India’s largest paint player Asian Paints is set to report its earnings for the four quarter of the fiscal year 2025 on May 8. However, muted urban demand, high competition and high operating costs could dampen the company's performance.

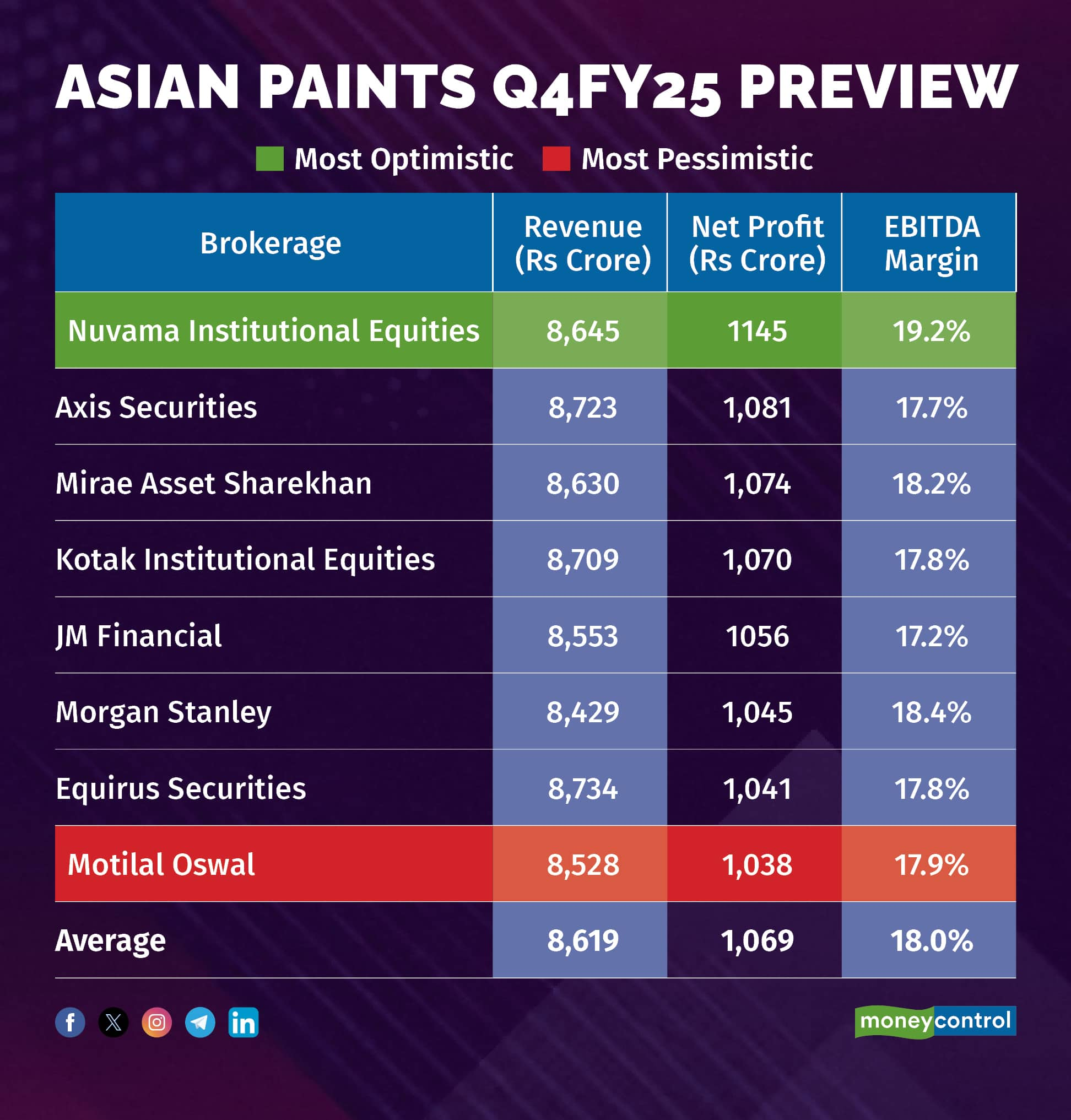

According to a Moneycontrol poll of 8 brokerages, Asian Paints is likely to report a 1.3 percent on-year fall in revenue to Rs 8,619 crore, down from Rs 8,731 crore reported during the same time last year.

Net profit is likely to fall 15 percent on-year to Rs 1,069 crore, down from Rs 1,257 crore from the corresponding quarter last year.

Earnings estimates of analysts polled by Moneycontrol are in a diverse range. Even the optimistic estimate sees Asian Paints’ net profit falling 9 percent year-on-year, while the most pessimistic outlook sees it slipping around 17.4 percent on-year.

What factors are driving the earnings?

The consumer demand was muted during the quarter as a result of the broad-based slowdown in consumption. However, there is a sequential improvement in demand.

Urban Slowdown: Brokerages believe that Asian Paints shall grow slower than peers as Asian Paints dominates big cities, which are facing the brunt of the slowdown. "The growth print remains weak as there is no material improvement in the demand conditions from prior quarters, especially in urban markets," said Kotak Institutional Equities. On the flip side, rural-focused paint players are likely to perform marginally better.

Margins: EBITDA is expected to decline on account of negative operating leverage, higher ad-spends owing to increased competition. Further, pricing continues to be negative due to an adverse mix, down trading and muted demand.

Volumes, pricing: Asian Paints is likely to see mid-single-digit volume growth given weak demand, entirely offset by adverse price/mix. "Recent price cut by Asian Paints is at the lower end to possibly fight against Birla Opus," said Nuvama Institutional Equities.

What to look out for in the quarterly show?

The raw material prices and their impact on margins will also be watched, along with increasing competitive intensity. Further, there will be a close watch on any commentary on price hikes and narrowing gap between volume and value growth.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!