The broader indices underperformed the main indices, with BSE Smallcap index fell more than 1 percent in the week ended November 8. During the week, the benchmark indices witnessed extreme volatility, amid weak Q2 earnings, persistent FII selling, ignoring rate cut by Bank of England and Federal Reserve in their latest meeting.

This week, BSE Sensex was down 237.8 points or 0.29 percent to end at 79,486.32, while the Nifty50 index was down 156.15 points or 0.64 percent to close at 24,148.20.

The BSE Large-cap Index, BSE Mid-cap Index and BSE Small-cap indices fell 0.7 percent, 0.4 percent and 1.3 percent, respectively.

Among sectors, Nifty Realty index shed more than 4 percent, Nifty Media fell 3.2 percent, Nifty Energy index declined 3 percent, Nifty Oil & Gas index was down nearly 2 percent. On the other hand Nifty Information Technology index added 4 percent, and Nifty PSU Bank index rose 1 percent.

Foreign Institutional Investors (FIIs) continued their selling in the month of November also as they sold equities worth Rs 14,485.12 crore during the week. On the other hand, Domestic Institutional Investors (DII) bought equities worth Rs 9,239.03 crore.

"The Nifty-50 Index and Sensex were flat to marginally negative in the past week, while the mid-cap index lost around 0.45% and small-cap index lost 1.3% underperforming large-caps. Indian Markets underperformed most global markets as markets grappled with slowing macro and weak micro conditions. Meanwhile, the Q2FY25 earnings season continued to remain weak, with more misses than hits observed," said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"Global market sentiment saw sharp volatility in the aftermath of Republicans winning all three branches of the US government, resulting in rising US bond yields and the dollar, as well as the US equity markets beating most EMs. Treasury yields had tumbled on Thursday after the Federal Reserve announced a 25-basis points interest rate cut to a target range of 4.50%-4.75%," he added.

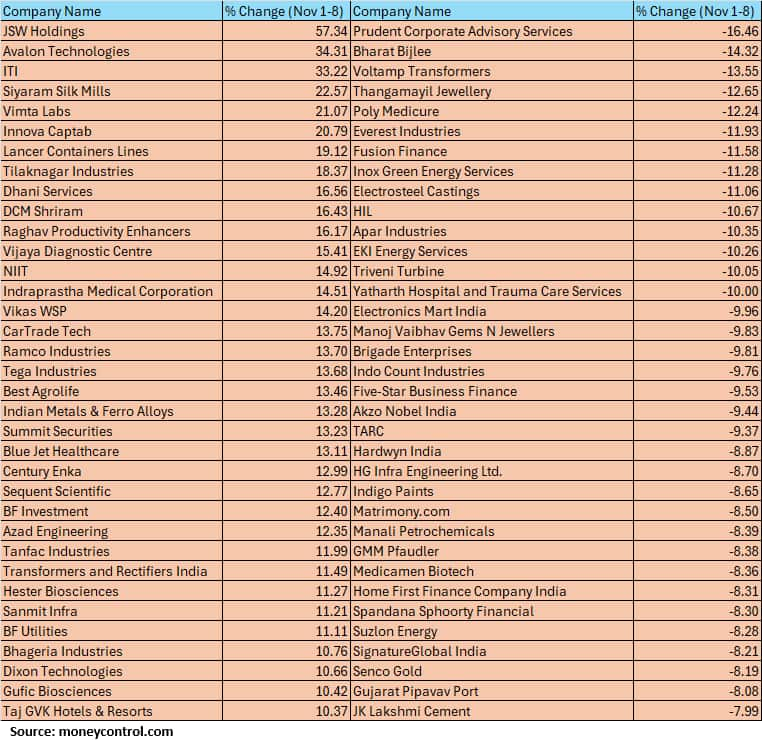

The BSE Small-cap index shed 1.3 percent with Prudent Corporate Advisory Services, Bharat Bijlee, Voltamp Transformers, Thangamayil Jewellery,Poly Medicure, Everest Industries, Fusion Finance, Inox Green Energy Services, Electrosteel Castings, HIL, Apar Industries, EKI Energy Services, Triveni Turbine, Yatharth Hospital and Trauma Care Services falling between 10-16 percent.

On the other hand, JSW Holdings, Avalon Technologies, ITI, Siyaram Silk Mills, Vimta Labs, Innova Captab, Lancer Containers Lines, Tilaknagar Industries,Dhani Services, DCM Shriram, Raghav Productivity Enhancers, Vijaya Diagnostic Centre added between 15-57 percent.

The 24,000 level is expected to serve as strong support for the index. If it holds above this level, Nifty bulls may still have an opportunity to regain momentum. However, a break below 24,000 could further weaken the market.

The RSI indicator remains in a positive crossover, indicating that short-term momentum is likely to stay strong. In the near term, the index may recover toward 24,500, but a dip below 24,000 could lead to a market correction.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP ParibasOn the daily charts we can observe that the Nifty is in the process of retracing the rise it witness from 23800 to 24500. Currently it is trading around the 61.82% Fibonacci retracement level (24090) which is likely to provide support and holding which can lead to resumption of upmove. A break below 23970 is likely to weaken the structure.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesA long negative candle was formed on the daily chart. The crucial overhead resistance of 24500 remained intact and the market was not able to sustain above the resistance area. Though, technically this candle pattern not showing any signs of bigger decline from here but some more consolidation or minor dip is expected towards 23800 or slightly lows.

The short-term trend remains dicey with short-term volatility in the market. Until Nifty surpasses above 24500 levels, meaningful upside rally is not expected. At the lows, the Nifty could find support around 23800 levels.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.