After a day’s break, auto stocks were back in the limelight with the sectoral index gaining more than 1 percent on June 28 and recouping the previous day's losses. The consistent buying came ahead of monthly sales data which will be released from July 1.

Among auto and auto ancillary stocks, Tube Investments of India jumped more than 7 percent, followed by Mahindra &Mahindra, Ashok Leyland, TVS Motor Company, Bharat Forge, and MRF that gained 1.5-3 percent.

Exide Industries, Bajaj Auto, Tata Motors, Eicher Motors, Maruti Suzuki, Bosch, Hero MotoCorp, Balkrishna Industries, and Amara Raja Batteries also ended in the green.

The Nifty auto index closed 1.25 percent higher at 11,832, taking the total gain to more than 10 percent since it hit a recent low on June 20. The major reason behind the outperformance is the stability in metal prices, which is a key material for vehicle makers.

June sales expectations

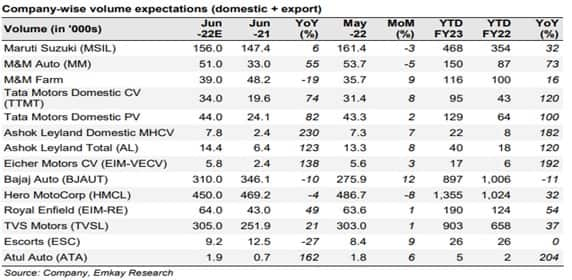

June sales figures are expected to show that all automobile segments barring tractors and two-wheelers posted strong growth year-on-year largely on a low base in 2021 when India was battling the second wave of the COVID-19 pandemic.

Emkay Global Financial Services conducted a channel check to gauge the sales volumes in June. "The channel checks indicate commercial vehicles (CVs) maintaining positive growth momentum on a sequential basis in June 2022. Tractor volumes are also likely to trend higher in a seasonally strong month," the securities firm said.

Further, "2-wheelers volumes would be better for most original equipment manufacturers (OEMs) thanks to a ramp-up in production. In comparison, passenger vehicle (PV) volumes should be a mixed bag for listed OEMs," it added.

In the commercial vehicles segment, on a sequential basis, Emkay expects positive sales growth for Ashok Leyland at 9 percent, Tata Motors at 8 percent and Eicher Motor-VECV at 1 percent, and a slight decline for M&M at 5 percent.

Among makers of passenger vehicles, domestic sales by volume should grow 2 percent month-on-month at Tata Motors, Emkay said. It predicted a decline of 1 percent for Maruti Suzuki and 3 percent for M&M.

For the industry, Emkay expects a sequential improvement due to better production and higher dispatches to dealerships. "Vehicle discounts have decreased month-on-month and remain significantly lower than the elevated levels seen in the past," it said.

Tractor sales by volume are likely to improve month-on-month, with a growth of 11 percent for Escorts and 10 percent for M&M in the domestic market. Sales growth has been restricted in the countryside because farmers have been hit by lower crop realizations in recent months, the research house said.

In the two-wheeler space in the domestic market, on a sequential basis, Bajaj Auto may report 4 percent growth in sales, Royal Enfield 3 percent, and TVS Motor 2 percent after a ramp-up in production and higher demand from salaried individuals and students, it said.

Emkay expects an 8 percent decline for Hero MotoCorp in domestic sales. Last month was better for Hero MotoCorp because of the strong demand in the marriage season.

Emkay Global has retained a positive view on the auto sector. "Among OEMs, we are positive on Tata Motors, Maruti Suzuki and Escorts, while in the ancillaries segment, we prefer Motherson Sumi and Minda Industries," it said.

Technical setup

Technically, the auto index is looking strong as it has formed a bullish engulfing candlestick pattern on the daily charts, indicating the uptrend may stay intact. Since the March lows, the index has been making higher highs and higher lows, which is a positive indication.

Even moving average convergence and divergence (MACD), the trend indicator, has retained its uptrend. The relative strength index has moved to the 66 levels. On a weekly basis, too, these indicators posted a positive trend.

Disclaimer: The views and investment tips of experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!