Headline indices Sensex and Nifty logged strong gains on July 28 as sentiment was underpinned by the expectation that the US Fed would maintain its dovish policy stance which will result in liquidity inflow in emerging markets like India.

Sensex closed with a strong gain of 558 points, or 1.47 percent, at 38,492.95 and Nifty settled at 11,300.55, up 169 points or 1.52 percent.

"Nifty has given a consolidation breakout of the last five trading sessions, by having a decisive close above immediate hurdle of 11,250. Now, it can extend its move towards 11,500 while key support exists at 11,150. The market is likely to be volatile this week, given the US Fed monetary policy on Wednesday and F&O monthly expiry on Thursday,” said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,195.33, followed by 11,090.17. If the index moves up, the key resistance levels to watch out for are 11,361.73 and 11,422.97.

Nifty Bank

The Nifty Bank index closed with a gain of 1.17 percent at 22,105.20. The important pivot level, which will act as crucial support for the index, is placed at 21,733.39, followed by 21,361.6. On the upside, key resistance levels are placed at 22,354.99 and 22,604.8.

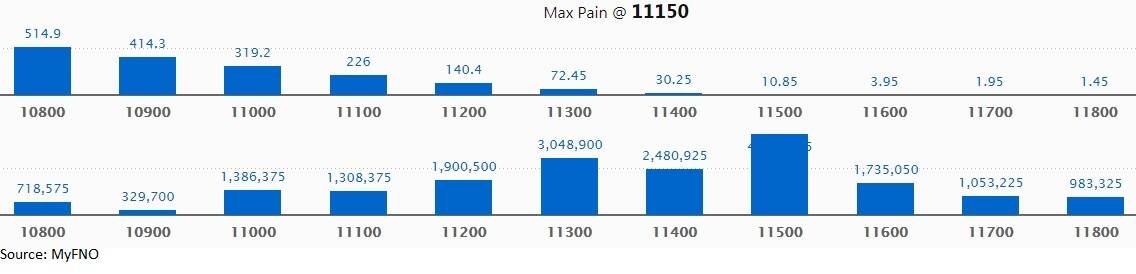

Call option data

Maximum call OI of nearly 43 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the July series.

This is followed by 11,300, which holds 30.49 lakh contracts, and 11,400 strikes, which has accumulated 24.81 lakh contracts.

Call writing was seen at 11,300, which added 1.56 lakh contracts.

Call unwinding was seen at 11,200, which shed 19.89 lakh contracts, followed by 11,700 strikes, which shed 15.1 lakh contracts.

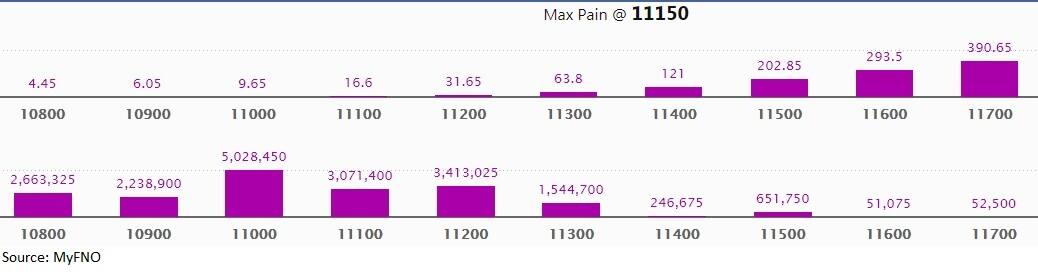

Put option data

Maximum put OI of 50.28 lakh contracts was seen at 11,000 strike, which will act as crucial support in the July series.

This is followed by 11,200, which holds nearly 34.13 lakh contracts, and 11,100 strikes, which has accumulated 30.71 lakh contracts.

Significant put writing was seen at 11,200, which added 22.13 lakh contracts, followed by 11,300 strikes, which added 13.28 lakh contracts.

Put unwinding was witnessed at 11,500, which shed 56,400 contracts.

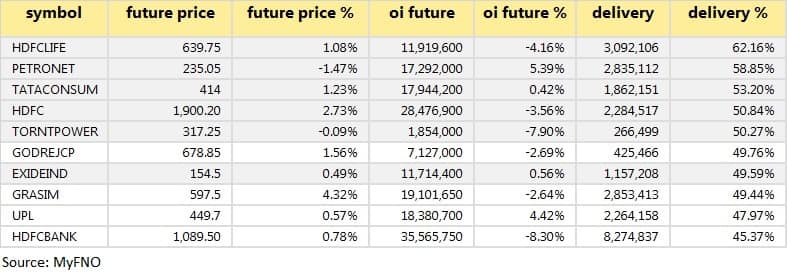

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

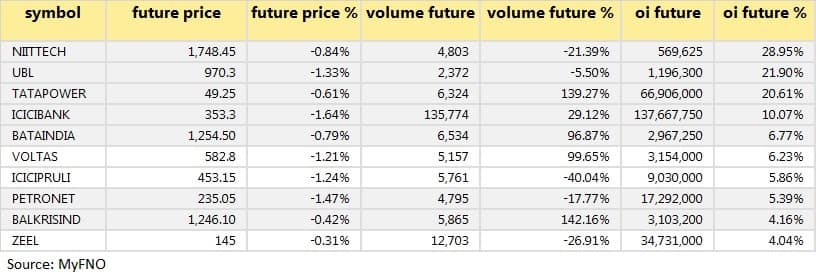

37 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

19 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

17 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

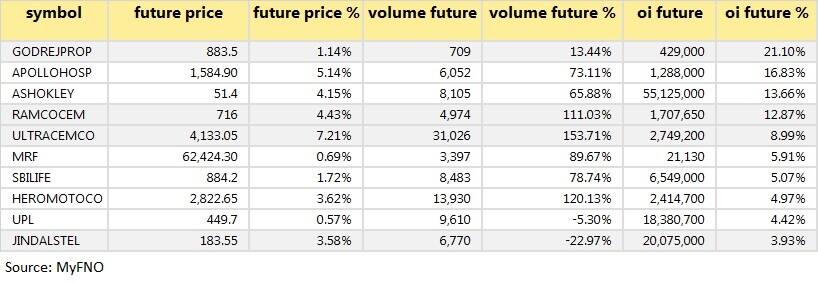

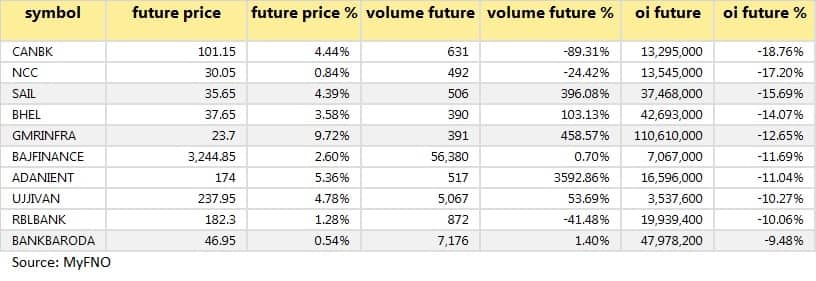

70 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

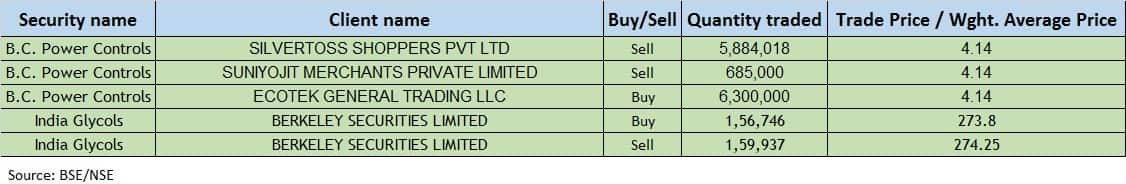

Bulk deals

(For more bulk deals, click here)

Results on July 29

Bharti Airtel, Maruti Suzuki India, Dr Reddy's Laboratories, TVS Motor Company, InterGlobe Aviation, Ansal Housing, Bombay Burmah Trading Corp, Carborundum Universal, CEAT, Chambal Fertilisers, Colgate-Palmolive, Genus Power Infrastructures, GSK Pharmaceuticals, GMM Pfaudler, Heritage Foods, Indian Energy Exchange, Indowind Energy, JK Paper, JMT Auto, Mahindra Lifespace Developers, Manappuram Finance, Mastek, Navin Fluorine International, Omaxe, Rail Vikas Nigam, Sagar Cements, Sasken Technologies, Security and Intelligence Services (India), Snowman Logistics, etc.

Stocks in the news

Yes Bank Q1: Profit at Rs 45.4 crore versus Rs 113.8 crore, NII at Rs 1,908.2 crore versus Rs 2,280.6 crore YoY.

Hexaware Q2: Profit at Rs 152.4 crore versus Rs 174.9 crore, revenue at Rs 1,569.1 crore versus Rs 1,541.7 crore QoQ.

Nestle India Q2: Profit at Rs 486.6 crore versus Rs 437.8 crore, revenue at Rs 3,050.5 crore versus Rs 3,000.8 crore YoY.

IndusInd Bank Q1: Profit at Rs 460.6 crore versus Rs 1,432.5 crore, NII at Rs 3,309.2 crore versus Rs 2,844 crore YoY.

RBL Bank Q1: Profit at Rs 141.2 crore versus Rs 267.05 crore, NII at Rs 1,041.3 crore versus Rs 817.32 crore YoY.

IDBI Bank Q1: Profit at Rs 144.3 crore versus loss of Rs 3,800.8 crore, NII at Rs 1,773.4 crore versus Rs 1,457.73 crore YoY.

Castrol India Q2: Profit at Rs 65.4 crore versus Rs 182.7 crore, revenue at Rs 490.6 crore versus Rs 1,039.6 crore YoY.

NIIT Technologies Q1: Profit at Rs 79.9 crore versus Rs 113.6 crore, revenue at Rs 1,057 crore versus Rs 1,109.3 crore QoQ.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 245.95 crore while domestic institutional investors (DIIs) sold shares worth Rs 1,017.4 crore in the Indian equity market on July 28, provisional data available on the NSE showed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.