As has become a trend for the past few months, the Indian market continued to stay largely in the negative territory in June, in sync with its global peers that are also going through a turbulence because of various economic and geopolitical reasons.

The intense selling pressure in the markets was mainly on the anticipation of a sustained higher inflation and faster normalisation in the policy rates in major economies. Global supply chain, too, continued to be disrupted mainly because of the conflict between Russia and Ukraine and fresh outbreak of Covid-19 in China and subsequent restrictions imposed on movement. Domestic equity market too has been a victim of these eventualities.

Inflation: The Biggest Concern for the Markets

Inflation continued to hog the limelight and remained the biggest concern for economists and central banks the world over. There is, however, a feeling in some circles that the inflation might be on its way to peaking out sooner, rather than later, and that will give some comfort to the central banks to reconsider their aggressive stance towards interest rate hikes. Controlling inflation takes a toll on the economic growth which, in turn, affects the whole gamut of macro and micro factors that affect the global population.

“With actions from various global economies and from the Indian government, we feel that the inflation will start easing in the coming quarters as the international crude prices are already below $100 a barrel, which is a positive for the importing country like India,” said Rajnath Yadav, Research Analyst at Choice Broking. This is one of the key reasons for the recent optimism in the domestic markets. “However, we believe this momentum is short-lived,” Yadav said.

Indices in June 2022

When we look at the performance for June 2022, while the Nifty was down 4.85 percent, mid-caps were down 6.49 percent, small-caps 8.29 percent and multi-cap or large-cap were down around 5.5 percent each. “Whenever the markets attempted to recover, it had only faced a fair amount of selling which was on the backdrop of weak US and European markets and the same kind of volatility was reflected in Indian markets as well,” said Raj Vyas, Portfolio Manager, Teji Mandi.

Experts believe that the market got relatively oversold as the investors were worried about the global macroeconomic headwinds. However, during the last two weeks of June 2022, the benchmark indices held on to the weekly gains for two weeks in a row led by positive sentiment in the market because of sharp decline in oil prices as concern over a global economic slowdown intensified, hope of good monsoon and a fall in dollar index which boosted the market sentiment.

However, the FIIs (foreign institutional investors) remained net sellers in the Indian equities for the ninth month in succession as they sold off equities worth Rs 58,112 crore in June 2022 while the DIIs (domestic institutional investors) bought equities worth Rs 46,599 crore.

Winners from the PMS world

Despite the volatility and bearish sentiments prevailing in the Indian markets, there were many portfolio management services (PMS) schemes that generated better returns compared to the Nifty and Sensex.

PMS schemes cater to wealthy investors with sizes exceeding Rs 50 lakh. Their professional fee structure is different from that of regular mutual funds.

Of 283 schemes tracked by pmsbazaar.com in June, 127 schemes (45 percent of the total) performed better than the Nifty. Seven schemes (2.5 percent) generated positive returns, while the returns generated by other schemes were in the negative.

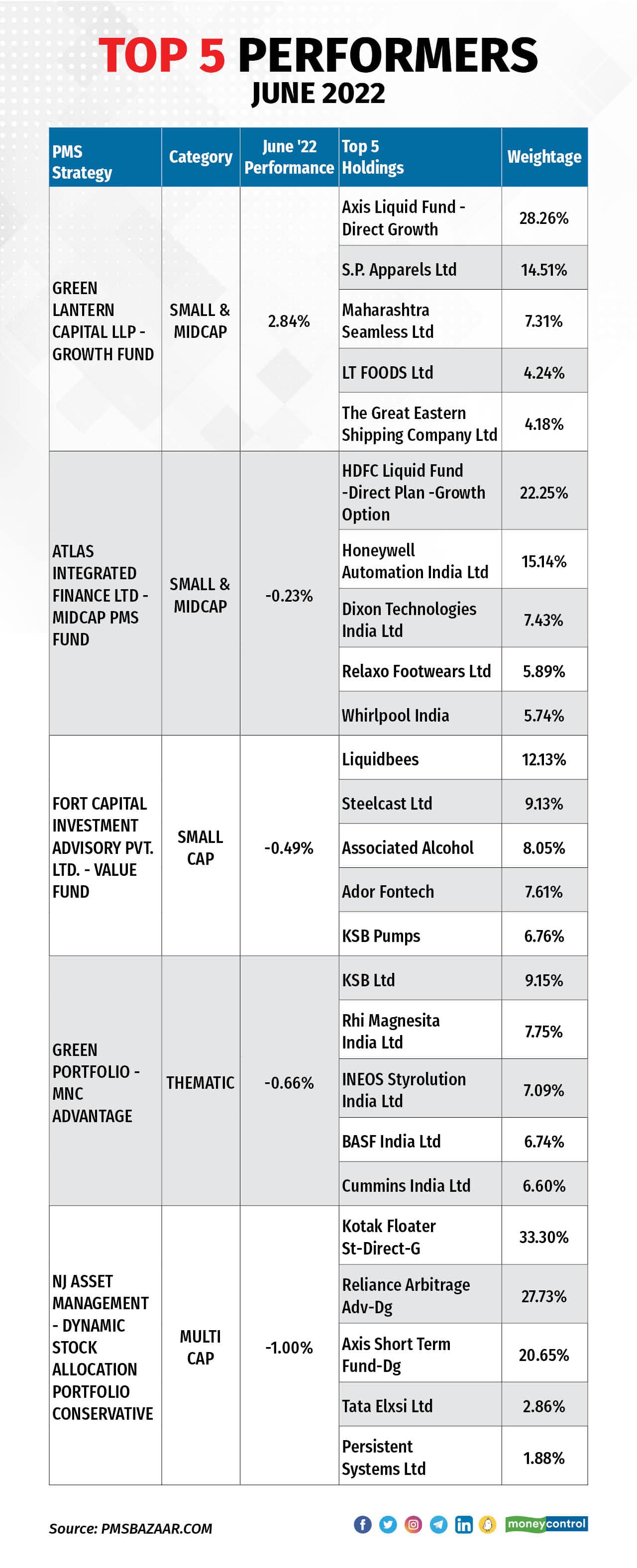

The highest return of 2.84 percent were generated by Green Lantern Capital LLP – Growth Fund scheme which was followed by Equitree Capital Advisors – Emerging Opportunities (+1.16 percent), Karvy Capital – Excel (+0.85 percent), Scient Capital – Aries Mid Yield (+0.82 percent) and Karvy Capital – Demeter (+0.48 percent).

Not all of these top schemes disclosed their stock holdings for May. Moneycontrol collated a list of the top five from among those that disclosed their holdings.

This list may give investors an idea about which stocks the fund managers of these schemes bet on. But they should not be considered ‘buy’ recommendations as every fund manager has his own investment strategy.

Green Lantern Capital LLP – Growth Fund

The small & mid cap focused scheme generated results of 2.84 percent during the month of June 2022. Its top holdings were Axis Liquid Fund – Direct Growth, SP Apparels Ltd, Maharashtra Seamless Ltd, LT Foods Ltd and The Great Eastern Shipping Company Ltd

Atlas Integrated Finance Ltd – Midcap PMS Fund

The scheme generated returns of -0.23 percent by investing in small & mid cap stocks like HDFC Liquid Fund – Direct Plan – Growth option, Honeywell Automation India Ltd, Dixon Technologies India Ltd, Relaxo Footwears Ltd and Whirlpool India Ltd.

Fort Capital Investment Advisory Pvt Ltd – Value Fund

Focussing on small caps, the scheme generated returns of -0.49 percent and its top 5 stocks were Liquidbees, Steelcast Ltd, Associated Alcohol, Ador Fontech and KSB Pumps.

Green Portfolio – MNC Advantage

This thematic scheme invested in stocks such as KSB Ltd, Rhi Magnesita India Ltd, Ineos Styrolution India Ltd, BASF India Ltd and Cummins India Ltd to generate returns of -0.66 percent.

NJ Asset Management – Dynamic Stock Allocation Portfolio Conservative

The multicap focused scheme could generate returns of -1.0 percent as it invested in stocks like Kotak Floater St – Direct – G, Reliance Arbitrage Adv – DG, Axis Short Term Fund – DG, Tata Elxsi Ltd and Persistent Systems Ltd.

The outlook

Experts believe that the volatility will continue to rule the roost in the near to medium term and a lot will depend on the inflationary headwinds which in turn will decide the path of global central banks.

“We believe that the markets will remain volatile for the next couple of months and during this volatility, it would be prudent to keep a larger part of one’s allocation to large caps and if one has a long-term investment horizon, then probably now is the right time to start gradually building allocation in good quality small and mid-caps”, said Nishit Master, Portfolio Manager, Axis Securities.

Also it is always necessary to keep in mind that from a long-term perspective, what is more important than market capitalization, is the quality of companies one invests in. “So good quality stocks with good promoters and a scalable business model should be preferred”, Master added.

Though we’ve been seeing a rebound in the index, the trend has not reversed yet. “Instead of focusing on opportunities based on market capitalisation, the prudent approach is to identify the sectors and themes which could lead when the market would reverse the trend”, said Ajit Mishra, VP – Research, Religare Broking Ltd. “We have strong signals from auto and FMCG pack and now we’re seeing banking, financials and select stocks from pharma and realty also pitching in for buying opportunities on dips”.

It is also to be noted that the Nifty P/E (price to earnings) valuation has come down to around 17-18x as compared to recent highs of 23x. The company’s management commentary during the Q1 FY23 earnings season will also play a crucial role in predicting the movement of the index.

“We believe that Nifty earnings will be adjusted down, after factoring the inflationary environment, thereby expecting more downside risk to the Nifty index”, said Yadav from Choice Broking.

Having said that, major indications would come from the US Fed, which is aggressively hiking the interest rate. “There are early indications of easing inflation expectations for 2023”, added Yadav, which may pressurize the US fed to stop the policy tightening without concerning much about the positive real rate. Equity markets are quick to anticipate such actions and thus are likely to react positively.

“We as a brokerage house are anticipating such eventualities and coming to a conclusion that H2 of the current fiscal will be positive for the equity markets”, said Yadav.

India’s macro factors are good but the Indian markets are really getting affected by the sentiments that are in the West or the liquidity conditions which are tightening around the world.

One can never time a bottom because no one can precisely say this is the bottom. Investments done during volatility or when they have corrected a bit have actually generated wealth for investors over the long run. “As has been seen in the past, after every correction, the Sensex in the last five years has given a return of 70 percent, in 10 years around 205 percent, in 20 years around 1,500 percent and since 1986 around 9,450 percent”, said Vyas of Teji Mandi. Hence, due to short-term volatility, don’t miss this opportunity for the India story and our advice will be to stay focused and keep investing”.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.