New Delhi-headquartered Eicher Motors Limited is set to release its earnings report for the second fiscal quarter of FY25 on November 13. A sharp rise in exports, about 11 percent, is expected to boost the company's sales to double-digit growth rates on a yearly basis.

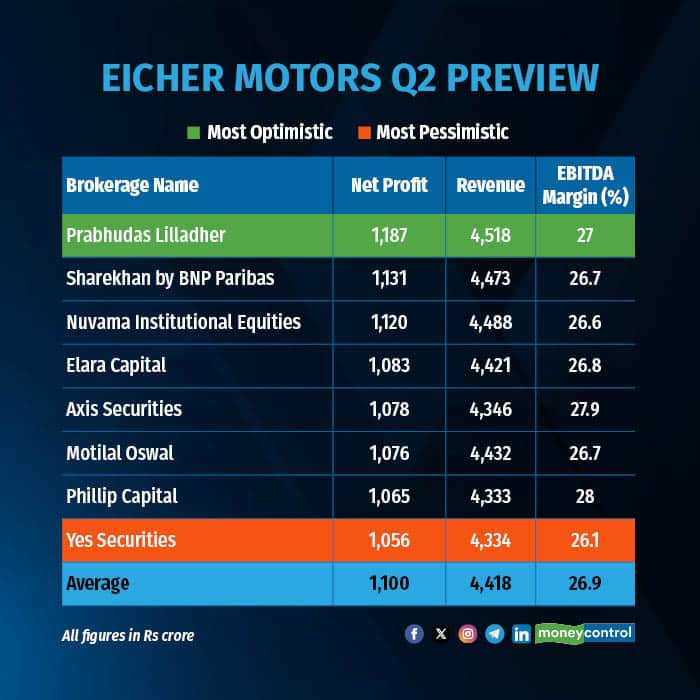

According to a Moneycontrol poll of eight brokerage firms, the Royal Enfield maker is anticipated to record a 12.4 percent year-on-year increase in revenue, reaching Rs 4,418 crore. Net profit is projected to surge 17 percent to Rs 1,100 crore, up from Rs 939 crore in the same quarter of the previous fiscal year.

Also read: 35 smallcaps give double digit return despite broader indices underperform

Total volumes for the quarter stood at 2.27 lakh units, lower by 2.29 lakh units sold in the same quarter of the previous fiscal year.

Earnings estimates from analysts polled by Moneycontrol are in a narrow range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price.

Read more: Divi's Labs Q2 Results: Net profit rises 46% to Rs 510 crore, revenue at Rs 2,338 crore

What factors could affect Eicher Motors' earnings?

Rise in ASPs: While the Royal Enfiled volumes have remained flattish, a rise in average selling prices due to a rich product mix is expected to bode well for the company. Furthermore, price increases undertaken in the last year will also benefit, partly offset by lower domestic sales which slipped 2 percent.

Steady EBITDA: Range-bound raw material prices and better realisation will help expand EBITDA margins. As per the Moneycontrol poll, the EBITDA margin will likely increase by 50 basis points to 26.9 percent during the quarter.

"Increased penetration of 350cc+ motorcycles in its volume shall aid in sustaining and improving the margin profile in the upcoming years. The company is also focusing on increasing its offerings in the 650cc category with a slew of new launches," Prabhudas Lilladher said in a recent note.

Higher A&P Spends: Axis Securities suggests that EBITDA margins, despite a possible rise, would be impacted by a higher sales promotion expenditure during the second quarter of the fiscal.

What to look out for in the quarterly show?

Key things to watch out for are the demand outlook in domestic and overseas markets and new product timelines. The quarter has been shaky for two-wheelers especially after Bajaj Auto trimmed its guidance to 5 percent.

At about 12:20 pm, Eicher Motors shares were trading marginally higher at Rs 4,808 on the NSE. The Eicher Motors stock has gained over 15 percent since the start of the year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.