Despite the Indian markets reaching new record highs in recent weeks, a significant portion of Nifty 500 Index stocks has not yet reclaimed their all-time highs.

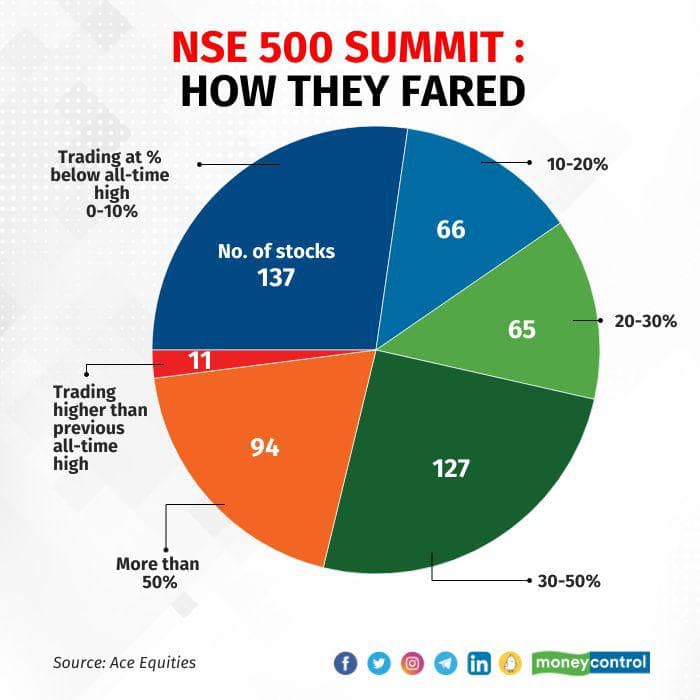

Around 76 percent or 382 companies of the Nifty 500 Index are currently trading below their respective all-time high levels. On the other hand, 225 stocks from the Nifty 500 have reached or are approaching their one-year high levels.

Analysts say that this data underscores the importance of stock selection. "Even during a strong bull market like the one we are currently experiencing, selecting the wrong stock or purchasing a good stock at an unfavourable price may result in a lack of returns. The quality of management, valuation and future earnings growth are the three crucial factors that determine investment returns," said Devarsh Vakil, Deputy Head of Retail Research, HDFC Securities Ltd.

Within the Nifty 500 Index, around 17 stocks are currently trading at substantially 80-90 percent below their record highs. Additionally, 74 stocks are down 50-80 percent from their peak levels. Approximately 193 stocks are trading between 20 percent and 50 percent lower than their all-time high levels while 72 stocks are seeing a drop of 10-20 percent from their record highs.

Yet to catch up

Among the blue-chip stocks, Reliance Industries Ltd is currently 9 percent away from its lifetime high of Rs 2,856.15 per share, which it reached on April 29, 2022. Similarly, Tata Motors is 2.5 percent away from its record high of Rs 605.90, achieved on February 3, 2015.

Other notable stocks that are still away from their all-time highs include Infosys Ltd, Tech Mahindra Ltd, Wipro Ltd, IndusInd Bank, Kotak Mahindra Bank, Bajaj Finance and Bajaj Finserv, among others.

Several stocks have been waiting to surpass their respective lifetime high levels for many years. NTPC, which hit its record high in January 2008, has not yet reached that level. Similarly, Oil & Natural Gas Corp has been waiting to exceed its lifetime high since June 2014. Sun Pharmaceuticals Industries and Coal India have been in the same situation since 2015, while Hero MotoCorp and Bharat Petroleum Corp have been awaiting new record highs since 2017. IndusInd Bank hit its record high in August 2018 and is still struggling to cross that level.

Furthermore, around 14 stocks, including Tata Consultancy Services, UPL, Dr Reddy's Lab, Tata Steel Ltd, Hindustan Unilever Ltd, Divi's Lab and Apollo Hospitals among others, hit their lifetime highs in 2021 but have not yet reached those levels again.

"These lagging stocks might initially appear as a cause for concern as their performance seems to contradict the overall bullish sentiment. However, it is important to note that the stock market is dynamic, and individual stocks can have diverse trajectories. Over time, as the leading stocks continue their strong rally, their positive performance and market sentiment often inspire confidence in other market participants," said Rupak De, Senior Technical Analyst at LKP Securities.

"While it is crucial to monitor the collective movement of stocks within an index, it is equally important to acknowledge the dynamics of leadership and lagging stocks during a bull run. The strong rally in leading stocks acts as a catalyst, lifting the overall market higher and eventually prompting the lagging stocks to align themselves with the prevailing market trend," De added.

Potential for tailwind

Meanwhile, some analysts say the current lag in performance is not a significant worry as approximately 86 percent of NSE 500 stocks are trading above their respective 50-day moving averages. However, it should be noted that a mean reversion move lower is expected for the Nifty index in the near term, which is a regular occurrence during a strong uptrend, analysts said.

"Froth in the market is a bigger worry than the presence of laggards. Laggards offer the potential for tailwinds while froth gives rise to the potential for a bubble. Presently, that few stocks have beaten their previous all-time highs is a good worry to have, encouraging us to hope that the rally will find new leaders with time. Rallies almost always start with a handful of stocks surging, and once benchmark indices start rising, it gives an ideal foil for mid and small caps to join the party if conditions are right," said Anand James, Chief Market Strategist at Geojit Financial Services.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.