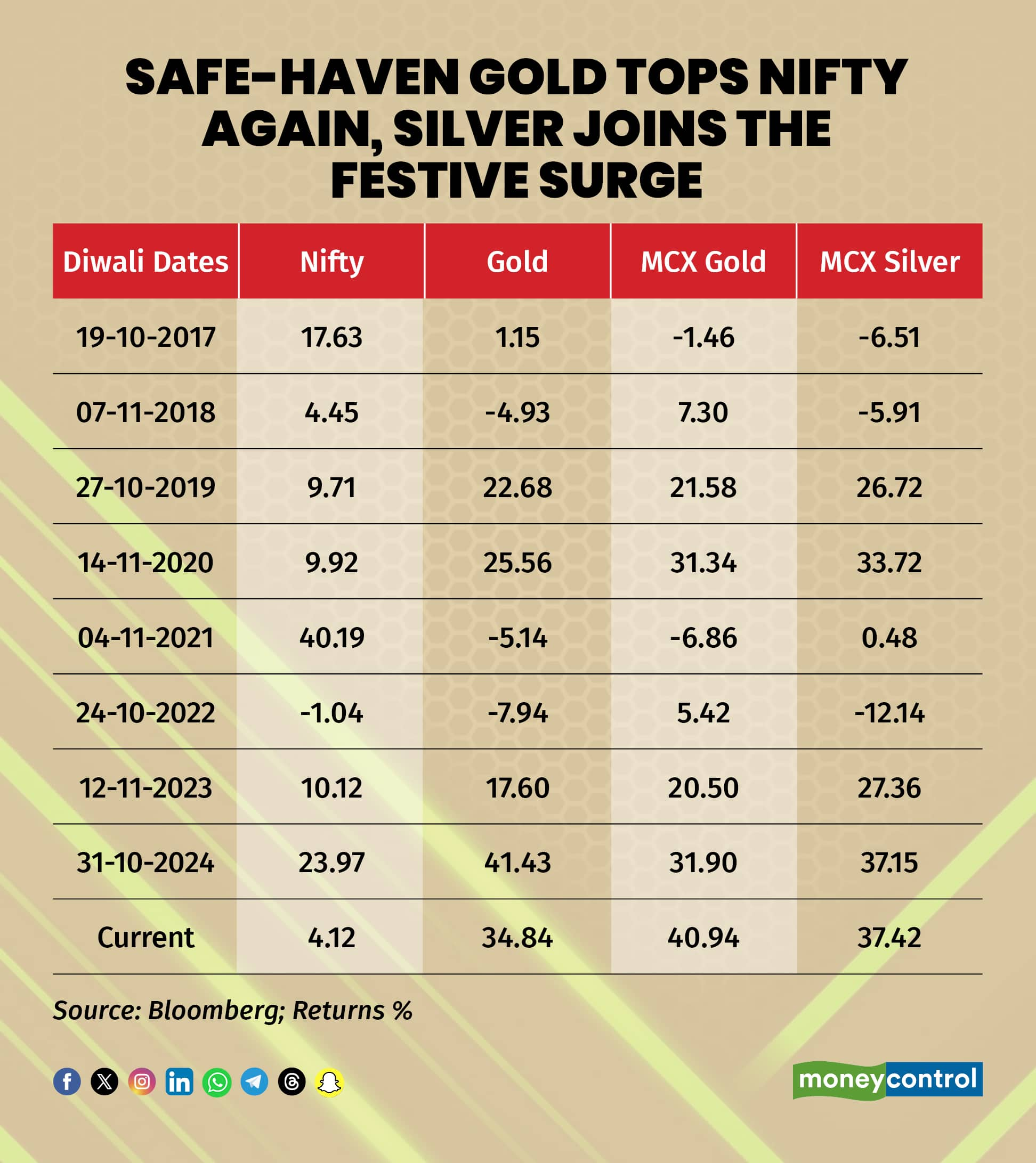

Gold has once again eclipsed Indian equities, marking its fourth straight year of superior Diwali-to-Diwali returns. Over the last eight years, the yellow metal has outperformed equities in seven, cementing its reputation as the go-to safe haven. Analysts caution investors not to be surprised if the trend extends through the next festive cycle.

MCX gold has rallied 40 percent since last Diwali, compared with a modest 5 percent rise in the Nifty 50. In 2024 alone, Diwali-to-Diwali returns show a 32 percent surge in gold against a 24 percent gain in the benchmark Nifty, while in 2023, gold jumped 21 percent versus Nifty’s 10 percent.

Market experts see the winning streak continuing, with Indian equities weighed down by stretched valuations, sluggish earnings growth, persistent foreign investor selling, and tariff-linked geopolitical jitters.

The recent bullion rally has been fueled by a mix of supportive forces — the US Fed’s policy easing, central banks ramping up reserves, and investors seeking havens amid geopolitical strife.

“Gold’s four-year Diwali-to-Diwali winning streak against Indian equities has been impressive. Given the current macro environment, the metal could extend its outperformance for another year, though equities may start narrowing the gap,” said Abhishek Khudania, Senior Executive Director – Wealth, Client Associates.

Experts say central bank accumulation and expectations of further Fed cuts could keep gold on an upward track well beyond the festive season. A structural drift away from the US dollar continues to underpin sentiment, with investors bracing for fresh uncertainty. Silver, meanwhile, is expected to move in lockstep with gold, supported by strong industrial demand in solar panels, semiconductors, and electric vehicles.

Aamir Makda, Commodity & Currency Analyst, Choice Broking, said geopolitics remains a crucial variable. Trade-related disputes, including the ongoing US Supreme Court case on Trump-era tariffs, keep the global trade outlook fragile. Security tensions are also rising, with NATO intercepting Russian jets over Estonia, raising fears of a wider conflict. Against this backdrop, gold’s role as both a hedge and a safe-haven remains firmly in focus.

Foreign brokers are turning more bullish. Goldman Sachs has projected bullion could approach $5,000 an ounce if investors shift even a fraction of their Treasury holdings into gold. Chris Wood, global head of equity strategy at Jefferies, has raised his long-term price target to $6,600 per ounce, citing historical ratios and rising US disposable income. His call comes as gold touched a record $3,700/oz this week before pausing on a hawkish Fed tone.

Silver, too, has extended its outperformance over Indian equities for a third year, emerging as both a defensive asset and a long-term growth play. Analysts believe its dual role will keep it in investor focus alongside gold.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.