Shares of rate-sensitive stocks were trading higher ahead of the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) meet outcome.

Such stocks react before and after the meeting’s outcome is known, especially on the interest rate front.

Sectors like banking, real estate and auto, among others, will be impacted the most from the rate hike as the cost of the products will be directly influenced due to increase in interest rate.

"The direct effect of rate hike will be seen on the borrowing capacity of banks from RBI as it becomes more expensive to borrow at a higher rate. As the bank borrowing will be at higher rate there will also be increase in the lending rate of Bank and that will impact the borrower or the company which borrows from Bank. The company may decrease their borrowing from bank as it makes difficult for the company to borrow at a higher rate and that would result in slowing down the growth of company," Ritesh Ashar, Chief Strategy Officer at KIFS Trade Capital told Moneycontrol.

The Bank Nifty was trading flat, but select stocks in the index gained up to 3 percent. IDFC Bank, PNB, SBI, Kotak Mahindra Bank, and Federal Bank among others, gained between half a percent up to 3 percent.

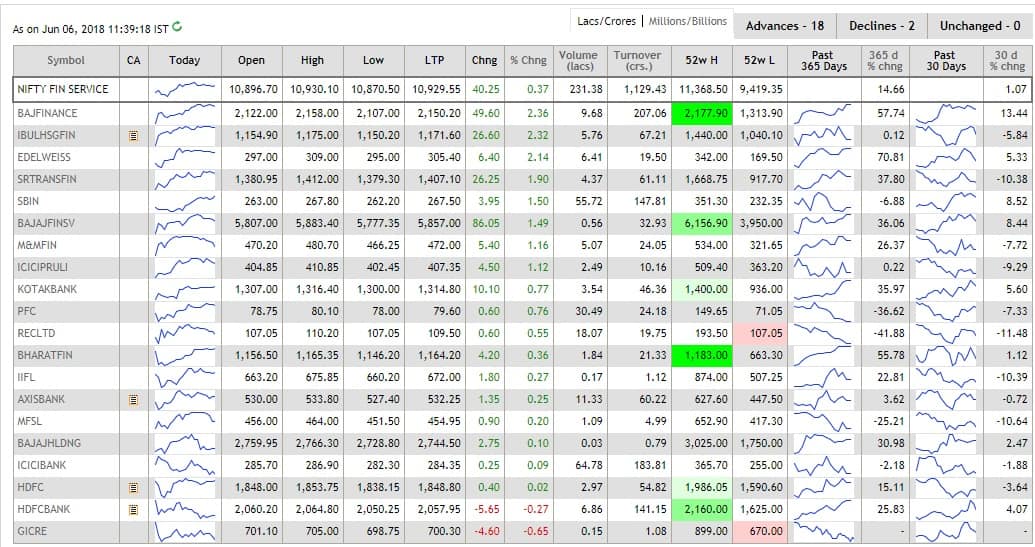

The rally was also seen in other rate sensitive sectors such as financial services as well. Bajaj Finance, Edelweiss, Indiabulls Housing, ICICI Prudential Life, and Bajaj Finserv gained 1-2 percent.

The Nifty PSU bank index traded higher by over a percent. Surge of 2-6 percent was seen in names such as Allahabad Bank, Union Bank, Andhra Bank, and Indian Bank, among others.

"Many leading banks have already increased lending rates by 10 bps recently anticipating a rate hike. Going forward we expect banks to pass on any incremental rate hikes to customer. Increasing lending rates will certainly curtail the growth in advances," Atish Matlawala, Sr Analyst, SSJ Finance & Securities told this website.

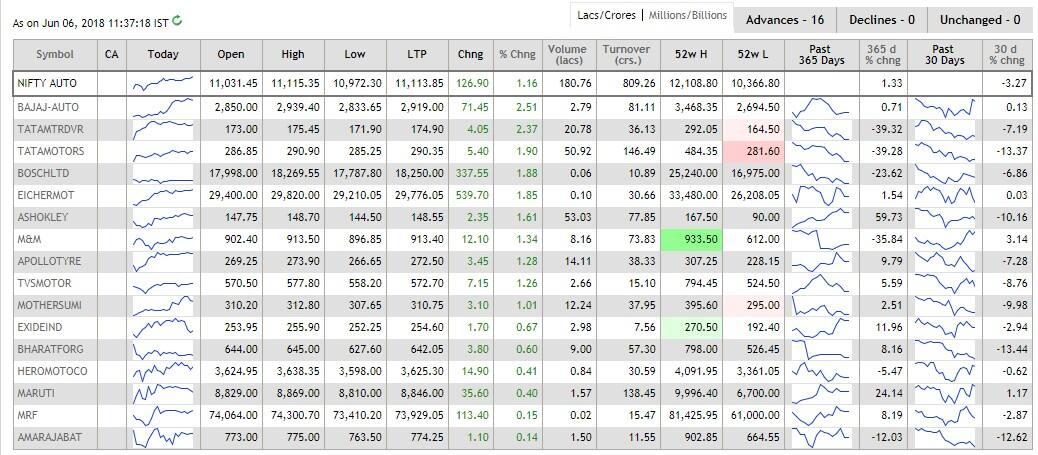

Meanwhile, auto names were buzzing as well. Nifty Auto index was up over 1 percent, led by gains in stocks such as Bajaj Auto, Eicher Motors, Mahindra & Mahindra and TCS Motor, among others.

Realty stocks, a part of the rate-sensitive pack, were also trading higher, with the Nifty realty index rising over 1 percent. Indiabulls Real Estate, Godrej Properties, Oberoi Realty and Sobha, among others, gained 1-3 percent.

Market voices on the D-Street are as such divided on the possibility of a rate hike in this meeting. Having said that, they also said that the Street has already priced in both the situations—a hike or not in this case.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.