Ahead of its results for Q4 FY25, Titan Company shares surged nearly 2 percent on May 8 to trade at Rs 3,395.60. The shares of Asian Paints and Larsen & Toubro (L&T), which are also scheduled to release their respective March quarter earnings today, were trading flat with marginal gains and losses.

Asian Paints shares were trading 0.24 percent lower in the red at Rs 2,328.50 apiece, while L&T shares were trading 0.73 percent higher in the green at Rs 3,345.80 apiece, as seen at 11.55 am.

Around 74 companies are announcing their results for the January-March quarter of the financial year 2025 today. Asian Paints, Larsen & Toubro (L&T), Titan, Britannia Industries, Bharat Forge, Biocon, Canara Bank, Ceigall India, Chambal Fertilisers & Chemicals, Escorts Kubota, IIFL Finance, Jindal Stainless, Kalyan Jewellers, MCX, Muthoot Microfin, Pidilite Industries, Sula Vineyards, Union Bank of India and Zee Entertainment Enterprises are some of the notable names among them.

Titan Company Q4 Preview:

Rakesh Jhunjhunwala’s biggest bet, Titan Company is likely to see an impact on its bottom line amid soaring gold prices and rising competition. According to a Moneycontrol poll of six brokerages, the jewellery player is likely to report a 14.6 percent revenue growth at Rs 12,904 crore. Net profit is likely to come in at Rs 824 crore, jumping 7.1 percent from Rs 786 crore in the corresponding quarter last year.

Titan Company Q4FY25 Preview

Titan Company Q4FY25 Preview

Asian Paints Q4 Preview:

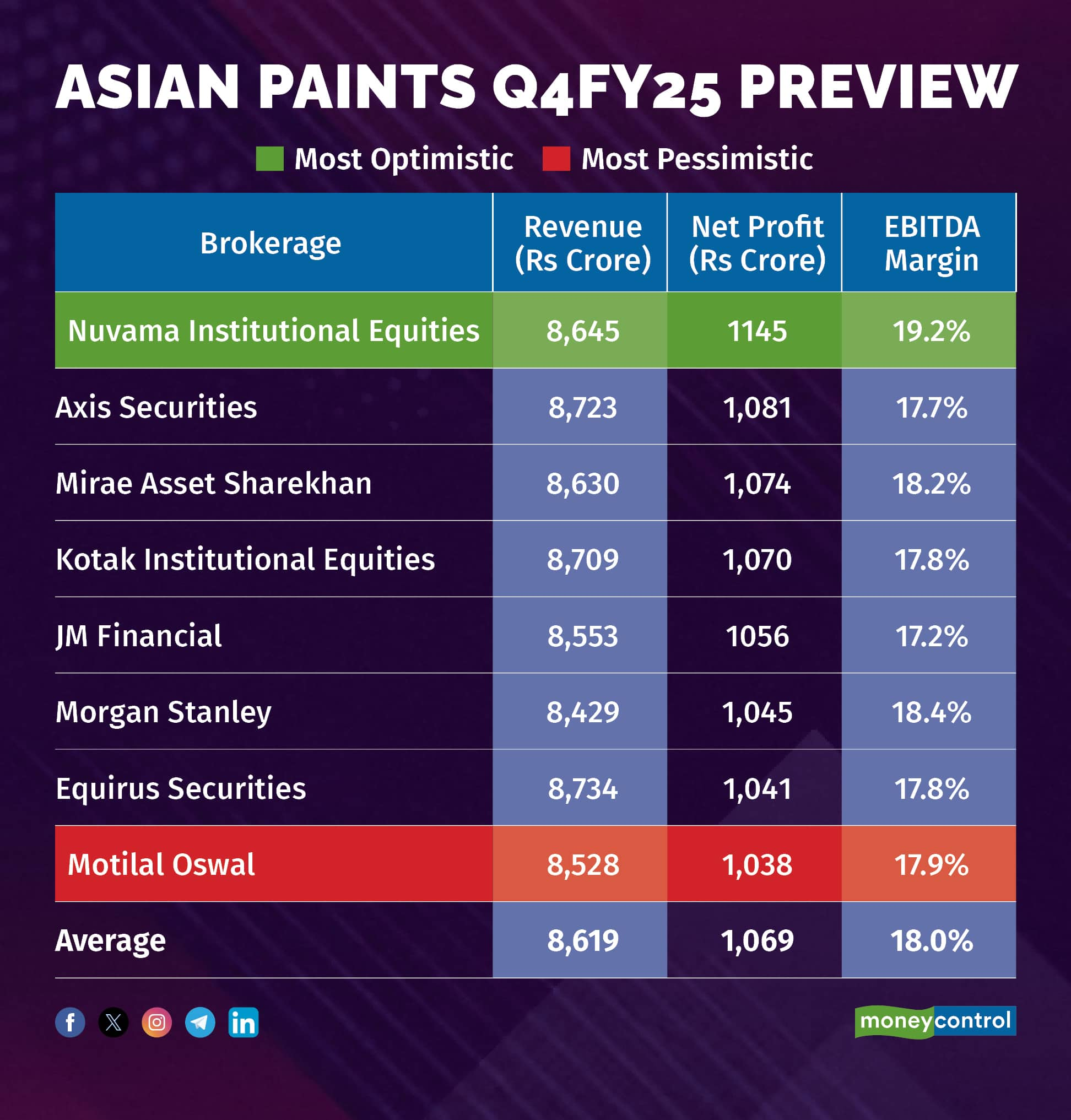

The Q4 results of Asian Paints, India’s largest paint player, is likely to see an impact from muted urban demand, high competition and high operating costs. According to a Moneycontrol poll of 8 brokerages, Asian Paints is likely to report a 1.3 percent on-year fall in revenue to Rs 8,619 crore, down from Rs 8,731 crore reported during the same time last year.

Net profit is likely to fall 15 percent on-year to Rs 1,069 crore, down from Rs 1,257 crore from the corresponding quarter last year.

Asian Paints Q4FY25 Preview

Asian Paints Q4FY25 Preview

L&T Q4 Preview:

Larsen and Toubro (L&T) is expected to continue its growth trajectory in March quarter on the back of strong order inflow. According to the average of a Moneycontrol poll of seven brokerages, the revenue of the construction major is likely to increase nearly 13 percent year-on-year (YoY) to Rs 75,979 crore, up from Rs 67,079 crore in the previous fiscal. Net profit is expected to increase around 10 percent YoY from Rs 4,396 crore. Earnings before Interest, Taxes, Depreciation and Amortisation (EBITDA) margin is expected to increase to around 10.9 percent from 10.8 percent in Q4FY25.

L&T Q4FY25 Preview

L&T Q4FY25 Preview

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.