Nifty Midcap index at record high: 10 stocks that rewarded the MF investors

The Nifty midcap 150 index and Nifty Midcap 100 index hit fresh highs, driven by sustained buying momentum. The mid-cap space is likely to continue moving higher as the fundamentals of the domestic market are healthy, say experts

1/11

While the Nifty 50 is within the kissing distance of its lifetime high, barometers for mid-sized companies, such as the Nifty Midcap 100 and Nifty Midcap 150, have hit all-time highs. The Nifty Midcap 150 index closed at a fresh lifetime high on June 20, at 13,256 points. The midcaps are witnessing a strong bullish run over the last three months as compared to the large-caps. Over the last one year, the Nifty Midcap 150 has gained more than 38 percent, outperforming the Nifty 50 and the Nifty Smallcap 250, which have gained 23 percent and 37 percent, respectively. Experts attribute this rise to the sustained buying momentum, thanks to the improved earnings, reasonable valuations and favourable macros. Siddhartha Bhaiya, Founder and Fund Manager at Aequitas Investment Consultancy, says: “In the last one year, India Inc stood out with its resilience and competence, amidst economic and geopolitical uncertainties. Proactive policy support, government’s focus on infrastructure development, and an agile and responsible monetary policy created the platform for companies to exploit growth opportunities in global as well as domestic markets.”

“While our service industries have always enjoyed a dominant position in global markets, our manufacturing sector is also beginning to make its mark overseas. Capital goods and infrastructure, B2B manufacturing, auto and auto ancillaries are driving returns for investors and attracting funds from both FIIs as well as DIIs,” Bhaiya said.

The mid-cap space is likely to continue moving higher as the fundamentals of the domestic market are healthy. Here are the top 10 stocks from the AMFI (Association of Mutual Funds in India) - defined mid-cap universe that contributed the most to the mutual fund schemes over the last one year.

Source: ACEMF.

“While our service industries have always enjoyed a dominant position in global markets, our manufacturing sector is also beginning to make its mark overseas. Capital goods and infrastructure, B2B manufacturing, auto and auto ancillaries are driving returns for investors and attracting funds from both FIIs as well as DIIs,” Bhaiya said.

The mid-cap space is likely to continue moving higher as the fundamentals of the domestic market are healthy. Here are the top 10 stocks from the AMFI (Association of Mutual Funds in India) - defined mid-cap universe that contributed the most to the mutual fund schemes over the last one year.

Source: ACEMF.

2/11

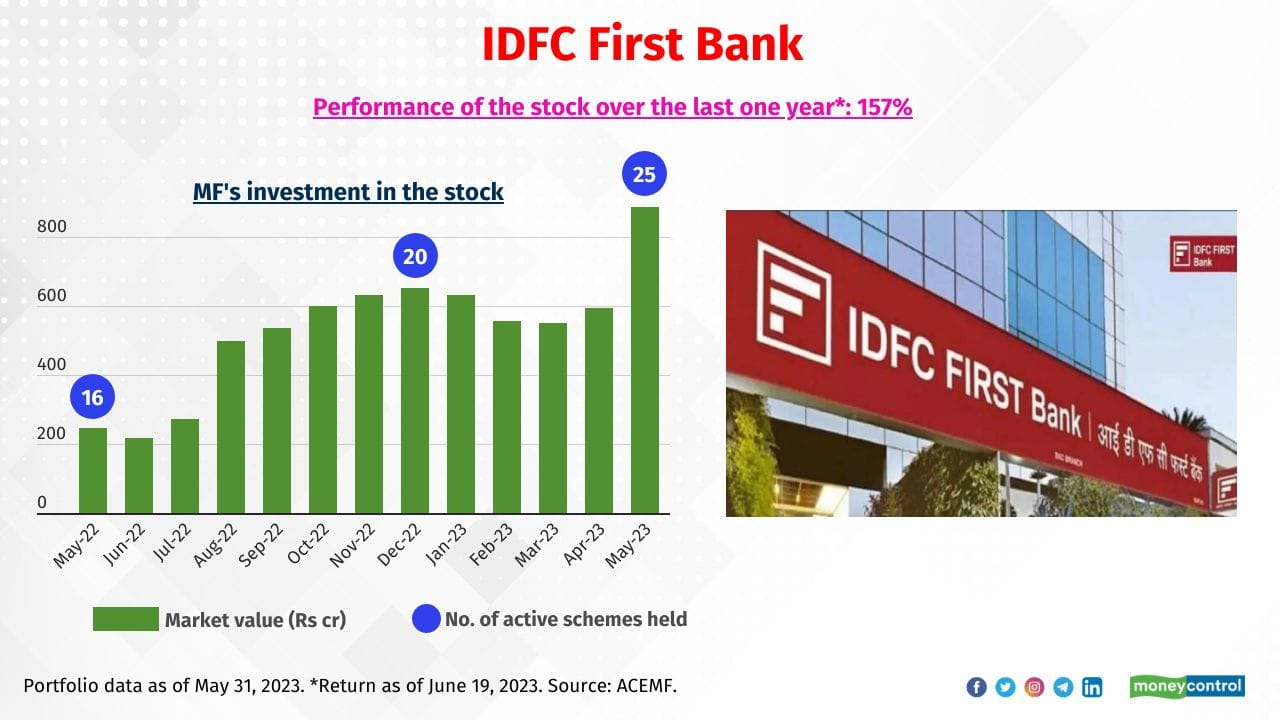

IDFC First Bank

Sample of schemes that held a significant exposure to the stock: Tata Large & Mid Cap and Aditya Birla SL ELSS Tax Relief 96

Sample of schemes that held a significant exposure to the stock: Tata Large & Mid Cap and Aditya Birla SL ELSS Tax Relief 96

3/11

Apollo Tyres

Sample of schemes that held a significant exposure to the stock: HDFC Mid-Cap Opportunities, Kotak Equity Opp and Franklin India Prima Fund

Sample of schemes that held a significant exposure to the stock: HDFC Mid-Cap Opportunities, Kotak Equity Opp and Franklin India Prima Fund

4/11

CG Power and Industrial Solutions

Sample of schemes that held a significant exposure to the stock: Axis Growth Opp, Motilal Oswal Midcap and Bandhan Sterling Value Fund

Also see: 12 new midcap stocks that PMS fund managers picked in May. Do you own any?

Sample of schemes that held a significant exposure to the stock: Axis Growth Opp, Motilal Oswal Midcap and Bandhan Sterling Value Fund

Also see: 12 new midcap stocks that PMS fund managers picked in May. Do you own any?

5/11

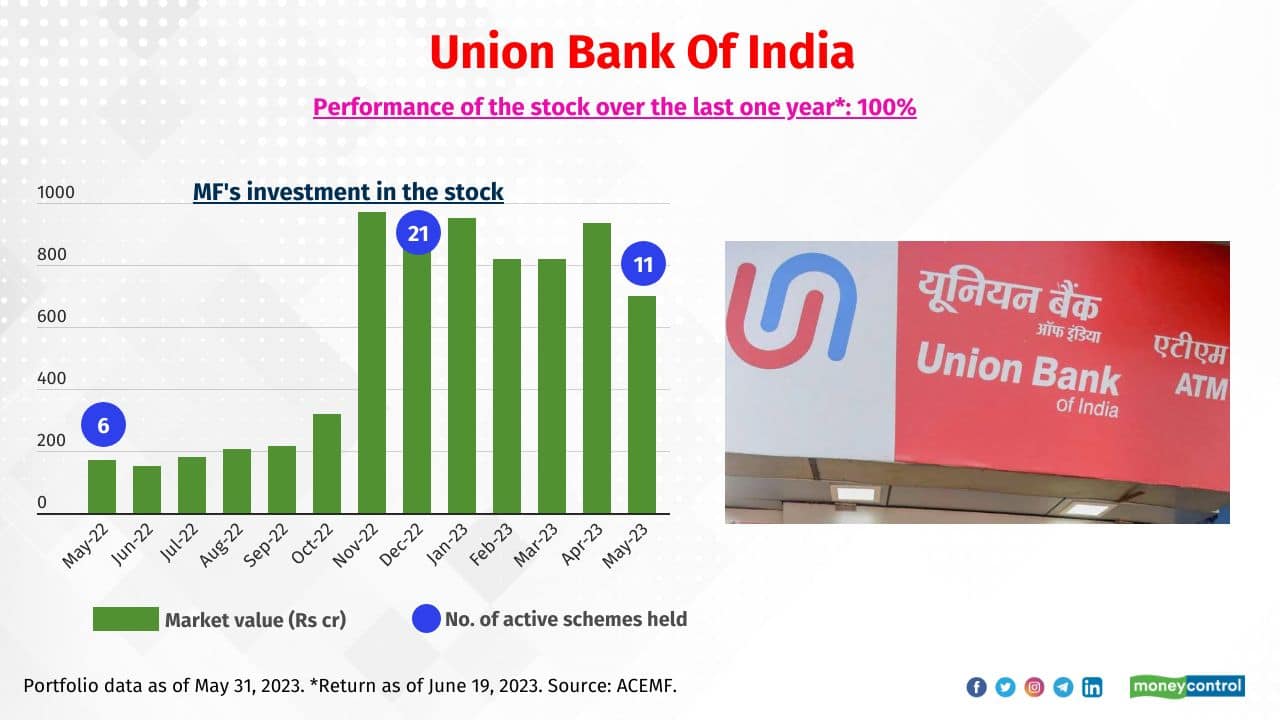

Union Bank Of India

Sample of schemes that held a significant exposure to the stock: HDFC Mid-Cap Opportunities, Quant Active and Bank of India Tax Advantage Fund

Sample of schemes that held a significant exposure to the stock: HDFC Mid-Cap Opportunities, Quant Active and Bank of India Tax Advantage Fund

6/11

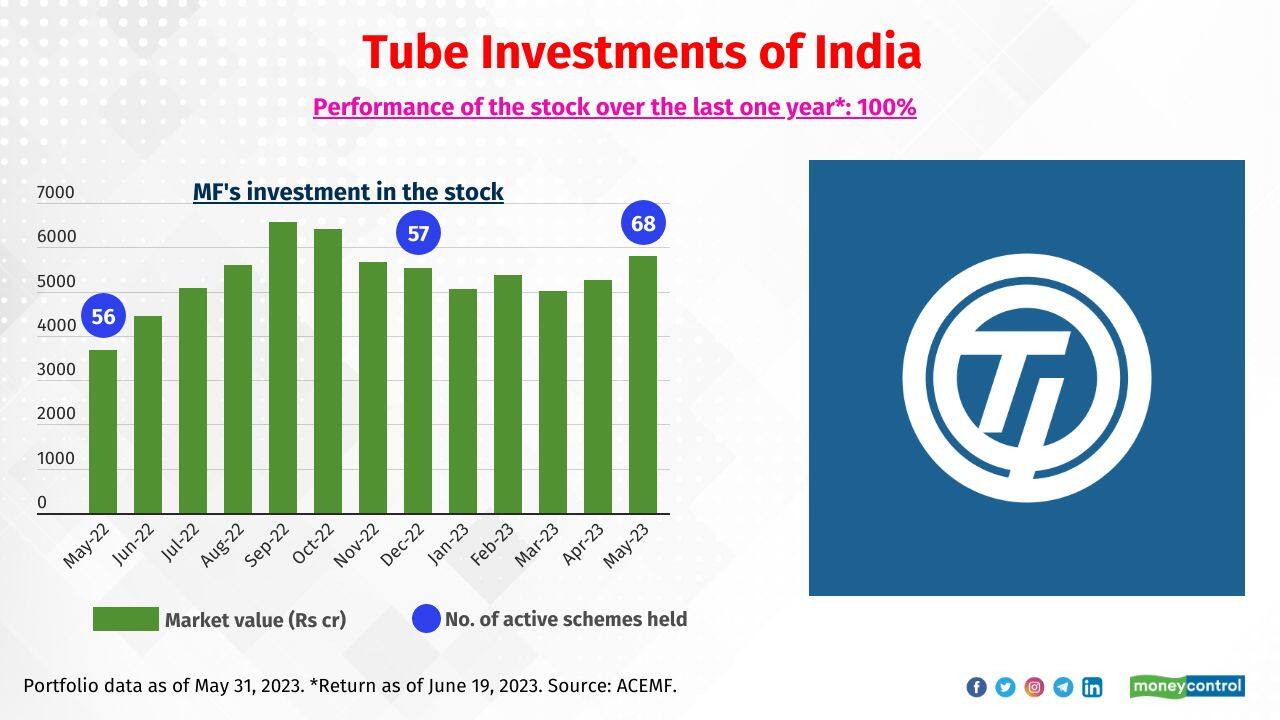

Tube Investments of India

Sample of schemes that held a significant exposure to the stock: Nippon India Small Cap, Motilal Oswal Flexi Cap and Axis Long Term Equity Fund

Sample of schemes that held a significant exposure to the stock: Nippon India Small Cap, Motilal Oswal Flexi Cap and Axis Long Term Equity Fund

7/11

Power Finance Corporation

Sample of schemes that held a significant exposure to the stock: HDFC Balanced Advantage, Nippon India Growth and Mirae Asset Emerging Bluechip

Also read: Motilal Oswal Nifty Microcap 250 Index Fund NFO: Check out these favorite microcap stocks of active MFs, PMSes & AIFs

Sample of schemes that held a significant exposure to the stock: HDFC Balanced Advantage, Nippon India Growth and Mirae Asset Emerging Bluechip

Also read: Motilal Oswal Nifty Microcap 250 Index Fund NFO: Check out these favorite microcap stocks of active MFs, PMSes & AIFs

8/11

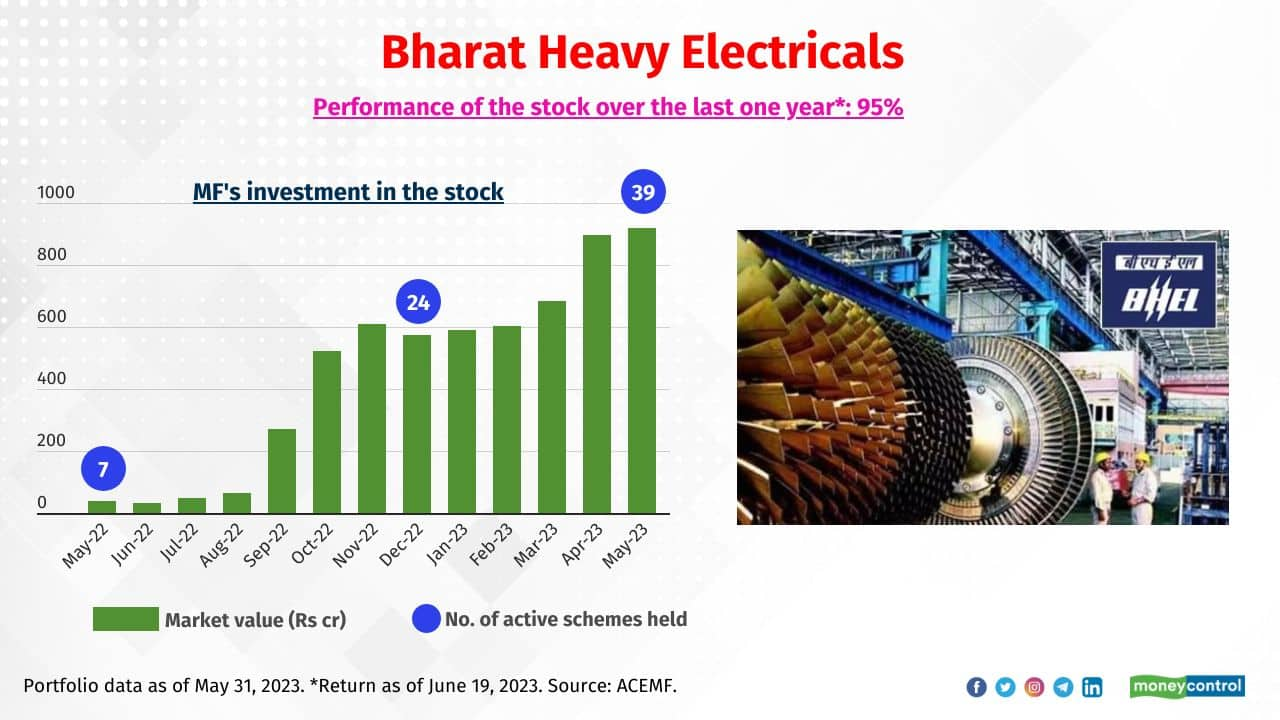

Bharat Heavy Electricals

Sample of schemes that held a significant exposure to the stock: Nippon India Small Cap, Sundaram Large and Mid Cap and Nippon India Growth Fund

Sample of schemes that held a significant exposure to the stock: Nippon India Small Cap, Sundaram Large and Mid Cap and Nippon India Growth Fund

9/11

Indian Bank

Sample of schemes that held a significant exposure to the stock: HDFC Small Cap, HSBC Small Cap and Edelweiss Mid Cap Fund

Sample of schemes that held a significant exposure to the stock: HDFC Small Cap, HSBC Small Cap and Edelweiss Mid Cap Fund

10/11

Bank Of India

Sample of schemes that held a significant exposure to the stock: SBI Banking & Financial Services, Aditya Birla SL Pure Value and Aditya Birla SL Small Cap Fund

Sample of schemes that held a significant exposure to the stock: SBI Banking & Financial Services, Aditya Birla SL Pure Value and Aditya Birla SL Small Cap Fund

11/11

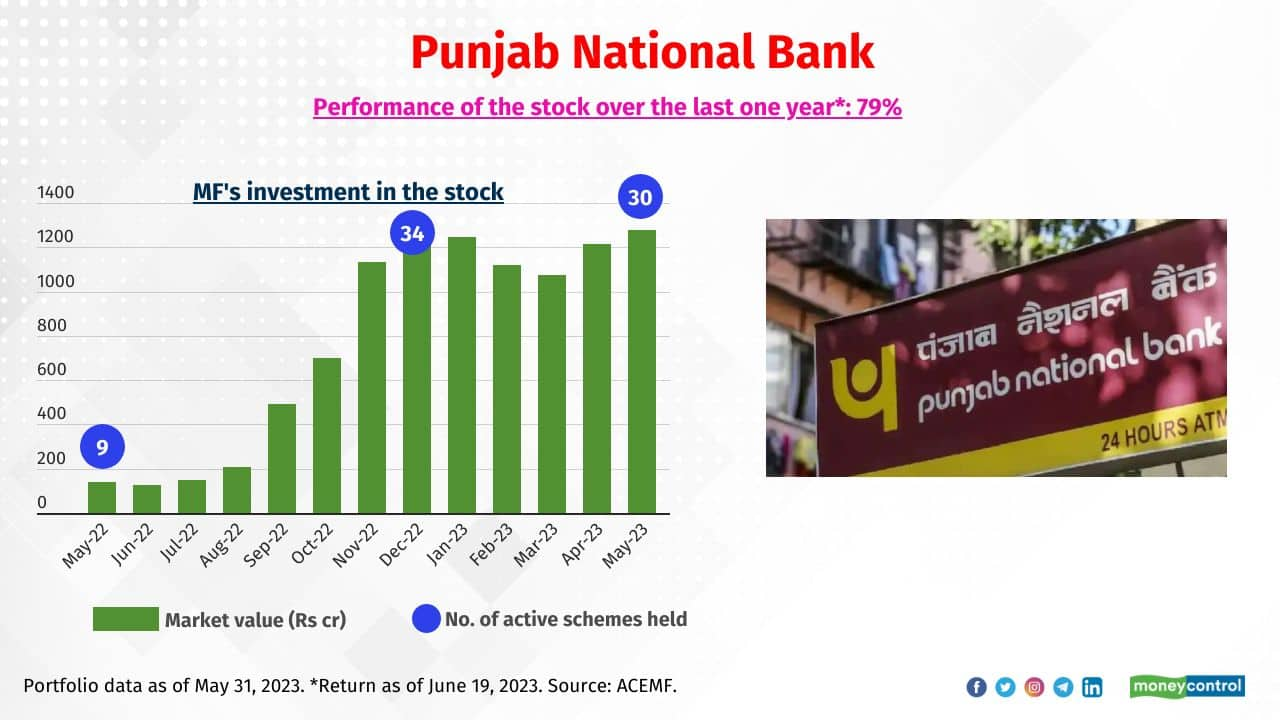

Punjab National Bank

Sample of schemes that held a significant exposure to the stock: SBI Contra, Quant Small Cap and Kotak Balanced Advantage Fund

Also see: Cautious of market highs, these large-caps exit MF portfolio

Sample of schemes that held a significant exposure to the stock: SBI Contra, Quant Small Cap and Kotak Balanced Advantage Fund

Also see: Cautious of market highs, these large-caps exit MF portfolio

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!