The benchmark indices gained around half a percent on October 17, continuing their uptrend for the third consecutive session; however, market breadth weakened. About 1,805 shares declined compared to 1,010 advancing shares on the NSE. Despite this, the market is expected to remain bullish, supported by healthy momentum and strong technical indicators. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

Tata Consumer Products | CMP: Rs 1,166

On the daily chart, Tata Consumer Products has confirmed a down-sloping trendline breakout at the Rs 1,155 level on a closing basis. The rising volumes over the past couple of sessions signify increased participation. The stock is trading well above its 20, 50, 100, and 200-day SMAs, reaffirming a bullish trend. Both the daily and weekly Bollinger Band buy signals indicate rising momentum, while the RSI on daily, weekly, and monthly timeframes reflects increasing strength.

Strategy: Buy

Target: Rs 1,200, Rs 1,255

Stop-Loss: Rs 1,155

M&M Financial Services | CMP: Rs 300.1

Since October 2024, M&M Financial Services has been consolidating within the Rs 293–240 range. However, with this week's price action, the stock has decisively surpassed multiple resistance zones around the Rs 293 level on a closing basis, indicating a short-term trend reversal. The stock is positioned well above its 20, 50, 100, and 200-day SMAs, all of which are gradually rising in alignment with price, confirming a bullish setup. Daily and weekly Bollinger Band buy signals and a strengthening RSI across all timeframes further support the bullish case.

Strategy: Buy

Target: Rs 325, Rs 345

Stop-Loss: Rs 294

Phoenix Mills | CMP: Rs 1,687.8

On the weekly chart, Phoenix Mills has witnessed a short-term trend reversal, confirming a triangular pattern breakout at the Rs 1,650 level on a closing basis. The gradually increasing volumes indicate heightened participation. Daily and weekly Bollinger Band buy signals along with a rising RSI on all major timeframes suggest the stock is gathering bullish momentum.

Strategy: Buy

Target: Rs 1,855, Rs 1,930

Stop-Loss: Rs 1,650

Rajesh Bhosale, Technical Analyst at Angel One

Adani Ports and Special Economic Zone | CMP: Rs 1,479.4

On the weekly chart, Adani Ports has confirmed a classic Inverse Head and Shoulders breakout, posting its second-highest weekly close with strong volumes and a bullish candle. Additionally, the RSI across all timeframes has closed above 70, signaling robust momentum. After a year-long consolidation, the stock appears poised for significant outperformance in the coming weeks. Hence, we recommend buying Adani Ports around Rs 1,479-1,470.

Strategy: Buy

Target: Rs 1,580

Stop-Loss: Rs 1,430

Radico Khaitan | CMP: Rs 3,108.5

Radico Khaitan continues in a strong uptrend, consistently forming higher highs and higher lows. Every dip toward the 50-EMA has attracted renewed buying interest. Over the past month, the stock underwent time-wise consolidation, but has now broken above its previous swing high, entering uncharted territory.

Volume patterns show muted activity during the consolidation phase, followed by a notable surge accompanying the breakout — a sign of fresh buying momentum. With a positively positioned RSI, the stock is expected to extend its uptrend in the near term. Hence, we recommend buying Radico Khaitan around Rs 3,108 - Rs 3,090.

Strategy: Buy

Target: Rs 3,480

Stop-Loss: Rs 2,970

Anshul Jain, Head of Research at Lakshmishree Investments

Shriram Finance | CMP: Rs 675.5

Shriram Finance has posted a small cup-and-handle breakout around Rs 638, setting the stage for a potential move toward the larger VCP (Volatility Contraction Pattern) neckline at Rs 712–714. Volumes are supportive of the bullish structure, confirming active participation. Momentum indicators remain strong, and the positively aligned moving averages indicate scope for a sustained uptrend. A breakout above Rs 714 could unlock significant upside. Shriram Finance appears well-positioned to lead the next leg in the financial space.

Strategy: Buy

Target: Rs 714

Stop-Loss: Rs 640

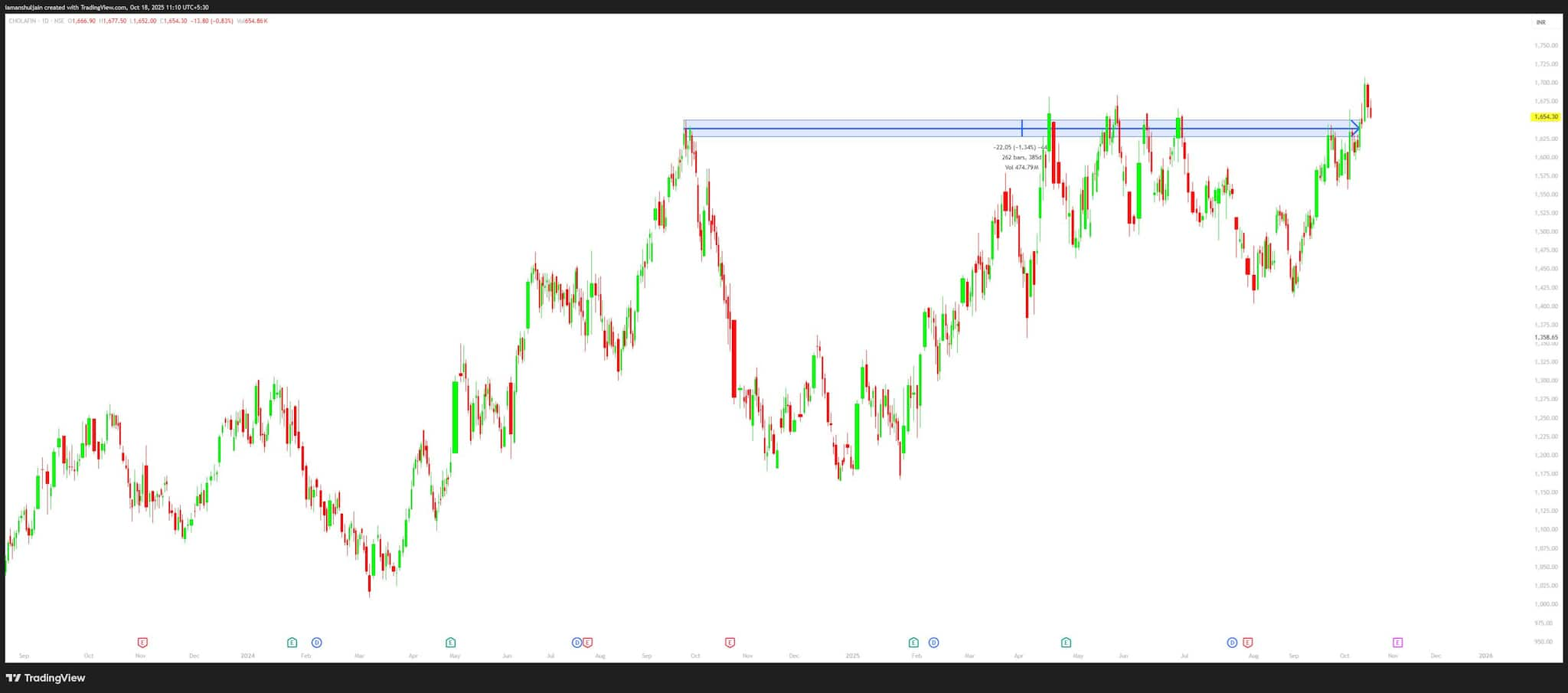

Cholamandalam Investment and Finance Company | CMP: Rs 1,654.3

Cholamandalam Investment has broken out of a 262-day-long VCP (Volatility Contraction Pattern), indicating a strong bullish setup. In the past two sessions, the stock has retested its breakout zone around Rs 1,650, confirming support.

Any further dip toward the Rs 1,620–1,650 range should be viewed as a buying opportunity, with an immediate upside target of Rs 1,850 — the smaller projection of the pattern.

Momentum indicators and moving averages remain positively aligned, acting as a propellant for the ongoing uptrend. The current setup suggests that the stock could continue to lead among NBFC peers in the near term.

Strategy: Buy

Target: Rs 1,850

Stop-Loss: Rs 1,600

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!