The market has been bouyant since the beginning of 'unlock' process. In the recent days, Nifty touched the psychological 12,000-mark and Sensex inched towards the 41,000-level. The improving economic data points, decent September quarter earnings, declining COVID infections and hope of further fiscal stimulus lifted the sentiment on the Street.

The benchmark indices are near eight-month high and are just about 3.5 percent away from their record high levels recorded in January 2020.

Given the massive rally, majority of experts feel that the correction is due but given the optimism following hope of another fiscal stimulus and falling COVID-19 infections with improving recovery rate, the momentum may continue along with some consolidation.

"We are very close to the all-time highs and new high is a possibility driven by liquidity. However, the risk-rewards are not favorable at this juncture and one should be cautious," Prasanna Pathak, Head of Equity at Taurus Mutual Fund told Moneycontrol.

As the September quarter earnings bouyed market sentiment and increased hope for strong earnings growth in the coming years, brokerages upgraded majority of quality stocks in current month.

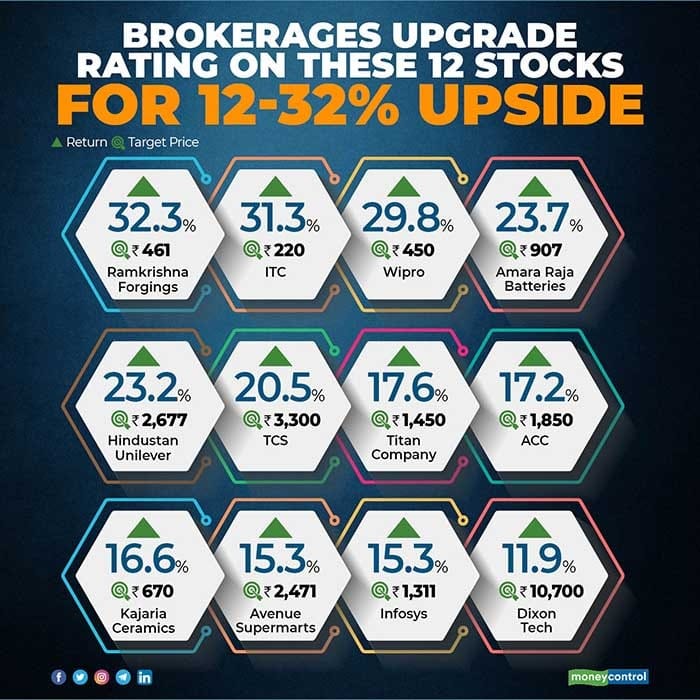

Here is the list of 12 stocks which got a upgrade in rating to buy from brokerage houses:

"Hindustan Unilver's Q2FY21 result was better with our estimates. Overall business recovers sharply from -7 percent YoY revenue growth in Q1FY21 to +3 percent YoY in Q2FY21. Outperformance of health, hygiene and nutrition portfolio (80 percent revenue share, +10 percentYoY) helped offset 25 percent YoY decline in revenue from discretionary and out-of-home portfolio. Inflationary raw material cost lead to the decline in gross margins however rationalization of advertisement spending helped EBITDA margin to expand marginally," IDBI Capital said.

"Rural growth remains resilient while urban continues to face COVID headwinds. Management expects raw material inflation to keep gross margin under pressure in near term. Accordingly, we have adjusted FY21E EPS estimates downwards by 4 percent. We have introduced FY23 in estimates. We expect HUL to grow EPS at 16 percent CAGR during FY20-23E. We upgrade rating to buy with a revised target of Rs 2,677," the brokerage added.

"Notwithstanding weak FY21 for the tiles industry, Kajaria's impressive show in tier II towns and beyond is heartening. Continued export demands for Morbi players would improve both the demand and pricing scenario for the organised player. Kajaria, with a net cash balance sheet and superior brand, is likely to capitalise on market share gain. We raise our earnings estimates by 52 percent and 41 percent, respectively, given low cost structure. We upgrade to buy with a revised target price of Rs 670 per share, at 30x FY22E P/E," said ICICI Securities.

"Ramkrishna Forgings (RMKF) reported a decent set of numbers in Q2FY21 amid a challenging environment, led by recovery in both, domestic and export revenue and cost control measures. Despite contraction in gross margin, EBITDA margin remains flat YoY at 18.1 percent," said Dolat Capital.

"We expect recovery in NA Class 8 trucks and domestic LCV volume to be key growth drivers in 2HFY21. However, challenges persist in the form of rising debt. Given the sharp recovery in the domestic CV and Class 8 trucks demand and incremental revenue from LCV business, we increase our EPS estimates by 71 percent for FY23 and upgrade our rating from reduce to buy with target Rs 461 (based on 15x FY23E EPS)," the brokerage added.

"Structural issues with respect to CoP need to be addressed for sustenance of healthy margins in the long run. On the positive side, strong balance sheet, improved cash flow remain key positives. Post a strong performance with improved outlook, we upgrade rating to buy with a revised target price of Rs 1,850," ICICI Securities said.

"Winning a production linked incentive (PLI) has Dixon well placed to capture the mobile local manufacturing opportunities. It is expected to see an eight-fold jump in its mobile revenues (at the cap revenue for incentives) in FY22. At a 3 percent EBIDTA margin, the expected revenues from PLI should catapult its EPS to Rs 236 from Rs 165, while FY23 is expected to see an EPS of Rs 297," Dolat Capital said.

"We had downgraded the stock in Q1 purely on valuations based on our earlier numbers devoid of PLI. We incorporate the PLI numbers in our estimates, which gives it an earnings CAGR of 23 percent over FY20-23E. While we maintain our earlier multiple of 40x, we roll forward to Sep-22 which gives us a new target price of Rs 10,700, and upgrade the stock to buy," the brokerage added.

"Avenue Supermarts (DMART) 2QFY21 result was better than our estimates. Overall business reached 88 percent pre-COVID level led by strong recovery in FMCG and staples while general merchandise and garment continues to face headwinds due to lower foot-fall. As a result, Inferior revenue mix led to decline in gross margins," IDBI Capital said.

"Store addition rate remain robust (added 6 stores during Q2 versus 2 stores in Q1). Interestingly; DMART shut down 2 stores (in Mira Road and Kalyan each) and converted them into fulfillment centers to support its online business. DMART also expanded online footprint to Pune. We have introduced FY23E in our estimates and upgrade rating to buy with a revised target of Rs 2,471 (40x FY23E EV/EBITDA)," the brokerage added.

"Infosys' had another quarter of an all-round beat to ours and consensus forecast. In Q2FY21 saw an all-time high large-deal TCV of $3.1 billion (net new wins being around 83 percent). Infosys' upward revision in guidance was also ahead of our and consensus expectation," IDBI Capital said.

"We factor the beat in Q2FY21 & FY21 guidance revision and increase FY21/22 revenue (in US dollar) by 2 percent/2.9 percent and EPS by 6 percent/7.9 percent. We introduce FY23 financials and forecast revenue/EPS CAGR of 11.4 percent/13.5 percent over FY21-23E. We roll-over to FY23E and now value INFO based on PER of 23x (versus 28x for TCS), increase the target to Rs 1,311 and upgrade the stock to buy from accumulate," the brokerage added.

"We upgrade Wipro from hold to buy with a revised target of Rs 450 as demand is improving across its large verticals. Q2 performance was in-line on revenue and margin front. Wipro provided better-than-expected growth guidance of 1.5-3.5 percent QoQ for Q3FY2021E; management expects growth momentum in BFSI to continue, while energy & utilities and technology verticals would recover in Q3," Sharekhan said.

"Although new CEO has a challenging task to get Wipro back to industry-level growth trajectory, we expect revenue growth to exceed historical levels in FY2022E/FY2023E," the brokerage added.

"Long-term positives are unfolding as revenue diversified. FMCG segment is set to become a major value driver. Legacy cigarette business is providing cash to meet its ambitious goals," said CLSA which expects FMCG to deliver an EBITDA CAGR of 30 percent in FY20-23.

"Value-accretive acquisitions and improving capital allocation will provide support. We upgrade ITC to buy from outperform with a target at Rs 220 per share," the brokerage added.

"Going forward, global digital technologies are expected to witness robust growth (around 20 percent CAGR in next five years) led by robust growth in cloud, customer experience and robust growth in cloud native technologies. TCS is expected to be a key beneficiary of this trend leading to double-digit revenue growth over a sustainable period. This, coupled with industry leading growth & solutions, better capital allocation, stable management and higher revenue growth trajectory than witnessed in the past warrant a multiple re-rating for the company. Hence, we now assign 28x P/E to the company's FY23E EPS. Based on this, we arrive at a target price of Rs 3,300 per share and upgrade the stock from hold to buy," ICICI Securities said.

"Given the encouraging demand recovery trends, we revise our revenue and earnings estimates upwards for FY21E by 10 percent and 15 percent, respectively. Titan remains a quality franchise with strong brand patronage. Over the years, the company has consistently exhibited its ability to gain market share amid a tough industry scenario," said ICICI Securities.

"We continue to remain structurally positive on the company and its long term growth prospects. We roll our estimates to FY23E and build in revenue CAGR of 13 percent in FY20-23E, mainly driven by growth in jewellery segment (15 percent CAGR). RoCE is expected to revert back to 30 percent+ levels by FY23E. We upgrade the stock from hold to buy with a revised target price of Rs 1,450 (50.0x FY23E EPS, previous target Rs 1,170)," the brokerage added.

"Its progress in battery technology in automotives would go a long way in Amara Raja Batteries gaining market share in two-wheeler OEM and, possibly, a rub-off effect in the replacement market in the next 2-3 years, in our view. We upgrade the stock to a Buy at a target price of Rs 907," Anand Rathi said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!