The Nifty has surpassed the 20,000 level yet again. The index has rallied around 11 percent so far in 2023, with various sectoral indices performing remarkably, rising by up to 60 percent. However, some sectors have missed the bus.

From the influence of midcaps to the impact of global economic conditions, Siddhartha Khemka, Head of Retail Research, Broking & Distribution, Motilal Oswal, shared insights into market trends in an interview with Moneycontrol.

Khemka spoke about how investors can generate alpha and pointed at key stocks and sectors that can strengthen their portfolios. With state-level elections and the upcoming General Election in 2024, he lists potential headwinds, tailwinds, favoured stock picks, and strategies for both short-term and long-term investors. Edited excerpts:

The Nifty 50 has risen around 11 percent so far in 2023, while several sectoral indices have outperformed, rising by up to 60 percent YTD. Is this on account of the stellar rally in midcaps? Should investors move towards a stock-specific investment approach and move away from index investment to generate alpha?

Resilient economic conditions, healthy corporate earnings, FII inflows (Mar-Aug’23), an all-time high SIP level, and retail participation drove the market. Further, moderation in inflation and expectations that global interest rates may have peaked in the last few months supported equities. The Nifty now trades at 17.7x 1-year forward earnings, which is a 12 percent discount to its 10-year average.

With Nifty earnings expected to grow at 19 percent CAGR over FY23-25, we expect the index to continue with its uptrend. However, to generate alpha, we believe that over the next couple of quarters, sector rotation could be an important driver. Some of the sectors still trading at reasonable valuations include Banking, Auto, Healthcare and select large-cap IT stocks.

Also Read | Nifty hits a new high, soars above 20,250 on GDP boost, FII buying

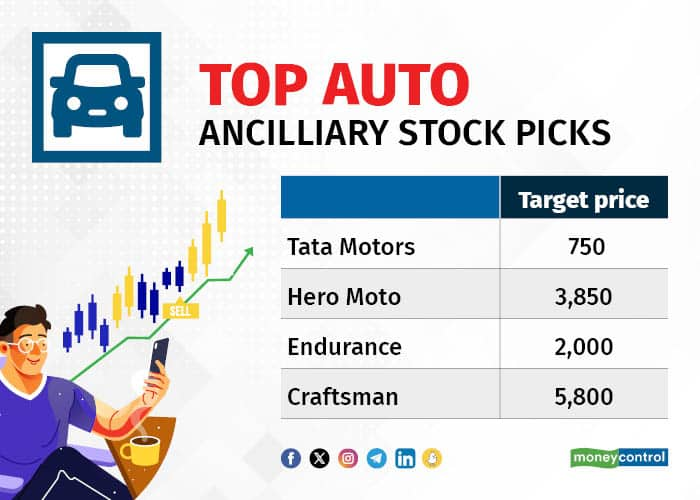

The Nifty Auto index has risen over 38 percent YTD. The sector saw better profitability, led by raw material savings and cost efficiency. What is your outlook for the sector and do you expect the index outperformance to continue? Which are your top picks in Auto, Auto OEM and Auto ancillaries?

The auto sector has witnessed a healthy rebound in terms of demand, supply chains, and operational costs after facing several macro as well as sector-specific challenges. While volumes of PVs, and tractors reached new highs in FY23, those of CVs/2Ws grew relatively slower. However, we are already witnessing a reversal in demand patterns, especially in the 2W segment. We are anticipating high-growth potential in 2W, along with MHCVs.

We thus now favour 2Ws, followed by MHCVs, while we turn cautious on the PV outlook. We prefer Tata Motors (TP: 750) as our top pick in the sector, followed by Hero MotoCorp (TP: 3,850) as it is a good proxy, especially on the rural market recovery, with its stronghold in the 100cc Motorcycle segment. Among ancillaries, we prefer Endurance (TP: 2,000), as it is a proxy play to the domestic 2W industry and Craftsman (TP: 5,800), led by the ongoing CV growth cycle.

Pharma has emerged as the real star this earnings season. The Nifty pharma index has risen around 28 percent YTD, outperforming the Nifty 50. Will the outperformance continue? What are the key headwinds and tailwinds for the sector and what stocks should investors look at and avoid?

In Q2FY24, operating leverage drove better profitability for Pharma companies, while hospitals sustained superior execution, partly supported by seasonality. After a robust performance in 1QFY24, US sales remained strong in 2QFY24 as well, led by increased niche launches, better traction in existing products and lesser price erosion. Further, the India pharma market jumped 16.5 percent YoY in October and has been on an uptrend for four months now.

The growth has been driven by a sharp revival in anti-infective therapy and continued momentum in gastro-intestinal and respiratory therapy. We prefer Medanta (TP: 1,050) as the scale-up of developing hospitals is driving operating leverage. On the other hand, we like Cipla (TP: 1,450), given its potential US generics pipeline/strong brand franchise in DF, and Sun Pharma (TP: 1,310) given its specialty/brand-led robust earnings growth.

Also Read | Why Sensex lags behind Nifty in race to new highs? Blame it on these top gainers BSE index lacks

Realty stocks are on solid ground on account of Q2 earnings comfort, strong pre-sales, and healthy demand for luxury homes. The Nifty Realty Index surged almost 62 percent YTD last week. Do you think there's more steam left for this rally? What stocks can investors bet on for gains?

Real estate companies registered their second-best quarter ever despite 2Q generally being considered to be the weakest quarter in terms of seasonality. New project launches are gradually picking up, as most of the players currently have ~12 months of inventory. The near-term project pipeline remains strong, the traction in business development also remains healthy.

We continue to see re-rating potential in the companies, which will provide further growth visibility led by strong business development through robust cash flows. We like Lodha (TP: 900), Prestige (TP: 1,000) and Godrej Properties (TP: 2,015).

After a solid rally last year, the Bank Nifty has been sideways so far this year. The RBI's crackdown on unsecured loans has put a damper on the sector. In light of that, do you believe the Bank Nifty may see some positive movement before FY24 ends or will the slump continue?

We believe that after the revision in risk weights for consumer loans, lenders could increase interest rates on these products to offset the impact on profitability. The cost of borrowings for NBFCs will also go up as banks look to increase lending rates while higher risk weights lead to higher capital consumption. The impact could be in a range of 30-85 bps on capital ratios.

However, strong profitability and healthy capitalisation levels across lenders will cushion the impact of this measure. In 2QFY24 results, most lenders suggested that they have tightened underwriting standards and are closely monitoring risks in the retail segment. But, we remain watchful of growth and asset quality trends in unsecured retail and believe the sector’s underperformance could continue.

Also Read | Retail investors underestimate options trading risks; returns may shrink, says Findoc’s Sood

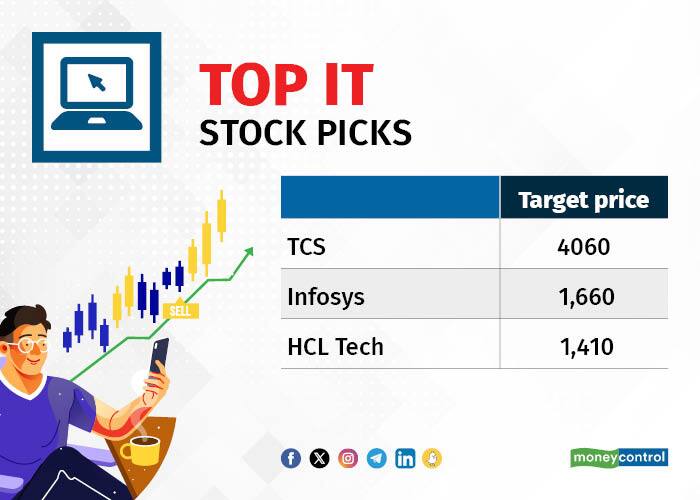

Considering the underperformance of the Nifty IT index, and Nifty Metal compared to the Nifty 50 YTD, what cautionary advice would you offer to investors regarding these sectors, and are there specific stocks within these sectors that you would advise against or would like investors to pick on dips?

Some of the IT companies announced FY24 revenue guidance cuts despite announcing multi-year mega-deal signings. This indicates a challenging 2HFY24 due to the impact of the delay in digital transformation and discretionary work, which is affecting volumes. However, despite near-term weakness, we expect companies to be key beneficiaries of the acceleration in IT spends in the medium term.

Moreover, the falling dollar index is likely to provide some comfort. We prefer TCS (TP: 4,060), Infosys (TP: 1,660), and HCL Tech (TP: 1,410) for their robust business models, strong management teams and attractive valuation.

Metals, too, would benefit from a weaker dollar index. Further, with an expectation of supply tightening and the Fed interest rate hiking cycle peaking, prices have started firming up. We prefer Coal India (TP: 380) and Hindalco (TP: 580).

What criteria or metrics do you believe investors should prioritise when identifying potential investment opportunities in the current market conditions, considering the divergent performances of different sectors?

The most important criterion that an investor should keep in mind while identifying opportunities should be growth potential. He must identify which sector holds long-term promise and which stocks within the sector are expected to deliver robust growth. Secondly, we also believe valuations will become an important criteria for stock picking to drive outperformance given the divergence seen so far.

Also Read | Lasting financial success not fleeting moments of greatness, Pankaj Tibrewal on his investment mantra

Lastly, what could be the major headwinds and tailwinds for the Indian share market as the year comes to an end, and in the run-up to the general elections in 2024? What should short-term and long-term investors do?

Several state-level elections were scheduled in November, followed by the General Election in May 2024. History is in favour of a pre-election rally. In the last five consecutive Lok Sabha elections (i.e. from 1999 to 2019), the Nifty has rallied 10-35 percent for the six month run-up until the announcement of election results (November-May period). Amid the run-up to the elections, global factors such as economic growth, interest rates, bond yields, inflation, geopolitical issues, etc are some of the key monitorables.

On the other hand, Nifty earnings are expected to maintain their healthy growth at 19 percent CAGR over FY23-25, as domestic macros continue resilience. While the overall market trend remains positive, we can see increasing volatility on account of these events. Thus long-term investors can seize the opportunity to buy on dips whenever the market offers that, while short-term traders are advised to adopt a stock-specific approach.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.