Indian market witnessed a selloff in the last two trading session of the week which pushed benchmark indices below crucial support levels largely on weak global cues.

The S&P BSE Sensex closed the week below 37,000 while Nifty50 failed to hold on to 11,000 for the week ended February 8.

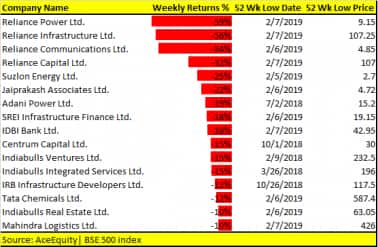

On weekly basis, Sensex rose 0.2 percent while the Nifty50 recorded gains of about 0.46 percent but as many as 16 stocks in the BSE500 index plunged 10-60 percent in the same period.

Stocks which saw a double-digit cut include names like Reliance Power, Reliance Infrastructure, Reliance Communications, Reliance Capital, Suzlon Energy, Jaiprakash Associates, Adani Power, SREI Infra, IDBI Bank, Centrum Capital, Indiabulls Ventures, Indiabulls Integrated Services, Tata Chemicals, Indiabulls Real Estate, and Mahindra Logistics.

The big carnage was seen in the small & mid-cap space which fell over 2 percent respectively for the week ended February 8. More than 300 stocks on the BSE hit a fresh 52-week low while on the NSE the number was slightly over 200.

As many as 21 stocks on the BSE hit a fresh all-time low in the week gone by which include names like Reliance Power, Reliance Communication, Suzlon, Inox, ICICI Securities, Cochin Shipyard, Coal India, Shankara Building etc. among others.

ADAG stocks saw their worst decline as most of the stocks hit their lifetime low during the week gone by. Anil Ambani-led Reliance Group on February 8 accused L&T and Edelweiss entities of "illegal" and "motivated" actions in invoking the pledged shares and selling them in the open market causing a steep fall in its share value.

Both L&T Finance and Edelweiss Group refuted the allegations made by the Reliance Group in separate media statements.

"Post Rcom bankruptcy, ADAG group may face credibility crisis as no lender may come forward to lend money to this group. Hence, stocks may under pressure for some more time and investors should avoid them in their own interest atleast for a couple of months till dust gets settled," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in.

The market direction in the coming week will be dominated by global cues as well as macro data, suggest experts.

"Volatility likely to continue amid growing concerns over the trade fight between the US and China, also Markets to closely track domestic macroeconomic data like IIP, CPI & WPI scheduled in the coming week," Hemang Jani, Head - Advisory, Sharekhan by BNP Paribas said.

"We continue to maintain a positive view on the consumption sector and expect the coming election to act as a positive catalyst for volume growth. Any major decline in the market should be used to buy into quality names such as (HUL, Reliance Industries and Titan) which remain some of our preferred picks," he said.

Technical View:

Following the Doji formation on February 7, the Nifty witnessed a sharp reversal on February 8. In terms of the candlestick patterns, the price action over the last three sessions has resulted in the Evening Star formation.

The pattern got formed post the completion of an Ending Diagonal pattern. This increases the bearish significance of the candlestick pattern, suggest experts.

"The Fibonacci retracements reveal that the benchmark index has reversed from the 61.8% retracement of the September – October decline. Hence the Nifty seems to have topped out at the recent high of 11,118," Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas.

On the way down, the Nifty has broken the key support zone of 10,980-11,000 on a closing basis. Thus the traders can add to the position on the short side. From short term perspective, 10,583-10,534 shall now be the key target area to watch out for with potential to head significantly lower, he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.