The market closed March 15 session as well as the week on a strong note, with the BSE Sensex rising 269 points for the day and 1,353 points for the week to top the psychological 38,000 level.

Positive global cues on renewed optimism over a US-China trade deal and a buying interest in banking and financials lifted market sentiment.

The Nifty rallied 0.74 percent on March 15, and 3.5 percent for the week to form a bullish candle that resembles a spinning top formation on the daily charts and a robust bull candle on the weekly charts.

The broader markets turned mixed with Nifty Midcap index gaining 0.65 percent and the Smallcap index falling half a percent. Among sectors, the Nifty Bank was up 1.58 percent and IT index was up 1.88 percent.

As the benchmark indices climbed higher for the fourth consecutive week, there could be a bit of correction or consolidation in the coming sessions, which was already indicated by Friday's off day's high closing, experts said.

"The near term uptrend of the Nifty is intact. Having moved up sharply recently, there is a possibility of a minor downward correction in the next week, but the expected weakness is unlikely to damage the uptrend status of the market," Nagaraj Shetti - Technical Research Analyst, HDFC Securities told Moneycontrol.

He said immediate resistance for the Nifty that should be watched during the next week is at 11,520.

"As long as the higher-high and the higher-low formation in the index is intact, we suggest trading with a buy-on-dip strategy. The immediate support for Nifty is at 11,270," Shabbir Kayyumi, Head of Technical Research at Narnolia Financial Advisors said.

We have collated top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 11,426.85 on March 15. According to the Pivot charts, the key support level is placed at 11,369.4, followed by 11,312.0. If the index starts moving upward, key resistance levels to watch out are 11,485.6 and 11,544.4.

Nifty Bank

The Nifty Bank index closed at 29,381.45, up 458.35 points on March 15. The important Pivot level, which will act as crucial support for the index, is placed at 29,074.57, followed by 28,767.73. On the upside, key resistance levels are placed at 29,604.46, followed by 29,827.53.

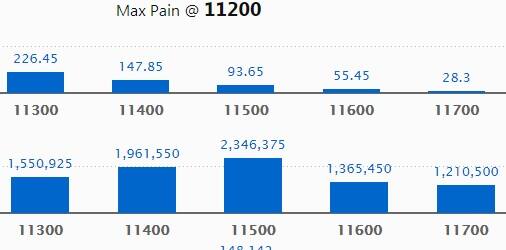

Call options data

Maximum Call open interest (OI) of 23.46 lakh contracts was seen at the 11,500 strike price. This will act as a crucial resistance level for the March series.

This was followed by the 11,400 strike price, which now holds 19.61 lakh contracts in open interest, and 11,300, which has accumulated 15.50 lakh contracts in open interest.

Significant Call writing was seen at the strike price of 11,700, which added 6.04 lakh contracts, followed by 11,800 strike, which added 3.96 lakh contracts, and 11,600 strike, which added 0.64 lakh contracts.

Call unwinding was seen at the strike price of 11,400 that shed 4.95 lakh contracts, followed by 11,300 strike that shed 3.39 lakh contracts and 11,500 strike, which shed 3 lakh contracts.

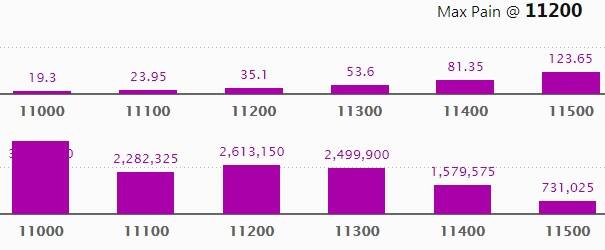

Put options data

Maximum Put open interest of 39.11 lakh contracts was seen at the 11,000 strike price. This will act as a crucial support level for the March series.

This was followed by the 11,200 strike price, which now holds 26.13 lakh contracts in open interest, and the 11,300 strike price, which has now accumulated 24.99 lakh contracts in open interest.

Put writing was seen at the strike price of 11,400, which added 10.29 lakh contracts, followed by 11,500 strike that added 3.27 lakh contracts and 11,300 strike that added 2.28 lakh contracts.

Put unwinding was seen at the strike price of 11,200, which shed 1.73 lakh contracts, followed by 11,000 strike, that shed 0.76 lakh contracts and 10,900 strike, which shed 0.75 lakh contracts.

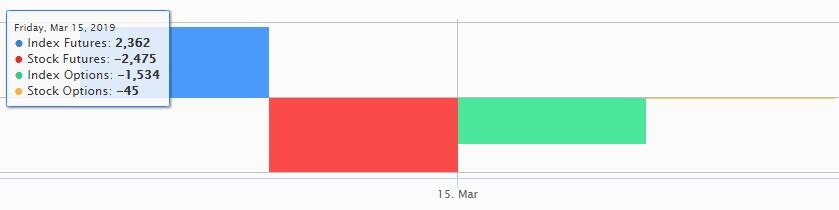

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth Rs 4,323.49 crore while Domestic Institutional Investors (DIIs) sold Rs 2,130.36 crore worth of shares in the Indian equity market on March 15, as per provisional data available on the NSE.

Fund flow picture

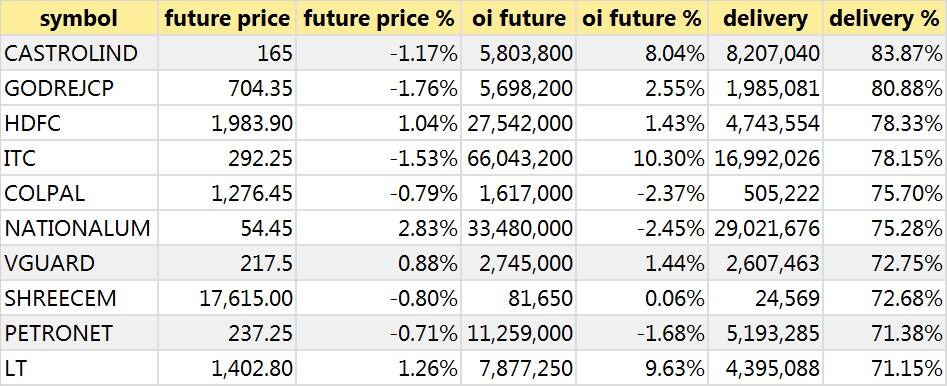

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting the delivery of the stock, which means that investors are bullish on it.

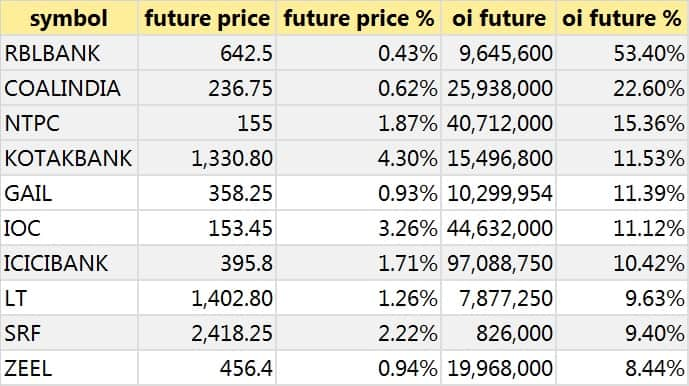

54 stocks saw a long buildup

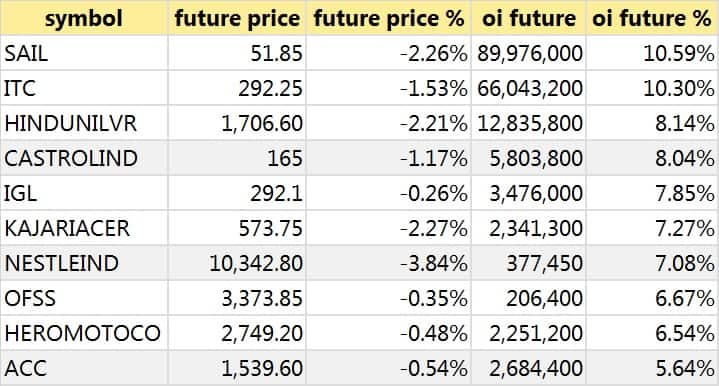

59 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

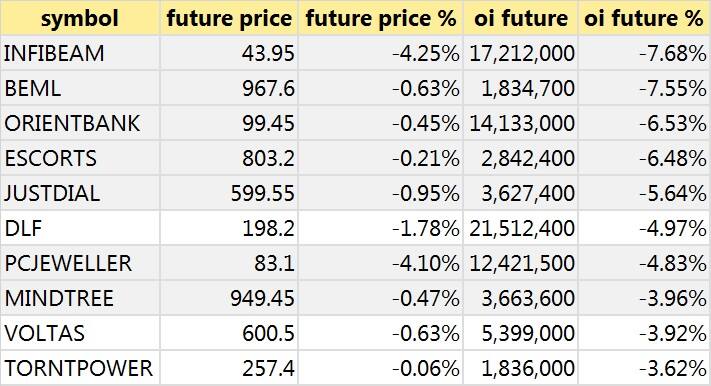

49 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

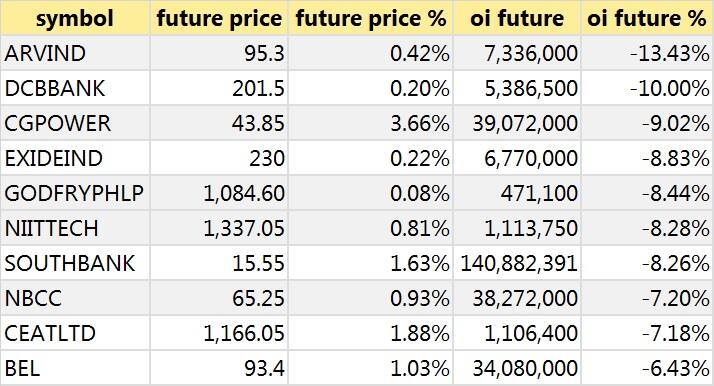

38 stocks saw long unwinding

Bulk Deals on March 15

(For more bulk deals, click here)

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

EID Parry India: Board meeting will be held on March 22 to consider the second interim dividend on equity shares, if any, for the financial year 2018-19.

Finolex Industries: Company's officials will meet investors/analysts on March 18.

PSP Projects: Company's officials will meet analyst/institutional investors on March 18 and 25.

Emmbi Industries: Company's officials will meet Moneybee Investment Advisors on March 18.

Deep Industries: Officials of the company will be meeting investors and analysts on March 19.

Jindal Steel & Power: Analysts and Investors visit to Angul plant is scheduled on March 18.

South Indian Bank: Officials of the bank will be meeting a group of institutional investors organised by SBI Caps Securities on March 19.

Stocks in news

Lumax Auto Technologies: Company decided for discontinuation of the PCB manufacturing w.e.f. April 1, 2019. In addition, the board has also approved the disposal of plant and machinery to Lumax Industries relating to PCB Business on arm’s length basis and not below its book value.

Jaiprakash Associates: Board approved the re-appointment of Manoj Gaur, Executive Chairman & CEO and Sunil Kumar Sharma, Executive Vice Chairman for a further term of three years.

Future Consumer: Company announced redemption of non-convertible debentures.

Karnataka Bank: The bank partners with Karvy DigKonnect for contact centre services.

Kesoram Industries: The company's rating pertaining to that portion of its long term/short term banking facilities as been assigned to CARE Ratings Limited for rating has been revised to BB+/ A4+ (under credit watch with developing implications).

Majesco: Board approved to sell, transfer and dispose of, as a going concern and on a slump sale basis, the company's India Insurance Products & Services Business to Majesco Software and Solutions India Private Limited, a step-down subsidiary of the company, for a lump sum consideration of Rs 24.4 crore.

Mishra Dhatu Nigam: Board declared payment of Rs 1.68 per share as the first interim dividend on equity shares for the financial year 2018-19 and fixed March 26 as the record date for dividend payment.

SAIL: CARE has assigned AA- outlook stable to company's long term fund based facility (term loan).

Indo Amines: 'No observation' letter has been received from BSE for proposed amalgamation amongst Core Chemical (Mumbai) Private Limited and Key Organics Private Limited with Indo Amines Limited, so as to enable the company to file the scheme with NCLT.

DHFL: Special Committee of the board of directors accorded approval to disinvest to Olive Vine Investment Limited an affiliate of the Warburg Pincus Group.

Santosh Sharma (currently the CFO) will assume a new role as the Head - Corporate Strategy.

Lupin: Subsidiary Novel Laboratories Inc. has received a letter from the USFDA classifying the inspection conducted at its Somerset (New Jersey) facility in December 2018 as Official Action Indicated (OAI). The US FDA has stated that this facility may be subject to regulatory or administrative action and that it may withhold approval of any pending applications or supplements in which this facility is listed.

Cadila Healthcare: Zydus receives final approval from the USFDA for Valsartan and Hydrochlorothiazide tablets.

Mirc Electronics: Vishal Barot has resigned as Chief Financial Officer (CFO) of the company due to personal reasons.

Zuari Global: Company has acquired around 48.98 percent shares of Forte Furniture Products India Private Limited (FFPL) from Indian Furniture Products Limited (IFPL), subsidiary of the company.

Five stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For March 18, Adani Enterprises, IDBI Bank, Jet Airways, Reliance Capital and Reliance Infrastructure are present in this list.

Out of F&O Ban: BEML, Reliance Power.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.