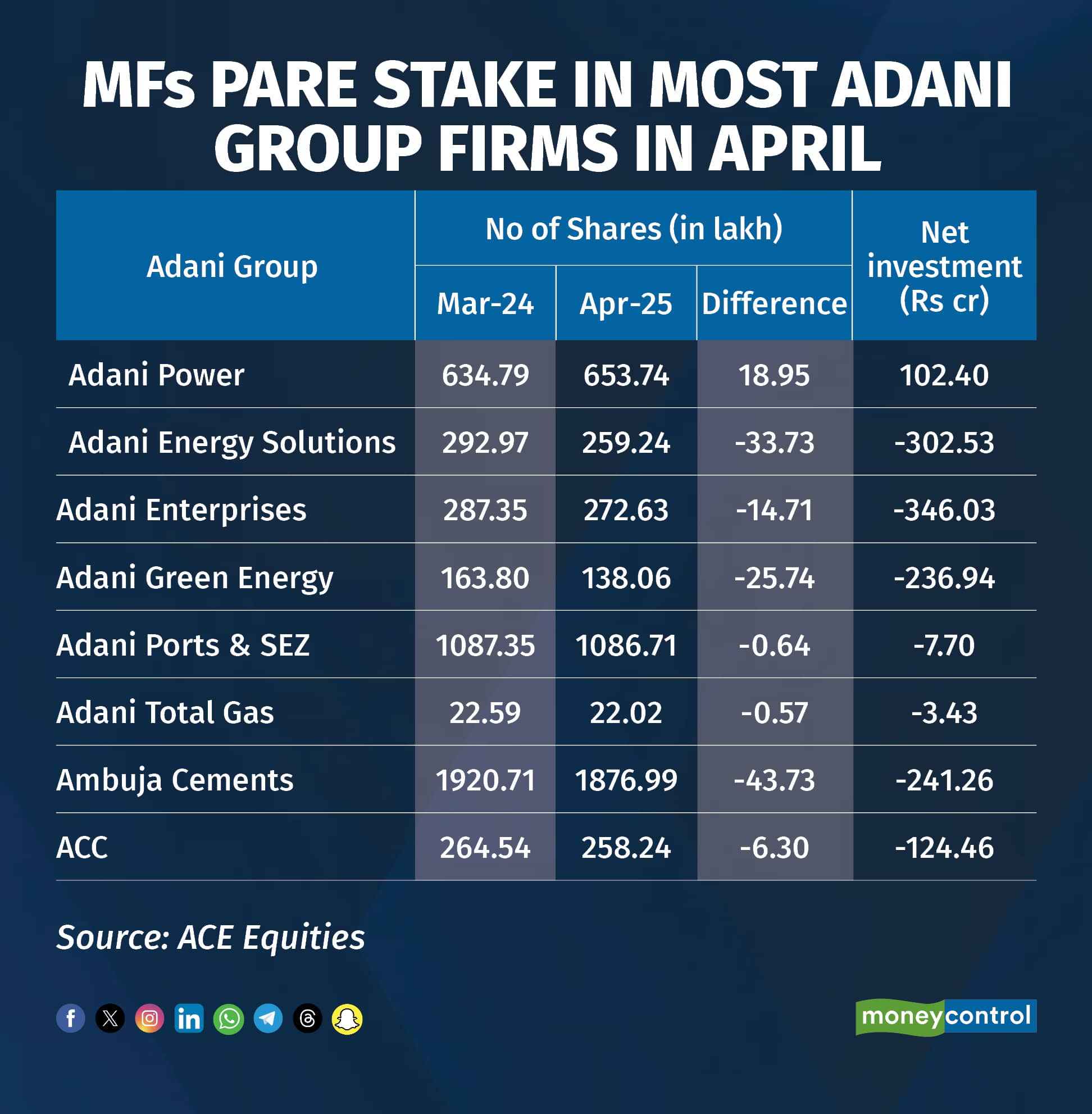

Mutual funds are gradually reducing their exposure to Adani Group companies, signalling a sustained decline in interest. In April, mutual funds collectively sold shares worth over Rs 1,160 crore across eight listed entities of the Adani Group.

Seven of the listed Adani companies saw mutual fund's shareholding go down in April, up from four in March.

The largest divestment was seen in Adani Enterprises, with mutual funds trimming their holdings by over Rs 346 crore. This was followed by Adani Energy Solutions and Ambuja Cements, where fund managers reduced their stakes by Rs 302 crore and Rs 241 crore respectively.

Other notable selloffs included ACC (Rs 124 crore), Adani Ports & SEZ (Rs 7.7 crore), and Adani Total Gas (Rs 3.43 crore). The only stock that saw increased interest was Adani Power, where mutual funds raised their stake marginally, investing Rs 102 crore.

The trend of cautious disengagement was evident in March as well. Barring Adani Green Energy and Adani Enterprises, rest of the group’s shares witnessed net selling. In February, mutual funds divested around Rs 321 crore across eight Adani Group entities, continuing the subdued sentiment that began in January, when purchases were limited to Rs 480 crore.

Experts say this ongoing reluctance is driven by a combination of governance concerns, high valuations, regulatory scrutiny, and sector-specific risks. Market experts said many mutual funds, particularly those with conservative investment mandates, continue to view Adani Group companies as high-risk, largely due to their history of volatility and ongoing skepticism around financial disclosures.

Experts added that valuation concerns are a key factor behind the decision to trim holding, as shares of several Adani Group companies are trading at significantly elevated multiples compared to their respective peers. In a challenging macroeconomic environment, fund managers tend to prioritize stocks with strong earnings visibility and reasonable valuations.

Separately, a Bloomberg News report revealed that representatives of Gautam Adani have held discussions with officials from the Donald Trump-led US administration, seeking to have criminal charges related to an overseas bribery probe dropped.

These meetings reportedly began earlier this year and have intensified recently. Adani’s representatives have argued that the case is inconsistent with the current administration’s policy priorities and have requested for reconsideration. If talks progress at the current pace, a resolution could be reached within a month, the report had said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to consult certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.