| Advanced Enzyme | 327.15 5.82% | 1.59m 98,502.00 | 1,515.00 |

| Namo Ewaste | 217.00 13.26% | 633.60k 44,800.00 | 1,314.00 |

| Atal | 24.04 -3.03% | 1.36m 100,889.20 | 1,246.00 |

| MPS | 2,388.30 6.45% | 138.31k 10,865.20 | 1,173.00 |

| Durlax Top Surf | 39.50 -9.51% | 276.00k 23,200.00 | 1,090.00 |

| RBZ Jewellers | 169.10 3% | 1.59m 144,314.40 | 1,001.00 |

| AMSL | 274.20 8.84% | 1.75m 175,747.00 | 898.00 |

| UTKARSHBNK | 15.80 -2.11% | 11.36m 1,045,114.80 | 987.00 |

| Parag Milk Food | 356.90 13.5% | 10.45m 1,147,965.00 | 810.00 |

| Arham Tech | 134.95 7.06% | 104.00k 13,000.00 | 700.00 |

| Hester Bio | 1,646.00 0.37% | 46.22k 5,801.80 | 697.00 |

| MSP Steel | 34.74 4.23% | 4.21m 565,016.00 | 645.00 |

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Indian Emulsifi | 126.20 | 25.20 | 100.80 |

| Safe Enterprise | 241.00 | 23.12 | 195.75 |

| Venus Remedies | 548.80 | 22.97 | 446.30 |

| Jay Jalaram | 202.00 | 21.10 | 166.80 |

| Bliss GVS | 154.40 | 20.72 | 127.90 |

| Indigo Paints | 1,201.00 | 19.61 | 1,004.10 |

| Lumax Auto Tech | 1,433.50 | 19.44 | 1,200.20 |

| Party Cruisers | 76.85 | 19.15 | 64.50 |

| Voltamp Trans | 8,364.00 | 16.85 | 7,158.00 |

| Namo Ewaste | 217.00 | 16.32 | 186.55 |

| Apex Frozen | 270.43 | 15.81 | 233.52 |

| Bafna Pharma | 202.06 | 15.75 | 174.56 |

| Kavveri Defence | 112.64 | 15.74 | 97.32 |

| Moxsh Overseas | 86.10 | 15.73 | 74.40 |

| Simbhaoli Sugar | 11.87 | 15.47 | 10.28 |

| Vipul | 10.04 | 15.01 | 8.73 |

| ANB Metal Cast | 350.00 | 14.94 | 304.50 |

| Polysil Irrigat | 313.00 | 14.67 | 272.95 |

| Pearl Global In | 1,563.20 | 14.60 | 1,364.10 |

| Mahamaya Steel | 760.00 | 14.52 | 663.65 |

-330

November 12, 2025· 11:57 IST

Sensex Today | Max Financial Q2 Total APE up 16%, VNB margin rises

#1 Total APE up 16 percent at Rs 2,507 crore versus Rs 2,170 crore, YoY

#2 Retail APE up 9 percent at Rs 2,338 crore versus Rs 2,145 crore, YoY

#3 VNB up 25 percent at Rs 639 crore versus Rs 510 crore, YoY

#4 VNB margin at 25.49 percent vs 23.6 percent, YoY

-330

November 12, 2025· 11:56 IST

Sensex Today | Gujarat Fluorochemicals Q2 consolidated profit up 48%

#1 Profit zooms 48 percent to Rs 179 crore Vs Rs 121 crore, YoY

#2 Revenue rises 1.9 percent to Rs 1,210 crore Vs Rs 1,188 crore, YoY

-330

November 12, 2025· 11:54 IST

JSW Steel may sell up to 50% stake in Bhushan Power: CNBC-TV18

Japan’s JFE Steel is frontrunner to pick up the stake, the channel reported ...Read More

-330

November 12, 2025· 11:53 IST

Sensex Today | 2.74 million shares of Samvardhana Motherson International traded in a block: Bloomberg

Samvardhana Motherson International was quoting at Rs 105.40, down Rs 0.15, or 0.14 percent.

It has touched an intraday high of Rs 106.90 and an intraday low of Rs 104.50.

It was trading with volumes of 5,005,085 shares, compared to its five day average of 681,218 shares, an increase of 634.73 percent.

In the previous trading session, the share closed up 2.73 percent or Rs 2.80 at Rs 105.55.

The share touched a 52-week high of Rs 116.33 and a 52-week low of Rs 71.53 on 06 December, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 9.4 percent below its 52-week high and 47.35 percent above its 52-week low.

Market capitalisation stands at Rs 111,243.83 crore.

-330

November 12, 2025· 11:52 IST

Results Today | Indraprastha Gas, IRCTC, Info Edge (India), P N Gadgil Jewellers, among others to declares earnings today

Tata Steel, Asian Paints, Ashok Leyland, Honasa Consumer, Afcons Infrastructure, Bajaj Hindusthan Sugar, CARE Ratings, Aditya Infotech, Endurance Technologies, Gandhar Oil Refinery (India), Hindustan Aeronautics, Indraprastha Gas, Indian Railway Catering and Tourism Corporation, Info Edge (India), P N Gadgil Jewellers, Prestige Estates Projects, SpiceJet, Swan Defence and Heavy Industries, Travel Food Services, and West Coast Paper Mills will announce their quarterly earnings today.

-330

November 12, 2025· 11:50 IST

Sensex Today | Advanced Enzyme Q2 net profit rises 32% at Rs 43.3 crore versus Rs 33 crore, YoY

Advanced Enzyme Technologies was quoting at Rs 327.95, up Rs 18.05, or 5.82 percent.

It has touched an intraday high of Rs 339.10 and an intraday low of Rs 310.70.

It was trading with volumes of 80,815 shares, compared to its five day average of 4,894 shares, an increase of 1,551.24 percent.

In the previous trading session, the share closed down 0.05 percent or Rs 0.15 at Rs 309.90.

The share touched a 52-week high of Rs 411.80 and a 52-week low of Rs 257.85 on 11 December, 2024 and 03 March, 2025, respectively.

Currently, the stock is trading 20.36 percent below its 52-week high and 27.19 percent above its 52-week low.

Market capitalisation stands at Rs 3,670.64 crore.

-330

November 12, 2025· 11:49 IST

Sensex Today | MPS Q2 net profit up 57.4% at Rs 55.4 crore against Rs 35.2 crore, YoY

MPS was quoting at Rs 2,378.00, up Rs 130.70, or 5.82 percent.

It has touched an intraday high of Rs 2,454.90 and an intraday low of Rs 2,227.00.

It was trading with volumes of 8,584 shares, compared to its five day average of 566 shares, an increase of 1,415.54 percent.

In the previous trading session, the share closed down 0.06 percent or Rs 1.40 at Rs 2,247.30.

The share touched a 52-week high of Rs 3,071.85 and a 52-week low of Rs 1,763.15 on 24 March, 2025 and 13 January, 2025, respectively.

Currently, the stock is trading 22.59 percent below its 52-week high and 34.87 percent above its 52-week low.

Market capitalisation stands at Rs 4,067.76 crore.

-330

November 12, 2025· 11:48 IST

Sensex Today | Marathon Nextgen Realty launches residential development in Panvel

Marathon Nextgen Realty announced the launch of Phase III of its flagship township, Marathon Nexzone, in Panvel. The new phase, titled The Nirvana Collection, spans over approximately 3 acres with an estimated RERA Carpet Area of around 4.90 lakh sq.ft. and an estimated Gross Development of Value in excess of Rs 600 crore.

Marathon Nextgen Realty was quoting at Rs 588.80, up Rs 7.25, or 1.25 percent.

It has touched an intraday high of Rs 600.50 and an intraday low of Rs 583.20.

It was trading with volumes of 5,939 shares, compared to its five day average of 1,719 shares, an increase of 245.53 percent.

In the previous trading session, the share closed down 0.82 percent or Rs 4.80 at Rs 581.55.

The share touched a 52-week high of Rs 774.55 and a 52-week low of Rs 352.05 on 17 July, 2025 and 11 March, 2025, respectively.

Currently, the stock is trading 23.98 percent below its 52-week high and 67.25 percent above its 52-week low.

Market capitalisation stands at Rs 3,969.72 crore.

-330

November 12, 2025· 11:46 IST

Sensex Today | BSE Smallcap index up 0.5%, snaps 5-day fall

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Kirloskar Oil | 1,078.65 | 14.12 | 362.09k |

| Parag Milk Food | 356.70 | 13.54 | 494.72k |

| KMC Speciality | 81.80 | 12.42 | 391.39k |

| Yatra Online | 184.80 | 12.17 | 1.80m |

| Pearl Global In | 1,573.00 | 11.69 | 33.84k |

| Cupid | 282.55 | 11.61 | 481.30k |

| Abans Financial | 221.15 | 10.02 | 4.06k |

| IOL Chemicals | 97.38 | 9.7 | 1.28m |

| Indo Count | 300.00 | 9.59 | 87.90k |

| AMSL | 274.70 | 9.38 | 103.70k |

| GTPL Hathway | 113.90 | 8.74 | 250 |

| VTM | 86.20 | 8.35 | 208.09k |

| Carysil | 1,060.20 | 8.28 | 26.77k |

| Syrma SGS | 892.90 | 7.49 | 400.45k |

| Axtel Ind | 525.00 | 7.35 | 33.19k |

| Sandur Manganes | 221.60 | 7.31 | 517.56k |

| Tejas Networks | 542.15 | 7.08 | 119.75k |

| Websol Energy | 1,363.55 | 6.82 | 23.81k |

| Filatex Fashion | 0.48 | 6.67 | 7.09m |

| Fermenta Bio | 285.00 | 6.54 | 56.27k |

-330

November 12, 2025· 11:45 IST

Sensex Today | Goldman Sachs keeps ‘neutral’ rating on BSE, target price at Rs 2,460

#1 Q2 underlying EPS at Rs 13.6, 3 percent above estimate of Rs 13.2

#2 Operating revenue rose 12 percent QoQ & 44 percent YoY while opex increased 14 percent QoQ & 7 percent YoY

#3 From Sep’25, BSE will contribute 5 percent of transaction revenue to core SGF

#4 Underlying PAT grew 6 percent QoQ & 62 percent YoY, 3 percent ahead of estimate

-330

November 12, 2025· 11:43 IST

Sensex Today | Gujarat State Petronet Q2 consolidated profit down, revenue flat

#1 Profit declines 7.4 percent to Rs 260.8 crore Vs Rs 281.7 crore, YoY

#2 Revenue increases 1.1 percent to Rs 4,206.4 crore Vs Rs 4,159 crore, YoY

Gujarat State Petronet was quoting at Rs 299.85, down Rs 0.90, or 0.30 percent.

It has touched an intraday high of Rs 300.55 and an intraday low of Rs 296.20.

It was trading with volumes of 14,634 shares, compared to its five day average of 20,579 shares, a decrease of -28.89 percent.

In the previous trading session, the share closed down 0.33 percent or Rs 1.00 at Rs 300.75.

The share touched a 52-week high of Rs 394.95 and a 52-week low of Rs 261.55 on 12 December, 2024 and 04 March, 2025, respectively.

Currently, the stock is trading 24.08 percent below its 52-week high and 14.64 percent above its 52-week low.

Market capitalisation stands at Rs 16,917.88 crore.

-330

November 12, 2025· 11:39 IST

Sensex Today | Kirloskar Oil Engines Q2 consolidated profit jumps 27%, revenue up 30%

#1 Profit zooms 27.4 percent to Rs 162.5 crore Vs Rs 127.5 crore, YoY

#2 Revenue grows 30 percent to Rs 1,948.4 crore Vs Rs 1,498.6 crore, YoY

-330

November 12, 2025· 11:34 IST

Sensex Today | Container Corporation of India Q2 consolidated profit, revenue rise

#1 Profit soars 3.6 percent to Rs 378.7 crore Vs Rs 365.4 crore, YoY

#2 Revenue increases 2.9 percent to Rs 2,354.5 crore Vs Rs 2,287.8 crore, YoY

-330

November 12, 2025· 11:33 IST

Sensex Today | Jefferies keeps 'buy' rating on ONGC, target price cut to Rs 310

#1 Consolidated EBITDA/PAT broadly in-line with estimates

#2 Company guided for production growth from Q4FY26 onwards

#3 Company is driving opex optimisation to defend profitability in a soft crude environment

#4 Stock is cheapest among global peers & is discounting USD 60 crude price

#5 Cut FY27/28 EPS estimates by 5 percent/8 percent