Electricity Act, 2003 was a flagship legislature that changed the dynamics of India’s power sector.

By opening up the generation part of the utilities business, it created a flurry of private sector investments in new power plant capacity. As a result, India’s installed capacity grew a whopping four times in less than 20 years - from ~100 GW to the present 400+ GW - with an astonishing addition of renewable energy projects.

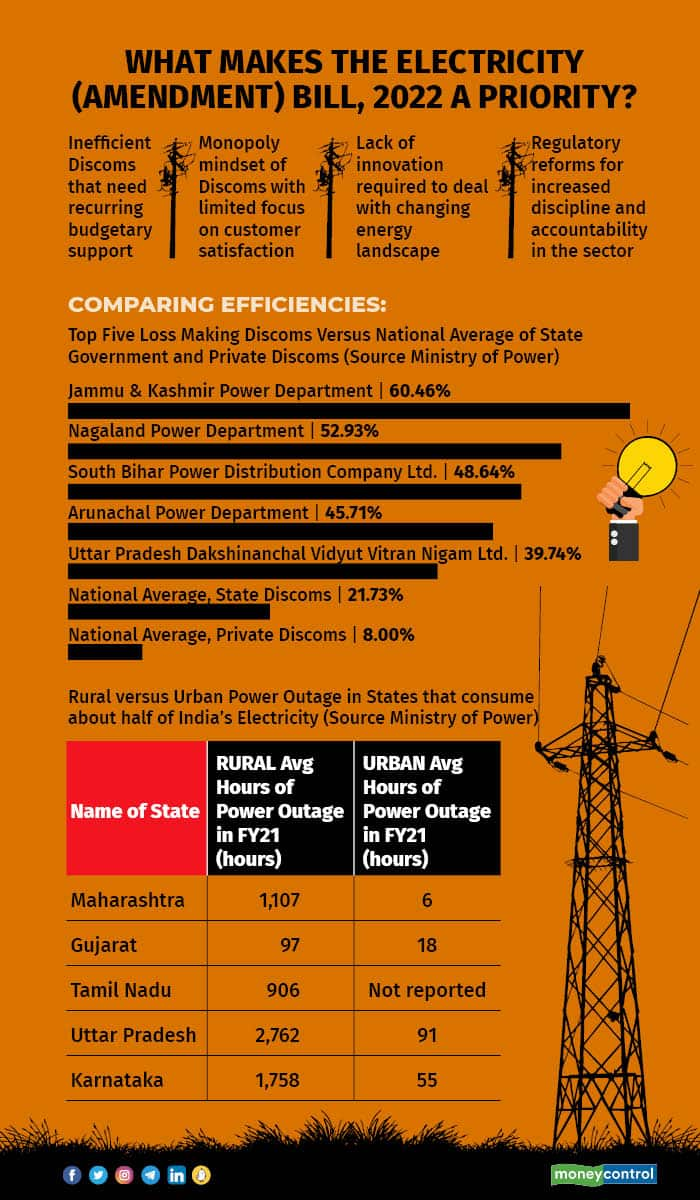

It was felt at that time that the distribution part of the business should be protected and therefore discoms, as a licensed entity, were carved out of the original State Electricity Boards. The state government- owned discoms have failed to live up to the expectations of India’s young and wired consumers; plus they are a huge financial burden on governments and taxpayers.

Proposed amendment

To solve these issues and reform the sector to confront newer challenges related to energy transition, the government has brought in the Electricity (Amendment) Bill, meant to plug in the gaps left open and discovered post- the Electricity Act of 2003.

In its current form, the Bill was tabled in the Parliament on August 8, 2022. It was referred to the Parliamentary Standing Committee of Energy for further discussions, and the power minister is hopeful of getting it passed in the upcoming Winter Session.

But is the Bill good enough? Or as they say, sometimes the good enough is neither good and nor enough. We take a look at the key provisions of the Bill and what some sector experts have to say on the proposed amendments to answer that question.

What’s in the Bill?

Well several things, but the two that matter the most are provisions for retail supply competition and governance reforms including the role of regulators. First let’s decode these to understand their implication for the sector participants and for the consumers.

Have you ever wondered why you cannot switch your electricity provider the way you can for other utilities such as mobile and broadband? This is because distribution of electricity is a licensed activity and although the Electricity Act, 2003 allows for multiple or parallel licensees in the same area of supply, in reality there aren’t any multiple license holders (except for Mumbai for historical reasons).

A simple explanation for this outcome is that distribution is a natural monopoly business. In other words, the society loses value if more than one provider invests in creating more than one sub-station, poles and wires that are required to supply electricity to one household or industry.

However, once you divide the distribution business into two functional parts -- ‘wires’ which represent physical infrastructure, and ‘supply’ which represents sourcing-metering-billing of electrons -- these two can be looked at differently. This is also known as Carriage and Content separation. As explained above, the wires business fits the natural monopoly definition, but the supply business can be competitively structured.

This is precisely what the Electricity (Amendment) Bill, 2022 aims to bring. The government wants the existing discoms to retain monopoly over the Carriage that is wires business and open up the Content that is supply business for competition, with private sector entry.

Governance and accountability

For increasing accountability, the Bill also proposes levy of a penalty in case discoms fail to meet their renewable purchase obligations target.

In terms of governance changes, the Bill gives power to the Central Electricity Regulatory Commission to approve licenses for multiple state suppliers. This provision overrides the earlier distinct set of responsibilities between the central and state regulators, given electricity is a concurrent subject and states fear losing control if their role is clipped further.

Yet another provision is on the powers of the central government in selection of the Chairman and Members of state regulatory commissions -- an area where the states feel uncomfortable given they currently call the shots.

The Bill also calls for increasing the number of members at the Appellate Tribunal for Electricity (APTEL) -- the apex judiciary body created for addressing appeals against orders of state and central regulators.

Role of the National Load Dispatch Centre (NLDC) is supposed to be strengthened with powers to dictate scheduling and dispatch at the national level for efficient grid operations.

The NLDC will also have to ensure power flows only when payment security mechanisms are in place. These provisions will solve the payment outstanding issues for generators and bring down the cost of power.

Arun Kumar Singh, Head of Digital Technology and Short-term Market at power trading solutions provider PTC India Ltd, says: “The Bill aims to achieve twin objectives of encouraging market participation by the private sector for the last mile and creating a more centralised system possibly for bringing uniformity across states in terms of implementation.”

“The Bill attempts to instill financial discipline and accountability for all parties in the electricity ecosystem, including the regulators.” said Neeraj Menon, Partner and Head, Energy Infrastructure and Natural Resources at Trilegal.

What’s not in the Bill?

First and foremost this Bill is not a full-fledged privatisation exercise as some would like to believe. The wires as well as supply business of existing discoms will continue to be owned and managed in the same way as at present, unless the state governments themselves decide to privatise these assets. There would be no change in the employment status of existing employees at the state discoms.

The new suppliers who are interested in competing for consumer attention could be private companies (such as the existing ones in the sector like Adani Transmission Ltd, CESC Ltd, Tata Power Company Ltd, Torrent Power Ltd) as well as other government entities (NTPC Ltd, EESL and such). Regulators would still have the mandate to regulate all entities, possibly with much more attention and power to ensure consumers are not adversely affected.

Private investments per se is not a bad idea. Imagine where the sector would be if not for the private investments that went into creating new generation capacity when it was badly needed. The problem is that the proposed segregation only half solves the inefficiency and indifference problem plaguing our discoms.

Concern over retail competition

The new suppliers can bring in managerial and operations efficiency in sourcing cheaper power and limiting commercial losses due to faulty billing and collection; but the issues which are due to sub-standard quality of distribution infrastructure may still remain and haunt the consumers.

Said Neeraj Menon: “Enabling retail competition is well-meaning, but this will indirectly worsen the existing discoms’ operations and financial situation, for which there is no conclusive solution in light.”

Dr. R. Srikanth, Professor & Dean, National Institute of Advanced Studies ( NIAS) Bangalore, has similar apprehensions. “I am unable to understand the reason for carriage and content separation, when even broadband TV/internet service providers in India do not share the same cable in multi-storey apartments. How can the incumbent state-owned discom with the assets on ground maintain them efficiently once their profitable consumers are enticed to switch by the private discom in the same areas?”

Another counterpoint is that this provision of multiple suppliers already exists in some form - under the name ‘open access’ - and has not turned out to be a success. As per existing rules, select large consumers can decide to take their supply from any source using the discoms’ infrastructure. They have to pay certain charges (such as cross-subsidy surcharge, additional surcharge and wheeling charges) to the discom to make up for its loss of cross-subsidy collection and to pay for use of its infrastructure.

Similar treatment of charging exiting consumers who switch supplier, for cross-subsidy and other losses or inefficiencies of the existing discom, may not result in a different outcome. One wonders why the fate of multiple suppliers would be any different than for open access. This lacuna could have been addressed to some extent via direct benefit transfer of cross-subsidy to consumers - a provision that was present in earlier drafts of the Bill, but has been subsequently removed.

Service obligations, purchase agreements

Yet another missing piece is the treatment of universal service obligation (USO) of discoms and the long-term power purchase agreements (PPAs) that they are already tied into. Would the new suppliers share USO responsibility with existing discoms and how much freedom they would have in sourcing power from alternative sources other than existing PPA generators, is unaddressed for the time being.

Industry experts also have doubts on further centralisation and scope of reforms.

“Federal regulation and overreach is not a panacea for all ills - for instance grant of distribution licenses from the CERC may turn out to be problematic. Additionally, some provisions may be practically unfeasible or difficult to implement, such as reduction in time for processing tariff petitions, sale of power to third parties in case of insufficient or absent payment security etc,” Menon said.

“What is missing besides the central versus state control debate, is that aspects related to how to bring in a higher share of renewable energy in the mix and increased digital technology penetration of power management of the utility business to the policies rather than mandate under the law,” said Kumar of PTC.

Similar views are echoed by Reji Kumar Pillai, who is the President of India Smart Grid Forum, a public-private partnership initiative of the government of India.

“India has a target of 500 GW renewable energy by 2030. The grid with more than 50% of intermittent renewable energy resources requires entirely different set of tools and operating philosophy which is not delineated in the new Bill. It should encourage important interventions to make the grid more flexible, such as peer-to-peer trading of green electricity, kWh-scale renewable energy certificates to be traded in near-real time on blockchain platforms, carbon markets, stronger regulations to displace diesel generating sets with battery energy storage systems and others,” Pillai said.

Calling for fresh thinking in the context of energy transition challenges, Pillai said: “The new electricity bill is in the work for the last 10 years and had several revisions. The authors of the new Bill are the usual suspects with baggage of the 20th century grid era. The evolving grid of 21st century is witnessing two-way power flows. The Bill is oblivious of the digitisation and cyber security related aspects and needs a thorough review to make it appropriate for the new age digital utilities.”

Srikanth of NIAS suggests a complete rethink. “It is more efficient to privatise the loss-making discoms through the PPP mode and see how they perform in areas with large subsidised power consumption. Maybe this process can start in Bharatiya Janata Party-ruled states so that there is some political and administrative support for the PPP partner to implement the necessary measures to enhance billing and collection efficiencies. This must, however, be accompanied by truly independent regulators since the current set of electricity regulators are beholden to the state/central government to protect the interests of the government companies even at the expense of the public.”

Reforms during turbulent times

Those who remember the Y2K problem may have not so fond memories of long summer afternoons with electric supply cuts aka load shedding by state electricity boards. Although we have come way ahead from those times, quality and reliability of electric supply is still problematic, especially in rural areas where the average hours of power outage is significantly higher as compared to urban centres.

Our need for energy is growing fast and the global price pressures on fuel, especially coal and natural gas, has had an impact on India’s electricity generation tariffs too. Ensuring domestic energy security takes precedence in these turbulent times of global political unrest and a looming recessionary scare is the number one priority. India has already achieved the necessary infrastructure growth on the generation side, and is expected to see more investments in clean energy going forward.

At the same time, we can’t be maintaining the status quo on the distribution side, which is highly inefficient and a drain on public finances. Not only that, India’s consumers must get the benefits of competition which can bring investments, innovation and fresh thinking into the distribution of electricity.

The Electricity (Amendment) Bill, 2022 is therefore crucial for what it strives to achieve. It is a much-needed reform and therefore voices from all strata of society should be heard and discussed. It is commonly said that in politics the urgent always ousts the important. Distribution reforms are both urgent and important, and the time to act is now.

(Rasika Athawale is Founder, India Energy Insights)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.