After a strong close in July, Bulls maintained their hold on D-Street as both S&P BSE Sensex and Nifty50 touched their fresh record highs respectively on Wednesday ahead of the crucial outcome from monetary policy committee (MPC) later today.

The Nifty50 pared gains after rallying to its fresh record high of 10,137.85 but over 100 stocks in the futures segment are trading well above their short term and long term moving averages which suggest a strong upward trend in the stocks.

"Nifty continued the momentum making a green candlestick pattern and confirming the uptrend in place. Resistance comes at 10200 while after that at 10300 while support is seen at 9950 - 10050 as a fresh base. We continue to have buy on dips as strategy," Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

As much as 119 stocks are trading well above its 200 simple moving average (SMA), 50-SMA, and 20-SMA which includes stocks like SBI, Ashok Leyland, JP Associates, ICICI Bank, Bharat Electronics, Vedanta, NTPC, Tata Steel, Escorts, Wipro, Infosys, RIL etc. among others.

A 200-days simple moving average (SMA) is often used by most traders to determine the long term trend of the stock or an index. If the price is trading above the 200-DMA then the level is considered as an important support for the index/stock.

As long as the stock is trading above this average, it is considered to be in an overall uptrend. But, 200-DMA is not a standalone measure to determine the direction of the trend, it is used in conjuncture with other short term moving averages such as 50-SMA and 20-SMA.

Short term moving averages such as 50-SMA is a common moving average plotted by traders as it represents intermediate support and resistance levels for the index or stocks.

In a sustained uptrend, the price generally remains over 50-SMA. The Nifty50 index remained above its 200-DMA and 50-DMA since January 2017. The index moved above its 50-DAM on 5 January and since then it has maintained the trajectory.

The Nifty50 has crossed the recent high of 10,114.80 and hit a fresh record high of 10,137.85. This indicates that the index is going for wave extension on the upside and the trend is clearly in favour of the bulls as long as it holds 9900-9950.

“The daily upper Bollinger Band is stretching towards the north along with the price action. Hence, the short term target continues to be at 10,380. On the flip side, swing low of 9944 becomes a crucial support for the benchmark index,” Gaurav Ratnaparkhi, Senior Technical Analyst at Sharekhan told Moneycontrol.

“On the daily chart the Nifty is above the 20-day moving average (DMA) and the 40-DEMA, i.e. 9886 and 9773 respectively. The momentum indicator is in bullish mode on the daily chart,” he said.

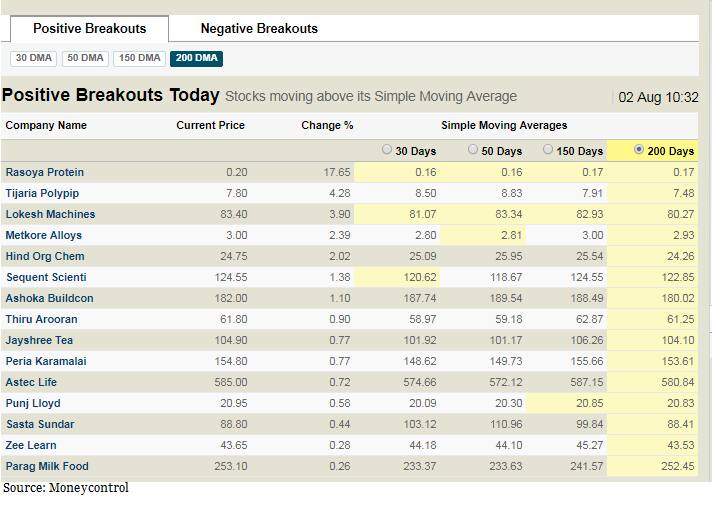

15 stocks witnessed positive breakout today:

Top fifteen stocks which recorded positive breakout which means they rose above their respective 200-SMA for the first time across NSE listed stocks include names like Rasoya Protein, Tijaria Polypip, Sequent, Ashok Buildcon, Jayshree Tea, Punj Lloyd, ZEE Learn, and Parag Milk Food etc. among others.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Image 1

To track stock which recorded positive breakout

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.