The benchmark indices have given positive returns in the past three years (2017-2019) despite economic slowdown and global concerns.

The Nifty50 rallied nearly 49 percent during 2017-2019, against the Nifty Midcap 100 index (up 19 percent) and Smallcap 100 index (up 0.93 percent).

But the rally has been very narrow with the indices being driven by a handful of stocks.

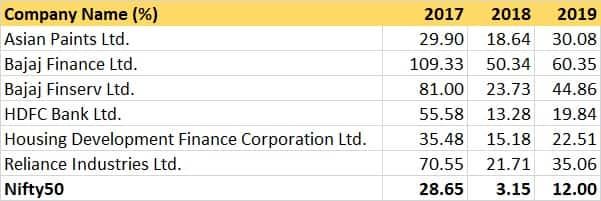

In Nifty only 6 stocks outperformed consistently while giving double-digit returns for three straight years due to their earnings growth, earnings potential in the longer run, strong business model and leadership in the segment.

These stocks were Asian Paints, Bajaj Finance, Bajaj Finserv, Reliance Industries, HDFC and Reliance Industries. These stocks together have a market capitalisation of more than Rs 26.3 lakh crore as January 22.

Table: Gains in percentage terms for each of these stocks in last 3 years

Will the bull run continue?

Experts feel that five out of these six stocks can retain their double-digit returns in 2020 as well.

"Asian Paints is expected to do well supported by its use of disruptive technology, expansion into home improvement business and robust paints business. Bajaj Finance might outperform its peers considering its strong risk management system with a large customer base and strong asset quality with good pricing power. With uncertainty in consumer demands and risk aversion in current market scenario, Bajaj Finserv might see some challenges in its performance," Gaurav Garg, Head of Research at CapitalVia Global Research - Investment Advisor told Moneycontrol.

"On the other hand, HDFC Bank is expected to continue its outstanding run as state-owned banks are facing capital issues and asset quality challenges. Increase in use of credit cards & digital transactions with higher retail lending are helping the bank to outperform. HDFC is also expected to continue its bull run, he said.

"Reliance industries' plan to deleverage its balance sheet and its deal with Saudi Aramco will bring momentum to the stock. However, it might not sustain its double-digit growth," he added.

Nirali Shah, Senior Research Analyst, Samco Securities also said Reliance has major exposure to cyclical businesses and has already returned 41 percent CAGR returns in the past 3 years, hence, it is possible that Reliance will give comparatively muted returns this year.

He feels the economy is likely to pick up this year and hence being leaders in their respective fields these stocks are going to further pick up pace.

"Hence, Bajaj and HDFC twins are likely to maintain their double-digit returns in 2020 as well. In the past 3 years, Bajaj Finance has returned the highest CAGR of 68 percent while Bajaj Finserv stands second with 46 percent CAGR returns. Compared to the Bajaj twins, HDFC Limited and Bank provided over 25 percent CAGR returns," Shah said.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.