BUSINESS

Discovery Series: Senco Gold Limited — Will it sparkle your portfolio?

SGL has received accolades as the most desired and trusted jewellery brand, has a track record of steady performance and one of the big four auditors on board, indicating transparency and robust governance practices. The current valuations seem reasonable.

BUSINESS

D-Mart: Margin pressures sustain; valuation expensive

While D-Mart has strong long-term growth prospects, near-term margin and earnings pressure would prevent re-rating.

BUSINESS

NCC Limited: Will re-rating sustain for this construction player?

NCC, with its diverse order book and track record in the execution of varied infrastructure projects, would be the prime beneficiary of the govt’s increased spend on infrastructure.

BUSINESS

Titan Company business update points to a show full of sparkle

We remain confident on the business prospects of Titan, given the huge growth runway in the jewellery space. Ramp-up of the non-jewellery business, led by new launches and enhanced network reach, is an additional growth trigger.

BUSINESS

Senco Gold IPO: Will it sparkle on the bourses?

Senco Gold focuses on lightweight jewellery and has a strong brand reputation and track record. IPO valuations are at a steep discount to comparable listed peers

BUSINESS

Campus Activewear: What next for you after the steep correction?

While the near term outlook is subdued, we are bullish on long term growth prospects. Campus, with its price positioning, entry into newer categories and expanding direct reach, is likely to reap the benefits of the strong industry growth over the long run

BUSINESS

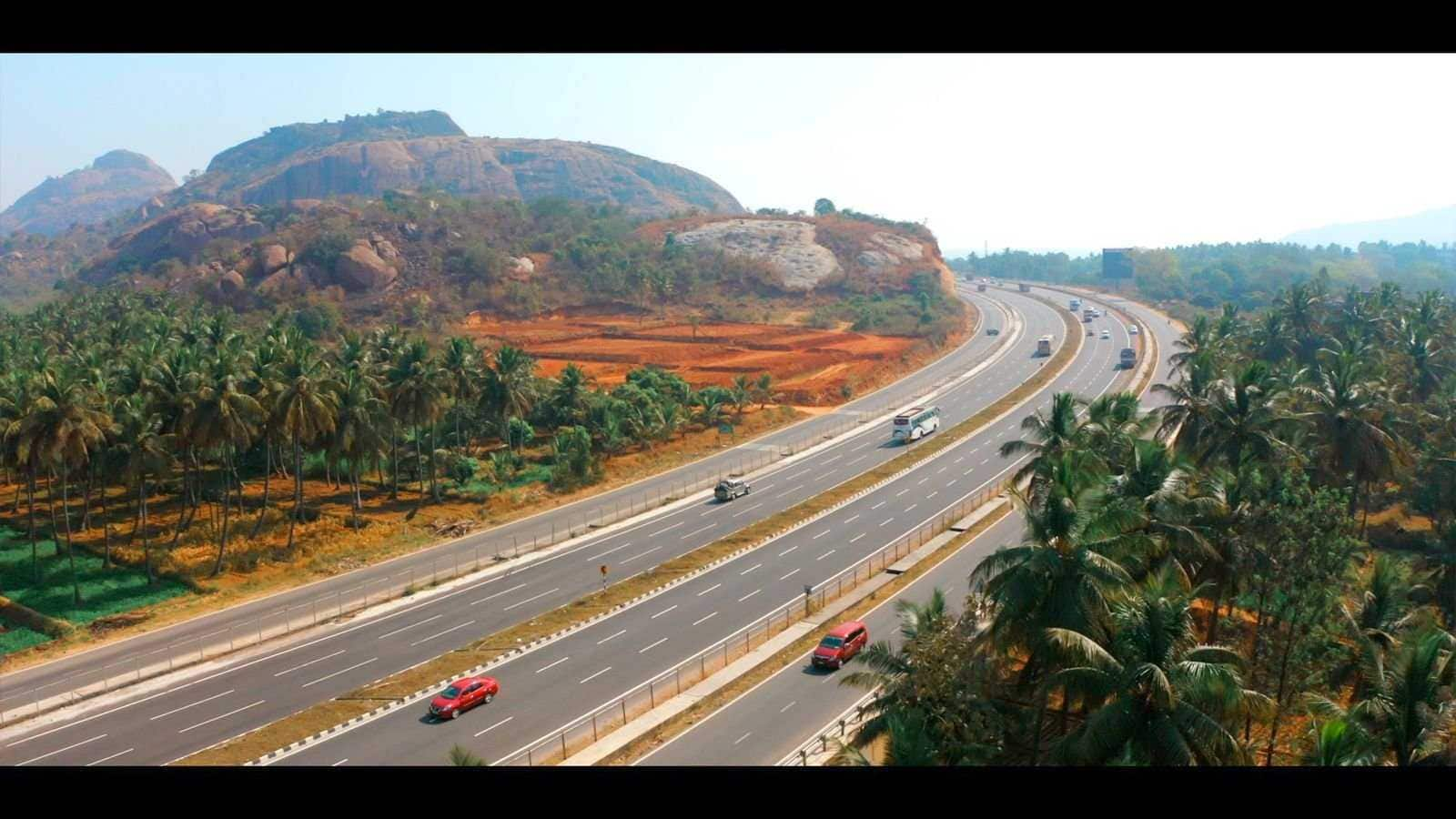

PNC Infratech: Quality stock to play the infrastructure upside

PNC Infratech has guided to a strong order inflow in the current fiscal, which, coupled with its healthy order book, brightens its growth outlook. PNC remains our preferred bet in the construction space

BUSINESS

Relaxo Footwears: Q4 FY23 marks trend reversal; getting back foothold

Relaxo regained market share in Q4FY23 as it narrowed the price differential with competition (realised lower raw material prices and cut prices). We expect resumption of robust volume growth as well as recovery of margins to pre-COVID levels from FY24

BUSINESS

Devyani International Ltd: Witnessing demand improvement, robust long-term prospects

DIL is witnessing signs of demand improvement in the current quarter and we expect it to reach the medium-term SSSG guidance of 6-7 percent for both KFC and Pizza Hut in H2FY24.

BUSINESS

Metro Brands: Is this the right fit for you?

Metro Brands has a huge runway for growth, given that it can establish its presence in double the cities it currently serves

BUSINESS

Lemon Tree Hotels: Poised to ride the industry upcycle

LMNT has planned aggressive room additions and aims to strengthen its presence across the country, thereby emerging as a frontrunner in the mid-scale segment.

BUSINESS

Campus Activewear Ltd: Headwinds in the near term; growth trajectory to resume from H2

While demand is expected to be subdued in the near term, CAL is bullish on the long-term growth prospects and expects healthy volume growth to resume from H2FY24.

BUSINESS

Mrs Bectors Food Specialities: Strong results; market share gains to sustain

Mrs Bectors Food Specialities would continue to gain market share in both biscuits as well as bakery segments led by improving distribution reach as well as introduction of new products

BUSINESS

Page Industries: Near-term headwinds; long-term story intact

Page expects the ongoing subdued demand to be temporary and is bullish on the long-term growth prospects.

BUSINESS

Nykaa: Should investors buy the stock, post the steep correction?

The management has exuded confidence in operating margin improvement, given the expected reduction in employee costs as well as continued improvement in unit economics, which would be a key re-rating trigger

BUSINESS

EIH Limited: Quality stock to play the industry up-cycle

EIH, with reputed brands (Oberoi, Trident), quality management, and a strong balance sheet, is among the best stocks to play the hotel industry up-cycle.

BUSINESS

Aditya Birla Fashion & Retail: Why we continue to remain cautious on the stock

New businesses would continue to drag profitability and margin pressures witnessed last fiscal are likely to sustain in FY24 also.

BUSINESS

Jubilant Foodworks Limited: Should you bite into this QSR stock?

The pressure on SSSG is likely to continue in the near term as pizza, being a relatively high-ticket product, has seen a greater impact of the slowdown. With elevated raw material prices and a ramp-up of the new Popeyes business, margins improvement is unlikely in near-term.

BUSINESS

Cantabil Retail India Ltd: Robust results, strong re-rating candidate

CRIL is aggressively expanding its reach and boosting same-store sales growth (SSSG) as it plans to double revenues by FY26.

BUSINESS

D-Mart: Margin miss in Q4; valuations rich

While D-Mart is rapidly enhancing its store network and has commenced sales of pharmacy products, we expect margin pressures to sustain in the near term.

BUSINESS

HG Infra Engineering Ltd: Will the re-rating sustain for this construction company?

We expect company to maintain strong momentum driven by huge growth opportunities and financial prudence. Further, diversification into newer areas would reduce the concentration risk and enable re-rating of the stock.

BUSINESS

Larsen & Toubro: Stock riding on high hopes, backed by strong orders

L&T is sitting at a record order book of close to Rs 399,526 crore. Even though order inflows are expected to be slightly lower this year (growth of 10-12 percent) because of the general elections, existing orders provide a good visibility.

BUSINESS

Nexus Select Trust REIT IPO: A better option with low risk, higher yield

Nexus Select Trust being a retail REIT, the upside to growth is high and the risk is low in the light of India being a booming consumption market

BUSINESS

Aditya Birla Fashion & Retail: How will the TCNS acquisition affect the company?

The acquisition paves the way for ABFRL to have a comprehensive play in ethnic wear and aligns with the management objective of being a leading player in the space.