The RBI’s Monetary Policy Committee (MPC) surprised the street with a front-loaded 50 basis points repo rate cut to support economic growth, while changing the policy stance from ‘accommodative’ to ‘neutral’ on June 6, along with a cut in the cash reserve ratio (CRR). Five of the six RBI MPC members voted for the 50 bps cut, which was above analysts’ expectations.

Some market experts believe the neutral stance marks the end of the official easing cycle, but keeps the door open to future rate cuts if required, depending on data.

"It is imperative to continue to stimulate domestic private consumption and investment through policy levers to step up the growth momentum. This changed growth-inflation dynamics calls for not only continuing with the policy easing but also frontloading the rate cuts to support growth," the RBI said in its release. Read More

The central bank also slashed the cash reserve ratio by 100 bps to 3 percent to further provide durable liquidity, potentially unlocking nearly Rs 2.5 lakh crore in liquidity for the banking system.

"The cumulative 100 basis point rate cut since February underscores the RBI’s urgency to support demand, while the shift to a neutral stance signals a more cautious, data-driven approach to balancing growth and inflation risks going forward," Anil Rego Founder & Fund Manager at Right Horizons PMS said.

Apurva Sheth, Head of Market Perspectives & Research at Samco Securities said the policy shift is more than a rate cut but a strong signal that the RBI has done its part and it is now up to corporates, consumers, and investors to seize the moment.

The stock market, which already delivered strong returns from the lows of April, has reacted positively to the RBI move. The Nifty 50 index reclaimed 25,000 level with a one percent rise, forming a long bullish candle with falling resistance trendline breakout.

Sectors like housing, autos, banking, and infrastructure are likely to see improved momentum as transmission picks up, Sonam Srivastava, Founder and Fund Manager at Wright Research PMS said, adding that it’s also a positive signal for rural and small business credit, where growth had been lagging.

Moneycontrol has collated a list of top 14 rate sensitive stocks from experts with short term perspective. The stock price of June 5 is considered for the calculation of returns:

Ashish Kyal, CMT, Founder and CEO of Waves Strategy AdvisorsHDFC Bank | CMP: Rs 1,949.60

For the past two months, HDFC Bank has taken a breather and has been undergoing a symmetrical triangle formation at the upper end. In the previous session, prices made a failed attempt to break out of the said pattern. For now, a decisive breakout on the upside is much-awaited for the next leg of the rally to resume. Additionally, the Bollinger Bands have been contracting, which is usually followed by a significant trending move. A break above Rs 1,970 followed by Rs 1,980 could trigger fresh buying in this stock.

In summary, HDFC Bank is trading at an important juncture. A decisive break above Rs 1,980 is a must, which could open the doors for targets of Rs 2,055 followed by Rs 2,150. On the downside, Rs 1,900 is the nearest support level to watch.

Strategy: Buy

Target: Rs 2,055, Rs 2,150

Stop-Loss: Rs 1,900

PB Fintech | CMP: Rs 1,886.7

PB Fintech is one of the top gainers in the financial sector, which is a strong bullish sign. On the daily chart, the stock, after two weeks of consolidation, has managed to close above the narrow range of Rs 1,723 to Rs 1,810. Prices also managed to break above the previous swing high of Rs 1,854, highlighting that bulls are gearing up for a fresh rally. The current rise has retraced up to 61.8 percent of the prior fall that started in January 2025, and with follow-up buying, prices could retrace up to the 78.6 percent level, i.e., near Rs 2,050. Additionally, the MACD has recently given a bullish crossover, further reinforcing the positive outlook.

In summary, the trend for PB Fintech has shifted in favour of the bulls. A break above Rs 1,895 could lead to a trending move towards Rs 1,970 followed by Rs 2,050. On the downside, Rs 1,820 is the nearest support level.

Strategy: Buy

Target: Rs 1,970, Rs 2,050

Stop-Loss: Rs 1,820

Prestige Estates Projects | CMP: Rs 1,626.1

The realty sector is one of the key beneficiaries of a rate cut, and within the sector, Prestige Estates is outperforming. On the daily chart, the stock is forming higher highs and higher lows, indicating bullishness. After reversing from the mid-Bollinger Band, prices are now trading near the upper Bollinger Band, with rising volumes highlighting strength in the ongoing trend. Additionally, the ADX (Average Directional Index) is showing a reading of 33, which is well above the 25 level, suggesting strong momentum. Given the steep rally, buying on dips seems a prudent strategy.

In summary, the trend remains positive. Use dips as buying opportunities, with targets of Rs 1,720 followed by Rs 1,800. On the downside, Rs 1,555 is the nearest support.

Strategy: Buy

Target: Rs 1,720, Rs 1,800

Stop-Loss: Rs 1,555

Vinay Rajani, CMT, Senior Technical and Derivative Analyst at HDFC SecuritiesMacrotech Developers | CMP: Rs 1,461.70

Lodha has broken out from a descending triangle pattern on the weekly chart. The stock is placed above key moving averages, indicating a bullish trend across all time frames. The realty sector index has been outperforming over the past couple of weeks. The monthly RSI has given a bullish crossover, indicating strength in the stock. Volumes have risen alongside the recent price rise. The stock has been forming higher tops and higher bottoms on both the daily and weekly charts.

Strategy: Buy

Target: Rs 1,680

Stop-Loss: Rs 1,300

Indian Bank | CMP: Rs 629.70

After breaking out from the bullish Flag pattern on the monthly chart, Indian Bank has experienced a running correction over the last three trading sessions. Considering the primary uptrend and the stock’s relative strength, it appears that the stock could resume its bullish trend with momentum at any time.

Strategy: Buy

Target: Rs 680

Stop-Loss: Rs 600

Mahindra and Mahindra | CMP: Rs 3,041.60

M&M is currently in a short-term consolidation phase, while the primary trend remains bullish. The stock is positioned above key moving averages and has been forming higher tops and higher bottoms on the weekly charts. The auto sector has seen sufficient consolidation and is on the verge of resuming its primary uptrend. Indicators and oscillators are showing strength on both the weekly and monthly charts.

Strategy: Buy

Target: Rs 3,200

Stop-Loss: Rs 2,950

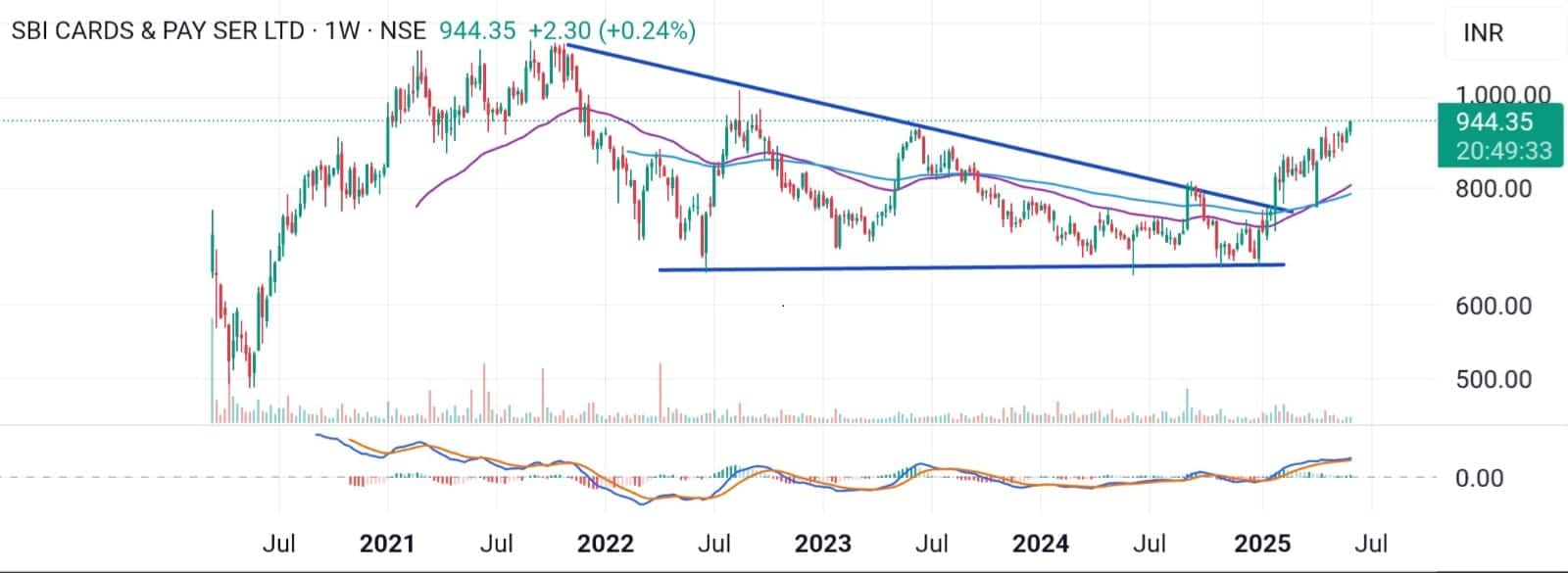

Vidnyan Sawant, Head - Research Desk at GEPL CapitalSBI Cards and Payment Services | CMP: Rs 944.35

SBI Card is demonstrating strong relative strength across all timeframes. On the monthly scale, the stock has broken out above its June 2023 swing high, signaling a structural shift. The weekly chart reflects a consistent uptrend, marked by higher highs and sustained price action above the 12-, 26-, and 50-week EMAs. Momentum remains firmly positive, with the MACD in buy mode across multiple timeframes, reinforcing the stock’s bullish undertone.

Strategy: Buy

Target: Rs 1,048

Stop-Loss: Rs 895

Angel One | CMP: Rs 3,271.7

Angel One has formed a double bottom pattern on the monthly timeframe, indicating a potential long-term reversal. On the weekly chart, the stock is showing signs of trend continuation, staying well above the 26-, 50-, and 100-week EMAs. Furthermore, the MACD is rising above the zero line with expanding positive histograms, signaling accelerating momentum and strengthening the bullish outlook.

Strategy: Buy

Target: Rs 3,730

Stop-Loss: Rs 3,070

Anshul Jain, Head of Research at Lakshmishree InvestmentsTata Motors | CMP: Rs 710.15

Tata Motors has rallied 38% in five weeks, forming a pole, followed by four weeks of tight closing, developing a bullish flag pattern on the weekly chart. This setup is supported by strong accumulative volumes, indicating institutional participation. Both daily and weekly moving averages are below current prices, acting as propellers for further upside. A breakout above Rs 730 will trigger the next bullish leg, targeting the weekly swing high of Rs 810 in the coming sessions.

Strategy: Buy

Target: Rs 810

Stop-Loss: Rs 690

Axis Bank | CMP: Rs 1,159

Axis Bank is in the seventh week of forming a weekly flag pattern, with low volumes indicating a healthy timewise correction. This consolidation is allowing the weekly moving averages to catch up, setting the stage for a strong breakout. A sustained move above Rs 1,225 will confirm bullish continuation and likely propel the stock towards Rs 1,500. The structure remains positive, with current sideways action building energy for a fresh upmove.

Strategy: Buy

Target: Rs 1,500

Stop-Loss: Rs 1,140

IndusInd Bank | CMP: Rs 803.2

IndusInd Bank has formed a bear trap and is currently trading above the trap level of Rs 800 while consolidating. A follow-through breakout above Rs 812 will neutralize the overhead weekly moving averages and trigger fresh bullish momentum. Volumes in the base have remained accumulative, indicating institutional interest. A breakout above Rs 812 is likely to flush out trapped traders, opening room for a swift rally towards Rs 926 in the coming weeks.

Strategy: Buy

Target: Rs 926

Stop-Loss: Rs 790

Mahesh M Ojha, AVP Research and Business development at Hensex SecuritiesDLF | CMP: Rs 825.7

DLF remains in a strong bullish trajectory, supported by sustained volume and a solid breakout structure. The RSI indicates healthy strength without overbought signals, while the MACD supports ongoing upside momentum. The stock shows potential for continued outperformance in the short term.

Strategy: Buy

Target: Rs 860, Rs 900

Stop-Loss: Rs 794

Godrej Properties | CMP: Rs 2,312

Godrej Properties is showing strength, with the RSI trending positively and a MACD bullish crossover confirming upward momentum. The stock is breaking out of a consolidation phase with rising volumes. Technicals favour sustained upside in the coming sessions.

Strategy: Buy

Target: Rs 2,650, Rs 2,700

Stop-Loss: Rs 2,180

Larsen & Toubro | CMP: Rs 3,642.6

L&T remains in a strong uptrend, consolidating above key breakout zones. The RSI is stable, and the MACD remains in buy territory, indicating continued momentum. Sustained volumes support a bullish continuation in the near to medium term.

Strategy: Buy

Target: Rs 3,690, Rs 3,750, Rs 3,800

Stop-Loss: Rs 3,530

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.