LiveNow

Closing Bell: Market ends with marginal losses; metals shine

Benchmark indices ended lower in the volatile session on October 16. At close, the Sensex was down 115.81 points or 0.17 percent at 66,166.93, and the Nifty was down 19.20 points or 0.10 percent at 19,731.80.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

Deven Mehata, Research Analyst at Choice Broking

After a flat to negative opening Nifty traded sideways for the day in a small range of 19690-19780 closed around the same level of opening forming a doji candlestick pattern on daily charts. Also Bank Nifty traded in a range for the day and closed at 44225.90.

The market has traded flat to negative with the Sensex losing 0.17 percent and closed at 66166.93 and Nifty was down by 0.10 percent intraday and closed at 19731.75 levels whereas Bank Nifty was down by 0.14 percent and settled at 44225.90.

Among sectors Nifty Auto, Nifty PSU Bank and Nifty Metal ended in green while Nifty Pharma, Nifty IT and Nifty FMCG ended on the lower side. In Nifty stocks, Hero MotoCorp, JSW Steel and Tata Steel were the top gainers while Divis Lab, Nestle India and TCS were the prime laggards.

India VIX was positive by 4.24 percent intraday and settled at 11.07.

Index has support around the 19600-19550 zone. Coming to the OI Data, on the call side, the highest OI observed at 19800 followed by 20000 strike prices while on the put side, the highest OI is at 19700 strike price. On the other hand, Bank Nifty has support at 43900-44000 while resistance is placed at 44500-44700 levels.

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets started the week on a muted note and ended marginally lower amid mixed cues. After the flat start, Nifty hovered in a narrow range and finally settled at 19731.75; down by 0.10%. Meanwhile, a mixed trend on the sectoral front kept the traders busy wherein metal and auto edged higher while pharma and realty witnessed profit taking. The broader indices outperformed the benchmark and closed marginally in the green.

We feel the muted action may continue in the index until we see alignment between the Nifty and the banking index. However, there is no shortage of trading opportunities across sectors, so participants should plan their positions accordingly.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened on a flat note and consolidated in a narrow range to close the day marginally in the red down ~20 points. On the daily charts the Nifty today has formed an Inside Bar pattern which suggests consolidation and also makes the extremes of the range of the previous day candle crucial levels from short term perspective. In this case the extremes of the range are 19805 and 19635. A breach of this on either side shall lead to a trending move in that direction. The daily and hourly momentum indicators provide divergent signals and in such a scenario a consolidation appears high probability. Contraction of the Bollinger bands also supports our sideways outlook on the Index. The range of consolidation is likely to be 19500 – 20100 from short term perspective.

Bank Nifty has also halted its fall and is in the process of recovering. Today’s low around 44000 shall act as a pivot point and until that is not breached on the downside we can expect a pullback till 44800 – 45000 from short term perspective.

Shrikant Chouhan, Head of Research (Retail), Kotak Securities:

Markets continued to witness range-bound trend with a negative bias amid weak Asian cues as selective profit-taking was seen in banking, realty and IT stocks, whereas buying in metal, auto and consumer durable stocks helped markets curb losses.

Investors are trading cautiously in an uncertain global environment as ongoing Israel-Palestine conflict coupled with weak overseas fundamentals and persistent FII selling have dampened sentiment.

Technically, the Nifty hovered between 19700 to 19780, and has formed an inside body candle formation which is indicating incisiveness between the bulls and bears. For the bulls, 19800 would be the immediate breakout level, above the same the index could rally till 19850-19880. On the flip side, below 19700, the selling pressure is likely to accelerate and could retest the level of 19640-19620.

JUST IN | HDFC Bank Q2 net profit at Rs 15,976 crore and Net Interest income at Rs 27,385 crore.

Vinod Nair, Head of Research at Geojit Financial Services:

Persistent geopolitical tensions continue to weigh down the sentiment on equity, yet the mid- and small-cap index witnessed bargain hunting ahead of festival-driven demand and optimistic Q2 result. If the oil price moves higher in a sustained manner, it may elevate yields and operation cost, potentially straining margins in H2FY24. As the earnings season gets into full swing, investors will be more inclined to take a bottom-up approach to restructure their portfolios.

Rupee Close:

Indian rupee ended flat at 83.27 per dollar on Monday versus Friday's close of 83.26.

Market Close: Benchmark indices ended lower in the volatile session on October 16.

Stock Market LIVE Updates | HDFC Bank shares trading marginally lower ahead of its September quarter earnings

Stock Market LIVE Updates | The Tinplate Co. of India Q2 Earnings:

Net loss at Rs 2.3 crore against loss of Rs 35.1 crore and revenue down 2% at Rs 942 crore versus Rs 960 crore, YoY.

Stock Market LIVE Updates | Jefferies On HDFC Life Insurance Company:

-Maintain buy call, target at Rs 800 per share

-APE & VNB growth of 7 percent & 4 percent YoY in Q2, were below estimates

-Forward-looking trends are more encouraging

-Wallet share in HDFC Bank has risen to 65 percent already

-Sales from agency can improve & other Banca partners are growing

Sensex Today | Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas:

Crude oil prices seen easing on Monday with WTI November futures trade $86/b as the large-scale ground assault has not begun after the 24-hour deadline that Israel first notified residents of the northern half of Gaza to flee to the south. Last week WTI oil prices gained 6% and Brent was up 7.5% as investors priced in the potential involvement of other oil producing nations involvement if the war escalates further. Iran’s direct involvement in conflict could derail possibility of additional supply of 1mbpd Iranian oil to worlds market, which would keep market condition tight. The Chinese September trade data showed 11% decline in oil import on MoM but 14% jump on annual basis.

We expect Chinese economy to stabilize in coming months that is a big positive for overall demand for industrial commodities. In short term prices could vary in either direction but given the resilient US economy and supply tightness by OPEC+ we expect crude oil to remain buy on dip counter. Crude oil prices are likely to trade in the range of USD 83-88.

Stock Market LIVE Updates | Jefferies On Avenue Supermarts

-Retain hold rating, target raised to Rs 3,850 from Rs 3,700 per share

-Q2 EBITDA below estimates on lower gross margin & higher staff costs

-General merchandise & apparel mix remained muted

-H1 SSG at 8.6 percent is respectable, with improving footfalls

-Store additions remained muted but should see a ramp-up

Sensex Today | Rajani Sinha, Chief Economist, CareEdge Ratings:

In September 2023, the Wholesale Price Index (WPI) exhibited its sixth consecutive month of contraction, with decline of 0.3% YoY, lower than the previous month's contraction of 0.5% YoY. The decline in WPI for September can be attributed to a substantial deceleration in food prices and the continued YoY contraction in fuel prices and manufactured products prices.

With the support of high base fading, some uptick in WPI inflation numbers could be seen in the second half of the fiscal year. Elevated global crude oil prices and risk to kharif harvest from a skewed rainfall pose upside risks to WPI inflation. However, with weak China demand, other global commodity prices are expected to remain benign and that should keep WPI inflation low. For the full fiscal year (FY24), we expect WPI inflation to average below 1% in FY24.

Stock Market LIVE Updates | CLSA On ICICI Prudential Life Insurance Company:

-Maintain buy call, target at Rs 700 per share

-ICICI Bank’s APE run-rate should translate into 1-10 percent YoY growth from Oct 2023

-Non-ICICI Bank channel closed H1FY24 with 6 percent YoY growth

-See Non-ICICI Bank channel growth at 8-15 percent YoY from Oct-Feb

-Low APE & VNB growth priced in at the current market price

-See limited downside risk for the stock

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee is trading on a flat note on Monday. Risk aversion in global markets and surge in crude oil prices put downside pressure on the domestic currency. However, lower than expected WPI and some FII buying on Friday cushioned the downside. India’s WPI declined by 0.26% y-o-y in September 2023 versus forecast of 0.5%. US Dollar eased slightly after US and its allies are trying to step in the contain the Hamas-Israel conflict, which has waned some safe haven demand for the greenback.

We expect Rupee to trade with a slight negative bias as risk aversion in global markets and elevated crude oil prices may keep Rupee under pressure. However, ceasefire or truce talks may support Rupee. Traders may take cues from Empire State Manufacturing Index data from US. USDINR spot price is expected to trade in a range of Rs 82.90 to Rs 83.70.

Stock Market LIVE Updates | CLSA On HDFC Life Insurance Company:

-Upgrade to outperform from underperform, target raised to Rs 725 from Rs 680 per share

-Flat YoY VNB margin of 26.2 percent in H1 on higher sales of lower margin products

-APE growth of 9 percent YoY in H1 driven by strong growth in protection/ULIP

-Share of non-par savings normalised to 28 percent versus 37 percent YoY

-Counter share in HDFC Bank rose to 62 percent versus 57 percent in Q1FY24

-Company is experiencing opposing themes in FY24

-See APE growth at 6 percent/14 percent in FY24/25-26 & flat margin (27.5 percent) for FY24

-Company continues to prove itself to be a steady performer

Sensex Today | Market at 3 PM

The Sensex was down 56.54 points or 0.09 percent at 66,226.20, and the Nifty was down 1.80 points or 0.01 percent at 19,749.20. About 1836 shares advanced, 1480 shares declined, and 123 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 3,159.60 | 1.97 | 839.77k |

| JSW Steel | 790.60 | 1.72 | 1.88m |

| Tata Steel | 127.00 | 1.56 | 20.18m |

| Coal India | 312.45 | 1.46 | 9.61m |

| LTIMindtree | 5,164.95 | 1.37 | 217.59k |

| UPL | 631.20 | 1.31 | 1.53m |

| Axis Bank | 1,006.60 | 1.26 | 3.78m |

| HCL Tech | 1,271.20 | 1.22 | 2.23m |

| ONGC | 186.90 | 1.08 | 10.58m |

| M&M | 1,575.70 | 0.85 | 857.63k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Nestle | 23,118.15 | -1.85 | 77.12k |

| Divis Labs | 3,668.25 | -1.8 | 204.45k |

| TCS | 3,531.10 | -1.11 | 1.35m |

| Asian Paints | 3,114.00 | -1.11 | 736.80k |

| IndusInd Bank | 1,448.15 | -1.06 | 1.72m |

| UltraTechCement | 8,289.00 | -0.96 | 318.58k |

| Adani Ports | 806.75 | -0.86 | 2.07m |

| Sun Pharma | 1,136.40 | -0.78 | 886.83k |

| Kotak Mahindra | 1,749.50 | -0.71 | 1.29m |

| Adani Enterpris | 2,437.90 | -0.68 | 659.68k |

Stock Market LIVE Updates | Jai Balaji Industries Q2 results:

Net profit at Rs 201.5 crore against Rs 21 crore and revenue was up 12.9% at Rs 1,546.6 crore versus Rs 1,369.4 crore, YoY.

Stock Market LIVE Updates | NELCO Q2 results:

Net profit up 26.7% at Rs 5.7 crore versus Rs 5 crore and revenue up 1.6% at Rs 76.6 crore versus Rs 75.4 crore, YoY.

Sensex Today: Pramod Ranjan, Managing Director & CEO, Oriental Hotels

“OHL reported a 5% increase in revenue in the second quarter aided by an increase in the Average Room Rates (ARR). He added, “Our asset management efforts which began with re-positioning of Vivanta Mangalore, ongoing renovation of the hotel in Coonoor and the commencement of a complete renovation of the iconic Taj Malabar Resort & Spa, Cochin in Q2, are all aimed at sustained value creation of the portfolio.”

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ceeta Industrie | 32.01 | 35.37 | 3.36 611 |

| Jindal Poly Inv | 607.10 | 665.80 | 58.70 4.08k |

| TCI Industries | 1,225.00 | 1,332.45 | 107.45 0 |

| Mihika Ind | 23.53 | 25.49 | 1.96 29 |

| Mishka Exim | 30.40 | 32.89 | 2.49 149 |

| Remedium Lifeca | 545.15 | 587.90 | 42.75 2.81k |

| Regis | 97.00 | 104.50 | 7.50 2 |

| ACCEDERE | 60.85 | 65.47 | 4.62 21 |

| Innovative Tech | 25.25 | 27.16 | 1.91 13.66k |

| Mediaone Global | 42.00 | 45.00 | 3.00 1.00k |

Stock Market LIVE Updates | Paytm edges higher as Goldman Sachs raises target price; stock up 76% this year

Paytm parent One 97 Communications Ltd edged a percent higher on October 16 afternoon after Goldman Sachs raised the stock's target price, saying the Noida-based payments company could be the most profitable among India's internet companies.

The Vijay Shekhar Sharma-led fintech company remains well-positioned to capture a share of digital payments in India, given its industry-leading scale and engagement, Goldman Sachs analysts said.

The foreign brokerage expects Paytm to turn net income positive in FY25, which is likely to act as a catalyst for the stock. Read More

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Tata Motors | 668.65 0.22 | 1.17m | 78.43 |

| HDFC Bank | 1,533.20 -0.23 | 499.74k | 76.39 |

| MMTC Ltd | 81.19 8.78 | 8.13m | 66.28 |

| GSFC | 210.80 12.79 | 2.73m | 55.78 |

| Infosys | 1,438.00 0.43 | 368.35k | 53.03 |

| ITI | 296.30 9.3 | 1.65m | 45.68 |

| Reliance | 2,349.65 -0.04 | 187.25k | 43.96 |

| MCX India | 2,187.20 3.63 | 175.54k | 38.17 |

| IRFC | 76.42 -0.29 | 5.02m | 38.48 |

| Suzlon Energy | 28.19 4.99 | 11.51m | 32.16 |

SpiceJet & Lessor Engine Lease Finance Corp Aviation agree to settle dispute, reported CNBC-TV18.

Stock Market LIVE Updates | Nomura On HDFC Life Insurance Company:

-Maintain buy call, target at Rs 800 per share

-Best-in-class product & distribution profile underpin our positive bias

-Distribution strength & strong support from the parent should help it regain momentum in H2

-Company has guided for full-year FY24 APE growth of mid-teen digits

-Maintain estimates for APE/VNB growth of 6 percent/5 percent in FY24

-See APE/VNB CAGR of 15 percent/16 percent during FY24-26

Stock Market LIVE Updates | Intellect Design Arena partners with universal bank in Philippines for bank-wide digital transformation in APAC

Intellect Design Arena has signed a digital transformation programme with a universal bank in the Philippines. This is the largest bank-wide transformation program in APAC.

Stock Market LIVE Updates | Indian Bank declares NPAs worth Rs 24.76 crore as fraud

Indian Bank has declared non-performing assets (NPAs) worth Rs 24.76 crore, including Rs 16.20 crore from Samsarapu Polaraju, Samsarapu Narasimha Raju & Maheswari Constructions & Engineering Works which have submitted fake documents and done diversion of funds. Further the bank reported NPAs worth Rs 8.56 crore from S V Exports due to diversion of funds.

Stock Market LIVE Updates | Godrej Properties subsidiary receives GST demand & penalty notice worth Rs 96.62 crore for Mumbai project

Godrej Properties' subsidiary Godrej Redevelopers (Mumbai) Private Limited (GRMPL) has received an order from the Additional Commissioner, CGST & Central Excise, Navi Mumbai, for GST demand of Rs 48.31 crore along with interest and a penalty of Rs 48.31 crore under the Central Goods and Services Tax Act. They alleged non-payment of GST in relation to one of the projects developed by GRMPL in Mumbai.

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Suzlon Energy | 1408579 | 28.19 | 3.97 |

| GTL Infra | 324433 | 1.02 | 0.03 |

| GTL Infra | 675568 | 1.02 | 0.07 |

| Reliance Power | 298500 | 18.18 | 0.54 |

| LIQUIDBEES | 11144 | 999.99 | 1.11 |

| KCL Infra | 272142 | 2.17 | 0.06 |

| Fert and Chem | 29194 | 658.05 | 1.92 |

| KCL Infra | 247009 | 2.17 | 0.05 |

| LIQUIDBEES | 10000 | 1000 | 1 |

| SBI | 21677 | 576 | 1.25 |

Stock Market LIVE Updates | Jefferies View On Avenue Supermarts

-Retain hold rating, target raised to Rs 3,850 from Rs 3,700 per share

-Q2 EBITDA below estimates on lower gross margin & higher staff costs

-General merchandise & apparel mix remained muted

-H1 SSG at 8.6 percent is respectable, with improving footfalls

-Store additions remained muted but should see a ramp-up

Stock Market LIVE Updates | HSBC View On HDFC Life Insurance Company

-Maintain buy call, target cut to Rs 790 from Rs 800 per share

-In H1FY24, high ticket-size business declined 45 percent YoY

-Rest of the business (in APE terms) apart from high-ticket size, grew 18 percent YoY

-IRR cuts making non-participating savings products uncompetitive

-IRR cuts can put near-term pressure on growth

-New launches, granular growth & parent support can offset IRR cut pressure

Stock Market LIVE Updates | RBI imposes monetary penalty of Rs 1 crore on Union Bank of India

The Reserve Bank of India has imposed a monetary penalty of Rs 1 crore on Union Bank of India for non-compliance with directions related to Loans and Advances – Statutory and Other Restrictions.

Sensex Today | Market at 2 PM

The Sensex was up 10.05 points or 0.02 percent at 66,292.79, and the Nifty was up 16.50 points or 0.08 percent at 19,767.50. About 1871 shares advanced, 1410 shares declined, and 130 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 19769.65 0.09 | 9.19 1.32 | -2.09 15.04 |

| NIFTY BANK | 44296.15 0.02 | 3.05 0.93 | -4.19 12.70 |

| NIFTY Midcap 100 | 40628.70 0.3 | 28.94 2.22 | -0.49 33.10 |

| NIFTY Smallcap 100 | 12967.40 0.57 | 33.25 2.84 | 1.36 36.23 |

| NIFTY NEXT 50 | 45449.35 0.35 | 7.73 2.35 | -1.31 10.08 |

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sreeleathers | 247.75 | 284.30 | 36.55 2.41k |

| ITI | 262.20 | 292.00 | 29.80 286.75k |

| Sonu Infratech | 50.85 | 55.50 | 4.65 12.00k |

| Oswal ChemandFe | 27.50 | 29.25 | 1.75 26.84k |

| Industrial Inv | 122.65 | 128.80 | 6.15 4.77k |

| Khaitan Chemica | 67.60 | 70.95 | 3.35 107.90k |

| Supreme Infra | 24.60 | 25.80 | 1.20 1.16k |

| JITF Infralogis | 439.95 | 458.00 | 18.05 2.42k |

| Hercules Hoists | 323.00 | 336.15 | 13.15 1.76k |

| Pearl Global In | 1,287.95 | 1,339.60 | 51.65 7.80k |

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Touchwood Enter | 162.40 | 154.00 | -8.40 16 |

| Jindal Poly Inv | 633.30 | 608.40 | -24.90 47.30k |

| Pansari Develop | 77.90 | 74.90 | -3.00 13.62k |

| C P S Shapers | 469.85 | 452.00 | -17.85 - |

| DB (Int) Stock | 34.35 | 33.05 | -1.30 7 |

| Bigbloc Constru | 173.25 | 167.65 | -5.60 237.95k |

| Vaswani Ind | 26.95 | 26.10 | -0.85 22.32k |

| Marco Cables & | 54.90 | 53.25 | -1.65 - |

| Infinium Pharma | 253.25 | 246.00 | -7.25 0 |

| DCM | 80.85 | 78.55 | -2.30 3.57k |

Stock Market LIVE Updates | RBI imposes monetary penalty of Rs 64 lakh on RBL Bank

The Reserve Bank of India has imposed a monetary penalty of Rs 64 lakh on RBL Bank for non-compliance with certain directions.

Stock Market LIVE Updates | RBI imposes monetary penalty of Rs 8.50 lakh on Bajaj Finance

The Reserve Bank of India has imposed a monetary penalty of Rs 8.50 lakh on Bajaj Finance, for non-compliance with the ‘monitoring of frauds in NBFCs directions.

Stock Market LIVE Updates | Persistent Systems appoints Ayon Banerjee as Chief Strategy & Growth Officer

Persistent Systems has appointed Ayon Banerjee as the Chief Strategy & Growth Officer, with effect from October 13.

Stock Market LIVE Updates | Super Spinning Mills board appoints Padmavathy Pas as Chief Financial Officer

Super Spinning Mills said the board members have appointed Padmavathy Pas Chief Financial Officer of the company, with effect from October 13. Padmavathy has been associated with the company for 23 years and has done various finance roles in the company.

Stock Market LIVE Updates | Amarendra Kumar Gupta resigns as CFO of Transformers and Rectifiers

Amarendra Kumar Gupta has resigned as Chief Financial Officer of Transformers and Rectifiers with effect from October 14 due to personal reasons. The company is in the process of appointing a new Chief Financial Officer.

Stock Market LIVE Updates | CLSA On ICICI Prudential Life Insurance Company:

-Maintain buy call, target at Rs 700 per share

-ICICI Bank’s APE run-rate should translate into 1-10 percent YoY growth from Oct 2023

-Non-ICICI Bank channel closed H1FY24 with 6 percent YoY growth

-See non-ICICI Bank channel growth at 8-15 percent YoY from Oct-Feb

-Low APE & VNB growth priced in at the current market price

-See limited downside risk for the stock

Sensex Today | Mohit Rahlan, Chief Executive Officer, TIW Capital:

Wholesale prices continued to decline for the sixth straight month. Price decline was seen in paper & paper products, chemicals, textiles and basic metals. However, manufactured goods witnessed a sequential rise in prices, indicating a recovery is underway in the sector. More importantly, Food prices continued to witness a sequential decline. Vegetable prices which had shot up in the last two months saw a significant correction. This bodes well for the inflation trajectory in the economy and will allow the RBI to stay put on interest rates. Because of this sharp fall in food prices, the WPI index also witnessed a decline on a MoM basis. This was the first sequential decrease in three months. India looks quite in control of inflation and this will likely give RBI the required headroom to react to global macroeconomic events and policy actions of the Fed.

Bank of Maharashtra Q2 results | Net profit up 72% at Rs 919.8 crore against Rs 535 crore, YoY.

Stock Market LIVE Updates | Ambit On Info Edge

-Buy call, target at Rs 5,500 per share

-Recruitment pain is likely to aggravate in H2, but will be short lived

-Non-IT strength & rebound in IT hiring to result in 20 percent billing growth in FY25

-Expect 15 percent FY23-28 recruitment revenue CAGR versus 17 percent in FY13-23

-68 percent of target is from recruitment, which we value at 39x FY25 EV/EBITDA

Sensex Today | Suman Chowdhury, Chief Economist and Head – Research, Acuite Ratings & Research:

India’s wholesale inflation print still continues to be negative at -0.26% in Sep-23 albeit it has tightened from -4.18% in Jun-23 respectively. A rapid drop in the increased vegetable prices and overall benign wholesale food inflation that declined by 4.5% MoM, has helped to keep the WPI sequential trajectory at -0.6% MoM.

One important trend in the WPI data is the reversal of the deflationary trend in manufactured products from Aug-23 with Sep-23 print at +0.4% MoM and such a trend is likely to continue, as reported by the last PMI Manufacturing Survey. Fuel and power inflation has also started to gain sequential momentum and stood at 2.3% MoM, given the sharp rise in the prices of crude oil since the middle of August. Core WPI continues to be in contraction but will be vulnerable to a migration to the positive zone in the near term.

We expect WPI inflation to be in positive territory over the next few months, given healthy industrial and consumer demand and the backdrop of increasing prices of crude oil, cereals and pulses. This is set to be hold CPI inflation in the range of 5.0-5.5% over the next two quarters and not allow it to come down sharply. RBI MPC will have limited option but to wait and watch the price scenario till the end of the current fiscal.

Stock Market LIVE Updates | Karur Vysya Bank Q2 Results:

Net Profit up 48.2 percent at Rs 511.5 crore against Rs 345.1 crore and NII up 11.4 percent at Rs 915.4 crore versus Rs 821.4 crore, YoY.

Gross NPA 1.73 percent versus 1.99 percent and net NPA at 0.47 percent versus 0.59 percent, QoQ.

Provisions at Rs 126.4 crore against Rs 159.4 crore, QoQ and Rs 227.2 crore, YoY.

Stock Market LIVE Updates | SpiceJet shares plummet 11% after reports of Rakesh Gangwal denying stake acquisition

Shares of low-cost carrier Spicejet tanked over 11 percent on October 16 after Rakesh Gangwal of IndiGo dismissed the reports claiming that he is looking to acquire a stake in debt-laden SpiceJet.

On October 13, reports of Gangwal considering buying a stake in SpiceJet sent the domestic carrier's shares soaring. The stock had zoomed nearly 20 percent during the day on claims that the former IndiGo promoter is looking to commit to a stake acquisition in the debt-ridden company. Read More

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| SBI Card | 797.75 | 798.00 790.30 | -0.03% |

125.15

736.65

178.95

4,550.05

1,560.05

635.20

3,381.05

479.20

160.15

Stock Market LIVE Updates | Delta Corp hits 52-week low over GST woes, stock down 22% in a month

Delta Corp Limited shares plunged 9 percent to hit a 52-week low of Rs 122.60 on October 16, extending losses for the third session in a row after a subsidiary received a notice for payment of Rs 6,384 crore for shortfall in taxes.

The latest notice takes the total demand from the group to well above Rs 23,000 crore, significantly higher than the company's market capitalisation of Rs 3,749 crore. Read More

Sensex Today | Hareesh V, Head of Commodities at Geojit Financial Services:

Gold is traditionally seen as a safe haven asset. During periods of geopolitical uncertainty, investors tend to seek refuge in assets that are considered less risky than equities or currencies. Gold's inherent value and lack of counterparty risk make it an attractive option. Gold is not subject to the same economic and political risks as other assets, making it a reliable store of wealth during uncertain times. It also acts as a hedge against currency devaluation and inflation. Usually, geopolitical crises lead to worries about a nation’s currency, people may turn to gold to preserve their purchasing power. In addition, gold is used to diversify one’s portfolio, investors diversify their portfolios to reduce risk during periods of crisis.

Gold is more appealing when the opportunity cost of holding other assets with interest rates, as the yellow metal carries nil interest rates. Usually, in war-like situations, the interest rates may be low or even negative. Furthermore, gold is highly liquid even in times of crisis making it a trusted asset during extreme situations. As this metal performed well during crisis periods historically, influencing investor behaviour as well.

As for Silver, the recent spike in silver prices was due to rising geopolitical uncertainty. However, silver is currently more used in industrial areas from where the demand outlook is bleak. Hence major rallies are less likely in the near future. Jewelry or ornaments demand during festivals and weddings also have less impact on prices.

Stock Market LIVE Updates | Dalmia Bharat gains on strong Q2FY24 net profit

Shares of Dalmia Bharat witnessed a positive trend on October 16, trading at Rs 2339. This surge came after the cement manufacturing company reported an impressive 121.4 percent surge in consolidated profit on October 13. Read More

Stock Market LIVE Updates | Skipper rises 3% on bagging orders worth Rs 588 crore

Shares of Skipper Limited, a heavy electrical equipment maker, surged over 3 percent on October 16 after the company said it won orders worth Rs 588 crore.

Skipper Limited said it won orders worth Rs 468 crore in the Domestic transmission and distribution (T&D) segment from Power Grid Corporation of India (PGCIL) and other customers. It also got business worth Rs 120 crore from international T&D businesses. Read More

Sensex Today | Market at 1 PM

The Sensex was up 33.12 points or 0.05 percent at 66,315.86, and the Nifty was up 21.50 points or 0.11 percent at 19,772.50. About 1910 shares advanced, 1340 shares declined, and 133 shares unchanged.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Sical Logistics | 114.73 | 1346.78 | 7.93 |

| Sical Logistics | 114.73 | 1346.78 | 7.93 |

| PRO CLB GLOBAL | 11.30 | 88.33 | 6.00 |

| Natural Biocon | 14.91 | 62.24 | 9.19 |

| Hind BioScience | 10.49 | 58.22 | 6.63 |

| Hind BioScience | 10.49 | 58.22 | 6.63 |

| Franklin Leasin | 13.98 | 55.33 | 9.00 |

| Sky Gold | 590.20 | 50.98 | 390.90 |

| Natura Hue | 12.44 | 43.82 | 8.65 |

| Super Spinning | 11.19 | 41.65 | 7.90 |

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Lagnam Spintex | 72.95 | 70.00 | -2.95 3.06k |

| Sonu Infratech | 52.95 | 50.85 | -2.10 0 |

| Apollo Sindoori | 1,639.00 | 1,585.00 | -54.00 57 |

| Airo Lam | 111.00 | 107.55 | -3.45 972 |

| Oriental Hotels | 106.00 | 102.80 | -3.20 117.23k |

| Krishna Defence | 288.50 | 280.00 | -8.50 286 |

| SecMark Consult | 98.85 | 96.00 | -2.85 3.84k |

| Adroit Infotech | 21.55 | 20.95 | -0.60 13.41k |

| United Polyfab | 102.95 | 100.10 | -2.85 542 |

| Vaswani Ind | 27.00 | 26.30 | -0.70 8.23k |

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Jindal Poly Inv | 562.05 | 634.90 | 72.85 1.14k |

| Jindal Photo | 664.15 | 746.50 | 82.35 32.15k |

| Technocraft Ind | 2,092.90 | 2,248.75 | 155.85 1.76k |

| Kohinoor Foods | 33.55 | 35.85 | 2.30 15.56k |

| KIOCL | 373.05 | 397.00 | 23.95 1.49m |

| MOIL | 252.35 | 267.25 | 14.90 157.32k |

| Magson Retail | 82.30 | 87.00 | 4.70 2.15k |

| India Tourism D | 438.65 | 461.50 | 22.85 317.45k |

| Vasa Denticity | 485.15 | 509.00 | 23.85 1.83k |

| Sikko Industrie | 68.50 | 71.80 | 3.30 14.97k |

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

Ideal buy on dip sectors are capital goods, automobiles and financials. Capital goods and automobiles are in a cyclical uptrend and the cycle will last for a few years. There is robust demand for capital goods and the automobiles sector will benefit from demand recovery plus margin improvement arising from fall in commodity prices. Financials, particularly banking, are doing well and valuations are lower than historical averages.

Stock Market LIVE Updates | Phillip Capital View on Pitti Engineering

Brokerage house expect EBITDA/tonne to increase c.45,858 and margin at c.14.9% by FY26. CFO of Rs 3.5 billion over FY23- 26 with strong ROCE/ROE of c.24.4%/22.4% respectively (FY23: 20/18%).

At CMP, the stock trades at a PE of 25x/18x/14x on FY24/25/26 earnings. Valuation to re-rate on higher earnings growth, strong cash-flow, and higher return ratios.

Broking House value the stock at 20x on FY26 earnings. This takes target to Rs 940 (46% upside). Initiate coverage with a Buy rating.

Stock Market LIVE Updates | Federal Bank Q2 Earnings:

Net profit up 35.6% at Rs 954 crore versus Rs 703.7 crore and Net Interest Income (NII) up 16.7% at Rs 2,056.4 crore versus Rs 1,761.8 crore, YoY.

Stock Market LIVE Updates | HDFC Bank shares trade flat ahead of Q2 Earfnings:

India’s largest private bank, HDFC Bank, is set to report strong profits for the September quarter driven by strong loan growth. This will be the first quarterly earnings announcement since group company HDFC was merged into it. Analysts are expecting some pressure on net interest margins (NIM) because of the merger as well as the incremental Cash Reserve ratio (ICRR) stipulations of the RBI. Read More

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Nexus Select | 128.99 0.77% | 1.06m 7,943.40 | 13,184.00 |

| Indag Rubber | 138.30 0.69% | 132.24k 4,356.00 | 2,936.00 |

| Quest Capital | 313.00 7.08% | 40.01k 1,437.80 | 2,683.00 |

| India Tourism D | 441.80 12.56% | 103.62k 3,729.20 | 2,679.00 |

| Shukra Pharma | 105.60 -4.99% | 26.20k 1,349.00 | 1,842.00 |

| CM | 19.30 18.04% | 30.40k 1,589.40 | 1,813.00 |

| Walchandnagar | 166.00 3.75% | 176.66k 10,768.40 | 1,541.00 |

| Sujala Trading | 22.51 19.99% | 18.83k 1,158.80 | 1,525.00 |

| Rajshree Sugars | 51.90 5% | 123.05k 7,815.20 | 1,474.00 |

| Innovative Tech | 22.01 -2.78% | 43.02k 3,130.20 | 1,274.00 |

Results Today:

Stock Market LIVE Updates | Ministry of Corporate Affairs initiates investigation on MIAL & NMIAL accounts

The Ministry of Corporate Affairs, Hyderabad, has initiated investigation of books of accounts and other books and papers of Mumbai International Airport (MIAL) and Navi Mumbai International Airport (NMIAL), step-down subsidiaries of Adani Enterprises. Ministry of Corporate Affairs sought information and documents pertaining to the prior period starting from 2017-18 to 2021-22. Adani Enterprises completed acquisitions of MIAL and NMIAL during the year financial year 2021-22.

Sensex Today | BSE Smallcap Index rose 0.5 percent supported by Vakrangee, GSFC, KIOCL:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Vakrangee | 20.14 | 16.82 | 10.57m |

| GSFC | 211.00 | 12.89 | 2.20m |

| KIOCL | 371.70 | 12.35 | 181.24k |

| MSTC | 511.80 | 12.22 | 597.72k |

| India Tourism D | 439.40 | 11.95 | 98.02k |

| PC Jeweller | 33.11 | 10 | 2.78m |

| SEPC | 18.09 | 9.97 | 5.39m |

| Faze Three | 456.25 | 9.85 | 52.90k |

| Gati | 161.75 | 9.77 | 172.19k |

| MMTC Ltd | 81.92 | 9.75 | 6.81m |

Stock Market LIVE Updates | NHPC expects loss/damage of Rs 788 crore caused due to flash floods at Teesta Basin in Sikkim

Teesta-V power station of NHPC in Sikkim with 510 MW capacity was affected due to flash flood in Teesta Basin on October 4. The expected quantum of loss or damage caused due to the natural calamity is Rs 788 crore wherein the material damage is Rs 297 crore and business loss Rs 491 crore. The assets and business interruption loss of power station is fully insured under mega insurance policy.

Stock Market LIVE Updates | Nomura View On Mphasis

-Maintain reduce call, target at Rs 2,120 per share

-Company announces acquisition of Sonnick Partners for USD 132.5 million

-The acquisition strengthens end-to-end salesforce enterprise cloud solutions

-Sonnick recorded turnover of USD 75.8 million in CY22

-Revenue of acquired company is 4.5 percent of Mphasis’ FY24 revenue

-Acquisition implies 1.75x price/sales multiple on a CY22 basis

Stock Market LIVE Updates | MCX rallies over 3.5% to record high as trading begins on new platform

Shares of Multi Commodity Exchange of India (MCX) rallied around 3.5 percent to an all-time high of Rs 2,185 on October 16 as trading began on the company's new software platform.

The trading session on the new software platform started at 10.45 am on October 16 and continued without any glitches so far, brokers said. Read More

Stock Marketr LIVe Updates | Thomas Cook & LTIMindtree sign agreement with Eurolife FFH for the green carpet platform

Thomas Cook (India) Limited and LTIMindtree have inked an agreement with Eurolife FFH, a leading insurance group based in Greece, servicing over 500,000 customers with Life and non-Life insurance products.

Sensex Today | Market at 12 PM

The Sensex was up 24.56 points or 0.04 percent at 66,307.30, and the Nifty was up 15.70 points or 0.08 percent at 19,766.70. About 1944 shares advanced, 1251 shares declined, and 154 shares unchanged.

| Company | Price at 11:00 | Price at 11:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Pattech Fitwell | 68.00 | 62.00 | -6.00 2.33k |

| Pansari Develop | 78.00 | 71.90 | -6.10 1.53k |

| SRG Housing Fin | 303.95 | 291.90 | -12.05 195.15k |

| Lotus Eye Care | 91.00 | 87.65 | -3.35 1.74k |

| Shreyas Shippin | 365.35 | 352.50 | -12.85 38.10k |

| Jainam Ferro | 136.75 | 132.00 | -4.75 4.00k |

| Shah Alloys | 64.20 | 62.00 | -2.20 6.38k |

| SecMark Consult | 102.00 | 98.50 | -3.50 13.01k |

| Beardsell | 48.85 | 47.25 | -1.60 43.87k |

| Panache Digilif | 72.40 | 70.20 | -2.20 375 |

| Company | Price at 11:00 | Price at 11:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| STC India | 134.95 | 149.95 | 15.00 957.50k |

| KIOCL | 339.25 | 372.50 | 33.25 320.50k |

| Venus Remedies | 248.75 | 272.90 | 24.15 41.23k |

| Infinium Pharma | 233.10 | 253.25 | 20.15 54.20k |

| Ishan Intl. | 32.20 | 34.90 | 2.70 4.80k |

| Fert and Chem | 582.90 | 629.90 | 47.00 765.77k |

| Arihant Super | 184.90 | 198.40 | 13.50 22.79k |

| Tera Software | 47.15 | 49.80 | 2.65 4.30k |

| Digjam | 78.70 | 82.80 | 4.10 1.44k |

| Alkali Metals | 115.00 | 120.10 | 5.10 1.40k |

JUST IN | September WPI inflation at -0.26%

Stock Market LIVE Updates | Nidlegy Phase III PIVOTAL trial meets the study’s primary objective

Philogen S.p.A. and Sun Pharmaceutical Industries Limited announced positive results from the Phase III PIVOTAL trial in patients with locally advanced fully resectable melanoma. The study compared neoadjuvant intratumoral Nidlegy (Daromun) followed by surgery (treatment arm) vs. surgery alone (control arm). Patients were allowed to receive approved adjuvant systemic therapies after surgery in both arms.\

Stock Market LIVE Updates | Texmaco Rail and Engineering zooms 13% on solid Q2 results

Texmaco Rail and Engineering jumped 13 percent to the day’s high of Rs 150 on BSE on October 16 after the company reported 70 percent year-on-year (YoY) rise in consolidated net profit to Rs 20 crore in the September quarter of the current financial year.

This year, the smallcap rail component manufacturer has gained 137 percent against an 8 percent rise in the benchmark Sensex. The stock touched a 52-week high of Rs 163 per on September 11, 2023. Read More

Society of Indian Automobile Manufacturers (SIAM) September Auto Sales Data:

September passenger vehicle sales up 1.8 percent at 3.61 lakh units versus 3.55 lakh units and 2-wheeler sales were at 17.35 lakh units against 17.49 lakh units, YoY.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MOTHERSON | 95.65 | 1.38 | 2.38m |

| Hero Motocorp | 3,140.05 | 1.34 | 374.28k |

| Tube Investment | 2,999.00 | 1.09 | 53.74k |

| Bosch | 20,690.00 | 0.78 | 9.94k |

| MRF | 109,691.85 | 0.55 | 2.59k |

| Ashok Leyland | 176.70 | 0.51 | 5.56m |

| Eicher Motors | 3,491.70 | 0.44 | 78.16k |

| Bajaj Auto | 5,073.00 | 0.41 | 88.80k |

| Bharat Forge | 1,121.00 | 0.28 | 187.25k |

| TVS Motor | 1,602.95 | 0.13 | 324.99k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Maruti Suzuki | 10,679.95 | -0.44 | 171.69k |

| Sona BLW | 559.15 | -0.17 | 114.87k |

| Balkrishna Ind | 2,584.55 | -0.03 | 93.57k |

Stock Market LIVE Updates | Ashok Leyland rides higher on 1,666-bus order from Tamil Nadu

Ashok Leyland gained more than a percent in the morning trade on October 16 after the company got a 1,666-bus order from the Tamil Nadu state transport undertakings.

The auto major said on October 13 that it has been the preferred brand of Tamil Nadu state transport undertakings with more than 18,000 buses, accounting for 90 percent of their fleet. Read More

Stock Market LIVE Updates | Dalmia Bharat gains 3% on strong Q2FY24 net profit

Shares of Dalmia Bharat witnessed a positive trend on October 16. This surge came after the cement manufacturing company reported an impressive 121.4 percent surge in consolidated profit on October 13.

For the quarter ending September 2023, Dalmia Bharat reported a 121.4 percent year-on-year increase in consolidated profit to Rs 124 crore for quarter ended September FY2024 driven by healthy operating numbers with fall in power & fuel expenses. Revenue from operations for the same period grew 6 percent year-on-year to Rs 3,149 crore. Earnings before interest, depreciation, taxes and amortisation grew 55.4 percent from Rs 379 crore to Rs 55.4 percent. Margin for the same period grew to 18.7 percent from 12.8 percent. Read More

Stock Market LIVE Updates | ICICI Securities predicts gains in discretionary sector

ICICI Securities recommends discretionary stocks for anticipated structural growth owing to formalization and income growth. Its analysis highlights a significant rise in the private corporate sector's wage bill, indicating higher-than-average income and a potential boost in per capita discretionary consumption. However, a near-term challenge is the IT hiring slowdown, affecting wage bill growth, it added.

These discretionary sectors include personal products, home furnishings, financial services, transportation, auto, communication, education, and audio-visual recreation. These stock-related sectors are expected to benefit from a growing "competitive advantage period", it said. Read More

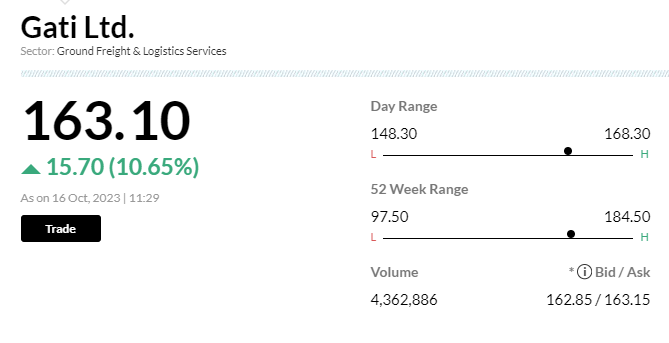

Stock Market LIVE Updates | Gati soars 14% as pre-festive orders drive Q2 volumes

Shares of Gati skyrocketed 14 percent to day’s high of Rs 168 per share on BSE on October 16 after volumes rose 18 percent year-on-year (YoY) in the July-September quarter of fiscal year 2023-24 (Q2FY24), as per the company’s business update. The S&P BSE Sensex stood flat at 66,205 levels, as of 11:32 am.

So far on October 16, around 3.9 million equity shares exchanged hands at both NSE and BSE versus 0.4 million equity shares on an average of one-week, suggested data.

In the past six months, the stock of this logistics company surged 42 percent as against 9 percent rise in the Sensex benchmark. Earlier, the company had touched its 52-week low of Rs 97 apiece on March 27, 2023 and scaled to a 52-week high of Rs 184 apiece on October 27, 2022.

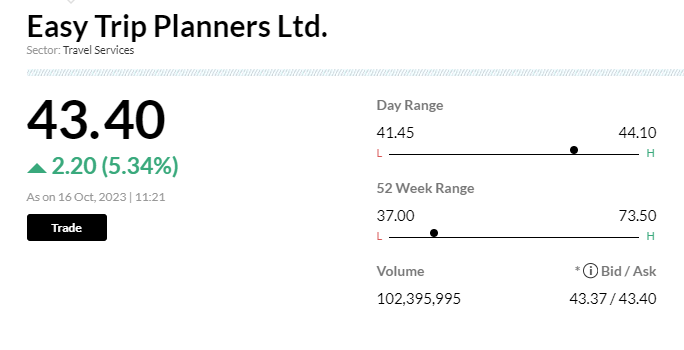

Stock Market LIVE Updates | Easy Trip Planners up 5% after huge block deal

Shares of Easy Trip Planners Ltd surged over 5 percent after a huge block deal. Around 31 million shares or 1.8 percent stake of the company changed hands in 12 bunched trades, Bloomberg reported. However, details of the buyers and sellers were not known.

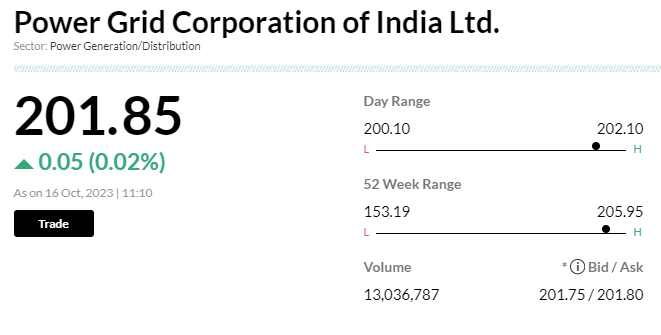

Stock Market LIVE Updates | PowerGrid trades flat after huge block deal

Shares of PowerGrid Corp of India were trading flat after a huge block deal. Around 10.4 million shares changed hands in two block deals, Bloomberg reported. However, details of the buyers and sellers were not known.

Sensex Today | Hemang Jani of Motilal Oswal Financial Services

D-Mart had slightly subdued performance in the last about two or three quarters, but the key monitorable over there is that the larger format stores which have a slightly better you know, per square feet profitability has started contributing more towards the overall revenue. And despite the weak discretionary demand on the company seems to be in a good shape to kind of start talking better sales store sales growth. So it's a little expensive, stock performance has not been that great. But you should look to buy into this name when you see about 5 to 7% kind of a correction from current price

Sensex Today | Market at 11 AM

The Sensex was down 33.66 points or 0.05 percent at 66,249.08, and the Nifty was up 2.30 points or 0.01 percent at 19,753.30. About 1910 shares advanced, 1234 shares declined, and 149 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Coal India | 312.50 | 1.48 | 5.29m |

| HCL Tech | 1,274.00 | 1.44 | 1.34m |

| Hero Motocorp | 3,138.80 | 1.3 | 268.93k |

| ONGC | 187.25 | 1.27 | 5.63m |

| LTIMindtree | 5,155.60 | 1.19 | 110.36k |

| UPL | 629.80 | 1.08 | 816.92k |

| JSW Steel | 785.60 | 1.07 | 576.27k |

| Titan Company | 3,317.80 | 1.04 | 394.68k |

| Tata Steel | 126.30 | 1 | 8.32m |

| Axis Bank | 1,003.30 | 0.93 | 1.47m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Nestle | 22,988.00 | -2.4 | 41.95k |

| Divis Labs | 3,683.90 | -1.38 | 81.35k |

| Asian Paints | 3,117.40 | -1 | 375.79k |

| TCS | 3,542.95 | -0.78 | 597.90k |

| Grasim | 1,968.75 | -0.7 | 286.38k |

| IndusInd Bank | 1,453.90 | -0.67 | 679.99k |

| Tech Mahindra | 1,186.70 | -0.62 | 1.26m |

| HDFC Bank | 1,526.95 | -0.57 | 2.90m |

| Adani Ports | 809.30 | -0.55 | 842.03k |

| TATA Cons. Prod | 909.50 | -0.42 | 737.12k |

Stock Market LIVE Updates | Mankind Pharma resumes operations at Sikkim manufacturing facility

Sikkim manufacturing facility of the pharma company has resumed operations as usual with effect from October 13. Operations at the said manufacturing facility were disrupted due to disturbance in power supply because of flash floods.

Stock Market LIVE Updates | Delta Corp sinks to 52-week low over GST woes, stock down 22% in a month

Delta Corp Limited shares plunged 8.6 percent to hit a 52-week low of Rs 128 in the early trade on October 16, extending losses for the third session in a row after a subsidiary received a notice for payment of Rs 6,384 crore for shortfall in taxes.

The latest notice takes the total demand from the group to well above Rs 23,000 crore, significantly higher than the company's market capitalisation of Rs 3,749 crore.

In the last month, the casino company stock has nosedived nearly 22 percent. Deltatech Gaming, formerly Gaussian Networks, runs gaming apps like Adda52 and Addagames. Read More

Stock Market LIVE Updates | Som Distilleries stock gains 2% after profit grows 80% YoY in Q2FY24

Shares of Som Distilleries & Breweries gained 2.6 percent to day’s high of Rs 355 per share on the BSE on October 16 after the company clocked 80 percent year-on-year (YoY) growth in consolidated profit to Rs 14 crore in the July-September quarter of fiscal year 2023-24 (Q2FY24).

In the past six months, the stock of this smallcap liquor manufacturer soared 129 percent as against 9 percent rise in the Sensex benchmark. Earlier, Som Distilleries stock hit 52-week high of Rs 389 apiece on October 5, 2023. Read More

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Tata Motors | 668.50 0.21 | 10.29m | 690.87 |

| MMTC Ltd | 81.95 9.85 | 69.18m | 563.77 |

| Easy Trip | 43.15 4.73 | 86.19m | 361.90 |

| HDFC Bank | 1,526.75 -0.59 | 2.38m | 363.01 |

| GSFC | 206.25 10.38 | 17.52m | 349.14 |

| ITI | 266.50 -1.7 | 8.86m | 239.15 |

| Infosys | 1,440.30 0.64 | 1.61m | 231.21 |

| Delta Corp | 126.10 -9.93 | 18.36m | 234.94 |

| Power Finance | 252.90 1.1 | 9.09m | 232.09 |

| SBI | 576.35 0.03 | 3.96m | 227.77 |