Banks’ provisional business updates for the July-September quarter suggest that loan and deposit growth continues to be robust.

Banking analysts and industry experts said the trend is likely to continue even in the upcoming quarters, despite worsening global macro headwinds and the central bank’s tightening monetary policy regime.

“Over the medium term, a well-capitalised balance sheet, improving loan growth and lower credit cost forecast are positive catalysts that should allow valuation multiples to improve as macro stability returns,” said Nilanjan Karfa, an analyst at brokerage house Nomura.

In this context, three narratives—banks’ current account savings account (CASA)-dominant compounding franchises, earnings geared to growth, and lower credit cost—will likely play out, said Karfa.

Also read: Bank lending rates set to rise further on expected RBI tightening, say experts

Numbers game

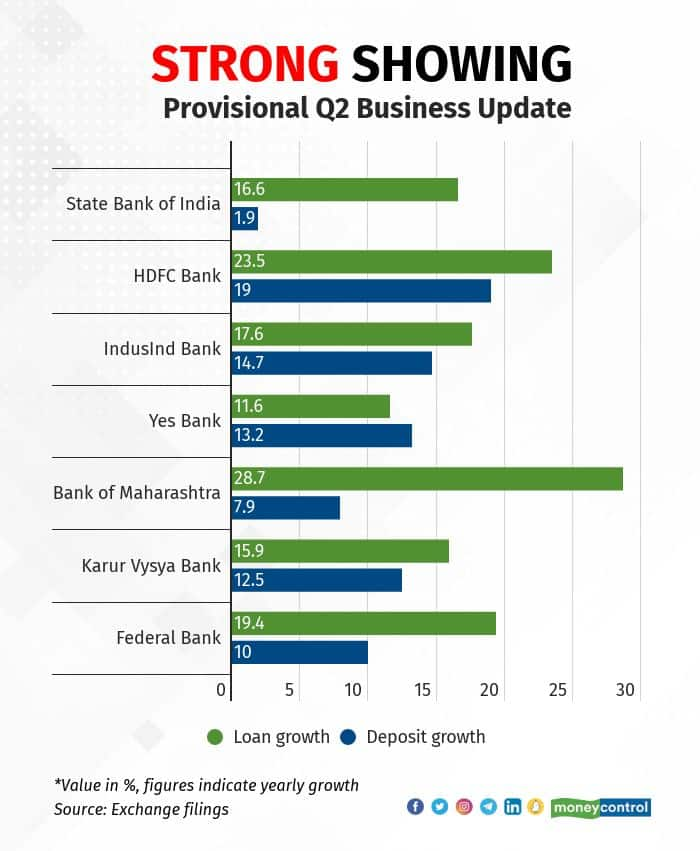

Banks’ July-September business updates paint a rosy picture for the sector. Top banks, including State Bank of India, HDFC Bank, IndusInd Bank and Yes Bank, have reported a double-digit increase in loan growth for the July-September quarter on a year-on-year basis. Deposit growth has also been strong.

HDFC Bank, for instance, reported a 23.5 percent increase in loans and advances year on year in the July-September quarter. On a quarter-on-quarter basis, loan growth increased by just over 6 percent. The deposit base grew 19.5 percent on-year.

IndusInd Bank, too, said its advances rose 17.6 percent and 4.7 percent on a yearly and quarterly basis, respectively. Deposits grew at 13.2 percent on a year-on-year basis.

State Bank of India, the country’s largest lender, said its advances stood at Rs 67,981 crore in the fiscal second quarter, up 16.6 percent on a year-on-year basis and just over 5 percent on a quarterly basis. Deposits were at Rs 88,503 crore, up 1.9 percent year on year.

Relatively smaller peers Federal Bank, Bank of Maharashtra and Karur Vysya Bank reported a similar trend as seen in the chart below.

Not just banks, mortgage lender HDFC was also party to the trend. HDFC’s assigned loans stood at Rs 9,145 crore in the July-September quarter, up 28.2 percent on a year-on-year basis. Individual loans sold were at Rs 34,513 crore, up about 27 percent on a year-on-year basis.

What’s driving loan growth?

Indian banks are recovering from the COVID-19 crisis, which rendered many Indians jobless. Now that the economy is recovering, credit offtake has improved significantly. According to RBI data, bank credit registered a yearly growth of 16 percent in August. Also, the July-September quarter numbers come on the back of a low base.

Now that the festive season is around the corner, analysts expect banks to capitalise on higher spending and report healthy credit growth in the upcoming quarters as well.

“We expect strong (credit) growth for banks. System credit is at 16 percent, this is likely to translate into strong growth for banks,” said Hemali Dhame, associate vice president–research, at Kotak Securities. “There has been better credit utilisation driven by MSMEs, strong personal loan growth, credit cards and housing.”

“We expect festive season credit growth to be healthy, too. We expect healthy credit growth trends for the year,” added Dhame.

According to Punit Patni, an analyst at Swastika Investmart, a rise in spending, the opening up of the economy as the coronavirus pandemic eases, strong housing and real estate demand, government spending, the thrust on infrastructure, and high capacity utilisation levels are some of the reasons that explain the improved credit growth.

“Following the normalisation of COVID effects, the banking sector is experiencing positive growth momentum, which is expected to last for the next few quarters,” added Patni. “The impending festival season will be the icing on the cake as retail spending and credit demand remain strong.”

Credit demand is expected to stay robust despite four successive rate hikes by the Reserve Bank of India (RBI), said analysts. The RBI’s Monetary Policy Committee (MPC) has increased rates by 190 basis points since May to quell inflationary pressure . Rate cues from the RBI are transmitted in the banking system when lenders adjust their lending and deposit rates.

Moneycontrol reported on October 3 that even though lending rates are edging higher, bankers and analysts do not expect the rate hike cycle to curb demand for loans.

Also read: Banks’ loan book to grow 14-15% YoY in FY23; GNPAs seen at 5% by March end, analysts say

Deposit mobilisation to continue

To fund the credit growth, analysts expect banks to mobilise deposits, especially in the wake of banking surplus liquidity tightening at a faster pace.

Already, lenders such as Axis Bank, DCB Bank, ICICI Bank and RBL Bank have increased fixed deposit (FD) rates following the RBI rate hike. RBI Governor Shaktikanta Das, in his post-policy briefing, said there would be more traction with regard to the adjustment of deposit rates, going forward.

“We expect a rate war sort of situation to mobilise deposits, especially in the mid- and small-sized banking segment,” said Swastika Investmart’s Patni. “However, banks with high CASA share, high liquidity coverage, and low credit-to-deposit ratios are better positioned to navigate the upcoming liquidity dearth.”

Kotak Securities’ Dhame concurred with Patni. “Deposit mobilisation is likely to be the way forward,” she said. Banks have raised deposit rates since the rate hike cycle has begun but not commensurate with the hikes in repo. We believe there is more scope for deposit rate hikes and mobilisation thereof.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.