The bull run in 2019 might go down as one of the most "hated" rallies as only a handful of stocks attracted the smart money.

The Indian equity market scaled new peaks in 2019 surging about 13 percent. However, the rally was primarily inspired by a few frontliners. These select heavyweights attracted a lot of attention from fund managers or boutique wealth management firms raking in big money from the ultra-rich in 2019.

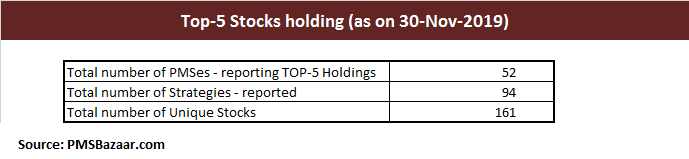

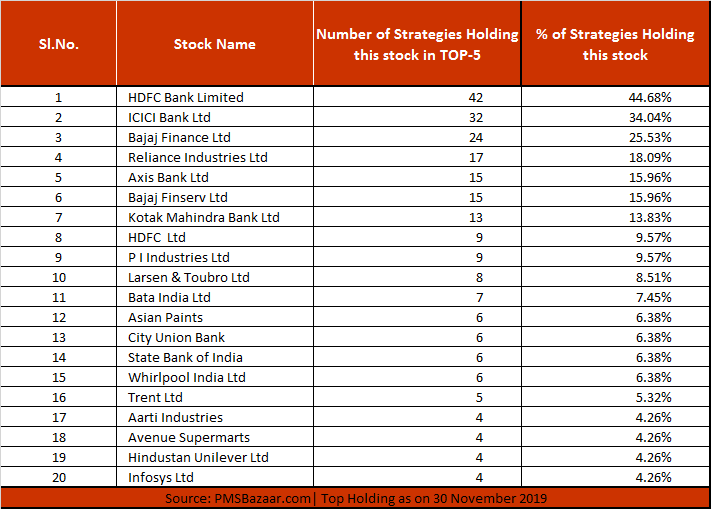

About 13 stocks emerged as favourites among Portfolio Management Schemes (PMSes) as more than 10 funds included them in their portfolio, data from PMS Bazaar, an online portal used for PMS comparison, investment and analytics, showed.

These include index heavyweights such as HDFC Bank, ICICI Bank, Bajaj Finance, RIL, Axis Bank, Bajaj Finserv, and Kotak Mahindra Bank.

Experts say the smart money is going in quality stocks or the ones which are displaying growth potential.

“The market has become very narrow where most of the money moved into top-quality stocks, especially the leader of a particular sector, because despite the slowdown in the economy these top 10-15 stocks manage to continue with their strong earnings,” Amit Gupta, Co-Founder and CEO, TradingBells told Moneycontrol.

Note: The above list is for reference and not buy or sell ideas

Portfolio Management Schemes (PMSes) cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. The professional fee charged by them is slightly higher than regular mutual funds (MFs).

Other stocks that are owned by less than 10 strategies include HDFC, L&T, SBI, Avenue Supermarts, HUL, ITC, Infosys, Jubilant FoodWorks, Berger Paints, Divi’s Laboratories, among others.

The schemes which have delivered maximum returns in the last one year are from the multi-cap category. Multi-Cap category funds are more diversified and include stocks from various market-cap baskets. A typical multi-cap portfolio comprises of stocks from large-cap, midcap, and smallcap space.

IIFL Multicap PMS scheme generated maximum wealth or return for ultra-rich in the one-year period starting from November 2018-November 2019. It recorded 27.76 percent return under the 1-year category, which exceeds returns across all categories, data from PMSBazaar.com showed.

Indian equities after a sharp rally during 2013-17 have largely been in a consolidation mode over the last two calendar years, and much of the consolidation was seen in the small & midcap space.

Experts feel that 2020 could be a year when we could see a catch-up rally in many of the small & midcap names as earnings start to look better with recovery in the Indian economy, so the multi-cap category could do well in the next 12 months.

“There could be earnings and valuation upgrade going ahead as nominal growth is expected to revive from lows which should aid both top-line and bottom-line growth,” Vinay Khattar, Head, Edelweiss professional Investor Research told Moneycontrol.

“2019 was characterized by a Broad-based slowdown in the domestic economy, tight credit conditions, escalating global trade war and muted global growth. Even in such conditions, markets managed to stay afloat though small and mid-caps took a significant beating,” he said.

Khattar further added that 2020 could bring substantial gains in core sectors and undervalued mid and small-cap stocks.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.